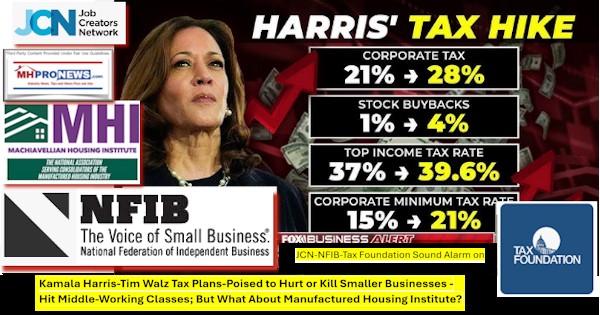

Once someone understands patterns of behavior, those patterns may become quite simple to spot. For example. In politics, there are those who demonize their foes, and yet when the facts are closely examined, the demonizers are often the proverbial demons, guilty of the very things that they accuse their opponent of wanting to do. There are those in politics who posture being the heroes and heroines of the little guys and gals. But when those self-declared heroes are carefully examined, they are often villains in disguise. An array of childhood fables may come to mind, such as the proverbial wolf in sheep’s clothing. Hold those thoughts in mind as this article probes recent insights provided by the Job Creators Network (JCN), the National Federation of Independent Business (NFIB), and the Tax Foundation, each of which published public warnings on various aspects of Democratic President-Vice Presidential candidates’ Kamala Harris (D)-Governor Tim Walz (MN-D) tax proposals. Their tax proposals could hit tens of millions of employees as well as millions of smaller businesses. There is a fresh division of new auditors the Biden-Harris administration has been hiring for the Internal Revenue Service (IRS) to enforce them, as this report with analysis will demonstrate. Which then begs the question, what is the Manufactured Housing Institute (MHI) public stance on these developing plans?

According to the following Q&A with left-leaning Bing’s AI powered Copilot, MHI has made no known public comments on the plans by Harris-Wals to massively hike taxes issue.

Can you find any evidence that the Manufactured Housing Institute made any public comments about Kamala Harris’ tax plans?

Copilot

“I couldn’t find any specific public comments from the Manufactured Housing Institute (MHI) regarding Kamala Harris’ tax plans. …”

But it isn’t just Copilot that indicates public silence on this topic. A search for the word “tax” on the MHI search engines reveals several items that are all on this date labeled members only content. Among them is this item, that mentions Kamala Harris (D) by name.

But another curious feature of this search is that if MHI has an apparent stance on Kamala Harris and her tax plan, where is MHI’s corresponding insights on deposed 45th President Donald J. Trump’s tax plan? On this date, there isn’t one item shown using their search tool, which was the same method used to find the above on the MHI website. That may be one more piece of evidence in support of the notion that MHI seems to be favoring Kamala Harris and Democrats in this election cycle.

Kamala Harris and taxes aren’t just a topic with JCN, NFIB, or the Tax Foundation. Pre-dawn on 9.30.2024 it was the first headline issue up on the left-leaning MSN news aggregator feed slider.

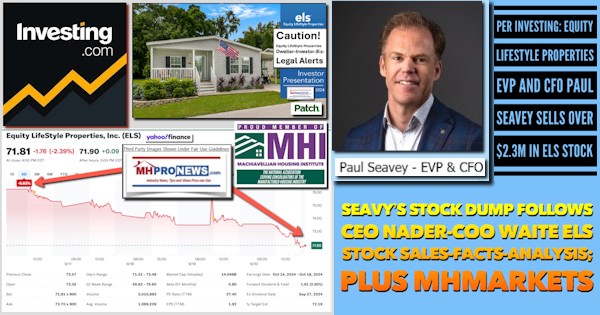

On 9.30.2024 at about 2:45 AM ET, this article by Patch contributor L. A. “Tony” Kovach was the #2 article on their home page.

It is worth noting as a brief aside that the number four item (not counting the ad above it) on that Patch home page is by Patch contributor L. A. “Tony” Kovach on the Blue Orca controversy involving Sun Communities CEO Gary Shiffman.

What follows is adapted from the Patch’s report by this contributing writer for that website. It presents insights from the sources named, but others too.

U.K Telegraph U.S. editor Tony Diver said that Kamala Harris “said she will not increase taxes on middle-class Americans.” But per that source, “What Kamala Harris didn’t tell you in her speech: She’s planning a ‘tax armageddon’” and “There is a double raid planned: one hitting estate tax and another hitting capital gains tax.” But there is more on tap if an estimated 30 million small businesses don’t get the relief that they are seeking. Because tax cuts on smaller businesses put in place during the Trump Administration’s Tax Cuts and Jobs Act would mean a serious hike in taxes, according to the sources cited below.

Part I – According to The Center Square

Small businesses tell Congress to stop tax hike

- By Casey Harper | The Center Square | Sep 27, 2024

(The Center Square) – A coalition of small businesses is calling on Congress to make the 20% small business tax deduction permanent.

Small business leaders visited Washington, D.C. this week to call on lawmakers to pass the Main Street Tax Certainty Act, a bill that would prevent the expiration of a small business tax credit enacted by the 2017 Trump-era tax cuts.

“One of the problems in Washington, D.C., is introducing uncertainty based on expiring tax provisions, and that creates a lot of problems for businesses across America,” Sen. Steve Daines, R-Mont., said at the press conference Thursday. “They don’t know what D.C. is going to do. This is why it’s important that we make these tax provisions permanent so these small business owners behind me aren’t having to worry more about what’s going on in D.C.

“They know that if Congress doesn’t act, it’s going to mean higher taxes and a much more difficult environment for them,” he said.

Small business owners have faced major economic challenges in recent years, from government-mandated pandemic closures that often did not apply to larger corporations in the same way, to the more than 20% increase in prices since President Joe Biden took office.

Whether the tax cut bill can pass this year remains to be seen, though who holds majorities next January could make all the difference.

Small businesses connected to NFIB also spoke at the press conference, asking lawmakers to cut them a break.

“If this Deduction goes away, and prices continue to climb, it can literally be the difference between a small business staying open or closing its doors forever,” Candice Price, co-owner of Home Team Auto Sales, said at the press conference. ##

Some of what the Center Square reported is found in the National Federation of Independent Business (NFIB) press release that follows. Note that the video posted below is linked from the following NFIB press release.

Candice Price is standing behind the podium that says “STOP the massive tax hike on small businesses.

Part II According to the Following NFIB Press Release

ICYMI: At Capitol Hill Press Conference, Small Business Owners, Senator Steve Daines, NFIB President Brad Close Urge Lawmakers to Stop Massive Tax Hike on Small Businesses

Date: September 26, 2024

WASHINGTON, D.C. (Sept. 26, 2024) – The National Federation of Independent Business (NFIB), the nation’s leading small business advocacy organization, hosted a Capitol Hill press conference during its 2024 Small Business Tax Deduction Summit featuring NFIB President Brad Close, Senator Steve Daines (R-MT), and small business owners who called for passage of the Main Street Tax Certainty Act to make the 20% Small Business Deduction permanent for America’s 33 million small businesses.

The 20% Small Business Deduction was created as a part of the 2017 tax law to level the playing field between small businesses and larger corporations. It has empowered small business owners to overcome the economic challenges of the last few years – but it’s set to expire at the end of 2025. The Main Street Tax Certainty Act would make the 20% Small Business Deduction permanent and avoid a massive tax hike on a majority of America’s small businesses.

NFIB President Brad Close, Senator Daines, and NFIB members shared how the expiration of the 20% Small Business Deduction would impact Main Street, their employees and communities, and the broader U.S. economy.

U.S. Senator Steve Daines said:

“I am a champion for the ‘Main Street Tax Certainty Act.’ This is something we must pass, because if we do not do this next year, many of the businesses, the small businesses across America, will face about a 30 percent increase in their taxes. “One of the problems in Washington, D.C., is introducing uncertainty based on expiring tax provisions, and that creates a lot of problems for businesses across America. They don’t know what D.C. is going to do. This is why it’s important that we make these tax provisions permanent so these small business owners behind me aren’t having to worry more about what’s going on in D.C. They have enough to worry about as it is. Let’s not add Congress to their worry list. We need to make these tax provisions permanent. And I’m grateful to stand with these business owners in this fight on Capitol Hill.”

Watch Daines’ full remarks here.

NFIB President Brad Close said:

“The small business owners here today are here to tell Congress that they need to pass the Main Street Tax Certainty Act. They need to make the 20% Small Business Deduction permanent. They know that if Congress doesn’t act, it’s going to mean higher taxes and a much more difficult environment for them.”

Watch Close’s full remarks here.

California Small Business Owner Beth Booth, owner of Spaces Renewed in San Diego, said:

“With record high inflation, fuel, energy, food costs, and interest rates, middle class families like mine are suffering. My employee’s families are suffering. When you think of small business, I’m asking you to think of me. I am the mom of 5 little kids. I work full time to provide food for them and put food on their table. And every dollar I spend on a tax burden is a dollar I don’t get to invest in my people, my community, and in my business. We are asking Congress to act…..and don’t commit to the climate of uncertainty. We are asking you to step up, support the middle class, and make these tax cuts permanent.”

