Accounting for nearly two-thirds of new construction, starts on single-family homes rose 3.3 percent in April, while multifamily (with five or more units) increased 10.7 percent to 373,000.

New applications for building permits rose 3.6 percent to 1.116 million from a downwardly revised March rate of 1.077 million. With permits trailing starts for the past three months, housing starts may slow down in the next few months.

In the first four months of 2016, single-family housing starts are up 16.8 percent compared to the first four months of 2015. When multi-family starts are included, the rate drops to 10.2 percent versus last year.

The number of privately-owned homes under construction hit 999,000 in April, the highest number since 2008, according to the Commerce Department. Multi-family units under construction reached 555,000, the highest level since 1974.

Other measures indicate 2016 is off to a rough start as sales of newly-built homes fell for the third straight month in March, although the National Association of Realtors (NAR) reports sales of pre-existing homes rose 5.1 percent in March.

The National Association of Home Builders (NAHB) tells MHProNews sentiment among home builders in May remains at 58, where it has been for four months, following eight months of readings above 60.

Many builders continue to report shortages of skilled labor and buildable lots. Additionally, in many parts of the country home prices are rising faster than wages, making it more difficult for would-be homeowners to save enough for a down payment. ##

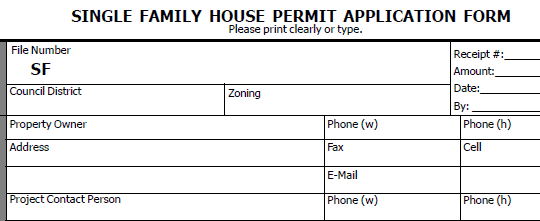

(Image credit: San Jose, CA government form)