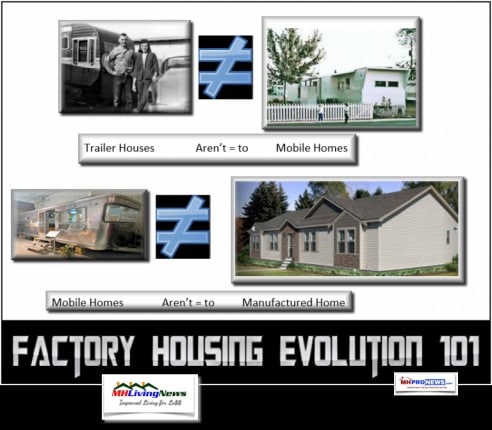

As Americans have long been a people ‘on the move,’ the original trailer houses started to pop up in the 1930s.

Those true trailer houses – that was their proper name – had to be ‘parked’ somewhere. Thus evolved the first ‘mobile home parks.’

Over time, trailers evolved into mobile homes. While most where built by companies that cared about quality, enough problems over issues such as thin and poorly insulated walls or fire safety, occurred that in 1974 – with the cooperation of many in the industry – a set of federal construction and safety standards took place.

Those standards were were by law regulated by the Department of Housing and Urban Development (HUD). Thus was born the HUD Code for Manufactured Housing.

Since June 15,1976, the day the first HUD Code manufactured homes were built, there have been no more mobile homes built in the USA. That many of those pre-HUD Code mobile homes were better built than many thought is attested to by the fact that roughly 2 million of them still exist today. Thousands upon thousands of those older, true mobile homes have been updated. They attract and keep people like the Chione family (see video interview below), who used to own conventional housing, who are now very happy in their more affordable, quality lifestyle.

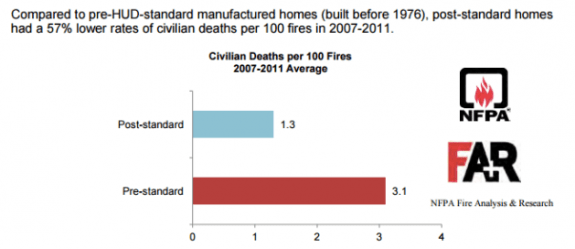

That said, numbers of those older mobile homes that aren’t updated tend to have more fires than modern manufactured homes.

The older mobile homes that aren’t properly installed are also more windstorm prone. So as news watchers note, those old mobile homes are often destroyed in tragic ways.

