This event involves a rare instance where Clayton, and FirstBank Chairman Jim Ayers, both owned nearly 100 percent of their respective banks pre-merger, and share a common interest in helping people.

“Jim (Ayers) and I have been great friends for decades and have a lot in common, including being from rural West Tennessee,” said Clayton to MHProNews publisher, L. A. “Tony” Kovach.

“Our primary interests involve banking and giving back,” Clayton said. “Ayres is the most generous and creative person I know, building an amazing philanthropic foundation that has produced amazing benefits in education, health, and quality of life in Tennessee.”

The acquisition is expected to close in the third quarter of 2017, and is subject to regulatory approvals, approval by shareholders, and other customary closing conditions.

“The Clayton Banks have a great team and are two of the most profitable banks in Tennessee. They have a relationship-based customer service culture that blends well with our culture. We look forward to joining with Clayton Bank and American City Bank and their associates to expand our banking services throughout Tennessee,” said FB Financial President and CEO Chris Holmes, in a BusinessWire press release.

“This was, in effect, a merger as shareholders of FirstBank (FBK – NYSE) now own shares of the combined banks,” Clayton told MHProNews. “Likewise, I own shares in the combined banks – my largest holding by far. I signed a multi-year contract as did the Sr. Management – including Kevin Kimzey (President) – who heads all MH (Manufactured Housing/Home) activities.”

“We both love the mortgage business and Jim [Ayers] is thrilled to combine the Clayton MH lending with the very large FirstBank Mortgage portfolio,” said Clayton. “I, and all the MH enthusiasts at Clayton Banks, are thrilled to add 40 deposit-gathering branches to support the Clayton MH units.”

About the Clayton Banks

Clayton Bank is headquartered in Knoxville, Tennessee.

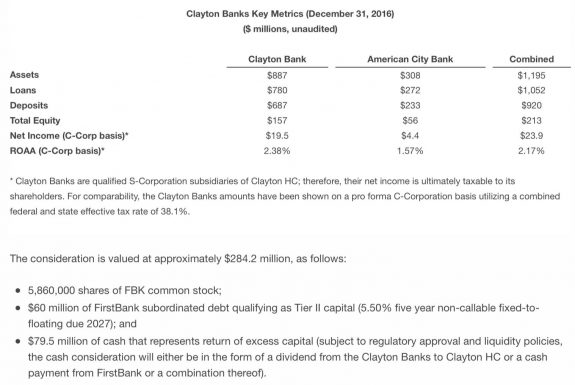

The operation has assets of approximately $887 million. The bank has 13 branches across its markets in Knoxville, Jackson, Oakland, Covington, Henderson, Lexington, Friendship and Cookeville, Tennessee.

American City Bank is headquartered in Tullahoma, Tennessee and has assets of approximately $308 million. It operates five branches in Tullahoma, Manchester, Lynchburg and Dechard, Tennessee.

About FB Financial

FB Financial Corporation (NYSE: FBK) is a bank holding company headquartered in Nashville, TN, and operates through its wholly owned banking subsidiary, FirstBank, the third largest Tennesseeheadquartered bank. The company has 45 full-service bank branches across Tennessee, North Alabama and North Georgia, and a national mortgage business with offices across the Southeast.

FirstBank serves five of the largest metropolitan markets in Tennessee and has over $3.2 billion in total assets. ##

(Editor’s note: Additional details from Jim Clayton will be published soon.)

(Top image credit, are the respective firms logos, used here under fair use guidelines. Other image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.