…former Commodities Futures Trading Commission (CFTC), Bart Chilton, has been making the cable news circuit. Chilton voiced his concerns about what’s behind the recent volatility, which will be part of tonight’s featured report.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Dow caps insane week with 330-point bounce

- These markets were the biggest losers this week

- Stocks flew too close to the sun. Now what?

- Exactly what happened during the stock market’s crazy week

- The stock market is scary. But here’s why you still should invest

- What’ll happen to the Tesla shot into space?

- You probably made more than Elon Musk last year

- Why SpaceX’s successful Falcon Heavy launch is so significant

Selected headlines and bullets from Fox Business:

- Stocks rise to cap roller-coaster week

- Record amount of cash pulled out of stock funds

- Dow has second-worst day ever. What’s going on?

- VIX blowup is the tip of the iceberg: David Stockman

- Stock market correction: What will Jamie Dimon do this time?

- The Dow’s biggest single-day drops in history

- Stock selloff creates bargain blue chips

- Oil prices slide on strong US production

- Amazon to challenge UPS, FedEx with new delivery service

- Amazon to challenge UPS, FedEx with new delivery service

- The service will reportedly be tested with third-party sellers in Los Angeles.

- Tax refunds: Most Americans expect a solid return this year, survey finds

- Stock market volatility good for firm: Howard Lutnick

- Richest US Winter Olympians: Lindsey Vonn, Shaun White top 2018 field

- Banks limited by slow loan growth: Dick Bove

- LL Bean imposes limits on its return policy, citing fraud

- Bitcoin worth $4.7M seized in federal fake-ID sting

- Just in time for Valentine’s Day: a $385 chocolate bar

- Retirement savings: Money in accounts like IRAs, on average, now tops $100,000

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,619.55 +38.55(+1.49%)

Dow 30 24,190.90 +330.44(+1.38%)

Nasdaq 6,874.49 +97.33(+1.44%)

Russell 2000 1,477.84 +14.04(+0.96%)

Crude Oil 59.23 -1.92(-3.14%)

Gold 1,314.50 -2.40(-0.18%)

Silver 16.32 -0.03(-0.16%

EUR/USD 1.23 +0.00(+0.02%)

10-Yr Bond 2.83 -0.02(-0.77%)

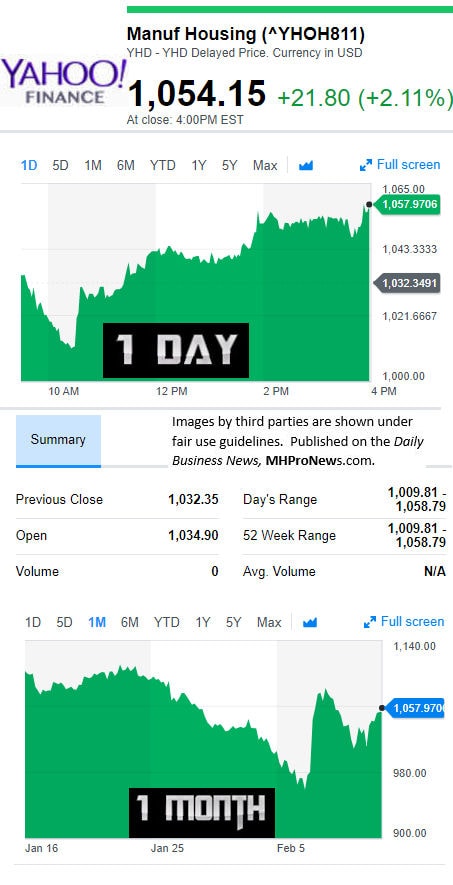

Manufactured Housing Composite Value

Today’s Big Movers

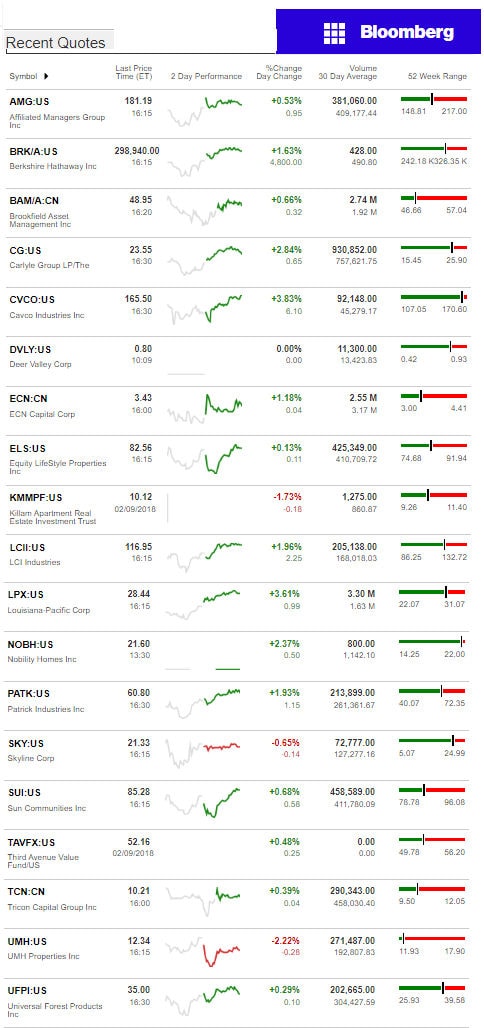

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Chilton Raises a Cryptic Concern Over the Recent Market Drop

Former Commodities Futures Trading Commission (CFTC), Bart Chilton said earlier this evening on Fox Business that he suspects ‘shenanigans’ in the recent volatility. That video is not yet available, but he didn’t say much beyond that, saying he’s heard some things that have caused him concerns, perhaps beyond what is said in this video clip.

Readers are reminded that last month Warren Buffett, Jeff Bezos, and Jaime Dimon put their heads together, and made an announcement that caused about a 300 point drop in the markets – the same day as the president’s State of the Union (SOTU) address. Is it a stretch to ask if those 3 made that announcement, knowing the market drop that would follow? Again, that preceded the more recent, and far more pronounced volatility.

To be sure, there’s plenty of views as to the why behind the recent drop, including a long awaited normal correction. But Chilton’s cryptic comment may signal that something else was afoot, and it is worth watching for in the day ahead.

Next…

…the White House press room sent this to the Daily Business News, the outline of the long-awaited infrastructure plan.

The President’s plan to rebuild America

America has long been a Nation of builders, President Trump told the country January 30 in his first State of the Union Address. “We built the Empire State Building in just 1 year—is it not a disgrace that it can now take 10 years just to get a permit approved for a simple road?”

He called on leaders of both parties in Congress to come together to deliver the safe, reliable, and modern infrastructure that Americans deserve. Today, he will outline his legislative principles to accomplish just that:

- $200 billion in Federal funds to spur at least $1.5 trillion in infrastructure investments with partners at the state, local, tribal, and private level

- New investments in rural America, which has been left behind for too long

- Decision-making authority will return to state and local governments

- Regulatory barriers that needlessly get in the way of infrastructure projects will be removed

- Permitting for infrastructure projects will be streamlined and shortened

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

Profitable Insight$ – POTU$ Trump Effect on MH Stock$ at 1 Year, Part 4

Trump Effect – 1 Year Election Impact on Manufactured Housing Connected Stocks, Part 2

Just the Facts – Trump Effect on Manufactured Home Connected Stocks, Part 1

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis, and Commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)