It’s not a secret that the need for affordable housing is a problem in major metro areas throughout the United States.

It’s not a secret that the need for affordable housing is a problem in major metro areas throughout the United States.

A new Pew Research study reports there are more renters than at any time since 1965.

Recent stories coming out of San Francisco are just one example of the growing housing crisis, like the decision to expand income restrictions to allow more individuals and families to be eligible for assistance.

Or Facebook’s announcement that they are building a “village” which will offer at least 15 percent of their units under market rates.

But another new study spotlights facts on just how far from true affordability the nation’s rental housing is.

NLIHC 2017 Out of Reach Report

The recently published “2017 Out of Reach Report” from the National Low Income Housing Coalition (NLIHC) shows that current rental rates are out of reach for low-wage workers throughout the United States.

Per that study, there are only 12 counties in the U.S. where a minimum wage worker can afford a one bedroom apartment at today’s market rental rates.

According to the NLIHC report, the average “per hour” rate needed for one person to reasonably afford a one bedroom apartment is $17.14; similarly it would require a single individual to make $21.21 per hour to afford a two-bedroom apartment.

“A full-time worker earning the minimum wage needs to work 117 hours per week for all 52 weeks of the year to afford a two-bedroom rental home or 94.5 hours per week for a one-bedroom rental home,” the NLIHC report says.

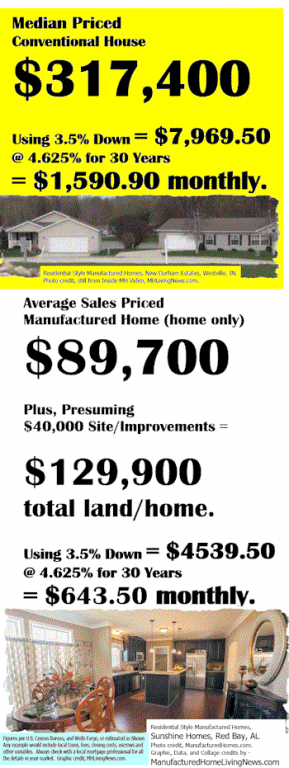

With the cost of rent so far out of reach, the idea of home-ownership is often far from the ability of a low-income earning renter to turn the dream of ownership into a reality.

That results in the “renters cycle” continuing – with 73 percent of renters paying more than half of their income for housing costs. That in turn means there is never a chance to save for a down payment large enough to qualify for a mortgage on a traditional home.

However, there is a solution that the industry’s professionals know very well.

“As we think about housing in today’s world, the most important aspect should start with affordability. When home ownership is affordable, it has ancillary benefits,” said actively retired businessman and minister, Donald Tye, Jr.

The average cost of a brand new single-section manufactured home in the U.S. in December 2016 was about $49,900, according to the U.S. Census Bureau.

The more affordable option is clear when you look at those numbers – but still manufactured homes are the generally overlooked answer to the affordable housing crisis that millions in the U.S. are currently drowning in.

While some non-profits and researchers note the manufactured home options, others miss it – sometimes, completely.

“This year’s report shows that housing affordability continues to be a significant challenge for low wage workers. It makes a compelling case that the problem is national in scope and is not limited just to urban areas or places with high housing costs,” Andrew Aurand, the NLIHC VP for Research wrote in an email to Refinery29.

“Affordable housing is not just an urban issue. It’s an urban, suburban, and rural issue,” Aurand says.

“These 12 counties, where a full-time minimum-wage worker could afford a modest one-bedroom apartment, are located in states with a minimum wage higher than the federal level. A higher minimum wage is important, but won’t solve the housing crisis. In no county can a full-time minimum-wage worker afford a two bedroom apartment, which is important for someone supporting a family. In many communities, even the average renter’s wage is insufficient to afford a two-bedroom apartment.”

As James McGee and Chet Murphree of Deer Valley Homebuilders told MHProNews, it’s all about education and debunking the old, outdated myths.

To share a public focused version of this report that can help more Americans get it about manufactured homes, click here. # # (News.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)