Sometimes referred to as “black hats,” the cocky predatory brands operating in MHVille should take notice. ‘Gray hats’ tempted to turn predatory ‘black hat;’ the case outcome reported herein may offer a good reason to think twice. ‘White hats‘ and affordable housing consumers who are hurt by an artificially diminished MHVille? Take heart. A jury found billionaire Sam Bankman-Fried (SBF) guilty last week on all charges in a major case that only took the jurors a few hours of deliberation to decide. As left-leaning CNN said on 11.2.2023: “Bankman-Fried, 31, was accused of mismanaging customer funds stored in his crypto exchange, FTX, to enrich himself and his family. He was found guilty of seven counts of fraud and conspiracy and could spend the rest of his life in jail.” Some sources are saying SBF could be sentenced to spend 100 to 110 years in prison. Yet not so long ago, Bankman-Fried was a seemingly well-connected Democratic megadonor who at times tossed money to Republicans too. SBF’s tale is one of a heady rise and a stunning fall.

Sam Bankman-Freid is also the tale of a wealthy and connected ‘insider’ in the ‘rigged system’ who was operating fraudulently that finally met lady justice and lost.

As an interesting, purported factoid many missed, left-leaning Vanity Fair and echoed by CNBC reported that: “Sam Bankman-Fried Wanted to Pay Donald Trump Not to Run for President Again—And Trump Was Apparently Willing to Do It for $5 Billion.” Be that as it may, that clearly suggests that Democratic megadonor SBF was not a Trump supporter.

lol what??

SBF was trying to pay Trump $5 billion not to run again. pic.twitter.com/ffbmfI3R9F

— Brad Michelson (@BradMichelson) October 2, 2023

Part I of this report was provided to MHProNews courtesy of the WND News Center. It provides specifics on SBF’s conviction on all charges.

Part II (A) is an update of a previously provided brief on massive financial scandals and crimes in the U.S., including the housing-financial scandal earlier in this century. Part II (B) are lessons learned for white hat and black hat professionals and for affordable housing consumers, including those in MHVille. Our industry’s white hats and consumers may need some encouragement that the battle to win in a rigged system has repeatedly been successfully accomplished. As the following will reflect, it takes time, solid evidence, and persistence.

CRIME AND PUNISHMENT

Sam Bankman-Fried convicted on all charges

Jury deliberated only a few hours

Jason Cohen

Daily Caller News Foundation

A jury found disgraced cryptocurrency tycoon and Democrat megadonor Sam Bankman-Fried guilty of fraud-related charges on Thursday.

Bankman-Fried co-founded and served as CEO of cryptocurrency exchange FTX, which collapsed in November amid allegations the company was mishandling billions in customer funds. The Department of Justice indicted Bankman-Fried on seven fraud and conspiracy-related charges in August, alleging he masterminded a scheme to divert the money to fund campaign contributions, donations to charities and real estate acquisitions.

The jury found Bankman-Fried guilty on all seven charges, reaching the verdict after around four hours of deliberations, according to The Messenger. Four of the charges have potential prison sentences of up to 20 years each, but the judge will make the final decision on sentencing.

His sentencing is scheduled for March 28, according to The New York Times.

The government gave its second closing statement, saying that, even if you believe Sam Bankman-Fried‘s testimony, then he himself has proved that he’s guilty 👀

The judge is currently reading the jury their instructions, and deliberations will likely begin between 2-2:30pm ET ⏳ pic.twitter.com/dSNPl5Y72D

— Laura Shin (@laurashin) November 2, 2023

Bankman-Fried had pleaded not guilty to the August indictment and faces a potential life sentence, according to CNBC.

The Democrat megadonor’s trial began in October and he has been in jail since August after the judge presiding over his case revoked his bail due to alleged witness tampering. Before that, he was under house arrest at his parents’ California home on a $250 million bond after the Bahamas extradited him to the U.S.

Bankman-Fried donated nearly $39 million to back Democrat-aligned causes and was the second-largest individual contributor to such groups during the 2022 midterm election cycle.

The former cryptocurrency CEO “misappropriated and embezzled FTX customer deposits, and used billions of dollars in stolen funds for a variety of purposes, including … to help fund over a hundred million dollars in campaign contributions to Democrats and Republicans to seek to influence cryptocurrency regulation,” according to the August indictment against him.

Caroline Ellison, Bankman-Fried’s ex-girlfriend and former CEO of Alameda Research, which is the sister hedge fund to FTX, testified that he instructed her to commit fraud regarding FTX and Alameda’s relationship. She asserted that he established a system to permit Alameda to withdraw unlimited funds from FTX.

“As a result of the spending of customers’ deposits, FTX and Alameda had a multi-billion-dollar deficit of customer funds,” the indictment states.

Bankman-Fried allegedly believed he had a 5% shot of becoming president at some point, Ellison testified.

This story originally was published by the Daily Caller News Foundation. ##

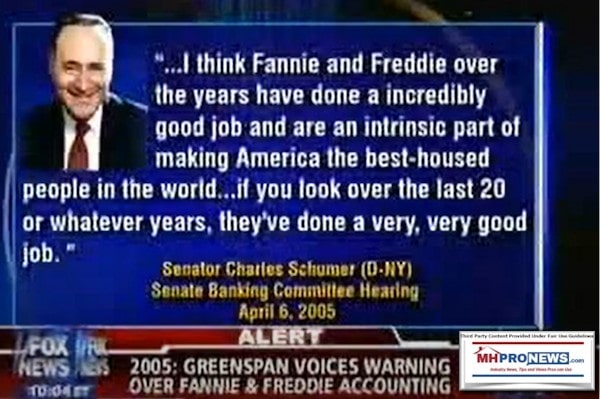

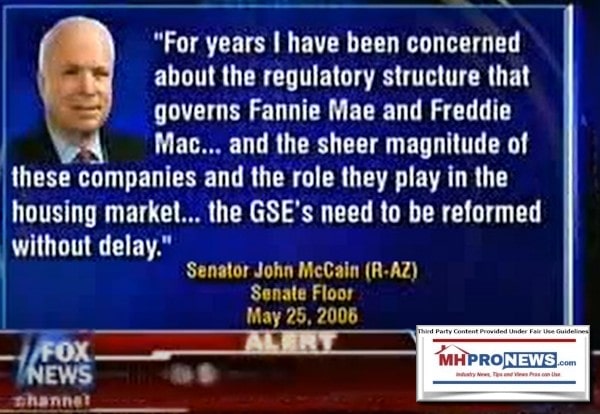

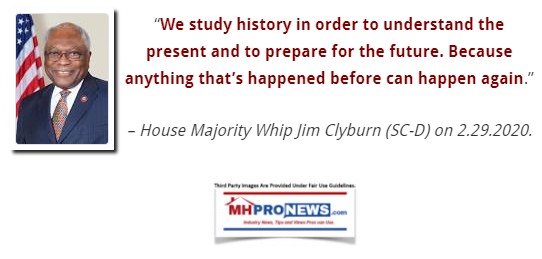

MHProNews note: the NBC News and Fox News videos below were not part of the report above or below. But the second, third, and fourth items that follow immediately below serve to illustrate the point that public officials are often made aware of apparently risky or illegal behavior sometimes years before action is finally taken.

SBF is just one of several mega-frauds and financial fiascoes in the 21st century. For those who keep hearing that manufactured housing lending still needs to be punished for the misdeeds of 20 plus years ago (hah!), what about Fannie and Freddie? Consider these flashback insights well in advance of the 2008 financial crisis.

Part II – Additional Information with More MHProNews Analysis and Commentary

The following was first published by WND on May 11, 2021 at 7:16pm but is adapted and updated here below by and for Manufactured Home Pro News (MHProNews).

The Solution to Big Tech and the Oligarchs

Anyone who thinks Big Tech will be reined in by regulations has not been paying close attention. The following cases exposed years of documented corporate, regulatory and accounting failures. They spotlight massive corruption and mainstream media misses.

- Sam Bankman-Fried (SBF) and FTX

- Bernard “Bernie” Madoff

- Theranos

- Enron

- WorldCom

- VW “Diesel-Gate”

- WeWork

- Solyndra

- Lehman Brothers (financial-housing crisis)

- Fannie Mae, Freddie Mac (Government Sponsored Enterprises/GSEs – financial-housing crisis).

Collectively, that list involved hundreds of billions of dollars in losses by investors. Various types of fraud, corruption and deception occurred. While the details of the purported scams may differ, because taxpayers and the broader economy were impacted in the cases involving Lehman Brothers and GSEs housing-finance scandals, the ripple effects of those resulted in the so-called Great Recession (circa 2008). The economic impact of the Great Recession on real estate and other parts of the economy collectively cost Americans trillions of dollars.

Among the questions that thinking people should wonder is this. What happened to the regulators in those cases? Why where they routinely late to act? Isn’t the job of regulators and law enforcement agencies to protect the public interest, sometimes specifically the economy or housing?

John Kenneth Galbraith said: “Regulatory bodies, like the people who comprise them … become, with some exceptions, either an arm of the industry they are regulating or senile.” Bingo.

Modern robber barons are dominating information and capital. Cold Fusion’s documentary about the Theranos’ scandal observed: “It’s the illusionary effect where if you repeat a lie enough times people start to believe it, especially if you have credible names surrounding the product.”

Problematic products or services can emerge from corrupt companies.

Theranos’ Elizabeth Holmes is shown with then Vice President Joe Biden (D) and President Barack Obama (D). In the massive Enron scandal, Ken Lay and Jeff Skilling are shown with then President George W. Bush (R). Those establishment politicians from both major parties are sufficient to make the point that the “illusionary effect” of “repeating a big lie enough times” when “credible names” are involved can and does work.

Harry Markopolos and his colleagues spent years trying to get public officials and mainstream media to expose the massive Bernie Madoff fraud that they knew existed. It took years before Markopolos was taken seriously and officials finally acted. Forbes says Madoff losses may have exceeded $50 billion.

Other regulatory failures are hiding in plain sight. The New York Times quoted Warren Buffett: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

Buffett’s “class” profited wildly in the 2008 and 2020 economic upheavals. How? CNBC quoted billionaire Bill Gates: “I didn’t even want to meet Warren [Buffett] because I thought, ‘Hey this guy buys and sells things, and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.'”

The CDC defines parasitic: “A parasite is an organism that lives on or in a host organism and gets its food from or at the expense of its host.”

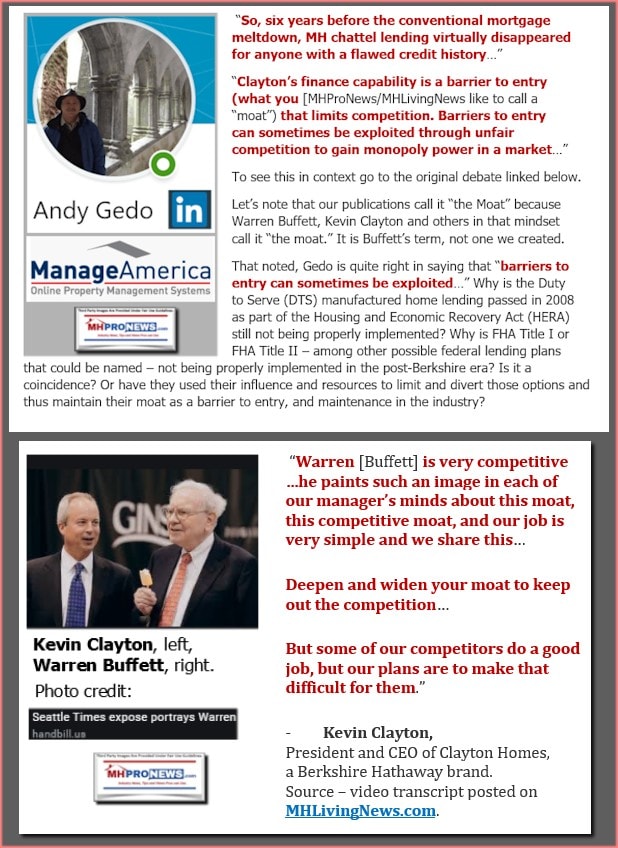

Buffett said, “The most important thing for me is figuring out how big a moat there is around a business. What I would love, of course, is a big castle and a big moat with piranhas and crocodiles.”

When carefully examined, several of the oligarchs and their businesses employ “parasitic” “moat” and “sabotage monopoly” methods. They create a slow-motion monopolization of various markets. Experts like James Schmitz Jr. say monopolies “inflict great harm on low- and middle-income Americans.” Schmitz and some of his economic colleagues at the Minneapolis Federal Reserve specifically mentioned the impact on these issues on affordable manufactured housing.

The solution to this problematic 21st century pattern? Vigorously enforce existing laws. That includes the need to seriously enforce antitrust laws to break pernicious giants up. They can obviously cause social, economic, and moral harm. Once broken up, watch the economy and America soar.

L. A. “Tony” Kovach ##

MHProNews note: the videos above and the one below “The Solution to Big Tech and the Oligarchs” were not part of the original op-ed above. But they illustrate the point that purportedly fraudulent and unjustified risks were being taken known to corporate officials, and sometimes downplayed or ignored by regulators and public officials too. Yet, for whatever reasons, the schemes were allowed to continue. The notion that big government is ‘good’ government is obviously not necessarily so.

Part II B. – What do Enron, Theranos, WorldCom, VW “Diesel-Gate,” Solyndra, Bernard “Bernie” Madoff, WeWork, Lehman Brothers, Fannie Mae, and Freddie Mac have in common?

Consider the interesting result to the search using Bing AI used in the Part II B subheading above.

Learn more:

> “It has been said that in the Madoff scandal, for example, that there was a system of incentives and rewards that kept the Madoff narrative going for years. Can you shed light on that?”

Learn more:

> “The Illusory Effect has also been mentioned as a factor in several of these scandals. “”It’s the illusionary effect where if you repeat a lie enough times people start to believe it, especially if you have credible names surrounding the product.” Can you shed light on how that may have played out in some of the corporate scandals mentioned in this thread?”

Learn more:

> “So, manipulation of the targets of such scams by various means kept the rip-off going for longer than it may otherwise have in the absence of gaslighting and plausible sounding evidence in support of the rip-off, is the correct?”

> “To help prevent or shorten the duration of such corporate scams or other wrongdoing, what would be the sorts of tips investors, the public, advocates and public officials should consider?”

> “There are some researchers and others in the manufactured housing industry that believe that the manufactured home industry has been artificially manipulated to allow for consolidation that may not occur to the same degree absent misbehavior. Who in manufactured housing have explored such concerns? What are some of the allegations raised by people within our outside of the industry?”

below the graphic below or click the image and follow the prompts.

As to the occasional criticism by this or that blogger within the MHI orbit, the case can be made that such critiques are less than authentic, and more due to giving say a blogger the illusion that they are interested in the truth and accountability too. Restated, such critiques appear to be self-serving for those involved. But examples can be shown that arguably reflect that previously some blogger(s) once did more authentic critiques, until they abruptly pivoted and largely became supportive of MHI. Rewards seemed to flow to those publications and bloggers who appear to be involved in fostering that “illusory truth effect” that has helped make this purported market manipulating scheme possible for so long.

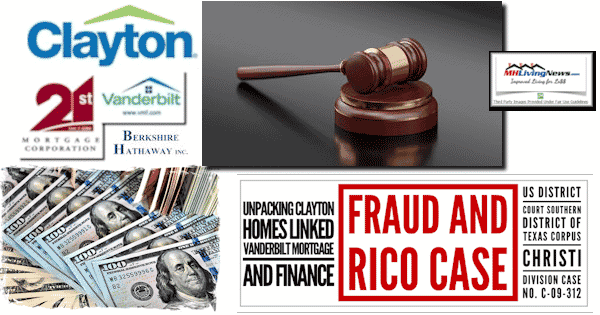

Antitrust – Past and Present

“…The [Tim Williams/21st] letter itself appears to be another clear violation of Section One of the Sherman Act, as well as Section Three of the Clayton Act, which prohibit what is colloquially called “tying.” This section of the Clayton Act states in relevant part:“It shall be unlawful for any person engaged in commerce, in the course of such commerce, to lease or make a sale or contract for the sale of goods…on the agreement, or understanding that the lessee or purchaser thereof shall not use or deal in the goods…of a competitor or competitors of the lessor or seller, where the effect of such lease, sale, or contract for sale or such condition, agreement, or understanding may be to substantially lessen competition or tend to create a monopoly in the line of commerce.”71

Here, Clayton [Homes and their affiliated lending] have done exactly that: from 2009 going forward, outside of loans insured by the FHA, if a retailer was going to offer 21st Mortgage financing, that financing was only going to be available for homes built by its parent company.”

