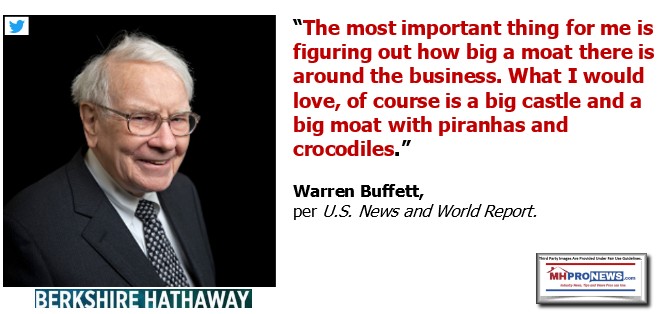

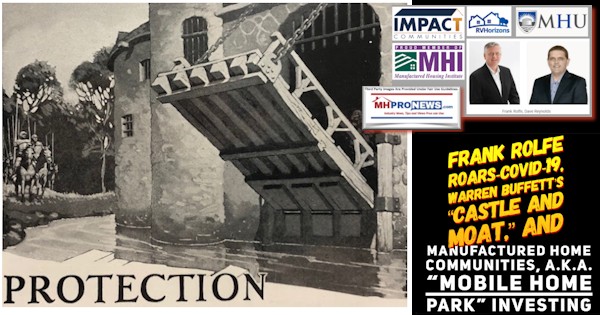

According to a post by Frank Rolfe on the Mobile Home University (MHU) website that he and Dave Reynolds have been involved in for several years: “If you are in an investment that has no “moat” right now you’re in real trouble.” Manufactured Housing Institute (MHI) member Rolfe also has a post of MHU under the title: “Evidence Again that the Mobile Home Park “Moat” Cannot be Breached.” It is Daniel Schmergel with LoopNet that wrote about “the unlikely benefits of a bad reputation,” but he did so in the context of an article that cited Frank Rolfe multiple times. This article will explore the writings of Rolfe on “the moat” and will do so in the context of Schmergel‘s LoopNet article “Investing in Mobile Home Communities: Advantages, Challenges and Responsibilities,” which quoted multiple past/current members of the Manufactured Housing Institute (MHI), including at least one Rolfe-Reynolds linked firm, Colliers International, and CBRE Manufactured Housing Group. The Affordable Communities Group is reportedly a member of the NC Manufactured & Modular Homebuilders Association and according to a previously published MHI page, the NC Manufactured and Modular Home Association is a MHI ‘state affiliate.‘ So, although the membership status of Affordable Communities Group as a direct (vs. indirectly through a state affiliate) is unclear due to MHI ‘hiding’ their membership list in recent years, they too have ties to MHI via one or more state associations, and something similar may be true of the other firms in Schmergel‘s LoopNet article, as Rolfe and Reynolds are on record as being members of multiple MHI-linked state associations. According to Oxford Dictionary a mashup is “a mixture or fusion of disparate elements.” Merriam Webster defines “the meaning of MASH-UP is something created by combining elements from two or more sources.” Left-leaning Bing’s AI powered Copilot said in a Q&A with MHProNews that: “Journalistic Fisking and Fact Checking are both methods used to scrutinize and verify information, but they have distinct approaches and purposes.” This report will include elements of a mashup, fisking, and fact-checking, and will do so in good measure through the lens of the paraphrases of remarks by Rolfe’s and Schmergel’s articles (provided below under fair use guidelines) to discern the facts-evidence-analysis (FEA) useful to those probing the manufactured housing industry or affordable housing in general, or the manufactured home community sector (MHC), or what Rolfe likes to at various times refer to as “trailer parks” or “mobile home parks.” It is Rolfe that borrowed the Warren Buffett terminology of “the Moat” and applied it several times to the MHC or “mobile home park” business. As the links to Schmergel and Rolfe reflect, MHProNews and/or our MHLivingNews sister site have explored Rolfe and “the Moat” on multiple occasions, so the prior reporting and research that follows should consider those apparently related articles and the evolution and depth of understanding of what they each stated and what it may mean in practical terms for the manufactured home industry and MHI.

As is common in articles like this on MHProNews, quoting in whole or part a source should not be construed as an endorsement of that source and/or its business practices by our publication or parent company. Their statements presumably reflect their views or editorial stance at the time that they were written. If nothing has shifted for the speaker/writer, those views may still hold for those individuals and businesses to this day. So, there can be historic, potential evolutionary, and current ramifications – business, ethical, and legal – for sharing these details.

One should keep in mind that in the now concluded Biden-Harris (D) era Department of Justice (DOJ) antitrust division top cop, Jonathan Kanter, said in a speech found at this link here that antitrust (anti-monopoly and monopolization or competition/consumer protection laws) said that those laws were “kitchen table” issues because they impact consumers. Kanter specifically referenced “the moat” as a reason for antitrust scrutiny. While some might say, that was then, and President Donald J. Trump (R) and Vice President J.D. Vance (R) are in executive branch leadership now, it should be recalled that Vance specifically mentioned Kanter and Lina Kahn favorably.

Isn’t it accurate to say that J.D. Vance spoke favorably about some of the policies of Jonathan Kanter and Lina Kahn in the antitrust field?

It was the Trump DOJ that initiated the most important anti-trust lawsuit: US v. Google.

JD Vance was among many – like Josh Hawley and Matt Gaetz — who effusively praised Lina Khan.

And many of Trump’s choices for FTC and DOJ are close to Khan on anti-trust enforcement: https://t.co/fhmk54VlzG

— Glenn Greenwald (@ggreenwald) February 18, 2025

Going forward with the stricter guidelines championed by former FTC Chair Lina Khan could indicate more robust enforcement of antitrust law than is typical for a Republican administration, attorneys said this week.https://t.co/KOyJdExGwX

— Corporate Counsel (@CorpCounsel) March 3, 2025

With those facts, insights, and preface, the plan for this report with analysis is as follows.

Part I – Frank Rolfe via Mobile Home University (MHU) – “Evidence Again That The Mobile Home Park “Moat” Cannot Be Breached.”

Part II – Frank Rolfe via Mobile Home University (MHU) – “Warren Buffett Disobeyed His “Moat” Mantra And Look What Happened.”

Part III – Frank Rolfe via Mobile Home University (MHU) – “An Unexpected Affirmation from Warren Buffett.”

Part IV – LoopNet’s Daniel Schmergel – “Investing in Mobile Home Communities: Advantages, Challenges and Responsibilities – How to Determine if This Sector is Right for You.”

Part V – Additional Information with More MHProNews Analysis and Commentary

Note that highlighting in what follows is NOT in the original, but the text as shown was provided via the “cut and paste” process used for Windows. The highlighting was added by MHProNews.

With that backdrop and no further adieu, and with God as our authentic copilot, let’s dive in.

Part I – MHProNews notes that the following is provided under fair use guidelines from the MHU website at this link here.

Evidence Again That The Mobile Home Park “Moat” Cannot Be Breached

About a decade ago I was at a mobile home park industry conference where a speaker gave a report on why single-family homes in the U.S. cannot be built at an affordable price. The reason was the high price of residential lots in most American cities, which average around $80,000 each. When you add the price of the home, the speaker remarked, there’s no way that even a small home could possibly go up for less than $150,000 or so. Recently a non-profit in Florida tried this unsuccessful strategy again and ended up with 900 square foot homes for over $200,000 which they claim was partially caused by lumber price increases as a result of the pandemic. But it all simply points out that the mobile home park “moat” of affordable detached dwellings cannot be breached in a modern America.

How do mobile home parks do it then?

Offering a detached dwelling for $1,000 to $40,000 would seem impossible in a modern world. But mobile home parks across America do it every day. Now, it comes with some strings, such as the $280 national average monthly lot rent. But let’s look at how the numbers stack up vs. a traditional stick-built home:

Type of Dwelling Price/Mortgage Property Tax (assume 2% of appraised value Lot Rent Total

Stick-built $200,000/$1,000/mo $333/mo. N/A $1,333/mo Mobile Home Park $10,000/$150/mo. $27/mo $280/mo $447/mo.

The bottom line is that mobile home parks can provide detached housing at roughly $1,000 per month less than the stick-built alternative. And, in the above example, it should be noted that the customer needs $1,000 for the down-payment on the mobile home and at least ten times that for the stick-built.

Why it offends people when they realize the brilliance of the mobile home park business model

For some reason, many find it offensive that mobile home parks are the only form of affordable detached housing in the U.S. Maybe it’s because of the failure of the stick-built industry to figure out how to do it, or perhaps it’s the American stigma against “trailer parks”. But, in many cases, it’s just professional jealousy and envy. I once was featured in a major media publication that was negative on the mobile home park business and then the writer said to me “off the record, do you really think that someone like me could buy a mobile home park – how would I go about doing that”. Of course, one way that the media gets back at the mobile home park industry is simply to ignore it when talking about the American affordable housing crisis. In every article or news story about the affordable housing crisis there is never a mention about mobile home parks, only stick-built homes and apartments.

Despite this reality, why there will never be any new parks built

The mobile home manufacturing industry – and certain people within it – are always talking about the concept that some day the U.S. government will intervene and allow new mobile home parks to be built. This is an interesting fairy tale in the same genre as King Arthur, but about as likely to happen. The reason that people say this (mostly home manufacturers or their agents) is to boost the incorrect assumption that the demand for new mobile homes will be endless when, in fact, most of the mobile home sales in the U.S. are from park owners who will end their orders once their properties become 100% occupied (which is already occurring in some part of the U.S.). So why won’t there actually be any new parks built in the U.S. in the years ahead? There are several reasons:

- The average American hates the concept of a mobile home park being built in their neighborhood. Some call this concept NIMBY which stands for “not in my back yard”. Since city politicians are the representatives of their constituency, that pretty much ends the argument right there. Without support, zoning administrators will not zone land for mobile home park development.

- The cities also hate mobile home parks as a land use just as enthusiastically as their constituency, although for different reasons. Their issue is that mobile home parks are not producers of big property taxes but cost a fortune in the form of school tuition, uninsured healthcare and other city services. Essentially, cities lose money with mobile home parks and then get nothing but negative feedback from developers who are scared off by their existence.

- It is a fact that single family homes located next to mobile home parks do, in fact, drop significantly in value, and this statistic means that that the NIMBY concern is grounded in fact.

- The federal government has no influence over city zoning, and the only places where they might have any influence at all are typically dangerous, blighted areas of cities in which there is not only no demand for affordable housing, but no demand for housing at all.

- For all the reasons above, there are only roughly ten new mobile home parks built annually in the entire United States. With roughly 100 being torn down for new development annually, mobile home parks are literally an endangered species.

Conclusion

No medieval castle has ever shared as impregnable a moat as mobile home parks. This one feature alone makes mobile home parks one of the safest investments in America – and this will never change going forward.

By Frank Rolfe

Frank Rolfe has been a commercial real estate investor for almost three decades, and currently holds nearly $1 billion of properties in 25 states. His books and courses on commercial property acquisitions and management are among the top-selling in the industry.

Part II – MHProNews has cut and paste the text of Rolfe’s article from MHU, a site he and Dave Reynolds have been associated with for years, under fair use guidelines for media from his post linked here.

Warren Buffett Disobeyed His “Moat” Mantra And Look What Happened

Paramount has struggled in recent years, suffering from declining revenue as more consumers abandon traditional pay-TV, and as its streaming services continue to lose money. The stock is in the red again this year, down nearly 13%. Buffett said the unfruitful Paramount bet made him think more deeply about what people prioritize in their leisure time. He previously said the streaming industry has too many players seeking viewer dollars, causing a stiff price war.

Warren Buffett’s Berkshire Hathaway bought around 63 million shares of Paramount in 2022 and then lost around 50% on that investment in only two years. Buffett admitted that where it all went wrong was in relaxing his standards regarding a “moat” – a wall that protects a good business from competition. Paramount had no “moat” and the competition destroyed it with shares plunging from $30 to around $13. We have always adhered to Buffett’s “moat” mantra and that’s why we’re in the mobile home park business.

Why there are virtually no new mobile home parks built in the U.S.

To develop property in the U.S. you have to have the correct zoning. And virtually every city in the U.S. has eradicated mobile home park zoning from its maps – starting in the 1970s. The reason? You already know the reason: nobody wants a mobile home park built near their home or business. You can’t blame them. A simple look at Zillow will show that a stick-built home next to a mobile home park is valued about 40% less than one a block away. American’s associate mobile home parks with crime and poverty and want nothing to do with them. But there’s an even bigger reason that nobody has heard about: they cost cities a ton of money. Mobile home parks often have large numbers of kids and kids cost large amounts of tuition (roughly $10,000 per child). Although mobile home parks pay their fair share of property tax, their high density of school-aged children means that the annual loss to the city between tax and tuition can exceed $1 million on a larger park. At a time when city budgets are in the red, there’s no way you’ll sell them on letting a new mobile home park be built.

And why this will never change

The only people who talk about the need for more affordable housing is the Federal Government. Besides being hugely unpopular throughout most of America, their ability to force cities to allow for more mobile home park is basically nonexistent. The only time the Federal Government has leverage is in blighted areas that require a ton of federal aid – effectively opportunity zones or worse. If you built mobile home parks in those areas you’d have no customers as nobody wants to live in that section of town – and everybody knows that. Marcia Fudge – the now resigned head of HUD under Biden – vowed to force cities to build more affordable housing for three straight years and, in the end, failed to get virtually a single unit built. That’s because zoning is a state’s rights issues and from there filters down to the rights of the individual county, city or town. And they have no interest in such concepts.

How this impacts mobile home park investing

When you own a mobile home park you own a piece of an endangered species and the rarity alone gives it lasting value. But when you look at the blessings of zero future new supply you start to understand why every major investment group in the U.S. has started to enter the mobile home park industry. There is not a single other sector that has no future supply option. It’s easier to get a permit to build a landfill than it is a new mobile home park. This means that your investment is safe and the value is always increasing as the demand for affordable housing in the U.S. skyrockets. It’s simply the laws of supply and demand and mobile home parks win this equation every time.

At least Buffett got it partially right

It’s worthwhile to note that Warren Buffett’s Berkshire Hathaway is also a player in the mobile home sector, only in the manufacturing and financing side of the homes themselves. While this part of the industry does not share the attractive “moat” option, the fact that mobile home parks are set in stone does allow for the homes that Buffett finances in mobile home parks to hold their value and have very little in losses in the rare occasions when those homes default and are foreclosed on.

If you are in an investment that has no “moat” right now you’re in real trouble

Maybe you believe in the fantasy of a “soft landing” but just about 100% of actual economists do not share that opinion. The only question is if it’s going to be a recession or a depression. In either case, abundant supply leads to misfortune. Just look at the self-storage sector, for example, which has declining rents and occupancy due to massive overbuilding during Covid – and the recession has not even started yet. Why do you think Buffett sold Paramount now? It’s because he knows that an economic downturn is imminent and he wanted to unload those 63 million shares while he still could. The “moat” is what will protect mobile home park investments when the recession hits and allow them to flourish when all other sectors tank.

Conclusion

Warren Buffett is correct that a “moat” is the most important attribute of any investment. He violated his own code and got burned by it. Mobile home parks are perfectly situated for the coming U.S. recession and will be one of the few success stories in the years ahead.

By Frank Rolfe

Frank Rolfe has been an investor in mobile home parks for almost 30 years, and has owned and operated hundreds of mobile home parks during that time. He is currently ranked, with his partner Dave Reynolds, as the 5th largest mobile home park owner in the U.S., with around 20,000 lots spread out over 25 states. Along the way, Frank began writing about the industry, and his books, coupled with those of his partner Dave Reynolds, evolved into a course and boot camp on mobile home park investing that has become the leader in this niche of commercial real estate.

Part III – MHProNews has cut and paste the text of Rolfe’s article from MHU, a site he and Dave Reynolds have been associated with for years, under fair use guidelines for media from his post linked here.

An Unexpected Affirmation from Warren Buffett

Warren Buffett hasn’t been buying much lately – noting that the stock market has no bargains — but apparently, he quietly has been loading up on housing stocks – placing big bets that housing is the strongest part of the economy going forward. So why is Warren Buffett putting so much money into the U.S. housing industry at a time in which he earlier declared that “the incredible period” for the American economy has ended and projecting lower net income for all businesses going forward?

Betting on Necessities

When Warren Buffett told his shareholders that the “incredible period” for the economy had ended, he could not have been more clear that a U.S. recession is approaching. Most economists expect the recession to be formally announced at the end of the second quarter of 2024. And in times of recession, the only businesses that do well are “necessities” – things that people cannot do without. These categories are founded on food and shelter. To invest in the U.S. housing market is a clear shift to betting on necessities over luxuries and a telltale sign that bad times are coming.

Banking on the Inherent Housing Shortage

Warren Buffett has always been a proponent of the concept of investing only in industries that have a “moat,” which protects them from competitors. And one of the largest “moats” in America is the numerous barriers to entering the housing business. It’s virtually impossible to build a single-family home today for under $250,000. That’s the new entry price for new household formation. And to even hit that number you have to build in a large scale, which only the publicly-held builders can perform. And even then you have to find land which has access to utilities and the zoning to build on, in just the right location where there is demand. Unlike the 1950s where you could build new neighborhoods virtually anywhere, the modern housing market is stifled with giant roadblocks and scarcity of available land and builders who can deliver on lower price points.

Knowing that Affordable Housing is the Key Sector

You have two main sectors of the housing industry: 1) luxury and 2) affordable. While the average single-family home in the U.S. costs $400,000, those buyers are predominantly Baby Boomers (born between 1946 and 1964) who use the sale of prior homes to fund the purchase. And for new households buying their first home, there is a very limited supply of homes at their affordability level of around $250,000. That’s the highest price a younger two-income couple can afford, needing roughly $100,000 in combined annual earnings to qualify for the mortgage. While the luxury housing market can be fickle – with Baby Boomers often deciding just to sit out upgrading their home – the younger and newer household formations don’t have that option. As a result, Buffett appears to be betting on the affordability sector of the single-family housing market because he knows that the demand will always be there, as will the “moat” on supply.

This Is a Repeat of 2003 for Buffett

Many investors have forgotten Warren Buffett’s big move in 2003 when he purchased Clayton Homes for around $1.7 billion. He knew that the affordable housing sector would always be hot and figured that mobile homes offered the lowest price-point in U.S. housing. He additionally purchased, as part of that transaction, Vanderbilt Mortgage and 21st Mortgage, which are the dominant financiers of new mobile home purchases. This pure-play on the most basic affordable housing product has worked well for Berkshire Hathaway and the latest purchase of single-family home stocks is simply a repeat of 2003.

How This Relates to Mobile Home Parks

When the storm clouds hit the U.S. economy in 2024, housing will be the lone bright spot. Buffett intends on being a big player in both the mobile home market as well as the single-family home sector. Buffett’s firm, Berkshire Hathaway, does not buy real estate because it does not have a REIT designation (which he has pointed out in many interviews) but if he did have the freedom to buy mobile home parks, he would. Anything housing related will be a winner in the looming crash, and mobile home parks represent the most affordable option in the U.S.

Conclusion

We have been writing for months now about how the U.S. economy is about to collapse into recession and how the housing market will be the sole survivor of this turmoil. We have long advocated affordable housing as a contrarian bet on a failing U.S. economy. And now it appears that Warren Buffett agrees with all of this and is making big bets and apparently affirming our logic.

By Frank Rolfe

Frank Rolfe started his billboard company off of his coffee table, immediately after graduating from college. Although he had no formal training on the industry, he learned as he went, and developed his own unique systems to accomplish things, such as renting advertising space. Frank was formerly the largest private owner of billboards in Dallas/Ft. Worth, as well as a major player in the Los Angeles market.

Part IV – LoopNet’s Managing Editor Daniel Schmergel wrote “Investing in Mobile Home Communities: Advantages, Challenges and Responsibilities – How to Determine if This Sector is Right for You” found at this link here and provided under

Investing in Mobile Home Communities: Advantages, Challenges and Responsibilities

In this two-part series, LoopNet is providing an overview of the mobile, or manufactured, home community sector — one of the least understood and most intriguing real estate asset classes. Part one focused on the history and evolution of the asset class and considered the opportunities that exist for small private investors. Part two, presented below, centers around key investment criteria, relative strengths and challenges and approaches to responsible ownership.

When we left off at the end of part one of this series, Frank Rolfe, a private investor who is one of the largest owners of mobile home communities in the United States and the co-founder of Mobile Home University, was about to detail his key investment criteria for mobile home communities. So, without further ado:

Investment Criteria for Mobile Home Communities

Rolfe noted that the first mobile home community he purchased, in 1996, taught him what to avoid in communities going forward. Based on that experience, he delineated the five most critical items that he believes investors, particularly those new to the sector, need to consider:

- Infrastructure: Rolfe says that good infrastructure is paramount. He cautions against private septic or wastewater systems and wells, in particular, and he encourages investors to seek out communities with municipal water and municipal sewer access. Similarly, he is generally opposed to master-metered gas or electric systems, which essentially require a mobile home community owner to become a private utility. Managing mobile home communities’ energy use is particularly challenging given that modern manufactured homes utilize considerably more power than the older homes did, which can put a strain on existing systems and lead to costly repairs and upgrades.

- Density: According to Rolfe, the ideal density for a mobile home community is about seven units per acre. That enables the operator to put the largest possible double-wide or single-wide home on every lot. Some older communities have densities between 10 and 15 homes per acre, which is not ideal, but workable. However, some communities exceed 20 homes per acre. At that density, it won’t be possible to replace outdated, vacant units with modern homes, as they will be too large. In addition, you could run afoul of the local fire marshal. Technically, they require a 10-foot separation between homes for safety, and they possess the authority to shut down the community if the density doesn’t allow for that distance.

- Location: As with any real estate investment, location is a pivotal consideration when evaluating a mobile home community. Rolfe prefers to focus on communities that are either in upscale suburban locations — mostly populated with detached homes, in well-regarded school districts and featuring vibrant retail amenities — or in urban settings that are experiencing a renaissance and undergoing gentrification. He suggests that investors should avoid rural locations, or suburban locations that aren’t in good school districts.

- Age of the homes: Rolfe believes it is important for investors to consider the age of the existing homes in the community. Homes that were built prior to 1976, i.e. pre-HUD, are less than 14-feet wide, which makes them rather claustrophobic; they also lack modern amenities, such as washers and dryers. Accordingly, if a lot renter vacates one of these homes, it will need to be replaced, rather than repaired and renovated. If the park has a preponderance of pre-1976 units, this could create significant expenses for an investor in the future. On the other hand, Rolfe was quick to point out that you don’t want all of the homes in the community to be brand new, either. Brand new homes are, most likely, still being paid for, which means there’s a greater risk of the occupant defaulting on their mortgage, which would leave the community owner with an empty lot, or even mortgage payments, depending on how the loan was underwritten. Rolfe believes that the ideal scenario is a community populated by relatively modern homes that are already paid for.

- Economics: Rolfe suggests that the cap rate on the community should be roughly three points higher than the interest rate on the investor’s loan, assuming 70%-80% leverage. According to Rolfe, this spread will usually enable an investor to garner a cash-on-cash return of approximately 20%. On more desirable properties, Rolfe noted that you may need to factor potential upside from rent increases into your model in order to reach the recommended cap rate threshold.

While Rolfe’s criteria may serve as a framework for investors, it’s worth noting that other sources adhere to somewhat differing investment principles. For instance, Mike Conlon, CEO of Affordable Communities Group, said that, like Rolfe, he initially avoided mobile home communities that lacked access to public utilities, but he eventually revised that position, “because everything’s fixable.”

Conlon went on to say that location is his primary concern when evaluating a mobile home community. “I’m always going to buy a park that’s within 20 minutes of a major metro. And the reason I do that is my belief [that] all multifamily, whether apartments or mobile home parks, is about jobs.”

Nonetheless, he acknowledged that there are opportunities for investors in mobile home communities located in smaller, more tertiary markets. In those instances, Conlon suggested that it’s important for the investor to have firsthand knowledge of the local market and be comfortable with the area’s long-term employment prospects. Entering into a situation where a single employer — a local factory, for instance — is responsible for the majority of the jobs in the area could be precarious.

In general, Conlon’s view of the overall market was a bit more cautious than Rolfe’s. “It’s a tough market right now and there’s obviously a lot of advantages … with mobile home parks, but the prices are way higher than they used to be. It feels a lot to me like ’07, where even mobile home parks in Florida got way too [expensive] and people made mistakes.”

Nonetheless, everyone in the industry that LoopNet spoke with, Conlon included, remained largely, if guardedly, optimistic about the future prospects of the sector. If anything, as Conlon observed, the industry seems poised for growth. “New homes that we’ve brought in are all sold out for three months. We don’t even have them on the ground yet, and we have deposits; people who are downsizing [from conventional houses] are coming to us to buy these new homes,” he said.

Michael Nissley, executive managing director and national director of the Manufactured Housing & RV Group at Colliers International, put it even more succinctly: “I’m very bullish on the mobile home park industry.”

The Advantages of Investing in a Mobile Home Community

In articulating the relative advantages of investing in mobile home communities compared to other real estate assets, Rolfe referenced Warren Buffet’s moat analogy, in which a moat represents the circumstances that protect your investment.

“We’re the moat kings. We’re like a castle where there’s a moat, and there’s another moat behind that moat and then another moat,” Rolfe said.

More specifically, based on LoopNet’s reporting, we identified five primary advantages to investing in mobile home communities: limited maintenance and personnel costs; decreased turnover; the unlikely benefits of a bad reputation; significant upside potential; and a contrarian attitude.

Limited Maintenance Expenses and Responsibilities

Conlon began his foray into the real estate industry by investing in multifamily apartment complexes. Within a few years, he had acquired approximately 500 units, but he struggled to grow his business beyond that threshold, largely because of the maintenance-intensive nature of traditional multifamily assets. In 2005, he purchased his first mobile home community, and a year later he sold the apartment complexes and plunged headlong into investing in mobile home communities, which he says are simply “a lot easier to manage.”

To illustrate the minimized maintenance burden, Conlon told LoopNet that, of the 43 communities that he owns, only four of them feature a full-time maintenance employee. “In apartments, anything over 60 [units] required a full-time, certified [air conditioning technician], and those guys were tough to maintain and hold, so that was a big issue for us. We didn’t want to be beholden to those people, so the mobile home park makes it much easier from that perspective,” Conlon said.

Rolfe concurred with Conlon’s perspective. “It is just land rental … You don’t have to get involved in the homes, you don’t have to fix toilets and things. The stuff that people hate about [maintaining] apartments, we don’t have to [deal with], because we just rent land.”

Less Turnover

One of the most significant costs that owners of traditional multifamily complexes contend with is turnover. “By nature, apartments are more transitory, and they have anywhere between 40% and 50% turnover on an annual basis,” Conlon said. Conversely, Conlon told LoopNet that the annual turnover in his mobile home communities is approximately 15%.

“Mobile home parks tend to be [populated by] more long-term residents. The resident typically owns their home, so … they’re sort of invested in the property and they tend to stay longer. And you can develop a community that way,” Conlon said.

Norm Sangalang, a Senior Vice President with the CBRE National Manufactured Housing & RV Resorts (MHRV) Specialty Practice, concurred with Conlon. “At a stabilized occupancy level, the continuity of [mobile home community] occupancy is highly consistent and very durable.”

The relatively low level of turnover directly impacts an investor’s returns. As Conlon remarked, “Turnover costs you money, because you have to change the unit, fix up things, whatever; the lower the turnover, the better.”

When a Bad Reputation Is a Good Thing

Investors in mobile home communities need to possess a certain boldness; a willingness to venture where other investors might fear to tread, and that’s part of what makes the sector potentially rewarding.

As Rolfe put it, “The U.S. media has such an entrenched stereotype they have built about how terrible trailer parks are that most people won’t even look at investing in them.”

This bad reputation has also significantly constrained new development in the sector, which decreases the potential for unexpected competition. In fact, Nissley noted that many municipalities have even attempted to reduce the number of existing communities. He estimated that Miami-Dade County was home to as many as 500 mobile home communities at one point; today, he approximated that less than 75 of those communities remain. While Nissley acknowledged that some of those communities were destroyed by hurricanes, he believes that many were the victims of municipal agendas.

That phenomenon is not limited to Miami-Dade County either. According to Rolfe, “Supposedly, there’s about 10 [mobile home communities] built per year, and there’s about 100 torn down [in the United States], so we’re actually an endangered species.”

Significant Upside Potential

Lot rents at mobile home communities have trailed inflation by a considerable margin over the last 50-60 years. “The average lot rent in America is believed to be about $280 per month, and the average lot rent in 1960 was $500 a month in today’s dollars,” Rolfe said. That creates potential upside for investors.

There’s also the potential for long-term development opportunities in some regions. Nissley commented that some investors approach mobile home communities as a land investment, with the added benefit of an existing income stream. “Some people view mobile home parks as a land bank, and there’s a few investors in this business that just look at it that way. And their analysis [involves] a bit more than just the going-in cash flow and how can they improve the cash flow. They’re looking at the broader market; they’re looking at land prices; they’re looking at likely zoning for that particular area, and land use and density.”

Market Resilience

While LoopNet is hesitant to label any asset class as recession-proof, mobile home communities might almost warrant such a designation (emphasis on “almost”).

“During good times and bad … manufactured housing seems to be weathering the storm very, very well,” Nissley remarked.

In fact, according to Rolfe, the industry verges on contrarian, and can often perform better during intervals when the broader economy is experiencing economic distress. “Our sales pick up when people are doing poorly and they need more affordable housing,” Rolfe said.

Nissley went on to say that the sector’s stability is a feature it shares with multifamily and single-family homes — it fulfills a fundamental need. “Being primary housing, where someone lives, from a default perspective, you’re probably going to get rid of your boat, your car, possibly your office, before you get rid of your house.”

Nissley continued, “From that perspective, affordable housing is probably among the safer places to be in this market.” Nissley further observed that the CMBS data from recent market corrections supports this thesis, with mobile home communities and multifamily complexes outperforming other asset types.

The Disadvantages of Investing in a Mobile Home Community

The preceding benefits notwithstanding, mobile home communities, like any investment, come with their share of risks and challenges. Based on LoopNet’s reporting, the most notable potential issues that investors should be prepared for are the cost of replacing homes, skeptical (at best) municipalities, sketchy record-keeping practices and a degree of culture shock.

The Burdens of Home Replacement

According to Nissley, the most significant change in the mobile home industry over the last 20 years, from a community owner’s perspective, is the manner in which new homes are brought into the community. In the event that there is an existing empty lot, or a vacancy develops, the capital expense of purchasing new mobile homes or refurbishing existing units has often shifted from the lot renter to the owner of the community. “The number one thing that requires additional capital to this industry and that changed the business model was the need for an owner/operator of parks to fill [lots] or rehab the homes in the parks themselves, with their own balance sheet.”

While initiatives such as 21 Mortgage’s CASH program (discussed in part one of this series) endeavor to minimize this burden, they still require the owner/operator of the community to advertise the home and show it to potential purchasers. Further, in the event that the homeowner defaults on their mortgage, the owner of the community becomes responsible for the mortgage payments and upkeep of the home until they can secure a new purchaser.

Sangalang noted that the lack of robust financing options for mobile homes fosters this paradigm. “The purchase of individual manufactured homes has a much smaller pool of lenders, which is a proportionally much smaller percentage of the overall housing market. The scale of traditional housing loans provides a broader and more competitive lending market that leads to higher efficiency,” he said.

While Conlon sees a value-add opportunity — i.e., the ability to increase cash flow through improvements — in bringing new homes into a community (as outlined in part one), Nissley notes that investors need to proceed carefully. “The liability of maintenance and repair of a park-owned home can sometimes exceed your revenue, if you’re not careful.”

Uncooperative Municipalities

Mobile home communities are often subject to challenges from their local municipalities. Accordingly, Nissley says that it’s critical for prospective investors to grasp the zoning regulations and general attitude towards mobile home communities in the municipality where they are investing. In particular, Nissley says that investors will need to understand the difference between mobile home communities that are conforming and those that are nonconforming.

Conforming means that the property is legally zoned and currently operating as a mobile home community. However, over time, particularly in urban areas, some mobile home communities have had their land use or zoning changed by the municipality. This is because, possibly due to urban sprawl, the municipality no longer believes a mobile home community is appropriate for that area. Even if a park is technically zoned appropriately, or at least was at one time, it is considered legally nonconforming if the zoning or land use changes. While the existing homes are grandfathered for their current use, a community owner could be restricted from making any changes to the community, such as adding amenities or moving in new homes.

Rolfe suggests that the real issue that local governments have with mobile home communities isn’t necessarily the product type, but the lack of tax revenue that mobile home communities generate compared to other uses, such as office, retail or single-family housing. Regardless of the reasoning, Rolfe says that investors must ensure that their certificate of zoning and all required permits are in order to avoid any municipal complications.

Increased Research and Due Diligence

While the lack of consolidation in the mobile home community sector can create opportunities for investors, it also presents challenges. Finding communities to purchase can require some digging. And, even once a potential community is identified, investors shouldn’t expect that all of the records will be straightforward, or even available.

Because many smaller, or so-called “mom and pop,” owners don’t have any debt on the properties, they aren’t required to produce reports or keep computerized records. Even rent rolls could be hard to come by. “It’s not uncommon to ask the seller, ‘can I see your financials’… and it’s basically a spiral notebook with numbers written in purple crayon,” said Rolfe.

“Sometimes I’ll take over a park, I’m buying one right now on the west side of Charlotte, where there aren’t any records, there’s no leases, everything was sort of done in cash … that’s the type of thing you’re going to run into occasionally,” Conlon said.

Such obstacles are by no means insurmountable, but they do require particularly astute due diligence on the part of the investor.

Culture Shock

It’s a delicate issue, but it would be disingenuous not to acknowledge that mobile home communities are different than most other real estate asset classes that a typical investor may consider.

As Rolfe pithily noted, “The average American never goes into a mobile home park.”

Nissley observed that mobile home community ownership, more often than not, “comes with hardship.”

Rolfe went on to say, “It is a strange industry, and it takes a while to get used to it. There’s some degree of culture shock for anyone entering the industry, myself included. Unlike most other real estate sectors where you feel like you kind of, sort of, understand it, unless you’ve lived in a mobile home park, you don’t.”

Conlon cautioned that, “You need to understand that it’s a group of people that’s pretty much been kicked to the curb their whole life, and they can be sensitive about certain issues, especially rent raises.”

Or, to frame it from another perspective: mobile home community ownership comes with a unique set of responsibilities that a prospective investor should be aware of.

The Tenets of Responsible Mobile Home Community Ownership

The responsibilities of a mobile home community owner will vary depending on the particular community. Some communities are completely NNN, with pass-throughs for every expense, up to and including real estate taxes; while other communities are full-service, with the owner/operator involved in every facet of the community, including ownership of the homes themselves.

In most instances, though — assuming the community owner has no responsibility for the actual mobile homes, and they are just collecting lot rent — Rolfe indicated that the following items typically represent the core areas of responsibility for a mobile home community owner:

- Providing an uninterrupted flow of utilities, including water, sewer, electric, cable television, internet, etc.

- Maintenance of roads

- Providing sufficient ambient lighting throughout the community

- A well-maintained entry and signage

- Enforcement of community rules and zero tolerance for the breaking of laws

- Annual permit renewal (in some states)

- Snow removal throughout common areas, including entrance/exit (if applicable)

- General common area maintenance

It’s worth noting that Rolfe is a somewhat controversial figure within the industry, with a penchant for sometimes speaking indelicately about the sector and its customer base. However, in LoopNet’s interactions with him, Rolfe, as well as Conlon, emphasized the unique responsibility mobile home community owners assume.

“If we are anything, we are a solution, not a problem, because we are the only folks providing actual affordable housing in the U.S. … we are the only nonsubsidized affordable housing that exists,” Rolfe said.

Conlon said that he has developed a playbook for when he acquires distressed communities that is focused on creating a sense of camaraderie at the properties. This typically comprises removing any tenants whose behavior is detrimental to the community; repairing or replacing aged homes; and installing new amenities, including soccer fields, playgrounds, etc.

Rolfe echoed these notions, “We put in a lot of picnic tables, a lot of grills, a lot of playgrounds. We took old, abandoned facilities in parks … brought them back to life, made them into community centers. We had a park in Iowa where we put in a library with computers.”

Conlon reduced his basic philosophy to a single sentence, “Keep reinvesting in your community; that’s the number one thing you have to do.”

Rolfe felt similarly, saying, “As long as you go in with a positive attitude that, ‘as long as I’m in the business, my goal will be to profit from making things the best they can be,’ that’s a winning strategy, because then everyone’s happy with the end product. The residents, the city, the future buyer, the banker, the appraiser — that’s the only way you can get universal happiness.”

Part V – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following facts, evidence, and arguably relevant information and insights.

1) In a Q&A by MHProNews with Copilot on 3.6.2025 was the following.

Frank Rolfe has used the Warren Buffett “moat” terminology. Jonathan Kantor, specifically said that the “moat” can be a term used to describe monopolistic or possible antitrust-violating behavior, right? Rolfe has also said “If you like having a monopoly, holding all the cards, knowing the tenants won’t move their homes out, never worrying about someone building a new property near you and taking one of the tenant’s biggest assets if they default, then you’re going to love mobile home parks.” One, provide several examples of Rolfe speaking in such terms and two is there any known evidence of Rolfe or his partner Dave Reynolds ever recanting on those stances?

Frank Rolfe has indeed used Warren Buffett’s “moat” terminology to describe the competitive advantages of owning mobile home parks. Here are several examples of Rolfe speaking in such terms:

- Applying Warren Buffett’s Key Investing Concepts To Real Estate: Rolfe discusses the concept of a “moat” as a barrier to competition, highlighting how cities have not allowed new mobile home parks to be built for over 50 years, creating a strong moat for existing parks.

- Warren Buffett Disobeyed His “Moat” Mantra And Look What Happened: Rolfe emphasizes the importance of having a monopoly and holding all the cards, knowing that tenants won’t move their homes out and not worrying about new properties being built nearby.

- The “Moat” Keeps Getting Wider And Deeper: Rolfe talks about the increasing strength of the moat around mobile home parks, making it harder for new competitors to enter the market.

Regarding evidence of Rolfe or his partner Dave Reynolds ever recanting on these stances, there is no known evidence that either of them has recanted their views on the competitive advantages and monopolistic aspects of owning mobile home parks. They continue to promote these ideas through their Mobile Home University and other platforms.

: : : :

2) Let’s observe that Rolfe at times uses hyperbole or exaggeration to make his points. Using his figures should not be considered as a sure bet as being accurate. With hyperbole or exaggeration in mind, note that if the quote that follows from Rolfe from Part I above has a useful point, if not pressed literally. Namely, this.

“In every article or news story about the affordable housing crisis there is never a mention about mobile home parks, only stick-built homes and apartments.” – Frank Rolfe

Despite this reality, why there will never be any new parks built

The mobile home manufacturing industry – and certain people within it – are always talking about the concept that some day the U.S. government will intervene and allow new mobile home parks to be built. This is an interesting fairy tale in the same genre as King Arthur, but about as likely to happen. The reason that people say this (mostly home manufacturers or their agents) is to boost the incorrect assumption that the demand for new mobile homes will be endless when, in fact, most of the mobile home sales in the U.S. are from park owners who will end their orders once their properties become 100% occupied (which is already occurring in some part of the U.S.). – Frank Rolfe

MHProNews and our MHLivingNews sister site have previously explored Rolfe’s urging community operators or others to “never” build/develop new communities.

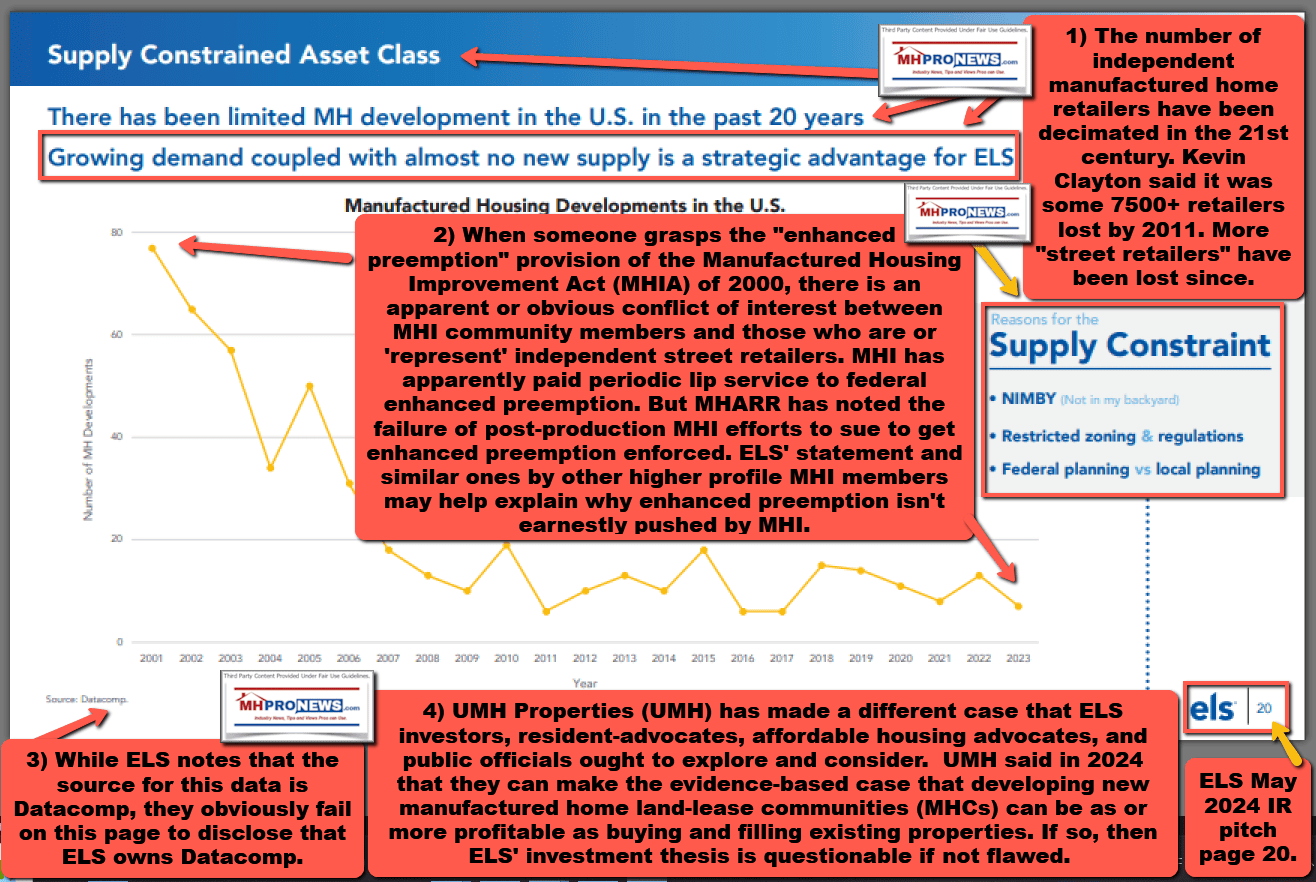

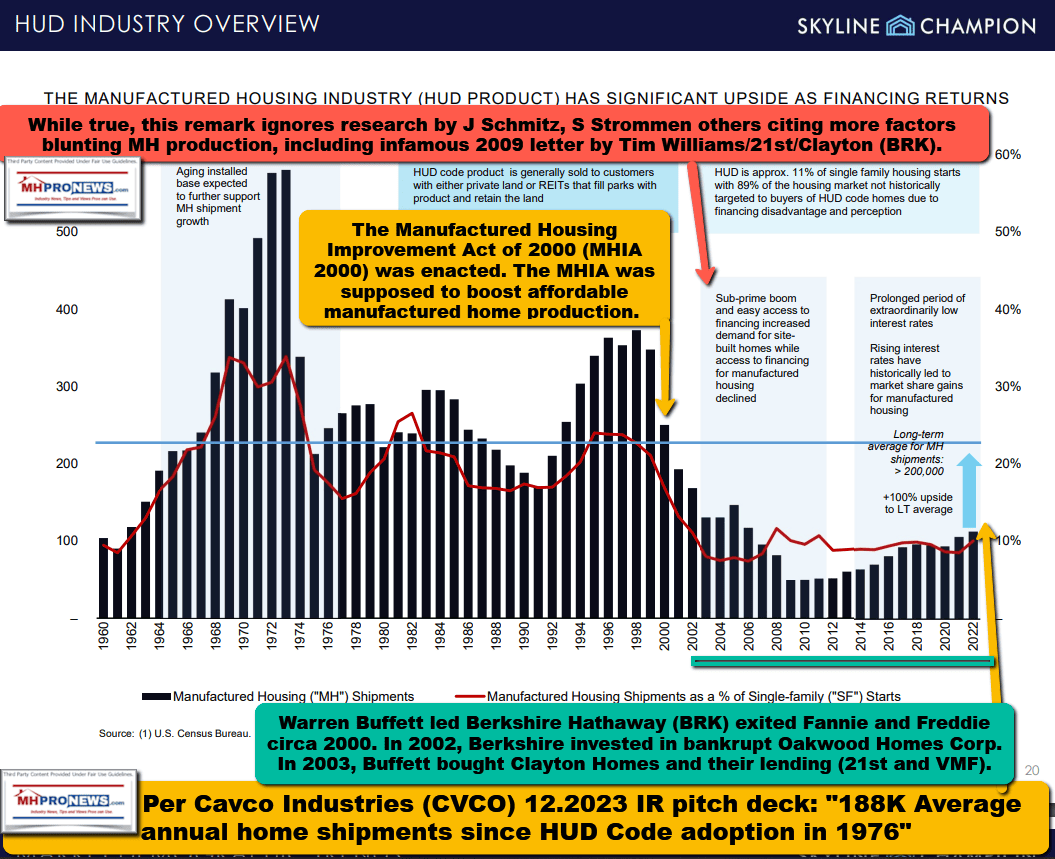

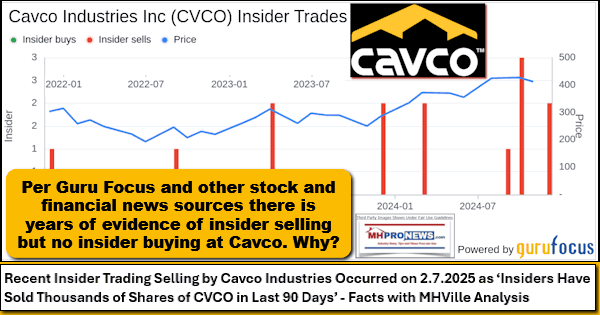

3) Again, Rolfe exaggerated (at best, is paltering or engaging in spin, propaganda, etc. or potentially worse is making an open push for market manipulation that could violate antitrust, RICO, or possibly other laws) when he said “there will never be any new parks built.” There are and have been new communities built every year before, during, and since that remark. Who said? How about fellow MHI members Equity LifeStyle Properties (ELS) and Sun Communities (SUI) in their investor relations (IR) pitches for some time. Since those IR presentations or “pitch” is supposed to be “materially accurate,” per the Securities and Exchange Commission (SEC), it should be safe to presume that Rolfe is factually wrong, and ELS and Sun are correct. More accurately, in the 21st century, there has been a dramatic curtailment of the development of new communities, although expansions of existing MHCs are reported by those firms and others on a routine basis when adjacent land for development exists. As the first illustration from ELS below said: “Growing demand coupled with almost no new supply is a strategic advantage for ELS.”

4) Note that the annotation to the ELS IR page is added by MHProNews. ELS also gave three bullets for “Supply Constraint” that include NIMBY, Restricted zoning and regulation and federal planning vs. local planning.” While this clearly contradicts Rolfe’s claim of “never,” when his apparent exaggeration to push his thesis is accounted for, Rolfe, ELS, Sun, Flagship, and others in that camp are behaving in an arguably similar way. Namely, they are consolidation existing properties while their behavior, advocacy and support are largely in the direction of maintaining this status quo which in their respective statements supports their business models.

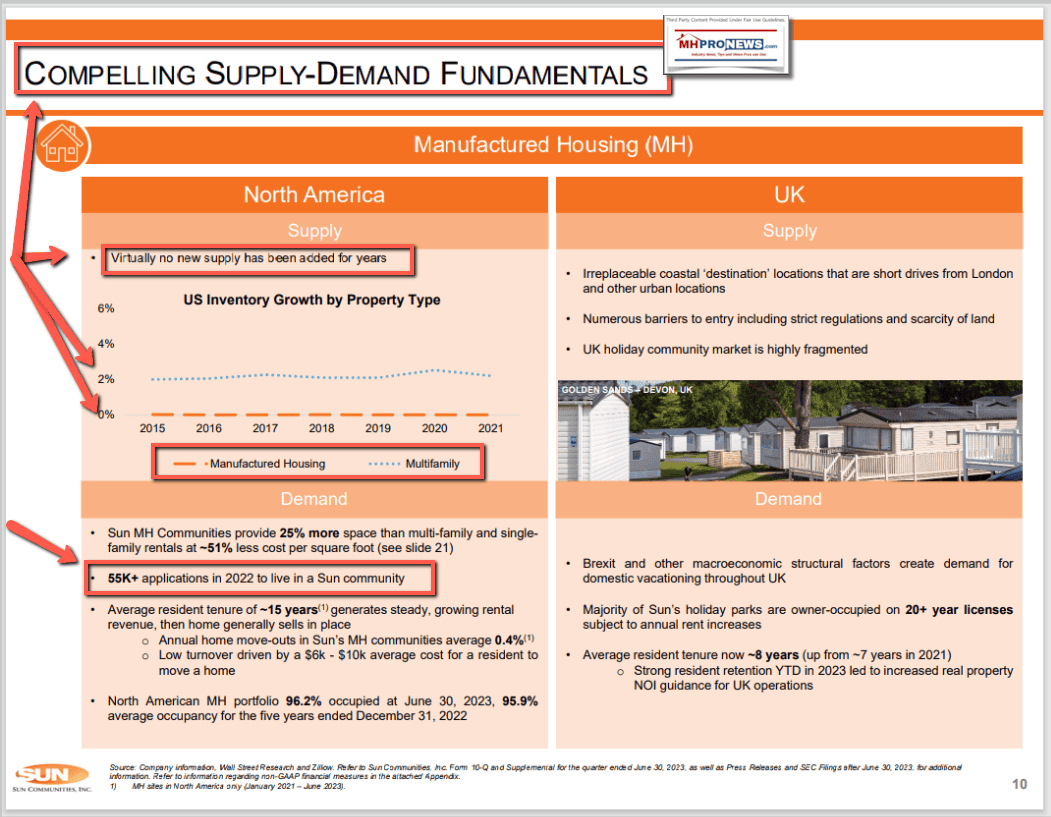

5) In the example from Sun Communities (SUI) below, this screen shot with annotations (orange arrows, boxes around certain remarks added by MHProNews, it said. “Virtually no new supply [of land lease manufactured home communities or MHCs] has been added for years” That statement is made under a heading similar to ELS’, namely, “Compelling Supply-Demand Fundamentals.”

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

6) With respect to Sun, the Rolfe/ELS thesis was curiously challenged by a remark by their controversial corporate leader, Gary Shiffman, during an earnings call.

To underscore, as the quote-graphic of Gary Shiffman above said, is this statement.

“Drew, it’s Gary. There certainly is and it’s certainly the West Coast, certainly right up to the Northwest is area of concentration where we feel, we can actually develop communities to a better return for our shareholders than buying them at the cap rates that they’re trade at currently.”

That quote by Shiffman is important for several reasons and is apparently ignored by Rolfe and LoopNet’s Managing Editor Daniel Schmergel in the article posted above. Ironically, Rolfe’s point about mainstream media appears to be a case of one finger pointing out while three are pointing back at him and Schmergel, since the opportunity to develop more profitably than acquiring, upgrading, and filling existing communities – i.e.: consolidation of existing properties. Note there will be more evidence of Shiffman’s remark further below to support the notion that: “we can actually develop communities to a better return for our shareholders than buying them at the cap rates that they’re trade at currently.”

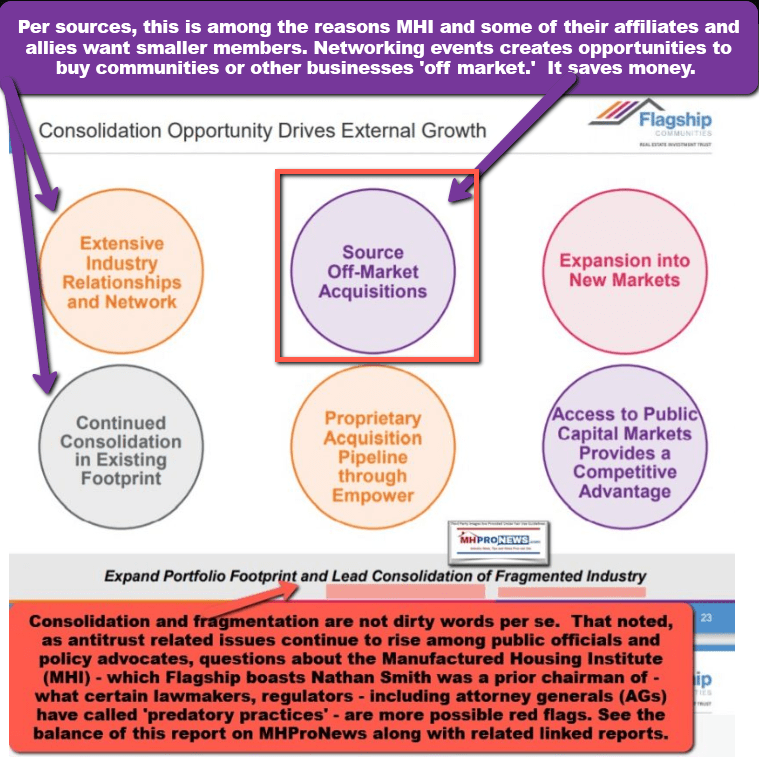

Why does that matter? Because Rolfe and Schmergel appear to consciously or unconsciously be pushing a narrative that when it is carefully examined in the light of known facts is not accurate. Before pushing on to evidence for that (8), let’s note what another higher profile MHI member firm, Flagship Communities has similarly said.

7)

So, Rolfe, ELS, Sun, and Flagship – among others – are clearly focused on consolidation. MHI’s National Communities Council (NCC) division essentially was demonstrating that too for a while via periodic press releases they issued like the one below. Note that when MHProNews began to reference that in articles, MHI apparently suspended those press releases that documented the trends of MHC consolidation. Note that MHP Funds is associated with Frank Rolfe and Dave Reynolds. SSK Communities has since rebranded as Flagship Communities. Flagship co-founder Nathan Smith has been publicly ripped by Frank Rolfe, but curiously, in a manner that once again is arguably a case of one finger pointing out while 3 more are proverbially pointing back. Smith is a former MHI chairman and still holds significant sway on various MHI and other boards, MHI PAC and related endeavors.

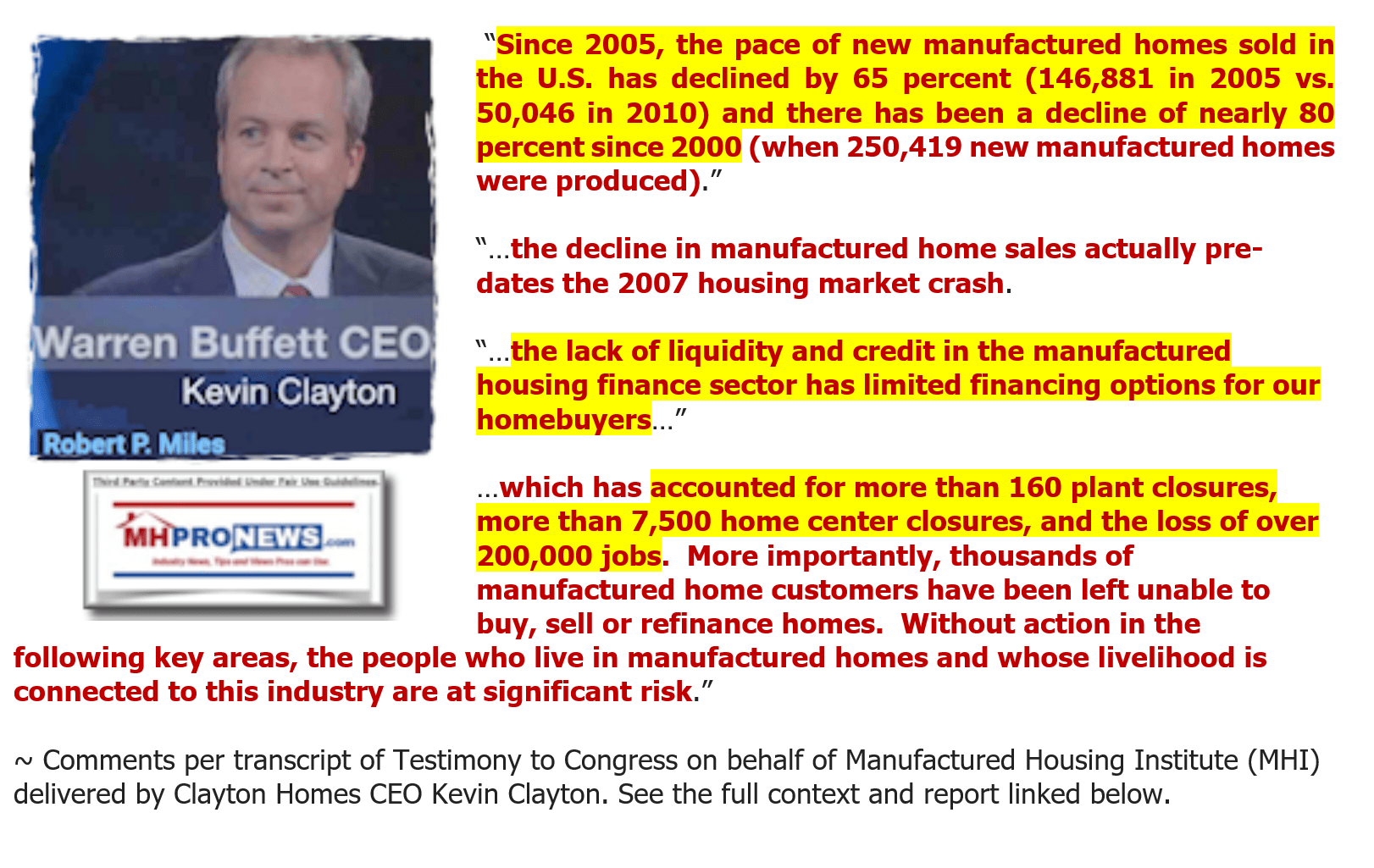

8) For the detail minded that can connect the dots note that a picture is already beginning to emerge. On the one hand, Rolfe and LoopNet’s article by Schmergel are pushing a narrative that land-lease manufactured home communities (MHC – but which Rolfe may refer to as a “mobile home park(s)” or “trailer park(s)” can be a good business investment. Fair enough. But Rolfe and Reynolds hold bootcamps for a fee. They profit by their ‘education.’ Others do similarly. Their mantra is, as the above has illustrated, that there is very little development and perhaps more closures of older/existing land lease communities than there are new ones being developed. Because of the vacancies that occurred in thousands of communities during the post-1998 industry meltdown one man’s (or couple’s or woman’s, partners, etc.) problem of declining occupancy, plus a decline in the number of retailers that used to keep those communities relatively or completely full, became someone else’s opportunity. It is much like a picture puzzle where the puzzle pieces have to be properly lined up based on known facts, evidence, and clear-eyed analysis. Keep in mind that the Kevin Clayton quote that follows may be broadly accurate but may nevertheless be paltering in the Harvard sense because some key insights are omitted.

9) So, as so called “mom and pop,” family-owned, or relatively modest partnerships existed that where once common in the manufactured housing community (MHC) side of the industry, or even in manufactured home retail and production too. But as the ‘weaknesses’ in the market were spotted by Buffett, Clayton, and those in that “moat” minded orbit, the industry found itself increasingly underperforming for (in hindsight) apparently obvious reasons. Zoning barriers. Image issues. A lack of competitive retail or wholesale financing. The industry’s business model in from its origins through to the late 1990s featured “mom and pop,” family-owned, or modest partnerships that in some instances over time grew into larger firms such as “old” Skyline, Champion, or Fleetwood. Those smaller and larger firms operated in a more or less competitive environment that was good for consumers and good for investors and smaller businesses too. What consolidation that occurred in the 20th century largely and arguably paled compared to what has taken place in the 21st century. Who says? The quotes and evidence from an array of sources, including ones like those that follow or are linked from this report.

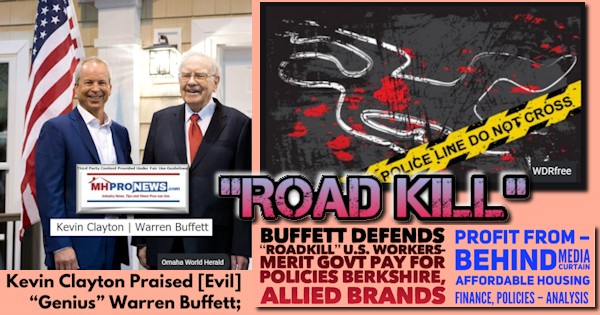

10) As longtime Buffett ally William “Bill” Gates III put it, “he [Buffett] found imperfections in terms of markets” and he “buys and sells things” – businesses and stocks – in a way “that’s not value added to society, that’s a zero-sum game that is almost parasitic.”

11) That may be what Kevin Clayton called Buffett’s [evil] “genius.”

12) Then MHI member Andy Gedo observed that: “six years before the conventional mortgage meltdown, MH [i.e.: manufactured home] chattel lending virtually disappeared for anyone with a flawed credit history.” “Clayton’s finance capability is a barrier to entry (what you [MHProNews/MHLivingNews] like to call a “moat”) that limits competition. Barriers to entry can sometimes be exploited through unfair competition to gain monopoly power in a market.”

Bingo.

13) Gedo was quite accurate in that observation, as the quote graphics above illustrated. Kevin Clayton, following the lingo and concepts of his big boss over Berkshire Hathaway (BRK) mantra of the “moat” that Frank Rolfe has been referencing in posts like those shown in Part I, II, and III above, said it clearly. “Warren is very competitive…he paints such an image in each of our manager’s minds about his moat, this competitive moat, and our job is very simple and we share this…Deepen and widen your moat to keep out the competition…” Clayton also said: “But some of our competitors do a good job, but our plans are to make that difficult for them.”

14) Does that (i.e.: Kevin Clayton) sound like someone that ought to have held a seat on the MHI executive committee for years if you were an independent operator in MHVille?

Consider the implications of that in terms of antitrust and MHI.

15) The base image above is from a page on MHI’s prior website, before some revisions since 2007 like the most recent one linked here and here. Note that Keith Holdbrooks is now a senior executive for Clayton Homes. Southern Energy is owned by Clayton Homes. MHI parody logo and this call out box and arrows are added by MHProNews.

16) Buffett has, as Rolfe aptly repeatedly noted, pushed the “moat” mantra for years. When Gedo said MHProNews/MHLivingNews had been reporting on that insight, he was quite correct. But for the most part, others in MHVille trade media and MHI itself avoided that lingo. Rolfe is an apparent exception to that rule beyond the boundaries of MHProNews/MHLivingNews and other writing by L. A. “Tony” Kovach for other publications, such as the Patch. Examples of that is use by Buffett follows, and the video with transcript and analysis linked below should be considered to keenly grasp the in connecting facts, “dots,” “puzzle pieces” or links to what Rolfe and LoopNet’s Schmergel wrote in Parts I-IV above.

17) or longer-term and detail-minded readers, MHProNews previously shined a light on Rolfe moat thinking below.

18) Before pressing ahead in this unpacking some of the wealth of takeaways from Parts I-IV by Rolfe and LoopNet’s Schmergel thinking as presented by them in articles provided in Parts I-IV, consider this. Buffett told Clayton (see transcript linked here and above) that he could access plenty of capital to do whatever he needed or wanted. Former MHI member Gedo aptly noted in Part V #12 and 13 quotes and insights as shown above. Meaning, by having access to capital and financing when others did not clearly limit the ability of smaller competitors, or in some cases, even larger ones that may nevertheless have lacked the capital access. That limits the market. Who, besides Gedo says so? How about former Harvard Joint Center for Housing Studies (JCHS) Eric Belsky, who bluntly said financing is the lifeblood of housing. Cut off or limit financing or capital access and watch the dominoes fall.

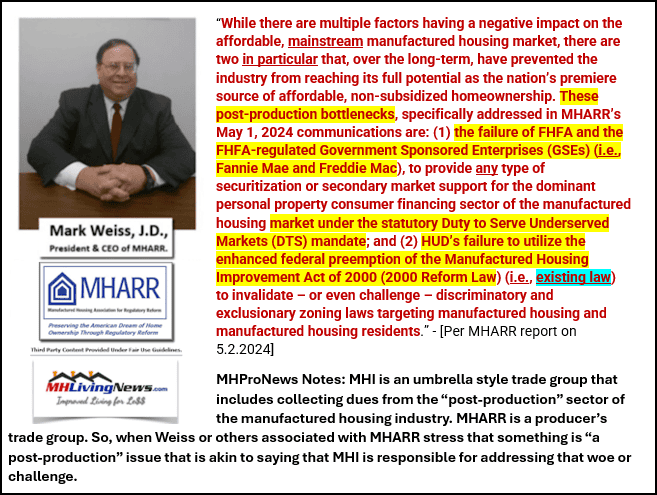

19) That’s also why the Manufactured Housing Association for Regulatory Reform (MHARR), which was formed with the notion of dealing with independent producer-focused federal regulations began some years ago to pivot somewhat to shine a light on how MHI failed to properly press the federal laws that included overcoming post-production issues such as zoning and finance.

With those elements in mind, let’s pivot back to what Rolfe said as provided in Part I above.

20) Rolfe said in part the following.

why there will never be any new parks built

The mobile home manufacturing industry – and certain people within it – are always talking about the concept that some day the U.S. government will intervene and allow new mobile home parks to be built. This is an interesting fairy tale in the same genre as King Arthur, but about as likely to happen. The reason that people say this (mostly home manufacturers or their agents) is to boost the incorrect assumption that the demand for new mobile homes will be endless when, in fact, most of the mobile home sales in the U.S. are from park owners who will end their orders once their properties become 100% occupied (which is already occurring in some part of the U.S.). So why won’t there actually be any new parks built in the U.S. in the years ahead? There are several reasons:

-

The average American hates the concept of a mobile home park being built in their neighborhood. Some call this concept NIMBY which stands for “not in my back yard”. Since city politicians are the representatives of their constituency, that pretty much ends the argument right there. Without support, zoning administrators will not zone land for mobile home park development.

-

The cities also hate mobile home parks as a land use just as enthusiastically as their constituency, although for different reasons. Their issue is that mobile home parks are not producers of big property taxes but cost a fortune in the form of school tuition, uninsured healthcare and other city services. Essentially, cities lose money with mobile home parks and then get nothing but negative feedback from developers who are scared off by their existence.

-

It is a fact that single family homes located next to mobile home parks do, in fact, drop significantly in value, and this statistic means that that the NIMBY concern is grounded in fact.

-

The federal government has no influence over city zoning, and the only places where they might have any influence at all are typically dangerous, blighted areas of cities in which there is not only no demand for affordable housing, but no demand for housing at all.

-

For all the reasons above, there are only roughly ten new mobile home parks built annually in the entire United States. With roughly 100 being torn down for new development annually, mobile home parks are literally an endangered species.

20a) There are multiple possible takeaways from the above. In no particular order of importance, the fourth bullet underscores that Rolfe was exaggerating to make the subheading point “why there will never be any new parks built.” Rolfe himself admits there are a modest number of communities developed every year. So, once more, the information from Sun and ELS shown above holds up on that limited developing point.

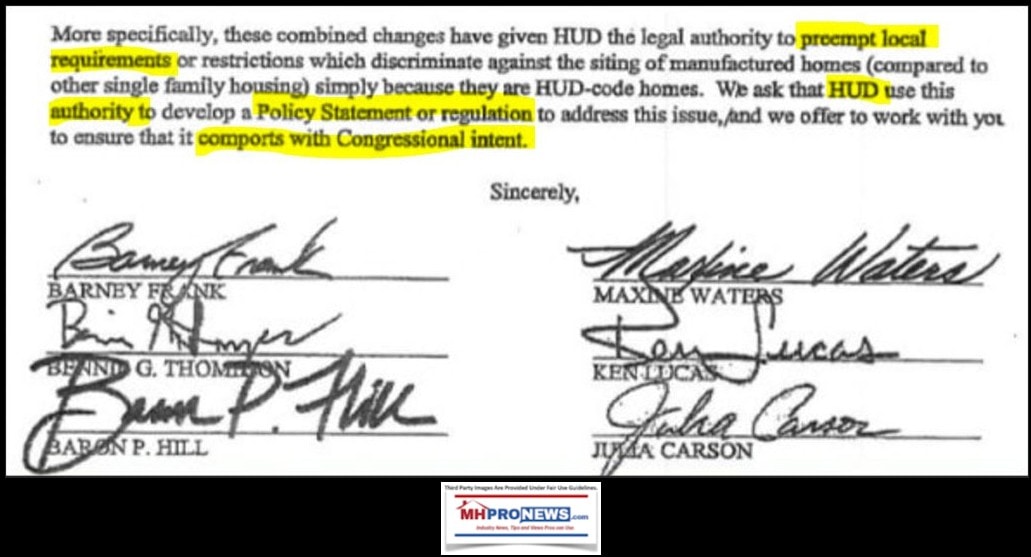

20b) Rolfe’s claim that: “The federal government has no influence over city zoning” is obviously mistaken at best, if not misleading and deceptive at worst. How so? The Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act) specifically gave HUD the authority to override local zoning that violated federal law. That power is commonly called federal (i.e.: HUD authority by Congress and the 2000 Reform Law) to exercise “enhanced preemption” over local zoning. Overcoming local zoning barriers could be robust, IF, HUD used its authority. That has been known for approaching 25 years. See some sample quotes below and a more detailed set of illustrating quotes about federal “enhanced preemption.”

So, Rolfe is demonstrably wrong, intentionally or through ignorance, and neither is good for a man who claims to be an expert on the industry. Because sources deemed reliable have told MHProNews that Rolfe is a regular reader of MHProNews, as are numbers of senior corporate and association leaders, plus thousands of others from MHVille (watch for an upcoming report that will dot the i with more facts and evidence on MHProNews ‘dominating’ in industry news), public officials, investors, attorneys and others. Meaning, there are good reasons to believe that Rolfe has paltered in those statements in the specific sense identified by Harvard and APA researchers. That could have legal ramifications for MHI, Rolfe/Reynolds, and several higher profile MHI members.

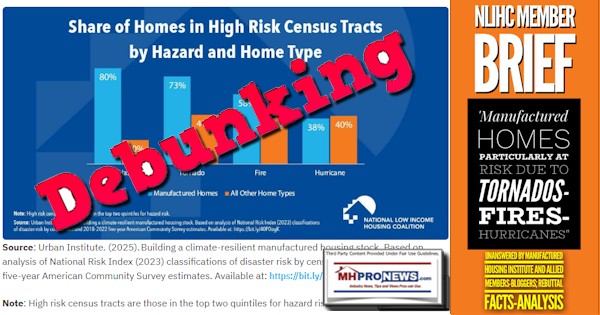

21) This remark by Rolfe is also arguably false, although it is a common misconception that he appears to be playing on rather than informing his readers of the truth.

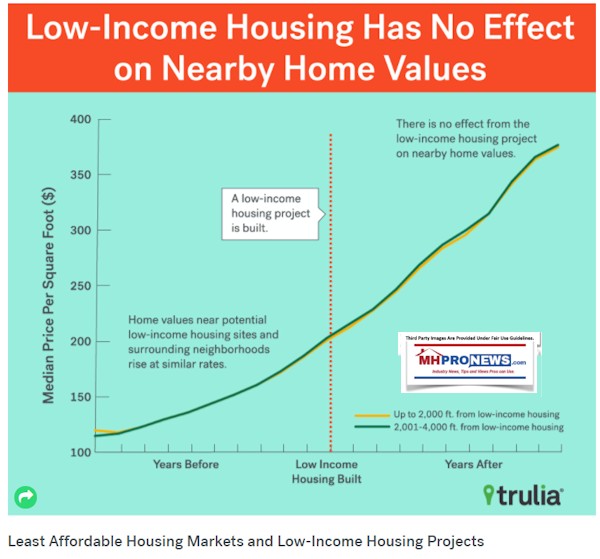

- It is a fact that single family homes located next to mobile home parks do, in fact, drop significantly in value, and this statistic means that that the NIMBY concern is grounded in fact.

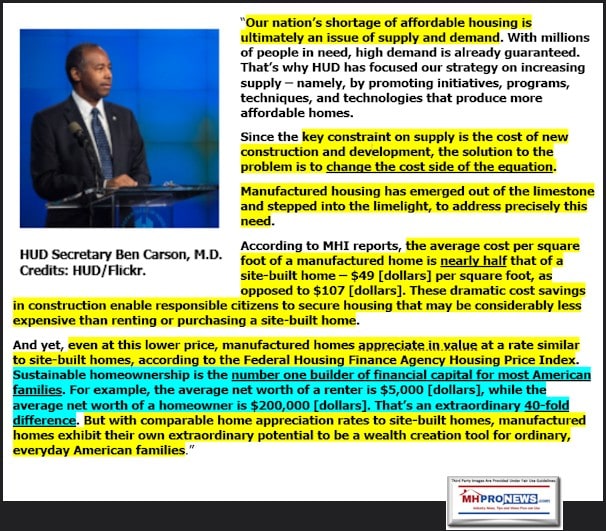

What is that truth? Per several reports, including but not limited to those that follow, manufactured homes and conventional housing appreciate side-by-side and have for years. If appreciation is occurring in a market area, and the homes are being properly maintained, perhaps a quarter of a century of periodic research has pointed out that appreciation for manufactured homes was possible, occurring, and more recently a routine fact.

22) Before the “Regulatory Barriers” published by HUD in 2011, Richard Genz came to a similar conclusion years before, citing specific examples.

23) To further illustrate how long that has been true, consider this Q&A with Copilot on this date (3.6.2025).

What year did Richard Genz research that pointed to manufactured homes appreciating in certain markets in the U.S. get published? What was the name of that research?

You can find more details about it …”

24) But the point presented by that range of evidence and sources ought to be clear. Rolfe is wrong in saying that manufactured homes next to conventional housing harms resale value. A different, but relevant point was made by Trulia too.

25) There are a range of possible takeaways from the above. In no particular order of importance are these.

a) MHI appears once again to have failed to enforce their so-called “Code of Ethical Conduct.” MHI can hardly deny what is published by Rolfe on his website under his byline. MHI’s so-called “code” is shown once more to be more window dressing than a serious statement of policy. Otherwise, numbers of current MHI members would be gone, and the association would be a shadow of its current size. Only one firm that was cited in that report on their “Code of Ethical Conduct” is said to no longer be an MHI member – Havenpark – and if so, the reasons for it are unclear. But the point is that Rolfe and Reynolds have been similarly aggressive as Havenpark on site fee hikes and their Impact Communities, or RV Horizons before it, have made statements for years that are arguably part of the image problem that the industry faces.

If MHI showed Havenpark the exit, why did they not do so with Rolfe and Reynolds? Or for that matter, with all of the firms that have been hit by multiple antitrust suits?

Why is nothing like that mentioned by Rolfe or that post by LoopNet’s managing editor Schmergel? If people enter the community sector without grasping such potential legal, ethical, and related concerns, is it ‘journalism’ – or a pitch aimed at getting new people/investors, some of whom may opt to buy a community solo and might not make it – into a sector that they are not given an imperfect image about? In fairness, Schmergel does mention the culture shock and some details that Rolfe didn’t in the articles quoted, but there is no mention by either of “enhanced preemption,” the Manufactured Housing Improvement Act, insights or mentions of MHARR, and several other concerns that are addressed in this report.

b) Schmergel said:

Rolfe concurred with Conlon’s perspective. “ It is just land rental … You don’t have to get involved in the homes, you don’t have to fix toilets and things. The stuff that people hate about [maintaining] apartments, we don’t have to [deal with], because we just rent land.”

Really? As Rolfe himself has said at times, and certainly others in the MHC sector have too, part of the business model for many firms is precisely buying a community with vacancies and filling those vacancies with new and/or preowned manufactured homes that get ‘the site rental meter’ going again. Those who do clearly end up fixing toilets and things, like it or not. LoopNet’s Schmergel aludes to that when he wrote:

“Norm Sangalang, a Senior Vice President with the CBRE National Manufactured Housing & RV Resorts (MHRV) Specialty Practice, concurred with Conlon. “At a stabilized occupancy level, the continuity of [mobile home community] occupancy is highly consistent and very durable.”

A “stabilized” occupancy level is precisely when once vacant sites are filled and the churn of residents that bought and later fell out, for whatever reason, is relatively muted.

c) That noted, part of what is useful in the LoopNet post is this.

As Rolfe put it, “The U.S. media has such an entrenched stereotype they have built about how terrible trailer parks are that most people won’t even look at investing in them.”

This bad reputation has also significantly constrained new development in the sector, which decreases the potential for unexpected competition.

d) Therein lies a key potential rub and therein lies some of the clearly contradictory and perhaps hypocritical behavior of several involved in MHI and/or several MHI linked state associations.

The bad reputation is in part fostered by MHI members, like Rolfe, previously Havenpark, or firms like ELS owned Datacomp, and the array of firms that have been hit by fines, probes, negative media, and/or litigation. All of that kicks up negative media. All of that fosters the NIMBYism that ELS touted in their IR pitch shown in the annotated screen capture above. Curiously, that confirms what Darren Krolewski (since bought by ELS) that one challenge for the industry is the lack of positive news. Who is behind that lack of positive news, if not those who are generating negative news?

26) This is a useful point to mention that Sam and Eugene Landy led UMH Prosperities (UMH), as was alluded to earlier in the context of Gary Shiffman’s similar remark, has openly called for the opposite of what Rolfe has pressed. Namely, the Landys have said that the industry should essentially triple the number of land lease communities. The Landys’ point to their years of experience in both acquiring and filling existing properties and developing new ones. They say that their method yields higher profits than their rivals.

Rolfe’s response to the Landy’s statement? He called it ‘asinine’ without actually debunking their evidence. But then note that Rolfe boldly asserted that “special interests” don’t want to solve the affordable housing crisis. The reason? It goes contrary to their business model. That doesn’t make them right, but that is their stance, as the reports above and below unpacks.

27) There is more that could be said by Loopnet/Schmergel’s article or those posts by Rolfe. But this is plenty for today. There are several reason to believe that years of antitrust behavior in some form of collusive sense is occurring that involves MHI. After a deep, deep dive by Google’s AI powered Gemini and xAI’s Grok. The article itself is shorter than this, perhaps 1/4th of this one, but has linked items go into far greater depth.

28) Also related to AI probes of these issues are linked below or quoted and documented as follows.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’