“Manufactured housing remains, by far, the most affordable non-subsidized housing option.”

– Hoya Capital.

“As is often the case, government regulation results in consequences that are exactly opposite of the original intent: a higher concentration of power in the hands of fewer. The implications of this are that while the overall housing recovery will continue to be sluggish, the larger homebuilders should continue to outperform the broader sector.”

– Hoya Capital.

“Size and scale have become essential for homebuilders. Stifling regulations, rising construction costs, and sluggish demand have squeezed margins and made it nearly impossible for smaller builders to compete.”

– Hoya Capital.

“Access to capital markets (or lack thereof) was the primary reason that the larger builders were able to avoid bankruptcy during the housing collapse.”

– Hoya Capital.

“To the victor go the spoils. We remain negative on the homebuilding sector relative to consensus. Restrictive zoning (NIMBY), rising construction labor costs, and buyer affordability issues will continue to hold back the recovery.”

– Hoya Capital.

Analysis of the Quoted Top Lines

While much of the above and what follows applies to manufactured housing, some of the issues that focus on conventional housing could be avoided by manufactured home builders, and retailers.

How? Why? Because a proper understanding and application of enhanced preemption could open up markets and locations that are currently being artificially closed to manufactured housing.

Industry Voices

Tony, I’ve been meaning to take a moment for a couple of weeks now, to send you this message. I apologize for mixing subjects, but – in the end – I believe you’ll find that all these topics relate to one another.

Under Hoya Capital’s Manufactured Housing Research link, one click reveals an article that begins with a report dated Oct 24, 2017 and opens with the following bullets.

Hoya Capital Seeking Alpha Manufactured Housing Research Summary

Notes:

Hoya provided graphics are so labeled, others and

related linked reports are from sources as shown.

“Manufactured Housing continues to outperform the broader REIT averages in 2017. The sector is up 20% YTD and more than 100% over the past three years.

3Q17 earnings were better than expected. Both Equity Lifestyle and Sun Communities beat earnings estimates and raised full-year guidance. Same-unit NOI rose 7.5% from 3Q16 and 2018 looks promising too.

After fearing the worst, Hurricane Irma and Harvey had only minimal effects on these REITs. Between the two REITs, only five seasonal RV resorts in the Keys sustained significant damage.

No economic segment stands to benefit more from the Trump agenda than the “forgotten” white rural working class. Economic confidence has improved dramatically since election day for this economic segment.

Manufactured housing remains, by far, the most affordable non-subsidized housing option. We caution, however, that residents may choose to upgrade to better housing options if their economic conditions improve considerably.”

While the last paragraph’s second sentence makes a statement that may not be born out by data – such as that produced by Foremost Insurance, in the report linked below – the thrust of the above is spot on.

Foremost Report: Manufactured Home Customer Survey and Market Facts – manufacturedhomelivingnews.com

Foremost Insurance Company has sponsored corporate studies of the manufactured home market since 1979. In recent years, their report is updated every 4 years. The 16 page report attached began by collecting information on October 2 through October 18, 2012.

Per their website, “Alex Pettee, founded Hoya Capital Real Estate in 2015 and has quickly established the firm as a leading voice in the publicly traded real estate sector.”

Their website also states (typos in their original, as of this date), “Hoya Capital Real Estate, LLC is a Connecticut Registered Investment Advisor. We individually advise and manage our client’s commerical real estate allocation through investments in publicaly traded equities.”

Against that backdrop, it’s clear that Hoya Capital is warm and open to manufactured housing (MH), and encourages investments in the manufactured housing REIT sector.

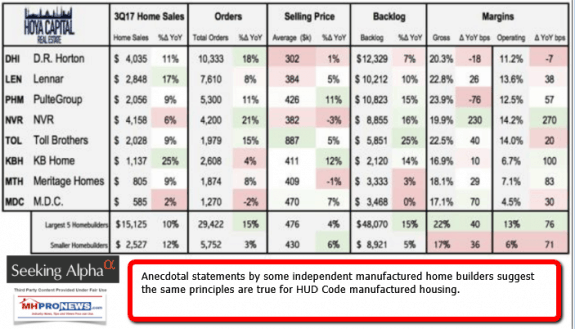

Against that backdrop, is a new report published in Seeking Alpha. Hoya makes their case why “Homebuilders: Go Big or Go Home.” While the report focuses on conventional housing, several of the points apply to manufactured home construction and scale too.

“Homebuilders: Go Big or Go Home.” – Summary

“A decade after the housing collapse, Wall Street is once again feverishly bullish on homebuilders. Homebuilders surged more than 60% in 2017 despite a disappointing 7% rise in new homes.

Size and scale have become essential for homebuilders. Stifling regulations, rising construction costs, and sluggish demand have squeezed margins and made it nearly impossible for smaller builders to compete.

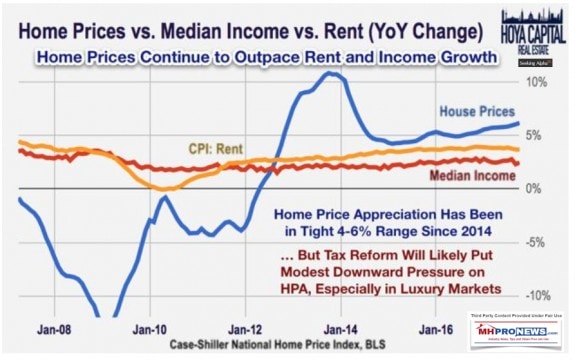

The rapid recovery in home prices since 2012 has made the economics of homeownership unfavorable relative to renting. Tax reform has tilted the scale even further towards renting…

…Unaffordability and attitudes towards homeownership remain constraints on demand.

To the victor go the spoils. While the overall housing recovery remains lethargic, we expect continued bifurcation as the competitive positioning of the largest homebuilders has strengthened amid continued consolidation.”

Note, the Daily Business News edited out a statement that reflects an area where contradictory data exists from other sources, as is found in the report below.

NAR’s Yun – No Quick Fixes Spell$ Manufactured Housing Opportunitie$

But the balance of the bulleted statements would draw widespread agreement from a variety of other sources.

2018 Outlook-Crisis Spell$ Opportunity, Per Leonard Kiefer, Freddie Mac Data

Further, what are cautions within the Hoya/SA report exit, they may not apply in the same way to the strategic visionaries among manufactured home retailers, communities, producers, and others in MH – who think long term, based upon trends, history, and actionable data.

Notable, Quotable from Hoya’s Report Included:

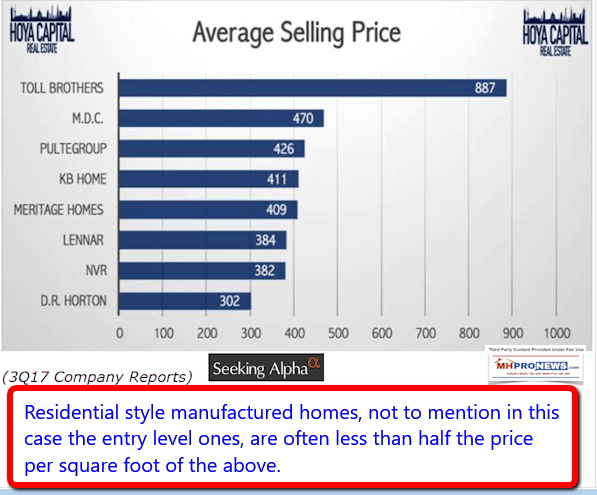

“Homebuilding segments can be roughly split into four categories: entry-level, move-up, luxury, and retirement. As construction and regulatory costs have risen, homebuilders have shifted their focus towards higher-end units which command high-enough margins to offset these increased costs. The average new home price was $377k in November 2017.”

“Mobile Home Ban” Suit Win, “Equal Justice Under Law,” Manufactured Home Owners, Buyers, Industry

“As we’ll discuss shortly, size and scale are a critical factor for homebuilders. Access to capital markets (or lack thereof) was the primary reason that the larger builders were able to avoid bankruptcy during the housing collapse.”

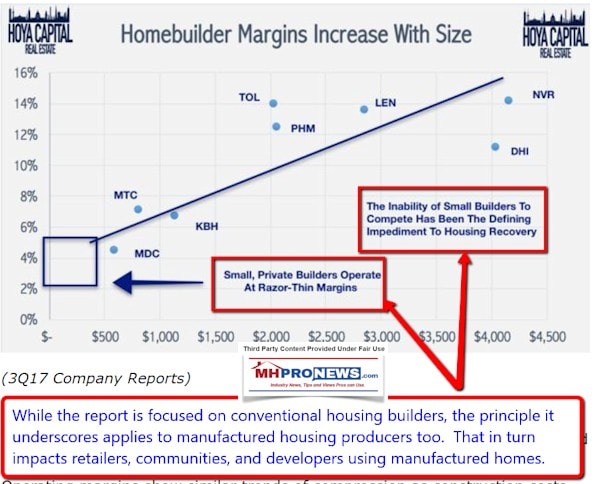

“Even within our index, which only includes the largest builders, the critical importance of scale becomes clear through the wide gap in operating margins, which declines linearly with decreasing size. The smallest builder in our index, MDC Holdings, operates at a measly 4.5% operating margins compared to the 13% average for the largest four builders.”

“Following that trendline, it becomes clear that the smallest individual private builders struggle to turn a profit on new home construction.”

“Operating margins show similar trends of compression as construction costs, and regulatory costs have shown steady appreciation since the end of the recession.”

“From the NAHB: By sharply reducing the number of taxpayers who would itemize, what’s left is a tax bill that essentially eviscerates the mortgage interest deduction and strips the tax code of its most vital homeownership tax benefit. This tax blueprint will harm home values, act as a tax on existing home owners and force many younger, aspiring home buyers out of the market.””

Note to manufactured home investors, enthusiasts and readers.

Hoya’s interesting data and reports should be a wakeup call to our industry, for both the opportunities it indirectly underscores, but also for the contributing factors to contraction and consolidation in the manufactured housing industry.

This and some other points made in the Hoya/SA report might be seen as bad news for conventional housing, but could with the proper education of home buyers, prove to be positives for manufactured home buyers.

Case in point, is the Florida Atlantic University report and exclusive comments to MHLivingNews about their study’s application to manufactured homes, linked below.

Researchers Shake Up American Dream? Rent vs. Buy, Ken Johnson, Florida Atlantic University, Exclusive to ManufacturedHomeLivingNews – manufacturedhomelivingnews.com

For those who want the bottom line first, new university research reveals that manufactured homes could be a superior housing value when it comes to wealth creation. With that executive summary, let’s dig into the details of the new research, and what the co-author of the university study specifically told MHLivingNews in an exclusive on-the-record statement.

Back to Hoya’s quotes:

“Zillow estimates that 44% of US homes currently utilize the mortgage interest deduction. Because of the doubling of the standard deduction, less than 10% of homes will now find it advantageous to itemize their deductions, eliminating a key incentive for homeownership.”

D.R. Horton, and Lennar acquisitions, “Clearly indicating that scale is essential in the homebuilding space, these two moves may just be the beginning of a wave of consolidation.”

“Again, the combination of strong labor markets and solid wage growth have historically been a good recipe for single-family housing demand.”

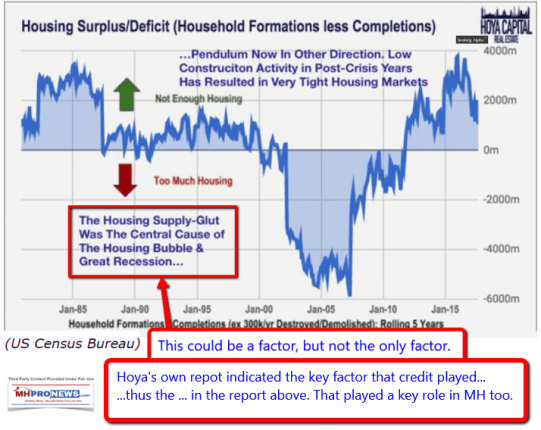

“…the subsequent financial crisis of 2008. The financial shock and devastation were particularly acute in the homebuilding sector. As we’ll discuss shortly, hundreds of small private builders went bankrupt during the crisis as credit markets froze up.”

“…housing demand is now exceeding housing supply on a rolling 5-year basis.” (That, Daily Business News readers should note, is similar to our reports from NAR and NLIHC reports, linked further above and below).”

NLIHC CEO Responds on HUD’s Worst Case Housing Needs Report, MH Leader Reacts

“Residential spending remains 45% below the 2006 peak after adjusting for construction inflation. Considering that the average age of the US housing stock is above 40 years, the higher rate of obsolescence will also act as a limit on supply growth. Overall, even if new single-family home construction surprises to the upside for several consecutive years, oversupply at the national level is unlikely to become an issue over the next decade.”

“…we believe that the bifurcation within the sector will continue as the largest homebuilders expand their competitive advantage over smaller players. Access to capital markets was a key factor in the survival of large builders in the aftermath of the housing crisis. As shown below, the largest builders quickly recovered while smaller builders such as Beazer Homes trade for a fraction of their peak value. Of course, for hundreds of smaller builders, the equity value was wiped out during the downturn.”

“Professor Michael Porter used the homebuilding sector as an illustration of the “Five Competitive Forces” at play in a 2003 presentation. With amazing precision, Porter correctly forecast that the competitive advantage of the largest homebuilders would expand over the coming decades, primarily a result of a regulatory environment that made it nearly impossible for small builders to compete. Land-use zoning and “Not-In-My-Backyard-ism” limits available land and serves to raise the barriers to entry by increasing the cost of construction and limiting margins.”

Out of Sequence, from Hoya/SA Report:

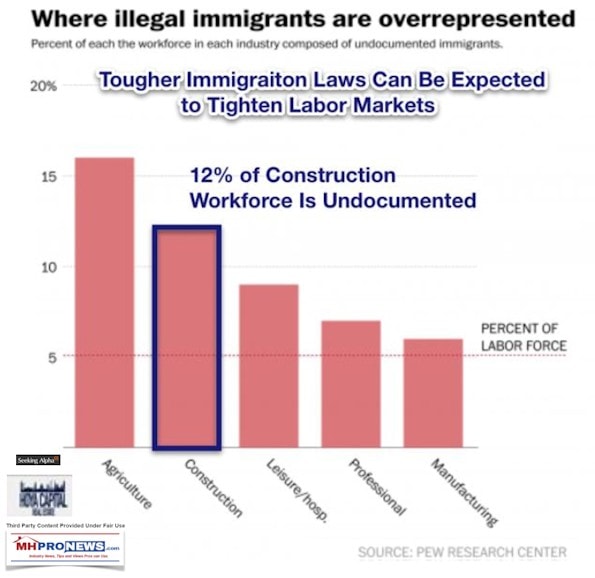

“A Pew Research study estimated that 12% of the construction workforce is undocumented. A significant reduction or crackdown on undocumented labor can be expected to put upward pressure on construction costs.”

“A NAHB study found that government regulations account for nearly 25% of the final price of a new single-family home, an increase of 30% since 2011. Roughly two-thirds of these costs come during the permitting process and one-third comes from fees, taxes, and ‘unnecessary’ code-related guidelines that do little more than serving to drive up the costs of construction.”

Conclusions From Hoya/SA…

- “As is often the case, government regulation results in consequences that are exactly opposite of the original intent: a higher concentration of power in the hands of fewer. The implications of this are that while the overall.”

- And….” housing recovery will continue to be sluggish, the larger homebuilders should continue to outperform the broader sector.”

- And “The financial shock and devastation were particularly acute in the homebuilding sector. As we’ll discuss shortly, hundreds of small private builders went bankrupt during the crisis as credit markets froze up.”

As regular MHProNews readers know, these points by third-party researchers at Hoya, dovetail with many of the reports made about manufactured housing, as it relates to giants and their favored national association.

Specifically, how the Manufactured Housing Institute (MHI) – acting in favor of larger firms such as Berkshire Hathaway owned Clayton Homes, Vanderbilt Mortgage and 21st Mortgage – have per sources consistently worked in ways that allowed regulatory burdens to remain or grow, rather than reduce them.

These voiced concerns have come politely from some, and pointedly from others, within the industry.

They say one thing, and do another.

Or as MHI award winner, Marty Lavin, JD has said, pay more attention to what people do than what they say, and follow the money.

Lawsuits for Triple Damages – Anti-Trust, Anti-Monopoly Law, Manufactured Housing, and You

MHPros, if you believe the implications from the Hoya/SA report, or from others inside and outside of the factory-built home industry, there is a need to “go big, go home.”

Or fight back via those methods that are available. ## (News, analysis, and commentary.)

Note 1: Thousands of MH Pros, Investors, Officials and Housing Experts do it. You, your team, and industry colleagues can sign up to the MH Industry leading headline news/updates – typically sent twice weekly – click here to sign up in just seconds.