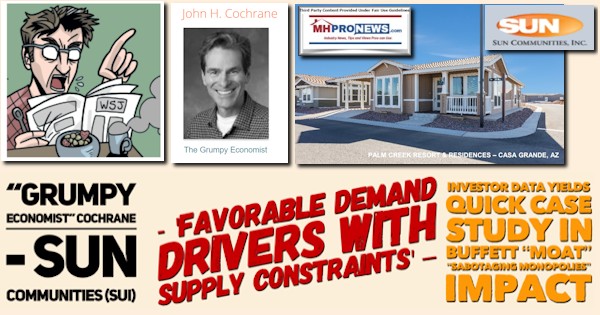

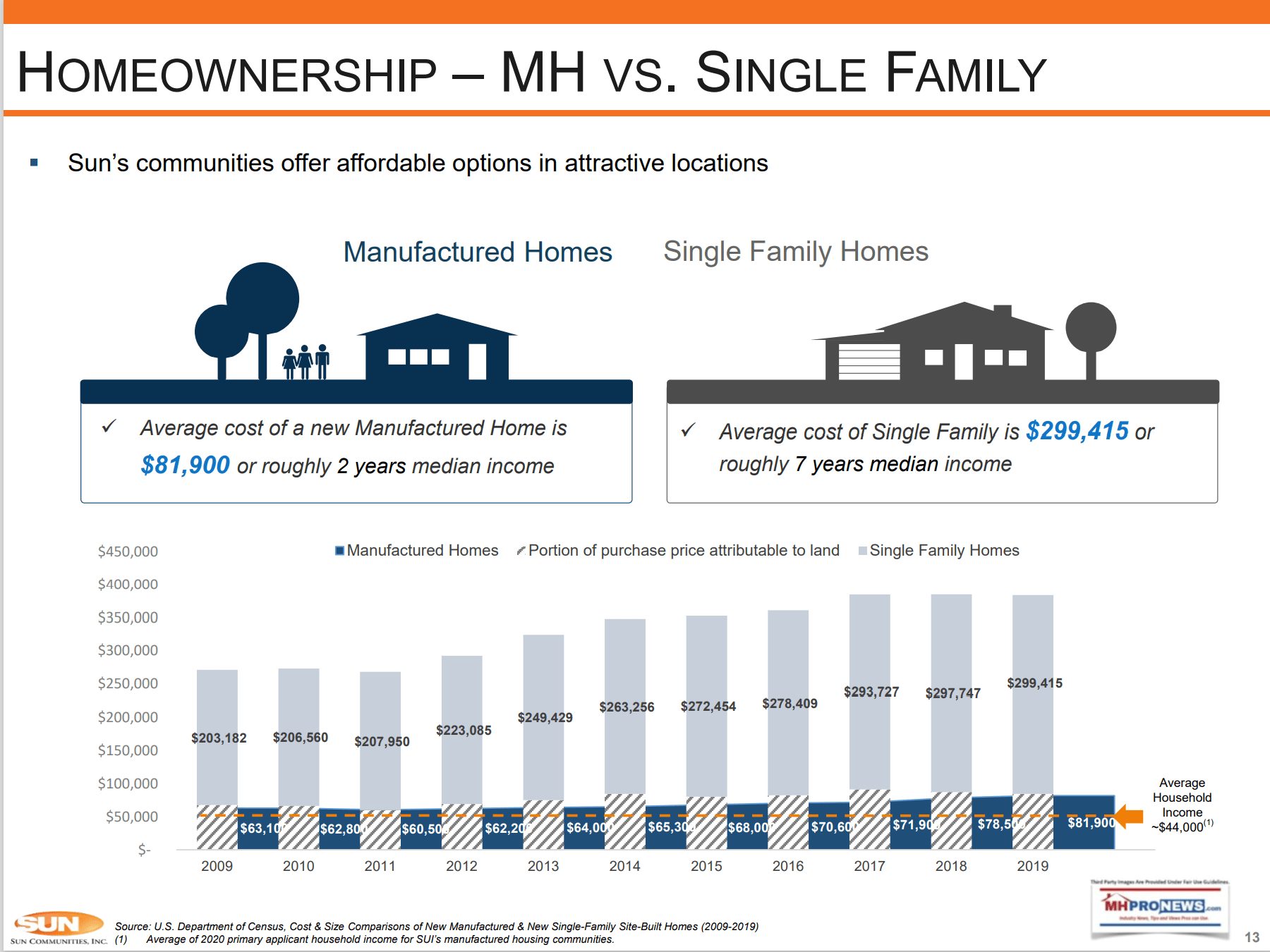

“Favorable Demand Drivers Combined With Supply Constraints” is a phrase from manufactured home community giant Sun Communities’ (NYSE:SUI) recent 2021 investor power point. “Jim Schmitz has released the first salvo in what promises to be a monumental work on monopoly, titled “Monopolies Inflict Great Harm on Low- and Middle-Income Americans,” wrote “The Grumpy Economist.” John H. Cochrane wryly says his kids call him “grumpy,” and he has weighed in on the work of James A. “Jim” Schmitz Jr. and his colleagues. Schmitz is a Senior Research Economist for the Minneapolis Federal Reserve. He is one of a group of research economists working on the topic Cochrane describes. Cochrane’s “The Grump Economist” blog’s bio says “I’m a Senior Fellow of the Hoover Institution at Stanford. I was formerly a professor at the University of Chicago Booth School of Business. I’m also an adjunct scholar of the Cato Institute.” It is through the lens of Cochrane’s boiled-down essence of Schmitz and his colleagues’ work that recent information published by Sun Communities (SUI) for their current and potential investors will be examined. First, the broad brush on “sabotaging monopolies.” Then the specific look at aspects of what manufactured home community giant Sun Communities and their chairman Gary Shiffman has stated, and how that fits with the Warren Buffett “moat.”

Cochrane quotes Schmitz in part as follows.

- “Today, monopolies inflict great harm on low- and middle-income Americans.”

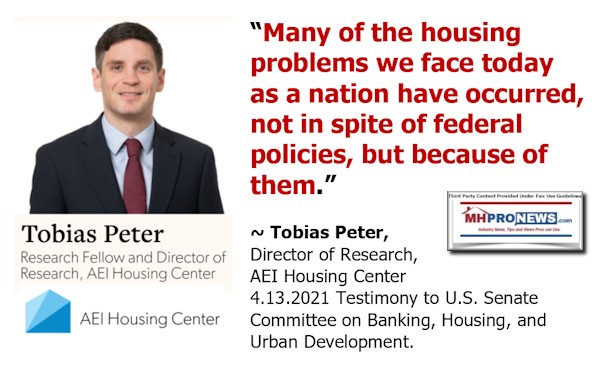

- He notes that Schmitz is examining low-cost options in housing which, by looking at Schmitz and his colleagues work, is more specifically a look at manufactured homes. Schmitz and his colleagues are also examining other professions. Quoting Schmitz: “I’ll argue that the U.S. housing crisis, legal crisis, and oral health crisis facing the low- and middle-income Americans are, in large part, the result of monopolies destroying low-cost alternatives in these industries that the poor would purchase.” Rephrased, this isn’t just our manufactured home industry that’s being waylaid, independents in other professions are being “sabotaged” too.

Cochrane asserts that per Schmitz, the main characteristics of monopoly are:

- “A. Monopolies sabotage and destroy markets. They typically destroy substitutes for their products, those that would be purchased by low-income Americans.

- B. Monopolies also use their weapons to manipulate and sabotage public institutions for their own gains…”

Additionally, Cochrane says: “Unlike worries about big business (or today’s FANGs), most monopolies are associations of smaller businesses…” here it might be useful to note that an association of smaller firms acting as a monopoly is called an “oligopoly.” An oligopoly, says Oxford Languages, is “a state of limited competition, in which a market is shared by a small number of producers or sellers.” It should also be noted that such an ‘association’ or alliance may be a stealthy effort to evade antitrust and other regulators. That added nuance should shed light on the statement above that “Monopolies also use their weapons to manipulate and sabotage public institutions for their own gains…”

That said, Cochrane quotes Schmitz:

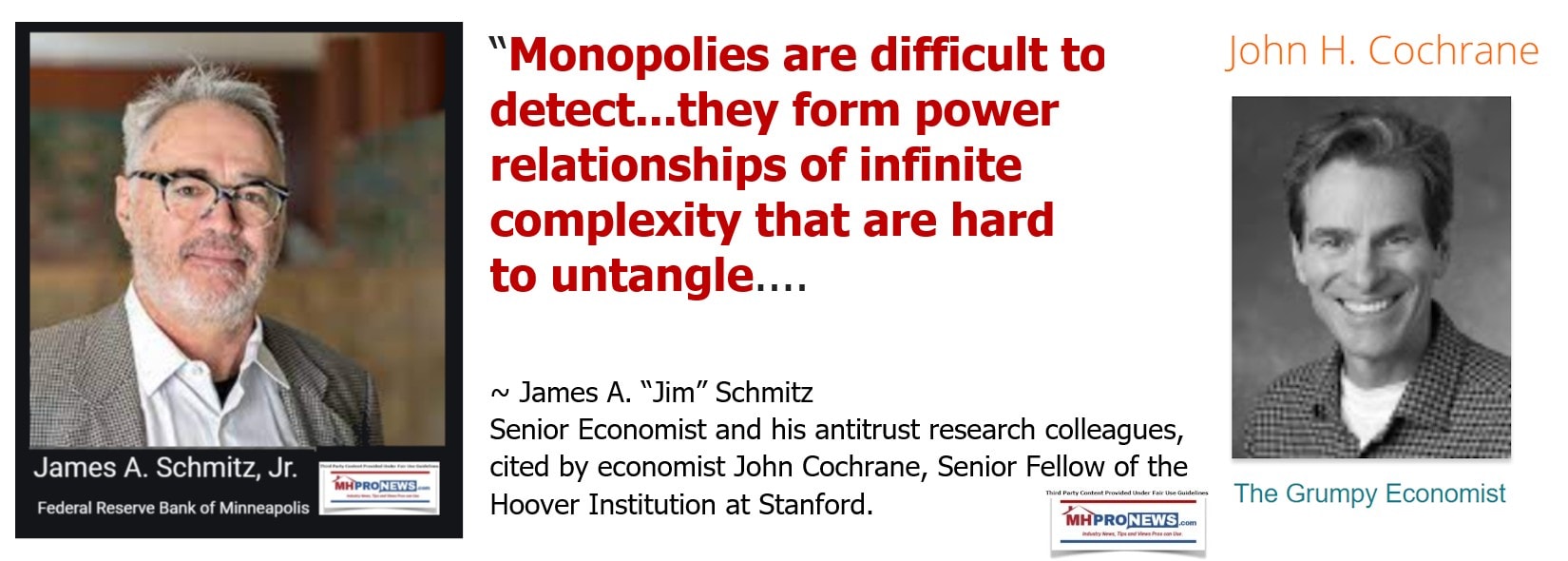

- “Monopolies are difficult to detect…they form power relationships of infinite complexity that are hard to untangle….

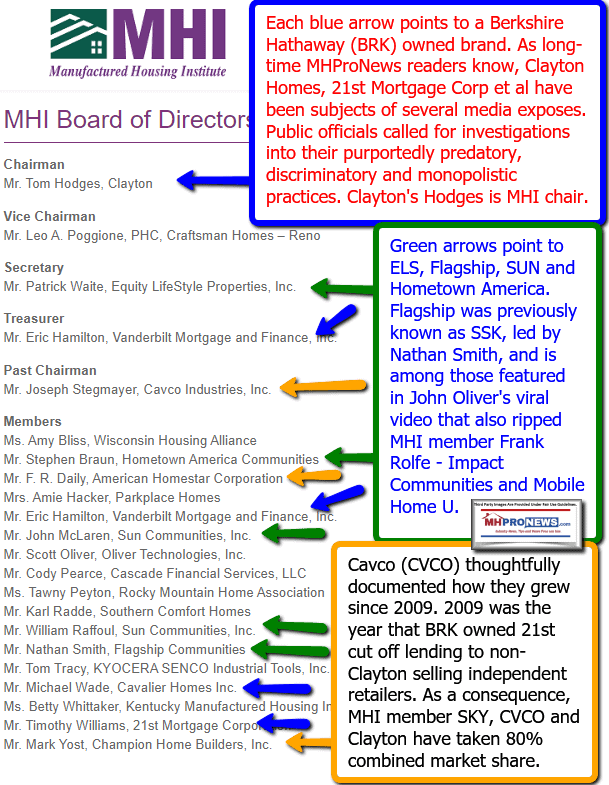

Now, Sun Communities is a member of the Manufactured Housing Institute (MHI), which has a division known as the National Communities Council (NCC). Here is a graphic that has as its base the information from MHI, with the comments and arrows added by MHProNews. Note that two of their board’s communities representatives are from Sun Communities.

It should be noted that MHI has an antitrust statement, which is linked here. It includes this statement: “The general requirements of the antitrust laws prohibit any agreement to restrict trade between competitors.” That and several of the other highlighted items and updated links in the MHI document are some of the many possible issues that bear examination for possible illegalities. Those purported illegalities may go beyond antitrust law into RICO (Racketeer Influenced and Corrupt Organizations Act), according to Samuel “Sam” Strommen at Knudson Law. Strommen makes the evidence-based legal argument that MHI, their REITs, Clayton Homes, and others are part of the Warren Buffett deployed Berkshire Hathaway “moat” are subverting manufactured housing from within for their own mutual benefit. In the context of Schmitz and company’s thesis, Strommen presents an independent and useful microcosm of what the research economists are describing in the broader housing market as it relates to manufactured homes.

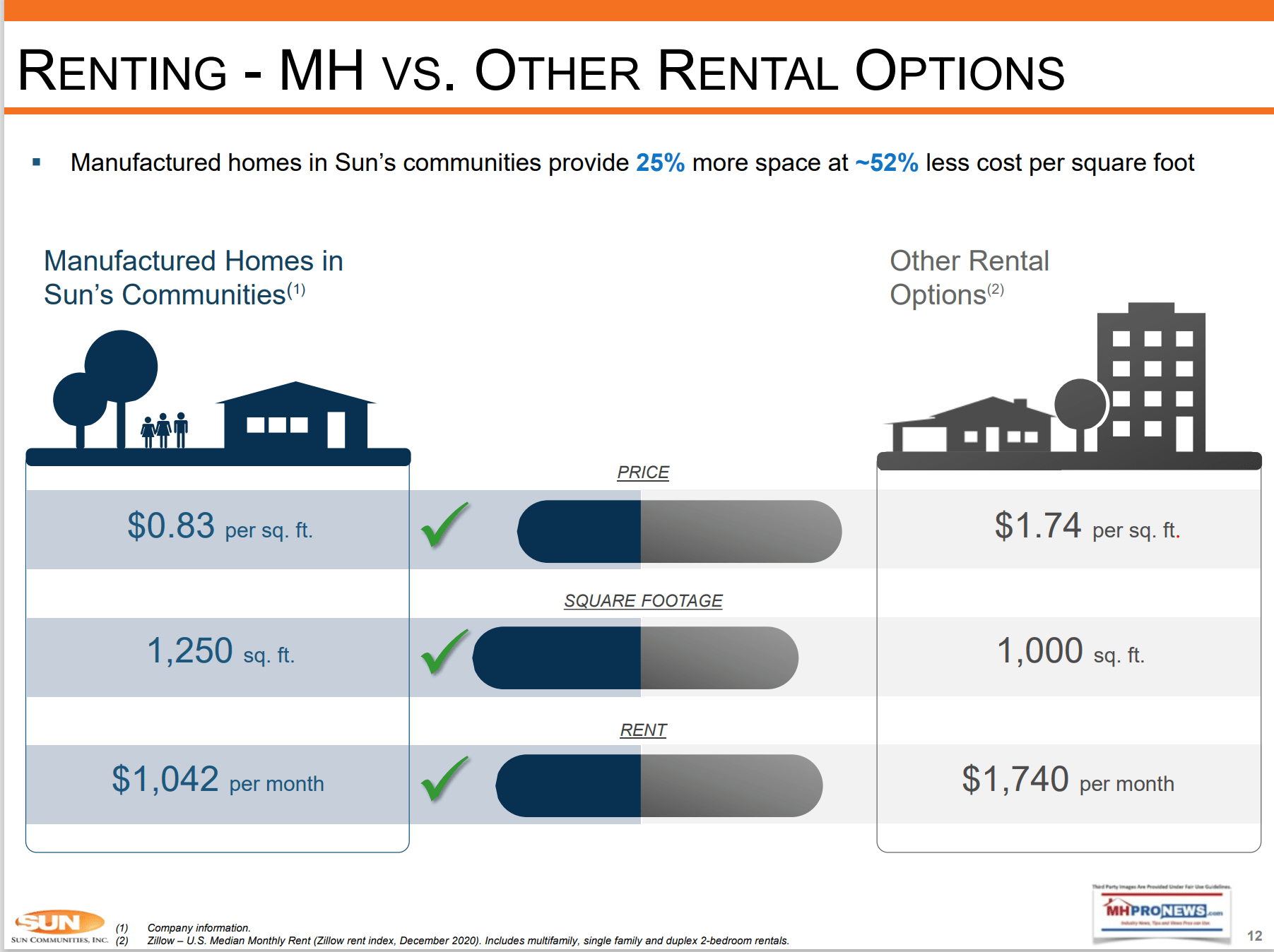

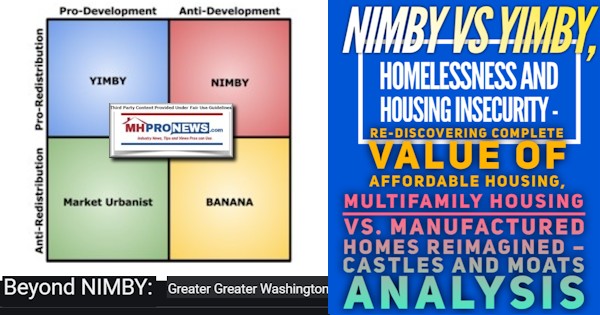

It should be noted that MHI periodically provides ‘developer’ and other discussion and presentation sessions. The graphic below reflects the point that more communities are closing than opening. Rephrased, while the classes and documents are real enough, they are also arguably more for window-dressing and cover that benefit those who are steadily consolidating or ‘monopolizing‘ the industry in an oligopoly fashion. This is significant with respect to antitrust and this statement by Sun under “Company Highlights” – “Favorable demand drivers combined with supply constraints.”

If that supply constraint is shown to be artificially forged due to actions of MHI/NCC member companies, legal issues arise.

Sun also says on that company highlights page: “Industry consolidator with proven value creation from acquisitions.”

A careful look at Warren Buffett and his preaching about the “moat” is examined in the report linked here and is also noted by Strommen. As Robin Harding, writing in the Financial Times put it, Buffett is rather open in his goal of limiting competition. Others – like Buffett-fans Guru Focus, which specifically named Clayton Homes as an example of Buffett’s moat – have made similar allegations.

That begs the question. Why haven’t antitrust and other regulators already stepped in on Buffett and his grip/power/influence over manufactured housing? That is examined in the link here in the context of numerous 21st century regulatory failures that in several cases cost tens of billions of dollars each. While each of those schemes are unique, they have certain commonalities too.

This next item from SUI is also telling.

Under the heading of: “POWERING SUN’S GROWTH ENGINE – EXTERNAL” are these SUI statements.

- 4.1x increase in properties since year end 2010.

- High degree of visibility into MH, RV and Marina acquisition pipeline with additional opportunities arising

Sun Communities Chairman and CEO Gary Shiffman shed added light on that last point. Shiffman doubled down by saying that they have a record number of possible acquisitions in their pipeline.

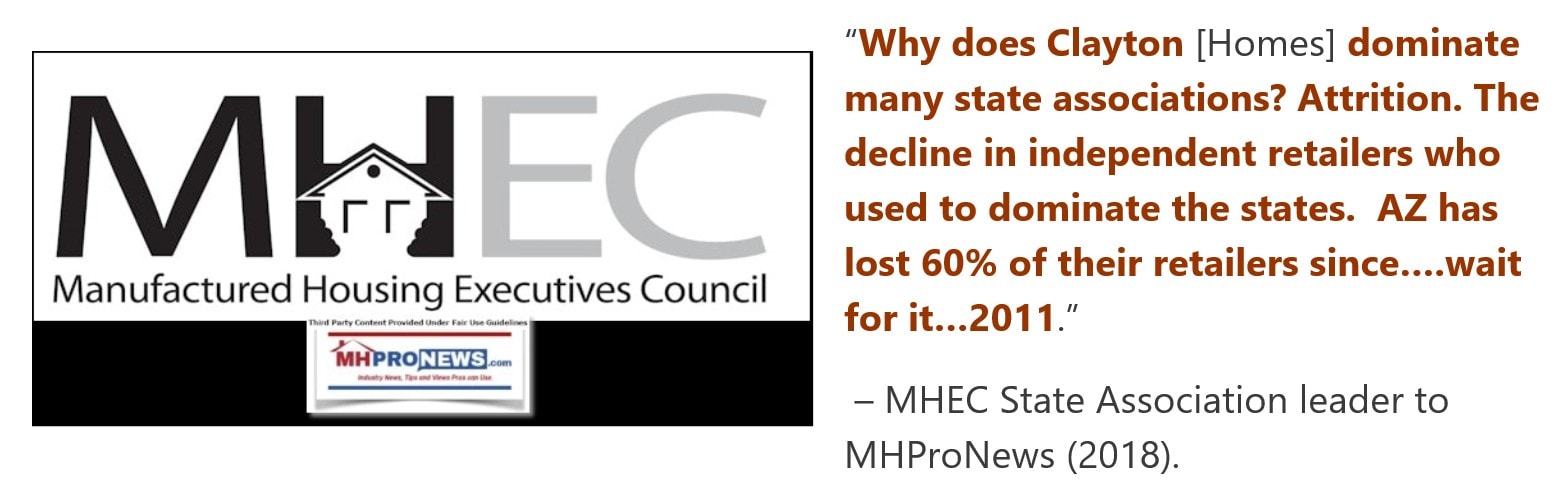

But let’s circle back to the first bullet above, and that 4.1x increase since 2010 because, as the report linked here details, MHI’s, Berkshire’s, and Buffett’s statements and other data clearly reflect the following. In 2009, the process of decimating the independent retailers in manufactured housing was launched. To the point that Cochrane, Schmitz, and company make about: “Monopolies are difficult to detect…they form power relationships of infinite complexity that are hard to untangle…” it is worth noting that Schiffman himself says that there is no reliable national data. Strommen told MHProNews that he found getting reliable information on manufactured housing to be difficult. Strommen said he reached out to several industry sources, and only MHProNews responded.

Similarly, Sun’s CEO Shiffman recently said that there is “no national repository” of information; an odd statement, given that they have 2 board members at MHI.

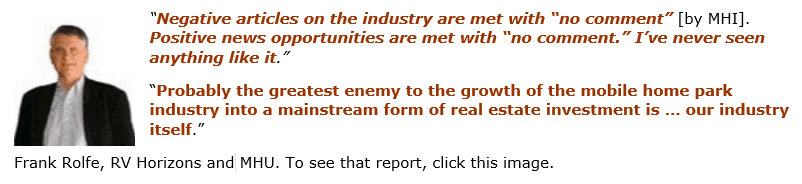

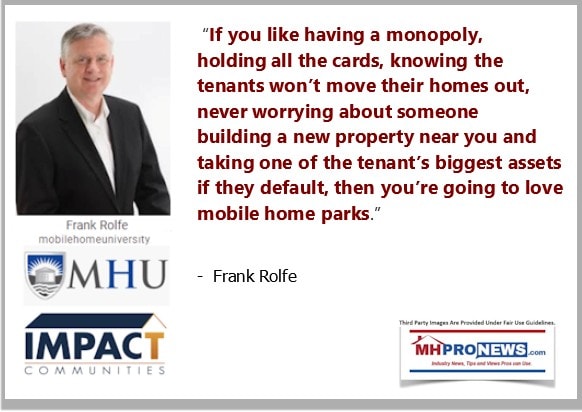

Those comments shed light on what now MHI member Frank Rolfe previously said. He claimed that MHI would not respond to many media requests, and Rolfe said that those in media were contacted him instead. Rolfe also ripped MHI for failing to defend the industry, or to properly promote it. He further ripped MHI for Nathan Smith, then MHI chairman, and his negative news generating legal issues with his residents. Some pull-quotes from Rolfe previously provided to MHProNews illustrate those claims.

Note, Rolfe references his own problematic image.

Then, note that Rolfe – who along with this partner Dave Reynolds are MHI members – has urged industry professionals never to build a new community. Isn’t that going to obviously result in supply constraints?

Rolfe has himself spoken about the castle-and-moat method that Buffett preaches.

Perhaps far more bluntly, Rolfe has said this. So, while Buffett is a bit subtle, Rolfe is not.

The Pre-Buffett Pre-Berkshire Business Model in Manufactured Housing

Additional Information, MHProNews Analysis, and Commentary

Industry newcomers and outsiders looking in may not realize that, pre-Berkshire, the industry’s common business model worked something like the following.

- HUD-Code manufactured home builders constructed homes. While some of those producers were vertically-integrated builders who had their own retail distribution outlets, many relied upon independently owned “street retailers” (errantly but colloquially dubbed “dealers” by some).

- Street retailers sold homes that would generally go to one of three places listed in 3, 4, and 5 below. Note that when the industry was roaring, there were some 20,000 +/- such retailers. See the new MHI document connected report linked here.

- Privately-owned land that the manufactured home purchaser owned or was buying.

- Privately-owned land, sometimes family or employer’s land, where the manufactured home purchaser was placing his own but did not own (placement might be leased, free, etc.).

- Land-lease manufactured home communities, also colloquially but routinely errantly known as “mobile home parks” or “trailer parks.” (Note: for those who may not know, Hawaii and Maryland, as well as parts of Chicagoland, have conventional housing on leased land, which commercial real-estate is often on. Put differently, this is not so odd as it may seem at first glance — but only so long as the terms of the lease are not punishing on the leaseholder(s).

- Land-lease manufactured home communities, in this pre-Berkshire era business model, routinely depended upon street retailers for sales of homes into their communities.

- Put differently, the above meant that when the majority of manufactured home independent retailers, and some of the vertically integrated producer-retailer (finance, insurance, etc.) firms failed post-2009, then the business model for community operators became far more complex. In many cases, community operators who may have rarely or never sold a manufactured home were now being forced ‘by the market’ into buying and selling homes themselves.

- But that ‘market’ force was arguably the direct result of 21st Mortgage Corp cutting off lending to thousands of firms that did not sell Clayton Homes’ products or those of 21st. That is seemingly a prima-facie case of tying, an antitrust violation. Furthermore, the case is made here that Buffett’s brands, allies, regulators, and the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac were effectively kept from doing manufactured home-only lending, even though they have a Congressional mandate to support manufactured home lending. Due, in part, to the placement of homes on leased land, some 80 percent of manufactured homes are financed with home-only or chattel loans. Those are precisely the loans that the GSEs are not making. Again, see the in depth report linked here.

- Accessible and competitive credit are near the heart of much of this scandal hiding in plain sight. When Berkshire-owned Clayton Homes sister-brand 21st Mortgage curtailed lending for a time – and because the GSEs were not seriously making single-family manufactured home loans, despite the Housing and Economic Recovery Act (HERA) of 2008 mandate to do so – the Berkshire brands wielded enormous influence over the entire manufactured housing market. In the 1990s into the 2000s, the bulk of the communities business was based on people that owned their manufactured homes or were financing them. Fast forward to the post-Dodd-Frank, post 21st Mortgage credit curtailments. Those forces that limited access to credit also sparked the beginning of land-lease communities that moved away from just selling homes, to now buying manufactured homes and renting them. A close look at the publicly traded firms (REITs) statements made it clear that more homes are being rented than sold.

- Put differently, instead of affordable home ownership, a large segment of the industry was shifted to ‘more affordable’ rentals. Once more, capital access and the significant change in the business model required mean that smaller community operators – so-called ‘mom-and-pop’ owners – may not have wanted to, or been able to, navigate all of these changes that they often never had to perform before. The result? Independent communities owners began to sell out. Community “consolidators” – such as MHI member Sun Communities and numerous others – began to acquire properties with far greater velocity than before. Thus that 4.1x growth by Sun since 2010.

As Shiffman has said, the push for higher taxes, along with other regulatory changes, is now moving the industry toward a new wave of consolidations. These are barriers for entry, persistence, or exit. It appears to be arm’s length from the beneficiaries of the changes in public policy. But when carefully examined, ties are often found.

By accident and/or design, the federal pressures, and failure to enforce various federal laws, is driving the next wave of consolidations. Of course, Sun and others in their circle are smiling. Big-brother government is eroding the opportunities for affordable home ownership. As the old Doris Day song goes, the rich are getting richer, and the poor are getting poorer.

Summing Up and Conclusion

MHProNews has taken years to unravel the knotty relationships that, once unraveled, now seem clear and almost self-evident. In fairness, yeoman’s work has been done by the Manufactured Housing Association for Regulatory Reform (MHARR) too. Those years of efforts go to the points by the economists mentioned above and cited again below.

Developing this picture is not easy. But once developed, the facts fit the contentions of Strommen, Cochrane, Schmitz, and their colleagues. It fits two other statements previously published by MHARR and MHProNews.

The case for antitrust and RICO are there. Regulators are clearly not acting.

While there are several things that should and could be done, they might be boiled down to the following.

- Greater public awareness of how this impacts virtually every non-millionaire or billionaire in the country. The affordable housing crisis is already here, but the next conventional housing crisis – unless the trajectory of ever-rising prices is changed – is looming.

- The problem of monopolies and oligopolies in general must be understood and dealt with. It is becoming easier to detect in manufactured housing, thanks to growing research and reporting. But much of the general public is still not aware of why this matters to them.

- Because regulators are apparently failing, lawmakers must be made to feel the heat so that they see the light and act.

Ecclesiastes 1: 9 says that there is nothing new under the sun (Biblical pun.,.well…intended…).

1 Timothy 6:10 says that the love of money is the root of all evil. Note that money is not evil. Money is morally neutral. It is the inordinate love of money that moves people to do bad things to their fellow man – that is the evil that the love of money and power can cause.

“The Christian condemnation [of the love of money] relates to avarice and greed rather than money itself,” says Wikipedia which also says: “Avarice is one of the Seven deadly sins in the Christian classifications of vices (sins).” Jewish theology is similar.

Sun Communities has once more helped document the impact of what “sabotaging monopolies” and the “moat” methods are doing to tens of millions of Americans. In the light of all that, Danny Glover’s pithy observation above – how the system has been rigged through powerful influence over information access and capital access – comes into its fuller meaning. Not surprisingly, that also fits what Cochrane, Schmitz and their colleagues have argued too.

###

###

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number-one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.