The below news release from the House Financial Services Committee should be of interest to you… please read it carefully.

The below news release from the House Financial Services Committee should be of interest to you… please read it carefully.

It is worth noting that while the federal government has been spending billions of dollars on failed programs such as these, the one HUD program that helps put lower and moderate income consumers (i.e., manufactured home buyers) into new homes that they can actually afford — the FHA Title I manufactured housing program — is subject to unreasonable and unnecessary restrictions that effectively limit it to only one financing provider and a minimal number of loans (1,834 loans during the fiscal year 2010)

It is a shame the way public/private consumer financing issue has been mishandled in Washington, D.C. At a time when all decision-makers in the nation’s capital are doing their best to help lower and moderate-income American homebuyers, the unavailability of HUD Code financing, a key post-production issue, is not even on their radar screen.

Manufactured Housing Association for Regulatory Reform

1331 Pennsylvania Ave N.W., Suite 508

Washington, D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: mharrdg@aol.com

For Immediate Release | Contact: 202-226-0471

February 24, 2011

Committee Will Markup Bills to Terminate Failed Programs

WASHINGTON: Financial Services Committee Chairman Spencer Bachus announced a subcommittee hearing and full committee markup of four bills that will terminate failed and ineffective housing foreclosure programs.

The four proposals – which terminate the troubled Home Affordable Modification Program (HAMP), the Neighborhood Stabilization Program, the FHA Refinance Program, and the Emergency Homeowner Relief Fund – will be the subjects of a hearing on March 2 by the Insurance, Housing and Community Opportunity Subcommittee and a full committee markup on March 3.

In an era of record-breaking deficits, it’s time to pull the plug on these programs that are actually doing more harm than good for struggling homeowners,” said Chairman Bachus. These programs may have been well-intentioned but they’re not working and, in reality, are making things worse.”

Insurance and Housing Subcommittee Chairman Judy Biggert said: We need to break down barriers that have delayed the housing recovery, including expensive and ineffective government programs that have failed to help homeowners. Unfortunately, these programs were set up in haste, executed poorly, and have done little to restore stability in the marketplace. A government program that spends more to save a single borrower than it costs to buy a home is no help at all – it’s just a waste of taxpayer money. We need to stop funding programs that don’t work with money we don’t have.”

The Committee will consider the following bills:

The HAMP Termination Act. The Obama Administration’s signature anti-foreclosure effort, the Home Affordable Modification Program (HAMP), has failed to help a sufficient number of distressed homeowners to justify the program’s cost. According to the Administration, HAMP was supposed to help 4 million homeowners. Instead, only 521,630 loans have been permanently modified under this program and the re-default rate is high. To date, the Administration has spent approximately $840 million of the $29 billion earmarked for HAMP from the Troubled Asset Relief Program (TARP).

Far from helping at-risk homeowners, HAMP has actually made many worse off, according to a report from the Special Inspector General for the Troubled Asset Relief Program (SIGTARP):

People who apply for modifications via HAMP sometimes end up unnecessarily depleting their dwindling savings in an ultimately futile effort to obtain the sustainable relief promised by the program guidelines. Others, who may have somehow found ways to continue to make their mortgage payments, have been drawn into failed trial modifications that have left them with more principal outstanding on their loans, less home equity (or a position further ‘underwater’), and worse credit scores. Perhaps worst of all, even in circumstances where they never missed a payment, they may face back payments, penalties, and even late fees that suddenly become due on their ‘modified’ mortgages and that they are unable to pay, thus resulting in the very loss of their homes that HAMP is meant to prevent. While it may be true that many homeowners may benefit from temporarily reduced payments even though the modification ultimately fails, Treasury’s claim that ‘every single person’ who participates in HAMP gets ‘a significant benefit’ is either hopelessly out of touch…or a cynical attempt to define failure as success.”

In a separate report, the SIGTARP noted HAMP “continues to fall dramatically short of any meaningful standard of success.”

The HAMP Termination Act ends the Treasury Secretary’s authority to provide new assistance under the program but preserves assistance already offered to homeowners through HAMP prior to the bill’s enactment.

The Neighborhood Stabilization Program Termination Act. Congress has appropriated $7 billion for the Neighborhood Stabilization program, including $2 billion in the Obama Administration’s stimulus plan. Two rounds of NSP funding have already been provided to states and localities. The Neighborhood Stabilization Program Termination Act ends the program and rescinds the unobligated third round of funding of $1 billion.

Critics have argued that the NSP does not benefit at-risk homeowners facing foreclosure, and may instead create perverse incentives for banks and other lenders to foreclose on troubled borrowers – arguably worsening the housing crisis.

The FHA Refinance Program Termination Act terminates the program and rescinds unobligated funding. The price tag for this program is $8.12 billion, of which only $50 million has been disbursed thus far. For this large outlay, the taxpayers have seen minimal return on their investment. As of December 13, 2010, only 35 applications had been submitted for this program.

The Emergency Mortgage Relief Program Termination Act ends the program and rescinds unobligated funding. The Dodd-Frank Act reauthorized the long-expired Emergency Homeowners’ Relief Act of 1975 and provided $1 billion to authorize HUD to make emergency mortgage relief payments to homeowners facing foreclosure for up to 12 months, with a possible extension of another 12 months. These loans will serve to increase the amount of the borrower’s indebtedness, so a borrower who is unable to pay back either the original amount of principal or the additional loans made under the program will be worse off in the long run.

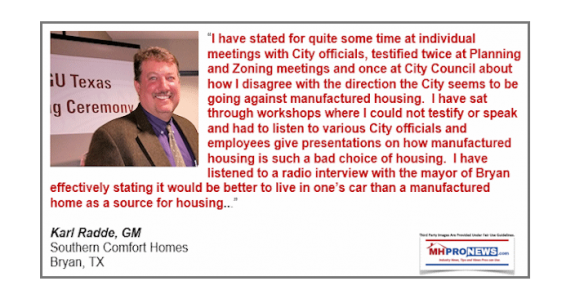

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …