According to Blue Orca: “an attorney provided a sworn statement that a Department of Homeland Security agent involved in the investigation said that the CEO “should be in prison.” This scandal, in our view, raises significant questions as to management credibility and trustworthiness as a steward of investor capital.” Their report said that “undisclosed to investors” “Our diligence reveals that SUI’s CEO received an undisclosed $4 million loan from the family of a purportedly independent Director who has sat on the Audit Committee and chaired the Compensation Committee for close to a decade.” “Incredibly, SUI’s CEO was also embroiled in a scandal involving the falsification of his mother’s medical records to facilitate the fraudulent sale of $63 million of life insurance policies he took out on his mother’s life. Although he was not charged or formally accused of wrongdoing by law enforcement, in a sworn deposition, the physician who faked the medical records accused the CEO of personally directing the insurance fraud scheme. Further, an attorney provided a sworn statement that a Department of Homeland Security agent involved in the investigation said that the CEO “should be in prison,” per Blue Orca’s pitch that for reasons that they are short on higher profile Manufactured Housing Institute (MHI) member Sun Communities (SUI).

Among the claims made by Blue Orca in their report that follows in Part IV is as follows.

History of Alleged Accounting Shenanigans and Reporting Failures Casts Shadow Over Current Financials. Sun Communities is no stranger to allegations of financial impropriety under its still-current CEO. The SEC settled an enforcement action against the Company, and then filed a district court lawsuit against CEO Shiffman, SUI’s then CFO, and its former Controller for hiding losses in a subsidiary and maintaining a literal “cookie jar” reserve to smooth earnings. The SEC eventually dismissed Shiffman and the former Controller from the lawsuit, but notably it settled the lawsuit against SUI’s then-CFO, requiring him to serve a two-year suspension from practicing before the SEC as an accountant (though, surprisingly, he remained with the Company in another capacity).

At the top of the Blue Orca document is this disclosure.

THIS RESEARCH REPORT EXPRESSES SOLELY OUR OPINIONS. We are short sellers.

We are biased. So are long investors. So is SUI. So are the banks that raised money for the Company. If you are invested (either long or short) in SUI so are you. Just because we are biased does not mean that we are wrong. …”

Each of the law firms that have issued a brief press release on this topic cited below (Parts I-II-III) named the Blue Orca research as part of the basis for their concerns.

While they do not cite MHProNews, several of the items in their report are on topics and purported evidence of corrupt behavior that MHProNews previously reported about Sun’s Gary Shiffman and the firm he leads. Our site metrics reveals a surge of interest in those articles, which may be from a combination of Blue Orca, potential litigators, and others concerned about the issues that law firms and Blue Orca has raised.

As is our custom, MHProNews is not endorsing any of the firms referenced in this report with analysis. The claims are theirs. That said, what makes this of potential interest are several evidence-supported and seemingly plausible concerns raised by Blue Orca, which when combined with other issues previously reported here on MHProNews and/or on our MHLivingNews sister site paints a dim picture about the leadership of Sun that would tolerate such claimed behavior.

In our view, while Blue Orca raised some new issues from our perspective, there are other issues that they, possible litigators on behalf of investors, and public officials have apparently not yet raised.

Additionally, there is the point that several of the antitrust actions involving other MHI members including Sun in our expert reading of their respective evidence-based allegations raised issue not only about Sun and those named firms, but also about a frequent common link. Namely, MHI and several MHI-linked state associations.

In no particular order of importance are three of potentially even more such announced probes by law firms on behalf of investors in Sun. One would think that those law firms have considered what Blue Orca and other sources, including MHProNews, have published about Sun and find if in their view there was sufficient substance to the concerns warranting their time, interest, and effort.

Following those three legal press releases are extensive portions of Blue Orca’s detailed narrative and stated evidence in Part IV, with the PDF of their allegations found here.

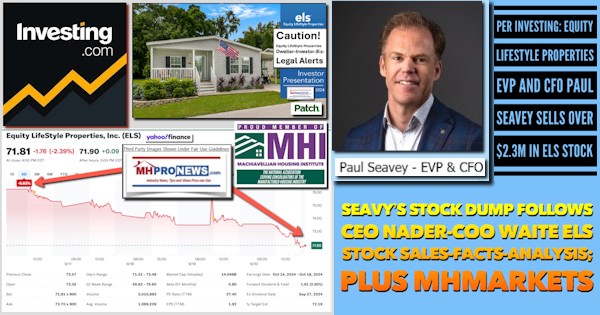

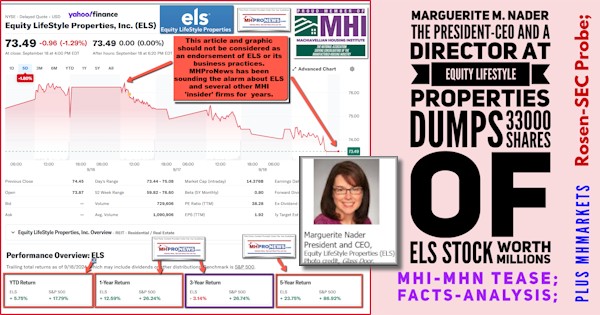

The markets report will be in Part VI and our insights and potentially related resources in brief are found in Part V. Note that the illustration below using Yahoo Finance data and stock trends indicates that the sharp fall shown was about the time and since the Blue Orca report was released.

Part I – Sun Communities Alert According to Block & Leviton

Sun Communities, Inc. Investors Who Have Lost Money Should Contact Block & Leviton to Find Out How They Might Recover Money Through The Firm’s Investigation

News provided by

ACCESSWIRE

Sep 26, 2024, 9:40 AM ET

BOSTON, MA / ACCESSWIRE / September 26, 2024 / Block & Leviton is investigating Sun Communities, Inc. (NYSE:SUI) for potential securities law violations. Investors who have lost money in their Sun Communities, Inc. investment should contact the firm to learn more about how they might recover those losses. For more details, visit https://blockleviton.com/cases/sui.

What is this all about?

Shares of Sun Communities are down following the release of a Blue Orca Capital report on September 25, 2024. The report alleges that Sun Communities, Inc.’s CEO had an “undisclosed $4 million loan from the family of a purported independent Director who has sat on the Audit Committee and chaired the Compensation Committee for over a decade,” and “this is not the only undisclosed personal loan we [Blue Orca] uncovered from a SUI Board member to the CEO.” We are investigating the company.

Who is eligible?

Anyone who purchased Sun Communities, Inc. common stock and has seen their shares fall may be eligible, whether or not they have sold their investment. Investors should contact Block & Leviton to learn more.

What is Block & Leviton doing?

Block & Leviton is investigating whether the Company committed securities law violations and may file an action to attempt to recover losses on behalf of investors who have lost money.

What should you do next?

If you’ve lost money on your investment, you should contact Block & Leviton to learn more via our case website, by email at shareholders@blockleviton.com, or by phone at (888) 256-2510.

Whistleblower?

If you have non-public information about Sun Communities, Inc., you should consider assisting in our investigation or working with our attorneys to file a report with the Securities Exchange Commission under their whistleblower program. Whistleblowers who provide original information to the SEC may receive rewards of up to 30% of any successful recovery. For more information, contact Block & Leviton at shareholders@blockleviton.com or by phone at (888) 256-2510.

Why should you contact Block & Leviton?

Block & Leviton is widely regarded as one of the leading securities class action firms in the country. Our attorneys have recovered billions of dollars for defrauded investors and are dedicated to obtaining significant recoveries on behalf of our clients through active litigation in the federal courts across the country. Many of the nation’s top institutional investors hire us to represent their interests. You can learn more about us at our website www.blockleviton.com, call (888) 256-2510 or email shareholders@blockleviton.com with any questions.

This notice may constitute attorney advertising.

CONTACT:

BLOCK & LEVITON LLP

260 Franklin St., Suite 1860

Boston, MA 02110

Phone: (888) 256-2510

Email: shareholders@blockleviton.com

SOURCE: Block & Leviton LLP ##

Part II – Per Bragar Eagel & Squire, P.C.

SUN COMMUNITIES ALERT: Bragar Eagel & Squire, P.C. is Investigating Sun Communities on Behalf of Sun Communities Stockholders and Encourages Investors to Contact the Firm

Provided by GlobeNewswire

Sep 26, 2024 9:00pm

NEW YORK, Sept. 26, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized stockholder rights law firm, is investigating potential claims against Sun Communities (“Sun Communities” or the “Company”) (NYSE: SUI) on behalf of Sun Communities stockholders. Our investigation concerns whether Sun Communities has violated the federal securities laws and/or engaged in other unlawful business practices.

Click here to participate in the action.

On September 25, 2024, Blue Orca Capital published a report concerning Sun Communities. In this report, Blue Orca Capital stated that “Our diligence reveals that SUI’s CEO received an undisclosed $4 million loan from the family of a purportedly independent Director who has sat on the Audit Committee and chaired the Compensation Committee for close to a decade. Put simply, undisclosed to investors, the family of a Board member overseeing the CEO’s compensation and Company controls has been lending the CEO money to finance the purchase of luxury real estate. Stunningly, this is not the only undisclosed personal loan we uncovered from a SUI Board member to the CEO.”

Following the release of this report, a decrease in the Company’s share price was observed during the early morning trading on the same day, September 25, 2024.

If you purchased or otherwise acquired Sun Communities shares and suffered a loss, are a long-term stockholder, have information, would like to learn more about these claims, or have any questions concerning this announcement or your rights or interests with respect to these matters, please contact Brandon Walker or Marion Passmore by email at investigations@bespc.com, by telephone at (212) 355-4648, or by filling out this contact form. There is no cost or obligation to you.

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York and California. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com##

Part III – According to Pomerantz LLP re: SUI

SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Sun Communities, Inc. – SUI

News provided by

ACCESSWIRE

Sep 26, 2024, 4:45 PM ET

NEW YORK, NY / ACCESSWIRE / September 26, 2024 / Pomerantz LLP is investigating claims on behalf of investors of Sun Communities, Inc. (“Sun” or the “Company”) (NYSE:SUI). Such investors are advised to contact Danielle Peyton at newaction@pomlaw.com or 646-581-9980, ext. 7980.

The investigation concerns whether Sun and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

[Click here for information about joining the class action]

On July 30, 2024, Paragon 28 disclosed that its previously reported financial results On September 25, 2024, Blue Orca Capital (“Blue Orca”) published a report alleging that Sun’s Chief Executive Officer (“CEO”) had an “undisclosed $4 million loan from the family of a purported independent Director who has sat on the Audit Committee and chaired the Compensation Committee for over a decade,” and that Blue Orca had also “uncovered” additional personal loans from members of Sun’s board of directors to the CEO.

Following publication of the Blue Orca report, Sun’s stock price fell $1.62 per share, or 1.16%, to close at $137.48 per share on September 25, 2024.

Pomerantz LLP, with offices in New York, Chicago, Los Angeles, London, Paris, and Tel Aviv, is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, Pomerantz pioneered the field of securities class actions. Today, more than 85 years later, Pomerantz continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered billions of dollars in damages awards on behalf of class members. See www.pomlaw.com.

Attorney advertising. Prior results do not guarantee similar outcomes.

SOURCE: Pomerantz LLP ##

Part IV – According to Blue Orca

(Note highlighting in what follows is added by MHProNews. Blue Orca and MHProNews logos added to several illustrations so that those finding those items online know the source).

COMPANY: Sun Communities, Inc. │ NYSE: SUI

INDUSTRY: Manufactured Home / RV REIT

We are short Sun Communities, Inc. (“SUI” or the “Company”), an egregious mess of conflicts

of interest and dubious executive behavior which we believe manipulates critical financial

disclosures to inflate adjusted funds from operation (“AFFO”) and organic growth.

Our diligence reveals that SUI’s CEO received an undisclosed $4 million loan from the family of

a purportedly independent Director who has sat on the Audit Committee and chaired the

Compensation Committee for close to a decade. Put simply, undisclosed to investors, the family

of a Board member overseeing the CEO’s compensation and Company controls has been lending

the CEO money to finance the purchase of luxury real estate. Stunningly, this is not the only

undisclosed personal loan we uncovered from a SUI Board member to the CEO.

Incredibly, SUI’s CEO was also embroiled in a scandal involving the falsification of his mother’s medical records to facilitate

the fraudulent sale of $63 million of life insurance policies he took out on his mother’s life. Although he was not charged or

formally accused of wrongdoing by law enforcement, in a sworn deposition, the physician who faked the medical records accused

the CEO of personally directing the insurance fraud scheme. Further, an attorney provided a sworn statement that a Department

of Homeland Security agent involved in the investigation said that the CEO “should be in prison.” This scandal, in our view,

raises significant questions as to management credibility and trustworthiness as a steward of investor capital.

Management credibility is central to SUI’s valuation because SUI is such a curious outlier compared to peers: by our estimate,

SUI’s peers (including its closest comp in the same industry) report 4-8x more recurring capex than SUI. The reason? We

believe that SUI arbitrarily excludes 26% of its mobile home / RV sites from recurring capex disclosures. It also excludes regular,

reoccurring capital spending required to replace departing tenants, an accounting treatment which has reportedly received push

back even from sell-side analysts. This inflates AFFO, a central component to how the market values REITs and the most

common metric on which analysts value SUI. Assuming constant AFFO multiples, our FY23 recurring capex adjustments

imply that SUI’s share price is inflated by 48%. We also find evidence to suggest, in our opinion, that the Company inflates

organic growth.

SUI is no stranger to allegations of financial impropriety. In the mid-2000s, the SEC settled an enforcement action against SUI,

and then sued several executives (including its still current CEO) for hiding losses in a subsidiary and maintaining a literal

“cookie jar” reserve to smooth earnings. The Company and the CFO settled, with the CFO agreeing to a two-year suspension

from practicing before the SEC as an accountant. The other defendants were dismissed. But we see parallels between this alleged

conduct and SUI’s conduct today, as SUI was forced to restate FY 2023 financials after reporting a material weakness around

goodwill impairment evaluations.

SUI is already heavily levered and has little room to maneuver at 6.0x Net Debt / Recurring EBITDA. Ultimately, we view SUI

as egregious governance failure tainted by scandal, whose business is growing far slower and generates far less AFFO than

investors are led to believe.

1) CEO Received Undisclosed $4 Million Mortgage from Family of Compensation Committee Chair. Undisclosed to investors, a purportedly independent Board member is a “closely-knit” stepcousin of SUI’s CEO whose family recently provided him with a $4 million loan to purchase one of the “most expensive homes for sale in Michigan.” What’s more, local property records indicate that the Board member’s family previously owned the home, and that they sold it to the CEO at a price approximately $2 million below the last public listing price. This purportedly “independent” Board member has been Chair of the Compensation Committee and a member of the Audit Committee since 2015, and is cited as an independent

Director despite his undisclosed personal financial ties to the CEO. We believe that such a large undisclosed loan from the family of a supposedly “independent” Board member who has played a role in two critical committees for close to a decade raises serious question about the integrity of the Company’s governance, controls, and financial disclosures. Incredibly, this is not the only time that the CEO has received an undisclosed loan from someone connected to a SUI Board member. In a deposition under oath, SUI’s CEO admitted to borrowing $700,000, among other loans, from a Board member who is a partner at the law firm that serves as SUI’s General Counsel. In our view, this tangled web of conflicts and undisclosed borrowings require an immediate investigation by an independent law firm and should likely be disqualifying to both the Board members and CEO.

2) CEO Embroiled in Life Insurance Fraud Scheme. Associates of SUI Founder-CEO Gary Shiffman were accused of multi-million dollar fraud surrounding the sale of $63 million of life insurance policies taken out by Shiffman on his mother’s life. Federal prosecutors alleged that a physician falsified Shiffman’s mother’s medical records and fabricated dementia and diabetes diagnoses, making the policies appear far more valuable and therefore easier to sell. Shiffman was neither named in the suit nor charged with wrongdoing, and the case was dismissed after an amendment to the charge shortened the statute of limitations.

However, in subsequent litigation brought against Shiffman by friends and family of the indicted parties, the physician, under oath, accused Shiffman of personally directing the scheme. Furthermore, an attorney provided a sworn statement that a Department of Homeland Security agent involved in the case said that Shiffman “should be in prison.” According to the federal indictment, Shiffman appears to have been under financial strain at the time, owing over $30 million to various creditors and having just $119,848 in cash and cash equivalents.

The allegations involving and against Shiffman have received minimal media coverage. To our knowledge, the Company acknowledged the existence of the investigation into Shiffman only once, in a disclosure buried on the fourth page of a six-page 8-K issued primarily to announce an unrelated $2.11 billion acquisition. Investors appear to be unaware of any of these developments involving the CEO. In our view, his very proximity to this scandal is disqualifying for leadership of a public company, and the allegations lodged against him under oath only serve to undermine the remaining credibility he may have. This scandal heightens our concerns surrounding the accounting and financial anomalies highlighted throughout the rest of this report.

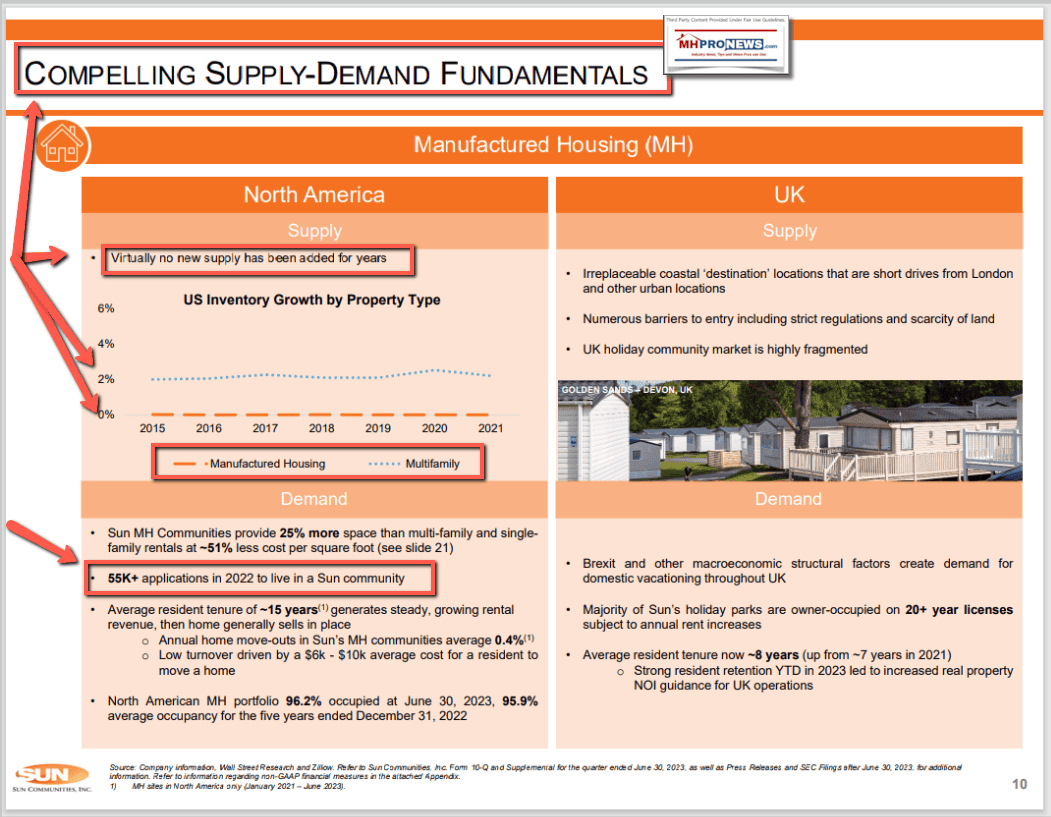

3) AFFO Inflated by Underreported Recurring Capex, Propping Up Excessive Valuations. We believe that SUI trades at an unjustified premium because, in our opinion, the Company underreports recurring capital expenditures, significantly inflating analyst and investor calculations of AFFO and thus its share price. We think that SUI maintains an aggressively broad definition of growth-oriented “non-recurring” capex that defies industry norms and common sense, giving it the lowest share of recurring capex (as a percentage of total capex) among its peer group by a dramatic margin.

SUI stands out as a major and inexplicable outlier among peers. Other REITs (including manufactured home REITs) report 4-8x times more recurring capex, measured as a percentage of total, than SUI. We believe that this is due to SUI’s inclusion of capex categories within “non-recurring” capex which rightly belong under the “recurring” classification. For example, a Company representative stated that SUI defines all capex associated with recently acquired sites as part of non-recurring capex, regardless of whether it is recurring in nature. Our calculations indicate that SUI excludes all capex associated with 26% of MH/RV sites and 15% of marina slips from recurring capex, even if elements of that capex are in fact recurring. Furthermore, the Company representative told us that sell side analysts have questioned SUI’s categorization of capital spending for lot modification as non-recurring, since this capex is required to replace departing tenants with new tenants.

When we adjust for capex associated with recently acquired properties and lot modifications, we estimate that sellside calculations of the Company’s AFFO were inflated by 60% in FY22 and 48% in FY23. Assuming constant AFFO multiples, SUI trades 48% above appropriate levels based on our FY23 recurring capex adjustments.

We think that management’s persistent and aggressive minimization of recurring capex has given analysts investors a misleading view of the Company’s financial results, resulting in chronic and significant overvaluation of the stock.

4) Organic Growth Manipulated through Inclusion of Converted and Expanded Properties. We believe that SUI inflates organic growth metrics by including converted RV sites in its same property sales and NOI calculations. SUI is currently transitioning several thousand of its RV sites from “transient” sites designed for temporary stays into “annual” sites designed for stays of a year or more. Per management, this has increased revenue at converted sites by as much as 50-60% in recent years. But management does not exclude these converted sites from its same property calculations, which in our opinion, gives investors a skewed and inaccurate view of organic growth.

The Company also includes manufactured home site expansions within same property growth calculations, which, combined with the effect of RV site transitions, could have inflated MH/RV same property growth by 200 basis points in FY22 and 169 basis points in FY23, or about a third of all growth in both years. When we remove the estimated impact of the Company’s RV transitions and MH site expansions, we calculate that actual same property sales growth at its manufactured home and RV properties is not keeping pace with reported rental rate increases, suggesting that occupancy is trending down. This is a worrisome sign for organic growth on its face, but it is doubly concerning in that it directly contradicts the Company’s own statements regarding same property occupancy rates at its manufactured home and RV sites.

5) History of Alleged Accounting Shenanigans and Reporting Failures Casts Shadow Over Current Financials. Sun Communities is no stranger to allegations of financial impropriety under its still-current CEO. The SEC settled an enforcement action against the Company, and then filed a district court lawsuit against CEO Shiffman, SUI’s then CFO, and its former Controller for hiding losses in a subsidiary and maintaining a literal “cookie jar” reserve to smooth earnings. The SEC eventually dismissed Shiffman and the former Controller from the lawsuit, but notably it settled the lawsuit against SUI’s then-CFO, requiring him to serve a two-year suspension from practicing before the SEC as an accountant (though, surprisingly, he remained with the Company in another capacity).

We believe that SUI’s history of alleged financial impropriety still has implications today. The Company recently took a $370 million write-down on a subsidiary which it acquired for $1.3 billion, recognizing the loss just over a year after the acquisition. It concurrently reported a material weakness around goodwill impairment evaluations and was forced to amend and restate results from prior quarters as a result. We see other parts of the business which continue to demonstrate financial weakness: the marinas segment, for example, requires ~3.5x recurring capex per slip than management originally forecast upon entering the business in FY20.

Given the prior allegations of hiding losses and smoothing earnings under its still-current CEO, we question whether the Company may be delaying the realization of impairments on segments which are long overdue for a write-down. The Company currently has a Net Debt to Recurring EBITDA ratio of 6.0x, higher than any of its peers. We believe that, should the Company have to recognize any such financial hit, it may harm its ability to support its strained organic growth without stretching its balance sheet to an unsustainable degree.

Ultimately, we view SUI as egregious governance failure tainted by scandal, whose business is growing far slower and generates far less AFFO than investors are led to believe.

I. CEO Received Undisclosed $4 Million Mortgage from Family of Compensation Committee Chair

Undisclosed to investors, a purportedly independent Board member is a “closely-knit” stepcousin of SUI’s CEO whose family recently provided the CEO with a $4 million loan for the purchase of a house that was called one of “the most expensive homes for sale in Michigan.” This Board member has been Chair of the Compensation Committee and a member of the Audit Committee since 2015, and is cited as an independent director despite his relationship with and undisclosed financial ties to the CEO. In our opinion, an undisclosed $4 million mortgage from the family of a purportedly independent Board member to the CEO fundamentally compromises the independence of the Compensation Committee and, critically, the Audit Committee, only raising more questions as to the integrity of the Company’s governance, controls and financial disclosures.

Furthermore, the CEO acknowledged in a deposition that he received loans from another Board member who is also a partner of the law firm which serves as SUI’s General Counsel. To our knowledge, no such loans were disclosed by the Company. Notably, the CEO acknowledged that this Board member advanced loans on his behalf to the individuals who were later indicted in the alleged insurance fraud described later in this report.

We believe that this pattern of undisclosed borrowing from Board members by the CEO requires an immediate independent investigation by independent counsel and, in our view, it should be disqualifying to the Board members and the CEO.

CEO Took out Undisclosed $4 Million Mortgage from Family of Chair of Compensation Committee On February 28, 2019, an entity named “DH Bingham Farms LLC” took out a $3.95 million mortgage from David B. Hermelin Trust and Doreen Hermelin Trust, jointly. DH Bingham Farms LLC was registered under the name of SUI CEO Gary Shiffman two days earlier, and he is the signatory for the entity on the mortgage.

Obituaries indicate that David and Doreen Hermelin, whose names are on the trusts that provided the loan, are the father and mother of independent SUI Director Brian Hermelin, respectively.

Brian Hermelin is currently a member of SUI’s Board of Directors and has served on the Board since January 1, 2014, and has served on the Audit Committee since that year. He also currently serves as Chair of the Compensation Committee, a role he has held since 2015. Furthermore, he is explicitly cited as an independent Director, despite his undisclosed relationship with and financial ties to SUI’s CEO.

We have retrieved a warranty deed that shows that the Hermelin family was the previous owner of the property, and that it transferred control of the property to DH Bingham Farms LLC (in a document submitted to “Shiffman Revocable Trust”) in February 2019.

We note that the latest list price for the house on Zillow was $6.995 million on November 17, 2018, at which point the listing was removed after it was labeled as “pending sale.”

We question why the CEO of a public company was apparently able to purchase the house from the family of a purportedly independent Director for $2 million under the reported list price just months later, in February 2019.

Regardless, because the family sold the property directly to the CEO for $4.95 million on a $3.95 million mortgage, we believe that the CEO paid the Director’s family $1 million directly (most likely a down payment of equity on the $4.95 million purchase price, in our opinion) – a payment between the CEO and the family of a purportedly independent Board member which was, again, not disclosed to investors.

Compounding the conflicts of interest created by this loan, our diligence indicates that, Hermelin is a stepcousin of the CEO, and their families reportedly have a “close-knit bond.”[1]

[1] The obituary of CEO Gary Shiffman’s father, Milton Shiffman, published in the Detroit Free Press, says that he was son to Joseph D. Shiffman and Florence Shiffman Hermelin, and stepson to Irving Hermelin (Source: Detroit Free Press, January 26, 2000. Archived online at newspapers.com). This same obituary states that there was a “close-knit bond” between the Shiffman and Hermelin families, and that Milton was also stepbrother to David Hermelin, former ambassador to Norway. The New York Times and Detroit Jewish News obituaries of David Hermelin published in November 2000 state that he was father to Brian Hermelin, and Florence Hermelin’s obituary also lists Brian among her survivors. If we follow the genealogy correctly, this would make Board member Brian Hermelin a stepcousin of the current CEO.

Archived online at the University of Michigan Library.

To our knowledge, this reportedly close family relationship was never disclosed to investors. In our opinion, it undermines any semblance of independence between the CEO and Brian Hermelin, despite the fact the Company holds Mr. Hermelin out as an independent Director.

Ultimately, the fact that the CEO took out a nearly $3.95 million mortgage from the family of an independent Director who has been Chair of the Compensation Committee and a member of the Audit Committee for close to a decade represents, in our opinion, an egregious violation of corporate governance standards that casts serious doubt on SUI’s internal controls. That the family of the Board member apparently sold the CEO the house for a price dramatically below the last listed price also raises a host of questions as to why this deal was never disclosed to investors.

Loans and Further Conflicts of Interest Between Shiffman and Another Board Member / General Counsel

Incredibly, this is not the only instance in which, undisclosed to investors, the CEO has borrowed from Board members or their families. In a deposition given during the legal proceedings discussed later in this report, SUI’s CEO acknowledged that he has borrowed from Arthur Weiss, another member of SUI’s Board and a partner of the law firm that serves as SUI’s General Counsel.

In the deposition conducted on March 28, 2023, SUI CEO Gary Shiffman acknowledged that he and Weiss have “had a relationship over 35 years where we’ve loaned each other money.” In one instance, Weiss paid the doctor implicated in the life insurance fraud $700,000 on behalf of Shiffman, another significant loan which, to our knowledge, went undisclosed to investors.

Weiss has been a Board member since 1996, just three years after SUI went public, and he remains a Board member to this day. He is also partner at law firm Taft Stettinius & Hollister LLP (formerly Jaffe, Raitt, Heuer & Weiss Professional Corporation), which according to the Company’s 10-K, acts as SUI’s General Counsel.

SUI has never disclosed the existence of such loans between Shiffman and Weiss, to our knowledge.

Remarkably, Shiffman’s history of borrowing from Board members may not end there. The federal indictment discussed later in this report alleged that he owed more than $30 million to multiple creditors. Among them was allegedly “a fellow member of the Board of Directors of the company for which [Shiffman] served as chairman and chief executive officer.” While SUI is not mentioned by name, we see no other entity to which “the company” can refer, given the context.

To our knowledge, no such loans between the CEO and any Board member was disclosed by the Company at the time.[2]

In our opinion, repeated undisclosed borrowing by the CEO from these Board members fundamentally compromises the independence of the Board as a whole, the Compensation Committee and, critically, the Audit Committee. In our view, such undisclosed loans only raise more questions as to the integrity of the Company’s governance, controls and financial disclosures. We believe that these large undisclosed loans to the CEO require an immediate investigation by independent outside counsel and, in our view, it should be disqualifying to both the Board members and the CEO.

II. CEO Embroiled in Life Insurance Fraud Scheme

Associates of SUI Founder-CEO Gary Shiffman were criminally indicted of multi-million-dollar fraud surrounding the sale of life insurance policies taken out by Shiffman on his mother’s life. Prosecutors alleged that Shiffman’s mother’s physician falsified her medical records to make her appear severely ill, including by fabricating diagnoses such as dementia and diabetes. As a result of such fabricated medical records, the $63 million in life insurance policies taken out by Shiffman on his mother appeared far more valuable and were therefore far easier for Shiffman to sell.

It is important to note that Shiffman was neither identified by name in the criminal indictment against his associates, nor charged with wrongdoing, and the criminal case against Shiffman’s associates was ultimately dismissed after an amendment to the charges shortened the statute of limitations. Shiffman was identified in the criminal complaint only as “Owner A,” and was never, to our knowledge, formally accused of any wrongdoing, including insurance fraud, by law enforcement or any government authorities.

Yet in subsequent legal proceedings, including civil litigation brought against Shiffman in Michigan by friends and family members of the alleged participants of the scheme, the physician, in a deposition under oath, accused Shiffman of personally directing the life insurance fraud scheme. Further, in other subsequent legal proceedings, an attorney provided a sworn statement that a Department of Homeland Security agent involved in the criminal investigation of the insurance fraud scheme stated that Shiffman “should be in prison.”

The allegations and sworn evidence in the subsequent legal proceedings involving and against Shiffman have received minimal media coverage and have not been addressed by the Company, to our knowledge, outside of a single obscure disclosure buried deep in an unrelated 8-K that offered no details regarding the case.[2] In our view, however, Shiffman’s very proximity to this scandal, not to mention allegations made under oath that Shiffman allegedly participated in and directed the life insurance fraud scheme, is highly concerning for leadership of a public company. In our opinion, such allegations undermine management’s credibility, which we think may provide a relevant backdrop for investors when evaluating the number of questionable accounting disclosures highlighted in this report.

CEO Involved in Alleged Insurance Fraud Scheme

The indictment against Shiffman’s associates charges that, as of 2008, Shiffman (identified in the criminal indictment as “OWNER A”[3]) held six life insurance policies against the life of his aging mother which, together, would pay a total death benefit of approximately $63 million.

Beginning in 2009, Shiffman began to fall behind on premium payments which, per the indictment, were estimated to be approximately $2 million per year. A few of these policies fell into grace in 2009 after Shiffman failed to make required payments, and one of the policies lapsed after a missed $44,608 payment in December of that year.

According to the indictment, a statement of Shiffman’s financial condition drafted by his financial advisor on December 31, 2009, reported that, despite “owning considerable assets,” Shiffman had just $119,848 in cash and cash equivalents. The statement also detailed that he had negative cash flow in 2009 and owing over $30 million “to various individuals and entities,” including his mother.

Allegedly facing personal financial strain, Shiffman tried to sell these policies beginning in late 2008. But his attempts proved unsuccessful. Life expectancy analyses determined that his mother had approximately another 148 to 165 months (~12-14 years) to live. Another examination performed in January 2010 pinned her expected lifespan at 170 months. Potential buyers balked at purchasing the plans, specifically citing the “long LE’s” (life expectancy) in February 2009.

According to the indictment, Shiffman hired local physician Dr. William Gonte to assist him in selling the insurance policies following these unsuccessful attempts to find a buyer. Shiffman entered into a profit-sharing agreement which, per the indictment, granted Dr. Gonte “up to 30% of the proceeds” contingent on the policies being sold within 24 months for more than the premiums paid on the policies, and not less than $3 million.[4] Separately, Shiffman declared the brokerage firm owned by another associate to be the exclusive broker of record for four of the policies.

The subsequent legal proceedings brought even more alleged details of this agreement to light. According to depositions given by both Shiffman and Dr. Gonte, Shiffman scribbled this profit-sharing agreement by hand. While Shiffman said that he did not clearly recall who was present at the time of the drafting, Dr. Gonte said under oath that

Shiffman intended it to be a “secret agreement” between them, and that Shiffman “didn’t want his attorneys to look at it” (referring to his own attorneys). A photograph of the agreement was included as an exhibit in two of the subsequent legal proceedings.

[2] It is possible that the unnamed Director referenced in this part of the indictment is Weiss, from whom Shiffman admitted to taking loans in the past. However, if it refers to a different Board member, then this would represent evidence of Shiffman borrowing from a third Director without disclosing the loan to investors. Even if it does refer to Weiss, the specific loan discussed in this part of the indictment would have been granted in 2009 or earlier, preceding the $700,000 loan granted from Weiss to Shiffman which Shiffman himself acknowledged in his deposition.

[3] An investigation into Shiffman’s sale of life insurance policies was mentioned in a single brief disclosure buried in an unrelated 8-K in September 2020, but neither the details of the case nor the existence of a federal indictment was disclosed, and it was the Company’s last and only acknowledgement of the case, to our knowledge.

[4] As noted, Shiffman was neither charged with wrongdoing nor specifically identified by name in the indictment of his associates. However, Shiffman was later sued by the wife of the doctor and a friend of the broker in separate civil cases for misappropriation and fraud, respectively, in Oakland County, MI (the court found in Shiffman’s favor in both cases). There were also other relevant separate legal proceedings involving Shiffman’s associates at the federal level surrounding the events of the alleged fraud. We collectively refer to all of this subsequent litigation as the “subsequent legal proceedings.” These subsequent proceedings unveiled more of the details surrounding the alleged insurance fraud scheme. Statements made by both Shiffman and his associates during these subsequent proceedings confirm that Shiffman was the individual identified in the criminal indictment against Shiffman’s associates as “OWNER A” who employed the doctor and broker to sell the $63 million worth of life insurance policies.

[5] In a deposition given during one of the subsequent legal proceedings, the doctor claims that another 20% was promised to him by Shiffman, for a total 50% profit share, but 30% was the maximum that Shiffman was “allowed to pay a broker.” He also claimed that, while the agreement was dated February 1, 2009, it was drafted later that summer, and that Shiffman wanted it “predated.”

According to the federal indictment against Shiffman’s associates, Dr. Gonte and the broker struggled to find a buyer for the insurance policies due to the relatively good health of his mother, and Shiffman continued to fall behind on his premium payments. The indictment states that Shiffman received notices from counterparties of past-due payments as late as March 2010, warning Shiffman that the policies were at risk of being terminated.

At this point, the indictment alleges that Dr. Gonte caused false laboratory tests to be generated for Shiffman’s mother, including swapping out the mother’s blood for the blood of a diabetic. This made it appear that Shiffman’s mother’s life expectancy was far shorter, making the life insurance policies more valuable and more attractive to potential buyers.

According to the indictment against Shiffman’s associates, on April 12, 2010, Dr. Gonte ordered a blood test for

Shiffman’s mother that reported her glucose level to be 99, which is considered normal. But shortly thereafter, on April 16, Dr. Gonte ordered another test using “substitute material that Dr, Gonte had fraudulently caused to be submitted to the laboratory in place of [Shiffman’s mother’s] blood.” Per Dr. Gonte’s deposition in one of the subsequent legal proceedings, this material was “control blood” that was known to be diabetic. The resulting test reported her glucose level to be 296 and A1C level to be 10.6, both suggesting that she was severely diabetic.

The criminal indictment charges that falsifying the mother’s blood tests produced new life expectancy estimates indicating that her anticipated lifespan had fallen by nearly 50% since the last study performed just months earlier in January 2010. Her life expectancy had dropped from 170 months (over 14 years) to just 90-94 months (~7.5-8 years).

The indictment alleges that it did not take long for buyers to emerge for the policies once the doctor began to market the allegedly falsified medical records and life expectancy reports. The indictment states that Credit Suisse, which had previously declined to bid on one of the policies in December 2008, January 2009, and February 2009, went on to submit an offer for that same policy in July 2010 for $2.1 million. The policy was ultimately sold to Wells Fargo, per the indictment (Credit Suisse allegedly purchased at least one other policy). The indictment states that employees at another institution also noted Shiffman’s mother’s “huge” and “very significant” change in health since January in their new evaluations of the plan, though this was based on an allegedly falsified medical report.

The indictment against Shiffman’s associates also notes that the doctor and the broker were listed as contacts for Shiffman’s mother who could provide third-party information regarding her medical condition, rather than an actual friend or an acquaintance with no interest in the transactions. The doctor accused of falsifying Shiffman’s mother’s medical report was himself listed as her primary physician, depriving potential buyers from access to her medical information from an objective third party. The broker continued to assume responsibility for providing periodic medical updates to the buyers after the sales were finalized, despite having no actual knowledge of her medical status, per the indictment.

According to the indictment, five of the six policies were ultimately sold for a total of $6.9 million. For this, Dr. Gonte received approximately $1.5 million and the broker received over $400,000, plus additional compensation.

Based on our review of SUI’s filings, the Company acknowledged the existence of an investigation into Shiffman’s sales of life insurance policies only once, with a disclosure buried in an unrelated 8-K announcing its largest ever acquisition. On September 29, 2020, the Company released a six-page 8-K announcing its $2.11 billion acquisition of Safe Harbor Marinas, LLC and discussing its financing of the deal. On the bottom of the fourth page, under “Other Events,” the Company said that the United States Attorney’s Office for the Eastern District of Michigan was investigating matters related to Shiffman’s sale of five life insurance policies on the life of a family member. SUI acknowledged that the investigation “could potentially result in charges against Mr. Shiffman,” but stated that Shiffman denied any improper or illegal conduct. Again, to our knowledge, this was the Company’s last and only disclosure on the topic.

As we have repeatedly emphasized, Shiffman was never charged in the indictment, nor, to our knowledge, was he ever charged or formally accused of wrongdoing in this scheme by any government or law enforcement agency. Indeed, while, in subsequent legal proceedings, Shiffman acknowledges he hired Dr. Gonte and the broker to sell his mother’s unusual policies, he claims that he never knew of the scheme to fake his mother’s medical records to make the policies more marketable to potential buyers, and never directed either man to carry it out. Shiffman’s denial in the subsequent legal proceedings is consistent with his denial of wrongdoing as stated in the Company’s September 2020 8-K disclosure.

But not everyone agrees. In a deposition conducted during one of the subsequent legal proceedings, Dr. Gonte alleged under oath that Shiffman was “an active participant throughout” who instructed him to produce medical records that would make his mother appear deathly ill.

In a particularly notable part of the deposition, Dr. Gonte testified point blank that Shiffman knew he was falsifying medical records to help sell his mom’s life insurance policies.

What’s more, Dr. Gonte testified that Shiffman prepped his mother to answer questions for Credit Suisse in a manner consistent with “absurd medical conditions.”

These statements were made under oath by a doctor who admits he took money to falsify medical records, so investors are free to take their own measure of his credibility (or lack thereof). But after the federal charges were dismissed against him, Dr. Gonte outlined the scheme under oath in a deposition which includes scandalous allegations of Shiffman’s involvement in the life insurance fraud scheme.

We reiterate, for the avoidance of any doubt, that Shiffman has consistently claimed that he did not instruct Dr. Gonte or anyone else to obtain the falsified medical records. He made this clear in his deposition taken during the same case.

He also claims that “false allegations” regarding his alleged involvement were cleared up during the process of the criminal investigation.

But others still allegedly believed that Shiffman was involved. According to a sworn declaration submitted by a defense attorney in one of the subsequent legal proceedings, a Department of Homeland Security agent who had interrogated the broker and was involved in the criminal insurance fraud was frustrated with the government’s decision not to have the broker wear a wire to record conversations with Shiffman. According to the sworn declaration, the

DHS agent allegedly said that Shiffman “should be in prison.”

In our view, a sworn statement from a member of the bar that the DHS investigator strongly suspected Shiffman’s involvement – to the point that he reportedly said that “the CEO should be in prison” – casts legitimate doubt on Shiffman’s narrative.

Ultimately, it is for investors to determine the significance of this scandal and what, if any, conclusions to draw regarding those allegedly involved. The allegations involving and against Shiffman have received minimal media coverage and have not been disclosed by the Company, to our knowledge, with the exception of a single disclosure buried deep in an unrelated 8-K that offered no details into the case. In our view, Shiffman’s very proximity to this scandal, not to mention allegations under oath that he allegedly participated and directed the life insurance fraud scheme, is disqualifying for leadership of a public company. Such allegations undermine management’s credibility, which we think should be front and center for investors given the number of questionable financial disclosures highlighted in this report.

III. AFFO Inflated by Underreported Recurring Capex, Propping Up Excessive Valuations

We believe that SUI trades at an unjustified premium because, in our opinion, the Company underreports recurring capital expenditures, which significantly inflates AFFO and thus its share price.

Peers report 4-8x higher levels of recurring capex as a percentage of total capex, making SUI an inexplicable outlier (even compared to its closest manufactured home comp). We believe that that this discrepancy exists because SUI maintains an aggressively broad definition of growth-oriented “non-recurring” capex that defies industry norms and common sense. The Company appears simply to exclude all capex associated with recently acquired sites from its recurring capex line for up to three years after the acquisition date, with apparent disregard for whether particular elements of capex at these sites are in fact recurring in nature. On a call with the Company’s investor relations, the representative confirmed as much.

The Company’s own disclosures indicate that it is excluding 26% of all MH/RV sites, and 15% of marina slips, from recurring capex. Furthermore, Company representative told us that they receive pushback from sell-side analysts regarding their inclusion of “lot modifications” within non-recurring capex. We believe that, as a result of excluding these items from recurring capex, analyst calculations of the Company’s AFFO were inflated by 60% in FY22 and 48% in FY23.

Because SUI, like other REITs, trades at a multiple of AFFO, when we shift elements of non-recurring capex into their proper place within recurring capex, the calculations suggest that the Company’s shares are worth considerably less than their current trading prices. Adjusting recurring capex and AFFO in line with FY23 figures would imply that SUI shares trade 48% above where they should.

Recurring Capex as a Percent of Total Capex is a Major Outlier Among Peers

As is common among REITs, SUI separates its reported capital expenditures into two categories: one which represents investments into the business for growth (“non-recurring”), and another representing capital spent on basic maintenance of the business (“recurring”).[1] “Non-recurring capex,” representing discretionary investment, is not regarded a drain on cash flow available for potential distribution and is therefore excluded from AFFO calculations. Investors and analysts calculate AFFO – which, in the case of SUI, the Company does not report itself – by deducting recurring or maintenance capex from reported Core FFO.

For comparable companies, reported maintenance capex comprises ~50% of total capex, on average. SUI, however, is a major outlier. Since FY20, it has not reported recurring capex of more than 9.6% of total capex over the same period, and it has maintained a startlingly low average of just 8.1%. This is dramatically lower than any of its peers.

[6] Some companies define these categories slightly differently, and assign different labels to them, but each categorizes capital spending into two segments corresponding to “growth capex” and “maintenance capex,” respectively.

At the high end, Essex Property Trust (NYSE: ESS) has averaged a recurring capex share of 65.8% of total capex over the same time period, and AvalonBay (NYSE: AVB) has averaged a recurring capex share of 62.3%. Put plainly, over the past four fiscal years, SUI’s peers report a recurring capex share of up to 8.1x higher than that of SUI, and no peer reports a recurring capex share any less than 3.9x that of SUI.

The discrepancy between SUI and its most direct peer is particularly informative. Equity LifeStyle Properties (NYSE: ELS), SUI’s closest comp and the only other manufactured home-focused REIT with a market cap above $10 billion, has reported recurring capex of 31.5% of total capex on average over the last four fiscal years. Compare this to SUI, which reports an average of just 8.1% in recurring capex as a percentage of total capex over the same period.

[7] The terminology used by each peer company is as follows: CPT / “Recurring Capex”, ESS / “Non-Revenue Generating Capital Expenditure,” AVB / “Asset Preservation Capex,” MAA / “Recurring Capital Expenditures,” UDR / “Recurring Capital Expenditures,” INVH / “Recurring Capital Expenditures,” ELS / “Recurring Capex” (also “Non-Revenue Producing Improvements to Real Estate”). CPT data includes pro-rata joint venture recurring capex, as reported. Excludes EQR, which is also commonly cited as an SUI comp, but which does not explicitly disclose actual recurring capex. However, in its press release issued alongside Q4 FY23 earnings, EQR states that “Similar to 2023, the Company expects that approximately 40% Capital Expenditures to Real Estate for Same Store Properties will be NOI-Enhancing.” We therefore estimate that EQR’s recurring capex is approximately 60% of total capex.

SUI never explains why its closest peer reports 4x times as much recurring capex as a percentage of total capex, but in our view, there is no question that SUI’s AFFO and its stock price receives a substantial boost because of this inexplicable discrepancy.

On the rare occasion when the sell side has tried to explain why SUI reports a far lower share of recurring capex than peers, analysts have posited that the Company’s low capex obligations may be explained by its low reported turnover and limited exposure to depreciating assets, as a manufactured home REIT that simply rents out plots of land. But if this were the case, SUI’s closest comp, another manufactured home-focused REIT, would also report a low share of recurring capex. It doesn’t. ELS benefits from the same low turnover and limited exposure to depreciating assets while still reporting a recurring capex percentage 4x that of SUI. In FY23, SUI reported five-year average annual turnover of 3.0% for customer departures and 6.9% for relocation to another Company site, for total turnover of 9.9%. While ELS does not regularly report turnover in its filings, management said on its Q3 FY23 earnings call that it has approximately 10% turnover annually. It also has a higher share of age-restricted communities for seniors, according to the ELS former with whom we spoke, which are regarded as lower-turnover properties. We therefore do not believe that low turnover rates are sufficient to explain SUI’s highly abnormal recurring capex rates.

Furthermore, SUI appears to be more aggressive than ELS in its allocation of various capex categories between recurring and non-recurring capex. Our analysis of the definitions of each company’s capex subcategories suggests that capital spending on various improvements and renovations are booked as recurring capex by ELS, but as nonrecurring capex by SUI. ELS also has no equivalent categories for “Rebranding,” “Capital Improvements to Recent Acquisitions,” and “Rental Program,” each of which is booked as non-recurring capex by SUI. As discussed below, we suspect that capex which would otherwise be recorded as recurring capex, but that just happens to be occurring at recently acquired properties, is being booked inappropriately as non-recurring capex by SUI (and apparently not by ELS). We also suspect that capex, which, for SUI, includes new signage and basic website costs, might be booked as recurring capex or even expensed by ELS.

SUI’s recurring capex is a major outlier from peers, suggesting, in our opinion, that it is inappropriately allocating capex between its “recurring” and “non-recurring” categories. Again, as a direct input to AFFO calculations, this has a major inflationary effect on the Company’s most critical financial metric among analysts and, hence, its share price.

The composition of capex is not a minor accounting matter among REITs: both investors and companies are attentive to relative capex allocations, and other companies with good governance have been generally transparent about the allocation. For example, on a recent earning call conducted by ELS, analysts asked directly about recurring capex levels, and management was clear and explicit about its general capex allocations:

CFO: So to come to the $100 million [of free cash flow], we have an assumption of $85 million of spend in recurring capex.

COO: Yes, I mean, let me just walk through our total capex spend. But Paul just touched on the recurring piece. And recurring for us is really about one third of our total spend – falls into two buckets, asset preservation and improvements in renovations. The next bucket for us is property upgrades and development – that’s a little bit more than half the spend…. And then the balance would be revenue-producing, expansion and development, property upgrades and repositioning. And the last bucket is site development – that is about 10% of our total spend. And that’s going to be with respect to improvements to the site, new homes in our MH communities.

– Equity LifeStyle Properties, Q4 FY23 Earnings Call (January 30, 2024)

By contrast, SUI is far from transparent. Its most prominent capex disclosure, found in its earnings releases and financial supplements, omits several elements of capex that can be found only in the notes to its 10-Ks and 10-Qs. It also combines capex with its acquisition spend, obscuring its share of recurring capex as a percent of total capex. See the appendix for a more comprehensive discussion of what we consider to be the Company’s misleading capex disclosures.

SUI Appears to be Inappropriately Categorizing All Capex at Acquired Sites as Non-Recurring

It is clear from the peer comparison that SUI reports a fraction of the recurring capital expenditures of its peer group, which in our opinion, massively and inappropriately inflates its AFFO. One of the mechanisms by which we suspect the Company underreports recurring capex is by disguising such obligations as capital improvements to recent acquisitions, which we believe fools investors into mis-categorizing maintenance capex as growth capex.

• Recurring Capex Obligations of Recent Acquisitions

We believe that SUI’s inclusion of “Capital improvements to recent acquisitions” as a component of non-recurring capital expenditure is aggressive and inappropriate.

On an investor relations call, a Company representative stated that SUI does, in fact, allocate all capex associated with recently acquired sites into the non-recurring capex category, notwithstanding whether elements of that capex may in fact be more recurring in nature. We believe that this represents a clear repression of reported recurring capex which, in turn, inflates AFFO and investor valuations of SUI shares.

The Company describes its capital improvements to recent acquisitions in the following way in its SEC filings:

We believe that SUI’s inclusion of this component of capex within the non-recurring category gives it an easy path to designating as “non-recurring” basic reinvestment in these acquired properties that should, in our opinion, be characterized as “recurring.” The above definition does not explicitly restrict this capex category to capex spent on “upgrading” newly acquired properties versus capex spent towards investments which, if the property just happened not to be newly acquired, would otherwise be designated as recurring.

The fact that the Company gives itself the latitude to designate capex at acquired sites as “non-recurring” for up to 36 months after the date of acquisition only makes us more suspicious. We doubt that most basic improvements would take this long to complete, and suspect that this simply gives management more discretion to allocate maintenance capex at newly acquired sites into its “non-recurring” capex category for a longer period of time.

At the extreme, in our view, the definition is so broad that it allows the Company to define all capital spending at newly acquired sites as “non-recurring.”

We believe that this is precisely what is happening. During an investor relations call, a SUI representative told us that the Company reports all capex associated with recently acquired sites in the “capital improvements to recent acquisitions” category within non-recurring capex.

Blue Orca: Your treatment of recurring capex – we were going through the line items. I’m just curious about how you treat the newly acquired sites. You have the line item, I think it’s… Company: Acquisition capex?

Blue Orca: “Capital improvements to recent acquisitions.” Is that inclusive? Is that all capex that’s part of those recently acquired sites? Or is it just the non-recurring component of that? Just curious how you treat that, and how it feeds into the rest of the model.

Company: That is all capex over around a two-year period of time from acquisition, where we’re bringing that property up to Sun’s standards.

– Investor relations call conducted by Blue Orca

SUI’s filings corroborate this statement. Company disclosures reveal, by our analysis, that the Company simply excludes all capex associated with 26% of its manufactured home and RV properties, and 15% of its marina slips, from counting towards recurring capex.

According to the first page of its FY23 10-K, the Company had 179,310 manufactured home / RV sites and 48,030 marina slips as of year-end FY23. However, when it calculates recurring capex per site in its financial supplement, the numbers imply that only 133,505 MH/ RV sites and 40,946 marina slips are being counted towards the calculation.

The footnote to the capex disclosure in the Company’s financial supplement states that the recurring capex per site figures cited by the filing are based only on the sites “associated with the recurring capital expenditures in each period.” We take this to mean that the capex tied to some of its sites is not counted towards recurring capex at all, regardless of the nature of the capital spending associated with these sites.

Our calculations reveal that the Company excluded a massive 45,805 MH/RV sites from recurring capex, and 7,084 marina sites – or 26% of its total MH/RV sites and 15% of its total marina sites.

Even its same property calculations at year-end FY23, which reflect all sites owned for the preceding two years, include 152,990 MH/RV sites, suggesting that the Company is excluding even more sites than those acquired within just the last two years. This aligns with the Company’s disclosure that non-recurring capex associated with recently acquired sites pertains to sites acquired within the last 24 to 36 months.

SUI’s own property counts also appear to corroborate that the Company is excluding acquired sites in particular from its recurring revenue calculations. The Company reported 38,881 wet slips and dry storage spaces at year-end FY20 and 45,155 at year-end FY21. This matches the ~41,000 wet slips and dry storage spaces implied by the SUI’s recurring capex per site calculation, which would exclude sites acquired in the last 2-3 years, we believe. SUI did report 149,295 developed MH/RV sites at year-end FY20, higher than the 133,505 sites implied by the Company’s recurring-revenue-per-site disclosure. However, this includes the sites that it has divested since that time. In our opinion, there are no realistic explanations for its exclusion of over a quarter of MH/RV sites other than the exclusion of sites acquired during the last 2-3 years. In our opinion, SUI’s exclusion of all capex tied to recently acquired sites from recurring capex is highly inappropriate: management should not assign basic improvement capex to the “non-recurring” capex category simply because it takes place at recently acquired sites. This capex represents a recurring source of capital spending that the Company faces now and will continue to face into the future. Giving itself discretion to designate it as “non-recurring” simply because it takes place at newly acquired sites is, in our opinion, highly aggressive and out of line.

Furthermore, we find no analogous capex subcategory among SUI peers when we evaluate their own capital spending disclosures.

For all of these reasons, we believe that “capital improvements to recent acquisitions” should not be included within its non-recurring capex subsegment.

• Lot Modifications

During an investor relations call, the Company informed us that sell side analysts dispute its inclusion of “lot modification” capital spending within non-recurring capex.

Company Representative: A lot modification – and we have this debate with the sell side all the time, or not all the time, periodically – where they’re like, “That sounds like recurring.”

Source: Investor relations call conducted by Blue Orca

Lot modification capex is defined by the Company as capital spending “incurred to modify the foundational structures to set a new home after a pervious home has been removed.” When departing tenants vacate a plot, these costs must be incurred to prepare the plot for a new tenant.

During our conversation, the Company defended its position that lot modification capex is “non-recurring” by claiming that “if we did not have one more occupancy gain, that number would go to zero.” The representative further explained that “if you held the portfolio on a static basis and you have no ins and outs, it just, you know, it would just continue – lot modifications would go to zero,” Lot modification capex is therefore “tied to gaining occupancy, and therefore generation of revenue.” Because the Company considers lot modification capex to be revenue-generating capital spending, it regards this spend as non-recurring capex.

We believe that this is flawed logic which conveniently allows the Company to allocate capex in a favorable manner. Tenant departures are regular and inevitable events for a manufactured home REIT, or any other residential or commercial REIT. There is no realistic scenario under which tenant turnover would cease, and it is not instructive to consider a hypothetical under which there are “no ins and outs.” Rather, if lot modification capex fell to zero, lots could not be prepared to accept new tenants after existing tenants depart, and occupancy, in the long run, would fall to zero. Replacing a departing tenant with a new tenant therefore cannot be regarded as an “occupancy gain,” as the representative construed it to us.

Accordingly, we do not consider lot modification capex as generative of incremental revenue, but necessary to preserve existing revenue in the face of inevitable turnover. The Company’s inclusion of lot modification capital spending within non-recurring capex is therefore flawed, in our opinion: it is not revenue-generating capex, but an unavoidable cost of doing business.

For the purposes of our pro forma adjustment of recurring capex, we remove only “capital improvements to recent acquisitions” and “lot modifications” from the non-recurring capex category. But, to be clear, we believe that this is the minimum that should be reallocated into recurring capex, and suspect that the company may be inappropriately designating other elements of capex as non-recurring.

In particular, we believe the following components of non-recurring capex should likely be considered recurring capex, if not expensed:

- “Rebranding” capex is defined as spending on “new signage at our RV communities and the costs of building an RV mobile application and updated website.” New signage associated with rebranding efforts may represent one-off capital spending, but the costs associated with maintaining and updating the Company’s web presence are best characterized as recurring, in our opinion.

- “Expansion and development” expenditures include research and development. We believe these costs should be excluded from capex entirely and instead expensed as incurred, per ASC 730-10-25.

Other elements of capex not explicitly enumerated in the respective definitions of its capex categories may also be legitimate candidates for reassignment from non-recurring to recurring capex. But we believe the above elements are themselves very serious candidates for reassignment and believe that actual recurring capex at SUI may well be higher than even our own adjustments suggest.

Underreporting Recurring Capex Materially Inflates AFFO

How REITs define recurring capex is not a minor accounting issue. Companies and analysts subtract only the recurring component of capex from FFO to arrive at AFFO. Excluding significant components of capital spending from recurring capex can therefore have a significant inflationary effect on AFFO. As AFFO is the most commonly cited metric on which valuations are based for SUI and other REITs among sell-side reports, aggressive capex allocations have dramatic implications for how REITs are priced by the market.

SUI itself does not calculate AFFO: its non-GAAP figures includes FFO and a company-specific “Core FFO” figure including one-off adjustments, but it does not take the next step of deducting non-recurring capex to calculate AFFO. Regardless, sell-side reports value the Company on AFFO, not FFO or Core FFO, and all analysts which show their AFFO calculations clearly determine AFFO by deducting only recurring capex as it is defined by the Company. SUI’s apparent minimization of recurring capex therefore causes analysts and investors to value SUI shares at far higher levels than we believe is appropriate.

We adjust SUI’s reported recurring capex by adding “capital improvements to recent acquisitions” and “lot modifications,” for the reasons described above. Again, we suspect that the Company may be designating even more capex as “non-recurring” that in fact belongs in the “recurring” category, but we believe at least this amount must be shifted from “non-recurring” into “recurring.”

Based on the comparison of capex category definitions between SUI and ELS provided above, we also think that elements of SUI’s “Expansion and Development” capex category are candidates to be labeled “recurring capex.” This is the Company’s largest capex category, and we suspect that it includes elements that are, in fact, both non-recurring and recurring, based on the comparison of definitions between the two companies. Because we cannot determine precisely how much of this capex is truly recurring, we do not adjust for this category. However, we emphasize that, by adjusting for only “capital improvements to recent acquisitions” and “lot modifications,” we are adjusting for what we consider to be a bare minimum of the Company’s stated non-recurring capex. In reality, the Company’s true AFFO may be, and likely is, even lower, in our opinion.

When we make the adjustment for “capital improvements to recent acquisitions” and “lot modifications,” the Company’s recurring capex as a percent of total capex rises from 9.6%, 8.0%, and 8.7%, respectively, in FY21, FY22, and FY23, to 40.1%, 42.7%, and 35.6%. This would put it in line with the low end of its peer set, but still well below many comps. This gives us comfort that our adjustments are entirely appropriate and, if anything, conservative.

When we make this adjustment, Company AFFO falls from $849.7 million and $828.0 million in FY22 and FY23, respectively, to just $530.3 million in FY22 and $557.8 million in FY23. LTM AFFO falls from $789.1 million to

$613.9 million. We believe that the Company’s aggressive classification of non-recurring capex caused analysts and investors to inflate AFFO by 60.2% in FY22 and 48.4% in FY23, and by as much as double or more in some quarters.

We believe that, as SUI is a serial acquirer, it makes sense for them to treat all “capital improvements to recent acquisitions” as recurring, and we accordingly adjust SUI’s recurring capex to include all of this capital spending. However, investors could also try to estimate the quantity of capex included in this category that would properly be recorded as recurring if these sites were established components of SUI’s property base, and were therefore permitted to contribute to recurring capex by the Company rather than be entirely excluded from the recurring category. We believe the best way to estimate this would be to use the average recurring capex share among peers, which has been approximately 50% over the past four years. Using this method, we would estimate that 50% of “capital improvements to recent acquisitions” is recurring, and 50% is non-recurring, while continuing to adjust “lot modifications” into the recurring category. Even under this method, we believe that SUI’s AFFO was inflated by 27% in FY22 and 24% in FY23.

In sum, regardless of how one wishes to perform their estimates and adjustments, we believe that SUI’s aggressive suppression of recurring capex has materially inflated AFFO and, therefore, Company valuations by as much as 5060%. In our opinion, it is abundantly clear that SUI’s apparent minimization of its recurring capex serves to inflate AFFO by a significant margin. Because AFFO is the metric on which analysts value the Company, it also has a direct effect on sell-side (and investor) valuations and price targets. We believe that, due to management’s aggressive accounting around its capex allocation, the consensus belief regarding the fair value of SUI shares is detached from the reality of SUI’s business and financial results. Valuations based on our adjusted FY23 AFFO, taking into account our recurring capex adjustments, would imply that SUI shares currently trade 48% above where they should, assuming no change in multiple.

IV. Organic Growth Manipulated through Inclusion of Converted and Expanded Properties

In addition to inflating AFFO, we also believe that the Company inflates organic growth, making it appear that the Company’s underlying business is far healthier than it is.

Specifically, we believe that SUI’s same property sales growth is inflated by its ongoing conversion of “transient” RV sites into “annual” sites, in addition to “expansion sites.” Despite the significant revenue uplift that conversions reportedly bring (50-60% in prior years, per management’s statements on earnings calls), the Company, by its own admission, does not exclude converted RV sites from its same property sales and NOI calculations, making them a misleading indicator of organic growth. During an investor relations call, a Company representative confirmed to us that SUI includes converted RV sites and expansion MH sites in its same property growth calculations. Even a sell side analyst has acknowledged that expansion sites are “not quite same-store.” When we remove the estimated impact of RV site conversions and the Company representative’s estimate of expansion MH site contributions, we estimate that the Company may be inflating MH/RV same property growth by as much a two hundred basis points.

When the estimated impact of these conversions is removed, it appears that same property sales growth at its manufactured home and RV sites is not keeping pace with reported average rental rate increases.

This is worrisome on its face, and a decisively negative sign for organic growth. But it also flies in the face of the

Company’s claim that same property occupancy rates are increasing among its manufactured home and annual RV sites. It should not be possible for same property occupancy rates to be increasing if average rental rate increases exceed same property revenue growth. It is possible that same property occupancy rates are also being inflated by RV site conversions, again rendering the statistic a misleading indicator of organic occupancy growth. But, if not, reported rental rate increases and occupancy increases do not square with the fact that, when our estimated revenue uplift from RV conversions is removed, same property sales at manufactured home and RV sites is not keeping pace with reported increases in rental rates. Either way, we think that organic growth is lower than investors believe or the Company’s reported occupancy rates are inflated, or both.

Same Property Sales Inflated by Site Conversions and Expansions

SUI is currently in the middle of a multi-year process of converting thousands of transient RV sites into annual sites. Transient RV sites cater to tenants who remain for only several nights or weeks, while annual sites cater to long-term tenants who remain for at least a year. The Company reports that this conversion produces a significant increase in annual revenue at converted sites: while management says that the uplift has fallen to 30-40% of late, it says that it was as high as 50-60% in recent years.