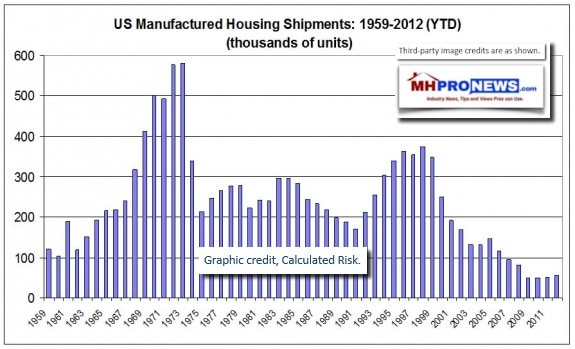

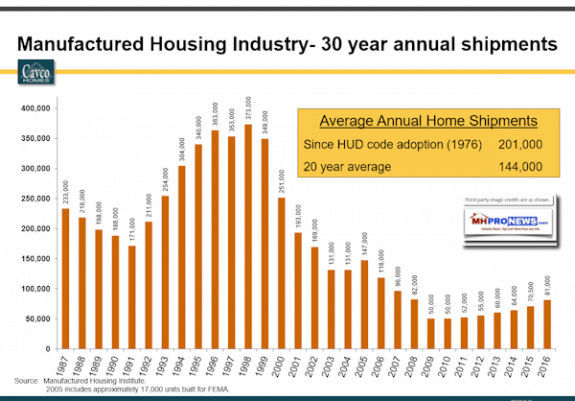

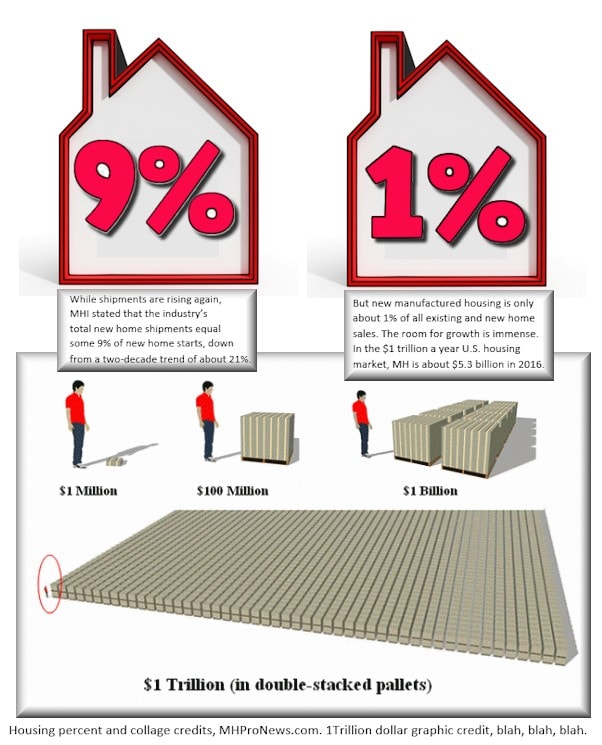

As the graphic reflects, hundreds of thousands of mobile homes and manufactured were being sold every year.

As engineer Skip VanZant says in the video interview below, factory built homes influenced conventional housing in some ways, just as site-builders also influence manufactured and modular home builders today.

A variety of conditions, including poorly underwritten and thousands of fraudulent loans were made in the 1990s. Manufactured housing had its version of the conventional mortgage/housing crisis about a decade before. But unlike the conventional housing lenders circa 2008 and its aftermath, manufactured home lenders that had loans that went sour a decade before got no federal bailouts.

Most of the personal property/home only/“chattel loan” lenders in manufactured housing left the space, never to return.

But other lenders either never entered into the questionable practices that caused the meltdown, or they instituted safeguards that cleaned up bad practices. There was no need for a manufactured housing version of Dodd-Frank post 1998-2003, because the loans were not taxpayer backed, and because the industry painfully cleaned up its own mess.

Mainstream Housing Compared to Manufactured Homes, by Informed Consumers

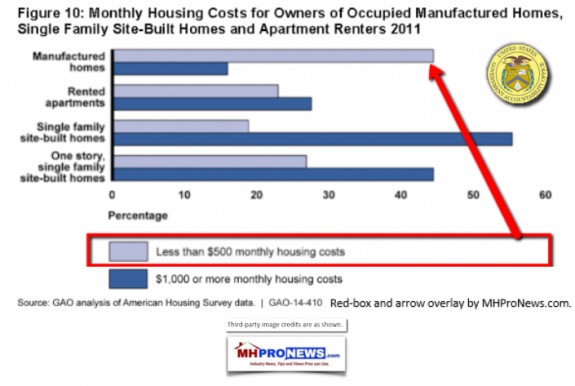

Informed consumers like Jerry and Karen McKibben are but one of many examples of well-to-do home owners who opted for the manufactured home lifestyle.

The McKibbens did so after careful study of the facts about the manufactured homes of today, vs. the mobile homes of yesteryear.

More than one veteran finance pros of that era told MHProNews phrases said that conventional housing lenders did similarly to what caused the MH Industry’s 1998-2003 meltdown. When “no doc,” ”liar loans” were made by the millions in the run-up to the 2008 mortgage/housing crisis, many of those customers may have been better suited to manufactured homes. But the conventional housing market made buying a new or existing site built house easy.

Additionally, the problems of FEMA/Katrina and the image issues that resulted from that impacted the industry too.

