With so much capital chasing land lease manufactured home communities, which are often – if inaccurately – called “mobile home parks,” a logical question should be – is it overheating?

To shed light on that timely concern, consider the following.

“A prevalent question in the mortgage industry is whether the real estate market is currently overheated or nearing that state,” wrote Marie Singer for Market Business News on 10.15.2020.

As Investopedia defines the “overheated market” phenomenon, “Simply put, an overheated economy is one that is expanding at a rate that is unsustainable.”

Realtor, part of the National Association of Realtors, recently raised that topic in their sector of the real estate market too. Here is how their report framed it.

“The nation’s surging home prices don’t seem to care about the recession the country is mired in. They can’t be bothered by the deadly coronavirus pandemic or the double-digit unemployment that’s come as a result. Instead, prices are defying logic, expectations, and even belief, as they shoot up to record highs amid an unprecedented health and economic crisis. It has all led some to wonder: Are some markets getting too hot? Could a significant correction be around the corner?”

Those third-party media observations frame the arguably related question as it applies to manufactured housing.

- With millions-to-billions chasing acquisitions in our sector of the affordable housing industry,

- with more land-lease community closures than new manufactured home communities being developed,

- with resident performance standards in manufactured home communities consistently outperforming on both length of residency and for payment history,

- and with financing terms quite favorable, including, but not limited to, low-rate Fannie Mae and Freddie Mac lending,

these are just some of the factors that are attracting investors. But aren’t some of those factors also possible reasons to think that the sector is overheating?

As Realtor put it, “Such questions have become louder in recent weeks, in the face of some startling growth numbers…”

NAR’s Chief Economist Lawrence Yun, Ph.D., mentioned anew the stress on housing in statements recently examined in the report linked above and below.

MHProNews will explore the concern for manufactured home communities overheating through the lens of one of several recent reports by investor-focused media. That report from Mergers & Acquisitions penned by editor Demitri Diakantonis will be examined below. That will be followed by some additional information, MHProNews analysis and commentary.

“The coronavirus is changing the lifestyle of many Americans profoundly. As more people work from home, learn online and engage in social distancing, they are buying products and services that cater to their emerging needs. As a result, dealmaking is surging in some sectors, including mobile homes,” said Diakantonis.

He continued by saying that “In our November/December cover story, Mergers & Acquisitions [M&A] identifies and explores five sectors receiving strong interest from strategic buyers and private equity firms: exercise equipment, cleaning products, food delivery, pets and mobile homes [sic],” adding “Here’s our look at the trends driving M&A in mobile homes.”

M&A’s report continues by saying “The pandemic has increased the demand for manufactured homes, or mobile homes, as millions of Americans remain out of work, and mobile properties offer an alternative and more affordable way for people to live.” Actually, as attentive readers of MHProNews know, the demand for manufactured homes at the wholesale levels has been in decline for much of 2020. Shipments of new HUD Code manufactured homes declined in 2019 vs. 2018 too. That correction noted, the balance of that paragraph is arguably corrected “At the same time, mobile home parks can provide a reliable income stream for commercial real estate investors.”

Presumably because their readers may not be well versed in manufactured housing, Diakantonis provides some ‘definitions.’ What follows is his commentary, better than some, but not precise. Definitions and illustrations will follow this from M&A.

“A manufactured home is a home built in a factory and then transported to the final home site, where it is assembled. The factory-built process allows for more consistency, quality control and accuracy that is seen with individually site-built homes, which can be plagued with delays and disruptions. Today, most mobile homes are more modern and can resemble styles of traditional houses, according to industry reports.”

Diakantonis wrote:

Blackstone is one investor that is interested in mobile homes, a subsector of the real estate industry that has been performing well during the pandemic. The firm is in exclusive talks to acquire roughly 40 parks from Summit Communities for about $550 million, according to Bloomberg News. During the pandemic, transactions involving mobile home parks have outpaced other corners of the commercial real estate market as investors steer clear of harder hit sectors such as retail and hotels, reports Bloomberg.

“Manufactured home park investing can certainly be a good asset for the right investor circumstances, especially when investors understand their investment needs, have taken the time to do due diligence about their target areas, and have chosen the manufactured investment homes with care,” TFS says. “Despite being a new concept to many investors, rented manufactured homes in quality manufactured home parks can be an excellent way to invest in the real estate market in a profitable way without large capital requirements. Manufactured homes typically generate higher near-term returns on investment than a comparable rented residential home rental investment does.”

According to real estate website Buildium, more than 20 million people live in mobile home parks. There are more than 50,000 mobile homes in the U.S., and only one in five are professionally managed. The majority of mobile homeowners are older people who are close to retirement, creating an ideal buying opportunity for real estate investors.

Buildium points out there will always be a need for mobile homes, no matter the economic cycle, because they are affordable. Mobile homes can be rented for less than $1,000. “If the economy gets stronger, home prices go up, making it harder for low-wage workers to afford housing; and if the economy takes a downturn, even more people need access to affordable housing. This means that mobile homes—the ultimate affordable housing, since they can be mass-produced in factories—tend to retain their value regardless of the economy,” the website says.

In another deal, the BoaVida Group, owner and operator of mobile homes, has acquired the Lamplighter Mobile Home Park in San Antonio, Texas. BoaVida founder Eli Weiner says the company will continue to look for acquisitions. “The rapid pace of acquisitions is continuing through the Covid-19 scare, with the company looking for fewer, but larger opportunities this year.”

## End of Demitri Diakantonis article from Mergers & Acquisitions on 12.1.2020. ##

Additional Information, MHProNews Analysis and Commentary

MHProNews reached out earlier today to Diakantonis and to Eli Weiner at BoaVida with specific questions about the report above. As of the time this is being published, they have not yet replied.

Among other topics, both were asked about the issue of the manufactured home community sector possibly overheating, due in part to the combination of factors noted at the top of this report.

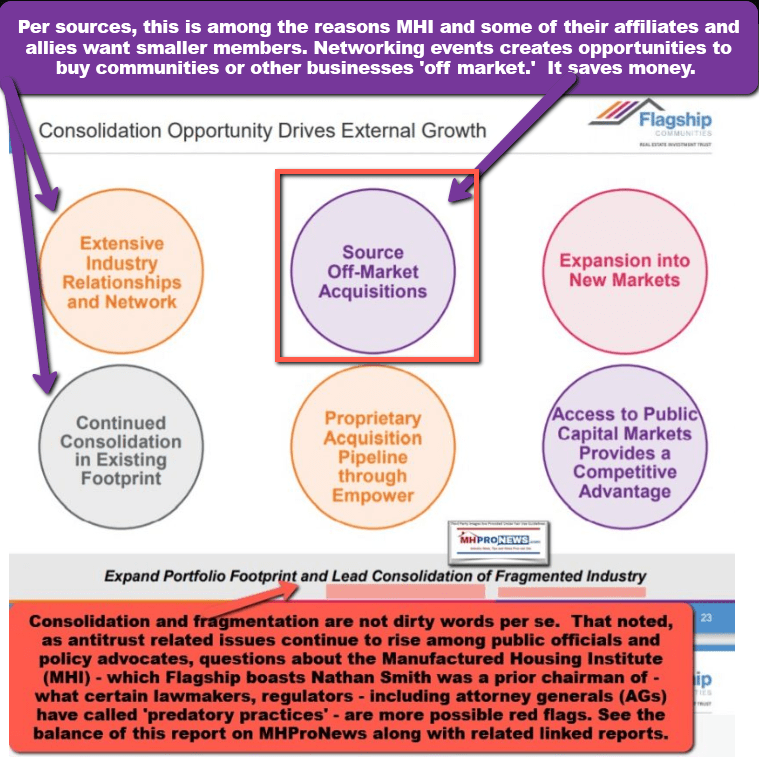

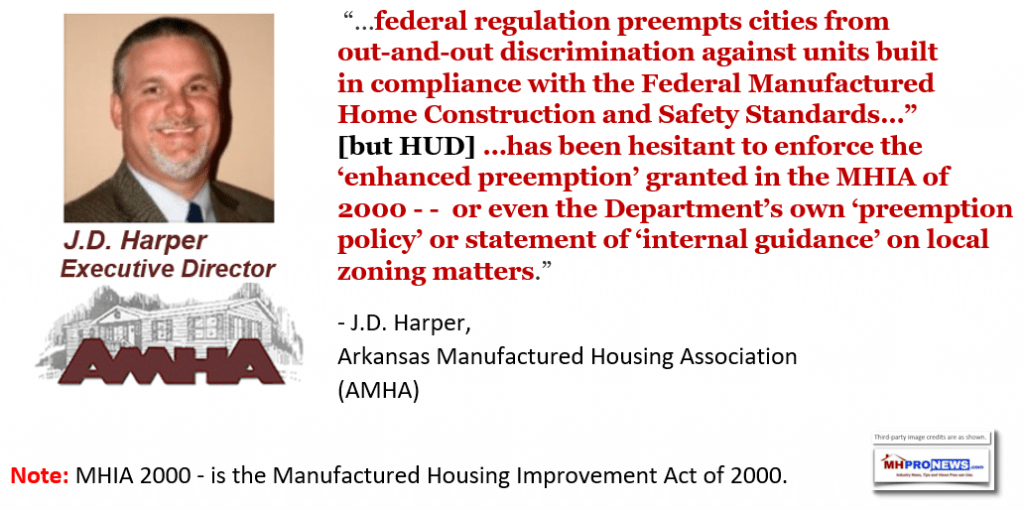

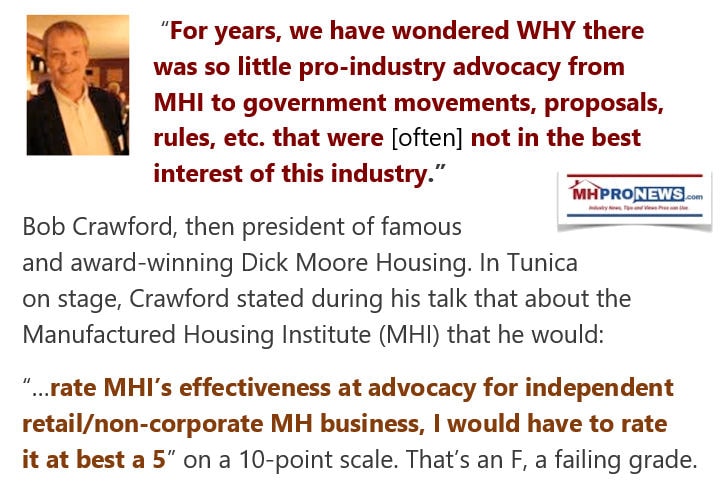

As MHProNews and MHLivingNews have periodically spotlighted the failure of the Manufactured Housing Institute (MHI) to actively and successfully push the proper and complete implementation of the Manufactured Housing Improvement Act (MHIA) of 2000 (sometimes called in industry circles “the 2000 reform law”).

That and a similar failure to promote the full and proper implementation of the Duty to Serve (DTS) manufactured housing finance mandated by the Housing and Economic Recovery Act (HERA) of 2008 are critical twin issues that has thwarted industry growth. Who says? Besides MHProNews and MHLivingNews, the Manufactured Housing Association for Regulatory Reform (MHARR).

Additionally, industry professionals, often with long ties to MHI, have raised similar concerns.

Absolutely not to be overlooked, tens of thousands of residents of manufactured home communities are often being placed in a difficult spot from this pattern of activities.

See the reports linked above and below as examples.

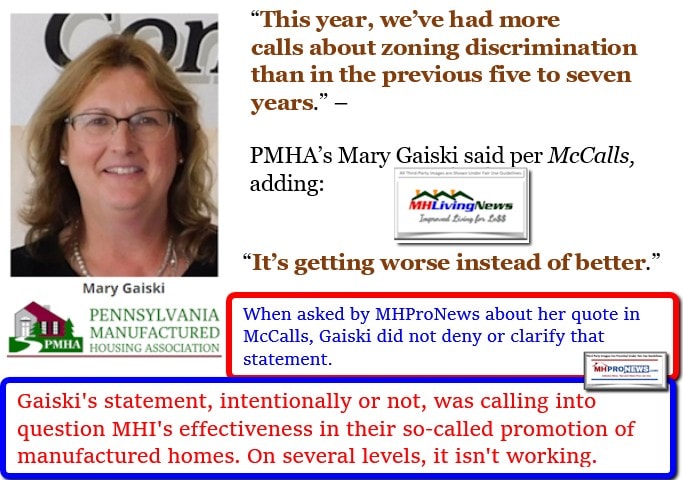

Pro-MHI state association executives are among those who have lamented publicly that the scenario in manufactured housing is getting worse on the placement issue.

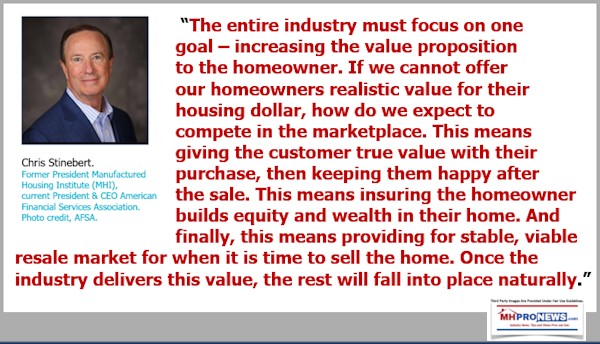

MHI’s prior president and CEO, Chris Stinebert, made the obvious point in his exit message that the interests and satisfaction of manufactured home owners had to be a priority for industry professionals.

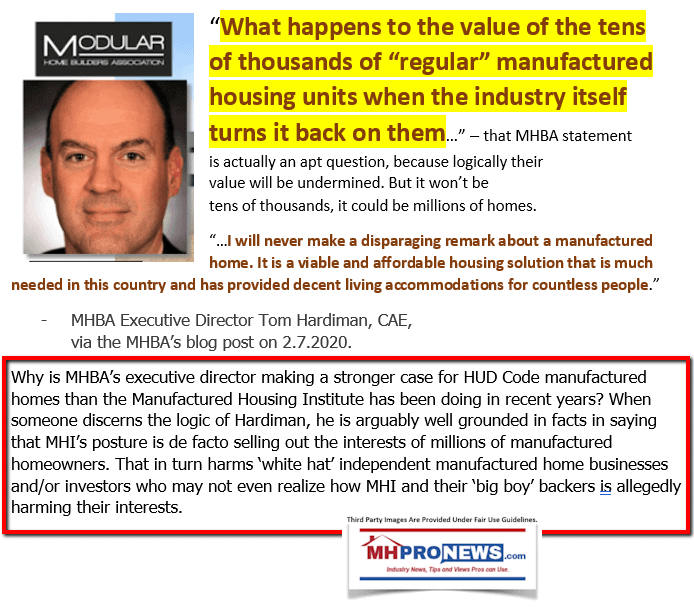

In slamming MHI for their arguably flawed “CrossModTM” homes scheme, the Modular Home Builders Association (MHBA) executive director Tom Hardiman made the point that MHI should be standing up for the industry and its homeowners. That is obvious, but regrettably as numbers of industry professionals have said, not what has been occurring for several years.

At the final MHI meeting this writer attended in February 2017, one of the questions I asked various industry leaders face to face was this. What do you think will occur on the production side of the industry as land-lease communities continue to gain occupancy and new manufactured home communities aren’t being built? Will production hit a wall? Several replied with words to the effect, that’s a good question. Either they didn’t want to answer it, or perhaps they had not considered it?

In fact, since that inquiry was posed to a range of MHI members, production in 2019 and 2020 has been either in a year-over-year decline or at times flat. The math was obvious. It was economics 101.

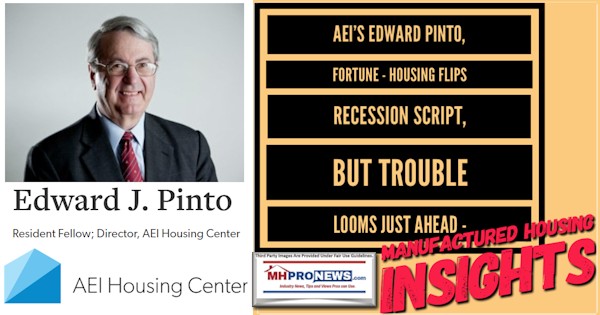

But that math, that economics 101, is what AEI Housing Center director Edward Pinto warned mainstream housing that a housing crash was looming in 2021.

That logic arguably applies to manufactured homes too.

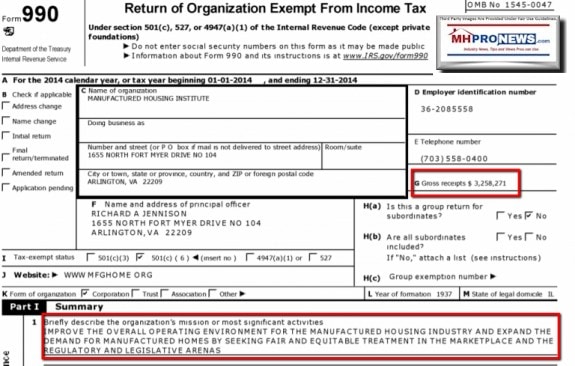

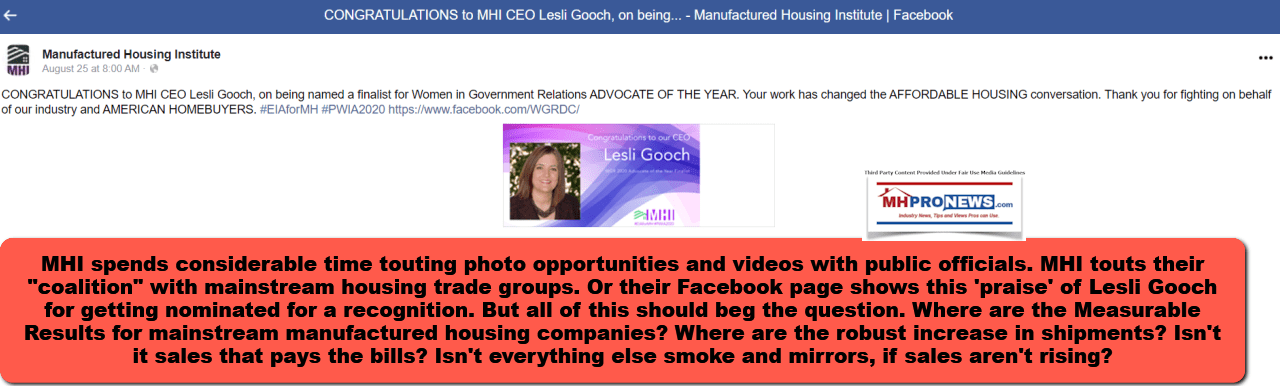

One solution? MHI should be doing exactly what it claims to be doing in several years of their IRS Form 990s. Truly improving the manufactured housing market, instead of posturing steps that purport to improve the manufactured housing market.

After all, if MHI’s efforts are seriously intended to grow the industry and treat customers and residents fairly and with respect, then the case can be made based on the production/shipment and media reports alone that they have failed badly.

In the alternative, as recent history reflects that MHI is unlikely to change its modus operandi, then a new post-production trade group should form. Additionally, new blood should be brought in that challenges the status quo in a profitable and ethical manner that would actually benefit consumers and the industry alike long term.

If that doesn’t occur, and the market proves to be overheated as several believe, based upon past patterns, there will be a few winners and many more losers. In the meantime, manufactured housing will continue to be artificially constrained during an affordable housing crisis.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.