That will be our market spotlight for today.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

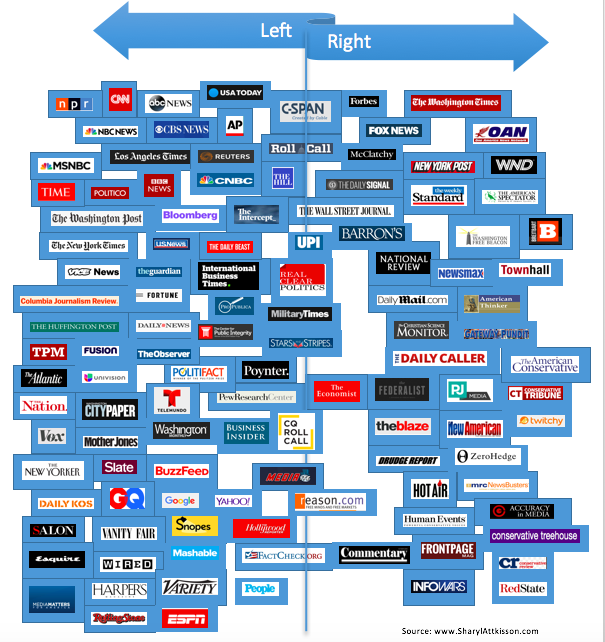

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

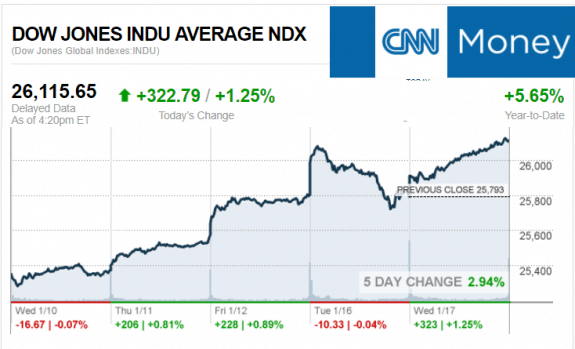

- Dow closes above 26,000 for the first time

- Apple pledges to create 20,000 jobs in five years

- American businesses can’t find workers

- H&M hires diversity manager

- Here’s what could derail the booming economy

- Google’s art selfies won’t work in all states

- Goldman Sachs is Wall Street’s big loser

- Driver death rate: zero

- You can’t get $1 out of a Venezuelan bank. I tried

- Facebook execs urge Congress to protect Dreamers

- 5 things Barnes & Noble can do to save itself

Selected headlines and bullets from Fox Business:

- Apple to add 20K jobs, pay $38B US tax bill to repatriate cash

- Dow surges 322 points, closes above 26,000 for first time

- Oil gives up early gains, but market still well supported

- Tax bill’s impact from a government shutdown would be negligible if not zero: Mulvaney

- IRS asks for extra cash: Are Americans more at risk of being audited?

- Five stocks leading the Dow’s blistering rally

- Counterfeit cash circulating in 11 states: Here’s how to spot it

- Ford stock takes a dive as investors sour on 2018 profit outlook

- Shari Redstone wants new CBS directors, renews push to merge CBS and Viacom

- YouTube’s latest step to remove ads from controversial videos

- Eric Trump: Great things happening & media asks if president enjoys McDonald’s cheeseburgers

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Today’s markets and stocks, at the closing bell…

S&P 500 2,802.56 +26.14(+0.94%)

Dow 30 26,115.65 +322.79(+1.25%)

Nasdaq 7,298.28 +74.59(+1.03%)

Russell 2000 1,586.66 +13.69(+0.87%)

Crude Oil 63.90 +0.17(+0.27%)

Gold 1,329.00 -8.10(-0.61%)

Silver 17.04 -0.15(-0.87%)

EUR/USD 1.2206 -0.0051(-0.41%)

10-Yr Bond 2.58 +0.034(+1.34%)

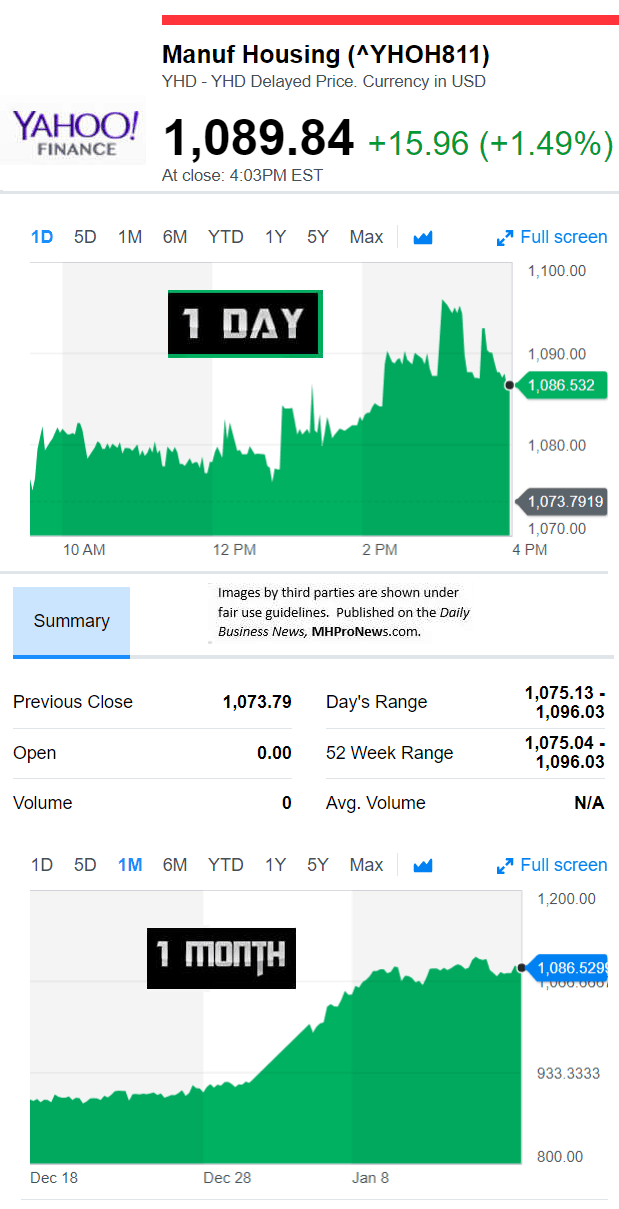

Manufactured Housing Composite Value

Today’s Big Movers

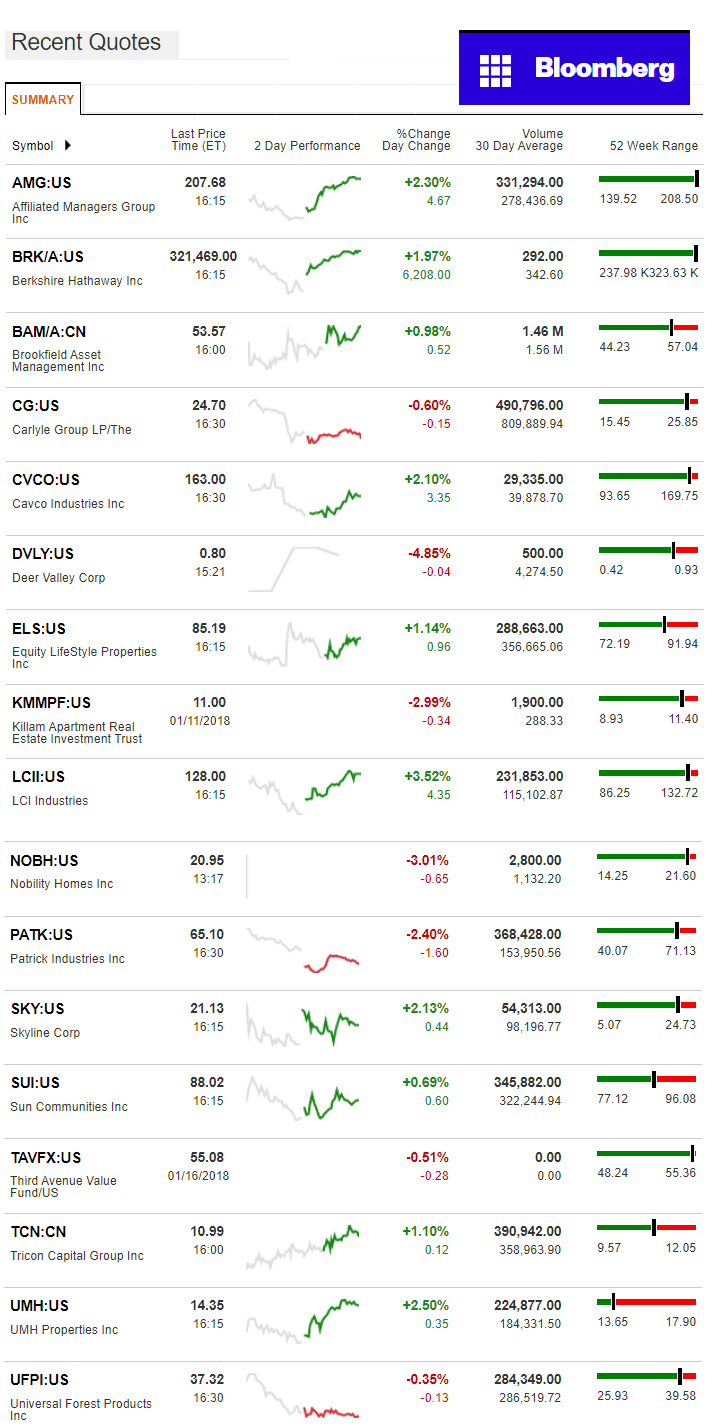

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

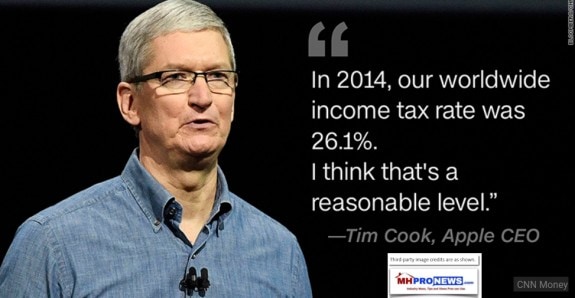

The Wall Street Journal, followed by others, have reported that giant Apple is bringing hundreds of billions back to the U.S., as a result of the passage of the Trump tax bill.

This was previously projected to occur, in the Daily Business News report, linked below.

- “Apple “anticipates repatriation tax payments of approximately $38 billion as required by recent changes to the tax law. A payment of that size would likely be the largest of its kind ever made,” the company said,” per CNBC.

- “Using the new 15.5 percent repatriation tax rate, the $38 billion tax payment disclosed by Apple means they are planning a $245 billion repatriation.”

There are several reasons this matters to manufactured housing, and factory built home pros. These have been noted in prior reports, some of which are linked below. But to “reader’s digest’ version is this. Capital is the obvious lifeblood for housing, and with hundreds of billions expected to return, the opportunities for investments in the housing field could be unprecedented in modern times.

Kevin Clayton Interview-Warren Buffett’s Berkshire Hathaway, Clayton Homes CEO

As more investors understand what Berkshire Hathaway has been doing, and why, that could spark a surge of capital into manufactured housing.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

Profitable Insight$ – POTU$ Trump Effect on MH Stock$ at 1 Year, Part 4

Trump Effect – 1 Year Election Impact on Manufactured Housing Connected Stocks, Part 2

Just the Facts – Trump Effect on Manufactured Home Connected Stocks, Part 1

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)