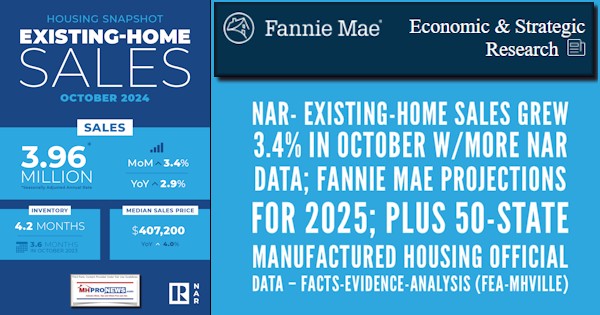

Rents Rise as Homeownership Falls

According to zerohedge.com, the uptick in home prices is transitory and more due to the Federal Reserve’s support of the economy than with organic growth or stability of consumers, as the homeownership rate is stuck at an 18-year low at 65.1 percent, and rents rise to an all-time high, increasing …