According to the press release from New York Governor’s office: “…Kathy Hochul today signed legislation to support homeowners at manufactured home parks, a critical source of affordable housing for residents in New York State, particularly Upstate and in rural areas.” New York State Senator James Skoufis said: “This bill package will empower residents to have a fair shot at protecting their communities from owners who don’t share their vision for the mobile home park as well as aligning civil penalties with federal regulations.” Meaning, the ‘predatory’ nature of several manufactured home community operators has been much of the spark and fuel for these three bills. Part I of today’s is their press release, which speaks for itself. Part II of this article will examine issues that have arisen in New York specifically, and other parts of the U.S. that has sparked local, state, and national legislation that has either been acted, is proposed, or is pending. Part III is our Daily Business News on MHProNews markets report and headline news recap.

According to the Governor Hochul’s Office:

- Legislation S. 5881-A/A. 5549-A Expands Right of First Refusal for Homeowners in Manufactured Home Parks When Owners of Manufactured Home Parks Consider Selling the Park

- Legislation S. 7541/A. 7403-A Authorizes the State of New York Mortgage Agency to Purchase Mortgages and Offer Mortgage Pool Insurance for Modular and Manufactured Housing

- Legislation S. 7381/A. 7422 Better Aligns New York State Law Relating to Civil Penalties Associated With Manufactured Homes With Federal Law

Governor Kathy Hochul today signed legislation to support homeowners at manufactured home parks, a critical source of affordable housing for residents in New York State, particularly Upstate and in rural areas. Legislation S. 5881-A/A. 5549-A expands the right of first refusal that homeowners in manufactured home parks currently have to include whenever owners of manufactured home parks make offers to sell or respond to offers to buy the park. Legislation S. 7541/A. 7403-A authorizes the State of New York Mortgage Agency to purchase mortgages for and offer mortgage pool insurance for modular and manufactured housing. Legislation S. 7381/A. 7422 better aligns New York State law relating to civil penalties associated with manufactured housing with federal law.

“This legislative package is our state’s latest tool to support New Yorkers in manufactured home parks – a key source of affordable housing in our state,” Governor Hochul said. “By expanding when homeowners in manufactured home parks have a right of first refusal, authorizing mortgages and mortgage pool insurance for modular and manufactured homes, and better aligning our legislative language with federal programs, we are helping to strengthen New York communities and continuing to provide New Yorkers with safe, stable, affordable homes. I thank the bill sponsors for their partnership in supporting this critical path to affordable homeownership for countless New York families.”

Legislation S. 5881-A/A. 5549-A expands the right of first refusal that homeowners in manufactured home parks currently have to include whenever owners of manufactured home parks make offers to sell or respond to offers to buy the park. Under prior state law, homeowners in manufactured home parks were only able to exercise this right when the purchaser of manufactured home parks certified their intent to use the land for a different purpose.

The legislation also requires that homeowners notify owners of manufactured home parks within 60 days if they plan to make an offer to purchase the park and requires that homeowners make the offer within 140 days. This legislation will help homeowners in manufactured home parks safeguard their affordable communities, without unduly hindering unopposed investments in manufactured home parks.

State Senator James Skoufis said, “This bill package will empower residents to have a fair shot at protecting their communities from owners who don’t share their vision for the mobile home park as well as aligning civil penalties with federal regulations. I thank Governor Hochul for signing this legislation to establish an equitable balance between the interests of manufactured home park owners and residents who seek affordable, secure housing.”

Assemblymember Fred Thiele said, “Thousands of senior citizens, residents on fixed incomes, and young families rely on manufactured homes as a source of affordable housing throughout the State. Homeowners residing in manufactured home parks lease the land on which their home is situated, making them vulnerable to the potential of serious dislocation or poor management practices through the sale of their park. I was pleased to work with Senator Skoufis in getting this legislation passed to strengthen the “Manufactured Homeowners Bill of Rights” under the Real Property Law by giving homeowners the right of first refusal when their park is put up for sale regardless of land use changes. I applaud the Governor’s favorable action that will now provide these residents with a robust tool to protect against takeovers that threaten to dismantle the security of their communities.”

Legislation S. 7541/A. 7403 authorizes the State of New York Mortgage Agency to purchase mortgages and offer mortgage pool insurance for modular and manufactured housing, which primarily are financed as personal property and thus were often ineligible for SONYMA financing and insurance prior to this legislation. This legislation enables SONYMA to provide critical support to homebuyers who rely upon modular and manufactured housing as affordable pathways to homeownership.

State Senator Leroy Comrie said, “This public authorities bill, which equips the State of New York’s Mortgage Agency (SONYMA), to purchase manufactured and modular homes with personal loans versus the standard mortgage, will help make housing and associated costs, such as insurance, more accessible to low- and moderate-income families seeking single-family housing options. I am proud to have passed this bill alongside my colleague, Assembymember Karen McMahon, as it is paramount to involve our state agencies as active partners to help address the housing crisis. I thank Governor Kathy Hochul for demonstrating her commitment to single family housing solutions by signing this bill into law today.”

Assemblymember Karen McMahon said, “This new law, which grants SONYMA the authority to purchase mortgages for modular and/or manufactured homes as personal property, will enable low- and moderate-income New Yorkers to finance affordable housing. The Assembly is committed to making housing fair and accessible to all, in New York’s urban, suburban and rural communities. I thank Governor Hochul for signing this legislation and Senator Comrie for carrying this bill in the Senate.”

Legislation S. 7381/A. 7422 includes several technical changes to better align New York State law relating to civil penalties associated with manufactured housing with federal law. It replaces the word “fine” with “civil penalty,” replaces the word “licenses” with “certifications,” and it replaces the word “article” with “title.” It also replaces the language surrounding civil penalties with “the maximum civil penalty” established by the Code of Federal Regulations. In doing so, this legislation helps to correct a misalignment between state and federal language to help ensure that manufactured homes are produced, installed and serviced safely.

Assemblymember Didi Barrett said, “Manufactured homes are often the only affordable housing and homeownership opportunities in districts like mine and throughout much of New York State. I thank Governor Hochul for signing this critical piece of legislation aligning state and federal policies to better deter exploitative investors and firms, keeping occupants safe.” ##

Part II – Additional Information with More MHProNews Analysis and Commentary

“James Skoufis (born October 18, 1987) is an American politician of the Democratic Party currently representing the 42nd District of the New York State Senate since 2023. Skoufis previously represented the 39th District prior to redistricting from 2019 to 2022.” So stated left-leaning Wikipedia. MHProNews previously reported on Skoufis’ stance with residents of New York manufactured home community residents in reports linked below.

Bing AI cited Ballotpedia and Wikipedia on this question:

> “What political party is New York Assemblymember Fred Thiele?

MHProNews previously reported on Thiele’s stance with respect to manufactured home community residents in the reports linked below. The 2nd linked item is a news brief from February 17, 2011. The more recent one is a longer report dated July 2, 2019.

Bing AI said that after “searching the web” it didn’t find “any relevant information on the topic of manufactured home trade media reports on James Skoufis and Fred Thiele with respect to their legislative involvement in the manufactured home industry or with their efforts on behalf of manufactured home community residents” other than articles on MHProNews and MHLivingNews. Beyond the ones linked above, Bing AI linked the following.

Beyond those lawmakers, other reports on legal controversies in New York and other states included the following.

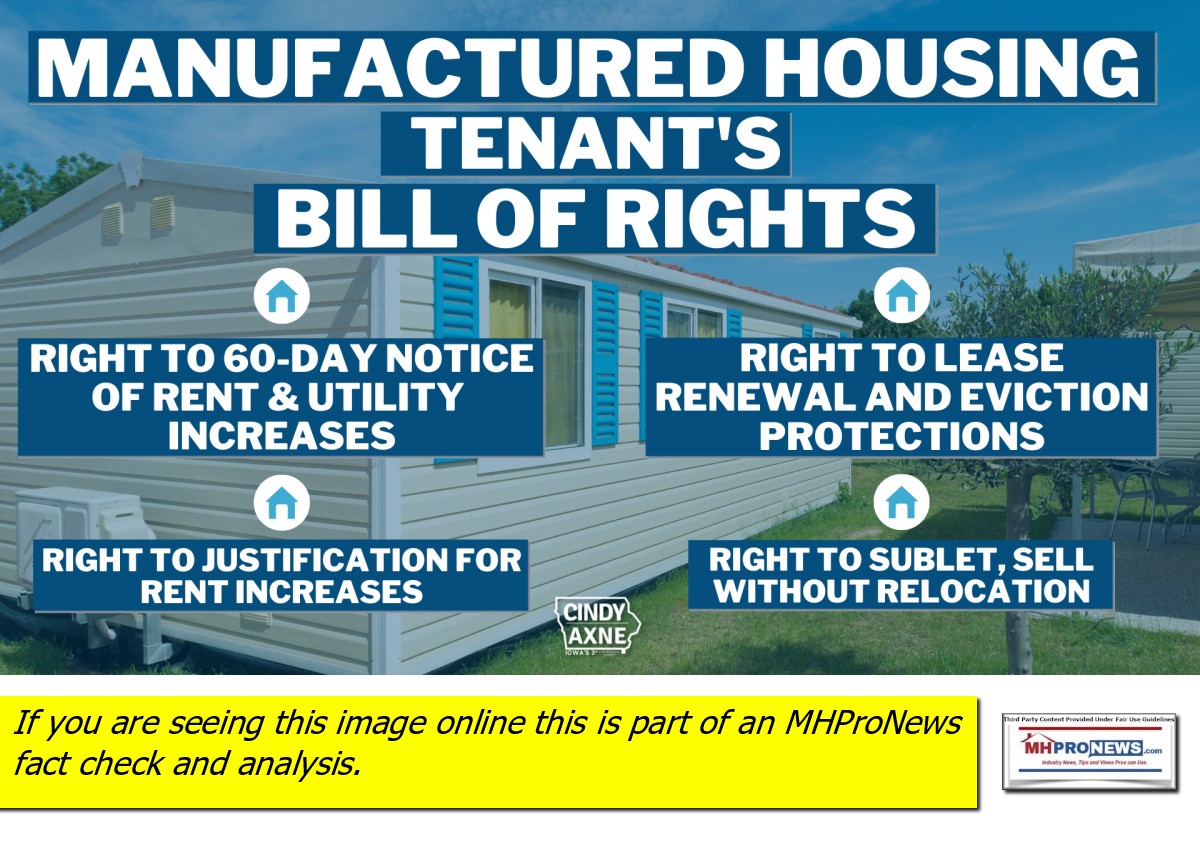

But there have also been local, state and national legislative efforts that have aimed at the manufactured housing industry’s so-called ‘predators,’ which has often focused on ‘predatory’ manufactured home community operators.

According to Spectrum News: “Gov. Newsom signs mobile home rent stabilization bill: This article reports on California Assembly Bill No. 978, which prevents mobile home companies from price gouging parks that are located within and governed by two or more incorporated cities.”

Per Business Insider: “San Marcos, California has a new rent control ordinance for mobile/manufactured homes.

According to the Urban Institute: “Senate Bill 275 in Nevada would prevent landlords of manufactured home parks from raising rents higher than the “maximum annual rent increase.”

There are several more possible examples of concerns and steps being discussed or taken in states from coast to coast.

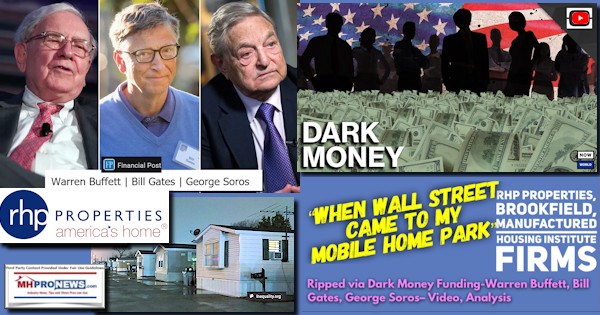

The problematic or ‘bad behavior’ of a specific manufactured home community operators over a period of several years has demonstrably moved residents to mobilize and act in ways that have generated these actions by lawmakers and attorneys general. As one of the above reports on MHProNews illustrated, behind some of these items are financial support that flowed from nonprofits organizations directly or indirectly funded by Warren Buffett, who is chairman of Berkshire Hathaway, parent company to Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance (VMF).

It may seem puzzling at first that Buffett bucks and like-minded allied donors like William “Bill” Gates III and George Soros would help fund organizing of residents and public attacks on manufactured home community operators in general, or even specific manufactured home community operators who are often a client of Clayton Homes or 21st Mortgage. But one must consider the following. Some leaders of the larger brands have expressed notions that indicate that they have and are willing to handle the legal and regulatory hurdles.

Michael Bilerman, Citigroup Inc, Research Division – MD and Head of the US Real Estate and Lodging Research asked the following question during an Equity LifeStyle Properties (ELS) earnings call.

“…Obviously, rent control is a big topic from a multifamily perspective across the U.S. I know you’ve dealt with it before, but there’s just a lot more movement in a lot more states. I guess how are you thinking about that impacting your business, where you’ve obviously been able to push rents pretty significantly over the years for your product. And look, I recognize the MH business is a more affordable product for people, but your rents have moved up pretty dramatically over the last decade. So can you talk a little bit about how you’re sort of evaluating the landscape today and where are you stand?”

That inquiry was answered by Marguerite M. Nader, Equity LifeStyle Properties, Inc. (ELS) – President, CEO & Director. Here was her response to Bilerman’s inquiry. Highlighting is above and below were added by MHProNews.

“Sure, sure. So as you said, we’ve been operating in a rent-control environment for a long time. We have 23 properties that are subjected to mandated rent control. That’s primarily in California. And so we’ve been very vocal in our opposition of rent control. Over the last 20 years, we’ve won some cases and in others, we are operating in a rent-control environment and you see our results as a result of that rent-control environment. So we’re able to still generate some very healthy growth rates even operating in an environment.

But then beyond the actual strict rent control, there are states that have regulations around rent increases. Like Florida, for instance, we operate under the terms of a prospectus and that prospectus runs with the land and governs the annual rent increases. This actually continues to be an important selling point for our residents considering to buy our properties. They — we establish a relationship with the homeowners’ association, and we spend time focused on meeting the needs of them — of the residents and trying to achieve fair rent increases.

And so in general, in our communities where we have mandated rent control, we see a transfer of the economics from the landlord to the tenant. So where monthly rental rates are suppressed, but there is no governor of the sale price of the home, and we’ve seen firsthand that, that does not — that rent control in our environment doesn’t make the overall housing more affordable, but it really shifts the payment from the monthly site rent to a payment for the home. So we closely monitor all the activity for the states that we operate in, and we’re also working with our National Association to make sure that our industry is represented. But it’s kind of — for us, it’s more of the same. I know others are dealing with it kind of for the first time but we’ve been dealing with it for a while now.”

The “national association” ELS’ Nader called “our” is the Manufactured Housing Institute (MHI) where currently Patrick Waite of ELS holds a seat on the “Executive Committee” of MHI’s main border of directors. ELS’ Ron Bunce also holds a seat on MHI’s main board of directors, along with Bill Raffoul for Sun Communities, Inc. (SUI) and Nathan Smith with Flagship Communities (MHC-UN.TO). Two out of the three of those firms have been named in the recently announced class action lawsuits against several MHI member manufactured home community operators. More on that shortly.

Let’s look more closely at what Nader said, mindful of her late bosses’ prior remarks about how ELS’ likes the oligopoly nature of the manufactured home business.

Bilerman for Citigroup noted: “you’ve obviously been able to push rents pretty significantly over the years for your product. And look, I recognize the MH business is a more affordable product for people, but your rents have moved up pretty dramatically over the last decade.”

Quoting Nader:

- we’ve [ELS] been operating in a rent-control environment for a long time

- we’ve been very vocal in our opposition of rent control.

- So we’re able to still generate some very healthy growth rates even operating in an [rent control] environment.

- This actually continues to be an important selling point for our residents considering to buy our properties.

- in our communities where we have mandated rent control, we see a transfer of the economics from the landlord to the tenant.

- and we’re also working with our National Association to make sure that our industry is represented.

Let’s add to Nader’s remarks and then rephrasing her responses.

- Bad news is generated by ‘predatory’ behavior that may include a mix of resident complaints with or apart from MHAction and their allies.

- Where MHAction was not yet involved, bad news generated by residents may attract MHAction’s attention and get them involved in specific local issues.

- Disgruntled residents are organized in several ways that include the financial fingerprints of other Manufactured Housing Institute (MHI) board members – Clayton Homes, 21st Mortgage parent company Berkshire Hathaway boss Warren Buffett to nonprofits that in turn fund MHAction and possibly other interest groups too. To be clear, there are other resident groups not affiliate with MHAction. But they too may be influenced by MHAction’s methods.

- Lawmakers know there are more votes possible with residents than property owners and their staff. So, some lawmakers may push for rent control and other increased regulatory actions.

- Companies like ELS protest and “oppose” rent control, which may also include litigation.

- But if rent control already exists and/or is established, ELS (and obviously others like them – i.e.: RHP Properties, Sun Communities, etc. in similar scenarios) “we’re able to still generate some very healthy growth rates even operating in an [rent control] environment” said Nader.

- “in our communities where we have mandated rent control, we see a transfer of the economics from the landlord to the tenant.”

MHProNews reported on the specific example of Delaware, where rent control passed. But residents still complained because the larger community operators learned how to adapt and still get what Nader called “healthy growth rates.”

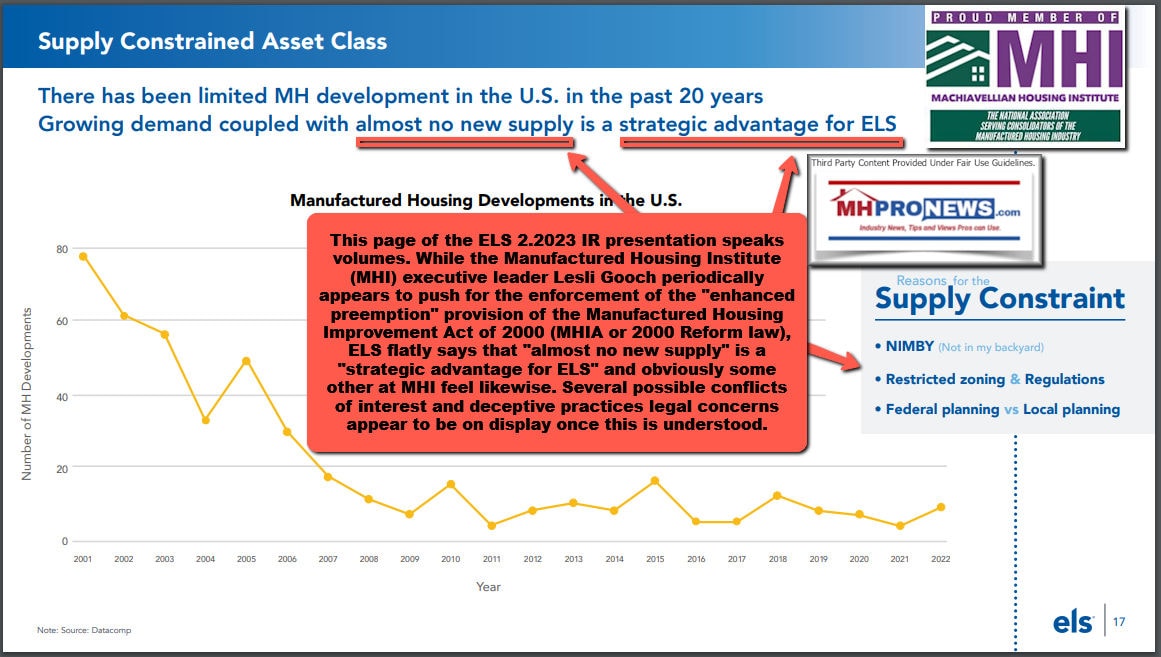

MH Communities, Owners, MH Independents Alert – NMHOA and MHAction Next Steps? – Part 1

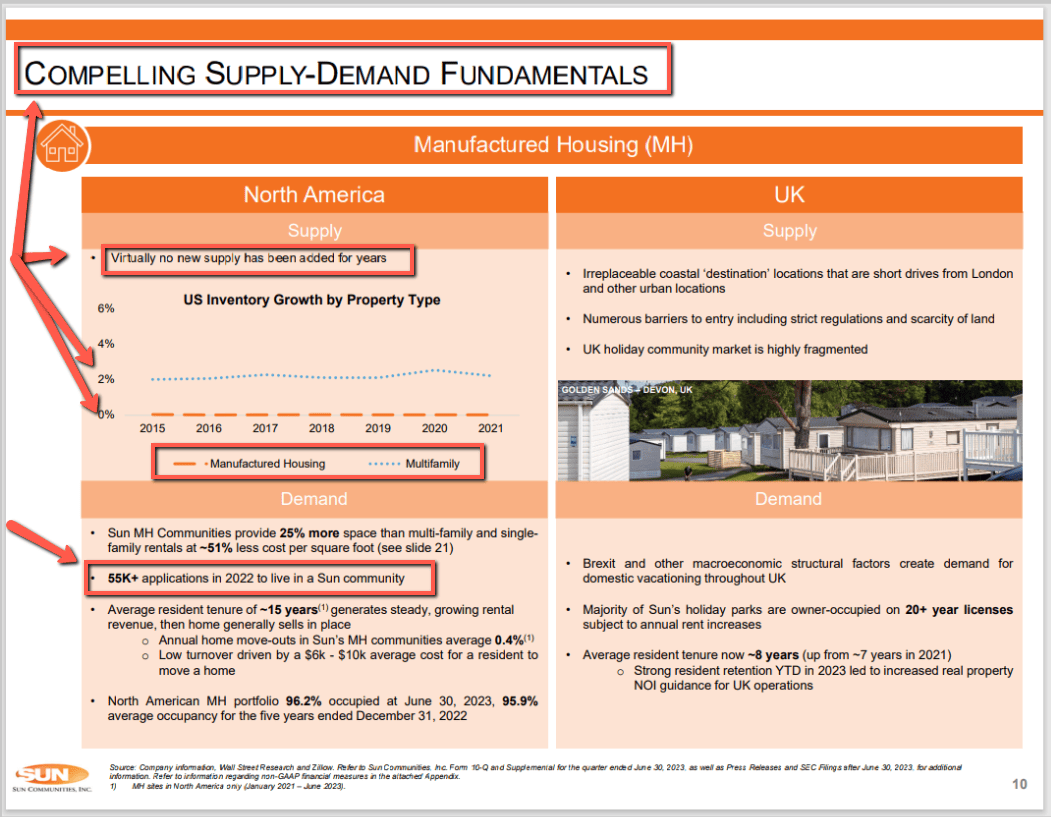

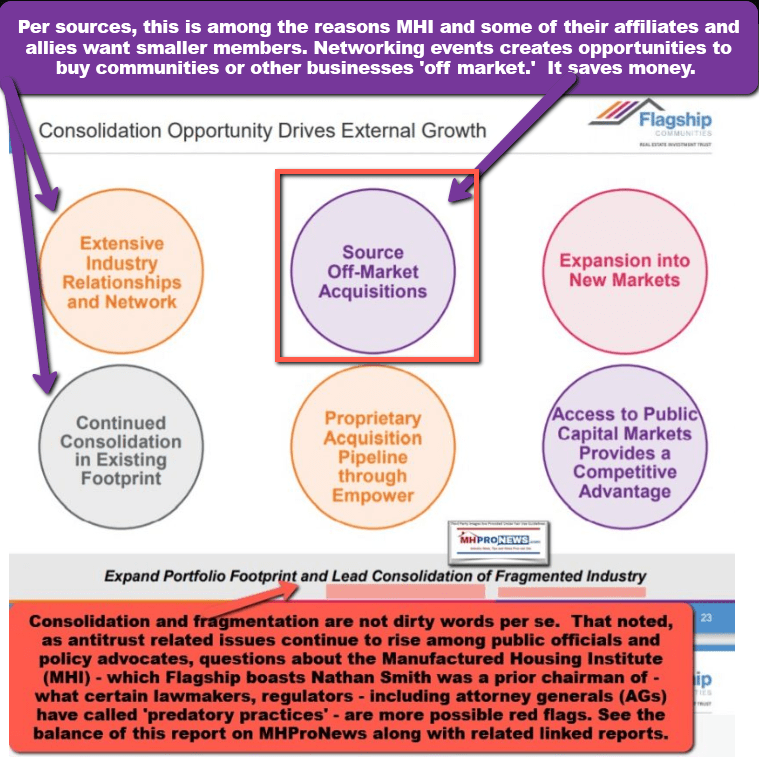

In hindsight, through the lens of the remarks by Nader and other known history, it seems that the aggressive or ‘predatory’ community operators have come up with a formula where they ‘win’ almost regardless of the circumstances. Without rent control, they are aggressive. But with rent control, they still manage “healthy” returns, said ELS’s Nader. Bad news also limits new development of manufactured home communities, which fits what ELS, Sun, and Flagship communities – all MHI members, and all publicly traded firms – have told their investors are useful for their business models.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

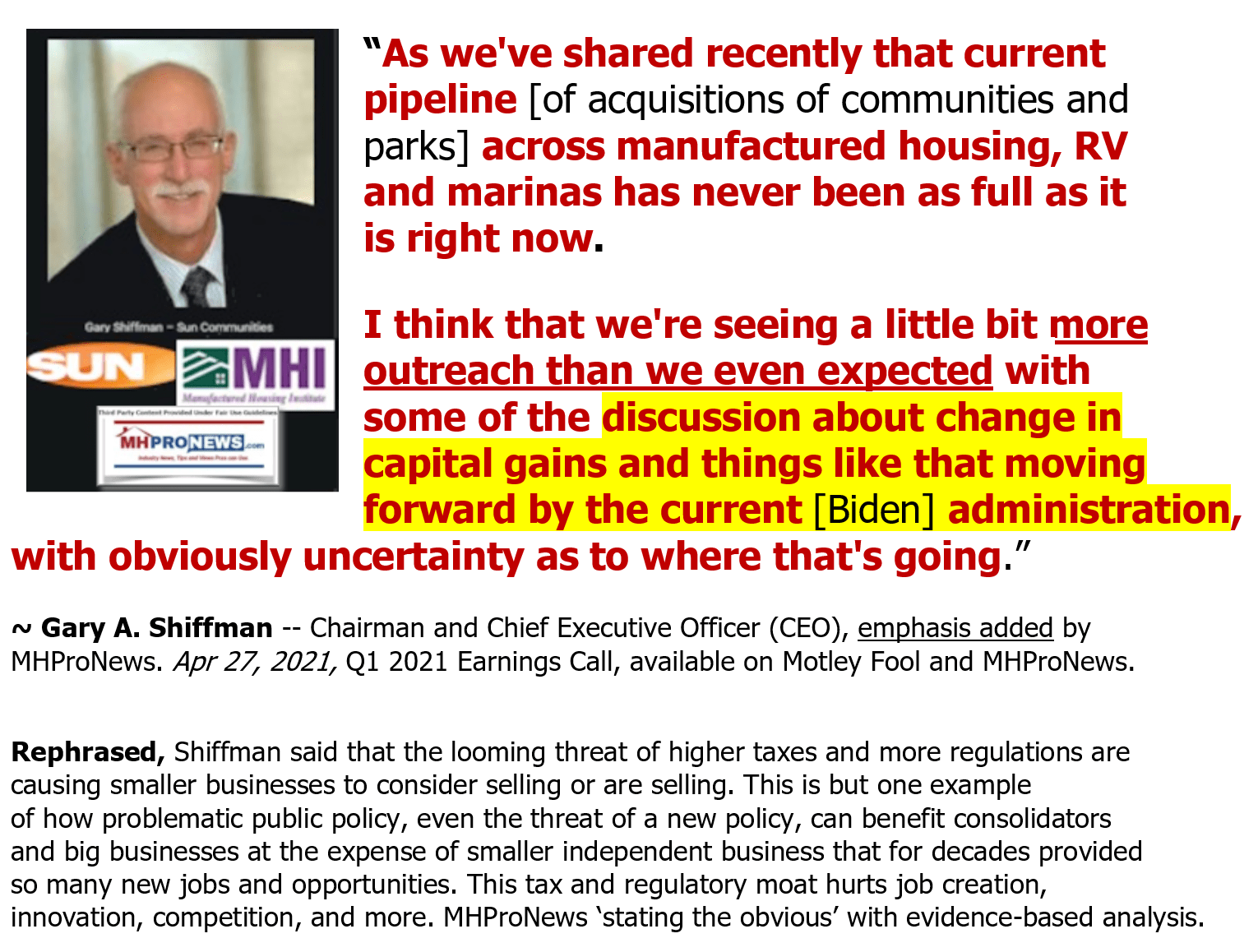

Note too that those land lease manufactured home community (MHC) operators that may consolidate other properties to some degree, but aren’t aggressive with their site fee hikes, could over time be placed in a more difficult spot by the bad behavior of the ‘predators.’ That’s a complex and nuanced issue that may be explored in a future report. But suffice it to say for now that the regulatory burden falls on all covered by certain laws or proposals. The larger firms with deeper pockets are better able to adapt to ‘threats’ from higher taxes, more regulation, or whatever. Who said? Look at what Sun Communities indicated occurred shortly after Joe Biden was declared with winner of the 2020 election.

Consider those remarks by Shiffman and Nader in the light of the bright insight from business/economic author Carol Roth: “…all regulation…excessively impacts small business…In fact, big companies secretly love regulation because regulations are in fact anti-competitive — every new rule, law, or compliance measure limits the ability of existing smaller competitors or new start-ups to compete.”

Whatever the motivation of the New York legislators and governor, the reality is that years of history demonstrate the following. The smaller operators, which may have a terrific relationship with their residents, could end up being de facto pushed to sell to escape the regulatory, tax, or other compliance burdens.

Tim Sheahan, a resident advocate, so not a paid professional as the leaders of MHAction are, said this in federal testimony. “Initially, stiff competition among various developers [of mobile home parks and manufactured home (MH) communities] during the only time a true “free market” situation existed in these communities commonly led to very reasonable starting rents…” “As the [land lease MH] communities filled with “im-mobile” homes, free market forces such as competition were lost and lot rents for captive homeowners skyrocketed in many areas…”

The late Robert “Bob” Van Cleef, another volunteer resident advocate, tied the notion of ‘temporary’ rent control with the need to push for more development of new manufactured home communities, so that the free-market forces could rebalance the pressure from aggressive community operators. That is akin to what Sheahan said. Van Cleef ripped ‘predators’ like Rolfe and Reynolds as ‘vampires.‘ Note Rolfe and Reynold’s RV Horizons and then Impact Communities – along with ELS, Sun, and Flagship – plus RHP Properties are all Manufactured Housing Institute (MHI) members.

