Mr. Rishel attended the June 2 Manufactured Housing Roundtable in Elkhart, Indiana regarding FHA Title I and Title II lending. It was a national

Mr. Rishel attended the June 2 Manufactured Housing Roundtable in Elkhart, Indiana regarding FHA Title I and Title II lending. It was a national

meeting hosted by Congressman Joe Donnelly from Indiana, MHI, and MHARR.

Every affected government agency was represented by their top people.

Attendees also included the top people from national industry lenders, the

owners of various manufacturers, industry consultants, and major community

owners Mr. Rishel will cover this meeting in his upcoming June newsletter.

Below, you will find the letter he wrote to Congressman Donnelly as a

result of this meeting.

submittd by Juline Anderson at CaptiveFinance.net

The Hon Joe Donnelly

207 West Colfax Avenue

South Bend, IN 46601

Dear Mr. Donnelly:

I first want to thank you for the time and attention you have given to the issues of the manufactured housing industry and for the time you put into the meeting at Elkhart, Indiana on Wednesday, June, 2nd. As I’m sure you gathered from the attendance, while this issue is important to your constituents and the area you represent, it is also of national importance. You are to be commended for your leadership role in addressing both the issues of government assisted financing of manufactured homes and the unintended consequences coming from the mandates of the SAFE Act.

As a longtime member of the manufactured housing industry who will not directly benefit from any positive efforts coming out of FHA financing, I still feel the importance of industry access to this type of financing, As a result. I am writing to share my view on what came out of the meeting in Elkhart, and how your role will be critical in achieving results favorable to your district and the entire nation.

I came away from that meeting with the feeling that the critical agencies represented were there because they had little choice and they were hostile to engaging their agencies in chattel (personal property) finance. I believe their reasons are as follows:

- The histories of chattel finance of manufactured homes are replete with failures and losses.

- While they are loath to admit it, they lack the experience and knowledge to correct the problem.

- Like any government agency at the state or federal level change is difficult, especially if it requires taking direction or assistance from the private sector.

I surmise it is easier for them to resist their duty to serve by subversion partly because they have convinced themselves that it isn’t possible to successfully make chattel loans on manufactured homes and not lose money. If this assessment is correct, their attitudes will condemn Title I to failure before it has an opportunity to succeed.

It was mentioned numerous times that the specialty lenders have attempted to share their data on loan portfolio performances with these agencies without much success. If they actually analyzed the data, the truth would soon become apparent to them and I believe they have minimized this data as a way of continuing in their beliefs rather than face the truth of their inadequacies.

Here are some truths about manufactured housing chattel finance:

- At least three times in the history of the industry, greed coupled with incompetence has led to spectacular meltdowns and failures of manufactured home chattel loan portfolios.

- Banks and Credit Unions are very wary of chattel loans for manufactured homes partly because they lack experience and expertise and partly because their regulators discourage such lending because so many institutions have lost money making these loans.

Yet,

- I, and the companies I own or represent, have never lost money making chattel loans on manufactured homes. None of our investors have ever lost a penny either. We have helped banks, credit unions, and insurance companies build some of their most profitable portfolios, as well as pension funds and thousands of private investors.

- Triad Financial Services, represented by Don Glisson Jr. at the meeting in Elkhart is a 50-year-old company that until about 12 years ago made only chattel loans on manufactured homes has had a stellar history of loan portfolio performance. (They now also do mortgage loans for manufactured homes and own a subsidiary company approved to do Title I and II.)

- Warren Buffet bought Clayton Homes in order to acquire their finance arms that were engaged in manufactured home finance.

- Jim Clayton utilized a considerable part of the funds he received from Warren Buffet to start a bank that is very active in manufactured home finance on a national basis.

- There is over five billion dollars in chattel loans currently that are being made through captive finance organizations funded by the owners of manufactured housing communities and retailers. The people that sell these homes are, in effect, putting their money where their mouth is. Two organizations, Precision Capital Funding and Origen/ManageAmerica are helping them do it (our method is very hands on while theirs is through purveying documents and software) and while I cannot speak for the second organization, I believe they, like Precision have extensive records on performance that would put the older federal histories to shame.

What is the cause of this disparate performance history? To understand means one has to accept the premise that loaning money for chattel loans on manufactured homes is a very specialized area of lending that requires special knowledge and expertise to do it successfully. This knowledge starts with setting up a system that has sufficient safeguards to eliminate dishonesty that is more than just a paper solution.

An industry specific credit matrix is also critical. There are reasons beyond just the four Cs of credit that affect loan performance that are unique to chattel lending on manufactured homes that must be taken into account when considering a loan, and I believe these are totally unknown or undervalued by most organizations when they begin to make these loans.

Because of the nature of the typical borrower, servicing properly must be different than servicing for a typical site built home. Proper servicing can lower nonperformance rates dramatically.

The replevins process also needs to be industry specific because the approach to the process can critically affect both the costs of replevins and the performance of the collateral. The current process in FHA rule is typical but is myopic and costly.

Collateral performance is critical to the whole of the transaction. The lower the cost of cleaning and refurbishing the better for the portfolio. The higher the dollars recovered the better the portfolio performs. It is a given there will be repossessions, but it is not a given that repossessions mean overall losses.

There was some offering of industry financial participation in loss prevention from several of the attendees that basically went unheeded by the government agencies. I would consider this a critical component to the success of any loan program for several reasons.

I believe these agencies will need legislative pressure or mandates in order to take this issue seriously. If they started thinking how they could make chattel finance for manufactured homes work instead of thinking, “it can’t work”, that would be a start, and this is something you can accomplish if you feel it is appropriate.

I would further suggest they recognize the people and organizations within our industry that could provide them with invaluable expertise and information in all of the key areas discussed in this letter. My suggestion would be to work through MHIwith the goal of getting Don Glisson Jr. of Triad Financial Services to head whatever effort should be made.

Through my work as the former Chairman of the Illinois Manufactured Home Quality Assurance Board and other governmental associations, I recognize the difficulty of any government agency implementing rules, policies, and procedures that originate from outside the agency itself. Perhaps an advisory board could be created consisting of industry lenders and consultants that were properly vetted and authorized to recommend policy and procedures that would assure the success of a chattel lending program, as well as supply historical performance data that could and should be utilized in formulating appropriate loan policies and mathematically modeled credit matrixes that actually work. In addition, that data would allow a proper reserve fund to be created to absorb any shortfalls as a result of non-performing loans to help assure no loss of taxpayer monies.

Should you want or need further information from me, I stand ready to assist you in any reasonable way I can. Again, I want to thank you for your attention to the manufactured housing industry and the people affected by your assistance. Please be assured that I will in the June issue of The Chattel Finance Newsletter, inform my 9,000 plus readers of your positive assistance to our industry both on the finance issue and in regard to the SAFE Act, giving you the credit you deserve for your efforts.

Respectfully submitted,

Kenneth Rishel

Kenneth Rishel

Precision Capital Funding

Publisher of The Chattel Finance Newsletter

(217) 971-3968

kennethrishel@captivefinance.net

For more information on this important issue:

FHFA Proposes Rule on Fannie Mae and Freddie Mac Requirements for Underserved Markets

Summit Meeting Addresses Industry Finance Issues

Stage Set for Action on Title I Moratorium

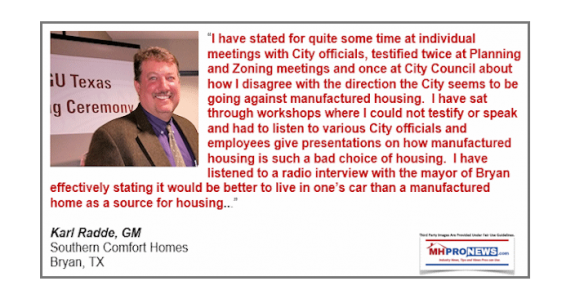

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …