TOPIC

The Duty to Serve (DTS) question for the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac regarding originating Chattel (home only, personal property) loans on HUD Code Manufactured Housing has been a topic of discussion for years.

BACKGROUND

To understand why I say what I do about DTS, the GSEs, MHI and manufactured housing (MH) below, some history will be useful. My experience with MH Affordable Housing and Duty-to-Serve spans nearly 35 years.

Upon entering the mortgage banking business, I worked in the mortgage division for Fleet Bank in St. Louis, Missouri. I made my first HUD Code MH land/home loan back in 1982.

At that time, HUD Regional Offices had to approve each subdivision and the homes that were being constructed within that community. HUD reviewed, approved and retained documentation and complete control of the Architectural & Engineering process.

The Regional HUD Office was located in St. Louis and Chaired by Joy Miller. Fleet was chosen by HUD because of its strong government lending (FHA & VA) platform, national presence with the ability to replicate the program. Fleet provided financing for the consumer’s purchasing HUD Code, single-sectional and multi-sectional, Redman Homes on short wall foundations in a subdivision in House Springs, Missouri. This was a new MH “beta test” community development project. It was one of the first HUD Code MH subdivisions outside of California. It was cutting edge and an exciting step for me right out of college.

At the time, I had no idea that my future in banking would be focused around Affordable Housing. From that point forward, I continued down the path of Affordable Housing which is truly a key for the to Duty-to-Serve.

In my follow-up assignment, I worked extensively at Ft. Leonard Wood, Missouri making over 600 VA loans in two years to accommodate relocating veterans and civil service personnel in the initial phases of the US Military Base Realignment and Closure (BRAC) program. Specifically, on the Ft. Belvoir, Virginia relocation of 2400 families to Ft. Leonard Wood over six years. Brick & mortar site built homes were selling for $35,000-$65,000.

Next stop was in 1995 when I was invited to join an exclusive group of high profile mortgage bankers who focused on Affordable Housing nationally. I had no idea when I was chosen that I was chosen for my HUD Code MH housing experience. The group of 30 members from around the country formed the Underwriting Barriers Outreach Group (UnBOG), lead by Rick Coffman and Matt Miller of Freddie Mac in Washington, DC.

The task force was formed to bring mortgage bankers together to discuss how to create loan programs to provide financing for the underserved, economically or geographically challenged consumers. These borrowers were credit worthy, but did not have down payment of 10% or 20% plus closing costs. Or they could not meet the debt-to-income ratios of 28/36. They needed expanded guideline programs. As a member of that task force, I helped craft the 97% LTV Alt-A, Section 8 Voucher-to-Own, Lease-Purchase and the 105% LTV loan programs.

During that time period, our government leaders on Capitol Hill put mandates on the GSE’s to produce and deliver Affordable Housing programs to the marketplace. The new mandates were tremendously difficult to meet. They were tied to creating and driving home ownership in the United States. The new mandates required that 1 out of every 2 mortgages purchased by Fannie Mae or Freddie Mac had to meet strict affordable underwriting criteria to be considered affordable.

The reason for the formation of the UnBOG group and the push to new loan programs as outlined above to expand homeownership, thus simultaneously answering the DTS mandate at the same time. It was from the UnBOG platform I learned how to write loan programs and how they were developed to serve a diverse and unique new classification of purchasers referred to in those days as “low-mod” borrowers.

In essence, our leaders on Capitol Hill were enforcing the Duty-to-Serve component which had been the focus of the creation of Fannie Mae and Freddie Mac from their inception. Nothing new, just a way to measure and enforce the GSE’s mission of Duty-to-Serve and expand homeownership.

FAST FORWARD

My invitation to UnBOG was to provide insight into the Manufactured Housing space. Specifically, how to create and deliver the MH product from construction loan through permanent end out loan on a product built in an off-site factory versus the traditional on-site method.

By this time, I had already successfully been making construction-to-perm loans on MH for 13 years. The GSE’s felt that a look into the MH industry, what I was doing and how I was doing it, could help them achieve these lofty Duty-to-Serve Affordable Housing goals now being enforced from Capitol Hill.

This point is that Duty-to-Serve is nothing new. It truly is the reason Fannie and Freddie were created.

For the first couple of years, we focused on Fee Simple loans known in the industry as Land/Home loans. Many of the programs coming through the development pipeline at the GSE’s were inclusive of MH Land/Home financing. Land/Home was sort of a no brainer, but subject to several gaps that needed to be closed with regard to title insurance, retiring titles, mortgage insurance, production and travel insurance, method of attachment and the creation of a true real property package upon completion and conversation to the permanent-end-out mortgage. Those topics we can save for another article.

In 1998, while working for First Tennessee Banks mortgage banking division, which would later become First Horizon Mortgage, I received a call from Freddie Mac asking me if I was interested in working on a new loan program crafted by a captain of the MH land lease community at MHI, a gentleman named Rick Rand. Rick had worked with program development guru Ginger Walters and Freddie Mac attorney Judith Agard to craft a program to serve as the Chattel Loan look-a-like.

The program was designed around a 35-year land lease, which created the real property entity necessary and required by the GSE’s to make a 30 year fixed rate loans on MH HUD Coded homes sited in MHC’s.

It was a brilliant piece of work by all parties, but there wasn’t anyone in the mortgage or banking space interested in the $300MM beta test “pilot program” that 99.99% of bankers had no clue about. It just so happened that I had extensive leasehold estate background from years gone by.

So when I received the call from Rick Coffman from Freddie Mac, my UnBOG colleague, I understood the program immediately.

Needless to saym it was exactly what the GSE’s needed to kill two birds with one stone. First and foremost, it met the Affordable Housing criteria right out of the box for Community Reinvestment Act (CRA) credit. Which meant it could be counted towards the GSE’s requirement to expand homeownership. Second, it answered the DTS question that had been long on the lips of all MHI leaders, pushing for rates and terms more readily associated with brick & mortar housing.

For me, it was just another niche market program that I was going to have to run up the flagpole with my boss, his boss, his boss and so on until I got to the banks president who just happened to understand the program.

Why, you ask did the president of a large bank like First Tennessee get it?

Well, because it just so happened our largest client on the books at the bank was this fellow name Jim Clayton, and his company was called Clayton Homes. You know – the gent who sold his manufacturing, retailing and MHC communities to the “Oracle of Omaha”, aka Warren Buffet.

There was a program which we launch at First Horizon where we worked out the kinks in origination, processing, underwriting, closing, funding and servicing and – oh, yes – securitization too. Because Fannie and Freddie had their securitization platforms built out years before this “real property” leasehold estate program arrived on the scene.

By the way…pricing was about a ½% above the then 30 year fixed rate pricing.

The program was strong and grew legs. We even added a One-Time-Close (OTC) Construction Loan to the menu as First Horizon was developing Construction-To-Permanent (CTP) and OTC loans at that time.

We then moved it to First Bank where it died on the vine, as it became tainted by those who thought we could utilize this program the same way the other Chattel programs were being used in the marketplace in that GreenSeco era of “No Income, No Asset, No Job, No Money,” no problem loans. The GSEs wanted none of the headaches that came from the mindset that spawned GreenTree, Conseco and the other related chattel lending meltdowns of the late 1990s, and the early 2000s.

WHAT’S THE POINT?

For years MHI has been attacking the DTS issue in hopes of pushing through some sort of chattel lending conduit for as long as I can remember. The Duty to Serve has been on the books since the inception of both GSEs.

The DTS guideline for both GSEs – Fannie Mae and Freddie Mac – in their view is clearly stated to be for real estate secured properties. Chattel loans by definition are not real estate, and most folks in the MH world don’t understand the cost to build the securitization process.

The roots of the issue from the GSE vantage point are several key components.

First, understand that neither of the GSEs have the platform to securitize and deliver chattel product into the market place. There is already a pipeline to buy/deliver loans on conventional housing, but there is nothing like that for the personal property lending space that manufactured housing operates in.

If the GSEs were to spend the millions and millions of dollars to build that secondary market, there was in the past insufficient product flow to support the expense.

Another prime example is that the major purchasers of GSE securities paper are not interested in buying chattel (home only, personal property) loan production.

Those investors, such as Goldman, BlackRock and Raymond James among a host of other institutional buyers of mortgage paper do not have a DTS requirement. They are a behind-the -scenes cause for the “Just say No” by the GSEs on MH chattle lending, not the GSE’s themselves.

The GSEs only buy what they can securitize and layoff out their back door to their institutional buyers. If the institutional players don’t want the paper, who else is there to purchase those MH chattel loans in volume?

It is MHI’s lack of understanding of the function the GSEs have in providing paper to their core secondary lenders, such as Wells Fargo, Bank of America (BOA) and U.S. Bank.

What causes a great part of this problem is the MH industry’s failure to create a program that delivers a standardized product. For example, when the GSE’s buy a loan from Wells or BOA, the home created is attached to the land through a standardized “method of attachment.” That’s commonly called a “foundation.”

The house is built for a slab or a stem wall foundation that attaches a given residence to the dirt creating a single package of “real estate.” Home, foundation (which again is standardized) are connected to the land, thus creating a single package of real property. That standardization allows the title insurance companies and private mortgage insurance companies to stand behind those loan products too.

Chattel loans on manufactured homes are seen by the GSEs as a hodgepodge of various foundation systems. Mock block in their view is nothing more than a faux exterior wall that doesn’t attach the home to the ground. They see MH as concrete blocks on plastic pads, tied down with cork screw anchors, metal straps and then commonly enclosed by using vinyl skirting.

In the eyes of the folks that buy all the securities from the GSEs, those aren’t true foundations, they don’t believe they’ll stand the test of time, i.e. the 30-year term of a mortgage. Thus, the home – and loan – in their view won’t perform.

This is in spite of the fact that there are thousands upon thousands of successful examples of manufactured homes that have stood the test of time on these foundations.

In a phrase, this is a perceptual issue that calls for insights and education.

But have you ever sat across the table from six “black box” investment bankers and actuaries from Goldman Sachs or Pieper Jaffery and tried to explain to PhD. so-and-so from Harvard, and Phd. so and so from MIT or Yale and argue such topics? Doubtful. But I have. And I must tell you it is exhausting and has often seemed to be wasted time.

One such academic who actually had a hand in creating the securitization business called me aside halfway through one such meeting and said “Titus, let me give you a bit of information from our perspective.” “Yes, sir” I said, all ears. “If it walks like a duck, quacks like a duck guess what? It’s a duck” …meeting adjourned.

In addition to the manufactured home foundation issue – right or wrong – the security buyers still view these homes as ones that can be moved to another location in the middle of the night.

The MH industry fails time and again to realize the GSEs are a conduit to the secondary market buyers.

The GSEs create “real property” securities that are sold into the marketplace. The GSEs don’t even have to service loans. They have four major servicers behind the curtain that can service loans, if necessary, on behalf of the folks who purchase the securities.

The Triad Financial Services and Clayton/Vanderbilt Mortgage and Finance chattel models are different yet similar, as they finance chattel loans that are either held in portfolio or sold at a discount to a note rate buyer looking for yield spread.

The Clayton/VMF model is successful because Mr. Buffet has deep pockets and likes the yield spread. Not to mention Jim Clayton had the brains and financial support to create it. And at their company owned retail centers, VMF only finances paper from Clayton dealers. Plus, Mr. Buffet owns Clayton manufacturing and many of its suppliers as well as its dealer base. He is thus able to finance low credit with higher down payments or he can finance 5% down for consumers with truly good credit scores.

Triad focuses on AAA grade paper from reputable dealers that have a strong track record with Triad’s independent MH retail base. They portfolio and service their loans in house. Don Glisson, Jr. and his team have done a terrific job of navigating the chattel waters for over 30 – sometimes tumultuous – years. Triad’s book of business is the testimony to Don’s success.

If the MH Chattel industry would produce a standardized product model, with a more traditional method of attachment, and pushed the model without deviation through a beta channel and proved that compliance, not circumvention is the new MH mantra, then they would have a secondary market delivery strategy.

Armed with such data, you can then approach the investment banking crowd with proof of your models success. But instead, every time there is a lack of lenders or funding in the MH market, MHI cycles back to the GSE’s and DTS.

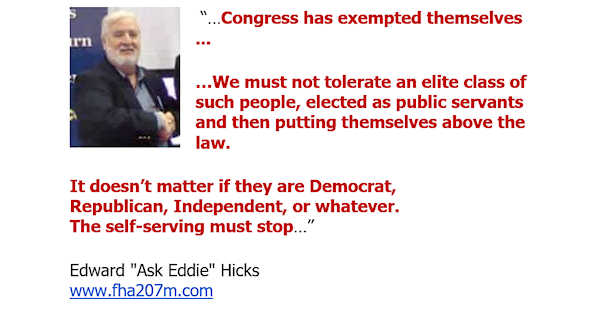

But there are powers that be in the good ole boy MH world who won’t learn and/or capitulate to those realities. As was noted in the Masthead blog linked here, the GSEs – as well as FHFA and most importantly our U.S. Congress – will not budge on this issue.

By the way, some of those House and Senate members will upon retirement want to go to work for the GSEs, or with the institutional actors such as Goldman Sachs or BlackRock. So they aren’t going to do much if anything in defense of chattel lending if it causes heartburn for those they may go to work for later in life.

The answer…is easy…follow in the footsteps of Jim Clayton, Don Glisson, Jr., and Warren Buffet and create a standardized program that delivers a product that can stand the test of time and contain the 4 S’s: Safe, Sound, Sanitary and Sustainable.

But the MH industry, year after year after year, fails to produce anything that the true secondary market is likely to hang their hats on. ##

Titus Dare

Titus Dare

Senior Vice-President

EagleOne Financial, Inc.

Editor’s Note: Other well reasoned letters to the edtior Op-Ed style viewpoints are encouraged on this or other MH topics.

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …