Meanwhile, the number of renters aged 45-64 has also risen due in part to an aging population, and because of the many foreclosures that hit this market during the housing breakdown. Household size has fallen in those 20 years: Single-person households rose from 31 to 36 percent; married-couple families who own their homes fell from 66 percent to 60 percent as the number of children under 18 dropped from 37 percent to 31 percent.

Commentator Robert Dietz, an economist with the National Association of Home Builders (NAHB), tells MHProNews U. S. housing policy needs to address these demographic shifts. As more seniors tend to stay in their homes, remodeling will be necessary to meet changing life-cycle needs. He supports replacing Fannie and Freddie with the Johnson-Crapo housing finance reform measure, and says younger homebuyers pay the most mortgage interest as a share of their income, and are the ones most affected by changes in housing policy.

As Paul Bradley of ROC USA (resident-owned communities) notes from Harvard University’s Joint Center on Housing report in an article for MHProNews, by 2040 one in eight Americans will be over 75, and as housing costs grow in relation to income, the doorway becomes wider for people to choose manufactured housing. Bradley suggests manufactured housing communities could develop great support networks and services for the aging population. ##

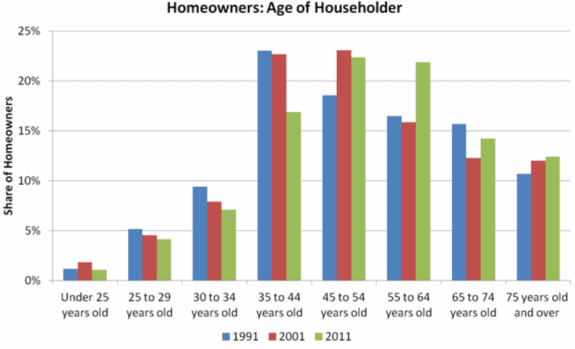

(Graphic credit: usnews.com/American Housing Survey/Robert Dietz