by Thayer Long

![]() Earlier this year, MHI outlined three broad areas where resources must be focused to protect and promote the industry. These three areas also encapsulate over two dozen separate legislative and regulatory initiatives MHI works on a regular basis. The three areas were 1) improved climate for financing, 2) updating the HUD-Code, and 3) protecting preemption.

Earlier this year, MHI outlined three broad areas where resources must be focused to protect and promote the industry. These three areas also encapsulate over two dozen separate legislative and regulatory initiatives MHI works on a regular basis. The three areas were 1) improved climate for financing, 2) updating the HUD-Code, and 3) protecting preemption.

At the time of this writing, the 2010 mid-term elections [were] just a few weeks away. And while the political landscape [was then] uncertain, the issues we are facing are not. In late September at the MHI Annual Meeting, MHI members and Board of Directors outlined priorities for the industry and the association in preparation for 2011 and the incoming 112th Congress. The priorities represent the collective input of manufacturers, lenders, community owners, manufactured housing state associations, retailers and suppliers—the entire MHI membership. A strong unified voice from all industry segments gives us a much greater likelihood for success. MHI is prepared to put forth every effort it can muster on these priority issues.

Of utmost importance will be implementation of the financial reform bill. The Dodd-Frank Wall Street Reform and Consumer Protection Act (H.R. 4173; P.L. 111-517) was enacted into law on July 21, 2010. The law is considered the most significant rewrite in decades of rules governing banking and financial services and will impact every financial institution and credit instrument in the nation.

One of the most visible and significant creations of the law is the establishment of a new independent and autonomous Consumer Financial Protection Bureau (CFPB), housed within the Federal Reserve, that will regulate all consumer financial products and participants, including mortgages, credit cards, banks, payday loans and other financial products.

Initial estimates conservatively indicate the act will require more than 240 new rulemakings, nearly 70 new one-time reports/studies, and more than 22 new on-going studies. This does not include the administration of existing regulations and laws that will be transferred to the new CFPB—there are nearly 20 existing consumer/housing finance-related laws that will now fall under the new bureau’s jurisdiction—or existing rulemakings that were in progress at the time of the bureau’s inception.

Since this legislation addresses all financial products, it stands to reason that provisions in this bill contain significant issues for manufactured home lending. Addressing these issues, and correcting them, must be the primary focus in 2011.

There still is work to be done at both the national and state level regarding SAFE Act implementation. The Dodd-Frank Bill transfers jurisdiction and oversight of a number of mortgage-related laws from the Department of Housing and Urban Development (HUD) to the CFPB. Included in the regulatory transfer is the shift of enforcement over the SAFE Act from HUD to the CFPB. HUD maintains jurisdiction over the SAFE Act until the designated transfer date of July 21, 2011. It is unclear if HUD will issue a final rule on the SAFE Act. However, regulatory oversight of the statute will eventually shift to the CFPB.

The SAFE Act, and uncertainty around its application to many industries, including manufactured housing, remains a key issue to be resolved in 2011. Achieving clarity in application and making the SAFE Act more relevant to the manufactured housing industry will be a high priority in 2011.

In the past three months MHI has been invited to White House sponsored events on the future of government in housing. All expectations are that the GSE reform will begin to move seriously in 2011. The U.S. Treasury Department is required to submit a report to Congress, no later than January 31, 2011, on ending the conservatorship of Fannie Mae and Freddie Mac and reforming the housing finance system. For more than a decade, GSE and federal support of manufactured home lending and finance has been limited, even with strong Congressional guidance in the Housing and Economic Recovery Act of 2008 (HERA).

Since manufactured housing is “housing” plain and simple, MHI will need to be actively engaged with committee members, administration officials and external stakeholder groups at the national and grassroots level to ensure manufactured housing is on a level playing field in any new housing finance system.

Tax extensions and tax reform have made the news headlines lately. Section 45L of the tax code provides a credit of $1,000 to manufacturers of Energy Star HUD Code manufactured homes and $2,000 for modular homes. The credit was originally enacted as part of the Energy Policy Act of 2005 and for the past several years has been extended on an annual/temporary basis. The credit officially expired December 31, 2009.

Regardless of whether tax extenders legislation is enacted during the 111th Congress “lame duck” session which is getting underway, the need to pass an extension will again arise early in 2011. The ability to rely on the long-term availability of the new energy efficient home tax credit is of critical importance. In addition, with energy efficiency standards potentially becoming more stringent the cost to build such homes will also increase.

In 2011, MHI will work to pursue a strategy that: 1) increases the amount of the tax credit; 2) provides for a long-term/permanent enactment of the tax credit; and 3) potentially monetizes the tax credit. MHI will also examine other options to provide maximum benefit to the industry.

A severe threat to affordability and the HUD-Code is underway because of the Energy Independence and Security Act of 2007 (EISA; P.L. 110-140) which contains provisions requiring the Department of Energy (DOE) to establish and implement energy efficiency standards for manufactured housing (Sec. 413).

The bill specifically tasks DOE, not the Department of Housing and Urban Development (HUD) to come up with new energy standards for manufactured homes. MHI has developed a legislative proposal that would place responsibility for implementing energy efficiency standards developed by DOE within HUD and ensure that new standards strike a balance between energy efficiency and maximizing housing affordability for very low- and low-income families. The 112th Congress may yield opportunities to make targeted revisions to EISA.

If 2010 has been a pivotal year for MHI and the industry, 2011 will be a critical year for the industry. The market appears to have stabilized, however significant economic headwinds, a fragile housing market, and an active legislative and regulatory environment still threaten the industry.

We are all in this together. In particular, state association members, homeowners and residents represent the lifeblood of the industry, and MHI will be giving special attention to its grassroots mobilization efforts in 2011. MHI will be gearing up on effectively engaging these constituency groups and stressing the importance of direct member and industry involvement in the government relations process.

MHI is here to serve. We always welcome suggestions and feedback. If you are not involved, I encourage you to become active at the national level. The industry needs your voice.

###

Thayer Long is Executive Vice President of MHI, the preeminent national trade association for manufactured and modular housing industries, representing all segments of the industries before Congress and the Federal government. He can be contacted directly at (703) 558-0678. For more information on MHI, visit www.manufacturedhousing.org.

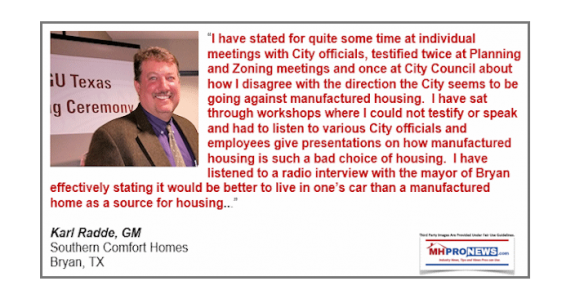

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …