According to a fresh real estate analysis by Redfin, “Investors Are Buying More Single-Family Homes Than Before” in the first quarter of 2024. “Investor purchases of single family homes rose 3.9% year over year in the first quarter, the first increase in nearly two years. Meanwhile, investor purchases of townhouses, condos/co-ops and multifamily properties fell 8.6%, 6.4% and 2.5%, respectively. Investors are likely keen on single-family properties because that segment of the market has posted relatively strong rent growth—AKA has stronger ROI potential—and also has lower tenant turnover.” An array of facts will be provided in Part I of this report from various sources, which often cited data in that report from Redfin. While much of the data is conventional housing focused, Part II of this report will provide perspectives that include manufactured housing specific takeaways. Per left-leaning Wikipedia: “Redfin Corporation, based in Seattle, provides residential real estate brokerage and mortgage origination services. The company operates in more than 100 markets in the United States and Canada. The company has a 0.80% market share in the United States by number of units sold and has approximately 2,000 lead agents.”

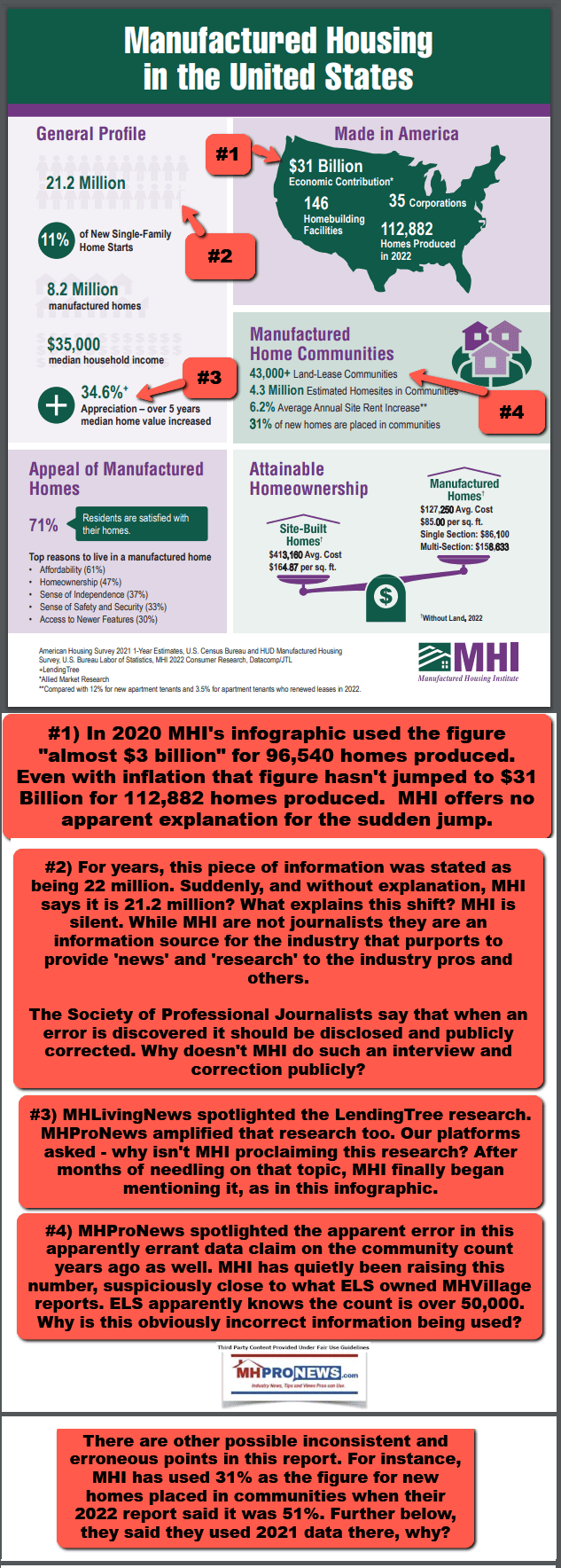

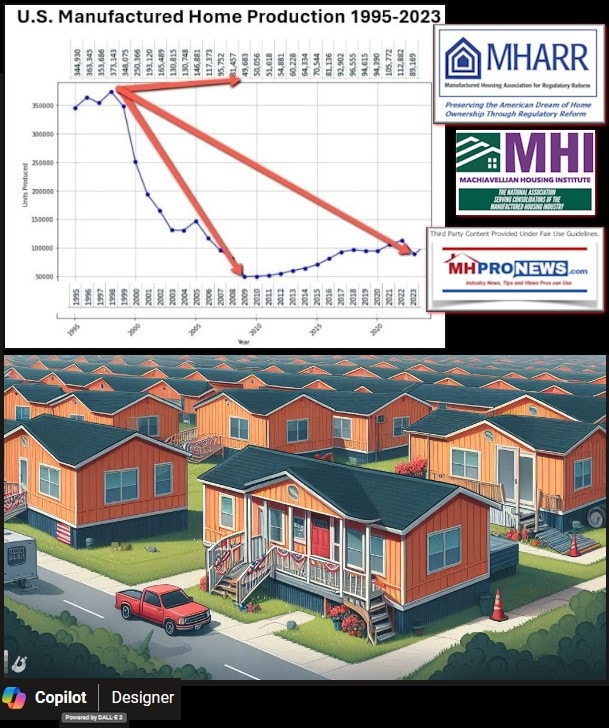

Note that what is described as some $31.3 billion in investor activity by Redfin in the U.S. housing market in one quarter dwarfs the total for a year that the Manufactured Housing Institute (MHI) asserted occurred for the entire industry in 2022 via a curious and at time apparently erroneous infographic linked here. Manufactured housing declined in 2023, but is beginning to rebound in early 2024 according to data provided by the Manufactured Housing Association for Regulatory Reform (MHARR).

Redfin housing news headlines included these recent (May 2024) items.

“The median home sale price rose 6% year over year to $434,000 as a lack of new listings buoyed prices. The total number of homes for sale hit a four-year high, but that’s partly because some houses are sitting stale on the market after being priced too high.”

Under the category of “New Construction” Redfin said:

“The share of houses for sale that are brand new is hovering at a level that’s nearly double the pre-pandemic rate. One-third (33.4%) of single-family homes for sale in the U.S. in the first quarter were newly built, essentially unchanged from a year earlier but down from a record-high 34.5% two years earlier.”

Each of those data points has relevance to the manufactured housing market, as additional facts with analysis in Part II will reveal. That odd MHI infographic linked above is also provided further below.

Part I – From the WND News Center to MHProNews plus Other Media Sources as Shown

A)

MONEY | FEARS OF THE FUTURE

Investors are snatching up 1 in 5 homes for sale, scooping up affordable housing

Homeownership has slipped out of reach for millions of Americans

5) MHProNews also previously reported that investors have bet some $2 billion on what might be described as factory-built alternatives to HUD Code manufactured housing in recent years. Some of those alternative investments have already failed, per reports detailed in the article linked below.

6) It is sadly rare that manufactured housing pros specifically mention the point that housing is considered one of the necessities of life (i.e.: food, clothing, shelter (i.e.: housing), transportation, and health). Tech is great, but an argument could be made that it is not as necessary for humanity as food, clothing, or shelter.

7) Some are obviously using recreational vehicles (RVs) for housing purposes, even though many units are not designed for full time living and RVs in general are routinely meant to be used for recreational or vacation purposes. So, while some RVs are designed for ‘full time’ living, they are generally the more expensive units, not the cheaper ones. That said, when manufactured housing (MH) production is compared to RV production (see report linked below for details), manufactured homes in 1998 outnumbered RVs by some 3 to 2 that year. But since then, RVs generally rose to the point where some years, RVs outsell MHs by some 4 to 1 or more. The takeaways? RVs have promoted themselves and defended their interests. By comparison, MHI – because they claim to be representing “all segments” of the industry, look to be ineffective, corrupt, or arguably both.

8) The Part I data from Redfin et al is still more evidence of just how questionable the remarks are by Cavco Industries (CVCO) leaders in their most recent quarterly report. In the light of some $31 billion in investments in the first 3 months of 2024 into U.S. housing, it seems apparent that it is questionable if not a mistaken use of $100 million by Cavco to do stock buybacks. X million dollars, either solo or in concert with other MHI member brands, could be deployed to Protect-Educate-Promote (P.E.P.) the manufactured home industry and/or their own interests. Several reports are found linked in the latest Cavco review that demonstrate that legal, promotional, and advocacy is clearly lacking. The RV experience (see Part II #7 above) demonstrates just how much manufactured housing could have grown. By logical inference, such objective realities means that Cavco leadership isn’t doing their job properly. By applied common sense, these facts all reveal that MHI’s board and top-staff aren’t doing their jobs properly either. This is why fact-checks using AI powered Copilot have revealed weaknesses in MHI’s claims, while Copilot has all but praised MHARR for its consistent efforts.

9) The accessory dwelling units (ADU) lesson’s learned and extrapolating from what manufactured housing should be doing based on population growth also points to just how poorly MHI, and several MHI-linked firms are doing. While it may not have been the intention of the Landy-led UMH Properties, their facts and presentation have made the argument that directly contradicts the notions advanced by Equity LifeStyle Properties (ELS), Sun Communities, and others. It is worth noting that UMH is not embroiled in the kinds of antitrust suits that ELS, Sun, and several other MHI linked firms are. See the report linked below for more granular details, evidence and expert analysis.

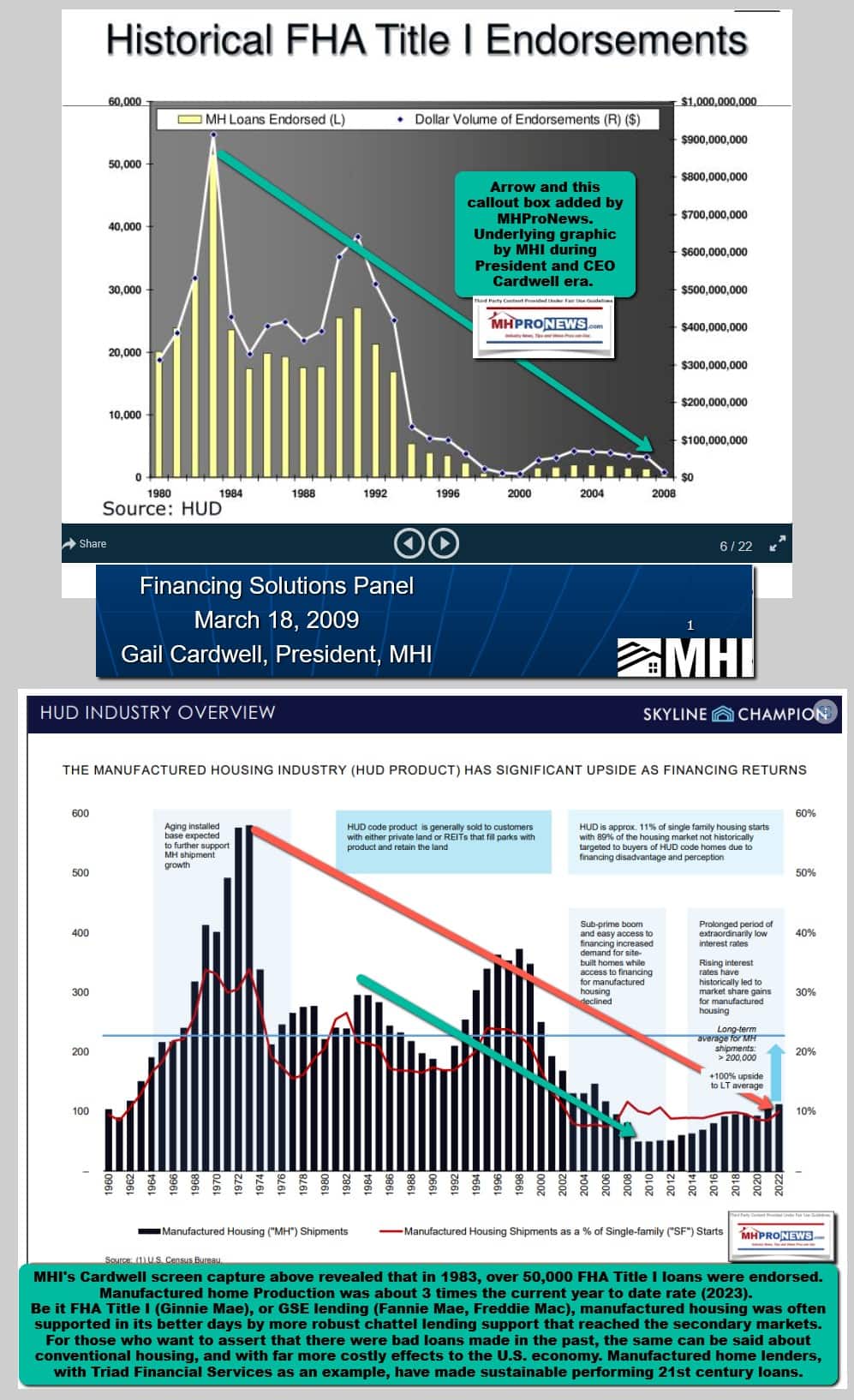

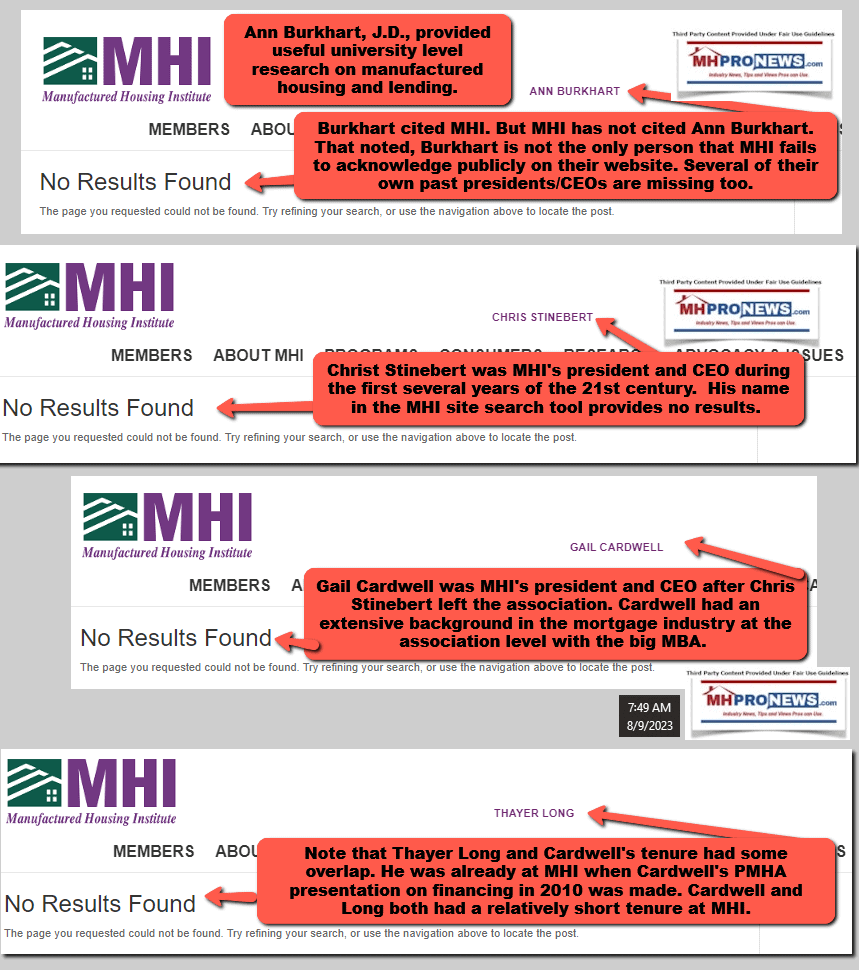

10) Statements and presentations made by prior MHI staff leaders also undermine the more recent MHI narratives.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

11) There are several possibilities for the type of strategy such exposes could cause prominent MHI member firms to consider. But before diving into some potential options, consider the evidence of what specific firms have said and done. Let’s note the MHProNews has said for years that not all MHI member firms are apparently in on the kind of arguably improper and possibly illegal behavior that is explored in linked reports that follow. Cavco was linked above.

12) MHI’s corporate leaders spin their investor relations (IR) narratives that are often contradicted by some of their own prior remarks and/or by remarks made by others connected with MHI. The lack of consistency in what MHI leaders have said and done is remarkable. But that lack of consistency is best brought to light in more detailed reports, which can examine current vs. other contemporary or prior claims. MHI leaders are often well educated and, in several cases, veteran business and manufactured home professionals. It would be incorrect to think that they are simply ignorant or making some understandable mistake. Rather, their words and behavior point instead to indications of plans that include the consolidation of MHVille. That consolidation is predicated in part on industry underperformance. To illustrate how troubling some of these arguments ought to be, imagine if multi-family housing leaders were celebrating the lack of new construction and development? That is analogous to the arguments being made by several MHI corporate and other leaders in the investor pitches.

a) Per ELS IR pitch – “supply constrained asset class” is a “strategic advantage for ELS.” Again, imagine if site builders tried to make the case that limiting new developing would somehow be in their best interest? Yet that is the argument that ELS and others in MHVille – routinely connected to consolidation central at MHI – often make.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

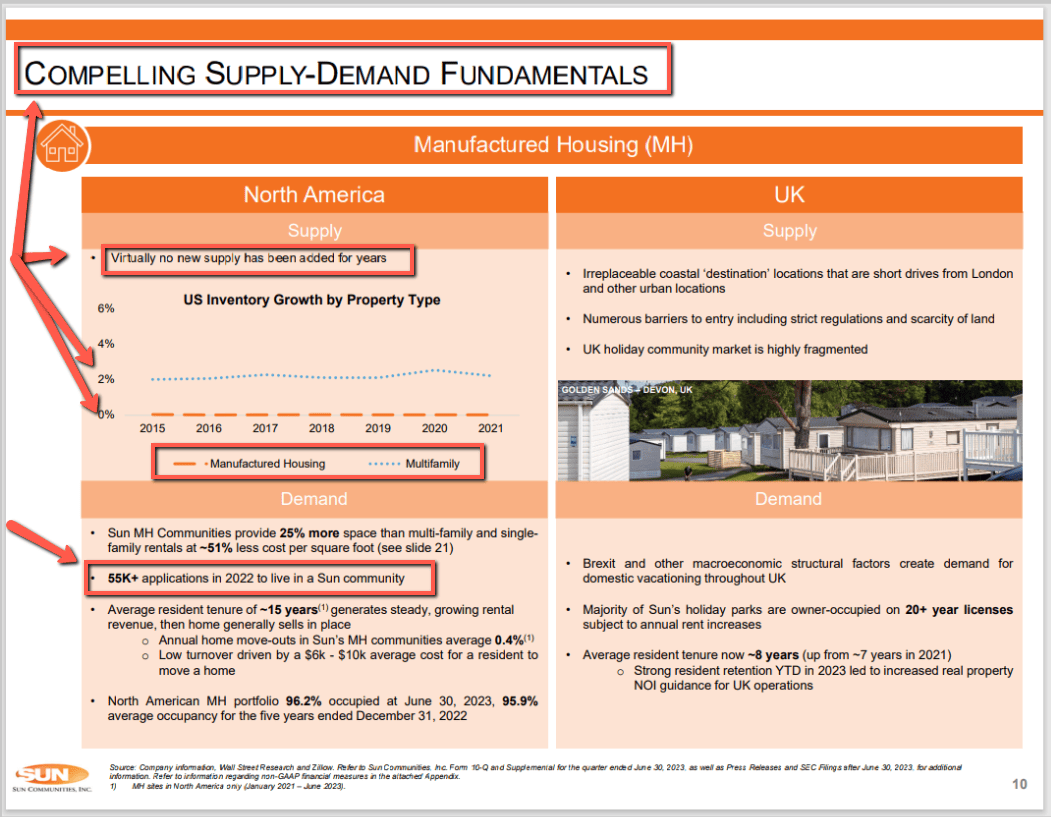

b) According to Sun Communities, similar to ELS’ IR Pitch, states that “virtually no new supply has been added for years” is part of their “compelling supply demand fundamentals.” But ironically, or comically (take your pick), that same Sun IR slide said they received some 55,000 applications to live in a SUI community. If they had so many applications, and their occupancy rate is so high, then why aren’t all Sun MHCs all completely full, with each of their properties boasting a long waiting lists?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

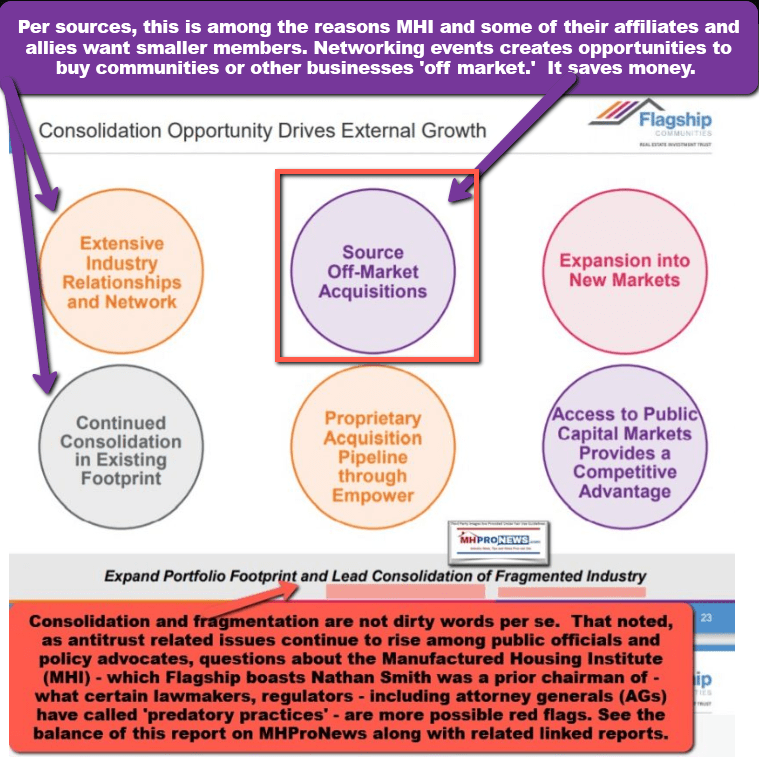

c) Flagship, Sun, and ELS all have board positions with MHI. Flagship’s IR pitch stated this. Flagship clearly makes the connection of consolidation with their plan (which is akin to others shown). Per Flagship’s IR pitch: “Expand portfolio footprint and lead [the] consolidation of [a] fragmented industry.” “Consolidation opportunity drives external growth.” As MHProNews mused about meetings as “Buffett’s Buffet” for consolidators some years ago, the apparent purpose of all of those in person MHI meetings is apparently often about the networking, besides the fact that MHI generates profit for their organization from those meetings. Meetings mean breakfasts, lunches, drinks, and dinners. Meetings create opportunities to forge ‘connections’ and ‘relationships’ that can later result in a ‘source of off-market acquisitions.”

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

d) Skyline Champion (SKY) has lived up to the following remarks. Skyline Champion has also made a move with ECN Capital into a more direct control over one of the industry’s last remaining and longtime independent lending options.

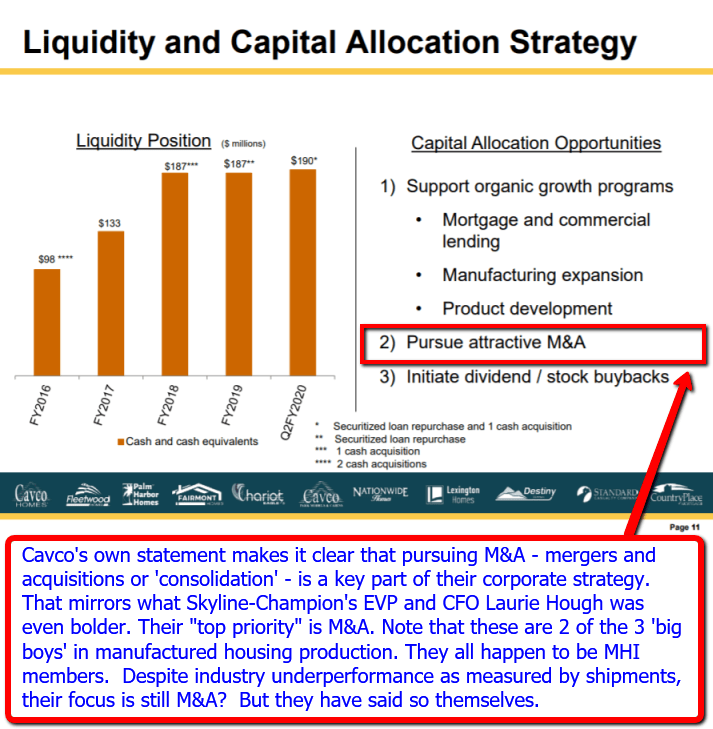

e) Cavco Industries (CVCO) IR pitch has been carefully tracked and reported by MHProNews for years, as have others shown herein. For at least 5 years (the following was uploaded on February 14, 2020), Cavco clearly pitched M&A – mergers and acquisitions – which is a different way of saying consolidation.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

f) This pattern is so brazen that industry outsider Samuel Strommen, in a legal antitrust research report for Knudson Law on consumer protection focused on manufactured housing, clearly identified the patterns and behaviors that he argued was a case of “felony” antitrust behavior that obviously involved the Manufactured Housing Institute (MHI).

13) More recently, James A. Schmitz Jr. and others have said that manufactured housing ought to be liberated in order to better serve America’s booming affordable housing needs.

Each of those articles provides a deeper dive into specifics. Neither MHI, nor those leading brands, have accepted the opportunity to respond to those evidence-based concerns, despite several of those leaders previously praising this publication for our accuracy and insights.

13) Instead of illusions, common sense actions that result in steady, measurable growth.

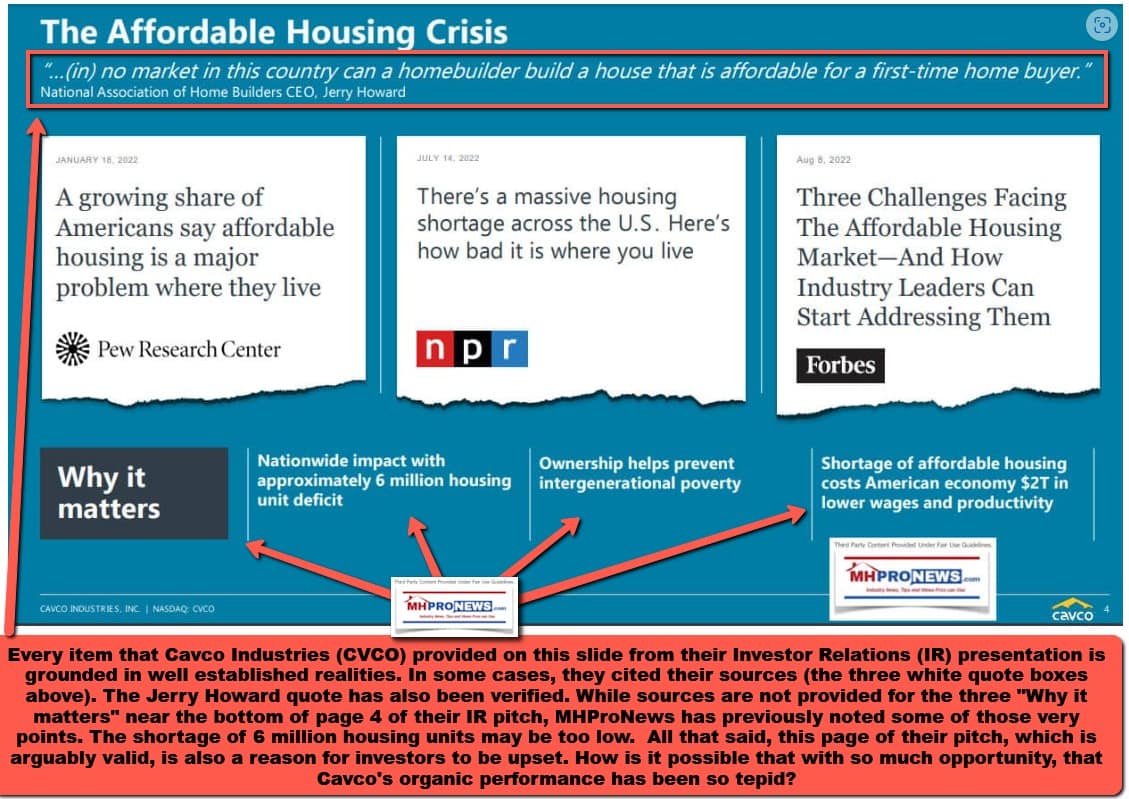

14) Redfin and the sources cited in Part I made it clear that millions of new housing units are needed. Ironically, Cavco pointed out that the drag on the U.S. economy caused by a lack of affordable housing is a staggering 2 trillion dollars annually.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Cavco and others have demonstrated the point that honest Abe Lincoln made over 150 years ago. No one has a good enough memory to be able to keep all of their lies, paltering, and half-truths straight. With the sheer volume of remarks made, in fairness, it would be difficult to keep their narratives coherent. The question is, will antitrust, other regulators, and law enforcement officials act? If so, when? Millions in need of affordable housing are waiting for action. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’