The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

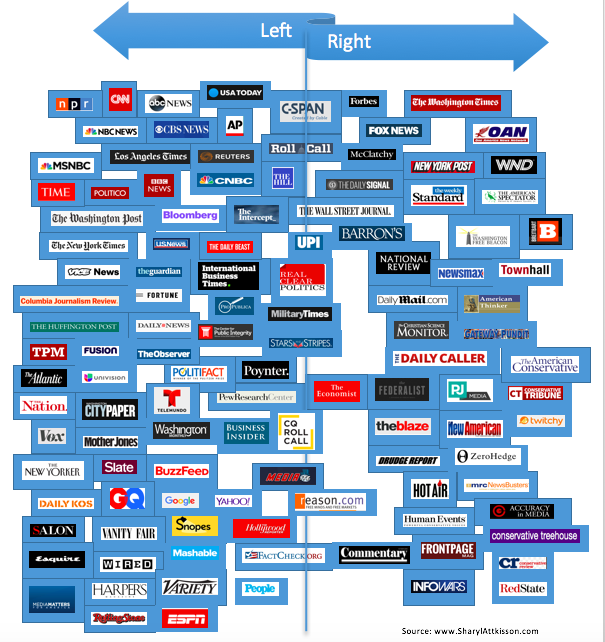

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- Europe ‘in battle mood’ over Trump’s steel threat

- Sears to close 43 more stores

- How Trump compares with Obama so far on jobs

- Germans should retire later, IMF says

- Startup uses energy from your lawn to heat your home

- Entrepreneur: I was sexually assaulted by my investor

- S. economy gains 222,000 jobs in June

- The opioid crisis is draining America of workers

- 5 financial mistakes that can doom your future

- Job training helped save her life

- Jay-Z’s ‘4:44’ everywhere but Spotify

Selected headlines and bullets from Fox Business:

- NJ millionaires-on-welfare ‘stealing’ from poor, fmr. Lakewood mayor says

- Retail jobs bounce back in June

- US adds 222,000 jobs in June, keeping Fed on course – (NOTE: see jobs related MH special report, linked here)

- Wall Street climbs after jobs data as tech, financials rise

- Oil prices fall more than 3% on signs market still oversupplied (NOTE: see oil related MH special report, linked here)

- Sears to close another 43 stores

- Fox News Poll: Melania Trump’s favorable ratings climb

- Who is Omar Khadr? Canada apologizes, pays millions to ex-Gitmo inmate

- Trump meets Putin: Even U.S. first lady couldn’t keep meeting on time, Tillerson says

- Facebook hopes to score streaming rights for 2018 World Cup

- ‘Make America Great Again’ singer Joy Villa: I’ve un-friended companies over Trump

- Mayweather vs. McGregor: Promotional tour to kick off in Los Angeles

- Is a robot coming for your job? (NOTE: see Sophia, Robot Worker related MH special report, linked here)

- Faulty car parts may cause gas leaks

- Ex-Dallas man gets 7 years for insurance scam of London firm

- ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

-

The numbers at the closing bell…

S&P 500 2,425.18 +15.43 (+0.64%)

Dow 30 21,414.34 +94.30 (+0.44%)

Nasdaq 6,153.08 +63.61 (+1.04%)

S&P 500 2,425.18 +15.43 (+0.64%)

Crude Oil 44.30 -1.22 (-2.68%) (NOTE: see oil related MH special report, linked here)

Gold 1,212.00 -11.30 (-0.92%)

Silver 15.53 -0.45 (-2.80%)

EUR/USD 1.1401 -0.002 (-0.18%)

10-Yr Bond 2.39 +0.02 (+0.97%)

Russell 2000 1,415.84 +15.02 (+1.07%)

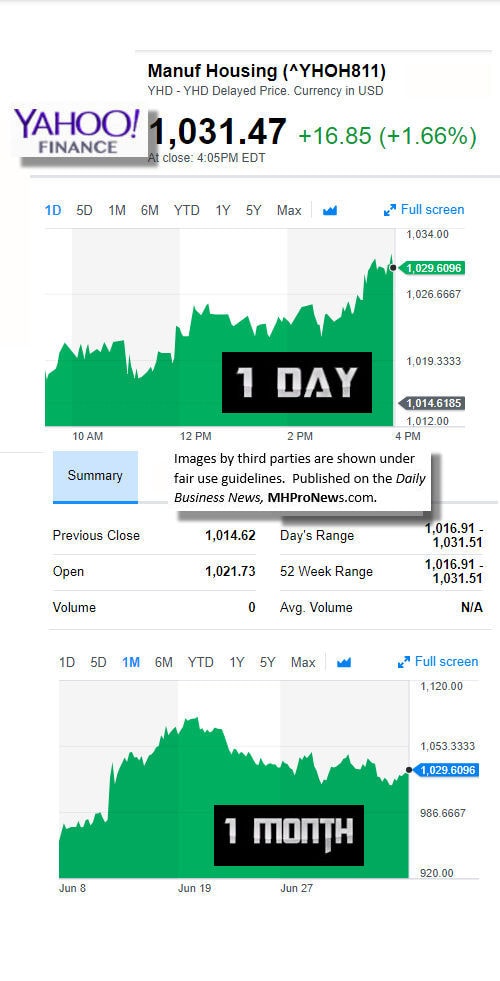

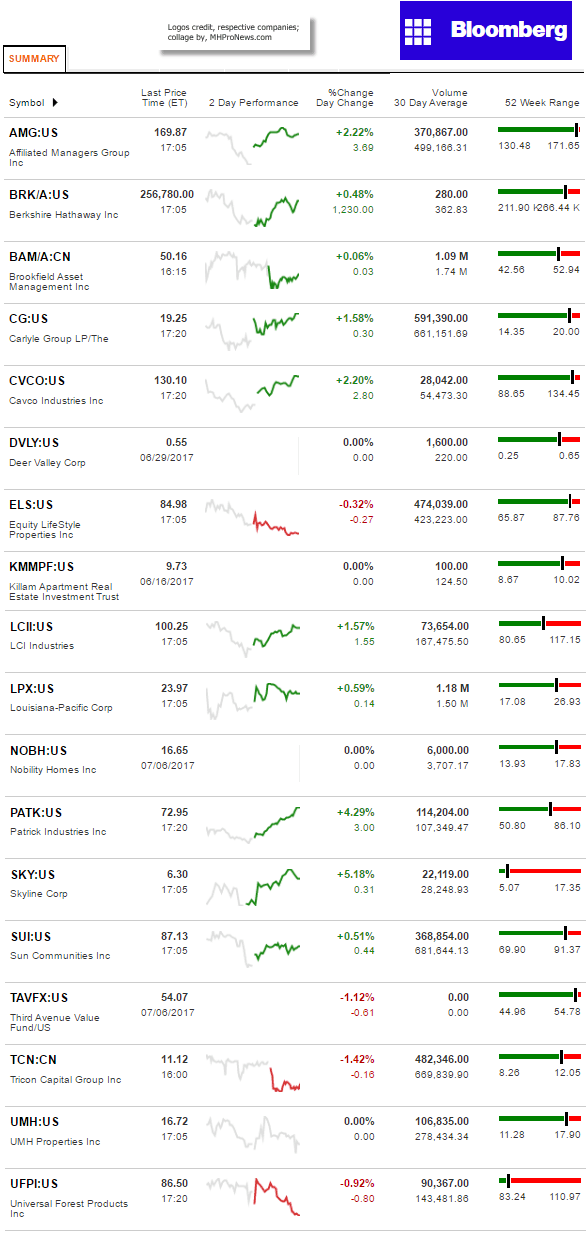

Manufactured Housing Composite Value

Today’s Big Movers

Today’s Big Gainers were Skyline and Patrick (See our recent spotlight on this firm). Leading the Decliners were Tricon and UFPI. Most stocks rose, but ELS was one of the exceptions. That report, below…

See below for all the ‘scores and highlights.’

Today’s MH Market Spotlight Report – ELS

Heavy ELS Stock Volume Rumble, But Leads this MH Community REIT Stock to Tumble…

Why?

Depending on who’s list you look to, ELS is one of the top 2 manufactured home community operators in the nation. MHProNews has tracked the comments of their chairman, Sam Zell, for years – he’s colorful and insightful, besides being successful.

Our most recent report on Zell is linked here.

ELS’ Howard Walker, JD – a confidant of Zell – is one of the four persons on the Manufactured Housing Institute (MHI) executive committee.

ELS is a company that is solidly positioned – in a variety of ways – to influence the manufactured home industry, especially in the community sector.

This report below from Equities.com was brought to our attention today, so we are making this our spotlight report, which is interspersed with images from their classy presentation story, which is linked below.

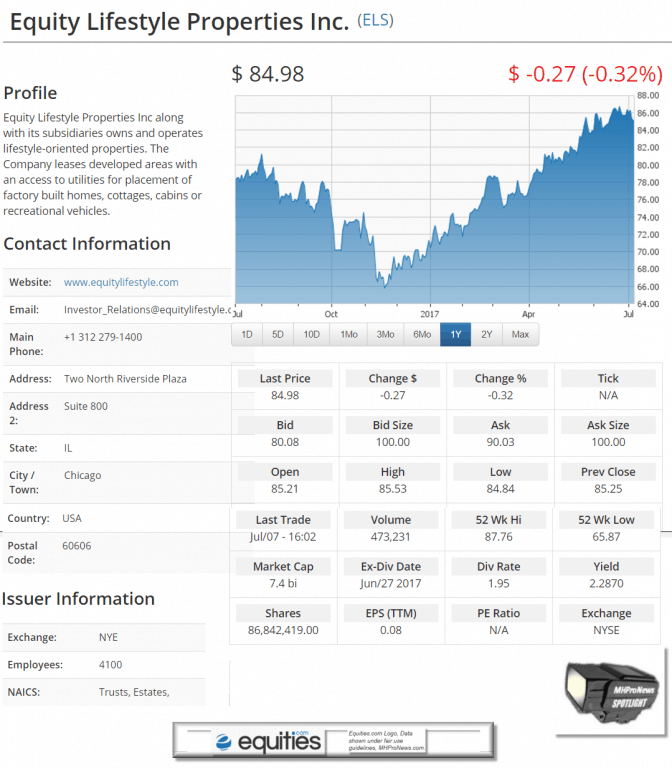

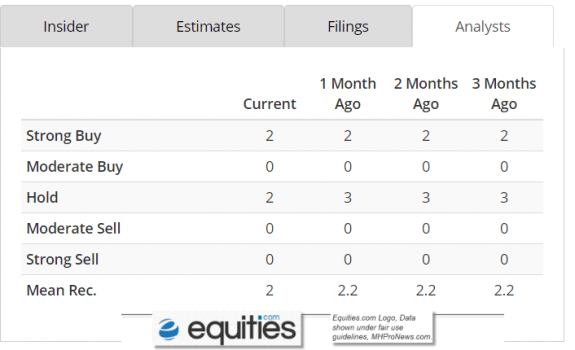

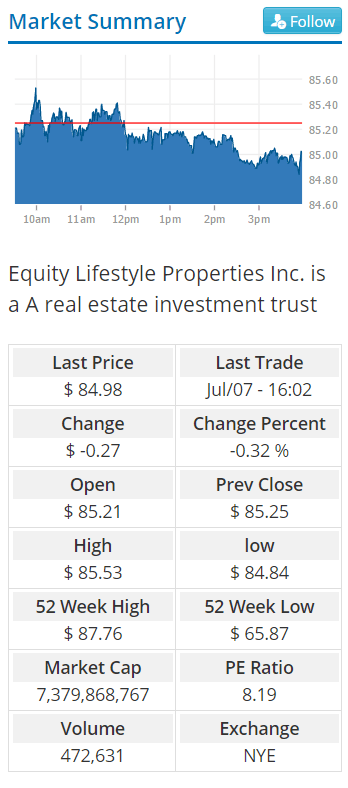

Equity Lifestyle Properties Inc. (ELS) Moves Lower on Volume Spike for July 06

Equity Lifestyle Properties Inc. (ELS) traded on unusually high volume on Jul. 06, as the stock lost 1.18% to close at $85.25. On the day, Equity Lifestyle Properties Inc. saw 713,467 shares trade hands on 5,888 trades. Considering that the stock averages only a daily volume of 407,296 shares a day over the last month, this represents a pretty significant bump in volume over the norm.

Generally speaking, when a stock experiences a sudden spike in trading volume, it may be seen as a bullish signal for investors. An increase in volume means more market awareness for the company, potentially setting up a more meaningful move in stock price. The added volume also provides a level of support and stability for price advances.

The stock has traded between $87.76 and $65.87 over the last 52-weeks, its 50-day SMA is now $83.78, and its 200-day SMA $76.10. Equity Lifestyle Properties Inc. has a P/B ratio of 8.21.

Equity Lifestyle Properties Inc is a real estate company. It owns and operates lifestyle-oriented properties consisting of manufactured home communities and recreational vehicle resorts.

Headquartered in Chicago, IL, Equity Lifestyle Properties Inc. has 4,100 employees and is currently under the leadership of CEO Marguerite Nader…

DISCLOSURE: The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)