Finance and financial products

And if all that wasn’t enough, last but not least is the finance and financial products division of Berkshire. The largest section of this group is Clayton Homes, which is the leader in both the production and financing of manufactured homes here in the U.S. In addition, there is also the 50% stake in Berkadia Commercial Mortgage, which services commercial real estate loans…

Patrick Morris owns shares of Berkshire Hathaway. The Motley Fool recommends Berkshire Hathaway. The Motley Fool owns shares of Berkshire Hathaway…”

The words above are those of the writer, Patrick Morris, circa 7.11.2019. Note the Buffettesque humor from Morris in his saying “only 491½ companies to go,” suggesting the Omaha mogul’s monopolistic motives. But just days ago, the Motley Fool – an investment advisory and stock analysis publishing firm – had a Warren Buffett specific story related to COVID19. Let’s tip the hat and note that these next two reports were brought to the attention of MHProNews by a routine source in MHVille that is not a client, nor has some like incentive to share such reports.

The “Fool” are certainly not alone in gazing at what Buffett is up to next. Business Insider is another example of recent mainstream reporting by financial reporters and analysts on Buffett during the Wuhan Virus pandemic.

Writer Theron Mohamed for Business Insider provided the following pull quotes from a recent Buffett interview.

Interview:

- “I’ve always felt a pandemic would happen sometime” — explaining why he isn’t surprised by the spread of coronavirus.

- “It wasn’t October 1987 but it was an imitation anyway, and the combination of the coronavirus and what happened with oil, that’s a big one-two punch” — referring to Monday, March 9, and the biggest stock-market decline since the financial crisis.

- “There will be interruptions, and I don’t know when they will occur, and I don’t how deep they will occur, I do know they will occur from time to time, and I also know that we’ll come out better on the other end” — on the inevitability and fleeting nature of disruptions to the global economy.

- “If you stick around long enough you’ll see everything in markets, and it [took] me to 89 years of age to throw this one into the experience” — outlining why he wasn’t rattled by the historic sell-off.

- “That’s only three of my lifetimes, and there wasn’t anything here” — trumpeting America’s relentless progress since its founding less than 250 years ago.

- “I’m drinking a little more Coca-Colaactually, that seems to have warded off everything else in life” — joking while shamelessly promoting one of his biggest investments.

- “I’m a probabilities guy in my nature. It’ll be 2.8 million deaths [in the US] this year and at age 89, I’m a little more likely to be in that group” — discussing the rising odds of his death with each passing year.

- “They puzzle me, but they don’t scare me” — sharing his view on negative interest rates, which could soon become reality in the US after the Federal Reserve cut rates to near zero this month.

- “I would say that’s the most important question in the worldbut I don’t know the answer. If we knew the answer it wouldn’t be the most important question” — on the impact of negative interest rates on financial markets.

- “If you promised to pay me something at 3% a year, that would have been a terrible instrument for me to own at almost any time in history, but today if you’re good for it, it’s fabulous” — detailing how historically low yields on government bonds make other investments more attractive.

- “I’ve seen evidence of that same awakening or whatever it may be of the public. They changed their behavior substantially” — describing how people are driving less due to coronavirus, leading to a “noticeable” drop in insurance claims filed with Geico and other Berkshire-owned insurers.

- “I was at a birthday party and that’s all they talked about. I suddenly became very popular, I was like a sports hero or something [for] a very brief period of time” — describing the surge in concern about money-market accounts in September 2008, as people feared they would lose everything.”

##

The following is from the Motley Fool’s Dan Caplinger (TMFGalagan).

It’s not surprising to see the Berkshire Hathaway CEO taking a longer-term view.

The stock market has fallen sharply because of the coronavirus pandemic, and value investors are licking their lips at all the opportunities they suddenly have to pick up stocks of their favorite companies at bargain prices. As the quintessential value investor, Warren Buffett has to feel like a kid in a candy store — or like something reminiscent of a more colorful metaphor the Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) CEO made in the late 1970s.

We won’t get a chance to see the moves that Buffett has made with Berkshire’s stock portfolio until the insurance giant files its quarterly disclosure with the U.S. Securities and Exchange Commission, which likely won’t come before mid-May. However, we’ve already gotten one hint about what Berkshire’s doing during the coronavirus bear market, and it shows just how important Buffett thinks it is to have as much ammunition as possible to take advantage of great investment opportunities as they arise.

You can’t ever have too much cash

On March 25, Berkshire Hathaway filed a prospectus with the SEC to sell senior notes into the bond market. Many of the details weren’t yet established, but the draft indicates that the Berkshire debt will be denominated in Japanese yen. Berkshire indicated that the proceeds from the sale will be used for “general corporate purposes” — the default catch-all category that most companies use when they raise capital by selling bonds or stock.

The draft prospectus also lacks both a fixed maturity date and the interest rate on the yen-denominated notes. However, looking at the Japanese bond market right now, interest rates are negative on two-year and five-year government debt, and right at 0% for the 10-year Japanese government bond.

Following up on success

It’s likely that Buffett is following the same strategy he used to raise money in the European bond markets recently. Back in late February, Berkshire raised 1 billion euros by selling five-year notes. Thanks to negative interest rates in the European bond market, Berkshire was able to get investors to lend it money at a 0% interest rate — essentially securing free financing.

Having free money is always a good thing in Buffett’s eyes, but doing so through bonds denominated in euros also suggested to some investors that the Berkshire CEO might look to make acquisitions of promising companies in overseas markets. The same could hold true for adding some Japanese yen to Berkshire’s stockpile of cash.

A billion here, a billion there

It might seem odd for Berkshire to raise even more cash, given just how much it has on hand already. Coming into 2020, Berkshire had $128 billion in cash and short-term investments on its balance sheet. Many of those following the insurance giant had become critical of Buffett’s stinginess, noting how badly Berkshire’s stock had lagged the overall market during 2019’s huge bull run.

Yet Berkshire hasn’t been afraid to incur debt when it’s able to get such attractive financing terms. In the long run, Buffett figures that he’ll be able to get a better return out of that cash than 0%. And while 1 billion euros, 100 billion yen, or $1 billion won’t necessarily make a huge difference given Berkshire’s size, every little bit will help add to the Buffett-led company’s performance.

Buffett’s attitude toward cash stands in stark contrast to what some other companies are facing. For instance, Boeing (NYSE:BA) has aggressively boosted its dividend and made stock buybacks in recent years, yet it now faces a liquidity crunch as its revenue sources dry up and it faces production halts due to the coronavirus outbreak. Boeing has drawn down credit facilities and has thus far avoided taking money from the U.S. government, but its stock has plunged as the aerospace giant faces the biggest disruptions to its business ever. Berkshire wants to be the company extending cash support to such companies — not the one needing help.

Buffett keeps looking at the big picture

Warren Buffett has been through many bear markets before, and he’s demonstrated an uncanny ability to keep his cool and find good deals when others are panicking. As interesting as it’ll be to see whether he adds some new stocks to his investment portfolio, knowing that Buffett’s raising more money to make as many smart investments as he can is reassuring to his shareholders…

Dan Caplinger owns shares of Berkshire Hathaway (B shares) and Boeing. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares) and recommends the following options: long January 2021

$200 calls on Berkshire Hathaway (B shares), short January 2021 $200 puts on Berkshire Hathaway (B shares), and short June 2020 $205 calls on Berkshire Hathaway (B shares).”

Pushback, Cheers and Jeers in MHVille – Analysis

By all accounts, there have been no perfect reports, writers, publishers, companies, people or organizations in over 1900 years. The last human who claimed divinity, perfection and equality with God was crucified, as we recalled on Good Friday.

The nation has just gone through a Passover and Easter season like no other in over a century. With Ramadan fast approaching, the early reports indicate there will be disruptions in their faith-practices too.

Facts are what they are. Reporters try to paint a picture, sometimes slanted, sometimes more even-handed. It is self-described Democrat and progressive former Washington Post journalist Joel Kotkin who complained about bias in media so bad – and he specifically included left-leaning writers – precisely because they were often only showing ‘one side of the story.’

When you publish often enough, it rapidly becomes evident that you can’t please everyone. You also can’t appeal to everyone. If the Creator of all doesn’t force mortals into reading the Word of God then it is a fool’s errand to believe that a lesser writer can attract everyone, each time and make those readers all happy.

Among the comments into MHProNews this week was one that used the phrase “hit piece” about a report that we’ve done. There is no doubt specific reports don’t make the subject ‘look good.’ At the same time, when the proverbial ‘both sides of a story’ are presented – when each party gets their say, it is inevitable that one or both won’t be entirely happy with the product. That’s the nature of journalism.

Our goals were many in launching into publishing over a decade ago. Perhaps, in hindsight, some of those goals were naïve. But what is now called MHProNews from early on grabbed the largest audience in our industry and has maintained that status, despite some rather brazen and evidence-free claims to the contrary from wanna be rivals.

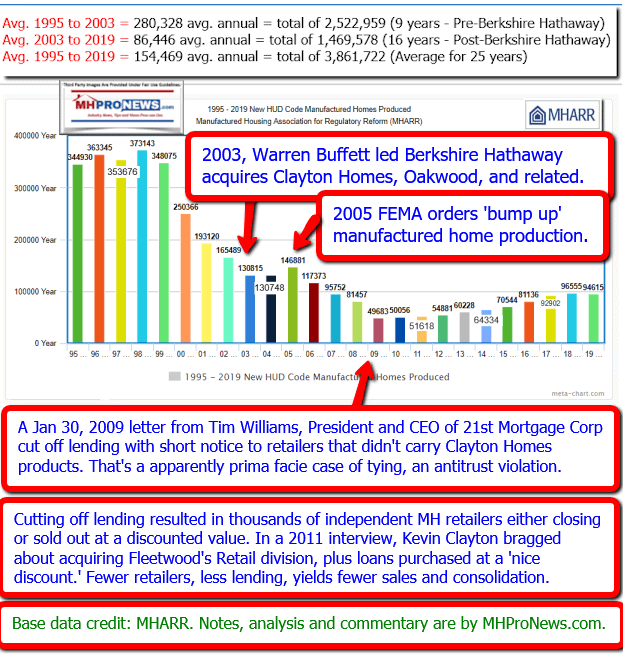

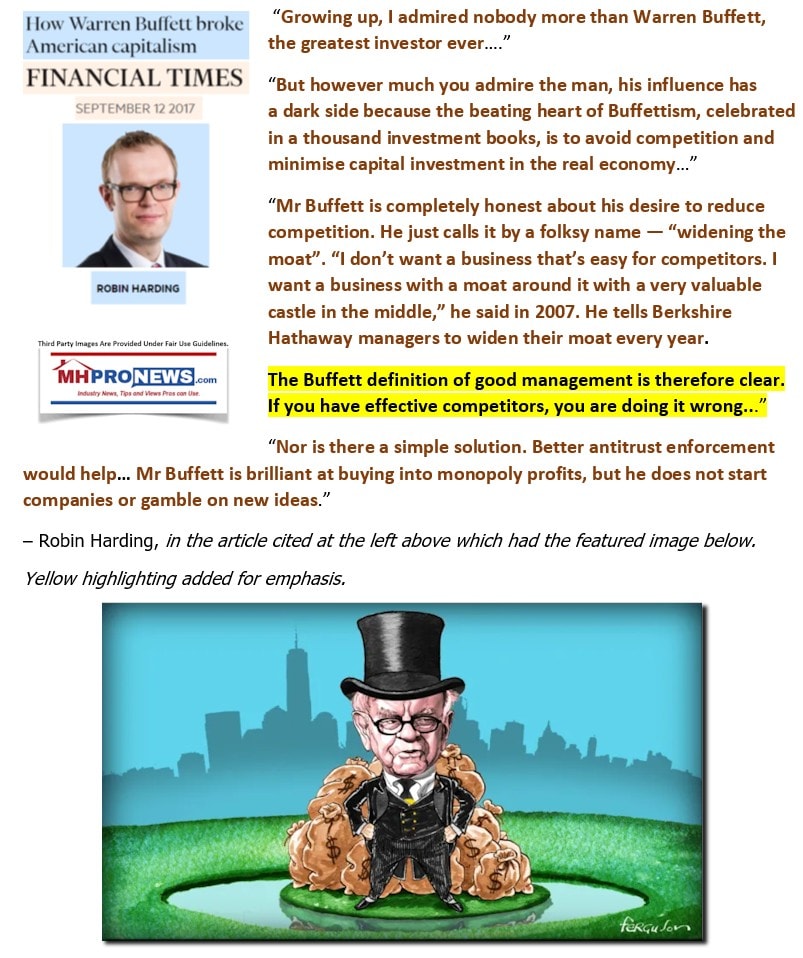

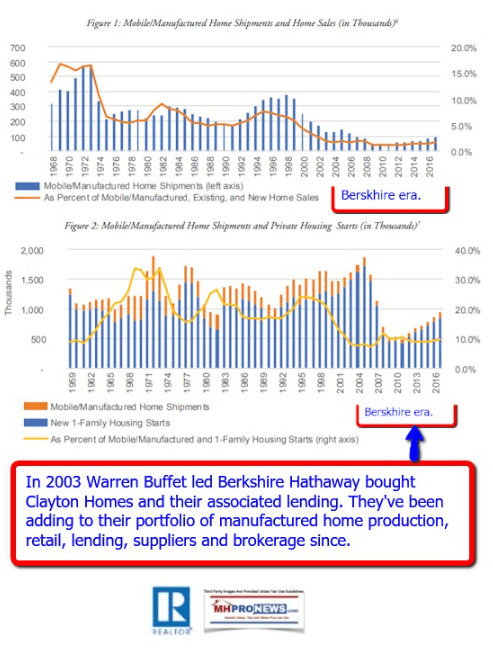

Manufactured housing is underperforming and has been for years. That’s simply a stark reality. A number of professionals from often large investment or multinational corporations that have or are peering into MHProNews have said that only after reading our reports and analysis did they find a hypothesis that satisfactorily explains manufactured housing’s underperformance.

That premise is based on the notion that several of the industry’s largest firms are de facto working in concert to keep the industry smaller that it would normally otherwise be. That seems counterintuitive, argued ManageAmerica partner Andy Gedo in an online debate that ended Sunday and was published Monday morning.

However counterintuitive or illogical it may seem that some are limiting industry growth, when Gedo was confronted with direct quotes in context from companies and leaders that included Clayton Homes (part of BRK), Skyline Champion (SKY) and Cavco Industries (CVCO), Gedo politely threw in the towel rather than go on and try to explain away what those firms and company leaders said in their own words.

Why does that matter to an independent, investor, or even to employees in larger firms that seem to among the handful of corporations that rule the roost at the Manufactured Housing Institute (MHI?). Simple. Because monopolies harm people, period. That connection between monopolies, oligopoly and what some like Kotkin and his fellow university researchers have called the “new feudalism” has been a known fact for hundreds of years.

As part of a message to MHProNews a claim was made that this publication stirs up controversies. There is a possible argument for that assertion, but in fairness, that’s not controversy for its own sake. Gedo, who is another mere mortal – as is this writer – while he took what could be called some cheap shots was also in several respect polite and made an obvious effort at fairness. The pro-MHI Gedo said the following.

The only way to challenge a status quo that is arguably choking off industry growth from within and by external manipulations too is first by exposing that process. Because the efforts by a relatively small number but influential parties to create barriers of entry, maintenance and exit are ongoing, the reports about that process must be too. No one in mainstream media writes a single story about President Trump, Nancy Pelosi, or other political figures. They do a periodic series of reports. That occurs here too.

With respect to Warren Buffett and what the anti-communist Epoch Times has labeled the CCP (Communist Chinese Party) Virus, MHProNews reported early on the likelihood that Buffett and his allies were going to cash in. Within days of that, a self-described Buffett/Berkshire investor made his first big score.

If there is massive market manipulation underway during the COVID19 outbreak, then the claim of a former U.S. ambassador that this is possibly the biggest crime in history could be made. MHProNews is going to do reports, analysis and commentary in an evidence-based fashion, because that is how credibility is maintained.

Whatever some might think or say about this writer or our reports, this much is clear. Our pivots in reports and analysis – clearly labeled as such at the conclusion of each column – has forged the runaway most read trade media in our industry. Why does that matter?

Because the little guys and gals need actionable insights, which the bigger players already have.

The only way to begin to level the playing field is to have a source where people can come and blow the whistle on what actual or would be leakers see as organizational wrongdoing. There is, of course, another side to those who are finding themselves facing documents, allegations, and evidence from within their own organizations. MHProNews gives opportunities for those to respond.

That may not be perfect journalism, but it is far more balanced and fair-minded than what any other independent publisher in this industry does. If they want to debate that, let them try. If Kevin Clayton, Tim Williams or other corporate leaders have the chutzpah that Andy Gedo has, let them engage in a public discussion live, online, or whatever.

But no, many of those ‘leaders’ have been invited repeatedly to do so. They pass. That silence in the face of mounting evidence speaks volumes too, doesn’t it?

Thanks in good measure to the insights, documents, support and efforts of people who have had enough and are willing to fight back, MHProNews is the go-to resource. That’s only possible because of the input and support of others. As a blatant plug, by tackling the tough topics in this fashion, our sponsors know that they get the most exposure and client-state best results for their money.

Telling the truth as it is known can pay off.

As a closing thought, a belief can be common and still be wrong. A truth can be rare and still be correct. While we would phrase it differently, Gedo made an important point about being a contrarian. He as a pro-MHI member stressed the need for that in an industry with so much consolidation. On that point, we’d be pretty close to agreeing.

One last point for today. One of our most enduring client relationships had at one point a rather public battle. The misunderstandings were ironed out years ago. It just goes to show that a temporary frustration or disappointment with a particular article or two doesn’t have to mean that a bridge has been blown. Candid communications can resolve problems that can’t be successfully addressed in any other way.

That’s a wrap on this hump-day report, but tuned for more from your #1 source for the most-read manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

February 2020, Latest National Manufactured Housing Production Data, MHI and MHARR Comparisons

Are Manufactured Housing Supply Chains in China Threatened by Coronavirus?