The MH train comes off the tracks.

It took me a while in the early 2000s to recognize a sea change had occurred in MH chattel lending. Always chattel lending had been a loser for virtually every lender involved in it. But it had powered the MH industry to 20% of all new housing starts, being responsible for up to 80% of all purchase money MH loans up to about 2000.

What always put new lenders coming into the industry to sleep is that with a growing loan portfolio size, the first 3-4 years of loan growth mask the true loan performance of the portfolio for the entering chattel lender. But once the portfolio size stabilizes, one can gauge the true portfolio performance going forward. It will show very poor performance. The lender will usually panic, not knowing what to do. The smart ones, not too many of those, will shut down the program right then and take their losses. Most others will muddle on as the employees try to keep their jobs by assuring their bosses that they can handle it. They never can. The program will ultimately collapse as things get even worse. “Take your losses now or take bigger ones later.” Some choice.

Before year 2000, the process went through repeated cycles of this start-hold-collapse for chattel lending by innumerable lenders, starting in the ’50’s. Always new lenders came lured by the “high rates” available in chattel lending. Few seemed to recognize how difficult it was too succeed in MH chattel lending. None wanted to recognize that it didn’t matter how high interest rates were, only how much of them you kept in the end. All believed they were smarter than the previous failed lenders, and would do a better job than those before them who had failed. Few did. (Boy, did I tire of hearing that crapiola!)

But in the early 1990’s Wall Street money came to chattel lending. Those were happy days! Money grew on every Tree, especially Green ones. A bevy of retail lenders came from 1991 on, all of whom were going to out-GreenTree GreenTree, the industry giant. All these lenders got easy access to “Wall Street” money, at least for a awhile. The infamous Asset Backed Securities provided liquidity for loans as seldom before seen in chattel lending. Since nothing had changed from the underlying difficulty of surviving chattel lending, few, if any, survived this bout as the industry peaked at 372,800 new home shipments in 1998, and started a descent which has yet to end.

It took me awhile to recognize this sea change in chattel lending. Few of us foresaw the true depth of the problem. But by 2001-02 I could see that this time it was different. Always in the past new lenders had come to subsidize the industry with the losses they took with unsurvivable chattel lending. In the past 50 years these horrific lender losses had allowed HUDCode factories to flourish, retailers to become millionaires and land lease community owners to keep parks full, even as many shamelessly raised rents. Again, this was all subsidized by terminally flawed chattel lending. It went unrecognized.

But worse, the Wall Street boys do not like taking losses up the butt and started to dissect the reality of MH chattel loan performance. What they found was chilling. Losses for the best paper in LLCs were in the 30-35% lifetime range. In the scratch-and-dent category, losses sometimes exceeded 100%. But worse, now that they knew, they blabbed the information to the world. Several Wall Street firms tracked MH chattel loan portfolios closely and put out monthly reports of the carnage. This differed from the past, when lenders, mostly banks, S&Ls and credit companies took their losses and seemed too embarrassed to tell the whole world of their travails. After all, just a year before they were widely touting how great the chattel MH portfolio was performing and the great contribution they were making to “affordable housing”. That would change soon enough. Little did they know then how great their “contribution” was to be.

Here is an interesting sidelight: I’ve identified above the recipients of the lender’s losses. Note I did not include the borrower. Yes, they got into a home they should not been able to buy, but they hardly ever got to keep the home. Either they couldn’t afford it, or when they tried to resell it, they were unable to, for a variety of reasons. This brought divorces, loss of home, children changing schools and all the other personal tragedy the loss of a home brings. Few apologies here by the industry. “We gave them a chance at home ownership was the industry refrain.” Swell.

By the time GreenTree/Conseco collapsed around 2001-2003, the MH chattel world had changed. Forever. Most did not recognized it. It was said to be just a periodic pullback. The industry would return, they said, it always had. Lenders had lost their nerve. We could get the GSEs to bail us out. We could get “Duty to Serve.” If they won’t do it, then Title I will. To this day we have Pollyanna’s carping this drivel. “Its simply a matter of better sales training. Now subprime is done, it will allow MH to return. (Forget MH chattel lending is the King of Subprime.) We are the only provider of non-subsidized affordable housing. Its simply a matter to fix HUD Subpart I.” In the face of a 90% reduction in volume, can it be that these thoughts still drive an industry? It seems unimaginable. (New to MH and the Subchapter I quest? It is a part of The Manufactured Housing Improvement Act of 2000 dealing with recalls, home installation and handling consumer complaints on MH. Like Don Quixote, the industry DC operatives, live to believe that only these DC quests are important.)

Around 2005-2006 the industry still had enough muscle to have faced that we were operating from a Failed Industry Model. The Roper Survey told us that. All of the reasoning above would not save us. Only an acceptance that drastic measures were needed could have changed it for us. Since we refused to act, “The Market” did it for us. It punished tone-deaf MH business behavior with ruthless abandoned, and is still doing it. The industry still doesn’t listen, though one wanders whether trying to really do something about it would have any impact at this point. Frankly, I doubt it. The high home value depreciation and high loan losses at increased loan volume seem impenetrable. We have failed to move against this, even if it is possible to do so, which is daunting at best.

With Dodd-Frank and SAFE in place, and other regulatory devices sure to come, the impediments to an easy, even a difficult industry response are many. n the face of this we are still worried about Subpart I? Were we to get everything we wanted there, how many more homes would we sell? Heaven help us that this is the response of a terminal ill industry by its leaders.

As with all struggling businesses, the industry has scurried to try to make up for the existing industry model deficiencies. Don’t have Greenseco-type chattel lending available? Heck, start some buy here-pay here and create your own. Want to keep rents coming in? Buy homes and rent them out. Many came to MH to escape the apartment business, but are now doing a version of apartments far worse than real apartments. Overlook the regulatory constraints, the illiquidity of self-lending loans, roll up your selves and go to WORK, boys and girls. Hey, it worked in the past going back to the 1950s. Oh, really, and how did they handle Dodd-Frank then, did you say? Or SAFE? Oh..

Its a changed world and having lost our own lending business here we’ve transacted since 1972, we are impacted as are most others. We are not and will not be alone, as the industry gets closer to 40,000 shipments than to 50,000. At those numbers, I can only assume a whole new tier of businesses are endangered, as most of us scramble to avoid facing the prime business dictum: Get out of a dead business. This is bolstered by my own Prime Dictum: “Never mind what people are saying, watch what is happening”. And what is happening is an open book. All can, or should be able to read it.

I suppose those folks who went to those long-ago industry speeches I gave, rolled their eyes then as I correctly prophesied the point where we now are, can point to their own acumen. Come on Marty, it can’t get that bad they said! Sitting there now with 50% LLC vacancies and unsalable self-financed loan portfolios as their response, they can take solace in their prescient course of action. Of course. Frankly, I would much prefer to have been wrong, very wrong.

So what does this all mean? I hate to say it because I’ve tried to remain in the same industry as you have, but my industry left me. Has it left you? What is the next stop on this train to oblivion? # #

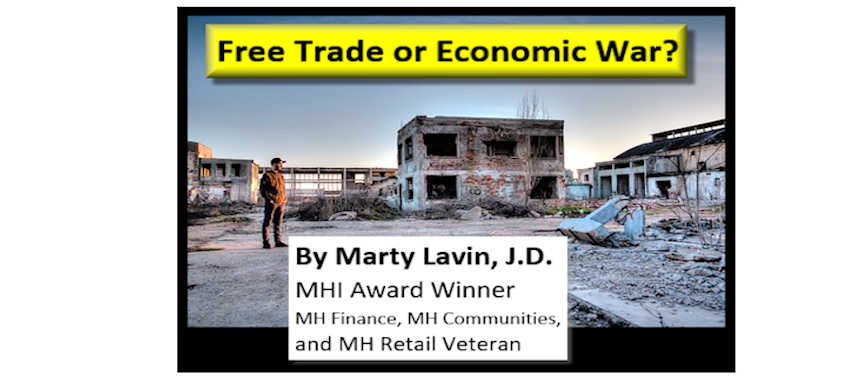

MARTIN V. (MARTY) LAVIN

attorney, consultant, expert witness

practice only in factory built housing

350 Main Street Suite 100

Burlington, Vermont 05401-3413

802-660-9911, 802-238-7777 cell

web site: www.martylavin.com

email mhlmvl@aol.com

Editor’s Note: We have honored the author’s request to post his article “as is.” As with all our Industry Voices Guest articles, we invite reader response and dialogue, either public (by posting a Discus response below) or private (phone or email). Thanks for reading and getting involved!

Karl Radde – TMHA, MHI, Southern Comfort Homes – Addressing Bryan City Leaders, Letter on Proposed Manufactured Home Ban

To All Concerned [Bryan City Officials, Others]: As the retail location referenced by Mr. Inderman, I would like to take a moment to address the …