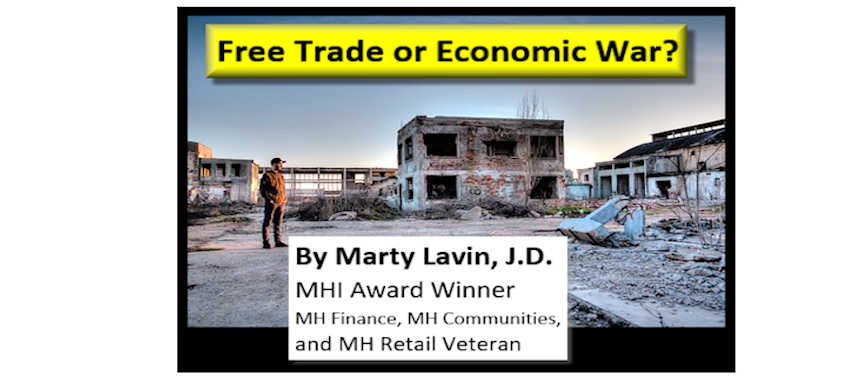

I’m exhausted, Jerry, exhausted I tell you. “Exhausted, Marty Boy, why?” Well there are many reasons, and in trying to sort it all out, I’ve exhausted my feeble brain.

I speak of course about the state of the industry. It starts with L. A. ”Tony” K, the MHProNews impresario, whose boundless industry enthusiasm doesn’t quit. Now all this, mind you, as we scrape along on an annual shipments level which in the past we equaled and surpassed in a single month.

Getting your head around that enthusiasm is hard to sort out. So many reasons why MH should be great but woeful results, that’s what is exhausting me.

Story Time

Let me tell you a little story. Sometime along the mid 2000’s, say 2006 or 2007, I was invited to join Urban Land Institute, ULI, a well-known and respected real estate trade association/think tank. It is populated by some of the largest and most powerful real estate interests, a pretty awesome “who’s who” of the Big Boys in real estate.

Inside Trailerville then were people who had come to our industry from the real estate industry and thought manufactured housing communities was a land use that should be represented at ULI. An MH council was formed and I was invited, along with 30+ others, to join and was frankly flattered to accept. ULI has a great reputation.

I started going to the ULI meetings and the MH luminaries were everywhere in the council. My consulting assignment at Fannie Mae at the time profited from my attendance as I was at the industry’s train of thought at the highest level. All good, right?

First Class

Now, understand something, ULI is not MHI or MHARR. ULI goes first class only, no Motel 6’s here. They meet at the very highest level venues, read this to mean “Expensive,” and invite powerful and well-known guests and speakers. Contrasting this with the MH world is eye-popping. If one spends an average of $1,000-$1,500 to attend an MHI convention, ULI seems to come in at $4,000-$6,000 per conference, a not inconsiderable sum for poor boys like me who peeled those dollars out of my own back pocket to attend.

I don’t really mention the cost of attending an MHARR meeting, as long distance phone rates are so low that the occasional MHARR meeting takes little time and virtually no expense. Networking is not really what MHARR is all about.

Lacking Candor

Back to ULI. I found most of the early meetings of the MH council, or whatever its name, a poor version of MHI meetings. While the intent was to foster an exchange of ideas and information from the very highest level of MHdom, the Big Boys were there, but they were all wearing vests so they could keep thoughts and information close to their vests. Even when we were to break for lunch seemed to be a secret. The lack of candid response from participants, who seemed to be going through the motions, disappointed me.

Here we had the greatest minds in MH, but I could gain better industry knowledge and information from the third string attendees from the same companies at an MHI meeting, at 1/3rd to 1/4th the price. I was beginning to waiver about my continued involvement in ULI.

Excited

Then, a ULI conference was announced, where the MH council was to feature a housing study by a prominent economist whose expertise was in housing demand. Whoa! Here’s something I could get my head around. Maybe after the study was presented I could relearn the words to “Happy Days Are Here Again” which in ’06 or ’07 I hadn’t sung since that 1998 post-HUDcode record of 373,000 home shipments. The best industry performance since the 1973 573,000 homes shipped, which had occurred when I was a young man and before the HUDcode.

The economist came, the lights went out, and the demand charts started to flow. Holy craps, Robin, get that song out! It was back. So I kept following the economist’s report carefully and he said the same things then we are still saying today: low cost housing demand, high conventional housing costs, factory built quality, yada yada yada, it was all falling into place, Jerry. Music!

But despite the obvious buy-in by most participants there, their choirboy gleams revealing, I had the uneasy feeling that, just as I do today, of an unfinished report.

Finally, biding my time, as I was as insignificant a participant as there was there, I screwed up my courage and asked the following: Yes, of course, I understand the demand side of the MH equation, but can you tell me, Mr. Eminent Economist, how your exuberant MH sales expectations will be financed?

What?

Huh? He was a housing demand expert. not a finance guru. He hadn’t the slightest idea as to how it would be done. Note that as you hear all the reasons today why MH should be kicking housing azz, that question remains unanswered for the most part.

I could see narrowed eyes around the room directed at me, the thought clear on its face; how dare you, you F’ing Azzhole, challenge Mr. Eminence? He just returned from Mt. Sinai with this report! I though it a fair question to ask, just as I do today.

In 1972 I came into the industry. By the time of the ULI economist meeting I had been kicked around HUDville 35 years. Even with my extraordinarily thick cranium, some knowledge had managed to creep in. By the early 2000’s I had seriously begun to question whether the 1998 shipments top and heavy decline thereafter was a “normal pullback” as had happened frequently in the past. Ah, it will all be back soon was the industry refrain. If I believed that early on, by 2002 there were clear signs to me this time was different, very different.

Not This Time

Working against the industry grain, my study of MH loan performance, the horrific losses suffered by lenders and their investors, got me to thinking the industry had real, long-term problems, from which recovery would be difficult, at best. Did I envision a drop to 50,000 annual HUD shipments? No, I was not born in swaddling clothes.

Further, and this was hard to grasp and accept, since the industry’s real volume emergence in 1969 to the 1998 top, the great volume the industry enjoyed was based on faulty lending losses by most lenders during that period, averaging close to 250,000 annual shipments. I then did the presumptive math on what volume might be with a rigid, but survivable lending regimen, and the numbers were scary low. Not as low as they got, but low.

If you don’t understand the preceding paragraph, read no further until you do. Every time you hear of glowing future prospects for HUD Code homes ask the predictor “How will they be financed?”

Huge industry volume subsidized by huge lender losses. It was an illusion, and it went on so long we all believed it would always continue. When I wrote about this early on in my Newsletter, “Marty’s News and Notes,” I can say the concept was neither generally accepted nor was my writing and lecturing about it well received. Let’s just say I was not the industry’s Favorite Son.

The Book

Fast forward to the present. I just plowed though “Dueling Curves; The Battle for Housing” by Bob Vahsholtz. This is a prodigious work, with the slant from a man well familiar with much of the industry’s early years and a home designer with great home building knowledge. His book is worth reading for the history lesson and for his ideas for reviving the industry going against the site builders.

I sought the answer from his book to my “How will it be financed?” and found in his multiple step program to improve the industry the following on finance:

“Accept the penalty of chattel financing or leasing and use it to include such necessities as skirting and exterior storage. Repos should result only from family disasters and crooks. Even better financing – even from local small-town banks – will come with a proven track record. Good affordable homes need no subsidies. Earn a solid reputation from performance rather than waiting for the government to enforce its arguable notions of engineering and financing.”

Very little to argue with there, but will that guide us back to 150,000 to 250,000 HUDcode homes? Annually? I wouldn’t hold my breath.

Phewff

Exhausted, Jerry, exhausted, I say, that questions just exhausts me.

Let’s be clear here, whether I was writing my newsletter, on my consulting assignments, at ULI or MHI, reading Vahsholtz’s book, or discussions with L. A. ”Tony” K and others, THE question which must be answered is to find a way to finance the demand for our housing, at a 150,000 to 250,000 annual sales level. The present sales level just won’t create a stable, growing industry.

So what is it that causes such low sales volume with such high demand? It is because a great part of our demand comes from a tier of people whose credit capabilities make them unfinanciable. Yah, Marty, no big secret there. And when we can finance some of our demand, it comes with a high tariff, an interest rate generally applied by Guido in his transactions These rates, often more than twice and even three times the present rate for site-builds, are needed to ameliorate our high default rates and high losses on defaults.

How?

Let’s deal with the most important reason for this missive; how does MH create demand that has a greater chance of being financed, assuming stupid lending money is not stage left, waiting to enter? How, indeed?

Sometime in the mid 2000’s, the industry commissioned a market study by Roper Associates to ascertain the public’s view of MH. Let me cut through the bull pucks, they reported they had never compiled a study where the industry had such a negative public perception. Oh, man, we finally were the best at something!

A lengthy industry discussion set in, mostly at MHI, meeting after meeting, innumerable committees, and finally a joint meeting with the RV boys to discuss the merit and results of their “Go RVing” campaign. The RV’ers were exuberant about their campaign and urged us in the strongest terms to do our own campaign.

The RV industry had a different problem than MH, just the opposite. Their customer demand came from buyers with good credit, they just weren’t seeing enough of them. On the other hand at MH, we see many customers, enough to fuel many more sales, we just don’t see enough customers with sufficient credit capability. We needed to find a way to get more credit capable people tromping our sales locations. The intent of the Roper study and the follow-up presentation was to lead to a campaign to induce more credit capable buyers to our stores. You know, a campaign to boast the image of the industry and consumer acceptance through increased positive knowledge.

Embarrassment

So meeting after meeting, discussions aplenty, and finally two outcomes, one embarrassing the other catastrophic. The first result was the campaign presentation meeting should have climaxed in a buy-in to move forward with the pros.

The initial presentation was hardly a finished campaign, but the MH Yahoos raised such a ruckus about their vision of what the campaign should be, that it turned into a bitching session of the first water. I saw MOBES who can’t spell “campaign” reaming the pros, turning into a bewildering babble of conflicting ideas. I found that in their other job, sales lot operators and LLC managers, carried out image campaigns, professing to know more than the pros, howling with authoritative criticism. The pros didn’t know MH. They, on the other hand, are the folks who brought you the 40-50,000 annual sales volume, so yes, they know MH.

I met one of the leaders of the campaign presentation after the meeting and he could only shake his head. Yes, not everything they had ever done for others went smoothly, but this was a different order of foolishness. He wondered why they had been hired, as the industry appear to have all the answers. Why, indeed?

Worse

But bad as that was, and yes I was embarrassed to see all of the negative comments I had heard about the industry from outsiders played out before me, the following was worse.

I don’t think I spill any secrets saying a small coterie of individuals run the industry associations. A cocked eyebrow from one of these Brahmins effectively ends any discussion. So the industry opportunity at salvation, already fleeting as all this occurred, tumbled completely due to the well-engrained industry principle, “never do anything that might help a competitor.” And the industry moment when there was still barely enough $$$ muscle to fund an image campaign passed, and with it the last of the passing life rafts.

Succinctly stated, so no one misses my meaning: The industry must find a way to attract a far more capable buyer to our sales locations, or what you presently see is what is likely to prevail. Chances are the image campaign train has left the station and another does not follow close behind.

Bear in mind that some people are prospering under the present scenario. Not too many, but a few, especially those with eyebrow power. Reduction of competition can be salubrious, even if it only consists of a larger portion of a smaller industry. I can only assume as the image campaign was eye browed down, people would know that, or at least suspect it.

No Mojo

So we now find ourselves as an industry with insufficient muscle to fire up any sort of campaign. Some have wondered whether social media or other Internet driven endeavors might substitute for the traditional media campaign we can no longer fuel as an industry, being a real block buster campaign driven by a $20-30 million effort, one that can successfully reach a broad segment of American consumers and educate them about the many advantages we claim for our housing, to attract those folks we so sorely need. Whether the vaunted Internet driven efforts can succeed, I have no knowledge, but I’ve seen no evidence it is being much attempted or positive residue therefrom.

Phone Call

Would it be that in 5 years someone calls me and says “Yah nana nana, you F’ing jerk. See I told you the ad hoc campaigns could work.” I’m not staying up nights in fear.

The years go by, the same silly things are repeated endlessly, about industry promise, the quality of the homes, the future of all homes to be factory built, the far lower cost, and on and on. All great stuff of course, but how do you sustainably finance 150,000-250,000 HUD homes annually? On that, which is the number one issue, the industry is remarkably silent. ##

MARTIN V. (MARTY) LAVIN

MARTIN V. (MARTY) LAVIN

attorney, consultant, & expert witness

350 Main Street Suite 100

BURLINGTON, VERMONT 05401

802-660-8888 office / 802-238-7777 cell

marty@martylavin.com

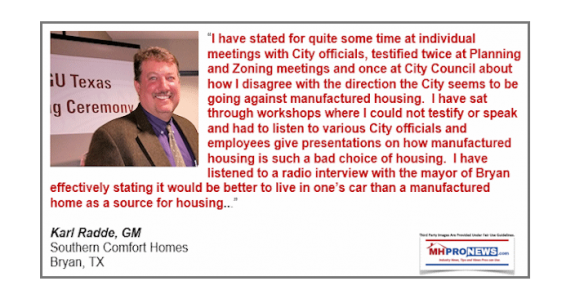

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …