“Patrick is one of the most exciting thinkers I’ve had the chance to converse with,” said billionaire investor Ray Dalio about Patrick Bet-David, in a quote from his website. “I believe in and follow Patrick Bet-David. He has the drive and the fire to make a difference,” said Steve Wozniak, Co-Founder of Apple per Valuetainment. Bet-David is a self-described Iranian-American. He says he has lived in several parts of the U.S., including California, Texas, and Florida, but names other places in the first video below. For those who know Iranian-Americans, they are often highly motivated, informed, well-educated, driven and passionate people. In the pages of MHProNews, some of the Iranian-Americans featured have included MHARR’s founding president Danny Ghorbani, the former Department of Justice antitrust assistant attorney general Makhan Delrahim, and of course this publication’s co-founder, Soheyla Kovach. Bet-Davis in these two videos posted below provides his unique take on two hot topics. “California, This Video May Trigger You – Watch At Your Own Risk” (8.1.2022) and “Another 2008 Housing Crash – Or Worse? Real Estate Bubble Explained.” Among those Bet-David on – and ‘takes apart’ – with his pages of economic, mortgage and housing data is Dave Ramsey’s view that housing won’t take much of a hit. “Patrick’s” forecast is also posted below. These two recent videos have had over 2 million views on YouTube alone.

California

The Next Housing Crash

Two of the evidence-based topics Patrick makes on his site are “High Interest Rates Equals Low Interest In Buying A Home. Mortgage Demand Falls To Lowest Level In Over 20 Years” and the second video above, “Another 2008 Housing Crash – Or Worse? Real Estate Bubble Explained.”

In one of his PowerPoints, Bet-David states: “Today’s economy is like a very dense forest

- There are a few big trees that catch all the sun and rain

- A few big companies that hire most of the good talent

- It’s hard for new younger trees to grow up

- The big companies buy out or crush the competition.”

That same Bet-David PowerPoint said:

Here’s what is happening today

- Inflation hits 40-year high of 8.5 percent

- Gas prices jumped 48 percent year over year

- rental rates have increased for eight consecutive months

- The average rent for a two-bedroom home in the U.S. is about $2,000, according to research from Rent.com — up by 22 percent year over year basis.

- Groceries are up by 10 percent year over year

The speaker-author entrepreneur is apparently among those who believe that the U.S. is already in an recession as it has long been traditionally defined: two quarters of Gross Domestic Product (GDP) contraction. But Patrick points out that historically various economic contractions – such as recessions, market crashes and depressions – have been opportunities in disguise for some. As an example, he noted that: “Companies that started During economic downturns • uber, slack and Airbnb all started after the great recession crash in 2008.”

Per Ben-David:

- Monetize fear

- the lazy, arrogant & Overleveraged will be filtered out

- Become bankable

- Strength in numbers

- create a cause your company can rally behind

- Cut the fat

- find your running mates

- Double down on positive distractions

- Equip your team with all possible audibles

- Increase your level of urgency

Additional Information with More MHProNews Analysis and Commentary in Brief

MHProNews has covered several of these topics in 2022. There is a split on the notion of a hard fall to the housing market, as Bet-David himself notes. Some fall into the camp of gurus like anti-manufactured housing financial coach, Dave Ramsey who think any hit on housing will be mild, because there is an inventory shortage. Some of the reasons why Patrick believes the impact on the housing market could be harder than that are cited above.

It is useful to look at the thinking of others, including the successful. This publication is not necessarily endorsing the possible conclusions Bet-David suggests. That noted, it would be foolish to think that his scenario isn’t looming. Reports linked below are reasons to ponder his arguments seriously.

But note that Bet-David never mentions manufactured housing. It is one of those professions that could be nearly recession proof, if the leadership of an operation – or the industry at large – were solid.

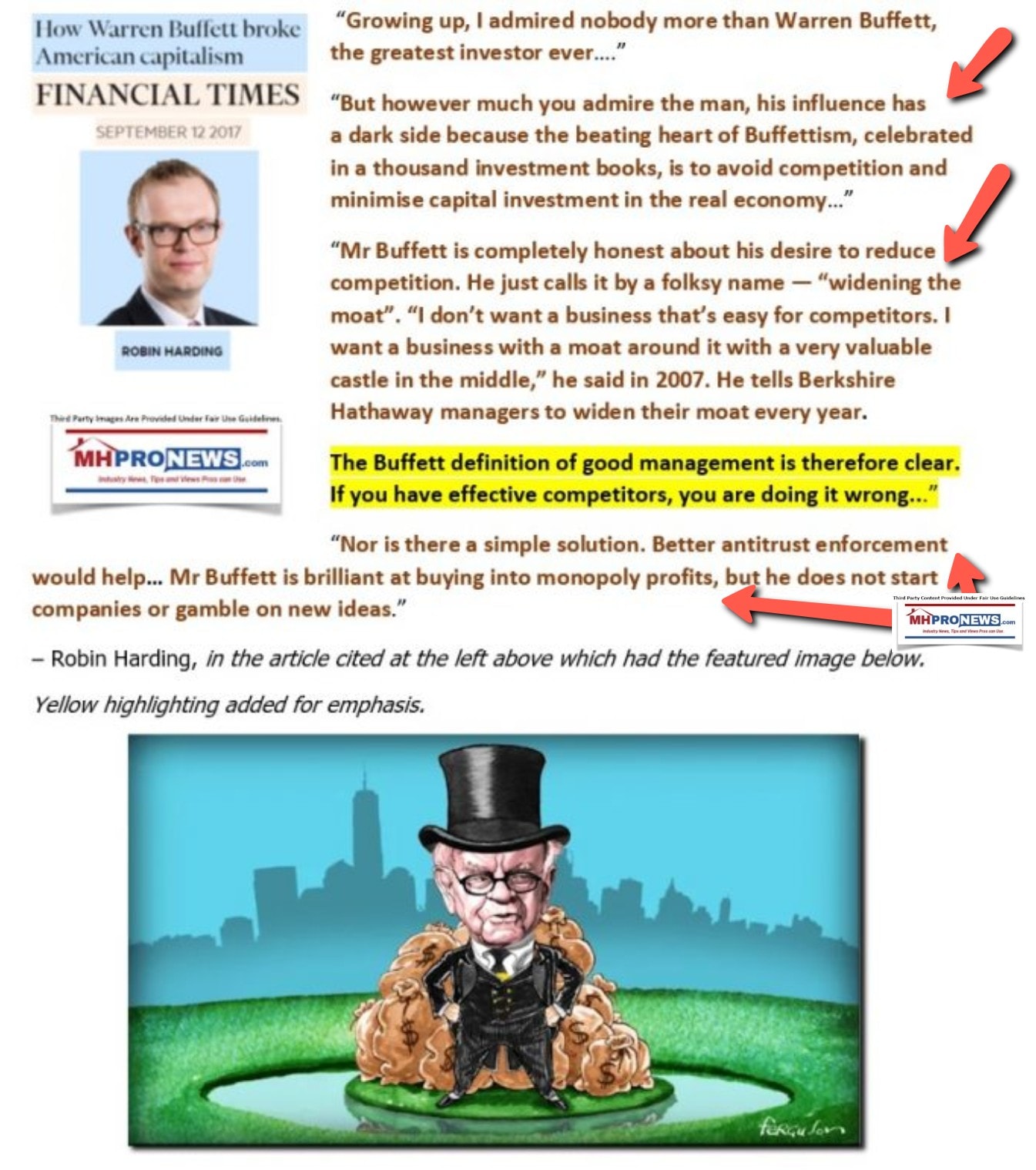

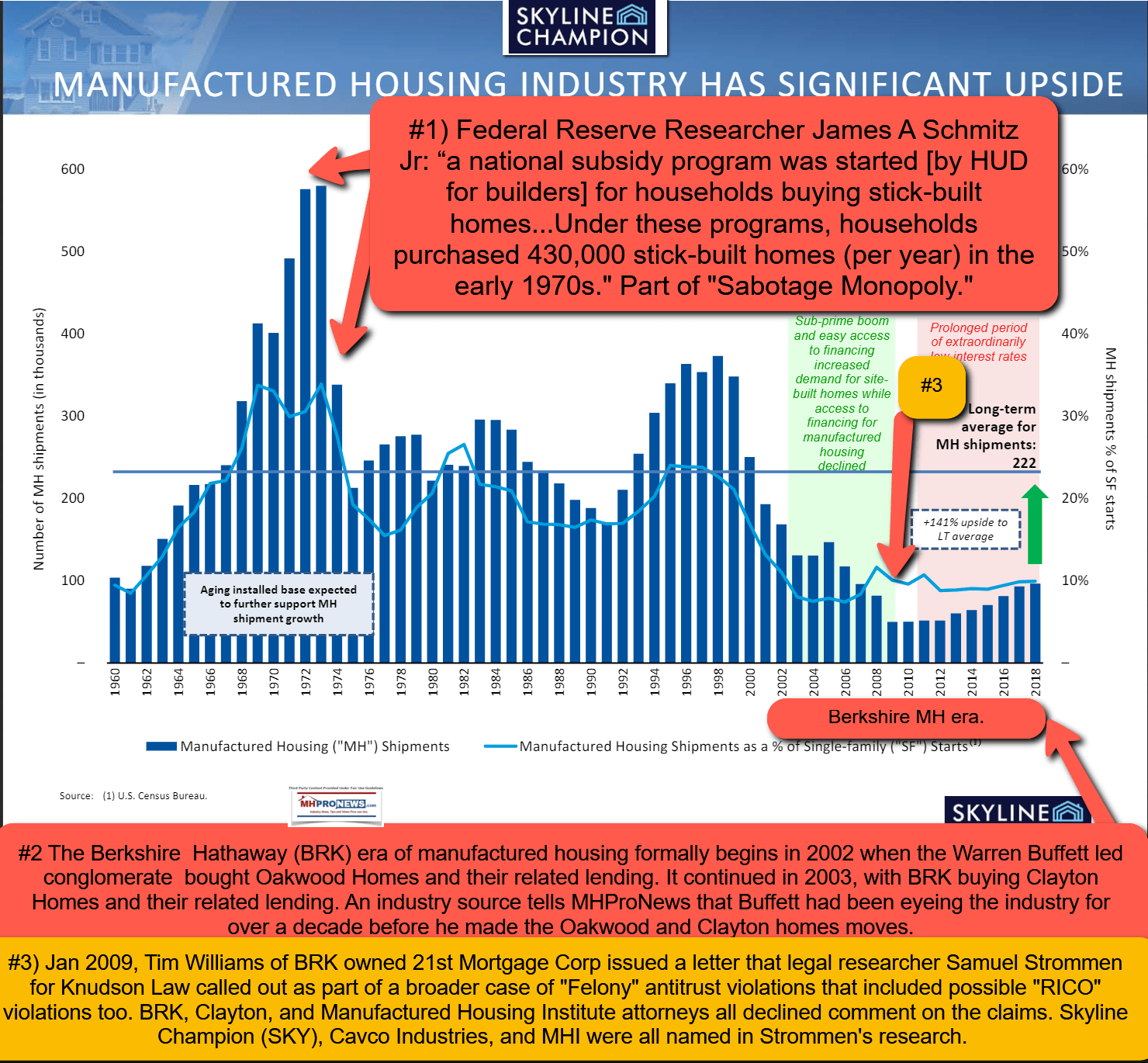

Unfortunately perhaps for manufactured housing, giant investors such as Warren Buffett have taken an interest. In Buffett-World, there are some similarities to the analysis of Bet-David and that of “Warren.” Warren has said that downturns are opportunities too. So, with that in mind, Buffett has arguably fostered downturns and/or taken advantage of downturns, in concert with his allies that include William “Bill” Gates III.

There is a distinction to be made between what people think of as history and what is authentic history.

There is a distinction to be made between what some believe are success methods and what is actually occurring in a given marketplace, nation, or the world.

It would be foolish to think that when some believe in the value of downturns and retain large sums of liquid assets – as Buffett-led Berkshire Hathaway does – that they won’t take advantage of poor economic conditions. MHProNews correctly predicted that COVID19 would turn into a bonanza for a few and it did.

Manufactured housing could outperform several segments of the marketplace. The industry should be roaring, but for over two decades has been relatively snoring. While it isn’t the only factor, one must ponder the impact of the biggest moat-builder in the mix, Buffett’s Berkshire and his related and allied brands. Why? Because the Buffett-method, said Bill Gates, is to find weaknesses in markets and then exploit them.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

Since Buffett’s Berkshire formally entered manufactured housing, the HUD Code manufactured home industry has been underperforming ever since. An apt illustration is the one below.

Coincidences? Hardly.

What the late Senator William Proxmire said about D.C. politics could well be applied to business too.

For greater insights, see the linked reports.

Programming Note: a series of 2022 market data that is manufactured housing specific is planned for the days ahead. It will cover a range of issues that should be of keen interest to marketers, advocates, researchers, and others. Stay tuned.

Note, our normal capture of market data and related headlines malfunctioned. Our apologies for the glitch. Yesterday’s and other recent market and industry-connected reports are linked below.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.