Tony,

I've been delighted with the self-financing articles and feedback you have gotten on the subject. I've never doubted self-finance can be done properly, but that said, I don't think most can or will do it properly. Instead I believed the industry would often take the course many are revealing in your discussions; non-compliance, "I'll take my chances."

Interesting, but hardly surprising.

As I've written in the past, the various recent lending laws, federal and state, will and are having a demonstrable effect on the industry, likely to put the finishing touches on what little remains of the industry, reducing it even further.

Does this mean total death? Oh, I doubt that. Remember companies still sell buggy whips, not many, but they are still sold. As long as the industry continues to put people in homes who are not good at putting themselves in homes, a segment will remain. As will homes going on to owned land by those who trotted down to their friendly Hometown Bank, sat with their hard working banker and earned a loan for a HUD going onto their land.

Not many homes you say? Well, yes I agree with that. But some will still sell. Captive Finance will do some, but risky, unprotected self-financing will sell most homes. Is it illegal to speed? Yes, if you get caught. Obviously the same holds true for non-compliant lending.

There are few if any reports of originators of non-compliant loans being called to the gallows, or of loans declared invalid, (big deal in an industry with innumerable invalid loans), but, and this is the big one, still few if any reports of fines and crowbar motel residency. I suspect until the crowbar alternative becomes far more common, as with your various admitters, non-compliance will grow and perhaps even prosper. This leaves open whether in 1935 Berlin, oops, 2013 America, the Gestapo/NSA is checking the papers, or like Sgt Schultz, will see nothing. So far, they see nothing.

I have no doubt many of these offensive laws were carefully crafted to include MH, which leaves the futility of trying to change these laws to not include us as somewhat pathetic, but as an industry we still seek the get-out-of-jail card, which is in the deck right beside Marvin Place. These are both hard to get, kiddes.

So's, we's takes our chances, the "buyer" gets his desired home, the retailer/park owner gets a down-payment, resident, a stream of income and everyone lives happily after, until "innocent buyer" defaults and Illegal Aid gets involved, and reports the non-compliance to the massive Inadequate Buyer Protective Society. Then, the soggy brown stuff could hit the fan with the strong arm of The Man going full force against TrailerBoy. Ouch!

Can or will that happen? Well, yes it can, but will it? My 40 year experience with destructive retailer fraud on buyers was that it was little noticed by the authorities, it had to be BIG.

It remains to be seen whether we now will be dealing with Col. Klink or Buford T. Justice on non-compliance with this panoply of laws. For the sake of the MH self-admitted "misdirected," lets hope Klinky is still doing reruns and too busy to notice the industry's escape attempts.

But if it turns out these Alphabet Laws are actually enforced by Henrich Himmler's heirs, I'm not sure it is wise to be "non-compliant." Sometimes you have to admit the cards dealt are a very bad hand. It seems that way for MH and the spate of new lending laws.

I know one park owner who simply rents the home to the buyer for three years or until early default, which ever comes first. Once the buyer demonstrates a pattern of payments, he conveys the home, takes a promissory note not secured by the home, and hasn't found a big difference over his past experience with home sale with mortgage, etc. But he sleeps well knowing he might get his azz rumpled by the borrower in this process, (so what is new?) but says at least at night he can sleep without the overhang of Att'y Gen Eric Holder visiting him for non-compliance.

Holder can bring those Philly Bad Guys from the voting place with their iron pipes to assure compliance. There is a true, Ouch! ##

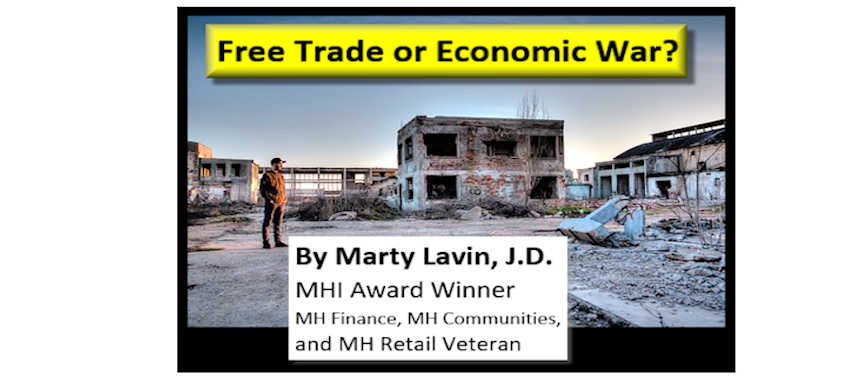

.jpg) MARTIN V. (Marty) LAVIN

MARTIN V. (Marty) LAVIN

attorney, consultant & expert witness

Practice only in factory built housing

350 Main Street Suite 100

BURLINGTON, VT 05401-3413

802-238-7777 cell 802-660-8888 office

“Forget what people are saying, especially politicians. Instead, watch what is happening.” – Marty Lavin

Editor's Note: Marty's column is in response to these keenly read, linked articles:

Publisher Tony Kovach will plan a comment on this topic on the Masthead blog, to be published later on 8.21.2013

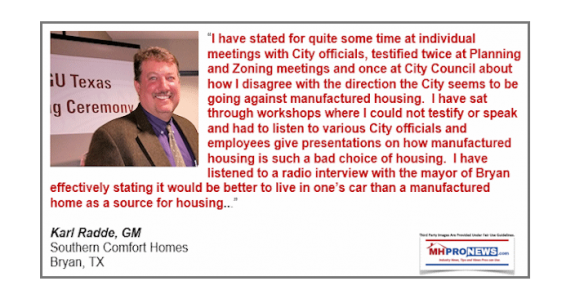

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …