That market insight will help tee up other topics that follow.

Yesterday afternoon, the Department of Housing and Urban Development (HUD) Office of Manufactured Housing Programs (OMHP) sent out the following update to ‘stakeholders’ and others.

That emailed report said the following.

Sent: Thu, Nov 12, 2020 1:34 pm

Subject: Minimum Payments to States Final Rule and Advance Notice of Proposed Rulemaking

On behalf of Administrator Teresa Payne and me, we are excited to announce the below press release and publication of the Final Rule implementing the long awaited Minimum Payments to States rulemaking. HUD has concurrently published an Advance Notice of Proposed Rulemaking (ANPR) seeking comment on potential future changes to state payments.

Thank you for your continued partnership and cooperation making the national manufactured housing program effective for the industry and the consuming public.

Best,

Jason

HUD STRENGTHENS MANUFACTURED HOUSING SAFETY AND AFFORDABILITY

WITH REVISED MIMIMUM PAYMENTS FOR STATE OVERSIGHT PROGRAMS

Final rule published today provides more equitable HUD funding for State Administrative Agencies

WASHINGTON – The Department of Housing and Urban Development (HUD) published today a final rule in the Federal Register which provides a revised structure for the payments HUD makes to states participating as State Administrative Agencies in the manufactured housing program. State Administrative Agencies in 33 states are fully or conditionally approved to carry out their manufactured housing oversight programs, and the majority of these states will see an increase in payments to administer their programs under the revised payment structure.

“More than 22 million Americans have used manufactured homes as a means of attaining the stability and financial independence of homeownership, particularly in areas where housing affordability is a challenge. Making sure that states are appropriately compensated for the work they do to ensure the safety and affordability of these manufactured homes, for families within their own communities, is both right and responsible,” said HUD Secretary Ben Carson.

The final rule revises the state payment formula contained in the Manufactured Home Procedural and Enforcement Regulations so that payments are more commensurate with both the level of manufactured housing production, and the associated work performed in a state when a manufactured home is first produced and then installed in its permanent location. HUD has increased production payments from the current $2.50 per section of home produced to $14.00 per section, while maintaining payments to states of $9.00 per section for manufactured home siting. Further, for the first time in two decades, states that have received conditional approval of their state programs from HUD are now eligible to receive fiscal year-end supplemental payments for the work they are performing.

“This is another example of HUD reducing barriers to the adoption of manufactured housing as an affordable housing alternative,” said Assistant Secretary for Housing Dana Wade. “States are valuable partners in this process. We believe this change will strengthen existing partnerships, incentivize more states to participate in the program, and reduce the reliance on federal resources for activities that are more appropriately handled at the state and local level.”

In conjunction with the final rule, today HUD also published an Advance Notice of Proposed Rulemaking to solicit public comment on additional refinements to state payments that HUD may consider in the future. The considerations include additional options to fund state participation in a way that recognizes the contributions each state makes, and to incentivize state participation in various elements of the manufactured housing program to the maximum extent possible. HUD also looks forward to feedback from the Manufactured Housing Consensus Committee, a Federal Advisory Committee, prior to issuing a proposed rule on these refinements.

HUD’s Office of Manufactured Housing Programs administers the National Manufactured Housing Construction and Safety Standards Act of 1974 which authorizes HUD to establish federal standards for the design and construction of manufactured homes to assure quality, durability, safety, and affordability. The Office’s standards are carried out directly or through states that have partnered with HUD to inspect factories and retailer lots, implement installation standards for the homes, and administer a dispute resolution program for defects.

###

To tee up the quotable quotes, the following pull-quote from The Washington Post in an email to MHProNews begins with these words.

“What does this [2020] election tell us about our country? The outcome of the 2020 presidential election will help us understand what the past four years have meant, what they have taught us and where our country goes from here.”

What follows are some pull quotes from medical, nonprofit, and religious figures on the state of the 2020 race. Those quotes will be followed by our left-right media headline bullets this evening as well as 2 of the 3 market snapshots at the closing bell today.

Quotes That Shed Light – American Social, Industry, National Issues…

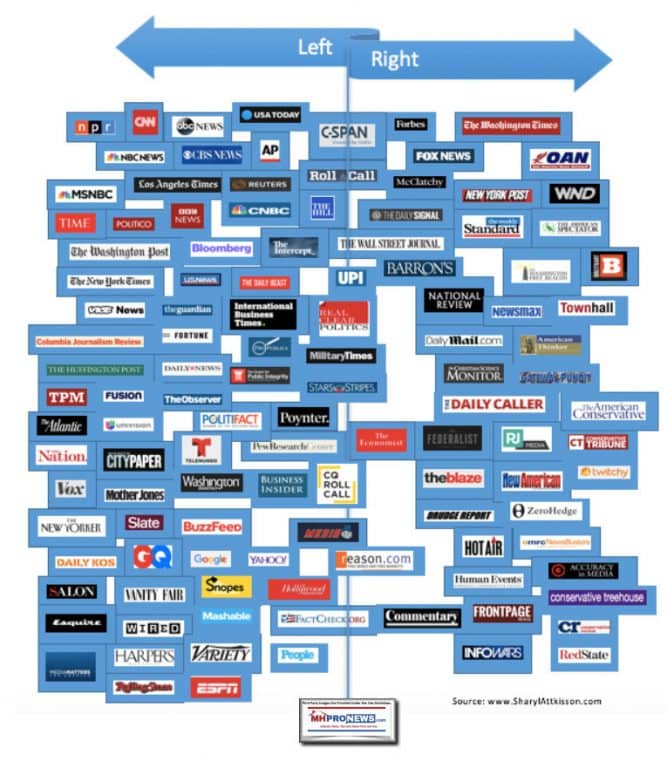

Notice: MHProNews is re-evaluating the long-standing use here of Fox Business in these left right media headlines. This is an apt time to remind readers that these headlines are to provide readers with a quick sense of news that may be moving the markets, from both the left and right of the mainstream media.

We are continuing our test of using headlines from Newsmax, which follows CNN below.

Headlines from left-of-center CNN Business

- In this Thursday, September 24, 2020 image, NASA’s SpaceX Crew-1 astronauts, from left, mission specialist Shannon Walker, pilot Victor Glover, and Crew Dragon commander Michael Hopkins, all NASA astronauts, and mission specialist Soichi Noguchi, Japan Aerospace Exploration Agency (JAXA) astronaut, gesture during crew equipment interface testing at SpaceX headquarters in Hawthorne, California.

- Weather delay moves SpaceX-NASA astronaut launch to Sunday

- Elon Musk may have Covid-19, putting SpaceX’s plan to launch astronauts this weekend into question

- Trump’s Fed pick nears confirmation despite unorthodox views

- Stocks rally as investors shake off worries about infections and the economy

- POP QUIZ How closely were you paying attention to the markets this week?

- The Trump-Fox News relationship is coming to a head. Here’s what might be coming next

- These Trump supporters say Fox News is too liberal

- Zuckerberg: Bannon’s beheading comments aren’t enough to ban him from Facebook

- TikTok granted two more weeks to reach a deal for US business

- SEC charges former Wells Fargo CEO and another top exec over fake-accounts scandal

- Bumble is reportedly planning for a 2021 IPO

- What Trump’s loss means for the solar industry

- A for sale sign stands in front of a house, Tuesday, Oct. 6, 2020, in Westwood, Mass. On Thursday, Nov. 12, U.S. long-term mortgage rates rose this week. They remain at historically low levels, now around a percentage point below a year ago.

- This is why it’s getting even harder to afford a home

- Jerome Powell, chairman of the U.S. Federal Reserve, speaks during a virtual news conference in Arlington, Virginia, U.S., on Thursday, Nov. 5, 2020. Federal Reserve officials kept monetary policy in a holding pattern, leaving interest rates near zero and making no change to asset purchases, as the final results of U.S. presidential and congressional elections remain uncertain.

- The economy as we knew it might be over, says Fed Chairman Jerome Powell

Headlines from right-of-center Newsmax

- Trump Talks Vaccine Rollout, Insists Administration Not Going Into Lockdown

- Court Won’t Block Detroit Election Certification Results

- Law Firm Representing Trump in Pa. Case Withdraws

- US Appeals Court Rejects Effort to Block Late Ballots in Pa.

- RNC Spending $10 Million on Election Legal Effort

- Peter Navarro: ‘Moot’ Point to Worry What Biden Will Do

- Trump Campaign Drops Arizona Lawsuit

- Georgia Begins Hand Tally of Presidential Votes

- US Officials: Election Was Most Secure in American History

- Miami Marlins Hire MLB’s First Female General Manager

- France Says it Has Killed Senior Al-Qaeda North Africa Operative in Mali

- Experts: Polls Tried to Suppress Republican Turnout

- Transition Official: Biden to Receive National Security Briefings

- Maine’s Susan Collins Defied Democrats to Win Reelection

- Consumer Sentiment Falls on Darker Economic Hopes

- S. consumer sentiment unexpectedly declined in early November

- Surging Home Values Inflate Dangerous Housing Bubble

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

“Rapidly rising housing prices in the U.S. has led to talk of another housing bubble like the one that helped trigger the financial crisis a little more than a decade ago,” said Newsmax in a report this evening. As an aside, Newsmax says they’ve had some two million downloads of their ap in the wake of what conservatives feel is the ‘betrayal’ of President Trump by Fox News. Fox tumbled into third behind MSNBC and CNN.

That noted, back to Newsmax’s housing report today, the Case-Shiller National Home Price index has gained over 6% per year on average since January 2012. Meanwhile net rental income barely kept up with inflation, increasing just less than 2% per year.

“The result of that combination is that home prices seem as overvalued as they were in the spring of 2005, nine months before the peak.

One way to measure home valuations is with a cyclically adjusted price to earnings (CAPE) ratio developed by Yale University professor and Nobel Laureate Robert Shiller for stocks.(2) The concept can be applied to a broad swath of assets by dividing the current price of an asset by the average annual inflation-adjusted earnings(3) over the prior 10 years. The chart below shows CAPE for U.S. home prices and the S&P 500 Index since 1996.(4)

Stock valuations soared in the late 1990s, only to crash from 2000 – 2002, tread water for six years, then tumble again in 2008. Home valuations ignored the 2000 equity crash, but shared the 2008 crash. Since then the two have increased roughly in line, but with home prices starting from a higher level. As a result, equity valuations are still well below peak values, but home prices are approaching the historic highs.

Much of the focus on the housing market lately has centered on the short-term environment, with the low inventory of homes cited for rising prices and a jump in rental vacancy rates driving rents lower. But if the concern is the possibility of major economic disruption—rather than just whether houses are good investments at current prices— the focus should be on long-term macroeconomics. Sure, real estate prices always drift up or down, and differ by location and type of home. A bubble in housing requires widespread overvaluation over years, which is what we have witnessed.

Home valuations are worrisome, but for different reasons than 2006. One minor point of comfort is the run-up from 1996 – 2006 displayed a classic bubble pattern of accelerating price increases near the peak. The increase in valuations since 2012 has been linear, with no sign of steepening…” The balance of their report with graphics is linked here.

Additional Information, plus MHProNews Analysis and Commentary

The environment in the housing market is well poised for serious growth of manufactured housing.

But the powers that be are apparently keeping their foot on the breaks instead of tapping the useful laws that would grow the industry in a serious way.

Beyond short term profits and the steady consolidation of the industry, the potential for making money on rental housing is another reason why they may be making some of the decisions that they have.

Watch for an upcoming report on a topic that relates to these issues which also impacts the nation.

Until then, check out the recent and related reports.

Related, Recent, and Read Hot Reports

VP Joe Biden’s Pledges vs. Behavior, What the Biden-Harris Team Said and Does Pre- and Post-Election

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

Fall 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.