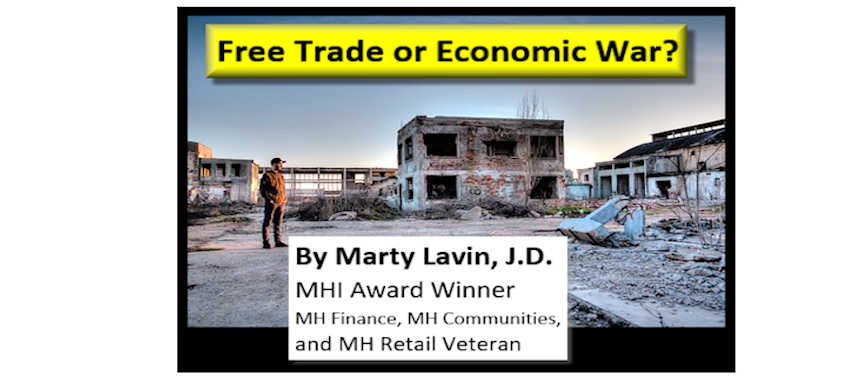

WHAT?

When I started speaking with MHMSM Publisher Tony Kovach recently about writing some pieces for MHMSM.com NEWSline, the usual question came up. “I know you’ve carefully explored in the past your ideas as to the dire condition of the MH industry, but how’s about some solutions, Pal? Do you have any?”

Ouch! That question can mean only one of two things; either Kovach has a short memory regarding the eight years of my monthly newsletters and the MHMerchandiser articles I wrote when that great resource was still alive, or, the boy doesn’t or hasn’t read my work. Do I have solutions, you ask? Does that mean solutions that “will” work to change things, or suggesting solutions which “might” change things? I guess mine, of which I have plenty, are mostly in the “might” category. For as we shall explore, there are no easy or surefire solutions to the industry’s problems.

WHEN?

Since the last home shipments top in 1998, the industry has slid through what I see as three separate phases, below:

- Phase One: From 1998 to 2003, the peak of the industry activity ending in 1998 and then starting a pretty aggressive decline. During this period the industry was convinced this was nothing more than one of the usual episodes of industry disturbances, which had been regularly seen over the previous 50 years. There was concern, but not much more. Chattel lending dissolved all during this period, which saw the last of the Greenseco “balls to the walls” lending

- Phase Two: 2004-2008 Shipments started to stabilize in the 125-150,000 home shipments per year range, helped especially by frequent hurricane destruction and FEMA using MH as “temporary” housing, which turned out to be 10 years-to-forever housing. Chattel lenders by this time are winnowed to a small number of able and cautious lenders. Not many loans under 660 FICO closed, and the industry is starved for more aggressive lenders and lending. The last great hope is FHA Title I, which is to be the “industry savior,” unless you read the 60+ page Government Accountability Office (GAO) report on the experience of chattel lending under Title I heretofore and the recommendations made to FHA in the report. Had you done so, as I did, you might not have been so enthusiastic. Still, the industry waxed poetic about this great new lending source, which I hear produced a whole 1900 loans nationwide in 2010. All during that period MHI and MHARR, especially the former, were holding industry leader retreats with the goal of fixing the industry, going so far as to spend $250,000.00, as I recall, on an industry study by Roper Associates. The “catastrophic” findings of that report led to an impetus to start an industry image campaign similar to the “Go RV’ing” campaign. That move ended when disparate industry segments clashed as they thought they knew more about how to proceed than the pros we hired, apparently not busy enough in their MH business. But more importantly, when the industry’s “Godfathers” pronounced the campaign as “too expensive”, the movement died. Amongst those are some still surviving, if not thriving, and several surviving in name only as they went to BK, which does not mean Burger King.

- Phase Three: 2009 to whenever. The industry slides further down to 50,000 annual shipments, even flirting with 40,000, looking for a bottom. Chattel lending remains ever-more constrained, enough so that many community owners resort to self-financing. Liquidity for loans within the industry is severe, even as Title I lives up to its failure to really fuel any sort of shipments surge, as I predicted well before it began. It seems FHA read the GAO report and heeded the warnings and recommendations therein. The GSEs rejected “Duty to Serve”, the other industry “savior” as revealed in the Elkhart meeting in mid-2010, and the string is still counting down on the ability for LLC owners to keep vacancies at bay. One large community owner, who had for years championed self-lending chattel loans to be highly effective, sold off a large package of LLCs producing those loans and the loans therein. Weren’t getting enough loans, apparently. More ominous, several new federal laws and a new consumer protection agency arrived to inject substantial constraints into chattel lending, this on an already overwhelmed industry and one which has not dealt effectively in the past with these types of regulations. The industry response, as usual, has been to attempt to get released from the provisions of the law which are doing exactly what they were meant to do. Presumably about the same time Subpart I of HIA 2000 is corrected, so will be those provisions of Dodd-Frank and S.A.F.E. which are biting so deeply. I’ll be dealing with this in an upcoming Phase Four piece in the future.

HOW?

This prologue is followed by my Saving Chattel Lending article from 2007, written at the height of “what can we do to make it better,” during Phase Two. I can say with Biblical certainty I did not save chattel lending, but then again virtually none of my recommendations were even attempted.

If you read the whole article, and I applaud you if you do, look at it from this perspective: there are two causes of defective chattel lending, and all recommendations made therein are calculated to try to correct these grievous defects:

- The Roper Factors The industry study I already referred to was meant to identify how we were treating our customers, what they thought of the industry, and how to correct our terrible performance. This is the “Customer satisfaction” component.

- Home Depreciation The rapid loss of home value endangers the homeowner, his lender, the community owner, and ultimately the whole industry. Were our MH financed for a short term, like an auto, then the depreciation might not bite. But the home deprecation typically is so great and so quick; the entire process destroys any hope of making chattel lending a “main stream” bank product, as the loan repayment term used to finance homes is too long to defeat the rapid depreciation. But, shorten the loan term, and the all-important affordability factor of MH is destroyed. Rock and a hard place, eh? This is the good value component.

Don’t believe me on these two most important components? I’m not surprised, neither did the 50 plus attendees at the Industry Salvation Chicago Meeting in May, 2005. They did came up with many other answers, all of which were components of these two, which are at the very root of our problems. Since the meeting never did identify “the” problems at their most basic, no answer was possible, and the cost of a trip to Vegas or Miami beach for OleMartyBoy was squandered getting to the Chicago Airport Hilton, which meeting came to nothing. Make up your own list and see how basic you can make the industry problem(s). Then start your own list of possible industry cures.

AGAIN

I read my “Saving Chattel Lending” article again for the first time in years. Virtually nothing has changed except the industry seems to have stopped all organized and concentrated attempts to save itself and the industry cannot and will not succeed unless the industry saves chattel lending, unless you think it is saved at 40,000 shipments. There are now scattered attempts to retrace the same industry steps previously made, mainly by people of short memory, or who didn’t participate before. These efforts are very likely to come to naught. HIGH FIVES! # #

June 21, 2011

MARTIN V. (MARTY) LAVIN

attorney, consultant, expert witness

practice only in factory built housing

350 Main Street Suite 100

Burlington, Vermont 05401-3413

802-660-9911 802-238-7777 cell

web site: www.martylavin.com

email mhlmvl@aol.com

email mhlmvl@aol.com

SAVING CHATTEL LENDING

By Marty M. Lavin

Manufactured Home MERCHANDISER, December 2007

As I get ready to journey to New York City to attend MHI’s Manufactured Housing Finance Forum, I’m going to propose some measures I think need to be instituted throughout the industry to correct the existing deficiencies of the chattel lending model. I do not believe we can have much of an industry recovery without better chattel (home only) lending especially in land-lease communities, and I have been saying so for years now.

I’m still surprised some folks fail to understand even today that manufactured home chattel lenders haven’t “lost their nerve” and are not “conspiring” to control the market for lending. No, the reality is far easier to explain. If heretofore (pre-2003) the basics and statistics of manufactured home chattel lending were poorly understood, today that has all changed. While the “smart” industry lenders have continuously updated their loan performance figures, always seeking the keys to more expansive lending while remaining profitable, the general understanding of manufactured home chattel lending still survives today on immense caution. Profitable manufactured home chattel lending is still very much a niche product best practiced cautiously; and therein lies the constraint to increasing the shipments of HUD Code homes.

In order to believe chattel lending is the key to industry growth, one has to reflect with clarity on the inability, so far, of real estate-secured HUD Code transactions to lift the shipments to any extent. As the late 1990s progressed and chattel deliveries first stalled, then plummeted, many industry participants and outside pundits believed conforming and non-conforming real estate mortgaged HUD Code sales, tied to the land, would pick up the slack. That was not to be.

Drop to low levels

While chattel secured homes, placed in land-lease communities and scattered sites were dropping to unimagined low levels, real estate-secured transactions did in fact increase slightly, but hardly enough to make up the loss of at least 150,000 chattel financed homes no longer being financed as the “Greenseco Finance” chattel loan model fell from favor, its non-profitability lethal for those using it, and dangerous even to bystanders, especially the borrowers who lost their homes in record numbers. That episode was a preview of the current subprime mortgage problem.

As we survey the last 50 years of lending on our product, there has been a constant effort to “mainstream” the product. By that, I mean allowing an intelligent lender, with good money availability, at market rates, staffed by average lending personnel to enter the manufactured home lending market, proceed as they might lending on boats, cars or site-built housing and stand a good chance of financial success, creating a lengthy history of profits. This makes a lending product popular with banks, credit unions and finance companies, and spurs industry success. It is indisputable that only successful manufactured home lending can revive this industry. Keeping it a niche product for just a few companies to exploit might help them, but will do little for the totality of the market. The ability to mainstream the product has thus far eluded successful chattel lending.

Come and go

Historically, while innumerable lenders have come and gone in the industry, profitability has eluded almost all of them, with exceptionally few successes. That of and by itself says a great deal about lending on manufactured homes, most of which (historically 80-85 percent) has been chattel, especially into land-lease communities.

During the 1960s and early 1970s era, the “automobile lending model” was in vogue for manufactured home lending. Apparent down payments were generally higher than today (if not actual), homes were far more modest, repayment terms were far shorter and mobile home parks, where the vast majority of homes sold where sited, were in the hands of people whose primary source of income was from the sales of the homes going into the parks. It wasn’t until much later that rental income from the parks became the greater income producer rather than the sales of homes. When this occurred throughout the industry, it brought new players and many changes occurred which are being sorted out even now.

Today of course, the refugees from the late 1990s-2000s downfall in manufactured home lending populate lender staffs at enumerable banks and Wall Street firms. Their experience was so bad and our market size of profitable lending today is so small, why get involved? Why indeed.

And as I head to the Wall Street/MHI lending forum, I believe that thought is very much on the minds of many of the participants we expect to attend. “After the crippling losses suffered by manufactured home securitized loans from originations between 1994-2003, perhaps the greatest percentage ABS bond losses of all time, what are the reasons we should get involved in manufactured home receivables?” I assume they will ask that?

And there are some positive answers we can give. Fraud in loans is far less. Loan documentation is very good, a previous weakness. Loans are made to far, far better credit risks than before and defaults will be decreased by an order of magnitude of 3-5 times less than before interest rates are significantly higher as compared to site-built housing than before and should render a good investor yield. And finally, you have a better customer, buying a better house, with more loans tied to land in some fashion, with ABS bond-performance-prediction recently being met and even surpassed. All pretty good stuff, frankly.

Good, but not enough

Yes, all the positives I’ve enumerated above are great, but to paraphrase the Wendy’s lady, “Where’s the volume?” You see, industry lenders have rationalized lending to become survivable based on loan quality, but they are having great difficulty changing other aspects of the industry model, which without changing, loan volume cannot increase much. There simply are no loan volume increases as new and even used home sales are skimpy. Is there a great HUD Code home buying demand? Yes, but it’s primarily coming from a non-financeable group of chattel buyers.

The HUD Code industry recently grafted many elements of rational lending, enumerated above, unto an overall industry model, which has arisen over many years of insufficient safeguards activity, lacking transparency, with few borrower/lender protections, and the industry seems incapable of sorting out what the final changes need to be or how they can be implemented. I think the situation is pretty clear; the marketplace has already rationalized manufactured home lending into an 80-130,000 homes per year industry, even now as company consolidation continues to drive down capacity and costs for people and places no longer needed in the industry. A permanent resizing is almost in place. Anyone who does not recognize that must be listening to industry rhetoric rather than viewing industry results.

Changes

All right, let’s get into the changes that, in my mind, need to occur in order to start a new industry shipments increase, sustainably derived, and tending to make it a more mainstream lending product. You cannot create a larger industry without a profitable and survivable lending model, which can successfully accommodate at least double the present volume, in an attempt to grow it back into the long-term new annual home shipments annual pace of 250,000 homes. This will require survivable lending to an average FICO tier at least 60-70 FICO points lower than recent ABS bonds and increased buying demand from reasonable credits.

I’ve spoken to a number of people lately, industry stalwarts, who finally agree that the industry model is broken. They recognize that the present grafting of a highly protective underwriting and loan closing regimen onto an otherwise disorderly industry model may well benefit some individual industry participants, but in the end, we are creating a far smaller industry. Some few prosper even as the industry sinks further.

At the Chicago industry retreat, which met several years back, I volunteered that I thought the industry defects could easily be broken down into two key elements:

The Roper Study Factors: Those are items which our consumers identify as industry weaknesses and tending to have our product sales, delivery, installation and after-sale yield far less satisfaction than our customers would like.

Home Value Deprecation: Those industry practices which tend to cause the home to lose enough value that with a modest down payment at purchase, the home is not later resalable within a reasonable time so as to allow the homebuyer to gain sufficient proceeds to pay off his or her home loan.

Note that without controlling home depreciation, significant industry growth is not really possible. And in the alternative, if you do control it, then the “Roper Factors,” while always important, take on less importance although complete industry salvation will require action on both weaknesses.

General Measures

Let’s start with general measures which tend to create better consumer satisfaction and progress into measures which tend to reduce home depreciation. An easy breakpoint between the two is difficult as a better home warranty, as an example, will not only create better consumer satisfaction, but also tend to reduce home depreciation. And many measures will be like that.

Without prioritizing measures, let’s just start a list.

• Image campaign

As I sat around John Diffendal’s (BB&T stock analyst) “investor dinner” in New York City the night before the MHI Financial Forum, my table was composed of several Wall Street investors, Larry Keener (CEO of Palm Harbor Homes) and myself. After listening to Keener and me respond to their queries, Christopher Abbott, senior vice president of Chilton Investment Company asked a simple question:

“You guys have a great story to tell, but I don’t think the public knows it. Have you thought about a ‘Go-RVing’ Type campaign?”

Whoa, that made ole Marty jump for joy! That has been one of my drumbeats for years. An image campaign to tell the public the role factory- built housing plays in the American housing segment is simply a necessity. Every day that goes by we cripple ourselves because we are not doing it. I suggest it is not only necessary, but frankly, inevitable. Why wait?

• Builder responsibility for integrity of the home installation/delivery

One of the big problems our consumers face is that they often feel left to their own devices after they buy. Our builders often don’t want to take responsibility for the shortcomings of their retailers and their subcontractors, because they don’t trust them. And the retailers don’t want to take responsibility for the installation subcontractors, again, for lack of trust. Yet both seem to have no difficulty transferring the results of that mistrust to the consumer and, by default, to the consumer’s lender. This is a major problem and the new MH select conforming mortgage program at Fannie Mae is the first to require significant protections for the consumer from that weakness in the present model. In a sense, this is like the recourse model so effectively used by many for years in the industry to protect a vulnerable lender from the troubles of manufactured home loans. This will ultimately spread to the chattel model as well.

• Longer and better home warranties

The consumer needs far better warranties and longer ones, say three or even five years, to insulate them from the financial shocks home repairs or breakdowns can bring. In the event some major home system dies at 18 months after purchase and the repair is $300 or more, a default causing event may have occurred and, without the warranty providing this protection, we’ve potentially created a repossession. Make no mistake; warranty adherence is expensive, but far cheaper than selling a whole industry down the river for lack of overall consumer value. We cast our customers aside because with very limited warranties, meager warranty compliance (see Roper Study) and short warranty term, the cost of homeownership, especially during the early years when its impact has the greatest financial impression, can strain the homeowner’s ability to pay his or her loan, if an untoward event happens.

• Cost of home site occupancy

After we put the homeowner into the dwelling, we frequently have sited them in land-lease communities, where the future cost of site occupancy has become an unknown, often with annual rent increases outstripping the ability of the homeowner to keep pace with costs through his or her earnings. This has contributed to substantial home value depreciation, resulting in a large decrease in chattel lending into communities placements.

• The high gross profit, low volume of sales model

The industry has evolved into low sales per location. This has seen an average of 36 new homes delivered annually by the average retailer. A sales location selling more than 100 homes is a giant retailer; however very few of those exist. The sales volume at each location is so low that a high gross profit must be achieved on the home in order to have any chance to survive. Even today, with far more rational lending, it is not unusual to see loans being made that represent 125 percent of the “invoice.” Note that this does not exclude the “slush” already in the invoice, such as volume bonuses, advertising allowance, dues and other items. Nor does it encompass the customer’s down payment, being the 5 percent or greater we see today in most lending. With down payments commonly averaging more than 10 percent and invoice “slush” more than 10 percent commonly; it is easy to see that basic home gross profit can easily be 145 percent of true invoice or more. Home value depreciation starts there. This type of mark-up will have to be throttled back. The industry must try to move to the “high sales volume, low gross profit sales model.”

• We treat used homes differently from new for financing

Most lenders will admit that given similar underwriting and scrutiny, loans for new homes and resale homes will perform in similar fashion. Still, the loan-to-value advance, the interest rate and other loan factors are usually harsher for resales than for new. This continues the home value depreciation as such treatment for resales creates value depreciation at first sale. The industry is not good at treating resale homes with the same respect it does new. In the whole, they treat resales as “throw-aways” and so they’ve become. A concerted effort to treat resales better is necessary.

• Our home loan closings lack formality

The real estate industry has evolved a voluntary and mandatory sales and closing routine calculated to protect the consumer, who is often unsophisticated in these matters. While it hardly guarantees an entirely trouble free transaction, it does a far better job than we do. Our industry has essentially refused to comply with real estate-type safeguards for chattel loans and only a few jurisdictions have forced such safeguards on us. We chafe at those few restraints. Transparency and consumer protections seem little on our mind.

In manufactured housing, we see few non-real estate escrow closings or earnest money going into trust, little involvement by appraisers, lawyers or the various other measures created as transparency and safeguards for the consumer. Many of these measures are avoided in chattel lending on manufactured homes and loan performance has been far below that of real estate loans. Many don’t want these safeguards in place because it slows the “process” down. I can’t help but think there is a lesson somewhere in there.

Without attending to these two, the Roper Factors and home value depreciation, there is little beneficial change that is likely to result. The marketplace is currently rationalizing the manufactured housing industry, imposing an ever-lower shipments basis that is survivable. This is caused because profitable lending cannot occur at the level that is needed without significant industry changes and we have yet to find a way to increase the attention of better credits in and to our products, igniting the demand side.

Changes in attitudes

And what are those needed industry changes? In no particular order, we need help in these areas:

• Invoice Database

All invoices of all homes produced must go into an MHI controlled database available easily and inexpensively to lenders, appraisers and homeowners, with the proper protections as they are accessed via the Internet. This also allows cradle to grave tracking of the home with uses we don’t even know yet. While invoices are provided for every loan for new homes, the industry does not make them available for used.

• Shorter loan repayment terms

When I polled chattel lenders to prepare for this article, to a person, they all recommended reduction of loan terms to 10-15 years on single-section homes and 15-20 years on multi-sections, both with sales price cutoffs. More than $40,000 to get 15 years on singles, and more than $60,000 to get 20 years on multis. This would tend to reduce the negative impact of home value depreciation with far quicker paydown of the note. Sales proceeds would then more commonly allow note repayment.

• Tighter loan-to-value advance

Lenders limit what they advance on all sorts of products. If using an invoice to loan on autos succeeds, it is because the allowable advance over true invoice rarely exceeds 10-12 percent, more commonly 5-7 percent. We have been allowing 140-150 percent and more of true invoice lending—and it is proven not to work well. A large loan advance to invoice amount guarantees home value depreciation. A high gross profit can only work on items which have high consumer demand coupled with scarcity of supply, like diamonds. Manufactured housing has neither high demand from creditworthy buyers nor limited supply. Continuing to get a high markup from a commodity in plentiful supply sold primarily to people on a budget is keeping the industry at low levels of volume. Tighter loan-to-value advances of not more than 10-20 percent over dead invoice, with limits on profit at sale will need to be instituted. This will tend to reduce home value depreciation. Using real home value appraisals for new homes might be even better than continuing loan-to-invoice to determine loan amount.

• Using standardized forms

The more we standardize procedures, regulations, safeguards and underwriting, the easier we make it to enter the industry and appeal to mainstream lenders. Keeping manufactured housing a small niche industry with arcane operating procedures, documentation and practices tends to shield existing participants from competition, but under current conditions, creates a very small industry. Standardized forms, like everyone using the same credit application, delivering it to lenders via the Internet and using standardized closing documents, as they do in conforming mortgages, is an important element to better action. Industry lenders must move towards this if we are to mainstream product lending.

• More use of appraisals

Using real value-based appraisals is said to reduce sales. Yet, if the consumer does not do an appraisal for us, they surely can’t avoid it by going to real estate. They will get one there if they go forward. The use of “books” only, with standard lender formulas and advance-to-invoice is no way to run a large, profitable industry, which delivers value to everyone. The book is only a cog in a complete appraisal, not to be used alone. Knowing the real market value of the collateral is a necessity for sound lending. Only market-based appraisals can do that.

• Longer house warranties

Homebuilders must find a way to deliver a fairly comprehensive three to five year warranty for homeowner protection. This might be done by the use of appropriate third party warranties, the cost of which is built into the invoice of the home. This will help stabilize the cost of home ownership for the early years when the borrower is most financially vulnerable. It also is a unique benefit differentiating our product from site-built.

• MLS system

We have the beginnings of an MLS for manufactured homes in several venues already. Most are just in the beginning stages. Far more is needed. Industry zeal must be directed at true issues, such as working towards an MLS, training of manufactured home resale brokers and every element of creating an organized resale marketplace. Can we partner more effectively with Realtors? Without a well-organized resale market, the homeowner is left to his or her own devices to resell the home. Failing frequently in that effort, they resort to “giving the home back” to the lender or selling, at a sacrifice, to another. Creating an organized resale marketplace is a centerpiece to rescuing the industry.

• Manufacturers statement of retail price (MSRP)

This is needed for several reasons. First of all, it provides greater clarity and shopping comparison opportunities for the consumer. Secondarily, it allows the builders to “guide” its retailers into a proper sales profit, consistent with volume and profits for the builder and the retailer. The current lack of pricing guidance is a disrespect to our consumers, putting in their minds that we are a disreputable bunch. Finally, the MSRP helps lenders deal with all customers being treated more alike. No one wants the black eye of “certain” consumers being treated differently. It also can be illegal.

• Posted home prices

I really don’t even know why this one is an issue. Most people do not like to buy items that are not priced, as they fear they are not being treated fairly. Yet, nothing is more common in the industry than waiting for the “up” to demonstrate an interest in the home before he is quoted the price. This simply is not ethical treatment and undermines our regard in the minds of our consumers. And this is an issue AARP and others have railed about. Isn’t it the right thing to do? What is the hold-up? Every home for sale at a retailer should have a clearly posted sales price. (The largest retailer chain told me recently every home they have for sale will have a posted price shortly!)

• Final Inspection of the home before delivery

No lender should fund a loan until it is convinced the home is properly delivered and the customer is satisfied. While this is moving towards industry lender practice, we are not there yet. Until the industry has established a long-term track record of compliance, this must be required and verified. The walk-through punch list site builders use before their closing with customer sign-offs is a good start for us. Not foolproof, but one more safeguard for all parties to the transaction. It is one more step to assure the integrity of the process and deliver more value to the consumer and his lender. It also keeps the sellers and builders on their toes making them do the right thing.

• Community Attribute System An important compendium of the details of land-lease communities in a database owned by MHI and operated by Datacomp Appraisals in Grand Rapids, Mich. Still in its infancy, the data is building, the cost to get data is low and over time can be used in tandem with an in-community MLS. No lender should be lending in landlease communities without accessing this data. It doesn’t take a genius to look at the 100+ attributes compiled therein, and if correct and current, a lender has a very good idea if that is a community wherein you want to lend. This is an important lender safeguard and allows better loan decisions. Lenders are using it and the data fields are being updated. It is also an important spur to community owners to work towards excellence

• Better finance treatment of resales

No Virginia, all resale manufactured homes are not crap-boxes to be financed for 5-15 years less term than when they sold new. We should require a real value appraisal so the quick “appraisal book” standard formula won’t undervalue (or overvalue) the home. We should not have the significantly higher interest rates on resales than we now see on new. We now know debasing the value of resales debases the new homes as well and you see the result of that all around you. For profitable lending and delivery of value to the customer, as go the used, so go the new.

• Proper and easy home identification

I did a quick study once on the damage caused by standard formula book appraisals coupled with improper home identification. I found the loss of value substantial. We all know the industry produces a bewildering variety of homes, often with enormous differences in selling price and some even being the same size and having similar model names. Yes, content does count in a home. Drywall construction, better windows, upgraded appliances, architectural details, better insulation and a number of other factors can make a big value difference.

Since most builders do not provide good (or any) home identification in their serial number, the true content aspects of the home may not be readily available, except in the invoice. At resale, invoices are rarely available, if ever. Lenders being the highly pragmatic bunch they are will take the lowest value that home could be, often without a great deal of further inquiry. In the event of calls to the factory for better home identification, some are helpful, but many are not.

The invoice database I discussed above is a great way to properly identify the house. A second way is to use a standardized serial number as is used in the automobile and other industries. The special serial number range could identify the many relevant factors so that by using the proper code sequence one could know all about the home. This would make home identification certain and more importantly, stop the guessing and depreciation of value occurring by use of standard valuation formulas because we can’t properly identify the home easily or at all.

As between the two, if I could only have one, I would prefer the serial number, as once you know the number all the relevant information is available to you immediately and free of cost. But the invoice databank is important for good identification purposes and also may have cost data, which appraisers and lenders love.

This one is the canary in the coalmine. By that I mean it will be a sure tip-off that if the industry is not serious about taking action to assist lenders, appraisers and homeowners with proper home identification after the home is sold, and being resold, where can the industry start to solve our dilemma?

• Third party final home inspection

No loan should be funded without a reasonable third party inspection and assurances that the home installation is proper, the customer got what they bargained for and the homebuyer has had a walk through the house and is satisfied. Expensive you say? It will create problems because we find out the process is incomplete or wrong? The retailer doesn’t want you to do this? Just think about those reasons for not doing it, as though defaults are cheaper or unhappy homebuyers don’t cause problems. We continue to avoid this at our own peril.

• Quality of homes

I am the first to tell my clients that in general, the industry builds competent homes and actually some are better than competent. However, I’ve been in far too many homes which are three or more years old and my impression has often been how “used” the home appears. Many times the visual impression is one of a home many years older than it is. Yes, I am aware some of our customers can be hard on a home. We can build for that.

It is easy to create extra space in a manufactured home and often builders will induce buyer interest by the large amount of space at very low per square foot costs, but use non-durable materials to achieve it. Our industry is very cost driven. The downside is that the home appears so “worn” in short order, that it creates problems at resale. The tatty home appearance reduces its appeal in contrast to the new similar home offering, which the homebuyer can get with more attractive financing, for little more in price than the payoff amount of the loan on the resale. Can you say “home value depreciation” anyone?

Substituting more durable materials of better quality and reducing home size might be a wise tack for the industry. Sell the consumer on durable materials for their satisfaction. Consumers are not all stupid, are they? At least not the ones with good credit who make informed decisions, which are the ones we need.

• Residential architectural characteristics

A recent industry move is to create homes, even modest ones, with a residential appearance. Couple this with more durable materials and we increase consumer appeal and create far better resale action. Extremely modest, chattel financed homes seem an endangered species. Appearance and good presentation grow ever more important, reducing home value depreciation.

• Factory invoice with clear retailer costs

The Truth in Invoice Practices Statement (TIPS) is calculated to try to create a verifiable home invoice so that any lender and its appraiser can see what is being paid for the home. While recent changes have created more reliable invoices, the fact is that only within ranges can a lender today easily know what the retailer is paying for the home. Strange you say? I agree. Invoices should clearly show what the home costs the retailer. Period.

• Long-term leases and lender /community agreement

Many of our best rental homesites are bent on maximizing rents. Often that is done without other considerations. In order to induce in-community lending, the elevated depreciation homes in land-lease communities undergo all too frequently, must be abated. One of the ways to do this is to negotiate lender/community agreements which determine a course of dealings between the two, especially after default and repossession. This can save lenders large sums upon default and gain the community owner’s valuable assistance to handle the repo, refurbishment and resale. The other necessary ingredient will be the use of long-term leases to induce a lender to extend a loan for a home going into the community, tying the rent increases to real increases in operating expenses plus real increases in earning capacity of the homeowners. Since we’ve allowed people to borrow on 20-25 year loan terms, closing a land-lease community without homeowners recompense or relocation assistance is a major and increasing problem. “Google Alerts” sends details of a new community closure almost daily. It does and will continue to cause the industry major problems.

• Use of indices for long-term leases

There is a current popular notion that a homeowner should be paying as rent the capitalized value of the homesite according to the OFHEO index of single-family residences, plus the increase in operating expenses. This has tended to be less than successful for both the landlords and the resident. The former has gotten increased vacancy and the latter suffered a high default rate caused by the resulting home depreciation. Lending in communities has greatly diminished as a result. This industry cannot prosper without a strong chattel-into-land-lease business and neither can the land-lease contingent.

The homeowner we need, as lenders to finance, will not value the rental homesite anywhere near as much as the OFHEO. And that index usually overwhelms the resident’s ability to pay based on annual earnings. As homesite rents increase annually, the resident “buys” the site over every year, unlike the real estate-secured borrower, who unless he refinances and gets money out, has fixed the cost of the purchase of the site until he or she sells. With rising rents, we never fix the cost of homesite occupancy.

Lenders will want to be protected with long-term leases to create more surety that the value of their collateral will not drop in tandem with overzealous rent increases. As lenders, we all understand the desire of landlords to maximize their return on their land-lease community. Still, if done at homeowner/lender expense, lenders must draw the line. The line drawn has tumbled in-community lending and without significant changes, is going to change little in the near to mid-term future.

• Proper installations

Recently, I heard a lender describe the actions his company has taken to encourage proper home installation. He rewards low set homes, those looking more like site-built foundations than the easy-to-do, not-so-good looking high pier home installations so common heretofore. He wants to see covered entryways, proper porches, front and rear entry stairs, good architectural design. And this is not conforming mortgages, but chattel! And why is this industry leading lender doing this?

Simple, good installations, completed on time, delivered as agreed upon with the homebuyer, set low with a distinctive home creates far greater home satisfaction for the homebuyer, AND when it comes time to resell the home, appeals much more to subsequent buyers than modest homes, poorly sited and installed, sitting on stilts up in the air. This reduces repossessions by greatly increasing the ability to resell and pay off the home loan through sales proceeds. To say nothing of the increased consumer satisfaction delivered and increased homeowner desire to keep the home “because he likes it.”

This lender is using the carrot approach. He gives a substantial interest rate reduction for such installations. It may take more than that in the future.

• Too many defaults

Part of the defense subprime lenders have given the media and regulators for the elevated defaults and repossessions likely to occur is that “they gave subprimers a chance for homeownership.” I’m not sure how much currency this will have as Congress and the regulators stick their nose into the causes of the subprime mess. But I would guess that in the case of manufactured housing, were we to continue to loan into communities, with known default rates in the 35 percent range (even with good credits), that if we use the above excuse and justification, we may well see an eyebrow or two raised. Me thinks that while the carrot approach can work well with a very hands-on lender who really works at his craft, in order to mainstream chattel lending in community placements may require a little more stick. And charging high chattel rates and having high defaults may work financially, but it is a poor business model. It smacks of “Buy Here, Pay Here” and is below what our dignity level should be. It also may catch the unwelcome attention of “busy bodies.”

• Retailer/builder relationship

It seems that the relationship between these two important industry segments has always been a handful. Retailers with good financial capability and experience in the industry are rare. It has historically been a “bootstrap” industry where retailers came with little, made little over a business career, tried to hang-in during the down times and ultimately faded into the sunset.

Along the way, consumers had various difficulties with them and consumer surveys find this industry participant, the retailer, with low grades. The industry itself views the retailer as a weak link. The difficulties lenders have with them are legendary, although I must admit that lenders too often have failed to protect themselves.

Lenders and builders are going to have to have far greater concerns over the experience and financial capability of the retailer. Where those are insufficient, and that is common, retail lenders are going to have to secure back-up performance from the builders the retailer represents. Without this builder back-up, the process continues to be a high default/large charge off endeavor which stands little chance of shipments increases, unless of course you believe that Greenseco Finance is alive and well in the wings, ready to burst back on the scene, chattel loans a-blazing.

• Protected territories and a good chance to make a profit

By being well capitalized, experienced, with protected territories and guided by their franchiser builder, we can turn retail locations into real businesses with an excellent chance of success. The ability to make a reasonable profit, consistently, draws retailer candidates with both experience and capital. We see this does work in some parts of the industry where builder-owned sales outlets are made financially capable through the parent’s financial strength, their managers are carefully selected and guided, and they have protected territories. Often, their managers are selected with greater care than their franchised retailers. Builders must move towards distribution representation, where franchised retailers are commonly experienced business people, with strong financial capability and protected territories.

As an industry, this very perplexing matter will need serious attention. But whether the industry fixes it or the market does, it will be settled. The market is likely to settle it at lower shipments than a unified industry approach that precedes a pace.

Final reflections

I’m not sure there may not be other needed measures. I have never been able to sit down and read this list of industry model enhancements needed to correct the failed model. And if you disbelieve me that the model is failed, I repeat the words of the “World’s Greatest Investor,” Warren Buffett. In my March 2004 newsletter, which was the early precursor to the comments in this letter, I quoted from Buffett’s Feb. 27, 2004 statement to his shareholders. In part regarding his view of the manufactured housing industry, Buffett said the following:

“During those years, (the 1990s) moreover, both the quality and variety of manufactured houses consistently improved.

Progress in design and construction was not matched, however, by progress in distribution and financing. Instead, as the years went by, the industry’s business model increasingly centered on the ability of both the retailer and manufacturer to unload terrible loans on naïve lenders. (emphasis mine)

“A different business model is required, one that eliminates the ability of the retailer and salesman to pocket substantial money up front by making sales financed by loans destined to default… Under a proper model—one requiring significant down payments and shorter-term loans—the industry will likely remain much smaller than it was in the ’90s.” (emphasis mine)

And I agree with Buffett that if only down payments and shorter loan terms are involved, we are likely to remain much smaller. The measures I proposed are to start a return to the 250,000 annual home shipments industry long-time trend line, with far more comprehensive action.

And why do I repeat Buffett’s words again? Because when I say what he says I know many people do not believe me. I’m a “nobody” and when I speak of a “failed industry model” in manufactured housing, people think they can disregard it. And for others, the concept of a “failed model” is beyond their comprehension.

I can hear their words. “This industry has always worked in the past”, “The lenders have just lost their nerve” (In reality, what the lenders lost was their shirt) and “This is simply a collusion by certain entities to take advantage of the market.” The only people I know who are doing well would prosper even more with a robust market. Alleging market collusion is so childish and avoids reality so deeply, that I can only shake my head when I hear it. It’s usually spoken from atop the “grassy knoll.”

Warren Buffett is a SOMEBODY. As you read his words above, can you afford to ignore them? Hasn’t he been proven right with such force that we should not doubt his words and undertake an immediate series of steps to correct the failed model?

That would seem an intelligent result, finally, and as the industry study committees met again in Hilton Head, S.C., we’ll review for industry progress. Can we rescue ourselves from the housing niche into which we’ve fallen and can’t get up?

Martin (Marty) V. Lavin, is a 35-year veteran of the manufactured housing industry from Burlington, Vt. He is an attorney, consultant and expert witness to factory-built housing interests. He is past chairman of the MHI Financial Services (2001-04) and recipient of the Totaro Award for Outstanding Achievements in the Manufactured Housing Financial Services Industry….

Editor’s Note: We have again honored the author’s request to post his article and the original “as is.”

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …