Dick Ernst Discusses Duty to Serve amidst the future of Fannie and Freddie and the potential return of private financing

Reporter Eric Miller with Publisher L.A. ‘Tony’ Kovach for MHMSM.com

We continue with the interview begun last week with Dick Ernst.

MHMSM: Even for Industry pros, there can be confusion with all the terminology, agencies, etc. Do you have a simple way or suggestion to help readers keep it all straight?

ERNST: I agree with the fact that it’s confusing. We’ve seen that recently in a couple of other blogs that were published. FHA is the Federal Housing Administration and it’s been around for years. The FHFA is the conservator for Fannie Mae and Freddie Mac and it was just recently put together to act as a conservator on behalf of the government. It deals only on the mortgage side of the business with Fannie and Freddie.

MHMSM: Will the FHFA go away when the future of Fannie Mae and Freddie Mac are determined?

ERNST: That is to be determined and I would expect that it probably would. I think it’s anybody’s guess right now. I don’t believe Washington really knows what’s going to happen to Fannie and Freddie; they still have huge issues and huge problems to work through. We’ve all seen the anticipated losses that the taxpayers are going to have to eat as a result of their involvement. I think there will be some privatization of that business, but the mortgaged-backed security market has to be alive and well and thriving. I think that there will be a continuing government role in some form of providing a marketplace, and it might focus on the low- to middle- and moderate-income families and affordable housing. That might be a better spot for them to play in. But it’s still too early to tell what’s going to happen to Fannie and Freddie and what role the government is going to play going forward, and whether FHFA continues to exist.

MHMSM: Any thoughts on the GSE’s Duty to Serve and how it can be enforced? Do you think the conservatorship excuse they have given holds water legally? If not, why not?

ERNST: There is a legal question and a practical question to be asked. Legally they are under an obligation, a legislative obligation, to create programs and it’s only enforceable to the extent that Congress is willing to hold their feet to the fire and say, “Look, you guys have an obligation to provide loan products to this industry because you’re only providing less than one percent of the financing that occurs when this segment of the housing market has historically averaged about 20 percent of the new single-family housing market. So it’s woefully underserved, and we passed legislation specifically for you to address it.”

That being said, the practical side of it is, who is going to put the pressure on it. Politically it could be suicidal because of the massive losses that Fannie and Freddie are taking. They would be saying “Oh, now we want you to go into this area of business even though there are some historical facts that this may have a higher default rate than what you are comfortable with.” I don’t think there’s many Congress people, including those on the housing finance committee, that really want to tackle this head on and hold Fannie and Freddie’s feet to the fire to say, “You’ve got to offer chattel financing, you’ve got to do this and you’ve got to do that.” There may be legislation there, but we’ve seen from a legal standpoint, obligations that the federal government has legislatively that they are just unwilling to address because of the potential political problems that exist for it.

MHMSM: Do you think that will be more palatable to address after they exit conservatorship, if that’s what happens?

ERNST: I think our industry is taking the right approach. We’ve always been big supporters of Fannie and Freddie, I guess in hope that they would step up to the plate and fill that Duty to Serve, and offer more programs and opportunities for a secondary market. We’ve made it clear to both agencies and the FHFA that the industry is willing to talk about skin in the game, talk about minimum credit qualities, talk about minimum equity requirements and have a good sustainable program. I don’t know that they’ve got the stomach at this point right now to take on something new. I think they’re overwhelmed with the size of the problems they have right now. That takes up the bulk of their time.

Once they’ve exited, I think we have to keep an open mind and say, “What is their obligation, what is their duty now to the housing industry, and what’s the role and how can we work within that?” I think the industry is taking the right approach to say, “Look, we’re not going to come out and say anything negatively against the agencies in terms of whether they should exist or not exist.” We continue to be hopeful that at some point it will provide us a source. We’re certainly not going to say anything about “take ’em private and the government should get out of this business” because I think that it’s a marketplace the government has to play some role in; we just don’t know how big or how much.

MHMSM: What are some of the biggest barriers to providing chattel loan financing privately? How can the Industry move beyond some of the past history of experiences like Conseco?

ERNST: Right now there is no asset-backed securities market. Chattel financing, up until the credit crunch occurred, was predominantly either being funded by portfolio lenders, or the asset-backed securities market was still providing some. I’ve got to back up a little bit here. Clayton Homes’ Vanderbilt Mortgage and 21st Mortgage were both big players in the asset-backed securities market until the early 2000s; and then when the cost of securitization became so expensive, they felt their own existence being threatened because of the cost.

I can remember in the early 2000s where if someone had a billion dollars worth of securities to go to market, they wanted securitization for a billion dollars worth of manufactured housing loans, they had to come up with an additional 200 million dollars in over collateralization to get that deal done. There aren’t very many companies in this industry that could withstand that for any period of time because if you have to do that for two to three years, then all of a sudden, you’re talking about $600 million dollars in additional over collateralization, and a lot of companies didn’t have that kind of excess capital or excess assets.

The landscape changed dramatically for our industry after the blow-up, if you will, of the sub-prime credit purchases that we were doing in the mid to late 1990s, and I think it’s changed pretty dramatically, and I really don’t see it getting back to where it was. I think the asset-backed securities market will come back, but I think the disciplines many lenders have in their portfolio will open up an opportunity to do some securitizations, because the credit quality is so high and the default experience has been very good on that higher-credit-quality customer.

MHMSM: Will there be a process and what will the process be for public finance returning as an option?

ERNST: The process is a comfort level in the capital markets. I’m sure you’ve read where there’s beginning to be some opening up in the mortgage-backed securities market as well as some asset-backed securities classes like automobiles and other things like that, where there are some asset-backed securities deals being done. Slowly I think, because of demand or the need to invest capital, I think that ultimately there will be that opportunity to do some asset-backed securities with some pretty high-quality manufactured housing loans. Some of the more recent loans that were securitized by Countryplace Mortgage and Origin, some of those had average FICO scores of more than 700. It was pretty high-quality and for the most part, those have performed very well. I think it’s a matter of investor confidence and sitting on a lot of extra capital right now that they need to get invested; but they want to invest it in something that’s going to have predictable returns and a predictable experience.

MHMSM: The manufactured housing industry experienced an easy-money, no-credit-score bubble in the late 1990s. That was repeated more recently in the site-built housing industry. Have we learned our lessons? What are those lessons?

ERNST: Who do you mean by “we”? If you’re talking about the manufactured housing industry, I’d say absolutely we’ve learned our lesson. I think there’s been a lot of slicing and dicing, so to speak, of that business that was purchased prior to 2000 or 2001; and a lot of people looking at the credit quality look at the way business was being done back then.I mean, we got pretty loosey-goosey back in the late ’90; and when I say loosey-goosey, it’s been reported Marty Lavin (who is kind of a statistical nut and likes to look back at things) has indicated that more than a third of the businesses purchased in the late 90s had less than 600 FICO score business.

We know, based on experience now, that that business cannot perform. It’s not a matter of IF it’s going to repossess; it’s a matter of WHEN it’s going to repossess. When you’re dealing with low- to moderate-income customers, they have less leeway to be able to withstand an adverse event in their life, whether it’s an income interruption or whatever it may be; they have fewer assets, fewer reserves and less disposable income to withstand that event. I think we’ve learned.

The survivors do a lot of verifications now: they verify down payments, they verify income, they verify employment, they look very carefully at what the customer’s disposable income is going to be, what their other expenses are, what their family size is – all of those things now, I think, are being looked at a lot more closely. I think that the lower-quality credit customers are just not able to get those loans financed for the most part. If they do, through a company like 21st Mortgage, they’re going to have to have some significant equity in that loan or put up some collateral, perhaps land that they own or something like that, so they have more at risk. I think our industry has learned a lesson.

I can’t speak for the site-built industry. It’s been pretty devastating what’s happened to them. You’d like to think that everyone learns a significant lesson from this, but we all know there are a lot of cyclical events that occur in major markets like this, and we can only hope that everybody has learned a lesson.

MHMSM: What are your thoughts on efforts like Ken Rishel’s to move chattel ahead via establishing captive finance programs, especially for land lease community operators?

ERNST: I think the captive finance entities that Ken works with and a number of community operators that provide financing for their own customers is absolutely through necessity. You have to remember that land-lease communities have two potential benefits. Number one is, they tend not to focus so much on the profitability on the sale of the house. They want it to be profitable to some extent, but there’s less emphasis on the profitability and they want to have a loan that they can put in their portfolio. They’re willing to take a little bit more credit risk because they have much more control of that individual transaction with the site manager who can monitor what that customer is doing on a monthly basis and look for the signs that they may be having some issues; maybe look out there and see that the guy bought a new motorcycle or whatever it may be. Sometimes those can be things that create difficulty with a loan going forward. I think the captives are by necessity.

At the same time I think the captives in the future – and I don’t know how long in the future – but I think at some point in the future, there will be the ability to securitize those loans with someone with some pretty high leverage, or I should say low leverage. In other words, if you put a billion dollars in loans together, you might be able to re-coupe a half a billion dollars in capital. In other words, you might have to do a two-for-one type of deal because of the potential risk involved. Now, the larger communities – and to the extent they are well capitalized and have access to capital – I think you see folks like Hometown America and others who have done that and done it successfully, believe it’s necessary for their business model to support the communities, to create revenue-generating customers, revenue from those lots that they lease, and they think it’s important. At the same time, they’d love to be able to securitize those loans so that they don’t have all that capital tied up.

I think it’s going to continue; and the numbers that have been published – I have seen both from George Allen and others, and Tony’s numbers – indicate anywhere from three and a half billion to as much as six or seven billion dollars worth of paper that’s being held by these community owners. I do think the SAFE Act is going to cause everybody take a look at that and make sure they are doing business the right way; but at the same time, the captives are a necessary part of their business model.

Be sure to catch the third part of the MHMSM.com exclusive report with Dick Ernst when we discuss the SAFE Act and its impact on the Manufactured Housing industry and the extent of a potential boost from FHA financing.

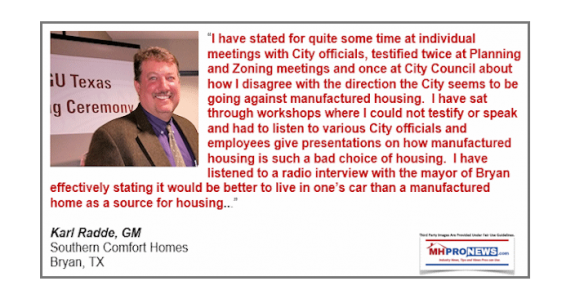

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …