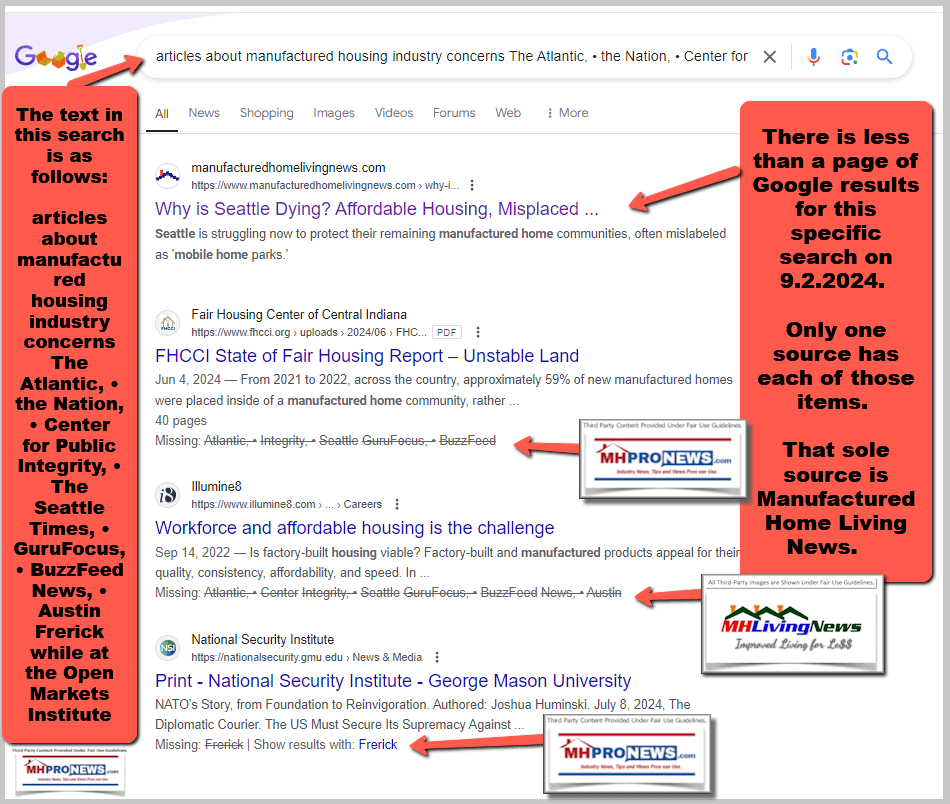

To set the table for what follows, let’s consider this partial list of mainstream and specialized publishers who have dealt with troubling aspects of concerns connected to the manufactured home industry.

- The Atlantic,

- the Nation,

- Center for Public Integrity,

- The Seattle Times,

- GuruFocus,

- BuzzFeed News,

- Austin Frerick while at the Open Markets Institute.

Most of those are left-leaning sources.

Those articles and the tweet above deal with aspects of how market consolidation, oligopoly style monopolization, and “the moat” have impacted the manufactured home industry.

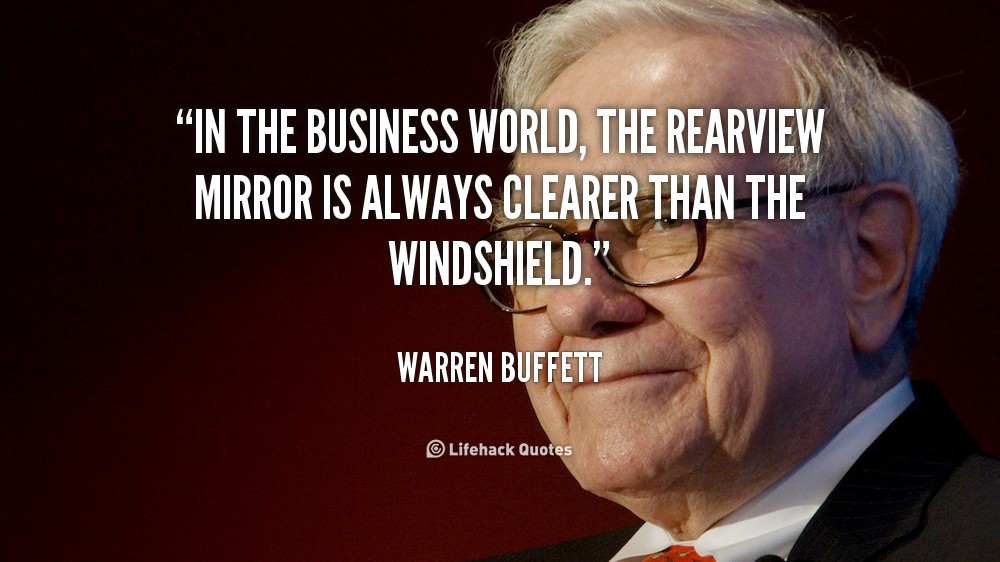

Before looking at the multibillion-dollar lessons learned from Harry Markopolos and 10 plus 21st Century schemes for MHVille or America more broadly, the following should call to mind the saying that hindsight can be 20/20.

The axiom “Hindsight is 20/20,” per Gemini, is found in the Yale Book of Quotations which “also cites the saying in Godey’s Lady’s Book in September 1892.”

“The phrase “hindsight is 20/20” is an idiom that describes the ability to see things more clearly after they have happened. It’s based on the idea that people often have better vision when looking backward than forward,”

left-leaning Google’ AI powered Gemini said.

As an analogy to life, drivers must glance back into the rear-view mirror while driving but must also pay attention to the windshield and sideview mirrors too.

Proper navigation is 360°. When anyone fails to look to the side or rearview, accidents and errors are more likely to occur. Business and other aspects of living is in several ways similar.

When Warren Buffett is pondering an investment, he reads and looks at the records – i.e.: into the historic rearview mirror – precisely because hindsight can be 20/20.

Then ManageAmerica partner Andy Gedo and then a Manufactured Housing Institute (MHI) member, said he agreed with the notion used by MHProNews that it can be useful to look at examples outside of manufactured housing (such as a look at RVs and conventional housing) to better understand what is occurring in manufactured housing.

Comparing what MHI, the Manufactured Housing Association for Regulatory Reform (MHARR), and what other sources claim is logically necessary and useful. Part of that is the prudential examination of the historic production and other achievements of manufactured housing. During an affordable housing crisis, based upon a range of evidence and experience, MHProNews can see facts in the industry’s proverbial rearview mirror that reveal the manufactured home industry’s is performing poorly in 2024. Which begs the question, why?

A good look back and to the side can help.

“It took five minutes for Harry Markopolos to figure out that Bernard Madoff was a fraud. But it took him nearly ten years to get the SEC – and the world – to accept the difficult truth…that the man regarded as the foremost investor of our time was actually behind the largest case of investor fraud in history. Thanks to Harry’s persistent flag waving and years of covert communications with the SEC, the veil covering Madoff’s “financial magic” was eventually lifted, revealing an intricate $65 Billion Ponzi scheme built on equal parts deception and SEC ineptitude, and making Harry Markopolos a true hero for the ages. A story you must hear to believe, Harry and his amazing journey have been featured on 60 Minutes, in The Wall Street Journal and in the documentary Chasing Madoff.”

So said AFP Speakers.

When considering the lessons of Madoff and Markopolos, the case can be made that too many observers get hung up on the word “Ponzi” and miss the word “scheme.”

“Ponzi” describes an aspect of what kind of scheme Madoff deployed. But without multiple individuals involved, Madoff’s scheme arguably would not have worked as long as it did. Who says? It is implied by Markopolos.

When he saw the illustration shown in the video clip below, he didn’t say he thought it was a Ponzi scheme. Rather, Markopolos said that something was obviously wrong. The specifics of what was wrong needed to be investigated to be better understood.

Markopolos said in the trailer to the docu-drama style video posted below that Madoff’s operation was “the biggest international conspiracy of modern times.” Perhaps. But the harms done by the lack of consistent enforcement of federal existing laws enacted to benefit manufactured housing contributed to the manufactured housing industry’s production to plumet from 1998 to today. Did manufactured housing just suffer from a series of bad luck breaks? Did numbers of experienced and intelligent leaders involved in the Manufactured Housing Institute (MHI), for example, all keep missing the obvious next steps needed to spark industry growth? Or did more sinister occur?

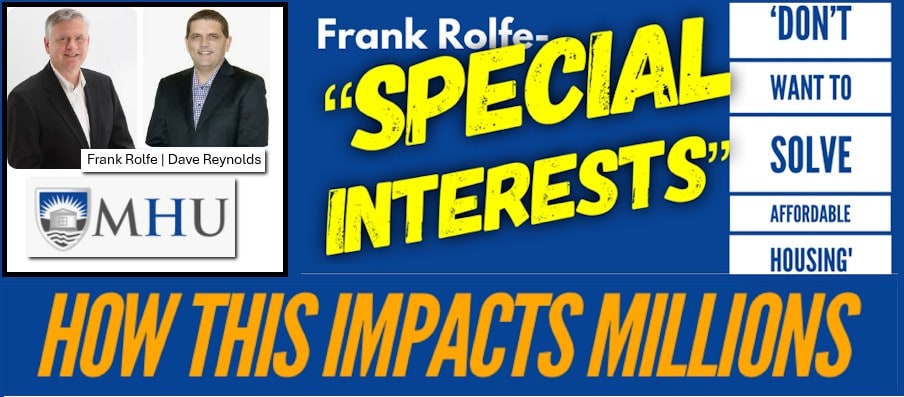

The Madoff and other scandals explored herein offer useful clues.

Sizable numbers knew something was wrong with Madoff’s methods, perhaps thousands, as was noted above. Maybe because they perceived they were benefiting from Madoff’s methods and/or due to concerns over possible reprisals, they largely remained silent. That too is indicated in the trailer to Chasing Madoff posted above.

It would be bad enough if the estimated $50-65 billion dollar scheme escaped regulators and so much of the media for so long.

But as the fresh look at the 21st century’s ten-plus financial and business scandals that follows reveals, the Madoff scandal was hardly the only one.

Too many media accounts probe the outlandish rip-off Madoff, and his associates perpetrated, but don’t mention that there have been several other multibillion dollar rip-offs. Those scandals may or may not have used a Ponzi method, but were nevertheless a scheme involving numerous individuals that long escaped the serious interest of regulators. Much of the media was also asleep at the wheel, or these schemes may have been mitigated sooner if mainstream media had probed those issues and stuck with it as Markopolos did.

The First Amendment was in the Constitution’s Bill of Rights for a reason. It says the following.

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

It has been observed that “the press” is the only profession specifically protected by the Constitution and the various amendments. That’s not necessarily so.

- If freedom of speech and of the press implies the media, and it does, then freedom of religion implies a range of vocations in the faith realm.

- The right to petition Government for a redress of grievances is often a premise for trade association work.

- The 2nd Amendment implies that someone can be in the business of making and selling firearms, and so on.

So, the Bill of Rights provides support for professions beyond the freedom of the press.

That noted, “Free speech is the not-nice stuff. Easy speech or speech that’s acceptable to everybody doesn’t need any protection. I’m there to challenge the audience.” – Comedian Rob Schneider, per AMAC.us.

From Big: “TikTok reads 230 of the Communications Decency Act to permit casual indifference to the death of a ten-year-old girl.” – Judge Paul Matey. Matt Stoller’s Big said about that ruling by Matey: “Judges Rule Big Tech’s Free Ride on Section 230 Is Over” adding: “Algorithms are no longer a Get out of Jail free card. The Third Circuit ruled that TikTok must stand trial for manipulating children into harming themselves. The business model of big tech is over.” While that remains to be seen, it sheds light on the battle over free speech in America, a featured item earlier this week with the Meta/Facebook’s Mark Zuckerberg’s remarks and attorney John Whitehead related analysis at this link here.

With that backdrop, “Harry Markopolos and his colleagues spent years trying to get public officials and mainstream media to expose the massive Bernie Madoff fraud they knew existed.” (See Part I).

It may seem like hyperbole for Markopolos to say that “he knew” after five minutes that he knew what was wrong with Madoff’s business model, but a closer look clears that up. It became clear in minutes to Markopolos that something was wrong. It took time and research for Markopolos and others to figure out what that something was.

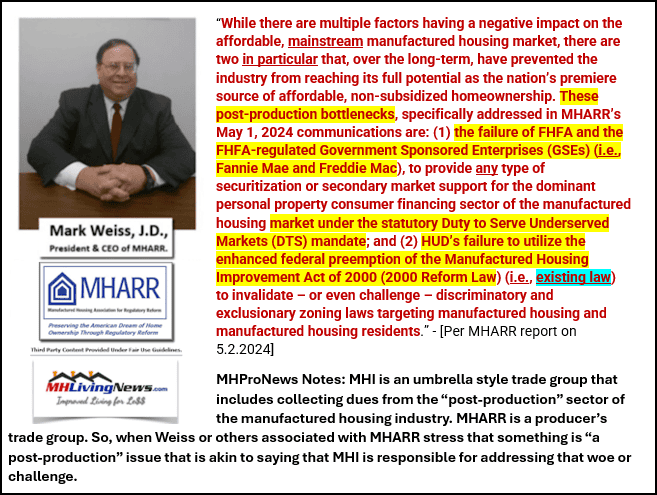

To draw the parallel to manufactured housing, our industry provides affordable housing. In certain respects, manufactured housing is protected and regulated, at least in theory, by federal laws. What MHARR calls the two key laws that are not properly enforced have been acting as bottlenecks to industry growth and production are arguably akin to what Markopolos “knew” after mere minutes.

What follows is the need to investigate, read, or research what has caused manufactured housing industry underperformance. Because multiple voices within and beyond manufactured housing have arguably done something akin to what Markopolos did. Namely, blow the whistle and provide sufficient evidence to spark interest and action by the public, investors, media, and public officials.

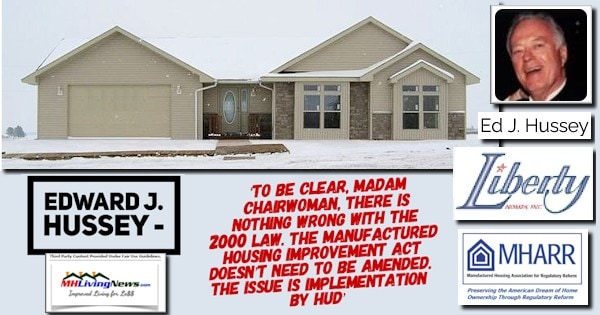

Once someone grasps that manufactured homes are routinely far more impressive to the public than most may be led to think from mere hearsay, that realization ought to spark interest, investigation/reading/research and action. As a point of fact, Congress did investigate the improper implementation of the Manufactured Housing Improvement Act of 2000 (a.k.a. MHIA, 2000 Reform Act, 2000 Reform Law, MHIA 2000). So too did the Government Accountability Office (GAO). Regrettably those investigations, which supported the contentions of MHARR, and others as reported by MHProNews or MHLivingNews, yet nothing substantive has yet changed.

That doesn’t mean that nothing will change. Again, Markopolos and his colleagues needed persistence to make change a reality. Other events occurred too. The confluence of Markopolos’ push and other occurrences finally resulted in Madoff being exposed, prosecuted, and imprisoned. Once an exalted Wall Street icon, Madoff died impoverished and in federal prison.

Harry Markopolos is “the man who knew” that Madoff and company where a massive, costly scam.

All of those videos above are probes into the rearview mirror. Hours of videos are available now that probe that scandal. That is useful as historic insights that can yield lessons to be learned for all professions, including ours. But they are also a reminder that for years mainstream media and public officials – for whatever reasons – missed this massive scandal.

So, with that in mind, pivoting back to manufactured housing, hearings were held by Congress about the lack of implementation of the MHIA in 2011 and 2012. MHProNews and our sister site have been virtually alone in MHVille trade media reporting on hearings that Kevin Clayton and others like John Bostick (Sunshine Homes, for MHARR) or Edward Hussey (Liberty Homes, for MHARR) have participated in.

Something similar has been occurring in the finance side of the manufactured housing industry’s woes. Legislation was enacted in 2008 that was supposed to fix the loss of financing that occurred during the industry’s meltdown in the later part of the 20th century and the early part of the 21st century. The Federal Housing Finance Agency (FHFA) has been holding in person or virtual hearings dubbed “listening sessions” for over 6 years. Comments from interested parties are filed at various times when Fannie Mae and Freddie Mac propose their next “plan.”

What has occurred? On the one hand, a body of evidence about what has gone wrong in manufactured housing has been established through those processes. That has its own utility. Our industry and the U.S. are better off with that body of evidence than if it had not been established.

But on the other hand, parallel to HUD and the MHIA, the FHFA, under both Democrats and Republican administrations, routinely failed to act in a manner that the Housing and Economic Recovery Act (HERA) law requires under its Duty to Serve (DTS) manufactured housing provision. More on this in Part II, but for now, here is one of several possible examples.

With that backdrop, noting that while some 40 months in the rearview mirror, the next information is as relevant as now as it was then. Additionally, developments since that evidence-backed op-ed about those scandals, plus new examples of corruption in another large scheme, have been revealed. Good information well-supported by evidence can have a timeless quality and ongoing value.

Part I. Per the WND News Center to MHProNews is the following.

The solution to Big Tech and the oligarchs

Anyone who thinks Big Tech will be reined in by regulations has not been paying close attention. The following cases exposed years of documented corporate, regulatory and accounting failures. They spotlight massive corruption and mainstream media misses.

- Enron

- Theranos

- WorldCom

- VW “Diesel-Gate”

- Solyndra

- Bernard “Bernie” Madoff

- WeWork

- Lehman Brothers

- Fannie Mae, Freddie Mac (Government Sponsored Enterprises/GSEs).

Collectively, that list involved hundreds of billions of dollars in losses by investors. Various types of fraud, corruption, and deception occurred. Because taxpayers and the broader economy were impacted by Lehman Brothers and GSEs housing-finance scandals, those cost Americans trillions of dollars.

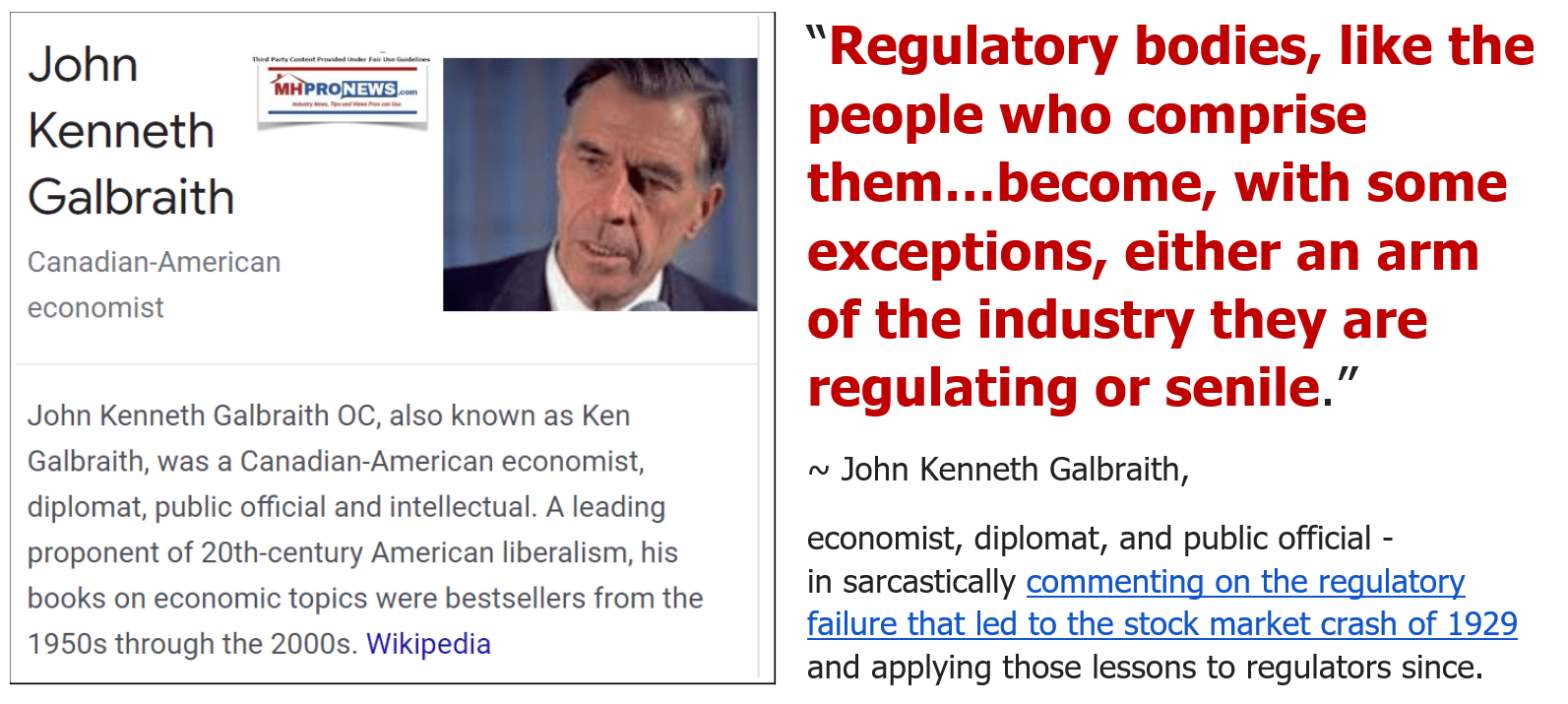

John Kenneth Galbraith said: “Regulatory bodies, like the people who comprise them … become, with some exceptions, either an arm of the industry they are regulating or senile.” Bingo.

Modern robber barons are dominating information and capital. Cold Fusion’s documentary about the Theranos’ scandal observed: “It’s the illusionary effect where if you repeat a lie enough times people start to believe it, especially if you have credible names surrounding the product.”

Problematic products are from corrupt companies.

Theranos’ Elizabeth Holmes is shown with then Vice President Joe Biden and President Barack Obama. In the massive Enron scandal, Ken Lay and Jeff Skilling are shown with then President George W. Bush (R). Those establishment politicians are sufficient to make the point of the “illusionary effect” of “repeating a big lie enough times” when “credible names” are involved.

Harry Markopolos and his colleagues spent years trying to get public officials and mainstream media to expose the massive Bernie Madoff fraud they knew existed. Forbes says Madoff losses may have exceeded $50 billion.

Other regulatory failures are hiding in plain sight. The New York Times quoted Warren Buffett: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

Buffett’s “class” profited wildly in the 2008 and 2020 economic upheavals. How? CNBC quoted billionaire Bill Gates: “I didn’t even want to meet Warren because I thought, ‘Hey this guy buys and sells things, and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.'”

The CDC defines parasitic: “A parasite is an organism that lives on or in a host organism and gets its food from or at the expense of its host.”

Buffett said, “The most important thing for me is figuring out how big a moat there is around a business. What I would love, of course, is a big castle and a big moat with piranhas and crocodiles.”

When carefully examined, these oligarchs and their businesses employ “parasitic”, “moat”, and “sabotage monopoly” methods. They create a slow-motion monopoly of various markets. Experts like James Schmitz say monopolies “inflict great harm on low- and middle-income Americans.”

The solution? Enforce existing laws. Break these pernicious giants up. They cause social, economic and moral harm. Once broken up, watch the economy and America soar. ##

L. A. “Tony” Kovach (initially published by WND on May 11, 2021) ###

Part II – Additional Information with More MHProNews Analysis and Commentary

For those who have read something similar on MHProNews before, step back and clear your mind for the next several minutes. Approach this information as if you had never seen it before.

In no particular order of importance are the following observations and possible MHVille insights and takeaways.

1) Since that evidence-backed op-ed on WND, two top leaders for Theranos have been convicted and imprisoned.

2) Since that op-ed on WND spotlighted in Part I, Sam Bankman Fried (SBF) was found guilty on all counts of the big FTX scandal. So, that was yet another financial scheme that operated for years as public officials and most media missed it as it developed.

3) Once more, shouldn’t it seem odd that in an information age with numerous regulators at the state and federal levels, how is it possible that so many scandals of big, large, to gigantic scales were able to operate and proceed for so long? Hold those thoughts.

4) In 2019, left-leaning Axios reported a “Poll: 70% of Americans believe the political system is rigged.”

5) In 2020, left-leaning Pew Research said: 70% of Americans say U.S. economic system unfairly benefits the powerful” and survey results stressed “The notion that the U.S. economy is “rigged” to benefit the wealthy.”

6) For most of the past 3 years, about 65 percent of this country has thought that our nation is on the wrong track.

7) As #4 and #5 above reveal, for longer still, some 65 to 70 percent of Americans believe that the system is rigged. Who is it rigged for? The public believes it is for the powerful and connected. As the quote-graphic linked here reflects, there are quotable quotes on the topic of the rigged system that date back decades.

8) Next, pivot back to what MHI member Frank Rolfe said as reported in the articles linked here and here. Let’s note for new readers that Rolfe need not be viewed as some saintly figure. That noted, Rolfe may or may not have realized that what he wrote was a kind of finger pointing at MHI, public officials and others. Those others include business interests that prefer the status quo that keep the affordable housing crisis as a reality. That noted, Rolfe’s finger pointing thus also arguably applies to he and his partner Dave Reynolds. The finger pointing outward were also pointing back at themselves.

9) Obviously, public officials should not need prodding to do the job that they were hired to do. That should be expected and common sense.

- FHFA is supposed to make sure that Fannie Mae and Freddie Mac (the government sponsored enterprises, GSEs, or “The Enterprises”) are properly implementing the Duty to Serve (DTS) manufactured housing.

- HUD is supposed to be implementing the Manufactured Housing Improvement Act of 2000 and its enhanced preemption provision.

- But neither of those are occurring. That failure by HUD and FHFA, among others, that DTS and “enhanced preemption” are improperly enforced is a point on which MHI and MHARR seem to agree. At least on paper.

- But for clarity, financing and zoning are post-production issues. That is but one point that dancing and prancing MHI member George Allen is 100 percent wrong on when he attempts to hold MHARR accountable for something that MHARR collects no dues from members, as does MHI. While both MHI and MHARR have significant statements and roles, it is logically MHI that is failing at their own self-described mission and priorities. Like Rolfe’s finger pointing, Allen’s fingers are pointing back at himself when he fails to hold MHI solely accountable

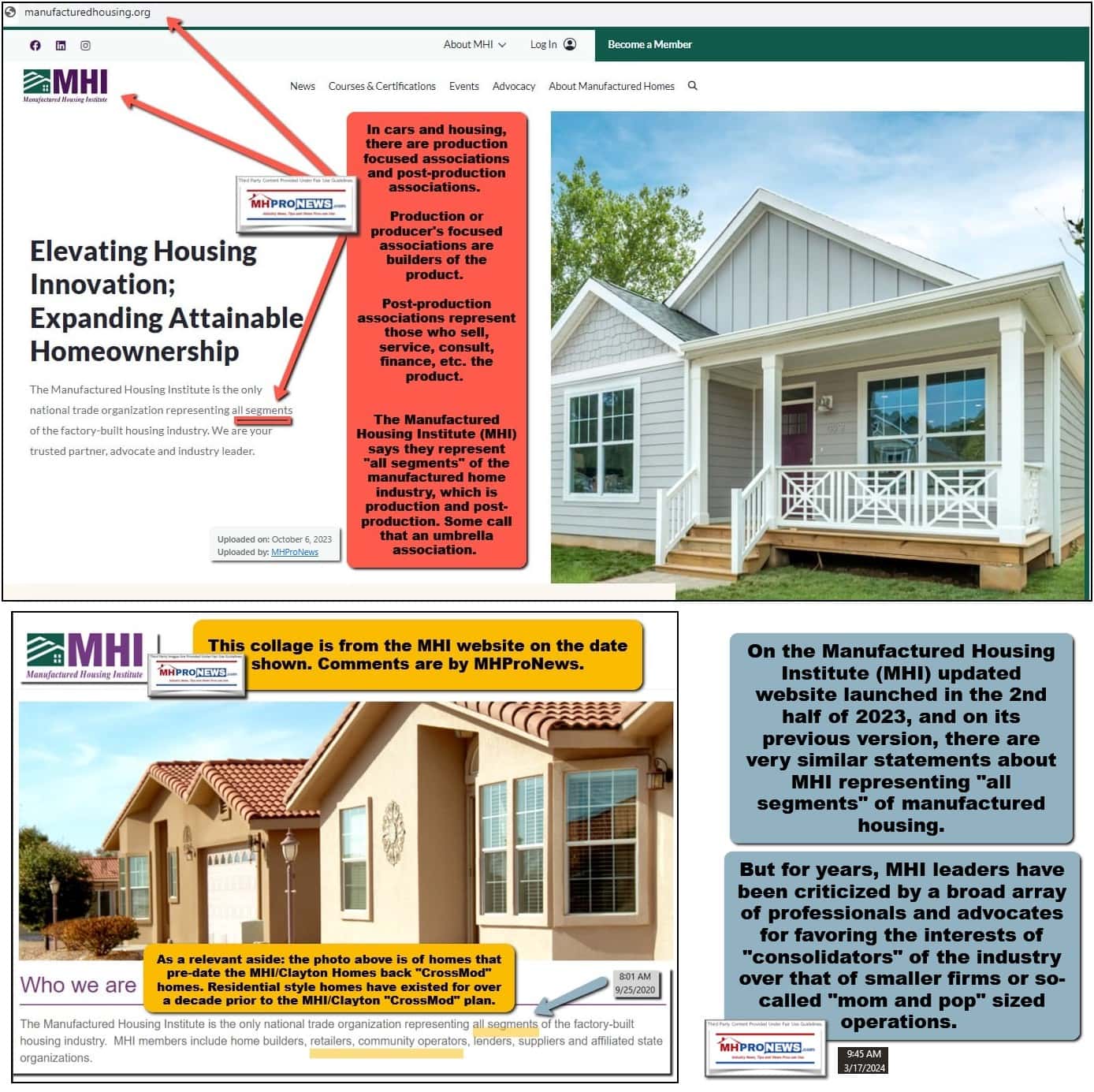

10) MHI correctly says that they are the largest national trade group. They claim to represent “all segments” of the manufactured home industry.

So, MHI and its leaders can’t have it both ways. They can’t claim to be this marvelously influential organization that gets recognition and is praised by its insiders and has a 50 years “partnership” with HUD. If they have such access, and they obviously do, and they are so knowledgeable and experienced, which they are, then why is it that 16 years after DTS was made law and almost 24 years since the MHIA and “enhanced preemption” was made law that those laws are not routinely and properly enforced? That on its surface is an obvious contradiction. You don’t have to have a last name or background like Markopolos to see that something is wrong in MHVille.

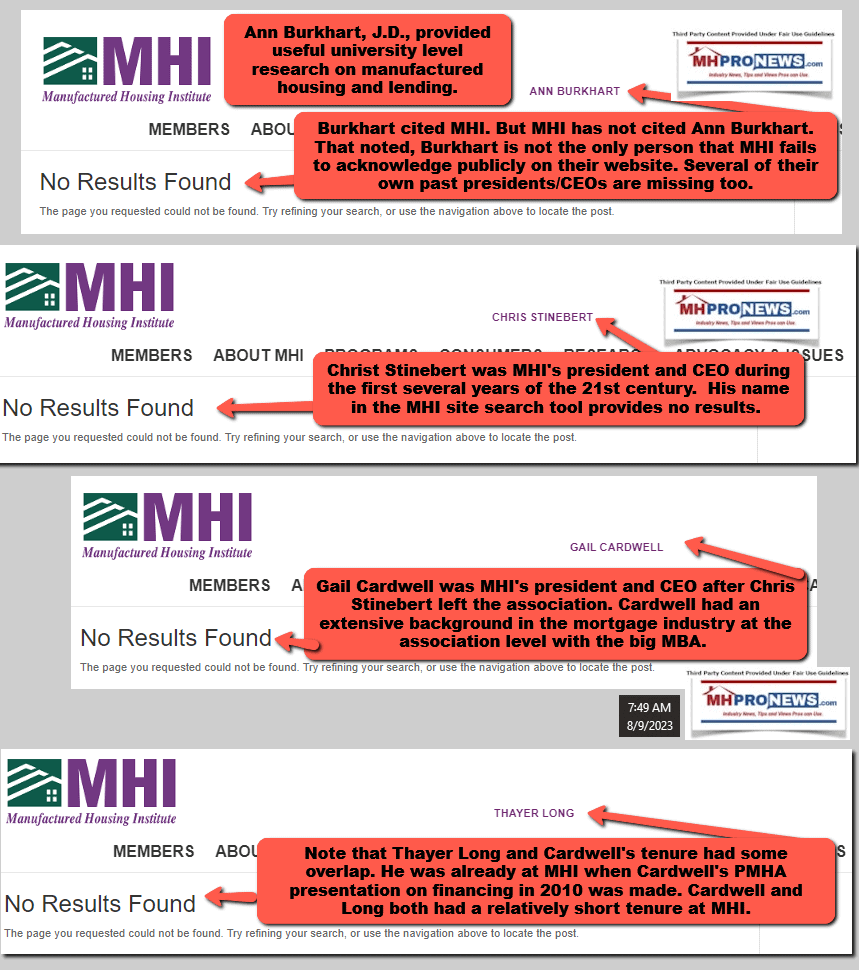

For instance. In 2003, MHI had posted on their website as a routine “activity” and “status” report update on implementation of the Manufactured Housing Improvement Act (MHIA 2000). The second screen capture below is evidence of accountability being sought by MHI, in conjunction with MHARR, by HUD for getting the MHIA and enhanced preemption implemented. Fast forward from 2003 to 2024. The first screen capture below reveals that on the public side of their website the words “enhanced preemption” are entirely missing. Something similar could be said about DTS and the hunt for more lending to fuel industry growth.

11) Paraphrasing what MHARR’s Ghorbani said, MHI postures, meets, and brags yet they are “bereft of tangible results.”

12) Or paraphrasing and underscoring what MHARR’s Weiss described as a shell game. The remark below distills down what Weiss says is where the industry’s (and thus, MHI’s) efforts need to be laser focused. MHI just talking, meeting, or writing about these items from time to time is obviously not enough to dramatically move the needle on production. The production graphic in #13 below makes that point obvious.

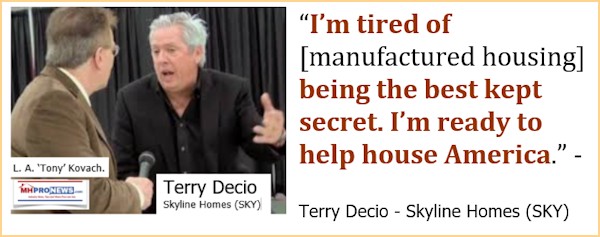

13) It has been over 9 years since MHProNews buttonholed Tim Williams/21st Mortgage Corporation into getting then MHI president and CEO Richard “Dick” Jennison to admit that the industry should have a much more robust goal than he previously said during a video interview with this platform. Jennison remarks below and what follows later are each revealing.

In 2014 – a decade ago! – Jennison said in the video below that the industry should grow slowly. Pardon me? Say, what?

Why grow slowly, so long as growth is sustainable and ethically achieved? In that moment and since, what Jennison said was stunning, but as a professional, at that time I had to hide my shock.

Prior MHI President and CEO Jennison said in that video clip above the following.

- “I don’t think we should grow too fast.”

- “A healthy sustainable growth is what we should be looking for.”

The industry was slowly recovering from the biggest fall in the entire history of manufactured housing.

The 21st century ‘bottom’ of the industry was in 2009 and 2010.

When Jennison made that remark in 2014, the industry that year achieved only 64,334 new homes built that year.

How long did Jennison think manufactured housing needed to recover? Only some 14,000 more new homes were produced in 2014 instead of the roughly 50,000 in 2009-2010.

If the MHI goal was, as Jennison said, not to grow too quickly, that is precisely what occurred. Nice job Dick and his backers.

By comparison, prior recoveries in MHVille were faster and more robust.

14) Did Jennison not realize that the industry had grown far more rapidly in the 1990s after a prior downturn?

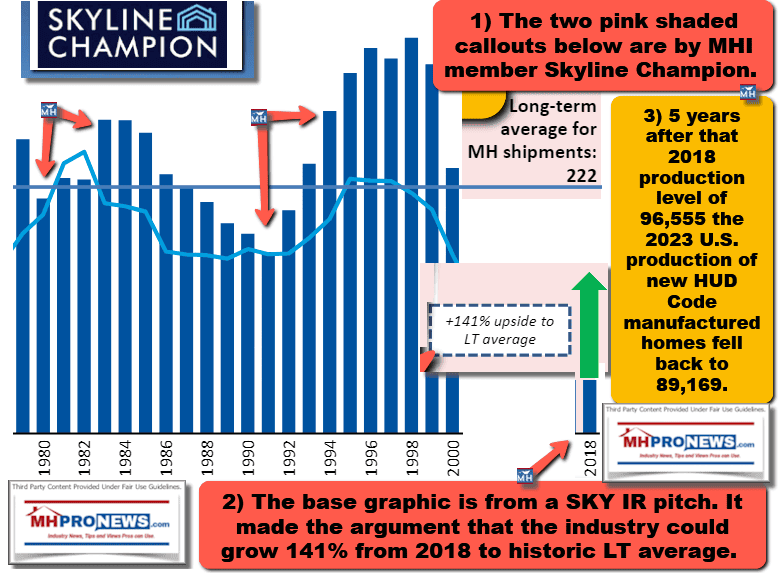

- Look closely in the graphic below from 1991 to 1994. The base graphic is from a Manufactured Housing Institute member Skyline Champion (SKY) investor relations (IR) pitch deck. Several times the manufactured home industry has proven its ability to recover far more quickly than it has in the 21st century.

- While not as sharp as the 1991-to-1994 timeframe increase, look at MHVille production growth from 1982 to .

- Again, the industry had a sharp fall, but it recovered far more rapidly than the post-2009-2010 meltdown.

a) The two pink shaded callouts below are by MHI member Skyline Champion.

b) The base graphic is from a SKY IR pitch. It made the argument that the industry could grow 141% from 2018 to historic LT (long term) average.

c) 5 years after that 2018 production level of 96,555 the 2023 U.S. production of new HUD Code manufactured homes fell back to 89,169.

d) Those examples make it clear. The past industry recoveries decades ago, during the 20th century, apparently were much more robust than what has occurred in the 21st century?!

15) If MHI was serious about industry growth and recovery to the levels of the late 1990s and beyond, which prior MHI President and CEO Chris Stinebert said was the goal, then why did Jennison answer as he did (see #13 and #14 above) after an anemic recovery of a mere 14,000 units over the course of 5 years?

16) That remark by Jennison was stunning then. But in hindsight, as #13-15 illustrate, it could be revealing. Because more evidence has emerged since Jennison so spoke, like that graphic above made possible in part by paying close attention to what MHI member Skyline Champion (SKY).

17) The most plausible explanation is what MHARR’s leaders said about MHI. MHI leaders are posturing one thing for members (and apparently, investors and stakeholders too), but are doing something quite different that reflects what industry insiders actually want.

18) That ‘something else’, per several publicly traded firm’s investor presentation documents, in earnings calls, in video or written remarks, etc. is manufactured housing industry consolidation. Follow the evidence. Follow the money. Apply common sense objectively.

19) For example. The remarks by then MHI chairman Nathan Smith that follow are from a video interview posted further below.

The Cincinnati Enquirer feature of Flagship Communities (previously SSK Communities) co-founder Nathan Smith remarks below was previously reported by MHProNews.

“Smith was first elected chairman in 2013 after serving as treasurer and participating as a member of the board of directors for 10 years. The Manufactured Housing Institute is a 300+ member advocacy and issues trade association for the manufactured housing industry.” (That was published: Dec 22, 2014.)

About a decade has elapsed since Smith did the video interview below with MHProNews. In that video he made the remarks posted. If someone carefully listens to what Smith said, and this was while he was MHI’s chair, he implies that the industry – often code words for MHI – said this.

The industry [i.e.: MHI] “has not always been, umm, forthright with itself…in governmental affairs, you need to be pro-active not reactive.”

“Reactive” is what seemingly occurred with the 2007 energy regulations that are still dogging the manufactured home industry (watch for an update on that DOE energy rule issue). Smith’s words are an admission that on several key issues, MHI has been reactive. MHI has been playing catch up.

When Smith said that it is better to meet with Congressional members while they are “in district,” that is the opposite of what MHI has been doing for years when they organize their fly-in type events. Then, Smith laughingly said he (and presumably, his partners and investors) want all of the communities for themselves.

That video below is arguably more useful now, in hindsight, than it was when it was initially produced.

20) These details are important. What several of these items, pieced jigsaw puzzle style side-by-side means forms a picture that is apparently scandalous and points to several unethical and arguably illegal behaviors. MHI insiders, like Smith and Skyline Champion have said one thing, but have done another, time and again.

As recently as last week, MHI leaders and their outside attorney were asked to respond to such concerns. Silence again. They can hide, but it only calls more attention to their ever more problematic behaviors and lack of performance as measured by the commonsense yardstick of annual industry production.

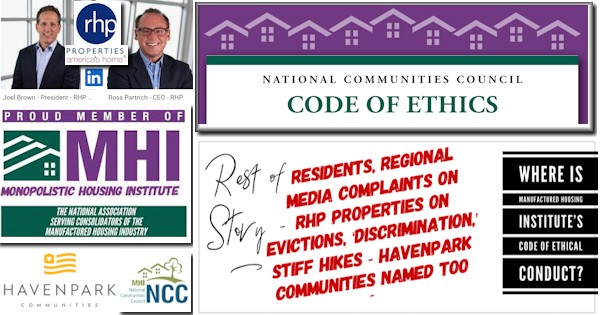

21) That means that MHI, instead of acting as a legitimate tool to help “all segments” of the industry and firms of all sizes, has apparently been posturing efforts for “all” while actually fostering consolidation of smaller firms by larger ones in the process.

That was notion was first reported by MHProNews years ago based on a tip. Once that tip was examined in the light of publicly traded firms involved in MHI, the evidence supported the tipster.

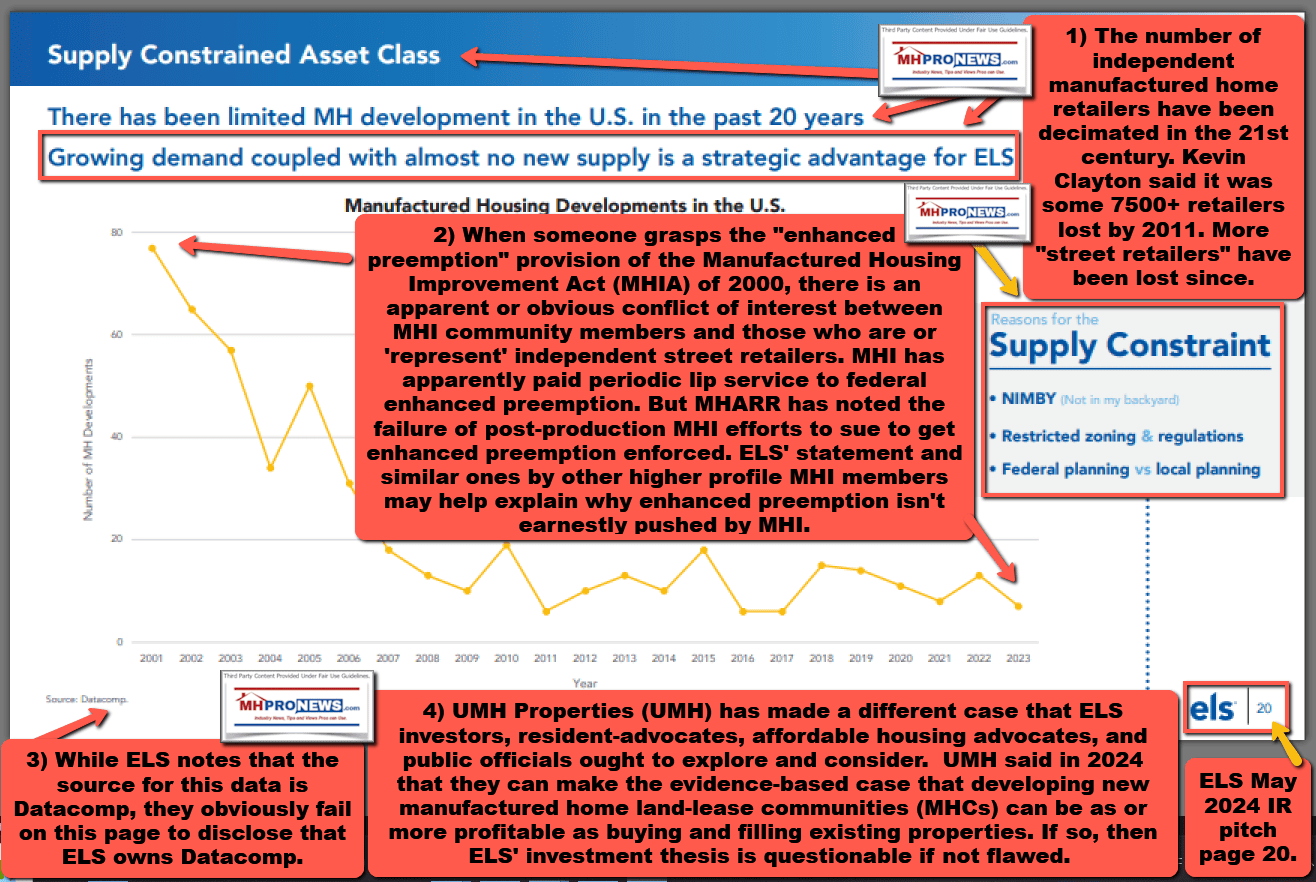

22) Equity LifeStyle Properties (ELS) has long had a board seat on the powerful MHI Executive Committee. This screen capture below from an ELS investor presentation is by law supposed to be materially accurate. ELS said that “Growing demand coupled with almost no new supply is a strategic advantage for ELS.” That’s blunt. That’s brazen. There is no wiggle room there. Supply constraints harm some sectors and thousands of growth-hopeful pros in the industry.

That slide that follows is apparently a “winners” (the insiders) vs. the “losers” (the outsiders) who may think they are dealing with an industry friend when in fact the consolidator they speak with at meetings and meals smiles because they hope they are talking to a colleague that could be their next corporate meal.

Per ELS, the “Reasons for the Supply Constraint:”

-

NIMBY (Not in my backyard).

-

Restricted zoning and regulations.

-

Federal Planning vs. local planning.

Here is that slide, which can be opened to a larger size in most devices. Click the image and follow the prompts.

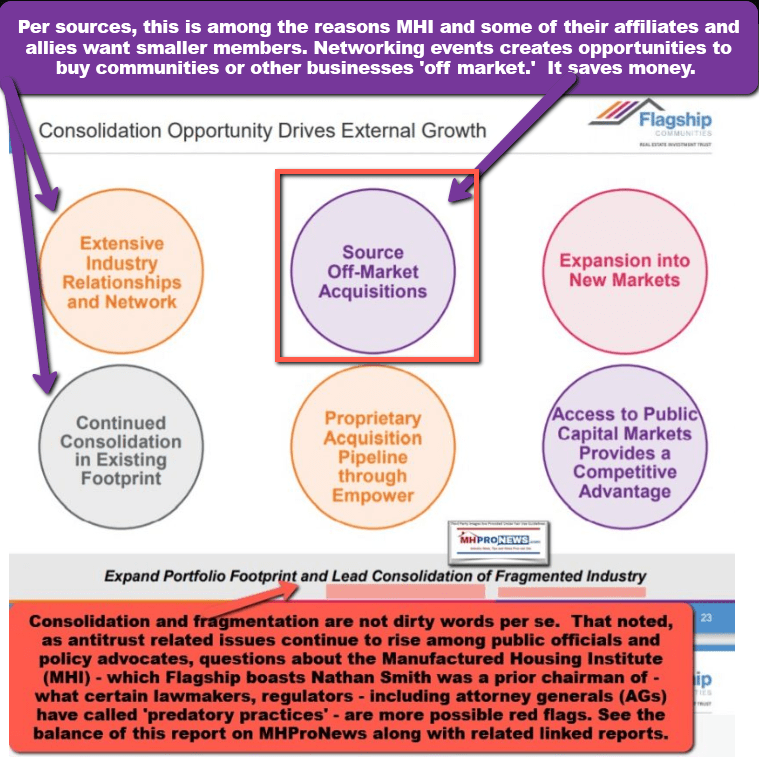

23) There are other presentations by other MHI member firms that say similarly. From Nathan Smith’s Flagship Communities is this.

“Source Off-Market Acquisitions.” That is arguably being facilitated at MHI and state association meetings, meals, golf games, and events. People become chummy. Those buddies may become the next acquisition. It is all but spelled out.

Publicly traded MHI member Flagship said in the above that they wanted this.

“Expand [Flagship] Portfolio Footprint and Lead Consolidation of Fragmented Industry.”

Flagship’s co-founder Smith, the former chairman (see again his remarks above about wanting all of the communities for himself) has said they want to consolidate a fragmented industry. Lack of production fosters consolidation.

What the 21st century history of manufactured housing demonstrates is dramatic closures and consolidation.

24) Now, go back to what Bill Gates was quoted as saying in Part I. Per Gates speaking about his buddy “Warren” Buffett.

“I didn’t even want to meet Warren because I thought, ‘Hey this guy buys and sells things, and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.'”

25) The Buffett methods have been adopted by several of the insiders at MHI that have apparently “rigged the system” in their own favor.

Not only has MHARR sounded the alarm on very similar themes, but so has Doug Ryan with CFED turned Prosperity Now.

26) With the above in mind, now look again at what Frank Rolfe said about there being no desire on the part of special interests to solve the affordable housing crisis. Rolfe’s remarks are a piece of the industry’s puzzle. As this article and analysis reveals, these puzzle pieces fit together neatly. They don’t have to be forced.

27) Approaching a decade has elapsed since Richard “Dick” Jennison said that the industry could be doing 500,000 new homes annually vs. then less than 100,000 new homes a year.

28) One more time, Skyline Champion in their IR pitchbook deck said that the industry’s long-term (LT) average was about 222,000 new homes a year.

29) Cavco’s William “Bill” Boor clearly said that the industry had the potential to catch up with site builders.

30) But it wasn’t just those industry insiders that expressed the view that the industry could grow robustly. Then Harvard fellow Eric Belsky with the Joint Center for Housing Studies (JCHS) said in remarks that used to be found on the MHI website that the industry could surpass conventional housing that decade. That decade would have been the first decade of the 21st century. Yet that first decade of the 21st century witnessed the most shocking fall that has ever been recorded in manufactured housing industry history.

31) Why is manufactured housing underperforming?

- One reason is because existing laws are not being properly enforced.

- But another apparent reason is that MHI linked “insider” firms seem to think that it is to their advantage to keep the industry underperforming while claiming to work for growth.

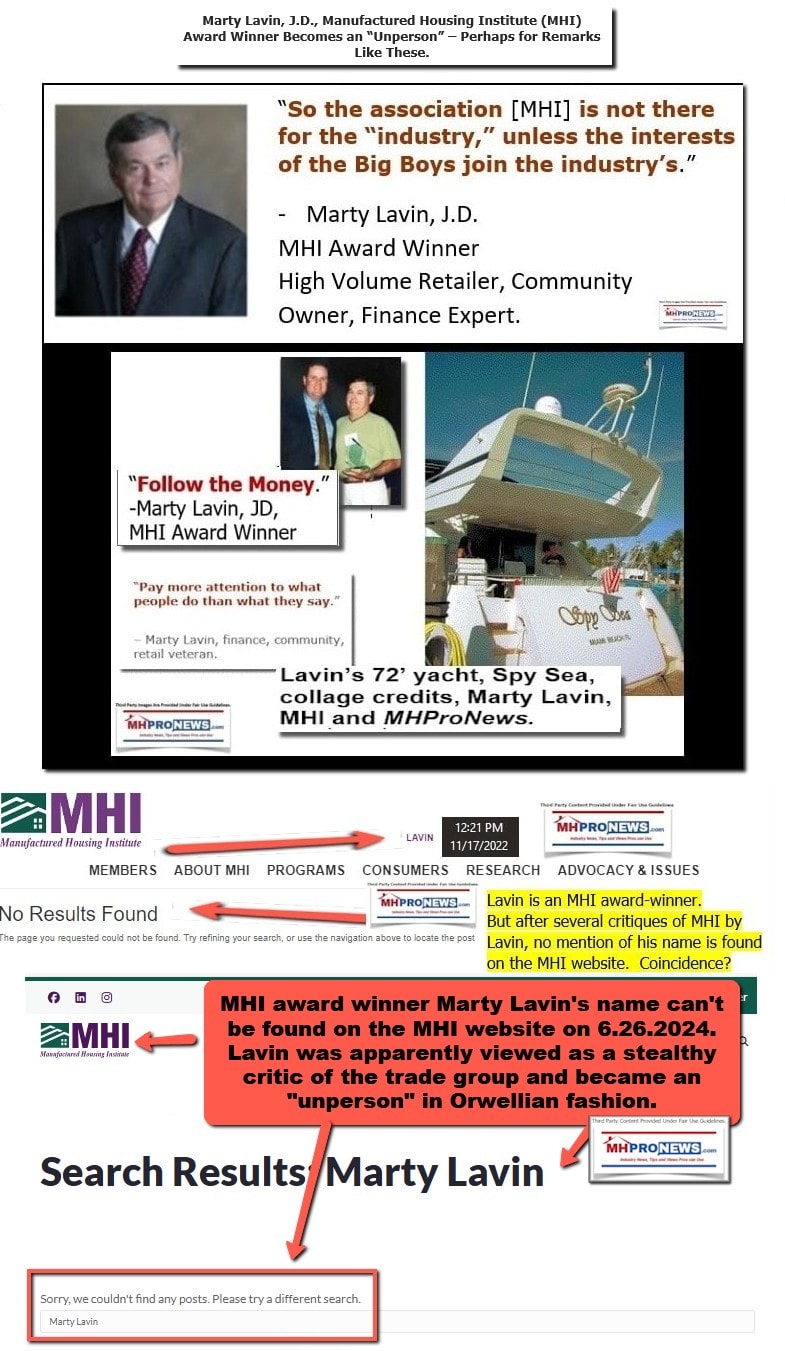

- With those thoughts in mind, consider what MHI award-winner Marty Lavin said. “So the association [i.e.: MHI] is not there for the “industry,” unless the interest of the Big Boys joins the industry’s.”

Let’s note that Lavin’s remarks above, while accurately quoted, may or may not be applied by him in this fashion. He is welcome to respond if he disagrees with this evidence-based analysis. The same could be said about Rolfe, Boor, Jennison, Williams, Smith or any others cited in this carefully researched report.

32) It is unclear at what point in time Lavin’s name was no longer available on the public side of the MHI website. But Lavin, perhaps for remarks like those quoted above, went from an MHI ‘lifetime achievement’ award winner to an MHI unperson.

The 21st century presidents and/CEOs at MHI have also had their names removed from the public side of the MHI website. Several MHI vice presidents are also unpersons today.

Again, MHI leaders have not yet responded to numerous inquiries on why they have eliminated certain people, remarks, documents, and names from their website. In what way does deleting the name of Stinebert, Lavin, Ghorbani, Lois Starkey, Jenny Hodge or others benefit the stated or unstated MHI agenda?

33) MHI has removed names of individuals who in several cases argued for industry growth done ethically. But by contrast, MHI has maintained as members firms who have arguably violated the organizations so-called code of ethical conduct. Again, see the report linked here to learn more.

34) This report with analysis opened with references to the following mainstream media reports involving manufactured housing.

- The Atlantic,

- the Nation,

- Center for Public Integrity,

- The Seattle Times,

- GuruFocus,

- BuzzFeed News,

- Austin Frerick while at the Open Markets Institute.

There are more, but that was sufficient to spotlight this point. Out of billions of websites online, apparently only our MHLivingNews website. That is stunning. For all the self-praise or circular praise from those in the circle’s MHI hot tub, there is a stunning lack of investigation as to what has gone wrong in MHVille.

35) Summing up the preface, Parts I and II. Much of the 21st century of the U.S. has witnessed massive scandals involving very visible operations that were once highly thought of before they were exposed as being fraudulent in various forms or fashions.

Perhaps the greatest scandal yet to be robustly revealed is the one about MHVille that is systematically revealed in this report. If one believes that Cavco is correct that the cost to the economy for a lack of affordable housing is about $2 trillion dollars annually, then potentially the cumulative harm in the 21st century cost to the American economy from the industry consolidation scandal is well north of $40 trillion dollars. This is simple math.

Those who blew the whistle early on those operations exposed in Part I were often questioned, blacklisted, or mocked. It was only later that they were lauded for having exposed the schemes that they did.

It often took years of efforts to expose the corruption that people like Markopolos revealed to the world. It was often as if regulators were looking the other way. Which is why the remarks of John Kenneth Galbraith loom large: “Regulatory bodies, like the people who comprise them … become, with some exceptions, either an arm of the industry they are regulating or senile.” Call it regulatory capture. Call it the revolving door. Call it what you will, but it seems that much of the federal regulatory system has failed time and again at its core functions.

The examples of the ten-plus 21st century scandals named in Part I and Part II may someday be joined in the history books by scandals involving corruption between certain officials involved at MHI and others in a scheme to benefit insiders while the affordable housing crisis raged on. The antitrust lawsuits that were launched in 2023 named over 10 firms, many of which are MHI members. Interesting, isn’t it?

There is more to know, but let those facts and thoughts sink in and see the related reports as your time permits. Because the evidence keeps growing. And the logic and apparent motivation of where the evidence points revealed that numbers in MHVille are more interested in consolidation of a “fragmented industry” than they are in robust industry growth. ###

The image below can be opened in many devices to a larger size. See instructions at the end or click the image and follow the prompts. Or click here and follow the prompts.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’