Federal Reserve Chair Janet Yellen recently implied that an interest rate hike is just around the corner.

“A rate hike could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the committee’s objectives,” said Yellen in her testimony before Congress’ Joint Economic Committee recently.

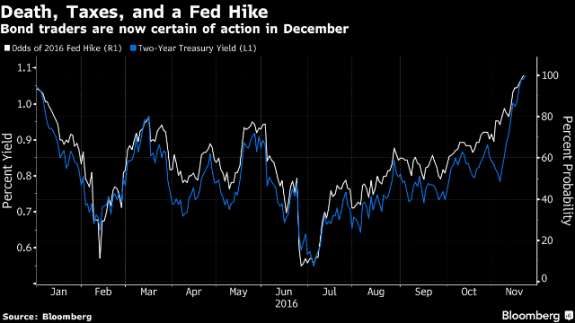

According to Bloomberg, The odds that the Federal Reserve will elect to raise interest rates during the December 13-14 meeting have reached 100 percent. The last Fed Rate hike occurred in December of 2015, with the last one prior to that occurring in 2006.

President-elect Trump campaigned on promises of “massive” tax cuts and spending of as much as $1 trillion over a decade to rebuild the nation’s infrastructure. His victory in the November 8th election, unexpected in some circles, spurred a rout in bonds, plus a surge in the dollar and gains in stocks.

“After the Trump Shock, it’s easy for the Fed to hike, because inflation expectations have gone up,” said Hideaki Kuriki, a debt investor in Tokyo at Sumitomo Mitsui Trust Asset Management.

As the Daily Business News covered recently, the markets have responded positively to the President-elect, with the Russell 2000 small cap stock index showing strong gains along with companies that focus on building and infrastructure. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.