“The road to hell is paved with good intentions,” or so goes a thought-provoking old maxim. California Governor Gavin Newsom (D) might merit some credit for legislation that made Accessory Dwelling Units (ADUs) statewide preemption in his state a reality. Democrats and Newsom also played important roles in enacting minimum wage increases during his tenure. However well intended, the former is leading to a wave of business closures, the loss of thousands of jobs, higher prices at fast food restaurants, a move towards more robotics, and a loss of opportunities for starter positions normally filled by those 24 and under. With that snap shot in mind, the “frontrunner felon” and deposed President Donald J. Trump has come under fire by some for floating an idea recently to end the federal income tax by replacing it with tariffs. Several sources have produced reports that state various reasons, including higher prices on imported goods, as motives not to end the federal income tax via replacing it with tariffs. But is the idea as crazy as some may have made it out to be? MHProNews will do an initial examination of the pros and cons to such as idea, to see if it is a cause for alarm or a notion that sooner or later ought to be embraced. Is ending the income tax and a reemphasis on tariffs a bad or potentially good thing, depending on how it is done?

In the U.S. and beyond, it is almost expected that politicos on the center-right (e.g.: Republicans, GOP, libertarians, etc.) slam the ideas used by the left (e.g.: Democrats) and that the left similarly often slams the concepts offered by the right. Once that dynamic is grasped, sone of the partisan noise is easier to sift for the proverbial wheat amidst the chaff.

Before pushing on, let’s give Copilot’s take on the role Gov. Newsom played in ADU expansion in his state some attention, because properly understood and presented, the ADU lessons learned can be good ones for HUD Code Manufactured Housing.

Per left-leaning Bing’s Copilot, using the blue or balanced setting is the following.

On the negative side, Newsom’s results with the minimum wage hike, again per Copilot, is not as rosy.

- Fast-Food Job Losses: Between last fall and January, California fast-food restaurants cut about 9,500 jobs, representing a 1.3 percent change from September 2023. This decline is attributed to the higher labor costs employers now face due to the increased minimum wage1.

- Specific Closures:

- Pizza Hut and Round Table Pizza: These chains are in the process of firing nearly 1,300 delivery drivers.

- El Pollo Loco and Jack in the Box: They announced plans to speed up the use of robotics, including robots that make salsa and cook fried foods.

- Price Increases: Fast food prices have risen since the law took effect. For instance, Wendy’s increased prices by 8 percent, Chipotle’s prices by 7.5 percent, and Starbucks prices by 7 percent.

- Hiring Freezes: Many other fast-food franchises have announced hiring freezes due to the wage hike1.

It’s worth noting that California now has the highest-priced fast food in the country, but there is an obvious limit to how much further prices can climb. The fast-food industry predominantly employs younger workers, with about 60 percent of its workforce aged twenty-four or younger, which contrasts with other industries where only about 13 percent of workers fall into that age group1…”

It is also worth mentioning the recent report on how California and much of the ‘left coast’ has some of the worst problems in the country when it comes to homelessness, crime, high cost of living, all of which makes it difficult for the lower and middle classes to advance. That’s not just a Republican talking point, it is advanced by several on the left, as the viral and evidence-based video journalist Johnny Harris analysis via the left-leaning New York Times revealed.

Yes, conservatives, centrists, and Republicans are among those slamming Democratic performance on the West (or left) Coast and other Democratic dominated states, where Democrats have supermajorities and can politically do pretty much whatever they decide to do. But it is also leftists that are slamming their performance.

Indeed, the retort that Trump-promoters and defenders have to Biden-backers and Democrats is simple. Americans already know what Trump has done. The economy was better. Housing costs were lower. Utility and fuel costs were lower. Income relative to inflation was rising. Inflation was lower. Crazy allegations of Trump locking up or murdering journalists are readily responded to by his defenders by saying ‘Trump didn’t do the horrific things he is being accused of in his first term, why would he do so in his second?’ The border security with Mexico was far better. There was no war between Ukraine and Russia, or no hot war in Gaza between Israel and Hamas. The conflicts in Iraq and Afghanistan were being brought to an end and causalities dropped sharply. More peace, more prosperity – promises made and promises kept is what Trump backers say. By contrast, Biden have so many policy flops and embarrassments that he and his Democratic backers in big media, big tech, big corporate and beyond have resorted to lawfare, fear and smear tactics.

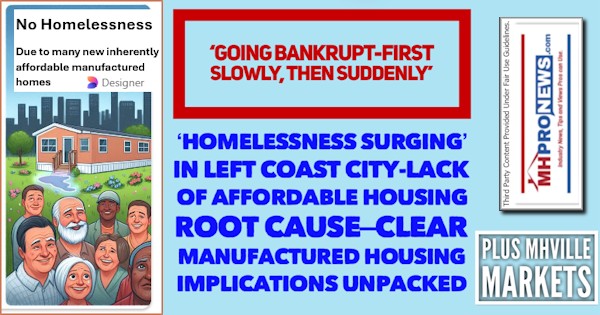

In numbers of devices the image below can be opened to a larger size.

Click the image and follow the prompts.

“Home shoppers today need to make more than $106,000 to comfortably afford a home,” according to the report. “That is 80% more than in January 2020.” – per the Center Square on 3.14.2024 based on Zillow Research. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

In numbers of devices the image below can be opened to a larger size.

Click the image and follow the prompts.

So, at a minimum, Trump’s notion of eliminating the federal income tax by replacing it with higher tariffs merits thoughtful consideration. What are the cons? What are the pros?

A D.C. insider told MHProNews the following.

“If he [i.e.: Trump] could do it [eliminate the income tax], more power to him. Lots of special interests would have a dog in that fight (like mortgage lenders for the home interest deduction) and would fight tooth and nail to prevent it. That a big part of the problem with any kind of tax reform.”

So, there is a phalanx of special interests with millions and many lobbyists that will oppose it. As readers ponder the cons, one should consider what special interests they represent and why they may not want to see the federal income tax code eliminated. With that tee up, a review of opposition – and there has been plenty of it – is next up in Part I of this report with analysis. It will be followed in Part II with insights that make the opposite case, why it is doable and why it may be a good idea.

Part I – Opposition to the Trump Notion of Replacing the Federal Income Tax with Higher Tariffs

In no particular order of importance are the following remarks and sources.

1) “Can tariffs replace the income tax? Simply put, no. Tariffs are levied on imported goods, which totaled $3.1 trillion in 2023. The income tax is levied on incomes, which exceed $20 trillion ; the US government raises about $2 trillion in individual and corporate income taxes at present.” -Peterson Institute for International Economics.

2) Left-leaning Newsweek said: “Trump’s “all tariff policy” idea to replace the federal income tax could hurt lower- to middle-income Americans, expert says.

3) Left-leaning New York Magazine similarly argued that: “Donald Trump floated a plan to Republicans in Congress to replace the income tax with a tariff, the burden for which would fall overwhelmingly on the poor and middle class.”

4) Left-leaning Yahoo Finance said: Janet Yellen [D] and Larry Summers [D] haven’t always agreed on everything, but a new tax proposal from the Trump campaign earned a strong rebuttal from both the current secretary of the Treasury and the former one.”

- “This is a prescription for the mother of all stagflations,” Larry Summers told [left-leaning] Bloomberg TV.

- The current [Biden Treasury] secretary, Janet Yellen, said it would make life unaffordable for Americans.

5) Larry Summers served the Clinton-Gore era Democratic Administration.

6) Left-leaning MarketWatch headline proclaimed: “Trump floats replacing income taxes with tariffs, gets criticized by economists.”

- ‘Fundamentally unserious stuff’ among the reactions from a range of analysts

- His suggestion came during a private meeting on Thursday morning with Republican lawmakers in Washington, D.C., according to a CNBC report, which cited unnamed sources at the meeting.

7) So, those pull quotes provide the flavor of the opposition to the concept. It should be noted that the idea was ‘floated,’ there is no detailed policy outline yet offered by Trump or his campaign. Jack Mintz with the Financial Post observed: “Republican presidential candidate Donald Trump knows how to make headlines. His latest is a “big bang” proposal to replace federal income taxes …”

More from Mintz and others in Part II, as those who think they idea is not so wacky is considered.

Part II – Background and Pro-Tariffs vs. Phasing Out the Federal Income Tax

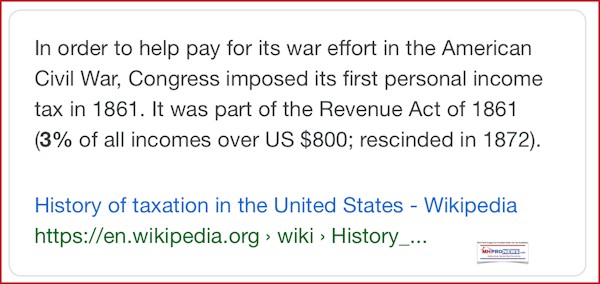

1) For most of U.S. history before the purported passage of the 16th Amendment which yielded the U.S. income tax, tariffs funded the then leaner U.S. government.

2) Per the right-leaning Washington Times editorial board, were the following points.

Politicians had their hands on citizens’ paychecks, and the spending bender never ended. Government expenditures amounted to around 3% of gross domestic product prior to the income tax, but federal spending now exceeds 36% of GDP.

At a town hall in Arizona earlier this month, Mr. Trump explained that tariffs are about more than spending. They are a tool of diplomacy. For instance, he told Mexico’s president to station Mexican troops at the border to discourage illegal immigration into the United States — or else.

“I said if you aren’t going to give [the troops] to me, we will charge you a big, beautiful tariff — 25%, 50%, or it will go up to 100%,” Mr. Trump declared.

The tariff strategy worked to curb immigration, but that’s not to say replacing an income tax with tariffs will be easy. Customs duties raised a mere $80 billion last year, almost entirely from levies on industrial goods, which are taxed an average of 2%. Half of the goods we import aren’t taxed at all.

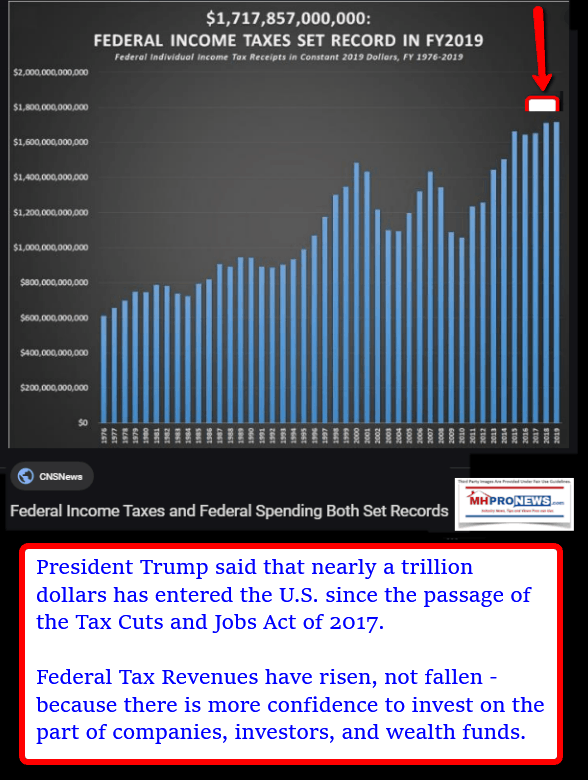

So, increasing the tariff to an average of 10% would raise about $400 billion per year. Sounds great, except the government Leviathan consumes far more than that. Annual corporate taxes amount to about $420 billion, payroll taxes amount to $1.6 trillion, and the personal income tax brings in $2.2 trillion.

Modest, 10% tariffs could easily replace the corporate income tax and kick-start massive economic growth, or they could give every American a 20% discount on April 15. Mr. Trump may have other plans for the size of tariffs and the allocation of funds.

Tariffs are not easy to implement because they invite retaliation from overseas competitors, and they will increase the cost of imported goods for consumers. On the other hand, that also encourages domestic production — exactly what Mr. Trump wants to see.

The difficulty in raising tariffs is what makes them an excellent tool for funding a limited government. As long as politicians are able to squeeze money out of paychecks by making the tax code more onerous, government continues to expand.

If Mr. Trump brings us closer to eliminating the IRS, or better yet, repealing the 16th Amendment, he has a winning idea. ##

3) A post on Forbes mused that an 85 percent tariff could fund the lost revenue from the federal income tax.

4) The right-leaning New York Post said on this topic:

Bryan Riley, director of the Free Trade Initiative at the National Taxpayers Union, notes that based on the current level of US imports, “it would take a tariff rate of 71 percent” to generate the same level of revenue that income taxes bring in.

“However, a tariff rate of 71 percent would dramatically reduce the volume of imports,” he argued. “As a result, the revenue generated would be nowhere close to $2.2 trillion.””

Former President Donald Trump on Thursday raised the idea of abolishing income taxes and replacing the primary government revenue source with tariffs, according to a Republican lawmaker.

The proposal was brought up by the 77-year-old presumptive GOP nominee for president during a joke-filled “pep talk” with congressional Republicans on Capitol Hill, his first since leaving office in January 2021.”

“Most intriguing policy idea from the GOP meeting at the Capitol Hill Club this morning,” Rep. Thomas Massie (R-Ky.) wrote on X. “Trump briefly floated the concept of eliminating the income tax and replacing it with tariffs.”

5) The Trump campaign didn’t respond to the New York Post’s request for comment on what Massie revealed. Clearly, Trump and the campaign are leaving their options open, as the discussion evolves for and against.

6) What is oddly lacking in several conservative articles on the tariff topic is that it should boost domestic production. Incomes would increase as production centers or factories would generally be higher paying work. It would also mean less dependence on oversees sources, which could mean less revenue flowing to Communist China and others that could cut their military spending and allow for less U.S. spending too.

7) Another point not mentioned enough is that some U.S. states are moving to a no-state income tax stance. Investopedia notes that: “Which Are the Tax-Free States? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.” While most of those states are generally run by Republicans, Washington is a solidly Democratic state, and the swing state of Nevada is often Democratic. Given that states are able to run their finances without income taxes, it is clear evidence that it is doable.

8)

Raising tariffs and cutting income taxes sounds regressive. What really happens depends on whether exporters to the U.S. cut their prices…”

…But is it as crazy as it sounds? After all, it’s consistent with the mercantilist philosophy that has been adopted not only by Trump but also by the Biden administration and in many other countries today. Governments are showering domestic producers with subsidies, border adjustments for carbon taxes and regulatory protection. …”

In 2023, the U.S. collected $80.3 billion in custom duties, equal to 2.1 per cent of the value of its imported goods and services, which were $3.852 trillion. Federal income tax collections are $2.17 trillion. So, if the whole federal personal income tax were to be eliminated, the average tariff rate would need to rise to 56.4 per cent to make up the lost revenue. That is a lot.

…True, 150 countries already levy a broad-based border tax: the value-added tax (VAT). To ensure consumers pay their consumption taxes, governments not only tax domestic production but also imports. The highest VAT rate is India’s at 28 per cent. And its average tariff rate is close to 10 per cent, meaning imported goods are subject to a 38 per cent tax, on average.

There is a significant difference between tariffs and VATs, however. A VAT applies to both domestic-produced and imported products. A customs duty only applies to imports. Because the VAT does not favour domestic production over imports it does not protect domestic producers. Trump’s proposal is a sales tax only on imported products, which not only raises revenue but also protects American producers from import competition.

Two centuries ago, tariffs were the primary source of government revenue in Britain, the U.S. and Canada, since many of today’s taxes couldn’t be administered and weren’t even considered. It would be ironic if customs duties, including carbon tariffs, were brought back as a major source of revenue.

Financial Post”

9) Dominic Pino is the Thomas L. Rhodes Fellow at National Review Institute and he wrote the following for the National Review.

Iowa went from a nine-bracket progressive income tax with a top rate of 8.53 percent to a flat tax of 3.9 percent. Arizona has a flat tax of 2.5 percent. West Virginia is on pace to eliminate its income tax entirely.”

From that same source is the following.

10)

Michel would cut the top income-tax rate to 25 percent, the capital-gains tax to 15 percent, and the corporate tax to 12 percent. He would also enact full expensing for investments and eliminate the estate tax, alternative minimum tax, and net investment income tax.

This would be possible by simplifying the tax code to eliminate deductions and tax credits. That would increase the tax base, so a lower tax rate can raise a similar amount of revenue. And it would raise that revenue in a less economically distortive way.

Just wiping out energy tax credits for businesses, which expanded greatly under the so-called Inflation Reduction Act, would save $119 billion per year, Michel estimates. Other special-interest-captured business tax subsidies cost $132.5 billion.

The much lower tax rates will make it possible to cut individual deductions as well without individuals facing a higher tax burden. Individual deductions, especially since the 2017 tax reforms, are disproportionately taken by high-income individuals, since most middle- and low-income individuals do not itemize their tax returns. “Eliminating itemized deductions and moving all taxpayers to the standard deduction could raise revenue by $336 billion a year,” Michel writes.

Exempting fringe benefits from taxation also disproportionately benefits high earners, who have more fringe benefits than lower earners. Michel would include fringe benefits in the tax base, treating them the same as wages, which would raise $447 billion per year.

He would also subject to taxation many nonprofits that aren’t really non-profit. “Nonprofit status should be eliminated for activities where there is a clear for‐profit private‐sector competitor,” Michel writes. So churches and charities would still be excluded, but organizations such as the NCAA, the PGA Tour, and credit unions would have to pay taxes.

The federal government does not have a revenue problem. “The erosion of fiscal space is driven almost exclusively by net interest costs and federal health spending,” Michel writes. We know from other countries that faced fiscal crises and successfully moved past them that spending cuts are much more important. Past conservative tax-reform efforts have not been as successful as they could have been because they did not include sufficient spending cuts to go with tax cuts.

Michel’s plan would have no chance of passing Congress as written. Way too many special-interest groups are harmed by having their special tax privileges removed, and they would send armies of lobbyists to make sure the plan dies. But this general approach — simplifying and flattening the tax code, by increasing the tax base and cutting tax rates — should guide conservative efforts at tax reform. The TCJA was a step in that direction, but there is still so much left to do.

Treating tax reform as a decades-long effort to repeal the federal income tax entirely is the right attitude for conservatives to take. It won’t be replaced by a tariff system in the next presidential term, and it shouldn’t be, but seeing the income tax as wrong in principle and bad for the economy is nonetheless correct.” ##

Part III – Additional Information with More MHProNews Analysis and Commentary

1) Often not mentioned by those who weighed in on this income tax vs. tariffs discussion is the notion previously reported by MHProNews. Namely, that Argentinian leader Javier Milei has slashed government positions and that inflation has fallen rapidly. The early signs are promising. That could be done in the U.S. too, so it may not require the massive amounts some are presuming.

2) As MHProNews has previously reported, the federal income tax is part of the progressive program that was advanced by the Democratic Woodrow Wilson Administration. What the Harris video, and the report below, both tend to point to is this. The ‘promises’ made by progressives have proven to be elusive. Housing policy is just one example. Much of the federal government might be eliminated, and the hundreds of billions (to a trillion or more) in spending would be working in the economy.

3) Furthermore, the Government Accountability Office (GAO) said: “2018-2022 Data Show Federal Government Loses an Estimated $233 Billion to $521 Billion Annually to Fraud, Based on Various Risk Environments.”

4) Citizens Against Government Waste (CAGW), per Copilot, said in 2023 that: “If adopted, these recommendations would save taxpayers $402.3 billion in the first year and $4 trillion over five years1.”

Meaning, the federal government is massively wasteful.

5) One of the reasons that some big companies export jobs to foreign nations is because there are often fewer labor protections, environmental, and other safeguards in numbers of countries that is true in the U.S.

6) So, there are reasons to believe that it could be accomplished, because the U.S. government operated without an income tax for longer than it has with an income tax. Several states have made it work, and more states are interested, per reports. Why not the federal government?

7) Ironically, while the Tax Foundation has slammed the Trump notion, it also has a page that says the following on the high cost of income tax compliance.

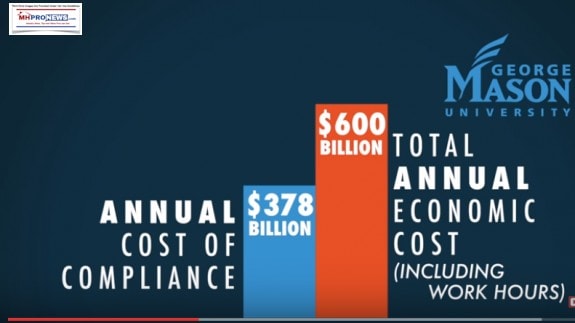

According to the latest estimates from the White House Office of Information and Regulatory Affairs (OIRA), Americans will spend more than 6.5 billion hours complying with IRS tax filing and reporting requirements in 2022. This is equal to 3.1 million full-time workers doing nothing but tax return paperwork—roughly equal to the combined populations of Philadelphia and San Antonio—and 39 times the workforce at the IRS.

The accompanying table lists the 25 most burdensome tax regulations. It shows that more than half of the 6.5 billion hours Americans spend on tax compliance is on complying with income tax returns. Taxpayers spend 2 billion hours complying with individual income returns (including small business returns) and over 1.1 billion hours complying with corporate income tax returns, plus 1.4 billion hours complying with business deductions and quarterly tax returns. The remaining 2 billion burden hours are attributable to complying with hundreds of other tax forms and schedules, everything from wage and tax statements for employees to estate tax returns.

Tax Complexity Will Cost the U.S. Economy Over $313 Billion This Year …”

8) The above insights, for and against, are better than ‘back of the napkin’ calculations and insights, but they certainly merit more detailed attention. While MHProNews ‘only’ spent a few hours to get the pro- and cons to this end-the-federal income tax via higher tariffs concept, it revealed that from those sources checked, none of them covered all of the topics mentioned herein in a single article. Those for, against or meh toward the Trump concept lacked factors that impact the calculus. But simply put, where there is the will, there is a way.

9) There is an evidence-based argument to be made that the income tax is a socialist scheme that is contrary to the interests of the notion of limited government advanced by the founding fathers. The income tax is a tool that allows federal officials to peer into the personal affairs of hundreds of millions of Americans. It is not efficient, just as the federal bureaucracy is not efficient at achieving its own stated goals.

10) It will be recalled that in the final tumultuous year of what may be the first term of the Trump presidency that a White House staffer’s remarks to MHARR and MHProNews that their team was looking at implementing the “enhanced preemption” provision of the Manufactured Housing Improvement Act (MHIA) of 2000 could come to pass. It will take someone with cojones, willing to challenge the status quo, to implement the MHIA/enhanced preemption and to take on the massive swampy relationship between numerous big corporate interests and various aspects of federal bureaucracy.

11) As MHARR reported during what was the final year of the Trump Administration at the time: “the White House Council on Eliminating Regulatory Barriers to Affordable Housing (Council) to remove existing and worsening barriers to the availability and utilization of affordable HUD Code manufactured housing. The Council, created by Executive Order 13878 (June 25, 2019) and chaired by HUD Secretary Ben Carson, has been directed by President Trump to “reduce” and “remove” overly burdensome regulatory barriers at the federal, state and local level “that artificially raise the cost of housing” and “cause [a] lack of housing supply.” (Emphasis added). The Council thus represents an unparalleled opportunity for the industry to address – and seek the resolution of – multiple issues that have needlessly stunted its growth, expansion and evolution as a premier source of affordable, unsubsidized homeownership.”

12) The press for Project 2025, Schedule F reforms, and more could well make such a swap of tariffs for the federal income tax doable. Job creation could soar along with incomes. Opportunities for Americans could well be far broader than they have been in decades.

13) A formal Trump official told MHProNews earlier this year that “elections have consequences.” It is entirely possible, per that source, that a Trump 2.0 could see revived antitrust and other actions.

MHProNews plans to monitor and report on this developing issue as deemed warranted. ###

Part IV – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report at the closing bell, so that investors can see-at-glance the type of topics may have influenced other investors. Our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines for a more balanced report.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day, readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 6.20.2024

- These employees moved across the country for work, then Disney canceled the project. Now they’re suing.

- Recalled Vitamix Ascent Series and Venturist Series 8-ounce Blending Container

- Vitamix recalls almost 570,000 blender parts

- Massive computer outage at car dealerships could last for days, company says

- Why Olive Garden doesn’t want to give discounts

- New York governor signs bill regulating social media algorithms, in a US first

- A commercial airliner passes in front of the sun in Boston, MA, on May 23.

- Flying is getting scary. But is it still safe?

- The all-new, three-row 2024 Toyota Grand Highlander is shown during world premiere event at Chicago Auto Show on February 8, 2023 in Chicago, Illinois.

- Toyota is recalling 145,000 big SUVs for an airbag problem

- AI is replacing human tasks faster than you think

- San Francisco, California, United States, North America

- Mortgage rates fall to their lowest level in almost three months

- Cailtin Clark and Angel Reese.

- Caitlin Clark and Angel Reese rematch poised to be the most expensive WNBA game ever with seats up to $9,000

- He tried to oust OpenAI’s CEO. Now, he’s starting a ‘safe’ rival

- Pulitzer Prize-winning Washington Post journalists call for leadership change amid publisher scrutiny

- Want your child to go to Eton? Get ready to pay $13,000 more each year

- The shipping industry is sounding the alarm as another vessel sinks in the Red Sea

- McDonald’s releases a new $5 value meal to combat inflation

- Elon Musk is trying to woo advertisers after telling them to ‘go f–k yourself’

- Americans could be on a tight budget this summer

- How a company whose name you probably can’t pronounce is now worth more than Apple

- Wikipedia now labels the top Jewish civil rights group as an unreliable source

- Alfa Bank: US-sanctioned Russian banking giant expands in China

- Pilots warned smoke could penetrate cabin if Boeing 737 Max planes have a bird strike

- Airbnb undermined team that removed extremist users, whistleblower claims

- Boeing committed ‘the deadliest corporate crime in US history’ and should be fined $24 billion, victims’ families say

To see this image below in a larger size, depending on your device,

click the image and follow the prompts.

Headlines from right-of-center Newsmax – 6.20.2024

- Report: Iran Has Massive Expansion of Nuclear Facility, Close to Bomb

- Israel at War

- Fmr Diplomat Ross: Gaza Aid Must Be Protected

- WSJ: No. of Surviving Israeli Hostages May Be as Low as 50′

- WH: Netanyahu’s Comments on Weapons ‘Incorrect’

- Houthis Sink 2nd Ship; Shippers Urge Red Sea Action

- US Military’s Stop-Start Gaza Pier to Resume Operations

- Head of Lebanon’s Hezbollah Threatens Israel

- WH Cancels Meeting With Israel Over Netanyahu Spat

- Shippers Urge Red Sea Action as Houthis Sink 2nd Vessel

- UN Rights Office: Israel May Have Violated Laws of War

- Israeli FM: Palestinian Authority ‘Can’t Rule Gaza’ After War

- Newsmax TV

- Comer: Oversight Probes NewsGuard’s Methods

- Mullin: ‘Very Positive’ About Upcoming Election | video

- Barbara Samuells: La. Commandments Law ‘Very Solid’ | video

- Hung Cao: GOP Can Win Va. Senate Race | video

- Comer: SEC Gives Bidens Deep-State Protection | video

- Hagerty: Biden Immigration Policy Will ‘Backfire’ | video

- Hinson: No Support for Biden in ‘Midwest’ | video

- Ben Carson: A Biden Decline Puts Us in Danger | video

- McFarland: US in ‘Period of Maximum Vulnerability’ | video

- Newsfront

- ACLU Sues Louisiana Over Ten Commandments Law

- The American Civil Liberties Union is suing Louisiana over a law requiring that all public classrooms display the Ten Commandments…. [Full Story]

- Related Stories

- Louisiana Classrooms to Display Ten Commandments

- Ernst Questions Biden Signs Next to Public Projects

- Joni Ernst, R-Iowa, is questioning why the Biden administration [Full Story]

- Trump Rips Fox, Urges Murdochs to Fire Paul Ryan

- Trump Rips Fox, Urges Murdochs to Fire Paul Ryan

- Former President Donald Trump threw napalm on the wildfire that is [Full Story]

- TikTok: Ban Inevitable Without Court Order Blocking Law

- ikTok and Chinese parent ByteDance Thursday urged a U.S. court to [Full Story]

- Recount Expected in Va.’s Tight McGuire-Good Race

- The closely watched Virginia GOP primary race pitting House Freedom [Full Story]

- Supreme Court Upholds a Tax on Foreign Income

- The Supreme Court on Thursday upheld a tax on foreign income over a [Full Story]

- Related

- Supreme Court Rules Against Convicted Drug ‘Mule’

- Russia Hits Ukraine’s Power Grid Amid Ongoing Tension

- Russia resumed its aerial pounding of Ukraine’s power grid and Kyiv’s [Full Story]

- Related

- FT: US to Redirect Patriot Air Defense Orders to Ukraine

- Russian-American Woman Goes on Trial for Treason After Donating Funds to Ukraine

- Emerson Poll: Trump Keeps Lead in Swing States

- Former President Donald Trump continues to lead President Joe Biden [Full Story]

- Related

- Biden Loses Support Among Women Voters

- Trump Gets Last Word at CNN Debate With Biden

- Lara Trump: Trump Will Be Nominee, Jailed or Not

- Trump Hits Biden Over ‘Witch Hunt’ Campaign Strategy

- Undecided Voters Await Biden-Trump Debate

- California Voters Lose a Shot at Checking Tax Hikes at the Polls

- The California Supreme Court on Thursday sided with Gov. Gavin Newsom [Full Story]

- 30-Year Mortgage Rate Falls Again, to 6.87@

- Home loan borrowing costs eased again this week as the average rate [Full Story]

- Talking With the Dead via AI – Is That a Good Thing?

