The writer of the Forbes column cited and linked below is a manufactured home community owner named Brad Johnson. Johnson, not unlike RV Horizon’s Frank Rolfe, misuses the terminology, perhaps for SEO or other reasons.

Johnson in Forbes cites Sam Zell’s Equity LifeStyle Properties or ELS. It’s Zell who made it a repeated public point to poo-pooh the ‘t-word.’

By contrast, former modest community owner and blogger George F. Allen, in his trade-mark inconsistencies, wags a finger at those who don’t say “land lease communities,” yet recently added the term “mobile home” to his blog’s header. Don’t try to figure retired Marine G.F. Allen (GFA) out. He’s arguably only consistent when it comes to what he thinks are his own interests, say former clients of his. The rest, per sources and experience with GFA, are details and commentary.

But the point is that there’s plenty of variables in the manufactured home community world on the use of correct or incorrect terminology. Some insist on it, others could care less, and some are blatant hypocrites.

Before pressing ahead, the reason we at MHProNews and MHLivingNews believe proper terminology matters is ironically alluded to indirectly by the Forbes writer, Johnson.

‘Mobile home parks’ are arguably better appreciated today than in some years gone by, for reasons cited in Johnson’s generally useful column. But despite consistent returns, and their ability to weather recessions, etc. what’s more properly known as a manufactured home community (MHC) are nevertheless not seen as ‘sexy’ investments.

‘Trailer parks’ are understandably even less appealing to the general public.

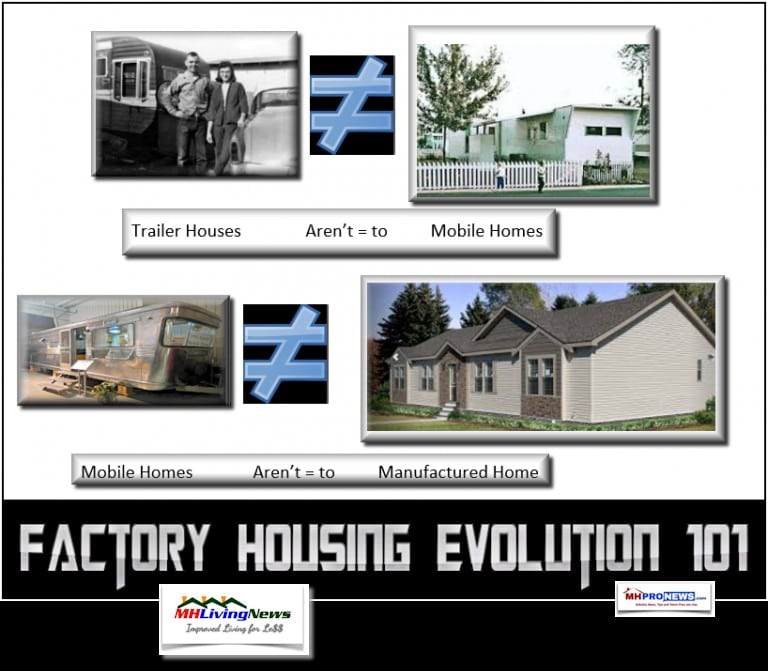

The answer isn’t to go with the flow on terminology or industry challenges. Dead fish go with the flow. But to effect lasting image change belongs to those who make it happen in their own local market(s). Anecdotal evidence suggests that residents’ value – and that of the industry – is being denigrated by the ‘t’ word, and is diluted by saying “mobile home,” if in fact someone is describing a HUD Code manufactured home.

Unless the units were built before June 15, 1976 – then ‘mobile home’ is simply not the correct terminology, period. Steve Duke, JD, in his pithy quote for MHLivingNews below underscored that point.

the terminology determines the

construction standards a home was

built to,” Steve Duke, LMHA.

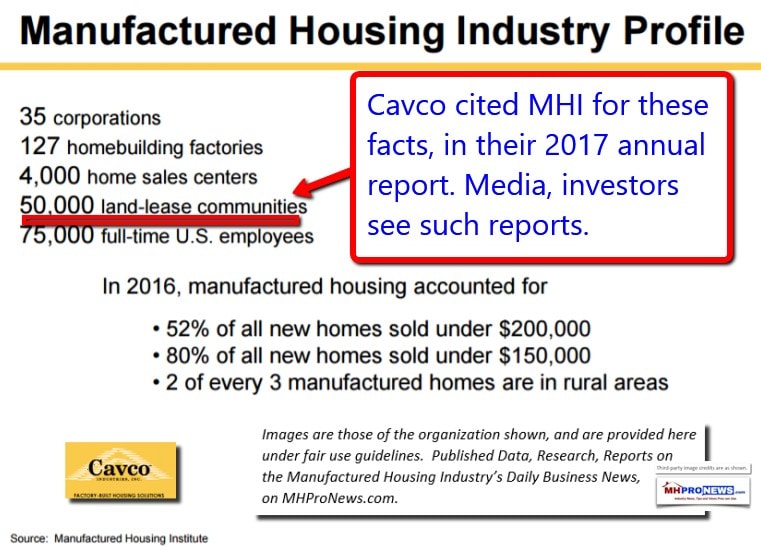

That said, one of the fascinating points obliquely made by Johnson is an oblique slam at the Manufactured Housing Institute (MHI) and their National Communities Council (NCC) for a ‘lack of sound data.’

ELS is used by Johnson as a publicly available standard for good metrics. Quoting:

“…Sam Zell’s Equity LifeStyle (ELS), the largest company in the mobile home park space (and our best proxy for industry data, which is nonexistent).”

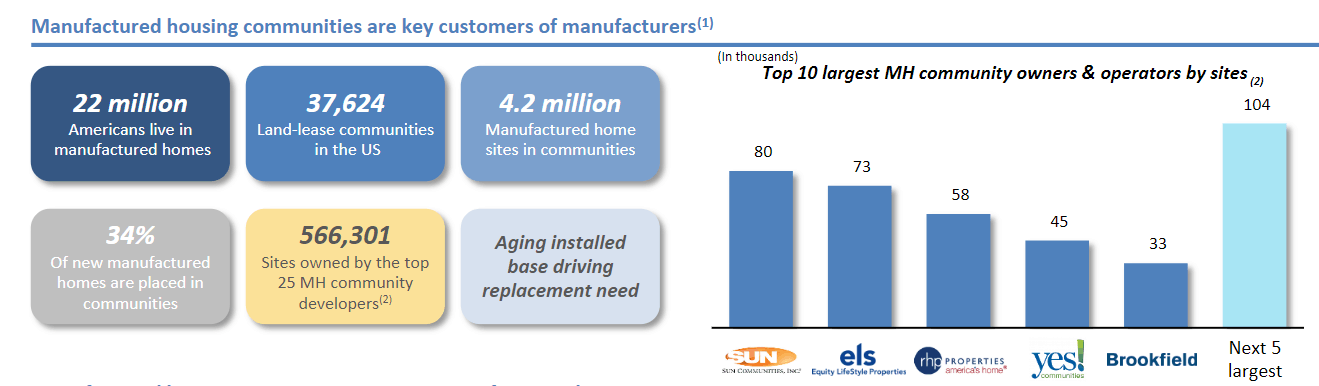

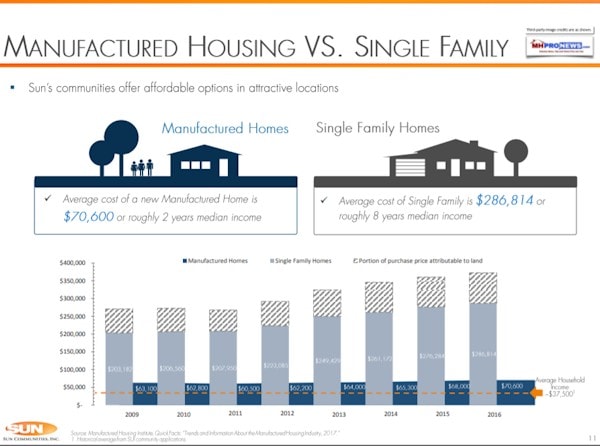

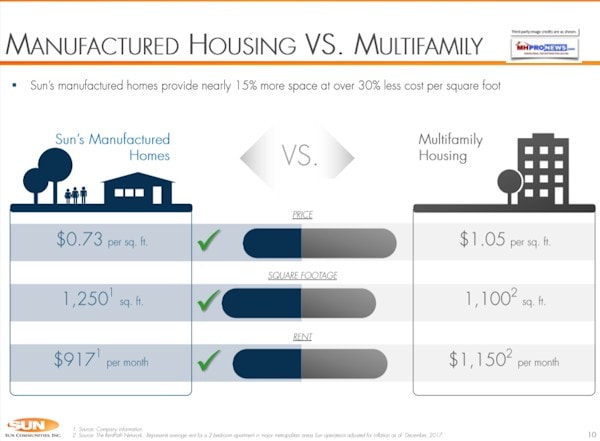

MHProNews has for years similarly cited Sun, ELS, and/or UMH Properties for their published data.

Why?

Because accurate information is otherwise largely lacking. Shame on the industry’s post-production association – MHI – for not curing those data deficits. Instead, MHI has arguably have made it worse to the degree that they weaponize favored firms claims vs less favored ones, even if the favored firms information is incorrect. Case in point. Each of the three current/former MHI/NCC member firms noted in the related report found in the linked-textbox below have different data points on manufactured home communities. MHI took the lowest total, from MHVillage – though sources at MHVillage have privately admitted that their MH Community count is too low.

Frank Rolfe, Dave Reynolds, George Allen, Manufactured Home Community Controversy Continues

One of several problems not mentioned by Johnson in the Forbes column further below is that the MH Communities sector is actually shrinking.

That may drive up demand short-to-mid term, as Johnson notes. Contrary to what Johnson suggested, there are some new communities being added, as the graphic below indicates. Some manufactured home communities are also expanding the number of existing sites, on adjacent previously-vacant land.

But despite a modest number of new opening MHCs, the overall trend for the number of communities in manufactured housing is down, due to community closures.

An analyst or investor can slide-rule that vexing trend in various ways.

But who do you know in the Investment World that argues that multifamily housing apartments are struggling because so many are being built every year? Think about that.

Manufactured housing in general – or even the demonstrably more stable manufactured home communities – are arguably underperforming. That means that a savvy investor enjoys good potential upside. Among the headwinds? Regulatory and stigma. The later is again why proper terminology should be consistently used. Capital has returned to the U.S. and to this sector of the industry, as MHProNews has reported, and both of those are a plus.

Let’s see how the Florida Manufactured Housing Association (FMHA) framed their battle against stigma for the public in a video supplied by their “Hand Built Homes” campaign, as shared 11 months ago to MHLivingNews.

With that introduction and analysis, let’s look at what Johnson wrote in Forbes, found at this link here, or from the in depth quotes below his headline and featured image.

Mobile home park investing is not an exciting cryptocurrency, a high-flying tech startup or a trophy office tower you brag about owning. A mobile home park is just a parking lot filled with single- or double-wides that kicks off a lot of cash flow.

I co-own a portfolio of 23 mobile home parks and help real estate investors grow their portfolios with mobile home park investments. There are a lot of unique aspects to the industry that make mobile home parks compelling investments. But, for some strange reason people do not gather around me at parties to learn about the intricacies of them. So, to keep your attention, let’s focus on just one strength most parks share: consistency.

A portfolio of mobile home parks purchased at the right price is a remarkably bankable investment. Mobile home parks deliver profits year in and year out, whereas their cousins (apartment buildings) are often far more erratic. Why?

Compared to apartment buildings, mobile home parks tend to:

- Have dramatically lower turnover: Only about 2% of the homes leave our parks per year, versus the average apartment tenant yearly turnover, which was 53% in 2015.

- Have lower operating and capital expenses due to fewer maintenance costs and amenities: We rent land, which is pretty cheap to maintain.

- Have less volatile rents due to reduced competition. There is essentially no new supplyof mobile home parks. Strict zoning laws make them nearly impossible to build. Compare that to apartments buildings, of which more than 350,000 new unitswere built last year. That’s a never-ending supply of new competition for existing apartments. That sounds horrible. Who wants to go out in the cold and slay a new dragon every year? I’d rather be back at the castle by the fireplace counting land rent.

All these differences translate to consistent profits. Consider the profit track record of Sam Zell’s Equity LifeStyle (ELS), the largest company in the mobile home park space (and our best proxy for industry data, which is nonexistent). ELS has achieved positive profit growth in every quarter since 1998. That’s impressive: America suffered a huge housing crisis in 2007, but ELS grew profits anyway. This isn’t a fluke or something unique to ELS. This consistency is structural to the industry.

Comparison To Other Commercial Property Types

To fully understand the lower capital advantage mobile home parks have over other non-multifamily real estate assets, here are the remaining major commercial asset types and their roadblocks to consistent cash flow performance.

- Office properties:Occupancy is highly susceptible to recessions and requires huge ongoing capital expenditures relating to building systems and staffing. Office landlords must spend hundreds of thousands and often millions on new tenant improvements and broker leasing commissions. These costs are paid upfront. If the tenant goes bankrupt on day one of the lease, the landlord cries.

- Retail properties:These are highly susceptible to recessions, and many are currently being methodically crushed by online retailers.

- Hotel properties:These come with high fixed expenses — and you can’t fire the staff if occupancy is low one night.

- Industrial properties:Though industrial properties tend to have the lowest ongoing capital needs next to mobile home parks, tenant concentration can be an issue. If your largest tenant defaults, you’re in trouble.

In contrast, mobile home parks are virtually recession-resistant, with low fixed costs and minimal capital needs. They have lower turnover rates, don’t require much staffing and have highly diversified tenant bases. In other words, they are consistent.

How To Make Your First Mobile Home Park Investment

If you’re a passive investor interested in co-owning parks, there are quality sponsors out there that you can invest with. If you would rather roll up your sleeves and do the work yourself, here are a few suggestions:

- Don’t start small:Counterintuitively, you don’t want to crawl before you walk in mobile home park investing. Buy a park large enough (~50 spaces) to provide tenant diversity and support an on-site (or nearby) property manager. If you go small, you’ll become the de facto property manager and will need to personally collect rents and enforce the rules.

- Narrow your search:You’re going to have a hard time competing against larger, more established players on brokered deals. Don’t plan on finding a great deal online. It took me years and a lot of cold calling to develop consistent deal flow. If it’s your first deal, your best strategy is to focus on a couple of markets and deal directly with the owners.

- Stay away from private utilities: If at all possible, stay far, far away from private utilities. The costs to replace private electrical, gas, water or sewer systems are often six figures and sometimes seven figures depending on the size and type of system. Do you want 100 families calling you in the middle of the night to report a gas leak? Unless you’re very lonely or very bored, probably not.

- Secure long-term debt:When mobile home parks fail, it’s often because a short-term loan came due and the owner couldn’t refinance.

- Make sure you have time to oversee the asset: Mobile home parks do not run themselves. You need the right team, software and systems to manage them for you. Or you need to do it all yourself. If you’re looking for mailbox money, look elsewhere.

Conclusion

Consistency can be boring, but it’s critical for long-term investment success. You can’t increase cash flow if you have to keep reinvesting in the property just to keep things afloat. If you can’t grow profits, you’ll be far too dependent on market timing and interest rates to achieve compelling returns.

The mobile home park industry has been reliably profitable due to its structural advantages that keeps mobile home park supply, tenant turnover, ongoing capital and recurring expenses low. This enables investors to compound capital as revenue growth flows to the bottom line and is not diluted by surprise capital expenses. ##

Grab your coffee or energy drink. This is your latest wake up call.

Opportunities knock, but they come dressed in overalls.

Johnson made several valid points in Forbes, but some needed adjusting or were exaggerated, etc. as noted above. Johnson who is clearly pro-industry, nevertheless had issues in his report. This article in Forbes is but one of many possible examples of why a report in the mainstream should not be merely forwarded, without a sound commentary and analysis. Otherwise, misinformation mixed with accurate information only spreads.

There are internal industry challenges that must be overcome. To better understand the issues, see the related report, below the notices and byline that follow, for more insights and details. “We Provide, You Decide.” © ## (News , analysis, and commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

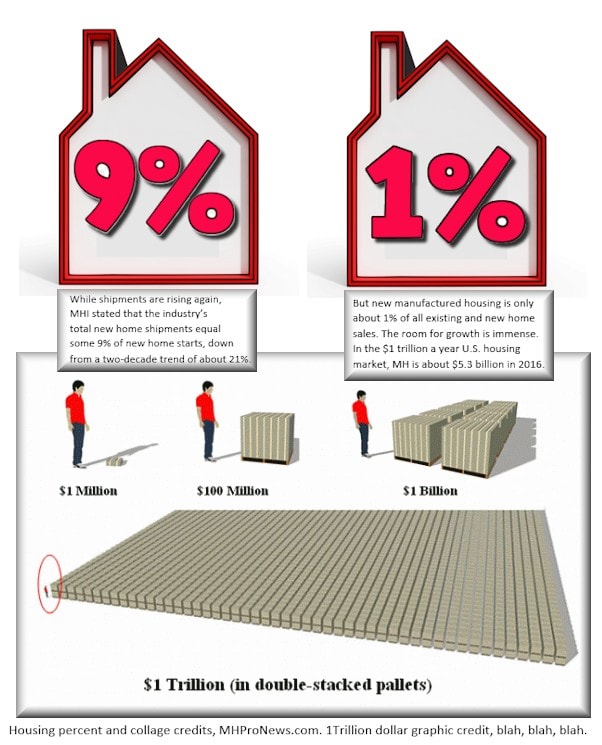

Eye Opening – Manufactured Homes in National, Global Context

Earning More Honest, Honorable Manufactured Home Industry Profits in 2019

MHARR Exclusive Report & Analysis, June 25, 2018

IN THIS REPORT: JUNE 25, 2018 SAA/PIA MEETING REFLECTS PROGRAM CHANGES NEW POST-PRODUCTION ASSOCIATION ANNOUNCED MONTGOMERY CONFIRMED AS HUD ASSISTANT SECRETARY MHARR CALLS FOR WITHDRAWAL OF HUD MH “GUIDANCE” HUD MUST NOT REPEAT PAST MISTAKES ON CONTRACT UNRESOLVED DODD-FRANK ISSUE RAISES MORE QUESTIONS REACTIVATION OF ENERGY RULE MAY REQUIRE LEGAL ACTION HUD LEADERSHIP CHANGES REFLECTED IN SAA/PIA MEETING Leadership changes within the HUD manufactured housing program – spearheaded by MHARR – were clearly reflected at the most recent HUD-PIA-SAA conference held from June 19-20, 2018 in St.