If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Big US banks just had a banner year

- You wouldn’t know it from watching their stocks, but they raked in a cool $120 billion combined

- US markets leap again on China trade talk reports

- Technology is changing how we grow old and die

- The problem with Netflix’s viewership numbers

- Women deserve credit for the success of their billionaire husbands

- Last year’s market losers are this year’s big winners

- Sears creditors condemn plan to save store, citing ‘misconduct’ by chairman

- Tesla cuts 3,000 jobs as Elon Musk cites ‘difficult’ road ahead

- Consumer sentiment drops to lowest level of Trump’s presidency

- Reporter with checkered past comes back with Trump Tower Moscow bombshells for BuzzFeed

- The world’s central banks will have trouble fighting the next big recession

- Shutdown comes at worst time for the economy

- Shopping Content by CNN Underscored

- These earbuds are an alternative to AirPods

- LIVE UPDATES Disney to give first look at streaming service on April 11

- breaking bad walter white bryan cranston

- Netflix is burning through cash. This can’t last forever

- America’s oil boom is terrible for the climate

- The other Sears that isn’t in bankruptcy

- Why Sears’ woes might not help JCPenney

- Gymboree’s second bankruptcy will kill the brand

- How Casper drove Mattress Firm into bankruptcy

- Brookstone closes all its mall stores

- You got a bad performance review. Now what?

- How some wellness programs encourage toxic attitudes about body size

- Pull yourself out of a work rut

- How to land a new job in 2019

Select Bullets from Fox Business…

- Stocks close sharply higher, 4th straight week of gains

- Facebook may face record FTC fine over data privacy violations: Report

- Kellyanne Conway: Confident on US, China trade talks

- This is what most Americans will spend their tax refunds on

- What’s wrong with pretax retirement accounts

- Oreo hit with complaint over ‘hiding’ rival cookies

- Elizabeth Warren wants Wells Fargo removed from college campuses

- A look at Ocasio-Cortez’s stances on economic issues

- PG&E’s bankruptcy will cost more than you realize, here’s why

- Why Maroon 5, other Super Bowl halftime show performers don’t get paid

- Dems shouldn’t be judged solely on Ocasio-Cortez: Former DNC chair

- Here’s how much JPMorgan CEO Jamie Dimon earned in 2018

- Walmart, CVS Health settle pharmacy feud: 4 things to know

- Netflix: Fortnite is a bigger competitor than HBO

- 10 best side hustles to pursue in 2019

- Perdue recalls nearly 70K pounds of chicken nuggets

- Americans, saddled with student debt, can’t afford a home

- Mexico farmers debunk avocado shortage rumors

- Americans are drinking less alcohol, and it’s changing the focus of retailers

- Why companies are turning to private equity

- John Sculley: Tim Cook’s FTC request on consumer privacy ‘makes so much sense’

- Ocasio-Cortez’s 70 percent tax plan tip of iceberg for Democrat-backed hikes

- What Gilette’s PC ‘toxic masculinity’ ad gets wrong about advertising

- Steny Hoyer has thrown doubt on Democrats’ unity: Varney

- PayPal offers $500 credit to workers affected by government shutdown

- Retail Apocalypse: These big retailers closing stores, filing for bankruptcy

- Los Angeles district estimates teachers’ strike has cost $97M

- Tax season tips: Get your 2018 refund quicker

Today’s markets and stocks, at the closing bell…

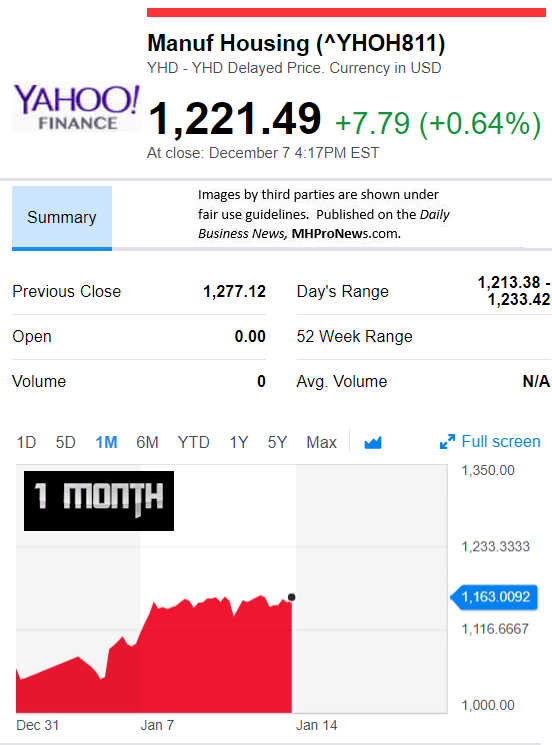

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

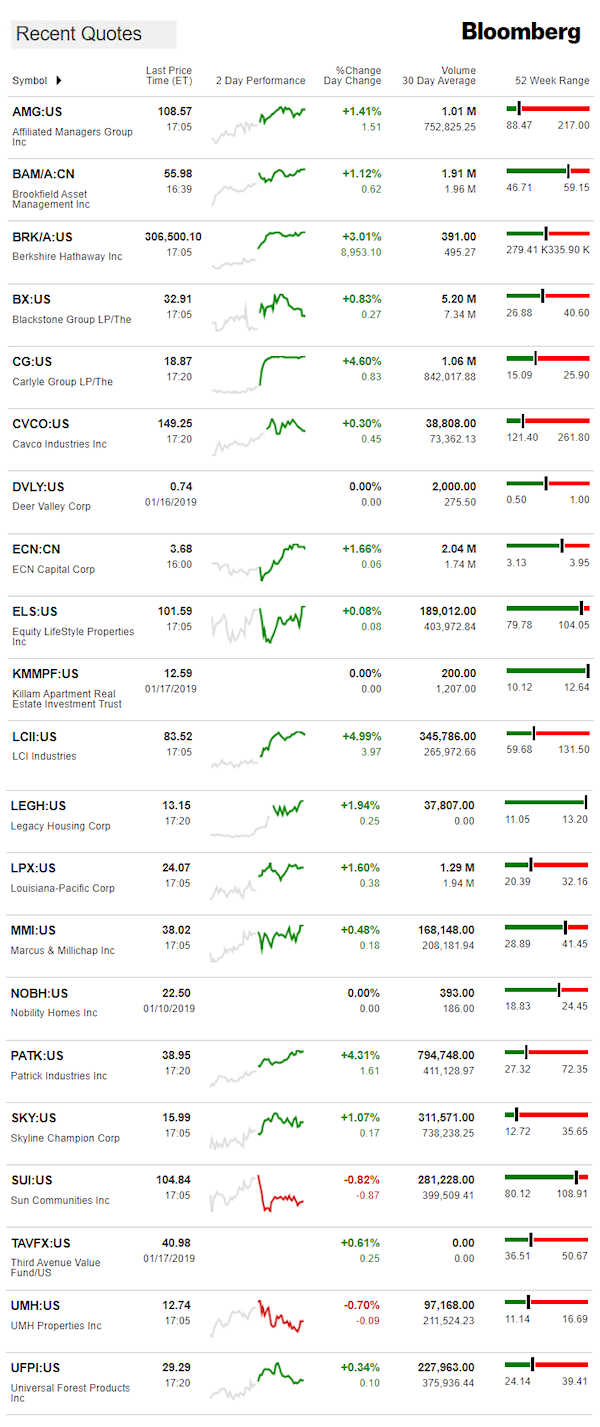

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

“Hagens Berman Notifies Cavco Industries (CVCO) Investors of the Firm’s Investigation” – via a news release to the Daily Business News on MHProNews said that they are looking into – “Possible Securities Law Violations,” saying in part, “If you purchased or otherwise acquired Cavco securities before November 9, 2018 and suffered losses contact Hagens Berman Sobol Shapiro LLP.”

The HBSS law firm is the latest to dive into the fray. The partial federal shutdown has temporarily iced the Securities and Exchange Commission (SEC) investigation. But the status of the SEC doesn’t necessarily stop private plaintiffs’ attorneys, acting on behalf of investors, from pressing ahead.

As a reminder to readers, or those who may be stumbling up this for the first time:

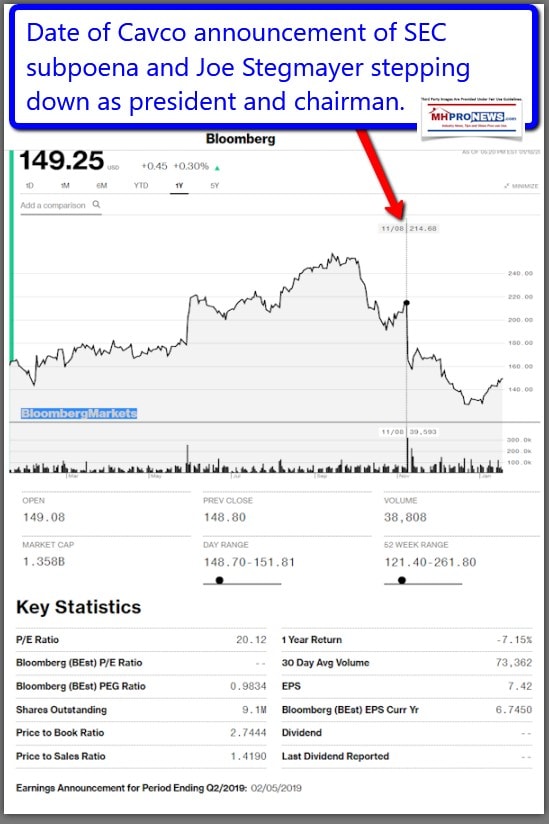

After the market closed on November 8, 2018, Cavco and senior management filed the Company’s Form 10-Q for the quarterly period that ended September 29, 2018 and disclosed:

“On August 20, 2018, the Company received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of another public company. On October 1, 2018, the SEC sent a subpoena for documents and testimony to Joseph Stegmayer, the Company’s former Chairman, President and Chief Executive Officer, regarding similar issues. At this time, the Company believes that Mr. Stegmayer traded in certain publicly traded stock in his personal accounts as well as in accounts held by the Company at a time when the Company had agreed to refrain from such trading.”

That news drove the price of Cavco shares down $49.48, or about 23%, to close at $165.20 on November 9, 2018, said HBSS, adding, “We’re focused on investors’ losses, the extent to which management’s statements about controls and compliance matters may have been misleading.”

Insider Trading

Insider trades that follow SEC rules can be legitimate, but in the light of the swirling controversies at Cavco, may be sending a problematic signal to other investors.

“CVCO stock…In other news, insider Charles E. Lott sold 2,032 shares…,” said the Fairfield Current last week. TNN reports that recent filings indicate insider ownership at CVCO stands around 6.40%.

The KReviewer reported earlier this month that, “The insider STEGMAYER JOSEPH H sold $2.82 million…” in a prior filing period.

YomiBlog said earlier today that “Since August 21, 2018, it [Cavco Industries] had 0 insider buys, and 3 sales for $4.88 million activity. Another trade for 11,740 shares valued at $2.82M was sold by STEGMAYER JOSEPH H. Lott Charles E sold $489,200 worth of Cavco Industries, Inc. (NASDAQ:CVCO) on Monday, August 27. Boor William C sold $1.57M worth of stock.”

“Investors sentiment decreased to 0.95 in Q3 2018,” said YomiBlog. “Its down 1.54, from 2.49 in 2018Q2.’

Reports about Cavco are mixed on a day that the stock closed up. While the previous, related reports shed various light on the issue, it is quite possible – per sources – that the stockholder investigators have still not stumbled upon a story as big – or bigger? – then what caused the SEC to launch its investigation in Cavco. The writer has no position in CVCO.

Related Reports:

Cavco Shareholder Suits Prepping, CVCO, SEC, Insider Responses to Growing Scandal

Manufactured Housing Institute on Cavco Industries, ex-Chairman Joe Stegmayer SEC “Debacle”

https://manufacturedhomepronews.com/masthead/manufactured-housing-institutes-three-stooges-seco-leaders-george-f-allen-spencer-roane-tom-lackey-and-rent-to-own-scams/

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.