CBS News and others in mainstream media reported on this housing data produced by the Dallas Federal Reserve’s research economist, Enrique Martínez-García, dated 11.15.2022. As a report on Equity LifeStyle Properties that is pending will reflect, the amount of equity in conventional housing is a factor that impacts all cash or large down payment purchases of manufactured homes by those who are selling their site-built houses. Information packed quarterly reports to investors from manufactured home companies Cavco Industries (CVCO), Skyline Champion (SKY), and Legacy Housing (LEGH) underscore the point that even as conventional housing sales are sliding, manufactured home sales have continued to rise year-over-year in 2022 compared to 2021. While the Dallas Fed research is fresh, this factoid from CNN on 11.18.2022 is also relevant. “The 30-year fixed-rate mortgage averaged 6.61% in the week ending November 17, down from 7.08% the week before, according to Freddie Mac, the largest weekly drop since 1981. A year ago, the 30-year fixed rate stood at 3.10%.”

That noted, to tee up the data from the Dallas Fed, the following insights from left-leaning CBS News on 11.16.2022 are useful.

More buyers are getting priced out of the market because of the combination of rising home prices and higher mortgage rates. The median income now required to buy a typical home is now $88,300, or about $40,000 more than was needed prior to the pandemic in 2019, NAR said.

The market is particularly tough at the moment for first-time buyers. Because of the spike in mortgage rates, a buyer of a typical starter home worth about $340,000 who put 10% down would face a monthly mortgage payment of $1,808 — about $600 more than a year ago, according to the group’s calculations.

NAR Chief Economist Lawrence Yun predicted earlier this month that home sales will slip by 7% next year as more people are priced out of the market, but said he expects the median home price will rise 1%. One reason he doesn’t expect prices to slide: Inventory remains tight, meaning that buyers are still competing for desirable properties.”

In the report by the Dallas Federal Reserve’s Enrique Martínez-García that follows terms such as froth and exuberance are used. While froth has several definitions, the one that the Dallas Fed’s senior researcher appears to be using is this: “worthless or insubstantial talk, ideas, or activities,” per Oxford Languages. Exuberance’s definition includes: “the quality of growing profusely; luxuriance” per Oxford Languages. More manufactured housing and general housing facts, analysis, and commentary follow. Per our Daily Business News on MHProNews routine, the manufactured housing connected stocks, REITs, and market moving left-right headline recaps is our third and final segment for this fact-packed article.

U.S. housing prices could plunge 20%, Dallas Fed warns

Skimming U.S. Housing Froth a Delicate, Daunting Task

Enrique Martínez-García

November 15, 2022

House prices have risen especially rapidly since the pandemic began—from first quarter 2020 to second quarter 2022—accounting for roughly 40 percent of the decade-long appreciation. Measures of profitability (price to rent) and affordability (price to income) have also jumped in the past two years, past historic highs dating back to first quarter 1975.

This unprecedented pandemic boom poses an outsized risk for the U.S. economy, pressuring housing rents and, consequently inflation, higher. The possibility of a sharp price correction leading to an economic contraction—were one to materialize—would further complicate Federal Reserve inflation-fighting efforts.

Housing Demand Outstripped Supply During Pandemic

Fundamental forces—whether temporary or more persistent—spurred the initial house price surge. Robust disposable income supported by pandemic-related fiscal stimulus and cheap credit boosted consumer demand, while supply-chain disruptions, COVID-19-related lockdowns, and rising labor and raw construction materials costs pushed supply lower.

Pandemic-induced lifestyle changes—work-from-home arrangements and internal migration—also help explain why demand so outpaced housing supply early on.

A housing boom—such as the pandemic-era run-up—becomes frothy when the belief becomes widespread that today’s robust price increases will continue unabated. If many buyers and investors share this belief, purchases arising from a “fear of missing out” (FOMO) further drive up prices and reinforce expectations of strong (and accelerating) future gains beyond what fundamentals could justify.

This self-fulfilling mechanism leads to exponential price growth until a price correction inevitably occurs.

COVID-Era Boom Became Bubbly

Economists often disagree on the fundamental value of housing and what causes expectation-driven bubbles. There is greater agreement on how to identify unsustainable exponential growth—a symptom of a bubble—in the data.

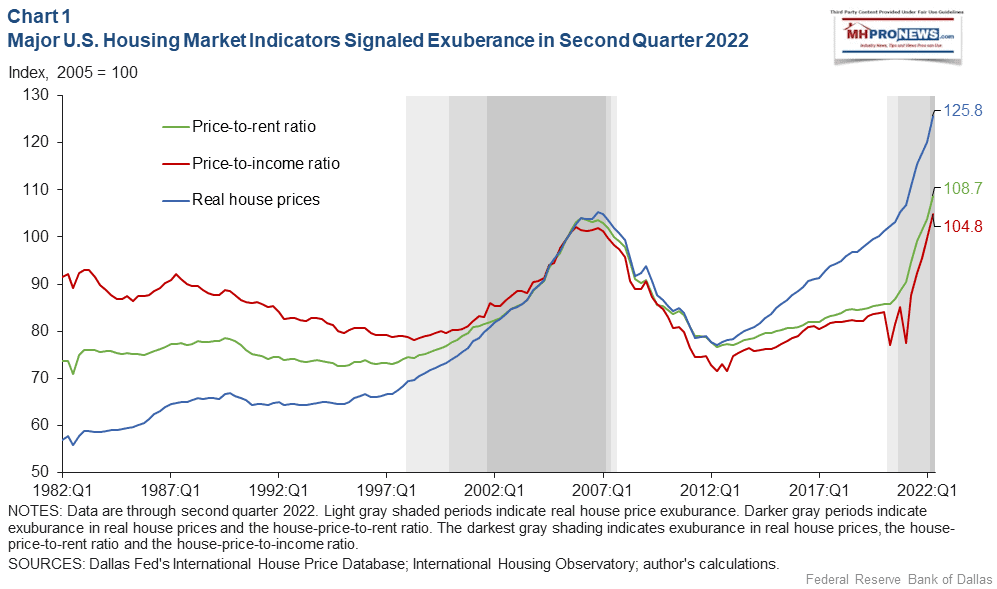

A novel empirical approach is based on so-called exuberance statistics. These measures can help detect if and when housing market indicators—quarterly real house prices, the house price-to-rent ratio and the house price-to-income ratio—start growing exponentially (Chart 1). An exuberance statistic above the 95 percent threshold signifies 95 percent confidence of abnormal unsustainable behavior in the underlying data series. Such episodes are identified in all charts with varying grades of shaded bars.

Prices adjusted for inflation rose 24.3 percent from first quarter 2020 to second quarter 2022, the largest nine-quarter gain since the mid–1970s and more than three times the rate of growth of the prior nine-quarter period (fourth quarter 2017 to first quarter 2020). This pace of acceleration cannot be easily reconciled with fundamentals, which did not display comparable behavior.

Moreover, the latest statistics from second quarter 2022 closely parallel the preceding housing bubble, with the data once again showing evidence of explosive behavior in the price-to-rent and price-to-income ratios as well. Accordingly, the pandemic surge before summer 2022 exhibited widening symptoms of a FOMO-driven bubble, one that extends beyond the U.S.

Monetary Policy’s Role Easing Housing Booms

The relatively high number of new houses currently under construction can be a silver lining since supply catching up with demand can take some air out of the market and curb housing affordability woes. However, completions continue to lag. Recent data also show slowing housing sales and softening prices as borrowing costs surge, easing market pressure and, perhaps, enabling builders to chip away on order backlogs.

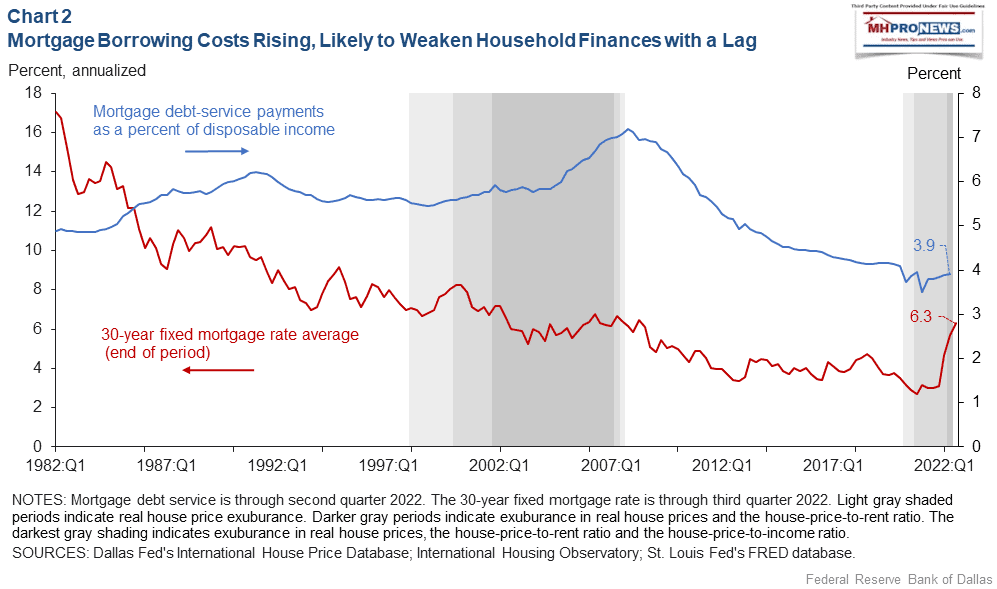

The share of mortgage debt service payments as a percent of personal disposable income stood at a historically low 3.9 percent in second quarter 2022. This remains well below the unsustainably high range of 6–7 percent reached at the peak of the last housing boom during 2005–07 (Chart 2). The mortgage share of income is poised to rise given the rapid increase of the 30-year mortgage rate―from 3 percent to above 6 percent at the end of third quarter 2022―induced by Fed monetary policy tightening since March 17, 2022. Rapidly rising mortgage rates have contributed to plummeting mortgage loan applications and declining housing sales.

The full effect of the ongoing tightening on households—including ultimately restraining housing demand—will take some time to be felt as the outstanding pool of mortgages gradually incorporates more of the recent vintages at higher rates.

Housing Poses Vulnerability for the U.S. Economy

The red-hot pandemic-era housing market poses significant risks to the Fed’s dual mandate of price stability and maximum sustainable employment.

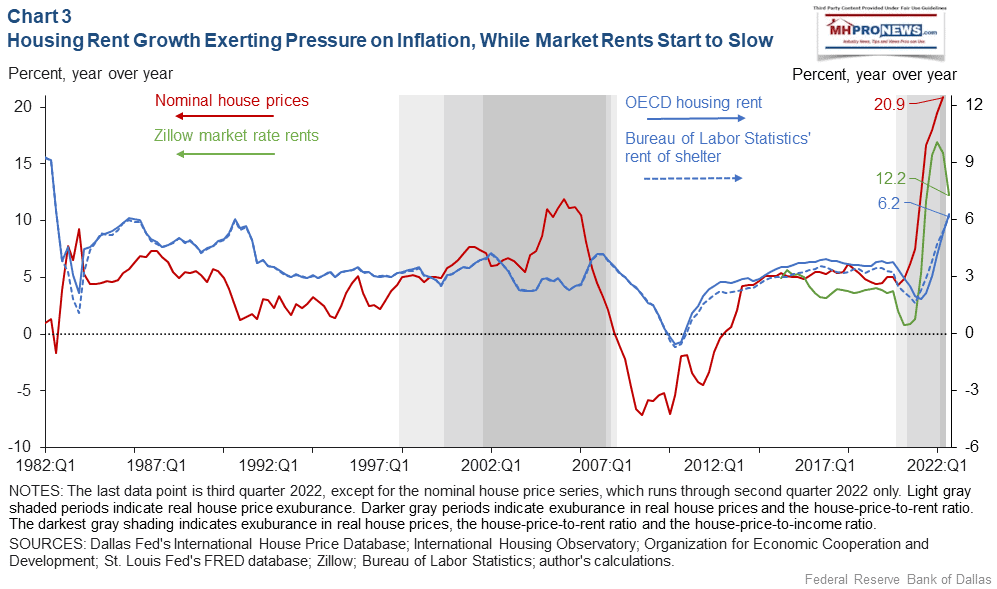

On the inflation side, the four-quarter change in asking rents climbed to 16 percent in second quarter 2022, modestly slowing to 12.2 percent in the third quarter, reflecting house price increases, according to Zillow data. The Bureau of Labor Statistics’ rent of shelter—a broad measure of household rental costs and a component of the Consumer Price Index (CPI)—reacts with a lag given that landlords’ asking rents are increased gradually as leases turn over. Even so, rent of shelter climbed to 6.2 percent in third quarter 2022—the sharpest rent increase since at least the early 1990s—and pushing overall CPI inflation higher (Chart 3).

Achieving a soft economic landing—taming inflation and avoiding a recession, as the Fed accomplished in 1994—cannot be taken for granted given that further monetary policy tightening can increase the household mortgage debt servicing burden and boost the odds of a severe house price correction.

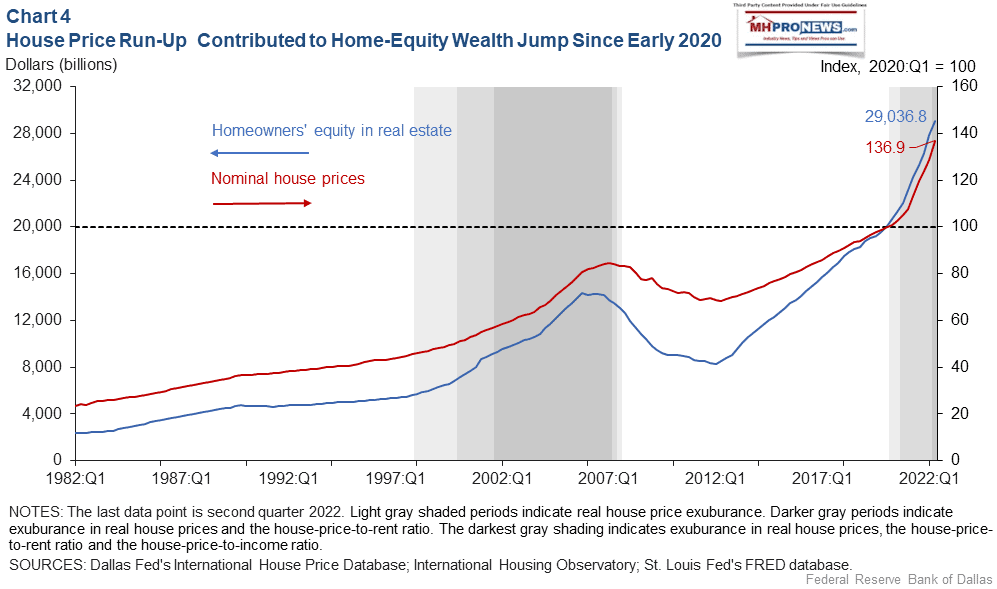

Housing wealth increased by nearly $9 trillion between first quarter 2020 and second quarter 2022, more than 82 percent through price gains rather than from an increase in the stock of housing (Chart 4).

Plausible estimates of the direct impact on housing wealth suggest that a pessimistic scenario—with a real price correction of 15–20 percent—could shave as much as 0.5–0.7 percentage points from real personal consumption expenditures. Such a negative wealth effect on aggregate demand would further restrain housing demand, deepening the price correction and setting in motion a negative feedback loop.

To complicate matters, the pandemic price boom has also widened wealth inequality since homeownership is the primary driver of household wealth.

Is a Major Housing Correction Unavoidable?

In the current environment, when housing demand is showing signs of softening, monetary policy needs to carefully thread the needle of bringing inflation down without setting off a downward house-price spiral—a significant housing sell-off—that could aggravate an economic downturn. Increasing mortgage rates, which follow from higher Fed policy rates, reduce the risk of prolonging the house price boom.

A gradual unwinding of the pandemic housing excesses can occur if policymakers can quell inflation without putting buyers under too much stress and can slow house price and rent increases while keeping underwater mortgages (housing worth less than what is owed) from rising.

Households and financial institutions are in better shape than during the housing boom and bust in the mid-2000s, likely providing more of a cushion to withstand some of the consequences of a negative wealth effect, were one to materialize.

However, after a housing boom partly driven by pandemic-era FOMO beliefs, cooling market participants’ expectations is key to shifting house prices toward a more sustainable path and avoiding the peril of a disorderly market correction.

A severe housing bust from the frothy pandemic run-up isn’t inevitable. Although the situation is challenging, there remains a window of opportunity to deflate the housing bubble while achieving the Fed’s preferred outcome of a soft landing. This is more likely to happen if the worst-case scenario of a price-correction-induced economic downturn can be avoided. ##

Enrique Martínez-García is a senior research economist and advisor in the Research Department at the Federal Reserve Bank of Dallas.

Additional Information with MHProNews Analysis and Commentary

The remarks from the Dallas Fed’s research above about the impact of increasing mortgage rates are the flip side of what the American Enterprise Institute (AEI) Housing Center has been saying for about two years about the driving factors in housing appreciation and demand.

- Undersupply of housing compared to demand from a growing population is a factor that have boosted prices to buy or rent a home.

- Low interest rates that have kept housing more affordable (than if rates were higher) have been a factor in driving purchase prices or rental costs higher.

- There are obviously regional variations in these patterns that create these national results. So, some markets in certain states where in-migration is higher, such as Florida, have witnessed even more home price appreciation than areas where the rate of population growth is flatter or in decline.

While there are several possible takeaways from these Dallas Fed factoids, some of them are illustrated, foreshadowed, or are hereby amplified in the recent reports linked. Among them? Biden era housing policy promises, periodically touted by the Manufactured Housing Institute (MHI), are proving to be illusory at best. That’s not a mere opinion, rather, it is what the evidence from a range of third-party research and reporting reflects.

Biden policy promises vs. reality.

USA Today reports that numbers of Democratic supporting voters believe that the housing market is “a scam.”

Martínez-García’s research largely confirms the thrust of articles linked herein from the sources as shown.

There is a demonstrable dearth of housing priced under $200,000.

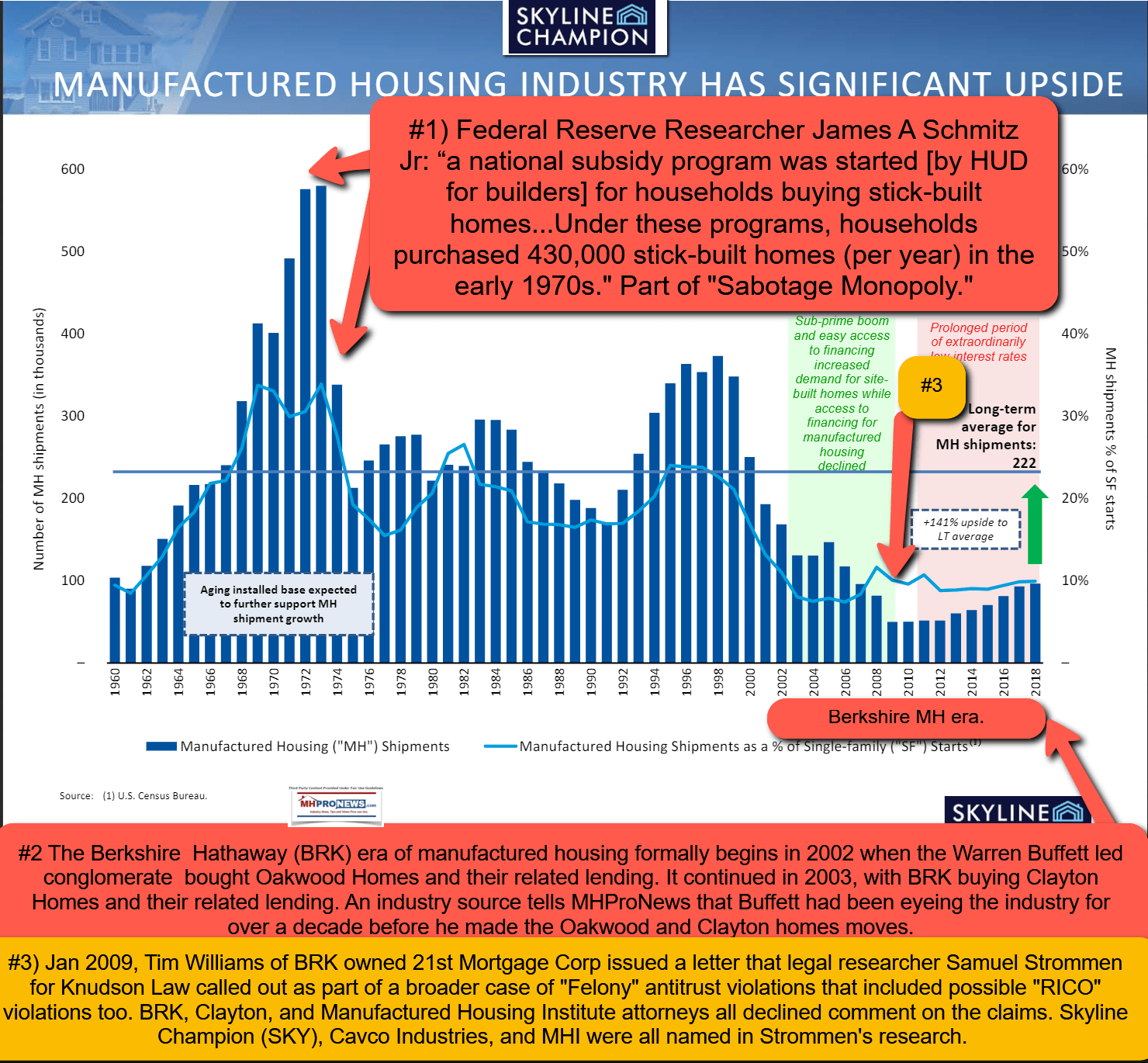

This pattern does benefit manufactured housing. But it manufactured home production could be multiples of the current levels, as the linked reports demonstrate.

There is a wealth of data, market/legal facts, and expert comments that indicate that manufactured housing ought to be soaring. While the industry has had modest growth, the robust growth that is possible has been missing.

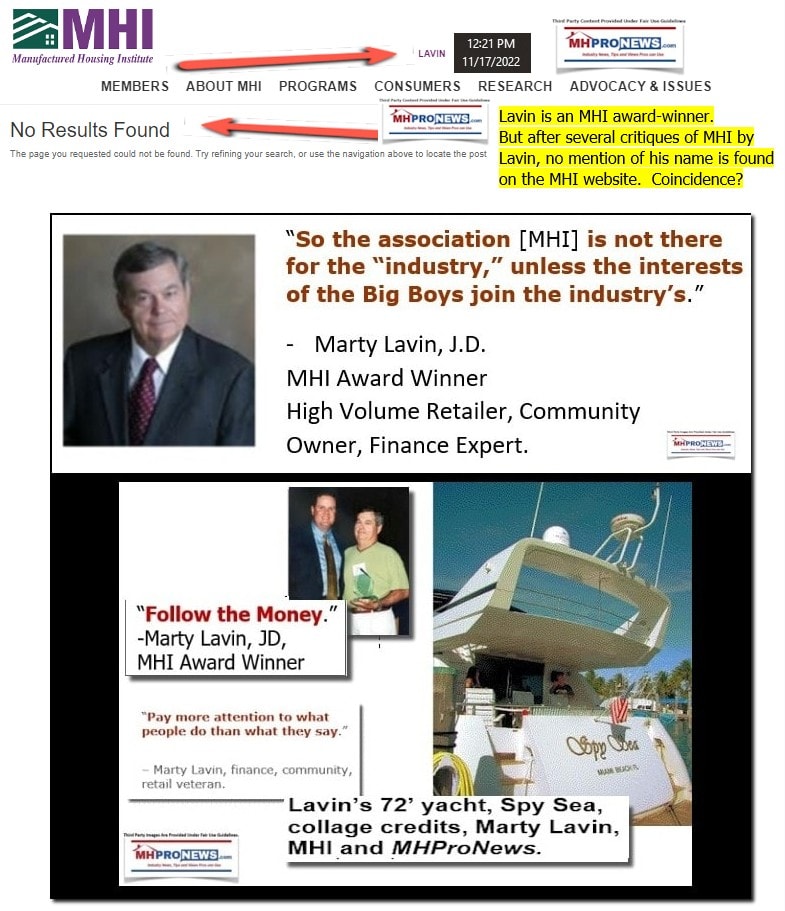

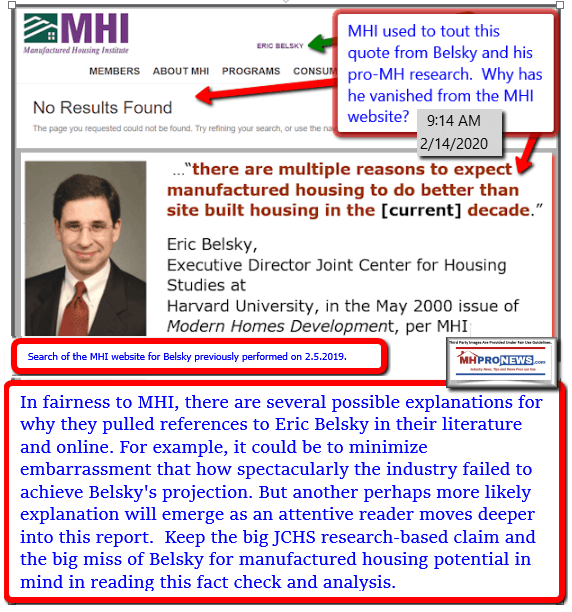

One might wonder why the insightful research by James A. “Jim” Schmitz Jr., which explains some of the reasons why manufactured housing has been underperforming for decades, is not found on the Manufactured Housing Institute (MHI) website?

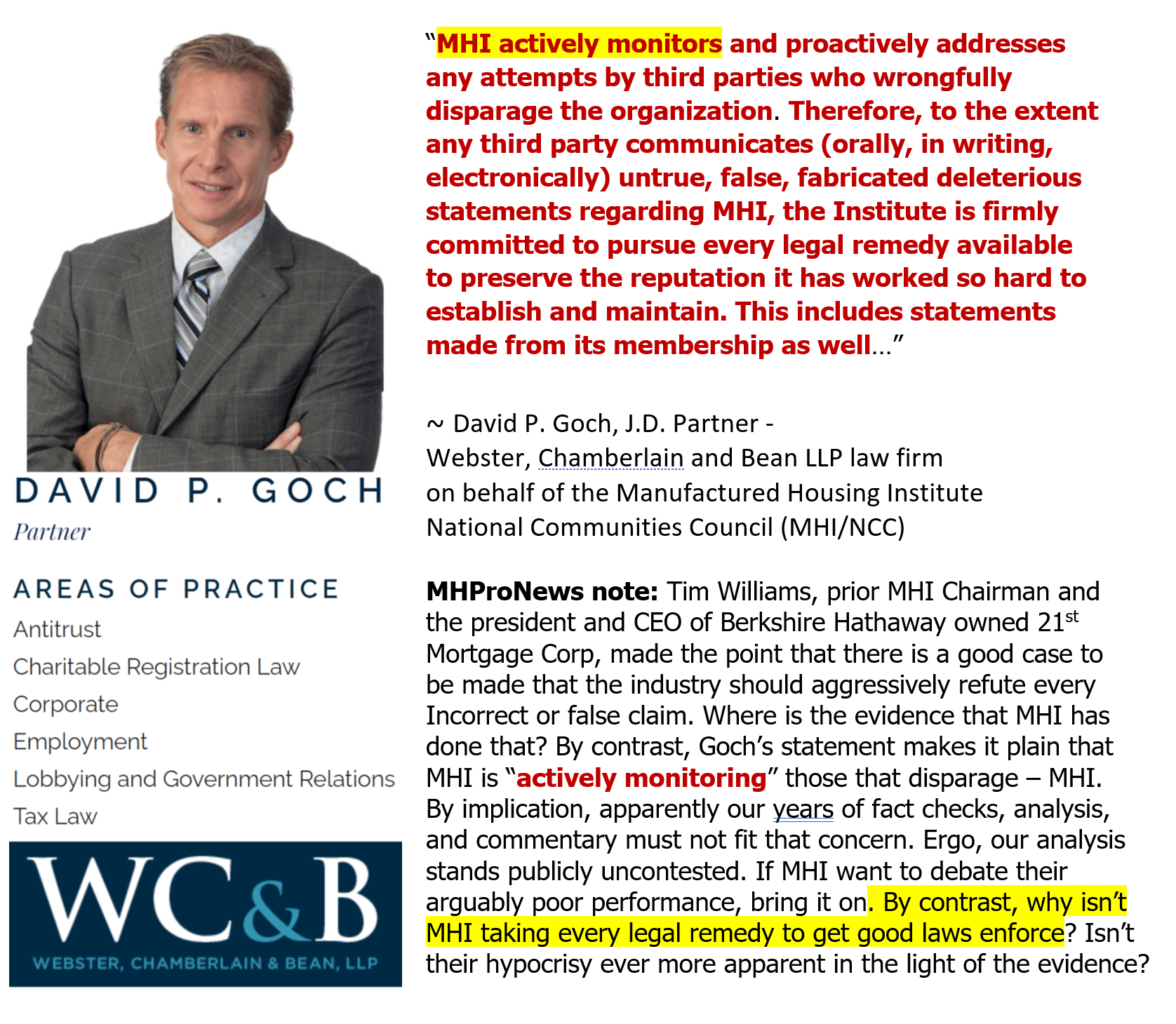

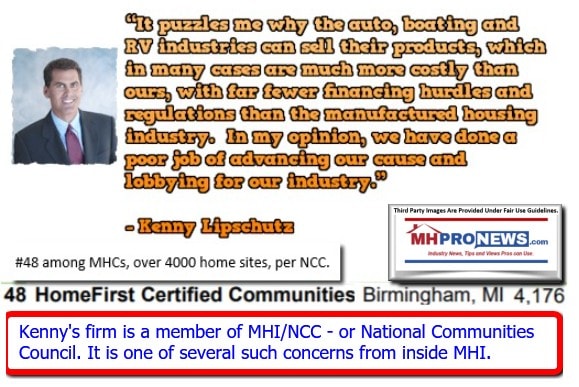

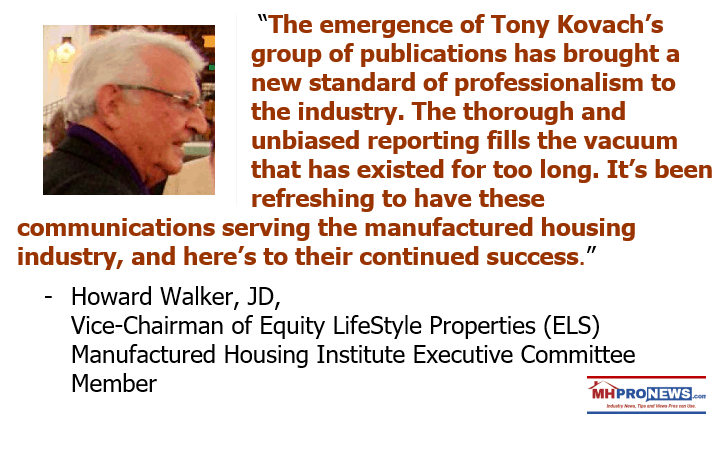

MHProNews has attempted for some 5 years to get MHI to publicly discuss and/or debate their performance. They have not only declined doing so, but in a documented instance below, a prior MHI executive cancelled his own appearance on stage to apparently duck questions from MHProNews or our readers.

Note, it was MHI who apparently frayed their own reputation with this publication. After all, their own leaders praised MHProNews publicly numerous times. Put differently, as their lack of performance and/or apparently deceptive tactics increasingly emerged, MHI limited engagement in the ways they were able to do so, despite having praised MHProNews for objective, accurate, and pro-industry reporting.

As pro-MHI state association executive Jim Ayotte put it, this isn’t rocket science.

MHI, their staff and corporate leaders, can only put forth the same tread worn pattern of drivel and empty promises before their “shell game” becomes apparent.

The latest on the looming Department of Energy (DOE) manufactured housing energy rules is examined below.

LINK MHARR DOE MHCC

Note that none of these third-party quotes below are found on the MHI website either! So, it isn’t just negative remarks that are missing, but positive or insightful comments about manufactured housing are missing too. Even the pro-manufactured housing comments by Eric Belsky, once shared by MHI, are now gone from their website. The infographic that follows suggests that manufactured housing could be doing some 6 times more production that it currently does IF the industry’s leaders wanted robust growth. They apparently do not. Why not? Because growth thwarts consolidation.

The bottom line is increasingly clear and simple. MHI apparently postures efforts, palters, but fails to deliver. The industry has grown, not because of their efforts, but apparently despite their efforts. Who says? It is the obvious implications by two more MHI members.

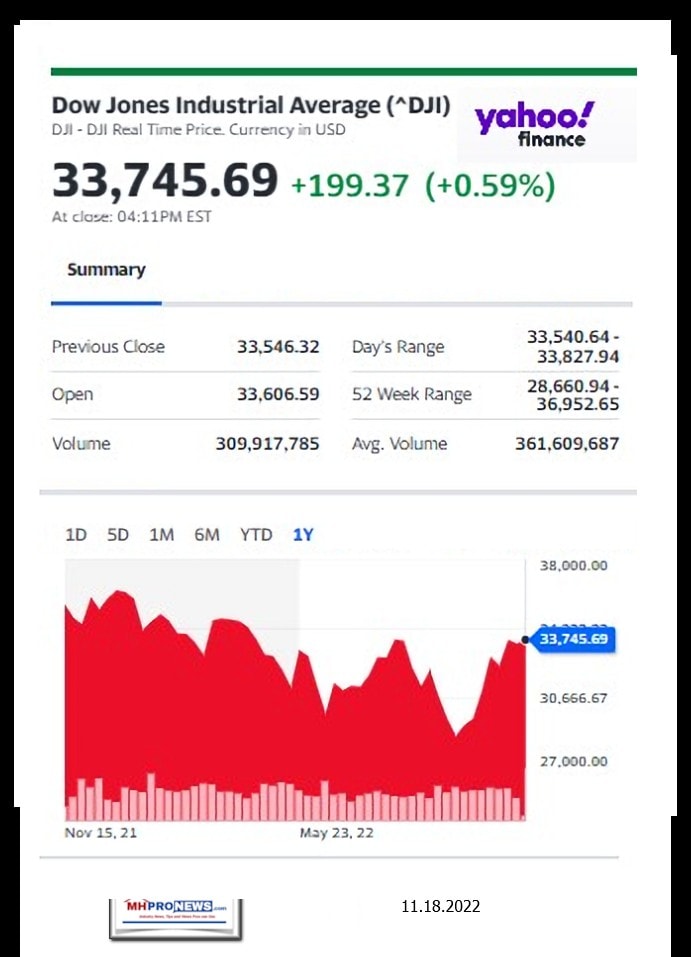

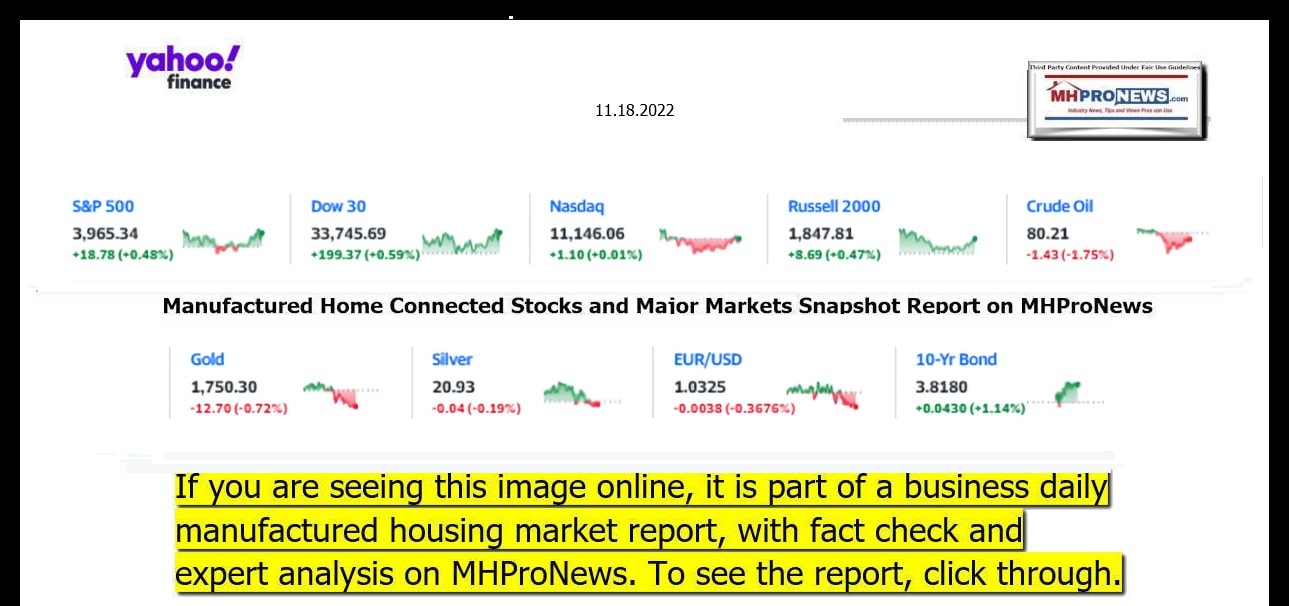

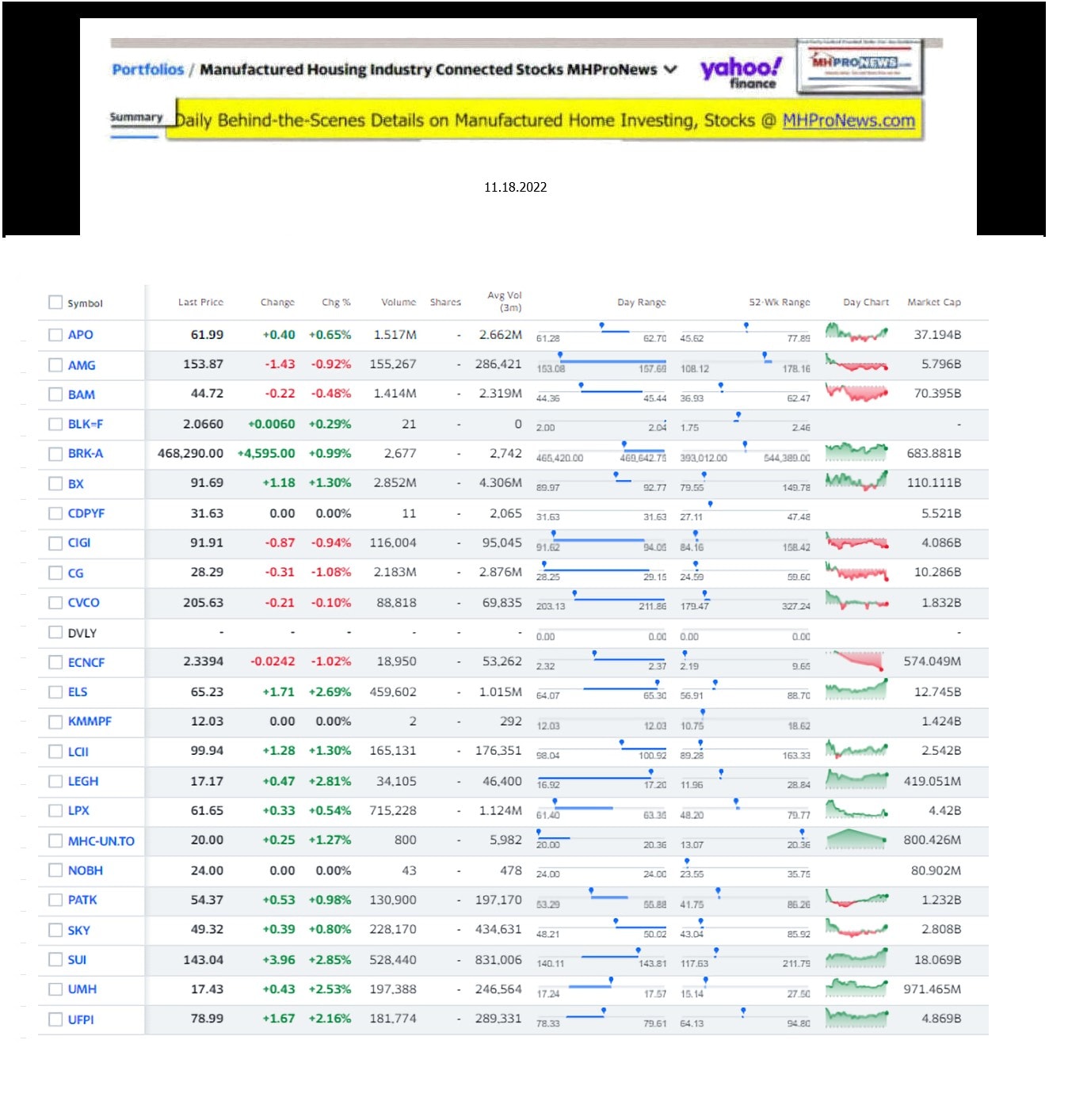

Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews recap of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.18.2022

- Fatter paychecks

- Employers are planning their biggest salary increases in 15 years

- Fed officials crushed investors’ hopes this week

- As Twitter staff empties out, users fear the worst for platform

- What to do if you’re worried about your Twitter account going away

- Twitter is the world’s digital public square. What happens if it dies?

- Parents are buying fewer baby clothes, a sign of deep financial distress

- Elon Musk’s $50 billion trial comes to an end today

- US home sales fall for 9th month in a row in October

- Elizabeth Holmes scheduled to be sentenced on Friday

- IKEA suppliers allegedly used Belarus prisoners under forced labor conditions, report says

- Foxconn has recruited 100,000 new workers for largest iPhone factory, state media reports

- What is Bud Zero, the only beer Budweiser can sell at the World Cup?

- Elon Musk unbans several controversial Twitter accounts, but says not yet on Trump

- Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during a Senate Agriculture, Nutrition and Forestry Committee hearing in Washington, D.C., U.S., on Wednesday, Feb. 9, 2022. The top Democrats and Republicans on the committee last month sent a letter to the CFTC calling for the regulator to take a more active role in overseeing cryptocurrencies.

- The crypto meltdown, explained

- Taylor Swift at the 2022 MTV Video Music Awards held at Prudential Center on August 28, 2022 in Newark, New Jersey.

- Taylor Swift speaks out after Ticketmaster fiasco

- MARKETS

- BUSINESS OF SPORTS

- Rick Fox, three-time NBA Champion and founding partner of Vision Venture Partners, speaks during the Milken Institute Global Conference in Beverly Hills, California, U.S., May 3, 2017.

- Former NBA champ is changing ‘how the world builds’ to fight climate crisis

- FTX investor sues Tom Brady, Gisele Bundchen

- Miami Heat’s FTX Arena will get new arena name

- Athletes leave Kanye West’s Donda Sports agency

- Adidas scoops up CEO who turned around Puma

- JOB CUTS

- The Facebook logo reflected in a puddle at the company's headquarters in Menlo Park, California, U.S., on Monday, Oct. 25, 2021.

- Big Tech misread pandemic demand. Now their employees are paying for it.

- Disney plans to freeze hiring and cut jobs, memo shows

- Oatly plans job cuts as investors sour

- Amazon confirms it has begun laying off employees

- Meta will lay off 11,000 employees

Headlines from right-of-center Newsmax 11.18.2022

- Trump Slams AG Naming Special Counsel to Oversee Probes: ‘Not Acceptable’

- Trump, who just announced his intention to seek reelection in 2014, decried the further step in the ongoing investigations against him as brazenly political. He also reiterated that he’s been accused of a host of misdeeds for six years without any finding of guilt. [Full Story]

- The 2022 Elections

- Boebert Declares Victory, Opponent Concedes Amid Recount

- Zeldin ‘Seriously Considering’ Bid to Head RNC

- State Sen.: Lake Must Look ‘Forward’ on Election | video

- Texas Probes Election Conduct in Harris County

- Ballot Harvesting Provides ‘Pathway to Winning Elections’ platinum

- Dem Rep.-Elect Mullin Win Puts House Tally at 219-210

- Newsmax Hasn’t Called Dem Rep. Costa’s Calif. Reelection

- Newsmax Hasn’t Called Dem Rep. Bera’s Calif. Reelection

- GOP House Candidate Duarte Back in Lead in Calif.-13

- DeSantis’ Redistricting Map Helped GOP Win House Majority

- Arizona’s Kari Lake: ‘I’m Still in This Fight’

- Sarah Palin Stuck in Alaska Ranked-Choice Limbo | video

- Newsmax TV

- Texas AG Paxton: Gender Care Bills Will Protect Parent Rights | video

- Ric Grenell: Investigation Needed in Union’s Nevada Canvassing | video

- Biggs: McCarthy Won’t Get Votes to Be Next Speaker | video

- Donalds: ‘Enough Information’ for Biden Hearings | video

- Arizona State Sen.: Kari Lake Must ‘Move Forward’ | video

- Christina Bobb: ‘Persecution’ Won’t Shake Campaign | video

- -Elect Kiley: Pelosi Exit Sweetest Part of Win | video

- Allen: ‘Time for a Change’ in House Leadership | video

- Steube: No Ukraine ‘Blank Checks’ in GOP-Led House | video

- Cruz: Biden’s Role in Son’s Actions Must Be Probed | video

- Newsfront

- CNN Chief Regrets Network Covered Trump 24/7

- CNN CEO Chris Licht vowed this time around the news outlet is “not going to be a 24/7 Trump news network.”… [Full Story]

- Twitter Reinstates Banned Users Griffin, Peterson; No Decision on Trump Yet

- Twitter has reinstated the accounts of U.S. comedian Kathy Griffin [Full Story]

- Related

- Twitter Saga Continues Amid Musk Takeover |video

- RNC Chair McDaniel Appears to Have Enough Backing for Reelection

- RNC Chairwoman Ronna McDaniel appears to have enough votes for [Full Story]

- Russia: Putin-Biden Summit ‘Out of Question’ Right Now

- Russia is open to more high-level talks with the United States, a top [Full Story]

- Trump Slams AG Naming Special Counsel to Oversee Probes: ‘Not Acceptable’

- Former President Trump on Friday blasted Attorney General Merrick [Full Story]

- Related

- AG Garland Calls Special Counsel for Trump Probes

- Confront China Belligerence With Force or Diplomacy?

- America and the West must come to terms with Chinese belligerence and [Full Story] | Platinum Article

- Related

- FBI ‘Very Concerned’ by Chinese ‘Police Stations’ in US

- Ballot Harvesting a ‘Pathway to Winning Elections’

- Instead of complaining about the potential problems posed by ballot [Full Story] | Platinum Article

- Why Do Some States Take so Long to Count Votes?

- Two decades after the recount fiasco that introduced “hanging chads” [Full Story] | Platinum Article

- Kari Lake Spotted at Mar-a-Lago

- Arizona gubernatorial candidate Kari Lake, who has refused to concede [Full Story]

- House Judiciary GOP Sets Sights on DHS’s Mayorkas

- Rep, Jim Jordan, R-Ohio, the incoming chairman of the House Judiciary [Full Story]

- Video Report: ‘Moms for Liberty’ Sees Midterm Success

- The parental rights group “Moms for Liberty” had success in the [Full Story] | video

- Zeldin ‘Seriously Considering’ Bid to Head RNC

- Lee Zeldin, R-N.Y., said this week that he is “very seriously [Full Story]

- DOJ Seeks Supreme Court Help on Student Loan Plan

- The U.S Justice Department on Friday asked the Supreme Court to lift [Full Story]

- NKorea Test Launches Missile Capable of Striking US

- North Korea on Thursday test launched a short-range ballistic missile [Full Story]

- Buffalo Already Under 2 Feet of Lake-Effect Snowstorm

- A dangerous lake-effect snowstorm paralyzed parts of western and [Full Story]

- Suspect Who Ran Down Sheriff’s Recruits Out of Jail

- A 22-year-old man, arrested on suspicion of attempted murder of peace [Full Story]

- Y. Hasn’t Licensed Pot Shops, Yet They Abound

- Eager, anxious and frustrated, Yuri Krupitsky is waiting to find out [Full Story]

- Jeffries Announces Bid for House Dem Leader

- Hakeem Jeffries, D-N.Y., announced his candidacy for House [Full Story]

- House GOP Can Pump Brakes on Biden EV Agenda

- Republicans’ takeover of the U.S. House of Representatives could slow [Full Story]

- Video Report: CBP Agent Killed, Two Injured in Shootout

- A Customs and Border Patrol agent was killed and two others were [Full Story] | video

- US, South Korea Talk Inflation Reduction Act at APEC

- S. Trade Representative Katherine Tai acknowledged Seoul’s concerns [Full Story]

- US Home Sales Fell in October for 9th Straight Month

- Sales of previously occupied U.S. homes fell in October for the ninth [Full Story]

- Boebert Declares Victory, Dem Frisch Concedes

- Lauren Boebert, R-Colo., declared victory in her reelection [Full Story]

- Fed’s Collins Says More Rate Rises Lie Ahead

- Federal Reserve Bank of Boston leader Susan Collins said on Friday [Full Story]

- Pfizer Omicron Shot Produces Antibodies Against Emerging BQ.1.1 Subvariant

- Pfizer Inc and its German partner BioNTech SE said on Friday their [Full Story]

- Dem Rep. Hakeem Jeffries Favored as Minority Leader

- Hakeem Jeffries, D-N.Y. is a likely top contender to lead the [Full Story]

- Rep.-Elect Mullin Win Puts House Tally at 219-210

- Newsmax can officially project Democrat Kevin Mullin the winner of [Full Story]

- GOP House Second Amendment Caucus Meets With Kyle Rittenhouse

- House Republicans in the Second Amendment Caucus met with Kyle [Full Story]

- Authorities: Man Wielding Knife, Ax, Sword Entered New York Times Building

- Police in the Big Apple said Thursday that a 32-year-old man entered [Full Story]

- Politico Poll: Trump Leads DeSantis

- While major media has been billing Florida GOP Gov. Ron DeSantis as a [Full Story]

- House Advances Proposal Touting More Transparency With Mail-In Ballots

- The House Oversight and Reform Committee has advanced a potentially [Full Story]

- Finance

- Average 401(k) Balance Declines 23% to $97,200

- Although retirement savers in Fidelity accounts continued to stay the course with steady contributions and asset allocations, the average 401(k) balance declined 23% to $97,200 in the third quarter…. [Full Story]

- Home Prices Could Plummet 20% in ‘Severe’ Correction: Dallas Fed

- Report: DOJ Probes Live Nation After Swift Ticket Debacle

- Twitter Saga Continues Amid Musk Takeover

- Pay Raises to Hit 4.6% in 2023

- More Finance

- Health

- Indoor Humidity Level Linked to COVID-19 Transmission

- A new study found that very dry or very humid indoor can worsen COVID-19 outcomes. Previous research has shown that proper ventilation can slow the spread of the virus, and now researchers at the Massachusetts Institute of Technology (MIT) have discovered that indoor… [Full Story]

- Expert Tips for Gathering Safely With Friends and Family

- Schools Struggle For Staff During Youth Mental Health Crisis

- USDA Program Keeps Extra COVID-era Money for Fruits, Veggies

- Chris Hemsworth Learns He’s Genetically Predisposed to Alzheimer’s

===================================

- NOTE 1: The 3rd chart above includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the equities named above follow.

2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.