“We treat our tenants fairly by limiting their rent increases to 5%, 6%, even though we may be able to achieve larger rent increases. These policies generate good relationships with our tenants, which results in lower turnover and turnover-related expenses,” (bold emphasis added) said Eugene Landy during the earnings call recently reported on MHProNews. Intentional or not, several of the remarks made by UMH Properties President and CEO Samuel “Sam” Landy, J.D., and UMH founder Eugene Landy, J.D., during that earnings call could be seen as a direct challenge to the types of de facto or apparently openly stated business practices that rival firms in the manufactured home community (MHC) business deploy.

As Part I will explore, instead of “aggressive,” “relentless,” or “predatory” business practices, the Landys and UMH treat their residents “fairly.”

They also have said that developing new manufactured home communities by the hundreds per year is important for the manufactured housing industry. That would mean a dramatic reversal of the corporate policies advanced by aggressive firms during much of the 21st century which seemed to discourage new developments. What UMH’s father and son leadership team proposed would be roughly equal to developing every 9 months throughout the U.S. a number of communities equal to what now Equity LifeStyle Properties (ELS) owned Datacomp claims was developed nationally in the U.S. in about 15 years.

Such remarks by UMH leaders could roil the go-along to get along stance several others may have at the Manufactured Housing Institute (MHI) and its National Community Council (NCC) division.

How such tensions will play out could prove interesting.

Why? Because the implications of the Landys remarks could cause or fuel grief to other MHI-NCC members on several fronts. Those include potentially legal, regulatory, and on the investment issues. While others at MHI have quietly mocked them behind their backs for some time, could it be that the Landys will have the last laugh? Time will tell. But UMH’s stated results suggests that is possible.

Thus, this pre-announced second and more focused look at the topics raised during that UMH earnings call may prove useful.

While editorial hunches can be challenging and are thus at times errant, the hottest two days for March 2024 readers on MHProNews per Webalizer were the day that article on UMH statements hit and the following one. So, that aspect of our hunch proved correct. The subjects raised by UMH and that report are apparently broadly interesting to MHVille pros, investors, advocates, public officials and others.

Part I

In no particular order of importance, and not necessarily in the order the remarks were stated during the recent UMH earnings call are the following.

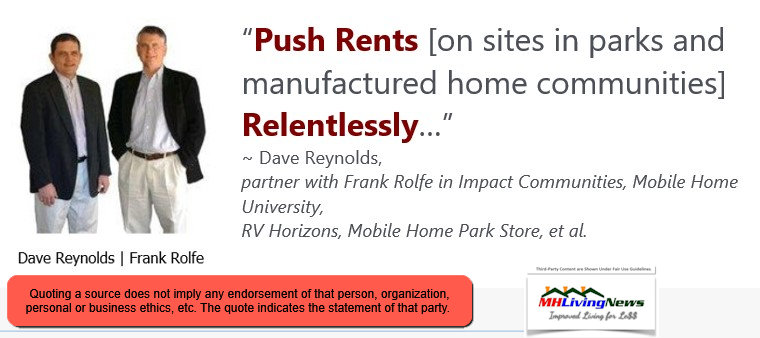

1) There are those involved in MHI/NCC who have openly advocated for aggressive hikes in site fees. While Dave Reynolds and Frank Rolfe have perhaps made the most ‘noise,’ others are seemingly into the same or similar thinking, per their published investor relations packets and/or other remarks.

In stark contrast to the above was the following from Eugene Landy for UMH.

Note that UMH has apparently tended to escape the type of push-back several other members of MHI-NCC have experienced over the years from resident-advocacy groups. Ishbel Dickens, J.D., then acting on behalf of the MANUFACTURED HOME OWNERS ASSOCIATION OF AMERICA (MHOAA) said this to members of Congress.

Dickens also said:

The push rents relentlessly mantra, purportedly in concert between ELS-owned Datacomp and other MHI member firms and/or MHI state association affiliate member firms could be approaching multiple legal and economic days of reckoning. Several antitrust laws suits are underway, see more on the firms involved in the report linked here.

2) Per Samuel A. Landy, J.D., President, CEO & Director of UMH Properties.

But comparing a sale to a rental, I can make the argument, we don’t even want to sell homes. But on the other hand, it benefits the resident. If a resident knows they’re staying 3 years or more, it benefits them to own a house because, then, they only receive the rent increase on the lot rent.”

As noted in our recent initial analysis of that earnings call, that is thoughtful argument.

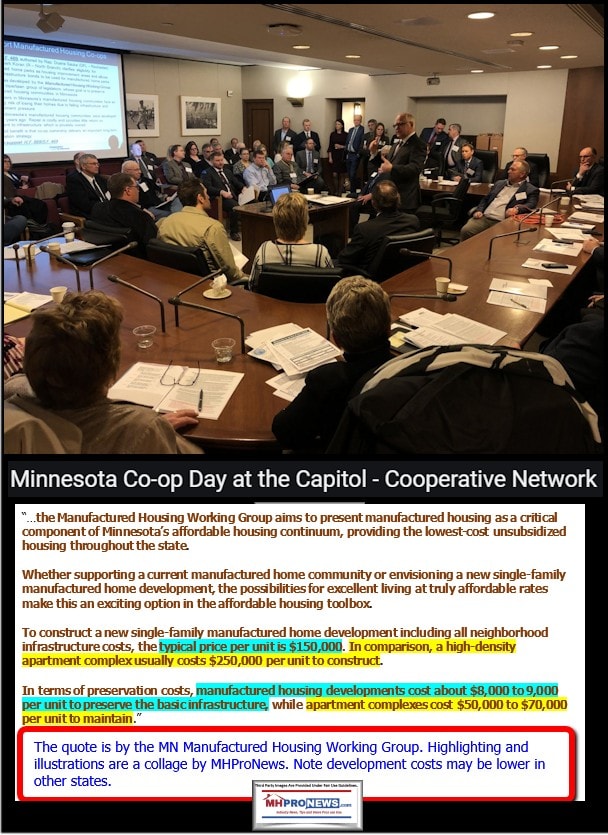

MHProNews has periodically noted the stark contrast between developers of apartments and the de facto thwarting of developments using manufactured homes. This is despite the fact that, as Landy aptly pointed out, horizontal manufactured home communities are less costly to develop. Who said? Minnesota’s Manufactured Housing Working Group, which studied the issue in a bipartisan manner.

It may not be coincidental, but is rather mathematical, that Landy can offer a three bedroom two bath manufactured home with enhanced privacy via some greenspace around the dwelling than the national rental rate for a typical one bedroom apartment. See the math at this link here.

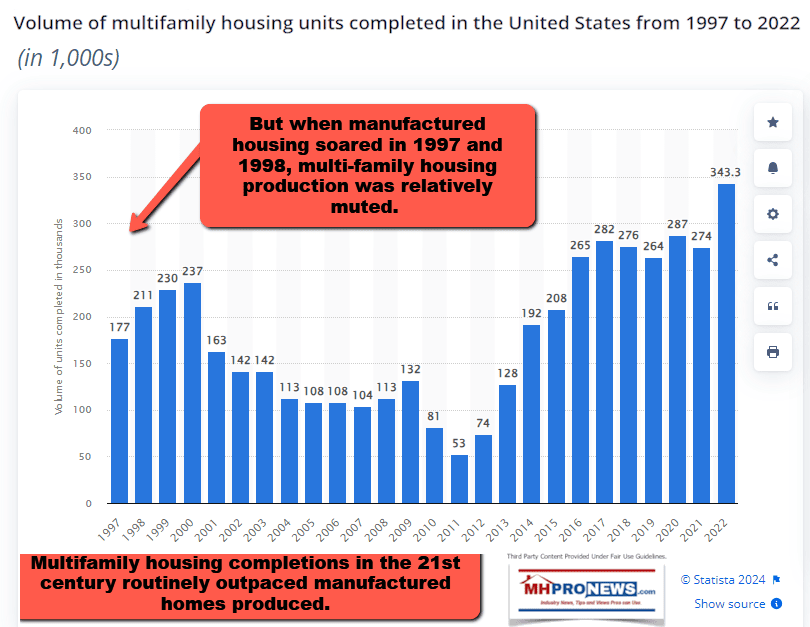

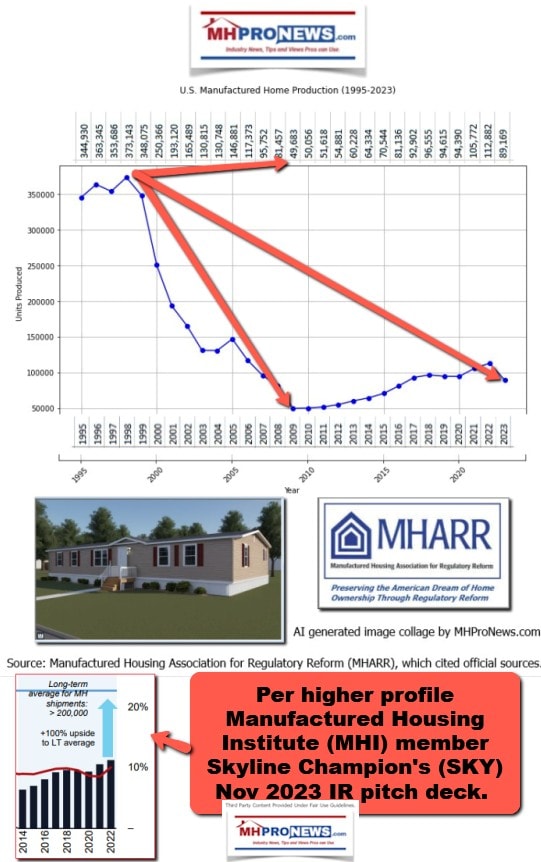

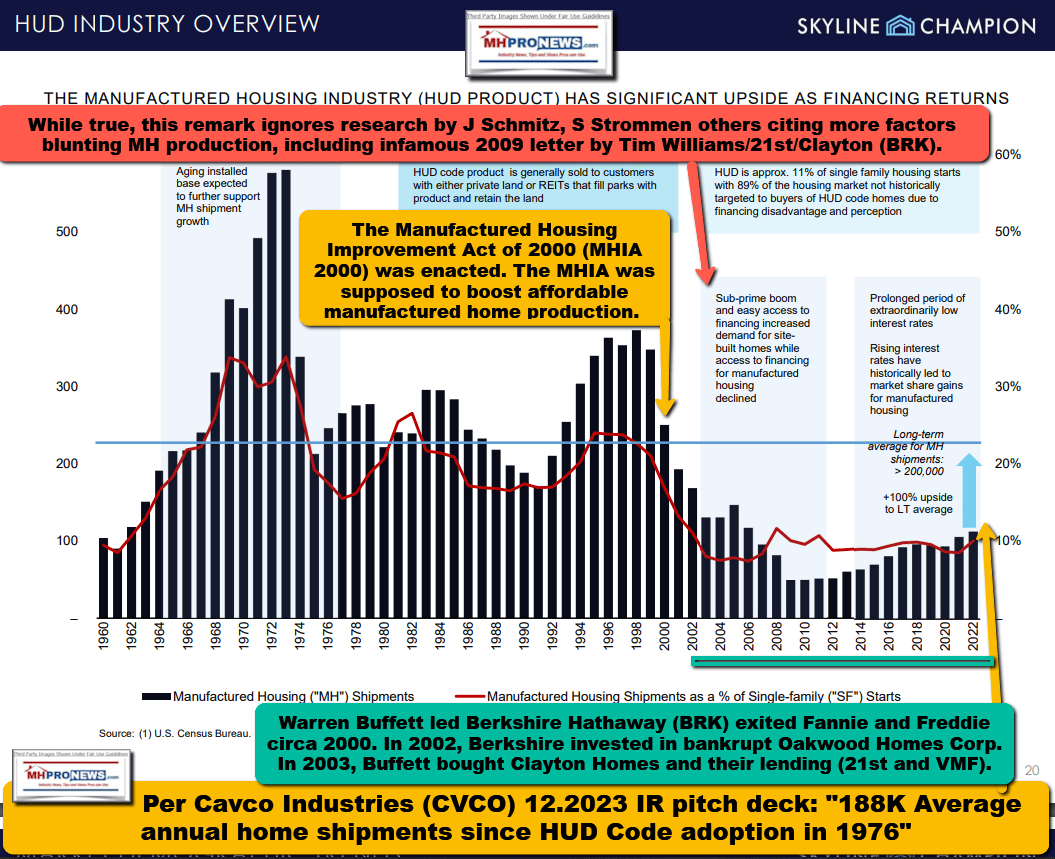

3) While hundreds of thousands of apartments (multi-family housing units) are being built in the U.S. annually for some years, that is arguably an indicator of the potential Landy’s/UMH thesis suggests that manufactured housing could achieve and potentially surpass. For example. Looking back at 1997 and 1998, when manufactured housing was roaring it roughly outproduced multi-family housing completions by some 2 to 1 (see both charts that follow).

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

But more recently, manufactured housing fell below the 100,000 total units produced mark again in 2023. Per Statista, the two most recent years covered by the graph above outperformed the two most recent years in manufactured housing by some 3 to 1. Ouch. That is worse than a complete reversal. Yet this is but one of several indicators of how problematic and arguably wrong-headed the leadership of MHI have been in the Berkshire era of the industry.

4) Something similar to what happened with multi-family housing starts vs. manufactured homes occurred in the comparison between RVs and manufactured housing. In the late 1990s, manufactured housing outsold RVs by some 3 to 2 in 1998. But in the 21st century, that is no longer so. RVs in several years outsold MHs often multiple times to one. See the side-by-side metrics detailed in the report below.

5) The ‘backlogs’ controversy hit UMH, while differently in some ways, in others not unlike how it impacted manufactured home street retailers. Carrying and others costs went up. Per Sam Landy.

6) But the case can be made that the “backlogs,” which some insiders have told MHProNews may have been avoidable, not only hurt independent retailers and some communities too, they ultimately also caused ripple effects that harmed production in 2023 vs. 2022. Meaning, shareholders in those firms have been harmed. Yet, thus far, no shareholders litigation firms have stepped up and sued. Will that continue to hold true, or will that change?

7) Again, wittingly or not, intentionally or not, points raised by UMH’s earnings call arguably reflect a series of challenges to how business has been done and narratives have been spun by MHI’s insiders for several years. Firms like UMH and Legacy Housing (LEGH), to pick but two examples, have arguably been harmed by the tactics deployed by others in MHVille. As the report below indicated, Legacy – and MHI member – could be used as a stand-in for other manufactured housing independents.

8) When Eugene Landy said the following, it is one of numerous reasons why manufactured housing ought to be soaring to record highs, not struggling as it has been in the 21st century.

Our new manufactured homes sell for as little as $90,000 and rent for as low as $1,000 per month. These are prices that are unmatched by any quality competition in the market. Families with a household income of $40,000 can afford to either buy or rent a home in a UMH-managed community.”

See the math in the focused report linked below.

9) According to MarketBeat on 3.31.2024, one investment firm trimmed its stake in UMH Properties, while several others raised their holdings in the firm.

The land-lease community sector is clearly of interest to private equity.

Part II – MHI and the Industry’s Struggle – To Pragmatically Favor Enhanced Preemption Deployment or Not Preempt Local Zoning?

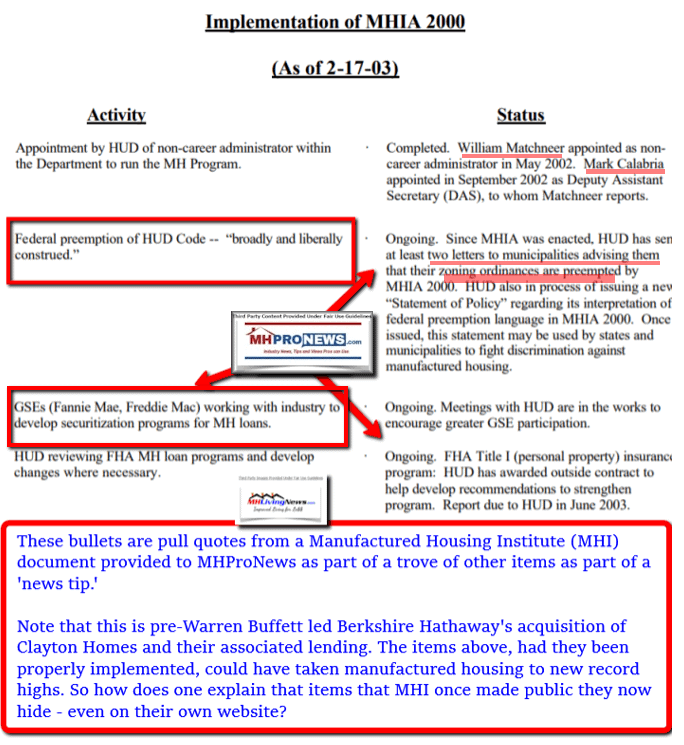

1) For most of the 21st century, the Manufactured Housing Institute (MHI) has ‘acted’ as if they favored the enhanced preemption provision of the 2000 Reform Law which MHI, MHARR, and the Texas Manufactured Housing Association (TMHA) among others – favored and successfully collaborated to enact.

But as MHProNews has meticulously documented in recent years, and which MHI leaders and their attorneys will not directly debate, respond to, or dispute, is this pattern of paying lip service to enhanced preemption, when in fact they do not mention those words on their own website, nor do MHI leaders seem to say those words “enhanced preemption” in the context of the Manufactured Housing Improvement Act of 2000 in making their affordable housing case to the public via op-eds or media remarks.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

2) The contrast between MHI and MHARR on this word search of their respective websites is revealing. On MHARR’s website, there are pages of reports that use the words “Enhanced Preemption” under the MHIA of 2000. But with MHI, before or since their 2023 website refresh, those words are entirely missing, per their own search tool. Yet, per an inside source that provided the following to MHProNews, MHI’s website supposedly once had the following base document available. Periodic checks revealed it is no longer publicly available.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note the misleading, wishful thinking, or apparent paltering by MHI above on the Government Sponsored Enterprises (GSEs) “working with the [manufactured home] industry to develop securitizations programs for MH loans.” 21 years have passed since MHI expressed those words in that dated document above! Isn’t that enough time for the magicians at MHI to pull some sort of rabbit out of the proverbial hat? Someone would have to be a lover of Russian literature to appreciate the irony: ‘The rules are simple. They lie to us, they know that we know that they are lying, but we pretend to believe them.’ Or if not irony, the hypocrisy and chutzpah.

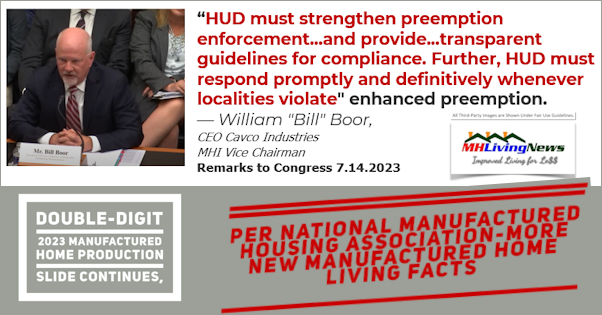

3) Arguably no trade group with the potential firepower at its command that MHI has could be this inept or incompetent. They trot out William “Bill” Boor to Congress to ask them to enforce enhanced preemption.

But they blithely or ignorantly (take your pick, and neither is a favorable look for MHI’s leadership) failed to mention that Congress heard from the industry on this same topic over a dozen years ago. Then and now, almost the same testimony could be made. Which is why the flashback reports are so valuable, because they reveal either how inept or treacherous MHI’s leaders have been, take your pick.

All of this goes to the heart of issues raised by the Landy’s in the report linked below in more depth and context and quoted above in a more focused fashion.

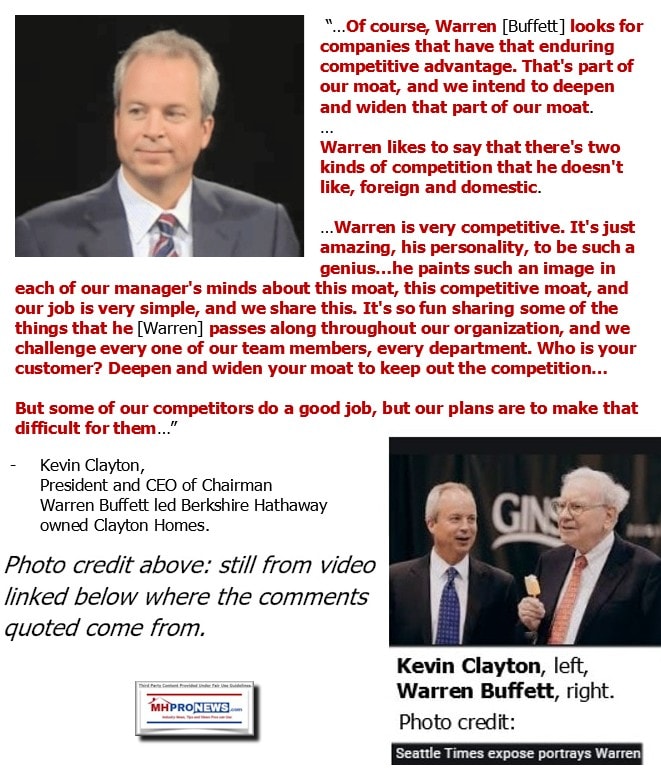

4) Per sources deemed reliable, there are reasons to believe that MHI and their attorneys carefully follow MHProNews and/or MHLivingNews, or for that matter, MHARR. The significance is this. Something like that Russian author, they know that we know that they are playing word games at best, they are inept, or they are treacherously undermining their own industry’s growth potential. Sam Landy mentioned Warren Buffett during that last earnings call. Understandably so. Buffett’s ally, William “Bill” Gates III made it quite clear. Buffett (and thus his business units) find weaknesses in markets to exploit them. Kevin Clayton said something similar. These are difficult to unsee once these remarks are clearly understood.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

No matter how much smoke “Kevin,” “Warren” or others in that orbit may blow, those remarks mean what they said. And the measurable impact of those remarks is that manufactured housing has underperformed for all of the 21st century since Buffett formally entered the industry in 2002. Copilot indicated that Buffett’s pull out from backing the GSEs may have contributed to the loss of that source of securitized chattel lending that is talked above for some 2 decades (or more) but seems to go nowhere except to programs like Clayton-backed and MHI branded CrossMods that are all talk and thus far almost no measurable action.

5) But a longtime insider has told MHProNews that there are federal programs that are lying essentially dormant which MHI has rarely, if ever, mentioned in writing. It is almost another example of “enhanced preemption,” but perhaps more so in this regard. The very types of developing that the Landys say that they want to see occurring in manufactured housing, the very types of developing that they are doing in JVs with Nuveen, might be accomplished with other financing tools already available under federal law. They would have to be compared to GSEs or Opportunity Zones, in terms of how and where they are best deployed for development purposes. But the fact that MHI likely has not mentioned them to UMH Properties ought to be troubling to manufactured housing industry growth minded professionals.

6) Much of what the Landys said in their recent remarks was significant. But their direct challenge to the arguably false notions peddled by some MHI insiders may be near the top. The Landys said that they can generate more profits through greenfield developing than by buying stabilized communities. Wittingly or not, they have made very similar arguments that MHProNews/MHLivingNews have advanced for over a decade. There is more potential profit, AND a better industry image possible by doing things correctly than by using devious machinations and arguably harmful manipulations.

- “Sam Zell said back in 1994 that there is nothing more stable than the revenue from a resident-owned home in a community. Well, after COVID, we proved that the rents on rental homes are just as stable as that revenue…”

- “But because nobody on the rental front can compete with a factory-built home on a lot, we did more of those because we know, we’ll maintain 95% occupancy and 98% rent collection.

- “We have the best quality affordable housing at a price point that can’t be matched. The affordable housing crisis is only going to intensify, from single-family homebuilders pulling back resulting in fewer housing starts, mass migration to the United States and the obsolescence of the existing housing stock.”

- “Our new manufactured homes sell for as little as $90,000 and rent for as low as $1,000 per month. These are prices that are unmatched by any quality competition in the market. Families with a household income of $40,000 can afford to either buy or rent a home in a UMH-managed community.”

- “The size of the market that needs our product increases as interest rates rise.”

- “The nation must build new manufactured housing.”

- “…you’re going to have to build 100,000 more communities.”

Which begs serious questions.

Why have MHI’s insiders not beat the drums on those themes to the wider public?

Why hasn’t MHI’s leaders used existing laws and litigation where needed to get the industry building a million new homes a year instead of under or around 100,000?

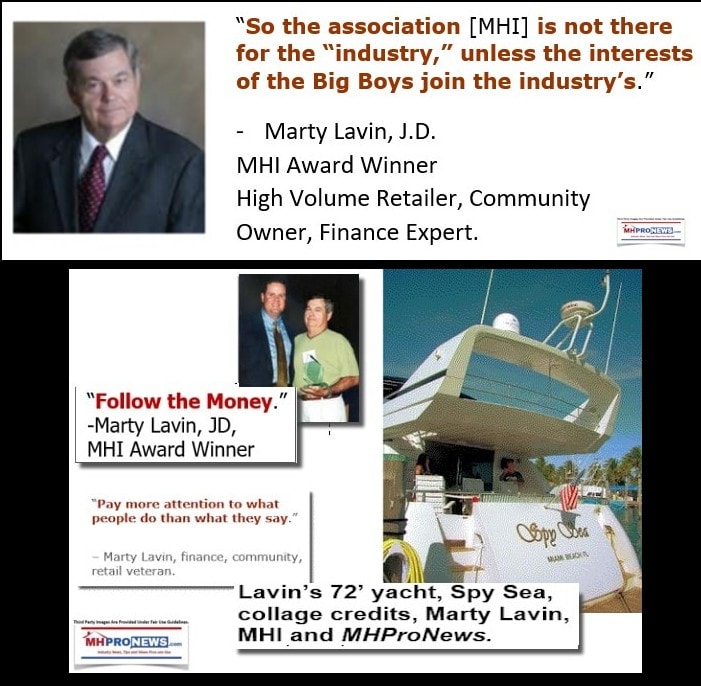

7) Sorry, but the evidence when considered with open eyes is increasingly clear. MHI’s leaders are picking winners and losers. They pat people on the back, they occasionally hand out a cheap trophy and call it an award, and then those award winners tout their award with a press release which routinely cost more than the award did to produce. MHI in the 21st century has become a game of smoke and mirrors, or a shell game as MHARR’s president and CEO said. If some can use the MHI decoder ring successfully, well, they might navigate the maze. But if they don’t use the MHI de coder ring successfully, they may get periodic applause, but they are not getting the benefits that the true insiders think that they enjoy.

While Berkshire clearly has buckets of money they could throw on these issues for lobbying, legal, or other purposes, they are hardly alone. Several of the brands being sued by residents also have plenty of capital access. The industry is apparently being thwarted from without, yes. But they are being thwarted from without thanks in part to the behaviors of insiders who have crafted a business model that think they works for them.

8) These are the facts that when remarks like those made by the Landys that should jump to mind for any good, honest, properly informed trade journalist or industry growth advocate. Oh, there doesn’t seem to be too many of those hanging out with MHI these days, does there? But lying, false, or misleading information – that is what Bing’s Copilot has asserted is a fair reading of MHI’s behaviors. And what, if anything, will UMH, Legacy Housing, and other firms that are being de facto limited by MHI going to do about it?

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

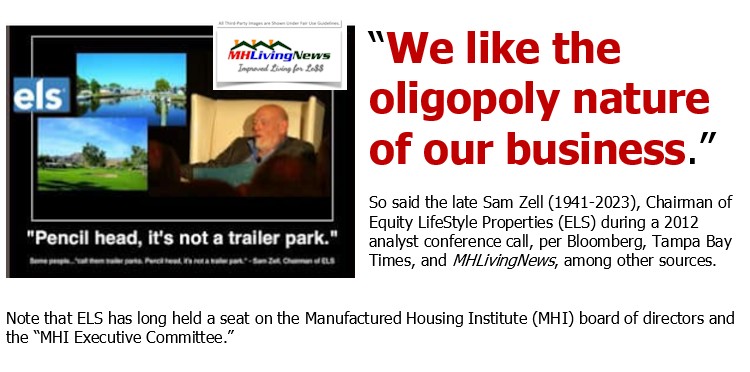

9) Don’t shoot the messenger, which changes little or nothing. Rather the thwarted should take aim at those who are making the messenger’s words necessary in the first place. There is an oligopoly of insiders running things for their own benefit, Zell said as much a dozen years ago.

The good news? The evidence is significant enough to make those insiders vulnerable on a variety of levels. Their so-called moats are so shallow, properly armed, those they have harmed – and there are many – could wade across and breach those dirty moats.

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

More evidence is ahead. Stay tuned. Because manufactured housing should be soaring, instead of snoring. A look at some of their own words make the insiders’ two plus decades of game playing tragically comical. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’