- People have forever wanted to reconnect with their deceased loved [Full Story] | Platinum Article

- WHO Warns Against Fake Copies of Ozempic, Wegovy

- The World Health Organization (WHO) on Thursday issued warnings on [Full Story]

- Pope Targets Conservative Archbishop Vigano, Wants Trial

- Archbishop Carlo Maria Vigano, former papal nuncio to the United [Full Story]

- Siena Poll: NY Congestion Pricing Pause Popular

- New York Gov. Kathy Hochul’s decision to pause Manhattan congestion [Full Story]

- One Bite of This Keeps Blood Sugar Below 100 (Try Tonight)

- Actor Donald Sutherland, Whose Career Spanned ‘M.A.S.H.’ to ‘Hunger Games,’ Dies at 88

- Donald Sutherland, the prolific film and television actor whose long [Full Story]

- Comer to Newsmax: GOP Probes NewsGuard’s Methods

- Republicans on the House Oversight Committee, who have launched an [Full Story] | video

- Americans Need $127K Down Payment to Afford a Home

- Middle-class Americans would need to put 35.4%, or $127,000, down on [Full Story]

- WSJ: Instagram Pushes Sexual Videos to Young Teens

- Instagram consistently recommends sexual videos to accounts for [Full Story]

- Report: Iran Has Massive Expansion of Nuclear Facility, Close to Bomb

- Iran is expanding a nuclear enrichment facility that could provide [Full Story]

- Turner: Russian Space Nukes Threaten the World

- House Intelligence Chairman Mike Turner, R-Ohio, who has been pushing [Full Story]

- Burgum ‘Very Worried’ About Another 9/11

- Doug Burgum, R-N.D., says he’s worried about another 9/11-type [Full Story]

- Fmr Diplomat Dennis Ross: Gaza Aid Must Be Protected

- Former U.S. diplomat Dennis Ross said the overwhelming majority of [Full Story]

- Kennedy, Stein Fail to Qualify for CNN Debate

- CNN confirmed Thursday that its presidential debate next week will go [Full Story]

- Madonna Fans End Suit After Lawyers Threaten Sanctions

- Two Madonna fans ended their lawsuit in New York accusing the pop [Full Story]

- Cartels Offer $6K VIP ‘Ticket’ Into US From Mexico

- Despite being riddled with vermin and filth, the dark and narrow [Full Story]

- Fentanyl Production Back to Business as Usual

- Seven months after President Joe Biden and Chinese President Xi [Full Story]

- Bowman Sorry for Downplaying Hamas Violence

- Embattled Rep. Jamaal Bowman, D-N.Y., a member of the progressive [Full Story]

- Migrants From ISIS Hotbed Skyrocketed Under Biden

- Migrants from Tajikistan, a country known for being an ISIS breeding [Full Story]

- Marist Poll: Biden Slipping With Committed Voters

- President Joe Biden appears to be losing ground among voters who say [Full Story]

- US Housing Starts Plunge to COVID Lockdown Lows

- S. single-family homebuilding fell in May amid continued high [Full Story]

- Equis Poll: Latinos Trust Trump on Immigration

- Latino voters in battleground states trust former President Donald [Full Story]

- More Newsfront

- Finance

- Americans Need $127K Down Payment to Afford a Home

- Middle-class Americans would need to put 35.4%, or $127,000, down on the average home costing $360,000 in the U.S. today to afford it, according to a Zillow report Wednesday…. [Full Story]

- Related Stories

- US Housing Starts Plunge to COVID Lockdown Lows

- Home Buyers Need 80% More Income Under Biden Than Trump

- Soaring Rent Stymies Fed’s Inflation Fight

- 30-Year Mortgage Rate Falls Again, to 6.87%

- 2 More Strong Indicators for Gold & Silver Price Growth

- Labor Market, Housing Data Point to Slowing Economy

- Rasmussen Poll: 30% Say Inflation Most Important Issue

- Coinbase Launches $2M Ad Targeting Latino Voters

- More Finance

- Health

- How to Stay Cool and Safe During the Heat Wave

- A record-breaking heat wave is spreading across the United States, baking the Northeast and Midwest with high temperatures and sweltering humidity. Everyone is at risk for heat-related illness as body temperatures rise, experts warn. Heat stroke, heat exhaustion and heat…… [Full Story]

- Adding Nuts to Diet Results in More Weight Loss

- Blood Pressure Meds May Prevent Epilepsy

- 1 in 4 US Yards May Have Unsafe Levels of Lead

- Prostate Meds May Help Prevent Type of Dementia

click the image and follow the prompts.