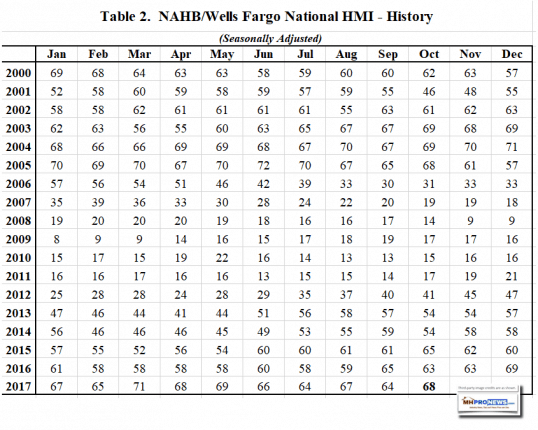

This is the highest reading since May, and you have to go back to October 2005 to find the same reading for this month.

“This month’s report shows that home builders are rebounding from the initial shock of the hurricanes,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas.

“However, builders need to be mindful of long-term repercussions from the storms, such as intensified material price increases and labor shortages,” the NAHB release said.

“It is encouraging to see builder confidence return to the high 60s levels we saw in the spring and summer,” said NAHB Chief Economist Robert Dietz.

“With a tight inventory of existing homes and promising growth in household formation, we can expect the new home market continue to strengthen at a modest rate in the months ahead,” per Dietz.

The manufactured housing industry currently has no similar research, but the Manufactured Housing Association for Regulatory Reform (MHARR) publishes the results of the monthly new home shipment reports. Their most recent report, is linked here.

MHARR encourages widespread sharing of their reports, while by contrast, the Manufactured Housing Institute (MHI) places a copyright and wants their reports reprinted only with “expressed written permission.”

Fortunately, trade media such as MHProNews are allowed by law what’s known as “fair use” which allows republishing without permission for the purposes of analysis, and other guidelines approved uses.

NAHB Methodology

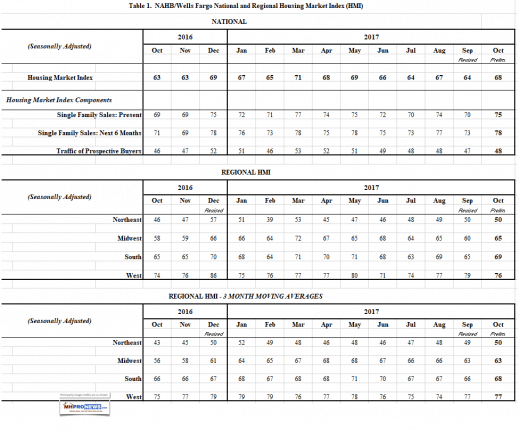

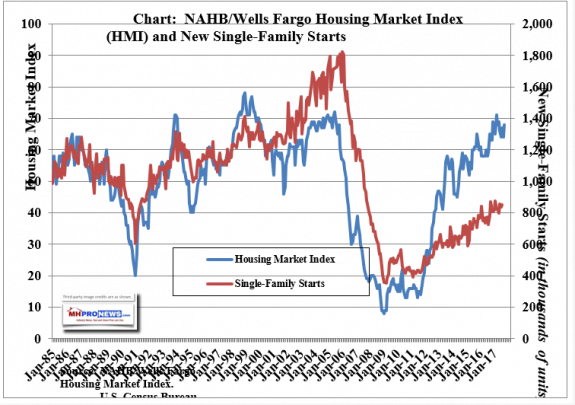

“Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index [HMI] gauges builder perceptions of current single-family home sales and sales expectations for the next six months,” they stated, using a simple “good,” “fair” or “poor” rating.

The NAHB survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.”

Scores for each component are then used to calculate a seasonally adjusted index, and any number over 50 indicates that more builders view conditions as good than poor. Against that understanding, all three HMI components posted gains in October.

They trade group also stressed that, “The NAHB/Wells Fargo Housing Market Index is strictly the product of NAHB Economics, and is not seen or influenced by any outside party prior to being released to the public.” Reports unfiltered by special interests? What a concept. ## (News, analysis, commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)