While some of those policies at 21st Mortgage later changed, there is a case to be made that by the time those policy changes were made, the damage had already been done to scores of independent retailers, which in turn hurt the independent manufactured home producers that supplied them. Recall the quote from Bill Gates in the op-ed to WND, posted above. “…Bill Gates: “I didn’t even want to meet Warren [Buffett] because I thought, ‘Hey this guy buys and sells things, and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.'”

The CDC defines parasitic: “A parasite is an organism that lives on or in a host organism and gets its food from or at the expense of its host.””

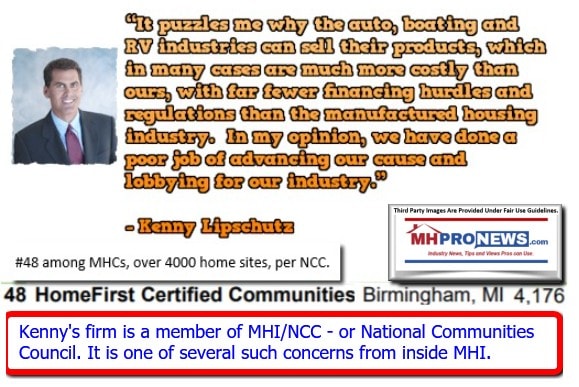

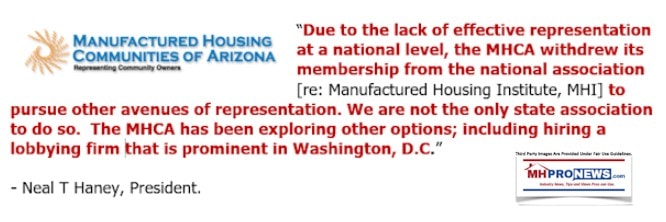

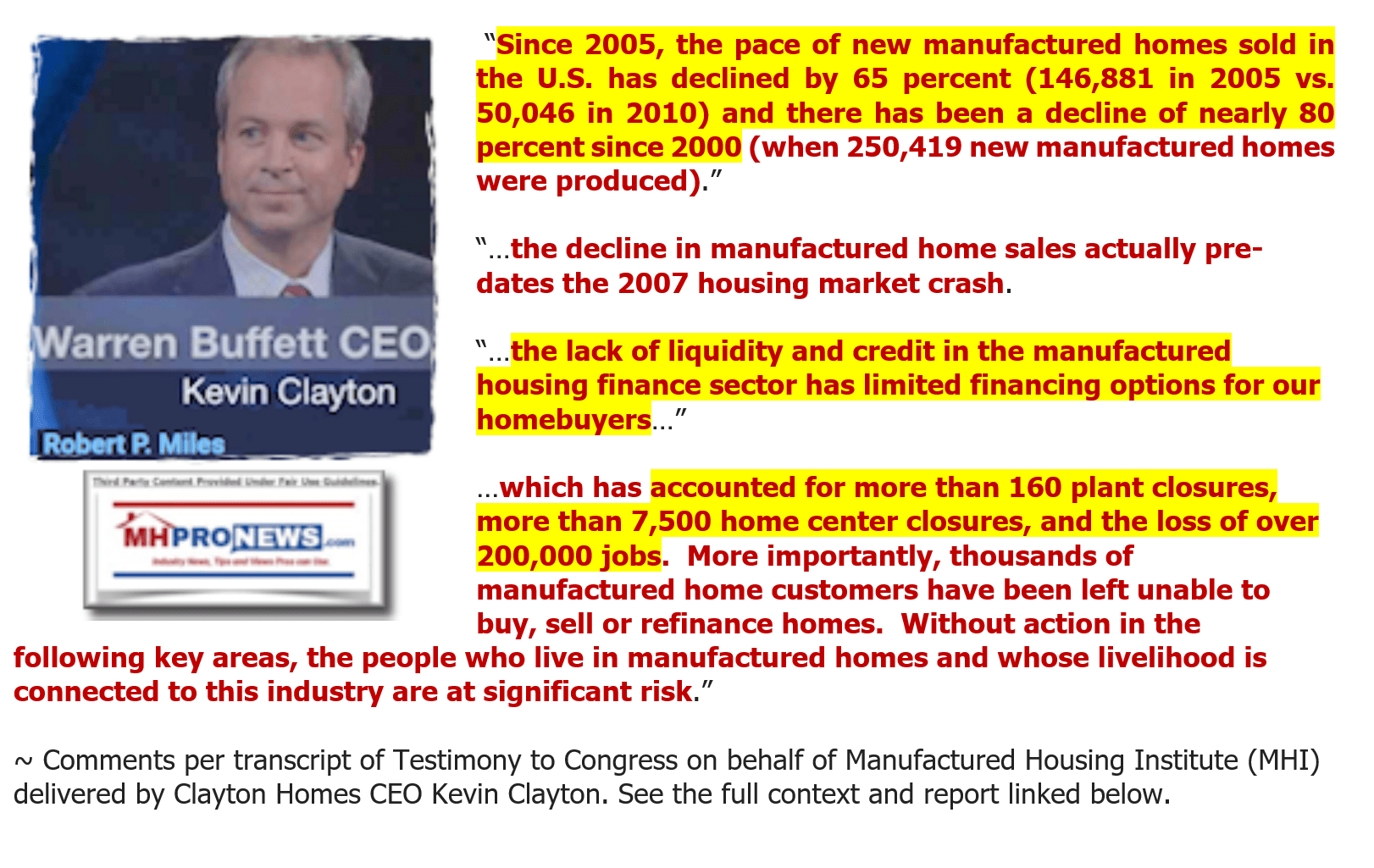

In the absence of financing, ‘street’ retailers and the manufacturers that supplied them vanished by the thousands. Some say 10,000 to 20,000 retailers have been lost in manufactured housing since the dawn of the 21st century. Kevin Clayton himself put the number of lost “home center” retailers at some 7,500. This testimony to Congressional committee in 2011 was later repeated in large part by Clayton Homes General Counsel Tom Hodges, J.D., who later became the chairman of MHI. The known facts make Clayton’s remarks below appear to be paltering, as well as deception and misdirection. While much of what he said is true, he conveniently failed to mention the point that 21st Mortgage Corporation, his firm’s sister company in financing for manufactured housing independents, had cut off lending to thousands that didn’t carry Clayton Homes product. Perhaps more egregious, as the analysis linked here demonstrates, the excuse given by Tim Williams in that letter from 21st appears to be contradicted by Warren Buffett in his annual letter to shareholders.

below the graphic below or click the image and follow the prompts.

below the graphic below or click the image and follow the prompts.

A possible array of charges could conceivably emerge from such evidence.

Communities Impacted by Crippling or Killing Off Thousands of Street Retailers

But to further understand just how much crippling or eliminating thousands of independent retailers impacted the manufactured home industry, one must keep in mind that so-called street retailers (as opposed to manufactured home land-lease community- or development-based retailers) were often the primary source of new customers for manufactured home communities (MHCs – sometimes errantly called “mobile home parks”).

So, when street retailers were lost, the business models of thousands of independent MHCs was also disrupted.

Between natural attrition in MHCs (modest but noteworthy), the great big sucking sound of a percentage of residents that may have bought a conventional house during the runup to the subprime crisis was combined with the loss of new residents previously supplied by retailers looking for a location for their customer’s new homes began to result in rising vacancies in mom-and-pop MHCs. As vacancies in the early 21st century began to grow from a variety of factors, including repossessions, deaths, or moveouts, the profitability of some properties was marginalized. That pattern made numbers of them ripe for acquisition by consolidators in the manufactured home community sector.

> “Robert Miles did the video interview with Kevin Clayton. Miles is a pro-Buffett, pro-Berkshire guy. Kevin Clayton himself spoke about the importance of the moat as preached by Warren Buffett and shared with his team, right? Bud Labitan’s book on the Moat is also by a pro-Berkshire Hathaway source, and it spelled out the importance of financing offered by Clayton-connected lenders in the marketplace, correct? The financial site GuruFocus is routinely pro-Buffett, but it criticized the business practices of Clayton Homes in a critique of their use of the moat. Can you provide some context for what those sources had to say with respect to the antitrust allegations in manufactured housing made by Samuel Strommen while he was at Knudson Law?”