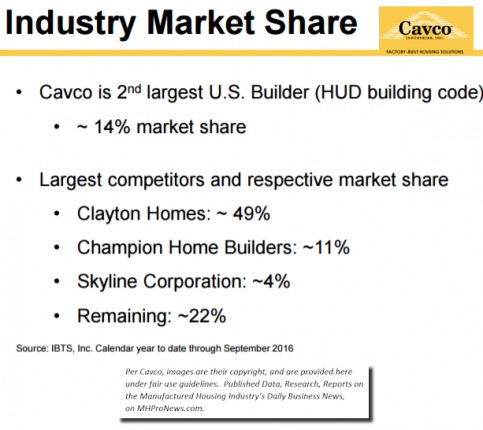

Not to be overlooked, was the buyout of Clayton Homes in 2003 by Warren Buffett’s Berkshire Hathaway. The subsequent buyout of Oakwood Homes by Buffett’s firm was later rolled into Clayton.

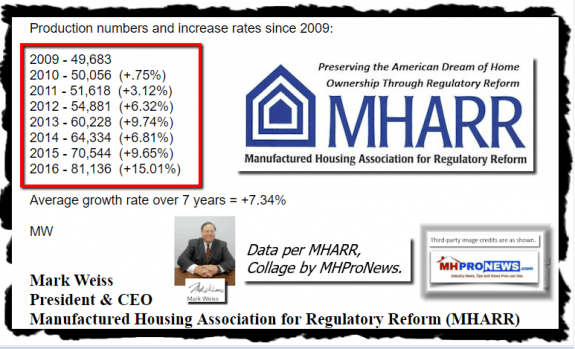

As this next chart reflects, the decline in shipments continued. The 2008 Conventional Housing Crisis, also impacted Manufactured Homes too. It was in mid-October 2009 that what we called today MHProNews was first published. The first mission was to get the industry to believe Itself again.

The industry finally bottomed out in 2010. The slow climb up is reflected in the numbers as shown.

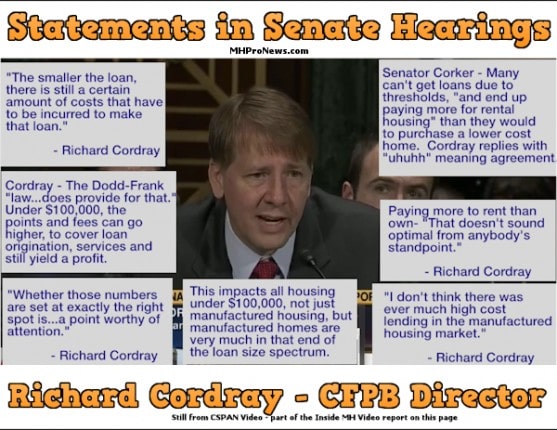

Meanwhile, federal support for the GSEs and the conventional housing market continued, but not without a price. The Dodd-Frank born Consumer Financial Protection Bureau (CFPB) took over the relevant parts of the SAFE Act.

Now recall that manufactured housing played no appreciable role in the multiple trillion dollar housing collapse. Manufactured home lenders played no role in that debacle. But the was punished, so to speak, along with the rest of the housing markets lenders.

As a result of a combination of factors, including regulator risk and relatively low volume of new manufactured home sales, several lenders who were profitable and prudent exited the market. U.S. Bank is the best known. Months before that event, MHProNews published an article entitled The High Cost of Low Volume Sales. It presaged in some ways the U.S. Bank and other industry exits.

Almost two decades since the peak of 1998, thousands of the industry’s professionals, including some owners, never experienced those higher volume heydays.

But the visionaries new all along that Manufactured Homes would make a come back.

Sam Zell,

John Bostick – Sunshine Homes,

Frank Rolfe,

Gary and Tom Fath – New Durham Estates,

John Caron – Caron Campbell,

Highland Mobile Park,

Deer Valley Homebuilders,

Bob Crawford,

dozens of other clients and sponsors, along with

MHARR and thousands of industry professionals across the spectrum have seen the value of promoting manufactured housing, and being goal and solution oriented.

However, there are also those industry professionals that point to:

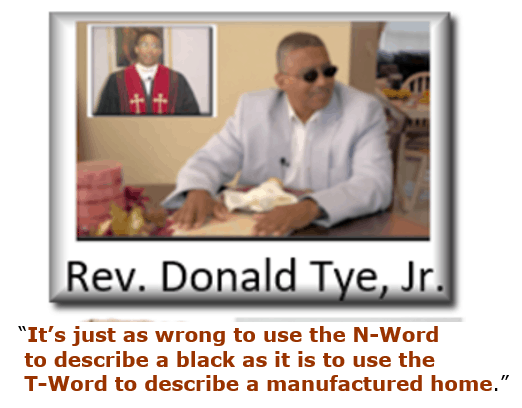

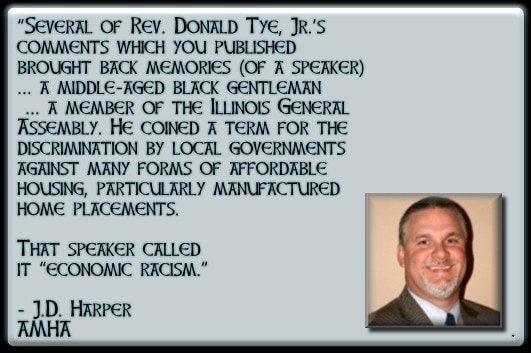

zoning,

rent control,

terminology,

preemption,

business certainty, the

truth about MH appreciation, and

HUD related regulatory issues among several other important causes for the industry’s failure to advance back to its true potential.

As each of the above links demonstrate, those are issues that MHLivingNews, MHProNews and/or MHARR have spotlighted, often for years.

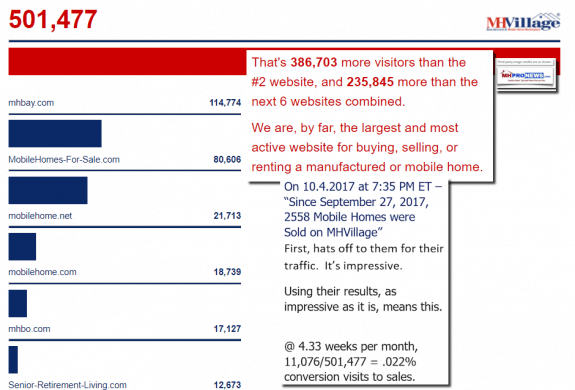

That these are serious issues are demonstrated by facts from MHI’s members, such as Clayton Homes or MHVillage. Clayton Homes has had cumulatively had millions of views of its videos. Even though they are the largest factory builder today, and sell roughly half of the new homes shipped last year, why aren’t their sales far higher?

MHVillage understandably boasts of millions of visitors each year. But their own statistics reveals that they are converting only a tiny fraction of those into buyers.

A client company told our publisher the following. ‘Tony, the most powerful thing I’ve heard at this event is when you said that if pretty pictures, Facebook likes and good-looking videos was all that was necessary for industry growth, then we’d be selling half-a-million or more new homes a year right now.’

What MHLivingNews and our related client experiences have demonstrated is this. Serious home buyers who are well qualified or who want to pay cash want answers, not slick ads. Tom Fath and Stan Posey said it well.

Just answer this. What good reason did MHI, 2, 3 or 4 years ago have for not promoting their own member’s – MHLivingNews – MHProNews – best practices, pro-growth efforts?

Education, and information are keys.

That education and information is necessary for professionals as well as for the general public.

MHI members, MHARR members, state associations and their members and others have praised the work of MHLivingNews and MHProNews.

Before MHProNews began seriously spotlighting the weaknesses at MHI, the question has to be asked. Why did MHI undermine, and/or fail to support our pro-growth, educational efforts? Even when those efforts would have benefited MHI and their members?

It is not the purpose of today’s article to do a deep dive into the MHI issue, nor about allegations of Dick Jennison and a few others at MHI trying to undermine our pro-growth work. But rather it is to create a baseline snapshot of where the industry came from, is and where it could be going. Our story is just a subset of the larger story of the industry.

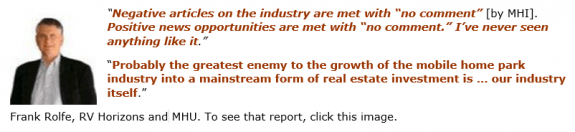

Isn’t Frank Rolfe correct in saying that to a great extent, ‘the industry itself’ (read, MHI) has slowed the progress of manufactured home acceptance and advancement in a market that is crying out for affordable housing solutions?

Nathan Smith – Pro-Active, not Re-Active and ‘All to myself…’

President Trump, Dr. Ben Carson, MHARR

Warren Buffett, Wall Street, CFPB and Secretary Hillary Clinton’s Presidential Campaign

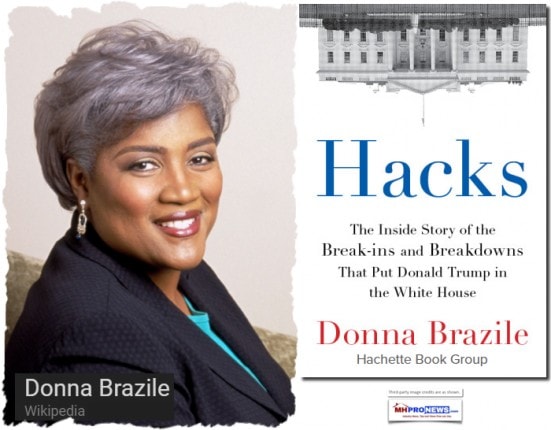

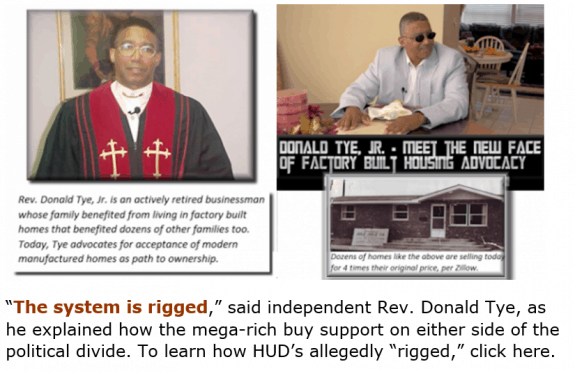

The bombshell this week revealed by interim Democratic National Committee (DNC) Chair Donna Brazile stated that the Clinton campaign colluded with the DNC to rig the nomination process in favor of Hillary Clinton. When asked this week by CNN, Senator Elizabeth Warren (D-MA) said she absolutely believes that the nomination process was rigged.

For close observers of the electoral process, none of it was a surprise. Many of those items about the “rigged system” and others were noted by MHProNews in the run-up to the election.

What was the surprise is that such a high ranking Democrat as Donna Brazile came out and said the system was corrupted in print. As the Daily Business News summary this week reflected, Brazile also tossed President Barack Obama under the bus as a cause for the Democrats poor financial and other party woes.

Warren Buffett supported Clinton, early on and proudly.

How did that make sense, for the owner of the industry’s largest manufactured home lenders and producers?

Is it because, as a rival producer has told MHProNews that Dodd-Frank and the CFPB helped make Berkshire Hathaway, Clayton, Vanderbilt, 21st Mortgage and Wells Fargo a lot of money?