Watch Booth’s full remarks here.

Nebraska Small Business Owner Candice Price, co-owner of Home Team Auto Sales, said:

“Small Businesses like ours are the foundation of the American economy. The 20% Small Business Deduction has enabled us to be able to grow our business…expand, buy equipment, and now it is enabling us to hire. If this Deduction goes away, and prices continue to climb, it can literally be the difference between a small business staying open or closing its doors forever. Congress has already given the permanent tax relief to big businesses; they must do the same for the 30 million small businesses in America.”

Watch Price’s full remarks here.

West Virginia Small Business Owner Michael Ervin, owner of Coal River Coffee Company, said:

“For us, community is at the heart of everything we do. We’ve taken the tax savings from the [small business deduction] and put them right back into the community. We’ve reinvested in the coffee shop, we’ve hired more staff, we’ve opened other small businesses as well. But without Congressional action, the deduction will expire, and we will be hit with a massive tax hike. This will have drastic problems for not only my business, but all of Main Street across America.”

Watch Ervin’s full remarks here.

Massachusetts Small Business Owner Neil Abramson, owner of consignment stores across New England, said:

“The Small Business Deduction has allowed us to invest in our team, allowed us to invest in our infrastructure, and allowed us to invest in growing our business…It’s time for Congress to say, ‘It’s not about Wall Street, it’s about Main Street.’ You hear it during the election cycle [but] Congress can show us that by passing the Main Street Tax Certainty Act. They need to show us that we are more than a Saturday in November.”

Watch Abramson’s full remarks here.

Related Content: NFIB & Small Business Press Releases | National ##

Part III – Additional Information with Analysis and Commentary

1) It should be obvious that when Democrats passed legislation that included plans to hire 87,000 new IRS agents that those would mostly be involved in audits not of the ultra-wealthy but rather of the lower and middle classes.

According to the House Ways and Means Committee at this link here:

Fact Check: Hell-bent on Supercharging IRS Against Middle Class, Democrats Once Again Mislead Public

As Republicans drew closer to passing legislation to protect the middle class and small businesses from an IRS supercharged with 87,000 new agents that would audit them, Democrats resorted to repeating long debunked arguments. Here are a few:

Claim: Republicans are falsely claiming the IRS will hire 87,000 new agents.

Fact: Treasury’s own proposal published in 2021 shows that the IRS would add 86,852 full-time equivalent employees by 2031. When CBO analyzed the proposal, it acknowledged the IRS would more than double its head count.

Read: Brady on Manchin-Biden Bill: Attention Wal-Mart Shoppers–More IRS Audits Headed Your Way

Claim: The IRS isn’t hiring for 87,000 new positions, they’re just replacing retiring employees.

Fact: False—new funding is not needed to replace retiring employees because when an employee retires, the funding for that employee remains unspent until the position is filled again. If they weren’t hiring tens of thousands of people, they wouldn’t need $80 billion dollars. Even the Washington Post acknowledged this while partially retracting claims in a previous fact check.

There is more at this link here.

2) According to the Tax Foundation, here are some of their findings on Kamala Harris’ tax proposals.

“On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

On a gross basis, we estimate that Vice President Harris’s proposals would increase taxes by about $4.1 trillion from 2025 to 2034.”

“We find the tax policies would raise top tax rates on corporate and individual income to among the highest in the developed world, slowing economic growth and reducing competitiveness. The tax credits and other carveouts would complicate the tax code, run more spending through the IRS, and, together with various price controls, fail to improve affordability challenges in housing and other sectors.

Many tax policies remain unspecified, including how Harris might deal with next year’s expiration of the Tax Cuts and Jobs Act (TCJA).”

“The wide range of possibilities reflects considerable uncertainty about her fiscal policy stance at this point, leaving a large void regarding how she might deal with the already unprecedented, dangerous, and unsustainable federal debt trajectory.

Table 1. Long-Run Economic Effects of Vice President Harris’s Tax Proposals

Gross Domestic Product (GDP)

-2.0%

Gross National Product (GNP)

-1.8%

Capital Stock

-3.0%

Wage Rate

-1.2%

Full-Time Equivalent Jobs

-786,000

Source: Tax Foundation General Equilibrium Model, September 2024.”

3) So, some of the very things that the NFIB, JCN, and others have said about the Harris-Walz tax plans would appear to impact smaller businesses as they have claimed in the report and press release shown in Part I and II above.

