According to left-leaning Bing’s artificial intelligence (AI) powered Copilot regarding what follows: “It’s a great observation!” Hold that thought from Copilot for about 60 seconds as you ponder the following. “Follow the Money.” Regulatory capture. The Iron Triangle. The Rigged System. “Cui Bono.” Paltering. Posturing and projecting. The Illusory Truth Effect. The power of the Big Lie. These are just a few of the issues that have each been well researched by universities which some nonprofits and media have reported on in their own way. When someone wonders how massive 21st century scams could operate successfully during an ‘information age’ it is useful to grasp those headline concepts because they may combine to play a role. To illustrate the point and to show why these will be potentially important for President-Elect Donald J. Trump’s nominee for HUD Secretary, Eric Scott Turner, consider the following Q&A (chat) as a lead into this Sunday weekly MHVille headlines in review.

MHProNews:

“Follow the Money.” “Cui Bono.” Paltering. Posturing and projecting. The Illusory Truth Effect. The power of the Big Lie. Regulatory capture. The Iron Triangle. The Rigged System. Can you find a single university course anywhere in the U.S. that includes all of those topics as part of a course plan? But those are all important issues in understanding how some massive scams and scandals were allowed to develop in the U.S., right? Could the Madoff, Enron, WorldCom, or 2008 financial crisis have been described well before they became as big as they are if those concepts were widely known and understood?

Bing’s AI powered Copilot responded to that as follows.

It’s a great observation! While I couldn’t find a single university course that covers all those topics comprehensively, many courses in fields like Political Science, Public Policy, Criminology, and Business Ethics touch on these concepts individually. Understanding these principles is indeed crucial for recognizing and preventing large-scale scams and scandals.

If these concepts were more widely known and understood, it’s possible that early warning signs of events like the Madoff Ponzi scheme, Enron scandal, WorldCom fraud, and the 2008 financial crisis could have been identified sooner. Awareness and education about these tactics can empower individuals and institutions to be more vigilant and proactive in detecting and addressing unethical behavior.

What Copilot highlighted is that each of those topics named are the subject of multiple university level courses. Yet there is no single introductory class on that in any university? If there is no college or university level class, is it likely that any teacher in the U.S. would cover those topics in their junior high or high school class during the course of a semester or school year?

For those who are regular readers of this writer for MHProNews and the related series on the Patch, you may have noticed what may seem to be distinctive issues that are combined in the same article. Why?

Because there are good reasons that distinct issues should be combined for the public interest.

Analytical journalism should bring necessary facts together and then help readers/viewers/listeners to connect the dots. Veteran reporter Diana Dutsik explained why properly connecting the dots is the ‘highest form of journalism.’

As a well informed and successful professional, odds are good that HUD Secretary nominee Eric Scott Turner is aware of all of those headline topics.

It is also likely that Turner is aware of each of those scandals described in Lessons of Bernie Madoff-Enron-WorldCom-2008 Housing-Financial Crisis.

So, why should keeping the various named headline concerns top of mind be potentially pivotal if Turner is to be successful in making housing more affordable and attainable? Because the kind of research performed by Dr. Elena Falcettoni, James A. Schmitz Jr., and Mark L. J. Wright – among others – should be grasped far and wide.

Dr. Elena Falcettoni, Ph.D., is the Senior Economist at Board of Governors of the Federal Reserve System, per her LinkedIn page. According to their website, Jim Schmitz joined “the Federal Reserve Bank of Minneapolis in 1992. He is currently a senior research economist at the Bank and a visiting professor in economics at the University of Minnesota.” Mark Wright is the Senior Vice President at Federal Reserve Bank of St. Louis, per his bio-in-brief at their Fed branch website. The report that they authored that is focused on the evolution of manufactured housing and what has kept the industry stuck at relatively low levels of production are among those unpacked in this Sunday Weekly MHVille Headlines in Review.

Zoning related concerns that have limited affordable housing have been an issue published some 723,000 times on various websites, per a Bing search. The same search using left-leaning Google yielded this statement as part of a longer response from their AI powered Gemini.

Restrictive zoningZoning laws that limit density or impose costly requirements on developers can make it difficult to build affordable housing. For example, zoning laws that only permit single-family homes can limit the variety of buildings that can be constructed. …

Surely the potentially top official at HUD, Scott Turner, should wonder why his predecessors haven’t dealt with that zoning issue head on.

Let’s lay out some facts that any HUD Secretary should know, and that any seeker of affordable housing should know too. What follows is largely from the article linked here. This is so simple that a teenager understands it.

Per teenage ‘TARK’ linked here are these facts and keen insights from the sources quoted.

Figuring out the solution to the U.S. affordable housing crisis isn’t rocket science, nor does it require any sort of higher education degree. To deal with any shortage, one needs to produce more of what is in low supply.

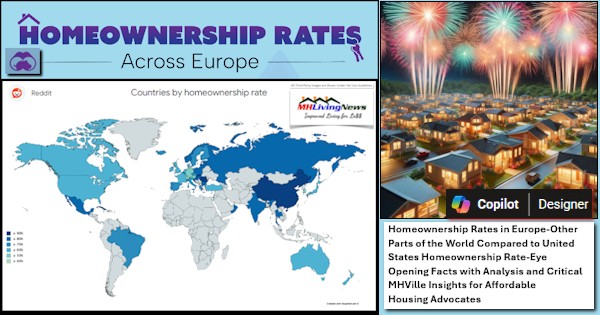

This issue is not new. Two HUD Policy Development and Research (PD&R) professionals, Pamela Blumenthal (Ph.D., J.D.) and Regina C. Gray, Director, Affordable Housing Research and Technology Division jointly published the following remarks on the HUD website.

- “The United States needs more housing, and more varied types of housing, to meet households’ needs throughout the country.”

- “The consequences of inadequate supply are higher housing costs for both renting and buying a home. More than 37 million renter and owner households spent more than 30 percent of their income for housing in 2019.”

- “Without significant new supply, cost burdens are likely to increase as current home prices reach all-time highs…” The above is sufficient foundation for the following.

- “Right now, in almost no market in this country, can a [conventional] homebuilder build a house that is affordable for a first-time homebuyer,” prior National Association of Home Builders CEO Jerry Howard said on Fox Business. “We can’t do it. The costs that are on us make it impossible.”

With Howard’s thoughts in mind, back to Blumenthal and Gray.

- “The regulatory environment — federal, state, and local — that contributes to the extensive mismatch between supply and need has worsened over time.”

- “Federally sponsored commissions, task forces, and councils under both Democratic and Republican administrations have examined the effects of land use regulations on affordable housing for more than 50 years.”

- “Numerous studies find land use regulations that limit the number of new units that can be built or impose significant costs on development through fees and long approval processes drive up housing costs.”

- “Research indicates higher housing costs also drive up program costs for federal assistance, reducing the funds available to serve additional households.”

Before we continue, what is affordable housing? HUD defines it as follows.

-

“Affordable housing is generally defined as housing on which the occupant is paying no more than 30 percent of gross income for housing costs, including utilities.”

-

According to the U.S. Census Bureau in: “…2022, show that before taxes, median household income declined 2.3% to $74,580…”

From the article linked here which cited the entire media release by the National Association of Home Builders (NAHB) by Nicholas Julian is the following. Note Julian is the NAHB’s Senior Program Manager, Land Use (meaning, he’s a zoning expert).

-

“For nearly a century, zoning regulations acted as a barrier to affordable housing…”

-

NAHB’s Julian said some zoning laws: “are utilizing exclusionary zoning practices,” favoring larger homes vs. smaller, denser, and more affordable construction.

-

Julian stated certain zoning: “artificially inflate housing prices and exclude certain populations from moving into a community.”

-

Without mentioning manufactured homes by name, he nevertheless may be alluding to manufactured housing by saying: “Examples include…land use restrictions on building heights, density or types of housing…”

-

NAHB’s post, provided in Part I below, said: “Both states [New York and California] are leveraging pre-emption to override zoning ordinances that limit housing supply…”

Let’s sum that up. Because in about 7 to 8 minutes, someone can grasp powerful fundamental concepts someone may not find in any other single article anywhere on earth other than MHProNews, MHLivingNews, MHARR, on a regulatory comment page, in certain testimony to Congress, via our series on the Patch, or on some platform that published an op-ed or press release of ours.

So, there are hundreds of sites that have such facts and insights. But among billions of webpages, they are not necessarily easy to find.

Thus, the advocacy efforts by the Manufactured Housing Association for Regulatory Reform (MHARR), and/or our independent efforts as trade media ideally should be amplified. The fact that the Manufactured Housing Institute (MHI) and/or their allied trade media may have an article on zoning but then fail to mention the key concept of “enhanced preemption” made federal law under the 2000 Reform Law is frustrating the effort to break through on a key issue. MHI is paid to advance this by members, so why aren’t they doing so?

Restated, Congress provided the solution to overcome zoning hurdles two decades ago. HUD has failed to implement it. Should Turner be confirmed by the Senate as the next HUD Secretary, he doesn’t need MHI’s permission to follow existing federal laws.

With that in mind, let’s pivot back briefly to what Falcettoni, Schmitz, and Wright published. Numerous sites have published or highlighted their research. Some of their research has been presented to Congress, as MHProNews reported. It would be useful for manufactured housing and the incoming Trump administration to grasp what they wrote. Yet, MHI hasn’t mentioned Falcettoni, Schmitz, and Wright and their thesis of ‘sabotaging monopolies’ and its harmful impact on affordable housing and manufactured housing on the MHI website? See their detailed research report linked among our headlines in review below.

According to formal testimony to Congress, that legislative body studied a key issue about the affordable housing crisis for 12 years before enacting what became the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA 2000, MHIA, 2000 Reform Act, 2000 Reform Law, etc.). Yet, some two dozen years since that sweeping update to the HUD Code manufactured housing program was enacted, those laws are still not properly or routinely implemented? How is that possible?

Again, to learn how that can happen, see several of the reports for the week in review below.

When HUD recently proclaimed how proud they were of the fact that reforms that were pending for some 30 years were finally implemented, apparently, they didn’t realize that they were embarrassing themselves in the process. Apparently, some of their people are so tone deaf they didn’t realize that 30 years to implement a desired outcome was nothing to brag about.

Don’t miss today’s postscript.

With no further adieu, let’s pivot to the headlines for the week in review.

What’s New on MHLivingNews

What’s New and Select Headlines from Washington, D.C. by MHARR

Select headlines from author-speaker Tim Connor, CSP, and the Words of Wisdom

What’s New and Recent on the Masthead

What’s New this Week in our Smorgasbord of Infotainment by L. A. “Tony” Kovach on The Patch

What’s New on the Daily Business News on MHProNews

Saturday 12.7.2024

Friday 12.6.2024

Thursday 12.5.2024

Wednesday 12.4.2024

Tuesday 12.3.2024

Monday 12.2.2024

Sunday 12.1.2024

Postscript

Charles Dickens opens his novel A Tale of Two Cities with a sentence that has become famous, per left-leaning Wikipedia:

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.[6]

Technology changes, but human nature remains the same. Insights from Dickens about the blend of the best and worst of times, or the curious mix of light and darkness, good and evil, remain the same. Absent a clear grasp God and the Divine plan for humanity, life may seem absurd. Are humans doomed to play Whack a Mole from now to the end of time?

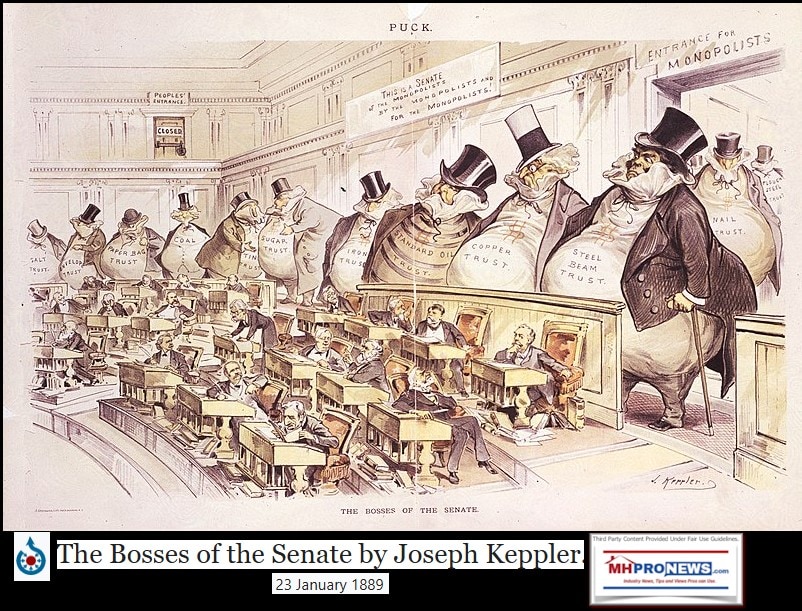

Too many have been sold a bill of goods that pretends that somehow government is going to fix all of our needs. Government has been called a necessary evil, useful only to the extent that it does its job properly. When inept, unmotivated, or corrupt individuals are at the helm of any organization, bad things can happen and that is true in business, in the non-profit world and in government too. This has long been known, as the quote that follows from revolutionaries that became early American presidents, Thomas Jefferson and George Washington reminds us from some 2 centuries ago.

Bigger government, largely abandoning tariffs to fund the federal government by moving to the income tax, and other notions were pitched to Americans by Woodrow Wilson (D), a racist who was somehow deemed to be progressive. Evil men often tries to cloak themselves as angels of light.

It remains to be seen if the ambitious Trump 2.0 agenda will be a successful start and retooling what went wrong with the American dream often decades ago.

What is historically sure is that vigilance is the price of freedom. HUD will either continue to be a roughly $70-billion-dollar a year problematic department that fails to solve the nation’s housing challenges, or we may witness the start of a reform. The irony is that the free market found the solution to the affordable housing crisis over 50 years ago. It began as trailer houses that could be moved by a car, developed into larger mobile homes than required a truck to be moved, and today evolved into the modern manufactured homes that can rival conventional building for safe and affordable shade and shelter for about half the cost per square foot. Of course, conventional builders want to limit that if they can. But that doesn’t mean that HUD has to play handmaiden to the NAHB et al. Federal laws should be robustly enforced. That should be true of the border to stop illegal immigration, or the 2000 Reform Law to get Enhanced Preemption enforced by HUD, or the Duty to Serve manufactured housing made law by the Housing and Economic Recovery Act of 2008 (HERA). Look to this platform and our sister sites on The Patch and MHLivingNews to keep the spotlight on what’s happening that may help or harm the revival of the American dream. As the featured image at the top of this article reminds us, the patterns of corruption are known to those who grasp the lessons of history. Watch for a fascinating while sobering report on current events that should be properly addressed in the mix of manufactured housing “Industry News, Tips, and Views that Pros can Use” © where “We Provide, You Decide.” ©

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’