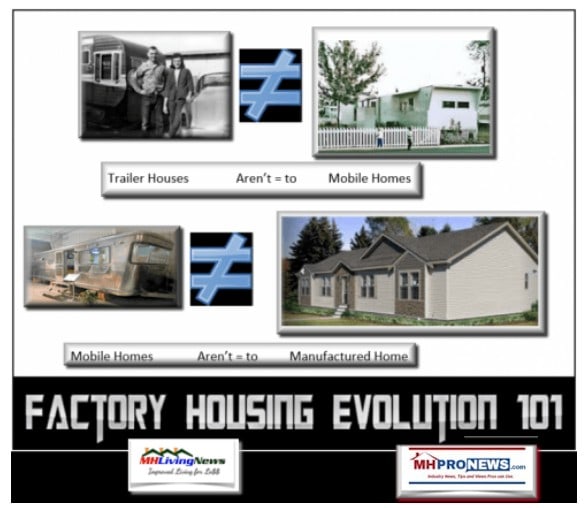

“The manufactured housing industry did not become the legitimate

and affordable housing of today from the trailers of yesteryear

THROUGH REVOLUTION, BUT RATHER THROUGH EVOLUTION,

thus establishing a long and rich history of success, which many

in the industry today tend to distort and/or forget altogether

in order to fit what is to their own benefit. We must not allow

this to occur.”

– Danny Ghorbani,

retired engineer, manufactured home trade association

executive, trade show manager, and periodic industry consultant.

The manufactured home industry in several ways is at what various voices describe as a crossroads. There are enormous challenges but also big opportunities, which some third-party facts will illustrate prior to our exclusive interview that will follow further below.

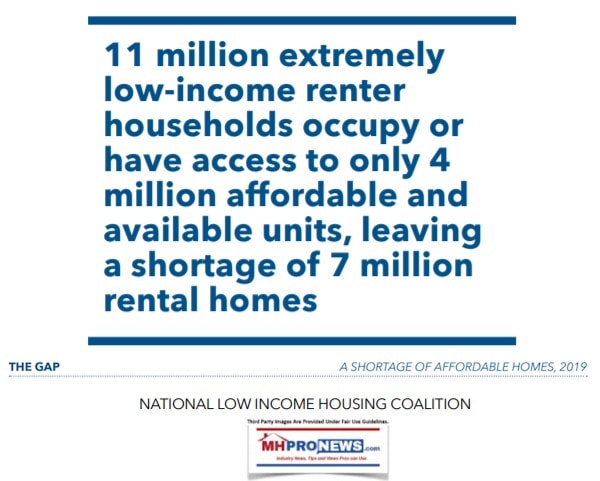

The National Low Income Housing Coalition (NLIHC) says that in all fifty states, affordable housing is in crisis. In their 2019 GAP report, they said that some 7 million affordable housing units are needed.

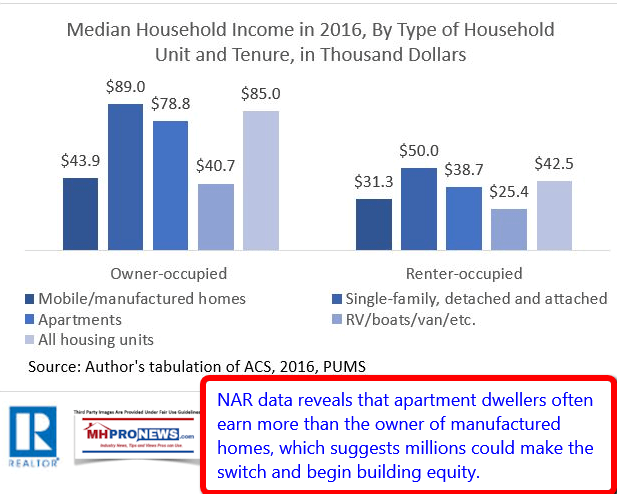

HUD Secretary Ben Carson recently certified the federal data on homelessness, which noted that over 500,000 Americans are in that tragic category.

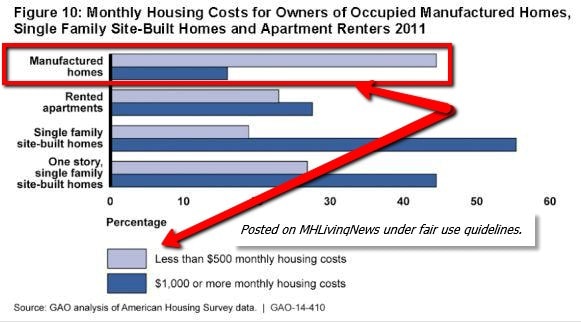

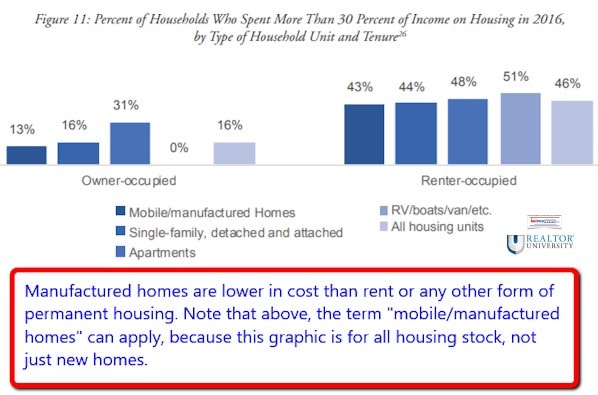

The National Association of Realtors (NAR) conducted third-party research on manufactured housing published in 2018. That NAR research for Realtor University was authorized by Lawrence Yun, Ph.D, and their chief economist. Certified Business Economist (CBE) Scholastica “Gay” Cororaton performed that research, which identified several key points. Among them was the fact that Cororaton’s research indicated that millions living in rental housing could afford to live in and own a manufactured home for the same or significantly lower payment.

Her NAR data coincided buttressed an earlier data-point established by the Government Accountability Office (GAO) study in 2014, which framed their data in the following fashion.

What even that brief snapshot reflects is the need for competitive and affordable financing in order to solve the affordable housing crisis. But there is more to this topic than merely ‘affording’ housing. Affording housing has never been the American Dream. Owning a home has been an essential part of that dream since early in the days of the founding of this nation.

HUD Secretary Ben Carson, M.D., has on occasion made the point that home ownership is the most proven way to create household wealth. Dr. Carson has said that the typical renting household has an average net worth of about $5,000 while the average home owning family has a net worth of some $200,000.

That too points logically reveals the need for financing to bridge the gap between renting and home ownership. Doing so would create more household wealth. It is a program that motivated the passage of key laws by widely bipartisan margins, one of which will be examined in the interview further below.

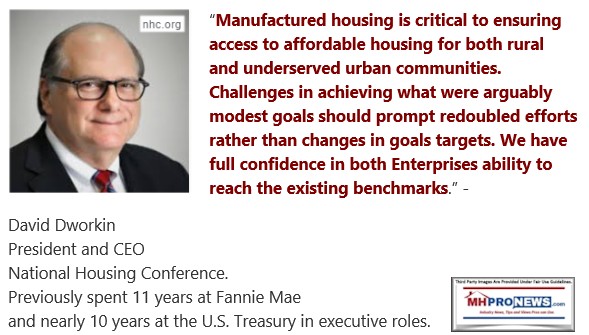

Rephrased, voices and research across the left-right divide have often pointed to the key role manufactured homes could play in solving the affordable housing crisis.

Then why has there been so little movement toward a programmatic solution?

House Majority Leader Jim Clyburn recently stressed the importance of understanding the history of a subject in order to understand how the present came to be. Here is how he phrased it.

Exclusive Interview

With that notion of the importance and relevance of history in mind, MHProNews reached out to an industry veteran who worked for years at the Manufactured Housing Institute (MHI) as a vice president before leaving that grade group. Danny Ghorbani has decades of experience, which begins in the era that predates the establishment of the HUD Code, something few in the industry today could candidly claim.

MHProNews asked him in his personal capacity, without any consideration of other industry voices or incentives, to shed light on key issues facing manufactured housing, in what we plan to be a periodic question and answer (Q&A) session. Ghorbani agreed.

The subject we selected to begin this periodic Q&A series with Ghorbani is financing.

Here is that question and answer session, conducted via email for maximum accuracy. This interview will be followed by an MHProNews analysis and commentary.

MHProNews. Its now been roughly 12 years since the “Duty to Serve” (DTS) mandate was passed by Congress as part of the Housing and Economic Recovery Act (HERA) of 2008. HERA’s DTS mandate required that Fannie Mae and Freddie Mac make financing affordable housing preservation, rural, and for HUD Code manufactured homes. Can you provide our readers some insight into the history of this matter and specifically how it relates to the ongoing failure of the GSEs to fully implement that law in accordance with its terms. In framing your reply, let’s set aside community financing and FHFA’s role in this for now, and focus on the what some call posturing and confusion which we’ve seen from the GSEs instead?

Ghorbani: This may or may not come as a surprise to you and your readers, but in my opinion, the two Government Sponsored Enterprises (GSEs) i.e., Fannie Mae and Freddie Mac, don’t have very much interest in the Manufactured Housing industry, and I doubt they would ever get involved in manufactured housing in a market-significant way (i.e., large volume), securitizing loans for mainstream affordable HUD code manufactured homes. And, more specifically, they are even less interested in securitizing the industry’s most affordable homes that are financed through personal property (chattel) loans and represent nearly 80% of our industry’s homebuyers — mostly moderate and lower income American families.

To be sure, they continue to go through the motions. They’ve “engaged” with the industry, attending and sponsoring industry events, shows, seminars and meetings on top of meetings, sweet-talking the industry and even some consumer organizations. They’ve provided targeted programs for the high-end/expensive homes built by the industry’s largest conglomerates. They’ve done endless public relations, pushing all the right buttons, etc., etc., etc. — anything and everything except securitizing loans (be it mortgage type, but more importantly chattel) for mainstream, affordable HUD Code manufactured homes in a market-significant way for moderate and lower American homebuyers — which, incidentally, is the main reason for their (i.e., Fannie and Freddie) existence…as stated in their respective charters.

My long held belief and opinion regarding their outlook and lack of interest in manufactured housing is based on personal observations and experience in dealing with them going back nearly forty years. There is a history here that not very many stakeholders (especially the newcomers and “wanna-be”-experts) are aware of, and cannot be ignored going forward if Fannie and Freddie are to be held accountable in full and complete compliance with their statutorily-mandated duty to serve the manufactured housing industry and the moderate and lower income families who rely on manufactured housing as the only means to own a home of their own. This history goes way back before we formed the Manufactured Housing Association for Regulatory Reform (MHARR) in 1985, when I was with Manufactured Housing Institute (MHI) for nearly two decades, and my many responsibilities included the management of the industry’s Annual National Show and Exposition in Louisville, KY every January. We used to bring GSE personnel to the show to see the new model homes, attend meetings and seminars, talk to industry folks, answer their questions…any and all relevant matters that would engage them with the industry in the hope that they would initiate some type of market-significant securitization of manufactured home loans. Again, and as usual, they did all the right things, as noted earlier, but nothing substantive ever happened.

Now, fast forward to the mid-2000s when the lack of an aggressive, independent National Post Production Association resulted in major set-backs for the industry in consumer financing for its homes (not to mention failures on such critical matters as SAFE Act and Dodd-Frank, which continue to haunt the industry to date), thus drawing MHARR into the consumer finance arena. The Association’s collective knowledge of the relevant consumer finance history, institutional memory and experience with Fannie and Freddie became quite effective in demonstrating to both Houses of Congress that they had to mandate an end to Fannie Mae and Freddie Mac’s discrimination against the Manufactured Housing Industry and its consumers, and start serving this industry as a “DUTY” — thus the enactment of “Duty to Serve Underserved Markets” (DTS) as part of the Housing and Economic Recovery Act of 2008 (HERA).

Unfortunately, though, nearly twelve years after the passage of DTS, because of the continuing absence of an aggressive, dedicated and independent national association representing the interests of retailers, communities and finance entities, coupled with the deployment of multiple schemes, excuses and creative methods of dodging by Fannie and Freddie, and given their very weak and ineffective regulator, the Federal Housing and Finance Agency (FHFA), the two GSEs have been able to stymie the full and proper implementation of the law, thus, once again, depriving moderate and lower American families of homeownership, while forcing them into what former Congressman Barney Frank used to refer to as “predatory lending.”

Based on all of this, do Fannie Mae and Freddie Mac really look like two organizations that are truly interested in securitizing market-significant volumes of affordable loans for moderate and lower income American homebuyers in accordance with their own charters and the mandate handed to them by DTS law? The simple answer is a resounding “no.”

Fannie Mae’s and Freddie Mac’s ongoing behavior vis-a-vis the Manufactured Housing Industry and consumers of affordable housing is a disgrace. Their unreasonable and expensive proposals that are only favorable to the largest conglomerates in this industry is a ruse and an insult to the hardworking Americans who cannot afford to purchase those more expensive homes. All of this is unacceptable and must be rejected not only by the industry and consumers, but by the Administration, Congress and FHFA…and the sooner the better.”

— End of Q &A —

MHProNews Additional Insights and Closing Commentary

MHProNews has sent questions to the Manufactured Housing Institute (MHI) and several Berkshire Hathaway executives operating in manufactured housing on several topics, including financing. Among them are issues tied to DTS and other issues. If they respond, we will so advise our readers.

As noted above, this will be the first of a planned periodic series of Q&As with Ghorbani, a voice that worked inside MHI for years, and then continued to engage with them after what is now known as MHARR – the Manufactured Housing Association for Regulatory Reform – was established in 1985.

For added context, our sources tell MHProNews that Ghorbani has at times “battled hard” with MHI leaders, but that didn’t keep them from finding common ground that resulted in their working together to enact the Manufactured Housing Improvement Act (MHIA) of 2000. One takeaway from that fact is that vigorous intellectual discussions and disagreements can occur while still yielding constructive outcomes.

But additionally, the points made by Ghorbani in the Q&A above underscore other sources that we’ve cited previously. Here is one example.

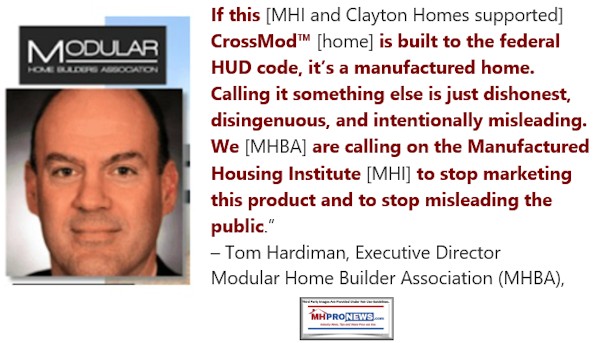

While on paper MHI says they support DTS, their emphasis in recent years has been to promote the use DTS for financing on commercial land-lease communities, and more recently still, on the controversial ‘new class of homes’ that they with Clayton Homes’ backing have dubbed “CrossModTM homes.”

Relevant and related topics to this financing issue are found in the reports linked above and further below the byline and notices.

Housekeeping notice: If you are not yet signed up for our industry leading emailed headline news, you can do so at the link below. Routinely, MHProNews emails are not only read, but are reportedly shared with others who often sign up for themselves.

That interview on the key topic of financing is a strong start to this work-week from the most-read source for manufactured home “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.