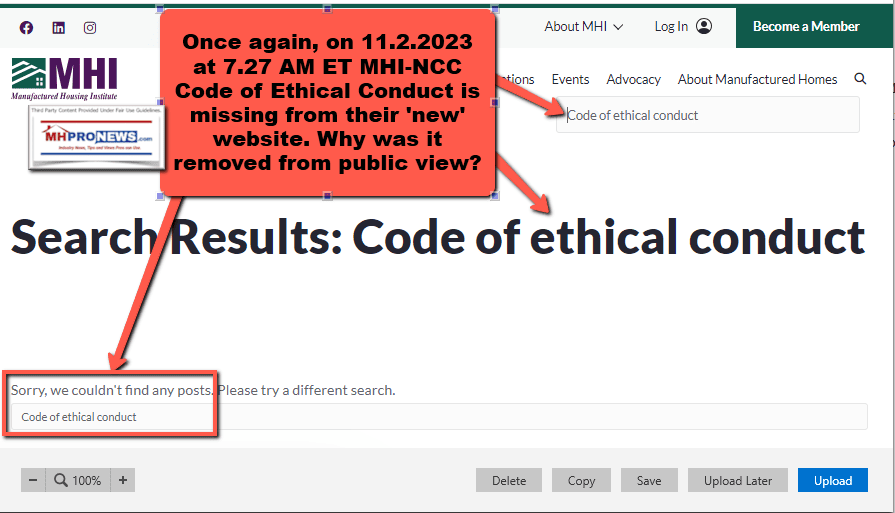

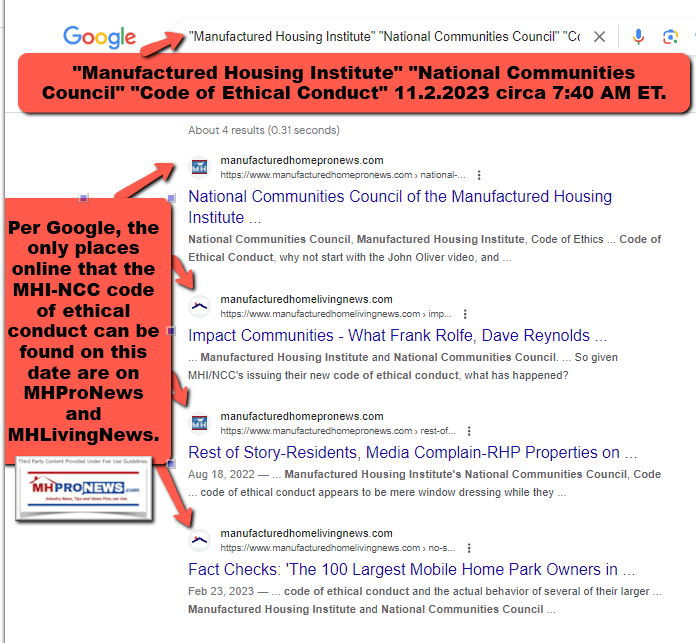

Much of this predatory behavior appears to be contrary to the Manufactured Housing Institute (MHI) National Community Council (NCC) “Code of Ethical Conduct.” It is unclear if Havenpark Capital left MHI on their own or if they were nudged out, as a source to MHProNews said that Havenpark is no longer an MHI member. But MHI no longer publishes their member list to the public. Nor does the new version of their website when checked below have that “Code of Ethical Conduct” which apparently only MHProNews has saved and published.

Note this inquiry to Bing AI.

> “I need a copy of the Manufactured Housing Institute code of ethical conduct. Where can I find that online?”

Learn more:

Once again, per a check of MHProNews of the MHI website on 11.2.2023 at 7.27 AM ET MHI-NCC Code of Ethical Conduct is missing from their ‘new’ website. Why was it removed from public view? See the follow up to Bing AI below.

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

> “Pardon me, but the Manufactured Housing Institute website does not appear to have that MHI-NCC Code of ethical conduct document any more. Is there anywhere else online that you can find that document and its text?”

Learn more:

Additional Insights, Summary and Conclusion

Heads they win. Tales you lose. That appears to be how ‘the game’ is played by MHI ‘insider’ members.

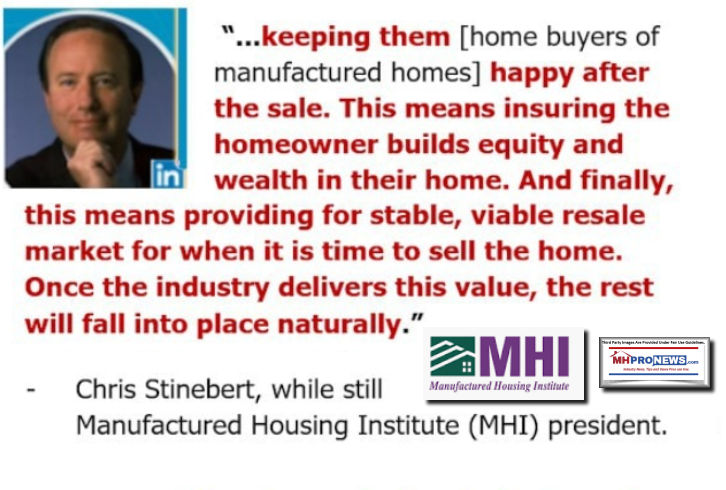

Consumers and smaller operators may get lip service, but the facts and evidence speak for themselves, don’t they? What can fix this artificially created mess? In our view, it will require vigorous antitrust efforts that could be benefited by a post-production trade group that creates a bright line distinction between ‘predatory’ brands and honorable ones that naturally want a profit, but that also are mindful of healthy relationship with consumers. Oddly, MHI’s prior president, Chris Stinebert, said something similar. Why is it that Stinebert’s name is not available on the MHI’s website on this date?

> “Can you find the name of Chris Stinebert, former Manufactured Housing Institute president and CEO on the recently updated Manufactured Housing Institute website? If you can’t find it on their website, can you find it on any other manufactured housing industry trade media site?”

Learn more:

The first link above is to an interview that included this quote from Stinebert in answer to the question “Are all these issues pretty much behind you?”

Per that transcript, Stinebert also said this.

Given such remarks, is it surprising that MHI has scrubbed Stinebert from the public facing side of their website?

When the known facts are laid out, it appears that MHI is part of what has been called an ongoing collusion between major brands with deeper capital access that are able to gobble up smaller firms. A ripple effect follows, as this article has outlined and then detailed. Predator behavior may spark legislation and legal action by state officials. However, unless more rigorous antitrust efforts are deployed by states or the federal government and concerns over possible RICO and other legal issues are probed, it seems that this troubled cycle will only continue. In that light, consider what attorney Samuel Strommen, then with Knudson Law, and the various antitrust class action civil lawsuits are alleging. These each tend to support the reports and analysis by MHProNews on these subjects. And these topics tend not to be covered by others in MHVille trade media. Those others in the MHI trade media routinely are MHI members. Do you see the pattern more clearly now? It isn’t that MHI is the root of all evil, nor that ever MHI member is a so-called predator. But a routine tie seems to exist between MHI and/or MHI state affiliates, and predatory behavior in MHVille. Public officials must probe that and prosecute as warranted, perhaps de-chartering and ‘killing’ particularly pernicious companies.

> “What do you call the process when a corporation is stripped of its corporate charter and what impact does that have on the corporation and its shareholders and stakeholders?”

Learn more:

With those notions, facts, and evidence in mind, check out the following. ##

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.1.2023

- J. Holmes and Amy Robach return to the air with a podcast. ‘Nothing is off limits’ for the former ABC anchors

- Markets rise after Federal Reserve hits pause again on rate hikes

- A “UAW On Strike” sign near a picket line outside the General Motors Co. Spring Hill Manufacturing plant in Spring Hill, Tennessee, US, on Monday, Oct. 30, 2023. General Motors Co. reached a tentative agreement with the United Auto Workers, according to people familiar with the matter, bringing an end to a six-week-old strike that had upended US automobile production and cost the industry billions of dollars.

- The UAW won big against Detroit automakers. Unionizing Tesla and Toyota will be tougher

- Wallet credit cards bills STOCK

- Interest rates are high. These are the best places to park your cash

- College Hall at the University of Pennsylvania is seen on Saturday, July 3, 2021 in Philadelphia, Pennsylvania.

- UPenn president launches action plan to fight ‘evil’ antisemitism after facing donor backlash

- Taco Bell is gaining ground as people look to save on food

- Chuck Schumer and Elizabeth Warren want FTC to probe blockbuster Exxon and Chevron mergers

- The Marriner S. Eccles Federal Reserve Board Building is seen on September 19, 2022 in Washington, DC.

- The Fed holds interest rates steady for second time

- Messenger, Facebook, Instagram and WhatsApp displayed on a phone screen are seen in this illustration photo taken in Krakow, Poland on August 6, 2023.

- EU clamps down on Meta’s use of personal data for targeted ads

- Sam Bankman-Fried ‘told you a story, and he lied to you,’ prosecutors tell the jury

- Charles Schwab lays off about 2,000 employees

- Apple’s ‘scary fast’ upgrades hint at its vision for the AI era

- Tinder owner Match Group settles antitrust claims against Google’s app store

- Here’s what this year’s Starbucks holiday cups look like

- AI Chatbots are scraping news reporting and copyrighted content, News Media Alliance says

- American inequality is rising despite higher wages

- Turkey prices have dropped by a lot as Thanksgiving planning ramps up

- WeWork’s shares plunge 37% on bankruptcy reports

- Magnolia Bakery is turning its most iconic desserts into cannabis edibles

- Toyota raises annual profit forecast by 50% because of weak currency

- ‘Awfully easy money’: Charlie Munger praises Warren Buffett’s big bets on Japan

- Realtors found liable for $1.8 billion in damages in conspiracy to keep commissions high

- Everything you wanted to know about Fed day and were afraid to ask

Note: to expand this image to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.