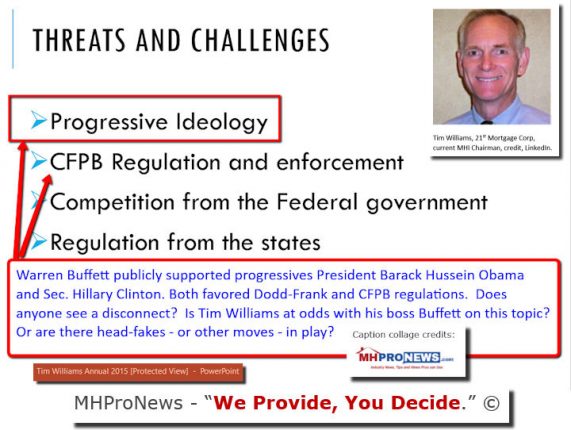

Why did 21st President and CEO Tim Williams say to an MHI audience that the threat to the MH industry was coming from progressive thought? Yet, Chairman Buffett was supporting that same progressive ideological stance by supporting Hillary Clinton?

Wall Street and Warren Buffett wanted Dodd-Frank kept in place. Why?

Is it because heavy regulatory burdens drove so many smaller lenders out of business?

Why did progressives like the Seattle Times, or CFED (since rebranded as Prosperity Now) attack Buffett, Clayton and his lenders? Why do they do so still? Do they really not see eye to eye on this relatively modest changes to Dodd-Frank that the Preserving Access to Manufactured Housing Act seeks?

If that is so important to the future of the industry, why is Buffett’s Clayton buying up retail locations, suppliers and production? Is it a conflict of interest for Clayton to dominate the Manufactured Housing Institute (MHI) and yet be buying up conventional home builders now?

Why has no one else in the industry noted that Buffett also has made a move in the real estate brokerage?

Housing will always be needed. Alan Amy isn’t alone or the first to suggest that the billionaires want to dominate manufactured housing.

Manufactured homes are the future of housing. But there are caveats, which the Manufactured Housing Association for Regulatory Reform (MHARR), MHProNews and MHLivingNews have documented over the course of the years.

The race for control of Congress in 2018 and the next presidential cycle in 2020 began just after the end if the last election.

President Donald J Trump, and his Vice President Mike Pence, began and have stayed on message with their agenda, saying they will be in the promise keeping business.

While MHProNews was editorially supporting the Trump campaign, MHI has not yet denied that it had two pro-Clinton speakers on their stage last year in Chicago, just days before the 2016 election. There was no formal endorsement of Clinton, but MHI was also predicting that the Senate would go Democratic too.

Tim Williams was Chair at the time. When the Obama Administration had promised to veto Preserving Access if it passed, why was there no hint that the election of then candidate Trump and the GOP holding the Senate would be good for Preserving Access? Instead, what was said was that MHI would approach both parities and seek that bi-partisan effort that had already failed for 5 years.

If MHI was serious about getting Preserving Access passed, why didn’t they promote any of the articles or videos that MHLivingNews and MHProNews produced in support of those efforts?

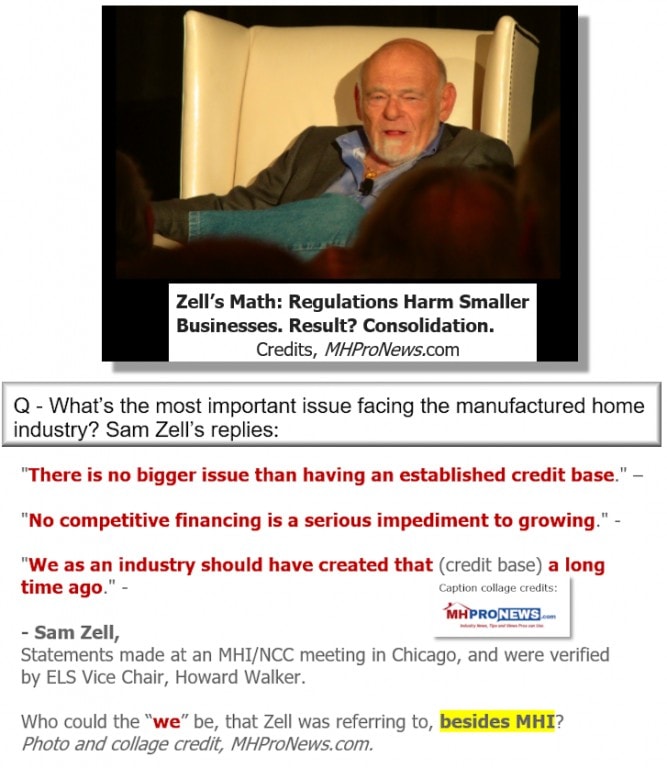

Doesn’t Equity Lifestyle Properties (ELS) Sam Zell suggest the answer?

Didn’t failure to secure an independent lending base for the industry cost the industry big bucks?

Who’s failure was it, if not MHI’s? It wasn’t MHARR’s bill, it was MHI’s bill. Unofficially, MHARR sources have told MHProNews for years that if any member of staffer of Congress asked them, they always said they supported Preserving Access.

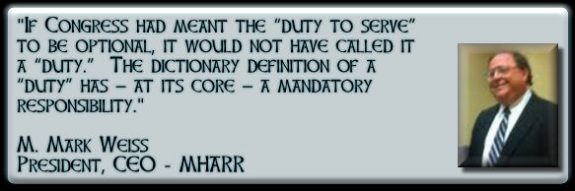

But MHARR felt that Duty to Serve was the better course. Isn’t Zell’s logic and MHARR’s alike?

The record reflects that this publication was supporting MHI’s Preserving Access efforts. We did so even when there was a steady stream of allegations and actions by MHI staffers, presumably with the consent of executive committee members, to undermine us, even as we were members and supported their efforts.

Next Friday, MHARR members meet by conference call. Among their decisions will be if they expand their membership to include the post-production, meaning lenders, financial services, communities, retailers, services, transporters and others that MHI now has as members.

The signals are mixed, and we aren’t going to predict if MHARR expands or not.

But isn’t there a need for an association that is going to faithfully represent the industry’s post-prosecutor without the kinds of apparent conflicts of interest that Buffett-dominated MHI has?

It is important to note that most of MHI’s members de facto have no say in the governing of the body. While there are several boards, only the four person MHI Executive Committee has the final say.

The facts, concerns, allegations and opportunities the industry has are hiding in plain sight, are thus not? Good people have worked for years to support MHI’s efforts. What has over 15 million in spending over 5 years achieved?

The Trump Administration has signaled that it will take a look at anti-trust issues. Some say that hasn’t yet occurred for a variety of tactical and strategic reasons. If it does occur, will that in time look into the anti-trust, racial, and other concerns about Buffett/Clayton and their lenders raised by Democrats like those shown?

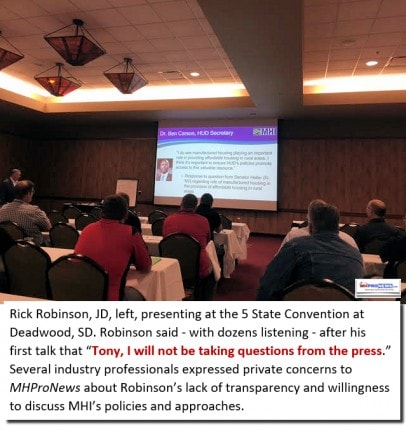

MHI and Berkshire Hathaway units like Clayton, VMF and 21st have routinely been given the opportunity to respond to such issues. In Deadwood, MHI Sr VP and General Counsel! Rick Robinson said, “Tony, I won’t be taking any questions from the press” in front of dozens of people.

Why has MHI taken so many logically flawed positions, such as de facto supporting Pam Danner, when the Trump Administration would make it easy to replace her?

If there is a problem with the facts as laid out, MHI, Berkshire Hathaway or their surrogates are hereby invited again to respond. Why have they routinely ducked, dodged, detracted, distracted, and defamed instead?

It’s your industry. Will you wait for a monopolistic operation to gobble you up for pennies on the dollar some day? Perhaps to wake up on day 5 years or so from now, and see that Manufactured Housing is doing tens of billions more a year in business? Only to see that your business was worth more than you obtained?

Nothing is changed until it is challenged. “We Provide, You Decide.” © ## (News, Analysis, Commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC,

parent company to MHProNews and MHLivingNews.com.