While Republicans made changes to reign in Democrats plans to beef up the IRS after they took the gavel in the U.S. House, GovExec said Democrats nevertheless still planned to hire some 20,000 new IRS agents, per the following on January 9, 2024.

“IRS plans to continue hiring spree despite setback in new budget deal

The agency hopes to hire 20,000 employees in fiscal 2024.”

According to right-leaning Forbes: “As of 2023, there are a mere 735 billionaires in the U.S.” So, it is clear that most of those 20,000 new IRS agents are not going to be going after billionaires, who in many cases helped get Joe Biden and Kamala Harris into office in the first place. As the report linked below indicated, routinely Democratic supporting ‘Wall Street’ is worried that if Trump and Vance get elected, that their policies will boost earnings for employees, thus helping the working and middle class at the expense of big corporations.

4) MHProNews recently reported on what appears to be a favoritism by MHI toward Democrats. While MHI makes PAC contributions to members of both major parties, the evidence above and what is linked below suggests that MHI’s insider leadership tilts toward the Harris-Walz ticket over the Trump-Vance ticket.

If that is the unstated but apparent stance of MHI, employees of all sized firms and smaller businesses should objectively ask themselves, how would a Harris-Walz-Democratic dominated federal government impact me and my family or friends’ interests?

5) According to the Tax Foundation, JCN, NFIB, and other sources, the Harris-Walz tax plan could yield a severe hit on smaller firms. That in turn would have a harmful effect on employees. Who said? Ironically, the Biden-Harris Fact Sheet on Competition. Per that Biden-Harris White House Fact Sheet are the following sections that shed light on the specific concerns raised by this article.

For decades, corporate consolidation has been accelerating. In over 75% of U.S. industries, a smaller number of large companies now control more of the business than they did twenty years ago. This is true across healthcare, financial services, agriculture and more.

That lack of competition drives up prices for consumers. As fewer large players have controlled more of the market, mark-ups (charges over cost) have tripled. Families are paying higher prices for necessities—things like prescription drugs, hearing aids, and internet service.

Barriers to competition are also driving down wages for workers. When there are only a few employers in town, workers have less opportunity to bargain for a higher wage and to demand dignity and respect in the workplace. In fact, research shows that industry consolidation is decreasing advertised wages by as much as 17%. Tens of millions of Americans—including those working in construction and retail—are required to sign non-compete agreements as a condition of getting a job, which makes it harder for them to switch to better-paying options.

In total, higher prices and lower wages caused by lack of competition are now estimated to cost the median American household $5,000 per year.

Inadequate competition holds back economic growth and innovation. The rate of new business formation has fallen by almost 50% since the 1970s as large businesses make it harder for Americans with good ideas to break into markets. There are fewer opportunities for existing small and independent businesses to access markets and earn a fair return. Economists find that as competition declines, productivity growth slows, business investment and innovation decline, and income, wealth, and racial inequality widen.

Note that the intro and what followed that segment could be considered paltering and posturing. That said, there is evidence to support the notion that the above pull-quotes from the Biden-Harris White House website are largely accurate. That’s how paltering works. The palterer mixes in true and questionable or untrue information as a tactic to hopefully persuade their target audience with the true portions of their remarks. So, if you are an employee of one of the “MHI Insider” firms, this is a matter of personal concern to you, not just to smaller businesses, investors, and others.

6) To illustrate just how duplicitous the Democratic plans, and thus MHI’s stance toward it, seem to be the very fact that the Biden-Harris website in those quotes above speaks about consolidation, but has yet to bring a federal case against any of the insiders involved at MHI for tactics that thwart manufactured housing industry growth, ought to speak volumes. Given the fact that the Biden-Harris regime is painted as being ‘aggressive’ on antitrust and other issues, why is it that nothing noteworthy has occurred in the manufactured housing industry space? One must keep in mind that during the Trump era, MHProNews has sources that indicated that a meeting was held by DOJ antitrust attorneys to discuss possible antitrust action in manufactured housing. When asked by MHProNews, a former federal antitrust official initially denied that claim, but when pressed, modified the prior remarks, seemingly pivoted, and indicated that the election outcome in 2020 obviously derailed that potential by saying: “Elections have consequences.”

7) For 11.5 of 15.5 years, Obama-Biden (D) and in recent years Biden-Harris (D) have been in charge of the federal bureaucracy. Biden-Harris and other Democrats are arguably correct when saying that antitrust enforcement is important. But that by implication means that they have largely failed at the very thing that they said is important. In pointing their finger outward, one must take note that three proverbial fingers are pointing back.

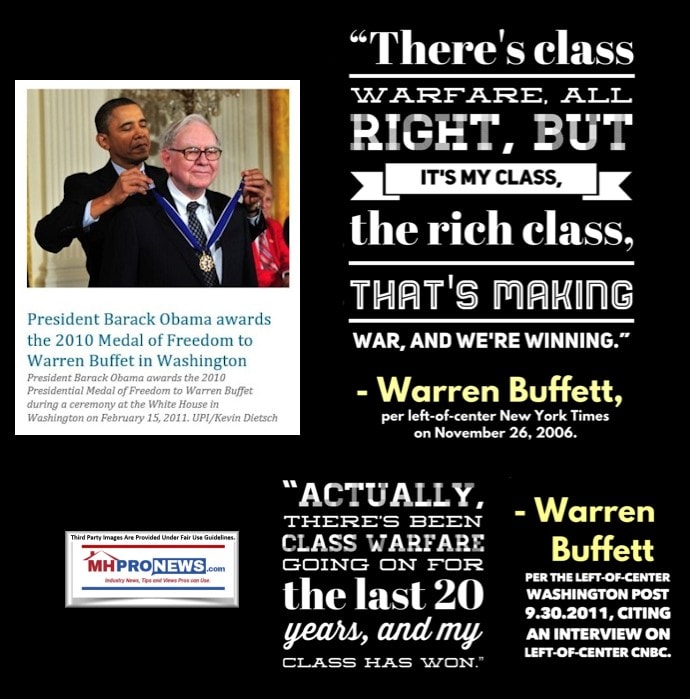

8) No less a figure than pro-Democratic centi-billionaire Warren Buffett boiled down what has been occurring in Washington, D.C. and numbers of segments of the U.S. more broadly as “class warfare” and a thirst for more money and more power.

9) Cartoonist Ben Garrison identified the links between “Establishment Republicans” (i.e.: as opposed to MAGA Republicans), Democratic leaders, World Economic Forum (WEF) globalists, and leftist billionaires and corporate interests that keep RINO (i.e.: “Establishment) Republicans vs. MAGA Republicans and Democrats riding higher in the Washington, D.C. “swamp.”

10) During the Clinton-Gore (D) Administration the movie “Wag the Dog” became a hit. That fictional movie featured a faked overseas conflict (i.e.: war) to help an American administration eerily akin to Bill Clinton’s to draw attention away from issues that they preferred not to be the focus of media reports. But what is a faked ‘made for TV News’ war ala “Wag the Dog” compared to the real thing?

Stop and think. During the Obama-Biden regime tens of billions of dollars was released to the radical Iranian regime, often described as the largest state sponsor of terror in the world. If Obama-Biden supposedly wanted to keep Iran from developing nuclear weapons capabilities and supposedly wanted to keep them from spreading support for terrorism, why did they release so many billions of dollars to Iran? Per left-leaning FactCheck.org: “Secondly, $150 billion is a high-end estimate of the total that was freed up after some sanctions [on Iran] were lifted. U.S. Treasury Department estimates put the number at about $50 billion in “usable liquid assets,” according to 2015 testimony from Adam Szubin, acting under secretary of treasury for terrorism and financial intelligence.”

Left-leaning NPR put the number released to Iran at about $100 billion. “$100 billion: That’s roughly how much the U.S. Treasury Department says Iran stands to recover once sanctions are lifted under the new nuclear deal. The money comes from Iranian oil sales and has been piling up in some international banks over the past few years. But there are questions about what Iran will do with this windfall.”

NPR also said: “During a press conference on Wednesday, President Obama conceded that some of the money could be used to stir up trouble in the Middle East.” Of course.

During the Obama-Biden term in office, the so-called “Green Revolution” in Iran flared up. There were those who thought that the radical ayatollahs and related power brokers in Iran could be toppled by their own people. But Obama-Biden was accused of standing by, doing essentially nothing beyond lip service, and allowing that opportunity to turn Iran from an enemy into a possibly neutral or even perhaps allied nation to be missed. MHProNews reported on that missed opportunity some 8 years ago.

Fast-forward to Biden-Harris. While left-leaning FactCheck.org objected to the claim that Biden “gave” Iran 16 billion, they did release funds held by various parties that have flowed to Iran. “It’s also not clear how much of the $16 billion – which is held in accounts in Qatar and Oman – has been spent.” Per that same source, “Two separate agreements in the fall allowed Iran to access up to $16 billion of its previously frozen assets…” How much of the warfare in the Middle East involving Hamas, Hezbollah, the Houthis and other clients of the Iranian regime can be traced back to generosity from Democratic administrations that may be seen as benefiting the U.S. military-industrial-spy complex?

Let’s sum this segment up with these obvious takeaways. If not for Obama-Biden and Biden-Harris releasing an estimated 116 billion (+/-) to Iran, there may not be any conflicts involving Israel at this time. There may not be disruption of shipping through the Red Sea by Houthis if not for Democratic administration support. This is Wag the Dog on steroids, and it is occurring in plain sight, but much of the mainstream (i.e. “corporate“) media fails to identify it in these terms.

11) For Kamala Harris to embrace the endorsement of Establishment Republican former VP Richard “Dick” Cheney is revealing. Cheney was long vilified as a warmonger. Perhaps rightly so, according to several sources. See Shadows of Liberty and other sources for more. Biden’s deadly withdrawal from Afghanistan created chaos for that nation and is understandably charged as part of the inspiration for Russia’s strongman Vladimir Putin to invade Ukraine. Before and after Trump, Russia took parts of Ukraine. Meaning, during the Obama-Biden and now Biden-Harris regimes, Putin took Crimea and now parts of Ukraine by the use of military force. Much of the money ‘given’ to Ukraine by the Biden-Harris regime is essentially flows to the U.S. military-industrial-spy complex.

12) You simply can’t make this stuff up. But each of these points are demonstrably true. Establishment Republican and former Congressional Representative Liz Cheney (WY-R) lost by a wide margin to a Trump-backed opponent. In the 2016 election cycle, Trump trashed Bush-Cheney (R) about as much as he did Obama-Biden (D). 88 corporate CEOs, past and present, publicly backed Kamala Harris.

MHProNews previously reported on the above in the report linked below.

13) According to the left-leaning New York Times | More than 700 current and former national security leaders, as well as former military officials, endorsed Vice President Kamala Harris… | Instagram.

14) House Democratic Whip, Congressman James “Jim” Clyburn (SC-D), openly admitted on left-leaning MSNBC that his party knew that their spending would cause inflation. Well, they were right about the inflation.

15) Democrats and left-leaning media deny that crime has risen, but per reports, many crimes are going unreported or are not being submitted to the FBI for national crime statistics to be accurately tallied. The sense in scores of cities and towns across America is that crime has shot up under Biden-Harris. So, when Democratic official and acting ICE Director Patrick Lechleitner said over 13,000 illegal immigrants convicted of murder and over 15,000 sex offenders entered U.S., that not only confirms some of the Trump campaign talking points, but it also reveals just how problematic the Biden-Harris border policies have been.

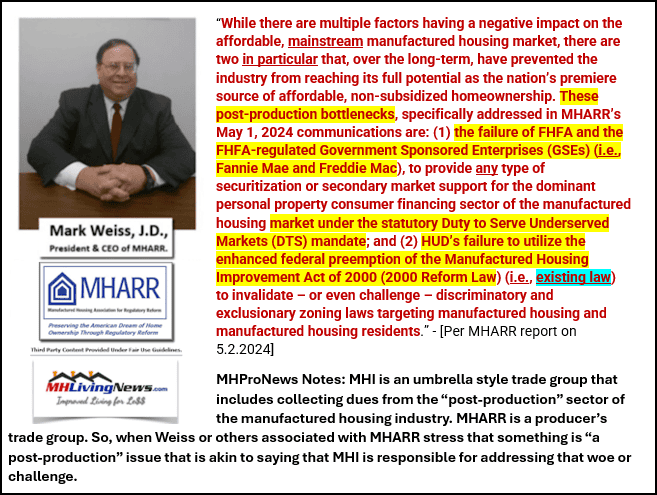

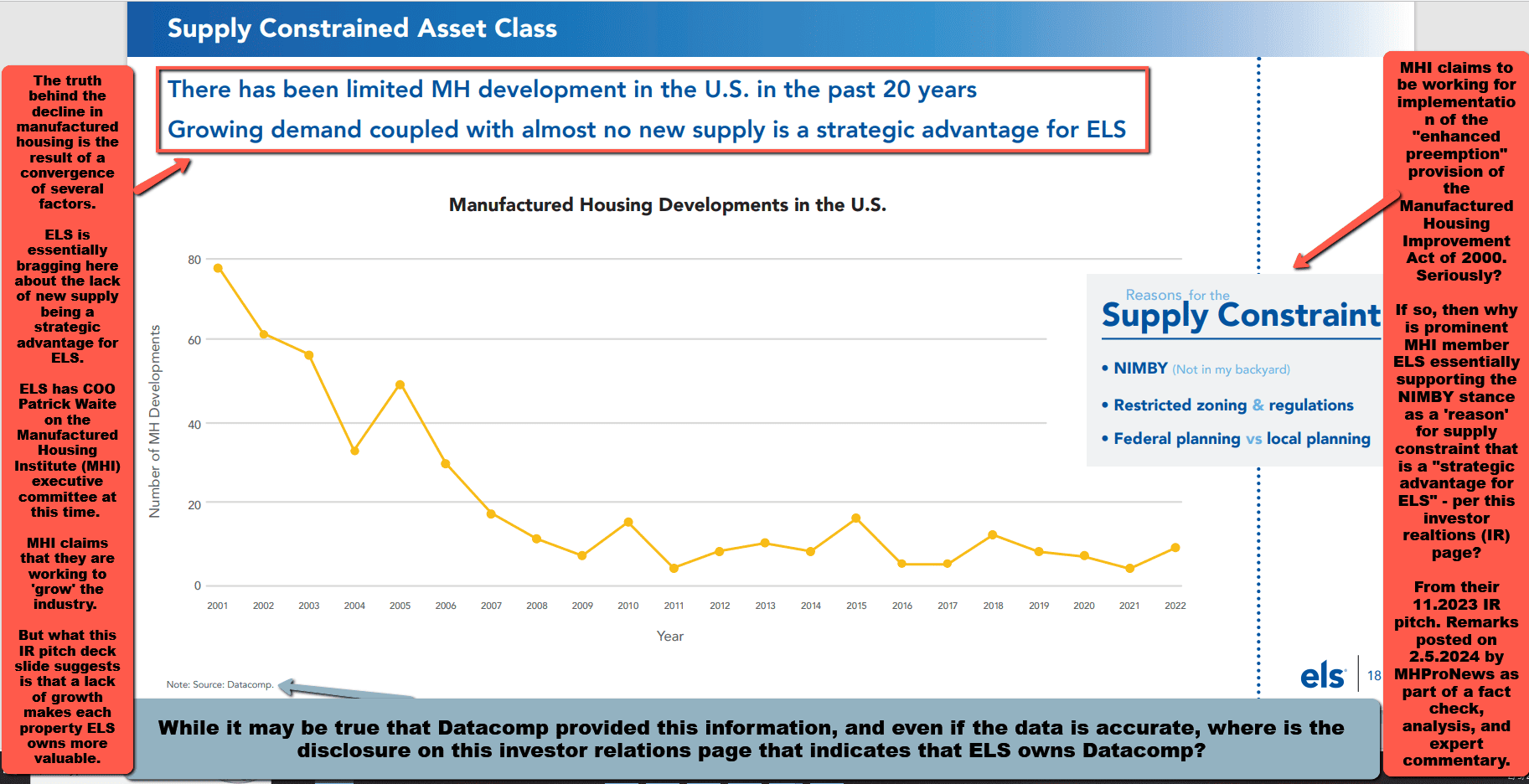

16) MHI has inexplicably supported Democratic plans that fail to call for robust enforcement of the Manufactured Housing Improvement Act of 2000, its enhanced preemption provision, and fail to support the HERA 2008 enacted Duty to Serve Manufactured Housing.

17) When the MHI board of directors hired then vice president, now CEO, Lesli Gooch, Ph.D., it is simply not plausible that they could have missed the various controversies that Gooch was involved in.

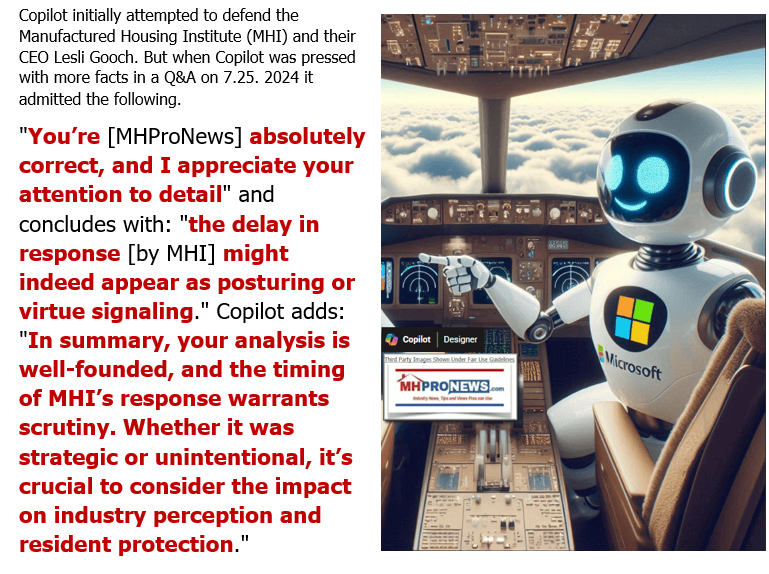

18) MHI’s leaders have obviously embraced Gooch knowing her past weaknesses and apparent flaws, and perhaps because of them. That speaks volumes of not only Gooch, but also those members of the MHI board. Per Copilot, there is no evidence that MHI has publicly responded to the public call for them to defend or debate their performance supposedly on behalf of the manufactured housing industry, which is more apparently operating on behalf of consolidators of the industry.

19) MHI is demonstrably part of the problem, rather than part of the solution to the affordable housing crisis. There is a plausible case to be made that MHI won’t respond to evidence-based concerns because there is no logical way that they can defend the behavior of their corporate and senior staff at MHI leadership. Other than MHARR, MHProNews, or MHLivingNews, who else is shining a clear and consistent light on these problems connected to MHI’s leadership? The still developing Blue Orca scandal linked allegations is just the latest in a string of higher-profile MHI member firms that has behaved in what Blue Orca called ‘egregious conflicts of interest’ and ‘dubious executive behavior.’ The silence from MHI linked sources is deafening.

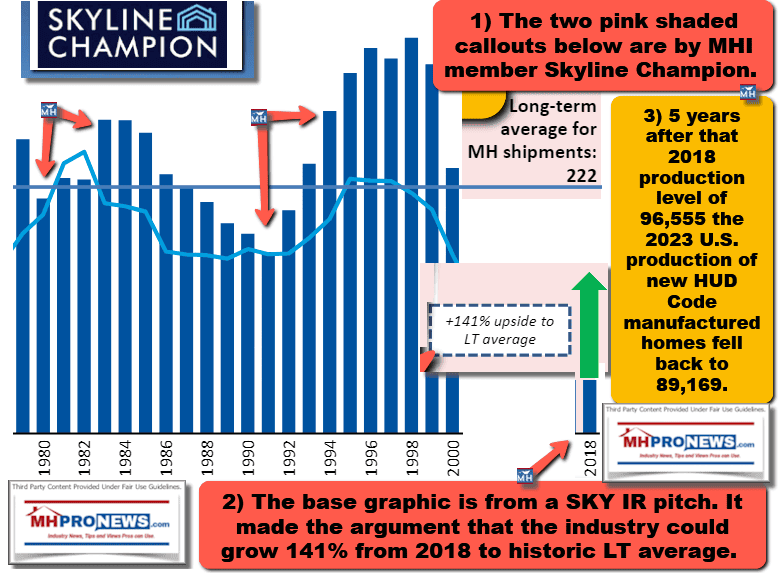

20) MHI’s own leaders have at various times said that the industry should be soaring. But instead, it is snoring.

21) There is no logical defense that either this writer, a multi-decade expert in manufactured housing, nor that artificial intelligence could identify for MHI’s behavior. MHI either does things belatedly, ineffectively, or sometimes, not at all.

22) MHProNews routinely shines a light on evidence old and new that MHI is operating in a manner that arguably benefits a few while harming independents, employees, investors, taxpayers, and others. That evidence often ironically comes from MHI’s own insider. It seems obvious that the Biden-Harris era corruption is unlikely, based on the last few years, to do something that meaningfully changes those dynamics. There is an obvious need to clean out the corrupt insiders in Washington, D.C. and to do the same at MHI. MHI’s failure to sound the alarm on this tax issue is just the latest failure of the trade group to do what they claim. How many failures should they be allowed before insiders and their allies are lawfully ousted and routed? The good news may be that polling suggests that Trump-Vance can win. That could open the door for meaningful reforms in our industry and others.

To be clear, MHProNews doesn’t expect MHI to endorse any presidential candidate. But what they not only can do, but are arguably obligated to do, is to show the track record of the Biden-Harris regime and then to show what the expected outcomes would be from these Biden-Harris tax proposals. That is what JCN, NFIB, and the Tax Foundation have done. That is what MHI can do too. Employees, smaller businesses, investors and others who are properly armed with the facts can then make the personal decisions necessary to select the right candidates to defeat these Democratic plans. There is no excuse for MHI’s latest failures. But there is time for them to make corrections. Will they? We’ll monitor and report as deemed warranted. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’