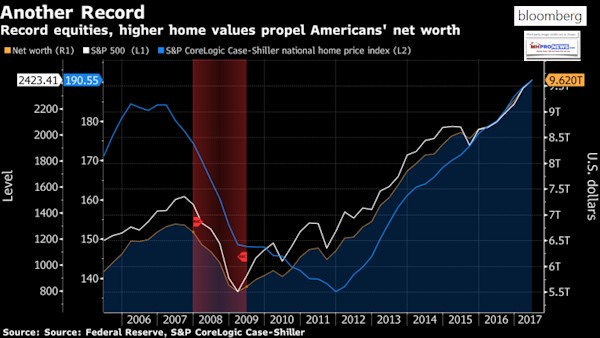

Snapshots from their household wealth research, per Bloomberg.

- Net worth for households and non-profit groups rose by $1.7t q/q, or 1.8%, to $96.2t, according to Fed’s financial accounts report, previously known as flow of funds survey

- Value of financial assets, including stocks and pension fund holdings, increased by $1.2t

- Household debt increased at a 3.7% annual rate in the second quarter

- Household real-estate assets rose by $508b; owners’ equity as share of total real-estate holdings up to 58.4% from 57.9%

As the Daily Business News has previously reported:

- Stocks have hit record highs

- Personal incomes are rising

- Consumer and business confidence are also up since President Trump took office.

That doesn’t mean that all is wine and roses.

There have been numerous warning signs that the Daily Business News has reported as well. The Fed’s stated intention of “unwinding” years of Obama era QEs is another risk on the horizon.

The need for tax reform, to repeal and replace ObamaCare and more are all measures that could continue the U.S. economic recovery.

Other Facts of Interest to Housing Professionals

- Mortgage borrowing advanced at a 2.8 percent annualized pace; other forms of consumer credit, including auto and student loans, climbed at a 4.6 percent rate

- Total non-financial debt grew at a 3.8 percent annual pace

- Federal government obligations expanded 3.6 percent, state and local government debt declined at a 1 percent pace, while business borrowing increased 5.3 percent ## (News.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)