The Corporate Finance Institute (CFI) defines “NIMBY” in this manner. “NIMBY, an acronym that stands for Not In My Back Yard, is used to characterize the opposition of residents to a proposed development plan in their area. NIMBY describes the phenomenon in which communities will adamantly resist a development plan near their area regardless of whether positive or negative externalities are generated.”

CFI goes on to say that “The concept of NIMBY explains (1) the phenomenon of low public acceptance to new developments, and (2) the reason behind strong opposition to new developments from those who live in close proximity to the proposed location.”

CFI cites these predominate motivations for NIMBY thinking and behavior.

- Lack of trust

- Dilution of culture

- Fear of change

CFI then explained that with regard to “housing” that “The construction of housing structures benefits the overall economy by making housing more affordable, improving the location’s economic conditions, and providing employment opportunities. NIMBYs will highlight the potentially increased crime rate, decreased utility for existing residents, and disruption from increased traffic.” CFI then gives an example of how initial NIMBY thinking and reactions over time “dwindled down” as an unwanted project proved not to be what they feared.

The question in the headline – “Zoning and Placement Battles, Is it Better to Fight or Switch?” – is suggested by the opening of the media release from the Manufactured Housing Association for Regulatory Reform (MHARR) in their “Issues and Perspectives” for February 2021. So too is the pull quote regarding the point that resistance to manufactured home placements are “Fundamentally Discriminatory in Nature.” That and more are found below, along with their insightful analysis as to causes and possible cures for the challenges described.

The “Issues and Perspectives” was penned by Mark Weiss, J.D., President and CEO of MHARR. Without mentioning it, sources say that MHARR’s Weiss was involved in the enactment of legislation that is described below.

There February 2021 “Issues and Perspectives” will be followed by some additional information, more MHProNews analysis and commentary.

MHARR — ISSUES AND PERSPECTIVES

By Mark Weiss

FEBRUARY 2021

“ZONING EXCLUSION — TO FIGHT OR SWITCH?”

For those of us “senior” enough to remember cigarette commercials on television, an iconic brand, with a somewhat unusual advertising approach, was Tareyton cigarettes. Tareyton commercials featured “smokers” with phony black eyes, who supposedly preferred to “fight” rather than “switch” to some other cigarette brand. The idea, of course, was to promote brand loyalty. Unfortunately, though, when it comes to the manufactured housing industry’s most pressing and economically damaging problems – exclusionary zoning mandates and discriminatory limitations on consumer financing support for the vast bulk of the mainstream HUD Code market — it appears that some, instead of “fighting” for full acceptance of the industry’s mainstream homes, might prefer to “switch” to something outside of that affordable mainstream.

Few would dispute that for almost its entire history, the mainstream manufactured housing industry has faced significant challenges to its advancement and growth. Over time, these challenges have affected aspects of both principal segments of the industry – its production segment and its post-production segment. Fortunately, within the production sector, MHARR, since its establishment as an independent trade organization in 1985, has been able to advance fair and reasonable federal regulation, capped-off by the enactment of the Manufactured Housing Improvement Act in 2000, which established and, in other cases, strengthened key regulatory protections for manufactured housing producers and consumers.

Unfortunately, the same cannot be said for the industry’s post-production sector. Within that sector, the Manufactured Housing Institute (MHI) — by subsuming the former National Manufactured Housing Federation (in 1991) and thereby ending any independent national representation for that sector and especially its smaller businesses — assumed and became solely responsible for the representation and advancement of post-production interests in the nation’s capital. Yet – or arguably because of the lack of aggressive, independent national post-production representation after 1991 — it is squarely within the post-production sector that the industry’s most serious problems, as noted above (i.e., lack of consumer financing and zoning equity), remain and continue to act as major roadblocks to the fulfillment of manufactured housing’s true and complete potential for Americans in need of affordable housing.

It cannot be overemphasized that the financing and zoning problems affecting the mainstream HUD Code post-production sector are not attributable to the quality or safety of the industry’s modern-day homes. The industry today – and for the entire twenty years following the enactment of the 2000 reform law – has been producing (and continues to produce) its best homes ever. These mainstream HUD Code homes not only offer homebuyers every amenity available in a modern high-quality home, but they do so at a price point that is inherently affordable for every American at every (and any) income level.

To the contrary, the zoning and financing limitations that have restricted the growth of the mainstream manufactured housing market and have unconscionably limited the housing choices of moderate and lower-income Americans, are fundamentally discriminatory in nature – i.e., they are not based on current-day provable facts relating to mainstream federally-regulated manufactured homes, but rather are an artificial, exaggerated relic of an earlier time and earlier prejudices that the product itself has long since outgrown. Put differently, these prejudices, like all others, are a product of groundless fear and ignorance divorced from the reality of the modern-day product and the modern-day mainstream manufactured housing market.

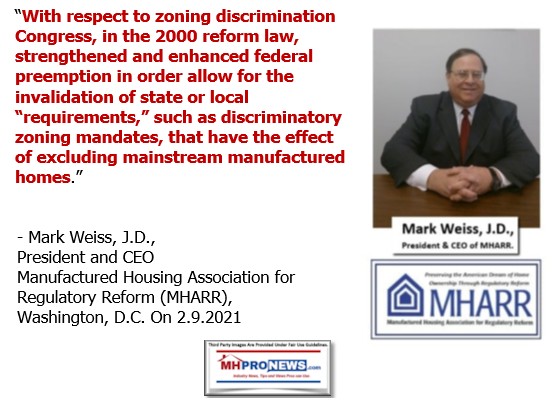

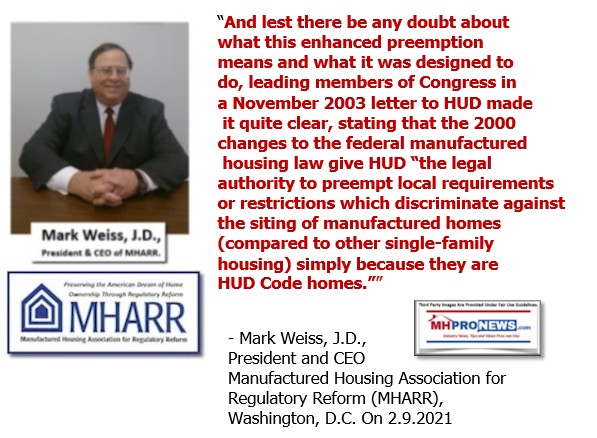

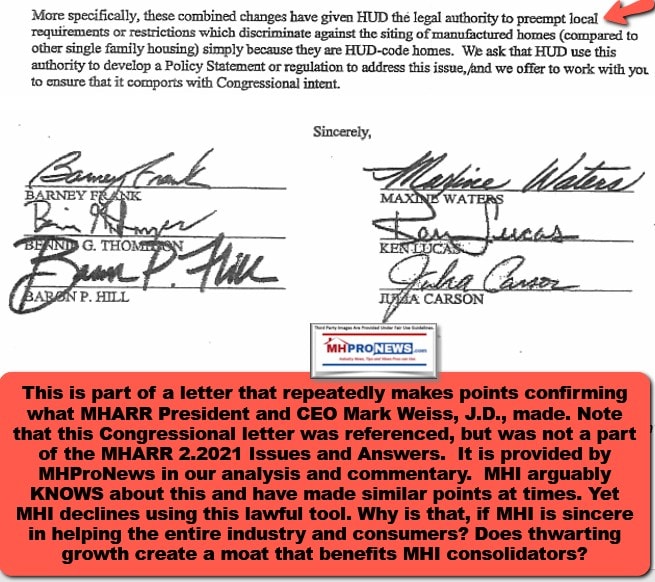

As such, these baseless, outdated prejudices could and should have been addressed and overcome over the course of time – and the past two decades, especially. Certainly, the tools to address these issues have been available for that entire time, as MHARR has repeatedly observed and emphasized. With respect to zoning discrimination Congress, in the 2000 reform law, strengthened and enhanced federal preemption in order allow for the invalidation of state or local “requirements,” such as discriminatory zoning mandates, that have the effect of excluding mainstream manufactured homes. And lest there be any doubt about what this enhanced preemption means and what it was designed to do, leading members of Congress in a November 2003 letter to HUD made it quite clear, stating that the 2000 changes to the federal manufactured housing law give HUD “the legal authority to preempt local requirements or restrictions which discriminate against the siting of manufactured homes (compared to other single-family housing) simply because they are HUD Code homes.”

Similarly, with respect to consumer financing, MHARR and MHI, working together, were able to secure congressional adoption of the “Duty to Serve” (DTS) mandate as a specific remedy for years of discrimination against manufactured home consumer loans by both Fannie Mae and Freddie Mac.

With these strong mandates at the disposal of the national representation for the industry’s post-production sector, significant progress (or at least some progress) should have been possible on both of these issues over time, with a persistent, aggressive, and unapologetic approach to both. Of course, though, the reality is, has been, and continues to be, quite different. For twenty years, HUD has faced little or no real pressure from MHI to implement the enhanced federal preemption of the 2000 reform law as a means to invalidate discriminatory local zoning mandates that either exclude or unreasonably restrict the placement of mainstream HUD Code manufactured homes. Meanwhile, both Fannie Mae and Freddie Mac – and their federal regulator, the Federal Housing Finance Agency (FHFA) — have been consistently praised by MHI, despite having done absolutely nothing, over the course of more than a decade since the adoption of DTS, to provide any type of market support for the personal property (i.e., chattel) loans that constitute nearly 80 percent of the mainstream manufactured housing consumer financing market. Again, all the while, consumers have suffered, while industry production has remained consistently below historical benchmarks.

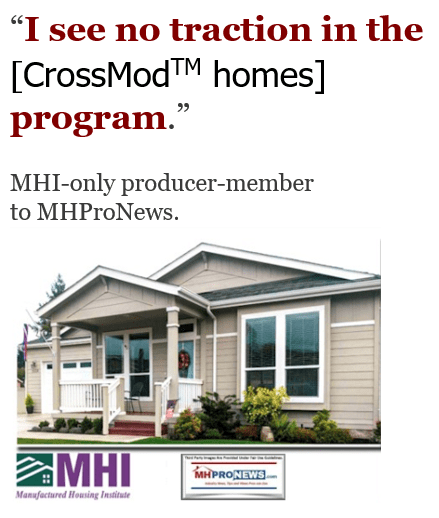

Against this backdrop, and to make matters even worse, there seems to be a “new” approach by MHI to both of these endemic problems. Rather than “fight” for the acceptance of mainstream, affordable manufactured homes, which would be best for the industry as a whole and for the vast majority of actual manufactured housing consumers, MHI, seemingly following the lead of its largest manufacturers, appears to have “switched” to pushing for much more costly hybrid or “boutique” type homes, as exemplified by its ostensibly proprietary “CrossMod” designation.

After doing precious little for twenty years, then, to advance the concept of enhanced federal preemption as a bar to discriminatory local zoning mandates against mainstream HUD Code homes, or otherwise vigorously pursue challenges to blatantly discriminatory zoning restrictions against manufactured housing (and manufactured homeowners), MHI has seemingly settled on a two-track approach to these destructive edicts. First acknowledge, finally, that the problem exists as a problem while, second, undertaking a somewhat less pronounced effort to sidestep the “problem” entirely by promoting the production, sale, use and securitization (under DTS) of boutique hybrids that are out of the manufactured housing market mainstream, are not affordable for many current-day manufactured housing consumers, and are almost exclusively the province of the industry’s largest corporate conglomerates, because their cost makes them impractical for most of the industry and most of the industry’s lower and moderate-income consumers.

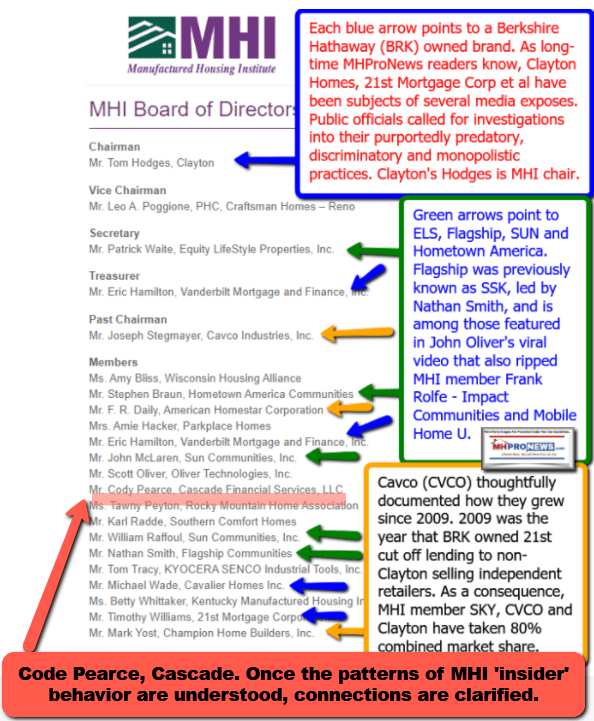

The “public acknowledgment” side of this effort is exemplified by a June 2020 MHInsider interview with MHI Board of Directors member, Cody Pearce. In that interview, Mr. Pearce states in part: “[W]e, as an industry, need to find a way to solve the zoning issues that prevent … HUD [Code] homes from going into most municipalities. It’s a real issue that MHI and their membership will be taking on. *** [S]imply improving the financing markets is not enough. The lean chattel market is really a reflection of zoning constraints and a misplaced stigma around the sector.” (Emphasis added).

Will be taking on? When? The discriminatory and exclusionary zoning problem that the industry faces today has been around – and has been a problem – for decades. MHARR, for its part, has been actively fighting this battle for years, even though it does not collect representation dues from the post-production sector. But MHI is just getting around to publicly acknowledging the problem and the need to confront it in an organized and consistent manner – sometime in the future … maybe? More to the point, while it is comforting to know that MHI — prospectively at least — plans to begin “taking on” the problem of discriminatory zoning and placement, which has been a drag on the national manufactured housing market for decades, that “plan” – more than twenty years after the enactment of the enhanced preemption provision of the 2000 reform law — has not been matched by any significant public action to change the sorry and destructive status quo.

Instead, it appears that far more effort is being put into the somewhat less-open second prong of this approach — promoting especially favorable DTS treatment for boutique hybrid homes, such as “Cross-Mod,” as a means of bypassing or sidestepping discriminatory zoning that excludes mainstream, affordable manufactured homes. Thus, in October 16, 2020 comments offered at an FHFA DTS “listening session,” MHI Chief Executive Officer Lesli Gooch stated: “CrossMod homes are a point of entry for home buyers who are currently priced out of homeownership because traditional site-built housing is not produced at below $200,000. *** These homes have the potential to reach areas of the country where manufactured housing has, in the past, been zoned out by discriminatory land use regulations at the state and local level.” (Emphasis added).

So, while MHI officials publicly state that it is prepared, at some point, to fight discriminatory and exclusionary zoning targeting mainstream, affordable, HUD Code manufactured homes — the type that is a true source of affordable housing and homeownership for all Americans — it is simultaneously leading the charge, using DTS as a “wedge,” to switch to proprietary hybrids (i.e., something other than mainstream, affordable manufactured housing) produced by the industry’s largest corporate conglomerates, as a means to sidestep and avoid the same discriminatory zoning restrictions and exclusions that it allegedly plans to “take on” — sometime. This would appear to be the polar opposite of the Tareyton folks – i.e., switching to something other than mainstream manufactured homes, rather than “fighting” anytime soon on behalf of mainstream manufactured homes and mainstream manufactured homebuyers.

Arguably, then, this “two-track” approach is little more than double-talk – i.e., say one thing publicly and then do another where it is less likely to be noticed and less likely to be called-out and exposed for what it is — which provides regulators at HUD and FHFA (as well as Fannie Mae and Freddie Mac) with a ready and convenient excuse to continue evading and circumventing the good laws that Congress has provided for the benefit of mainstream manufactured housing and mainstream manufactured housing consumers. This runs directly counter to the responsibility and obligation to protect, defend and advance the industry’s post-production sector, that MHI assumed in 1991 when it merged with National Manufactured Housing Federation.

MHARR, for its part does not – and will not — support changing the essential nature and inherent affordability of HUD Code manufactured housing. Instead, it supports properly using the law that is currently on the books in order to achieve the objectives and purposes they were designed to advance. In other words, MHARR would rather “fight” (figuratively) than switch. Advocating for what is right is more difficult than just switching to something else that is more in line with the preferences of the industry’s detractors and opponents. Ultimately, though, aggressive advocacy for mainstream, affordable manufactured housing will be far more beneficial for both consumers and the industry as a whole. ##

Mark Weiss

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

###

MHProNews Notice to new readers. It is worth noting that MHARR is a production vs. a

post-production association. MHARR’s mission is federal regulation oriented, as their self-

description states. By contrast, MHI claims to represent all segments, meaning production and

post-production, aspects of the industry. If so, then zoning and placement are post-production

issues. MHARR has previously said they have only gotten involved in such matters due to MHI’s

arguably failed performance on post-production challenges.

Note that the illustrations above or below are not from the MHARR column, but rather were added by MHProNews.

While not referenced, Weiss’ pointed quote above “Will be taken on? When?” recalls a theme that he has raised previously. Namely, that MHARR has said for years that MHI has engaged in what Weiss previously described as the “Illusion of Motion.” The charge was that MHI is posturing activity that leads no where near what the Arlington, VA based MHI claims.

It is with the passage of time that the penetrating insights to such keen, dry wit the above or the “Illusion of Motion” begins to emerge.

Additional Information, more MHProNews Analysis and Commentary

Some pull quotes from the above are useful in laying out this MHProNews expert analysis.

This quote from Weiss’ commentary above is on point to the NIMBY topic and how that can legally be overcome.

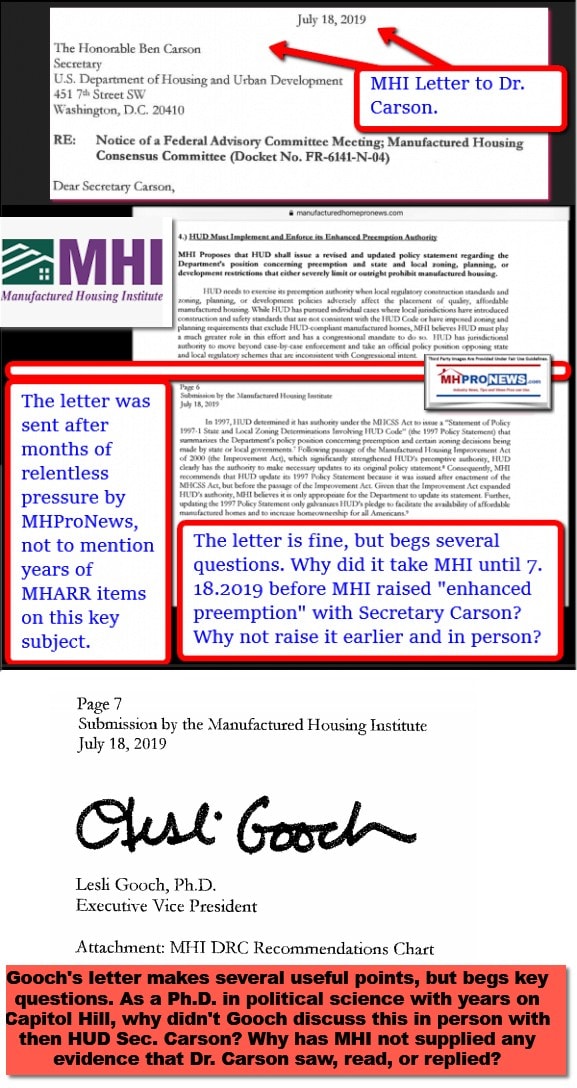

It should be underscored that MHI’s Lesli Gooch, Ph.D., made a similar point in July 2019. Which goes to Weiss’ thesis. Why would there be talk of addressing zoning and placement sometime in the future when the solution is already in hand by applying existing law?

Weiss then continued to hammer on how enhanced preemption could overcome the issue that Pearce and MHI claim they will deal with someday.

That letter Weiss referenced was coincidentally a key exhibit that was carefully explored in the deep dive report linked below. One of several pull quotes from that letter absolutely underscores Weiss’ claim. But so does the entire document from key lawmakers to HUD.

It should be noted that MHARR’s reference to it and MHProNews’ report was not coordinated. Facts are what they are. When informed parties explore a specific topic and they are aware of a range of facts, it is perhaps no surprise that they – in the instance MHARR – and MHProNews both thought of how that same letter from Congressional lawmakers applies to our industry’s current dilemma regarding mainstream HUD Code manufactured home zoning and placement.

Perhaps the more apt point is why has MHI – or Cascade’s Cody Pierce? – not raised that same Congressional letter Weiss or MHProNews did in order to deal with the industry’s longstanding plight?

Plight?

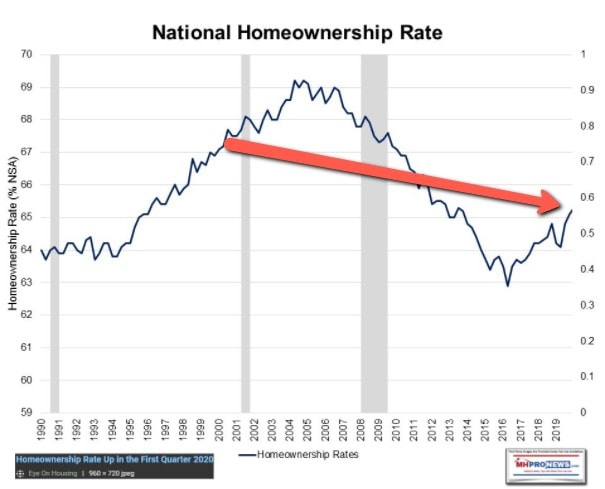

Yes, because there is, as Sam Strommen from Knudson Law in his groundbreaking legal research report observed, a widely acknowledged affordable housing crisis. Despite years of Democratic and Republican administrations alike claiming that more home ownership should be a goal, there is less home ownership as a percentage of the population today than there was 20 years ago.

“For twenty years, HUD has faced little or no real pressure from MHI to implement the enhanced federal preemption of the 2000 reform law as a means to invalidate discriminatory local zoning mandates that either exclude or unreasonably restrict the placement of mainstream HUD Code manufactured homes,” said Weiss.

After acknowledging that both national trade groups – MHARR and MHI – worked together to get the Duty to Serve provision into federal law, Weiss observed the following.

“Meanwhile, both Fannie Mae and Freddie Mac – and their federal regulator, the Federal Housing Finance Agency (FHFA) — have been consistently praised by MHI, despite having done absolutely nothing, over the course of more than a decade since the adoption of DTS, to provide any type of market support for the personal property (i.e., chattel) loans that constitute nearly 80 percent of the mainstream manufactured housing consumer financing market. Again, all the while, consumers have suffered, while industry production has remained consistently below historical benchmarks. “

Weiss in citing Cody Pearce, did not mention that he is an MHI member whose firm is also on the most recent board of directors for MHI. That is useful context, which Weiss – perhaps for the sake of length – opted not to delve into.

Without specifying, as Sam Strommen or MHProNews have each done, that there are clear ties between MHI and the MHInsider “magazine,” Weiss then hammers the point that MHI plans to address the issues at some unspecified point in the future. He teed that up with this quote from Pearce from MHI board member, Cascade Financial.

Quoting Pearce: “[W]e, as an industry, need to find a way to solve the zoning issues that prevent … HUD [Code] homes from going into most municipalities. It’s a real issue that MHI and their membership will be taking on. *** [S]imply improving the financing markets is not enough. The lean chattel market is really a reflection of zoning constraints and a misplaced stigma around the sector.” (Emphasis added by Weiss).

That statement by Pearce is valuable, because as Weiss underscored, it reflects their knowledge of the problem and their claim that they will be “taking on” the issue of “zoning constraints.” But Pearce also noted that the “misplaced stigma” still exists. Of course, the stigma persists. But it was about a decade ago that Kevin Clayton, President and CEO of Berkshire Hathaway owned Clayton Homes said that what Pearce aptly calls the “stigma” would be dealt with by the industry, which is often a euphemism used by members for MHI. What happened to that plan Clayton said was coming? Did it come, and we all missed it? Or did it come, and it failed so badly that the past two years of production and sales actually declined during an affordable housing crisis?

See Clayton’s video interview below. That video and transcript

are arguably among the more important items to be aware of

to grasp the true nature of the industry’s current woes.

Perhaps equally on point to Weiss’ thesis would be the pledge by former MHI Chairman Nathan Smith. The SSK Communities co-founder Smith, which has since been rebranded as Flagship Communities – perhaps in order to duck years of regulatory, legal issues, and negative media? – pledged to leave his role with MHI becoming a more proactive rather than reactive trade group. What happened to that pledge?

Keep in mind, Smith in that comment de facto slammed the prior performance of MHI before making that pledge, as the quote and video make clear.

- When was the last time MHI recalled that promise by Smith?

- How does that pledge to be pro-active vs. reactive apply to this issue of MHI’s decade plus failure to move the needle on zoning, placement, and more competitive retail financing?

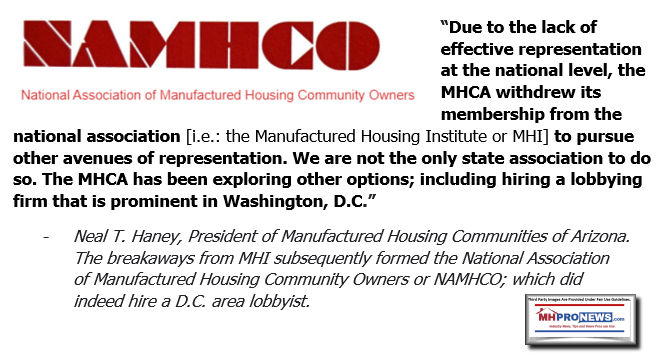

Also to underscore Weiss’ contention. Ponder that after years of failures to keep such promises as Smith’s or Pearce’s, that two state affiliates of MHI’s broke away. Isn’t it telling that they did so explicitly saying that they did so precisely because they were not getting what MHI had promised for years

Weiss, having reminded the dozens in attendance at the Washington, D.C. “listening session” previously reported by MHLivingNews at the link here, then hammers away at Gooch’s arguably duplicitous push for DTS and favorable zoning treatment for CrossModTM homes without making a similar public push for mainstream manufactured homes to get the same treatment.

“Arguably, then, this “two-track” approach is little more than double-talk,” said Weiss about Gooch and MHI.

By inference Weiss, then draws the “Iron Triangle” – explored within the context of the report linked here – together. He points out how MHI, and their corporate masters, have de facto involved HUD and FHFA in the process of thwarting good laws that could readily move the industry beyond NIMBY thinking and behavior in relative short order.

Meanwhile, MHProNews notes the recent manufactured home industry data which further buttresses Weiss’ claims.

Gooch’s “two track approach, observed Weiss, “i.e., say one thing publicly and then do another where it is less likely to be noticed and less likely to be called-out and exposed for what it is — which provides regulators at HUD and FHFA (as well as Fannie Mae and Freddie Mac) with a ready and convenient excuse to continue evading and circumventing the good laws that Congress has provided for the benefit of mainstream manufactured housing and mainstream manufactured housing consumers.”

Weiss closes the circle on his metaphor from the old Tareyton commercial to say: “MHARR, for its part does not – and will not — support changing the essential nature and inherent affordability of HUD Code manufactured housing. Instead, it supports properly using the law that is currently on the books in order to achieve the objectives and purposes they were designed to advance. In other words, MHARR would rather “fight” (figuratively) than switch. Advocating for what is right is more difficult than just switching to something else that is more in line with the preferences of the industry’s detractors and opponents. Ultimately, though, aggressive advocacy for mainstream, affordable manufactured housing will be far more beneficial for both consumers and the industry as a whole.”

Indeed, the argument can be made that Weiss’ claim is already reality. Ultimately… “aggressive advocacy for mainstream, affordable manufactured housing will be far more beneficial for both consumers and the industry as a whole” is demonstrated by the point that MHI’s “CrossModTM homes” has been a market failure. It was 2 years ago in February 2019 that MHProNews anticipated that market failure by saying that what was then called the “new class of manufactured homes” later rebranded as “CrossModTM homes” has already failed. Per an MHI-only producer member, the following makes that point.

But so too does other reports by MHProNews precisely about the clear failure of the as “CrossModTM homes” in application.

Indeed, the Modular Home Builders Association (MHBA) has, per informed sources, publicly dropped their initial protest precisely because the MHI plan was failing. Why battle something that is dying on its own? But MHBA’s Tom Hardiman made a relevant point that both industry professionals and consumers should digest and act upon.

That pull quote from Hardiman arguably brings the circle back to Weiss’ theme. An authentic, growth-oriented trade group should be pushing or “fighting” for all of the industry, not some specialized, new, and initially untested concept. Which of these Clayton concepts shown below have market traction today? Per Clayton sources, none.

Clayton can afford that error. Some of the larger MHI sources can afford that error. But can independents who are being harmed by the very association that claims to be their champion afford such duplicitous errors?

No. Both ‘white hat’ independents, authentic consumer advocates, and all those who care about creating more potentially generational wealth for renters and affordable housing seekers should be on or near the same page as Weiss and MHARR. MHI, by word and deed, continues to miss the target on their own stated goals, as MHARR, Sam Strommen, MHProNews, and MHLivingNews – among others – have duly noted.

To learn more, see each of the linked and related reports above and further below.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.