Learn more:

> “One of the sources you linked was the Urban Institute, which asked the question – why are so few manufactured homes being made? Indeed, didn’t Manufactured Home Pro News help document the sharp decline of manufactured housing since the late 1990s to today? And given the financial resources of Berkshire Hathaway, and the tremendous need for millions of affordable homes, isn’t it logical to consider the notion that they and some allies want the industry to underperform, at least for a time, so that they can consolidate the industry? After all, how much did Clayton Homes grow in manufactured housing market share since 2003 when Berkshire Hathaway acquired them?”

Learn more:

Ironically perhaps, but the late Sam Zell added a keen piece of insight into this mix when he said that he liked the oligopoly nature of the manufactured home industry. An oligopoly can be a form of monopolization.

Zell’s firm did more than just add that monopolistic insight. His brand, Equity LifeStyle Properties (ELS) went a step further, and bought Datacomp, MHVillage, and by owning the later, got trade publication MHInsider too.

Information useful to aggressive price hikes referenced by Bing AI above that are part of the subject of antitrust lawsuits involving several Manufactured Housing Institute (MHI) members eventually followed.

> “It has been said that when the Securities and Exchange Commission went after Cavco Industries and Joe Stegmayer, that Stegmayer stepped down from his role at Cavco. But Stegmayer maintained his position as the chairman at the time of the Manufactured Housing Institute, correct? Doesn’t that seem odd given MHI’s Code of Ethical conduct?”

Learn more:

> “Pardon me, but Stegmayer and Cavco both settled the matter with the SEC by paying large fines, didn’t they? So, those are now more than allegations and they are no longer being investigated because Stegmayer and Cavco settled with the SEC, isn’t that correct?”

While this Q&A and more details could be added, this seems to be a fine point to note that the disgraced Stegmayer was an ex-Clayton division president. What has been occurring in various aspects of the manufactured housing industry could be described as part of the Claytonization of the business, because the business model that existed in the 20th century has to a great extent be transformed following Berkshire Hathaway’s entry into the field.

Summary and Conclusion

- Do your research: Before investing in a company, conduct thorough research on the company’s history, financial statements, and management team 1.

- Be wary of “get-rich-quick” schemes: Be cautious of investment opportunities that promise high returns with little or no risk 1.

- Stay informed: Keep up-to-date with the latest news and developments in the financial industry 1.

- Be skeptical: Be skeptical of investment opportunities that sound too good to be true 1.

- Report suspicious activity: If you suspect fraudulent activity, report it to the appropriate authorities such as the Securities and Exchange Commission (SEC) or the Federal Bureau of Investigation (FBI) 1.

- Be aware of the risks: Understand the risks associated with investing and be prepared to lose money 1.

- Use caution with social media: Be cautious of investment opportunities that are promoted on social media platforms 4.

- Educate yourself: Educate yourself on the signs of fraud and how to avoid investment scams 2.

Investors should dig into the specific publicly traded firms that are periodically updated here on MHProNews.

Staying informed, being skeptical, being aware of the risks and self-education are among the reasons that thousands of industry professionals, perhaps you too, come to MHProNews daily.

Programming Notice. It is quarterly earnings season. There are other news items that are among the array of information routinely found here, and sometimes nowhere else in MHVille. Watch for some of the latest from your largest, most-informative, and reliable trade source for manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” ©

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.6.2023

- From OpenAI

- OpenAI unveils latest AI model, customizable GPTs and digital store

- Starbucks is handing out pay hikes and new benefits. But some are only for non-union workers

Bank deposit delays: Some customers still haven’t been paid - Fortnite scores its biggest-ever weekend with nostalgia-filled OG release

- Stop putting rhinestones on your steering wheel, federal government warns

- Harvard University stands in Cambridge, Massachusetts, on July 6, 2023.

- ‘Dire’ antisemitism allegations at Harvard could lead to donor exodus, billionaire Bill Ackman warns

- Whitney Wolfe Herd, founder and chief executive officer of Bumble, during an interview on “The Circuit with Emily Chang” in Montecito, California, US, on Wednesday, May 17, 2023. Herd said that AI could make singles better at courtship and envisions dating technology as a cure to America’s loneliness epidemic.

- Bumble founder Whitney Wolfe Herd steps down as CEO. She’ll be replaced by Slack’s leader

- Epic Games goes to court to challenge Google’s app store practices

- Drugstore closures could make pharmacy deserts even worse

- Paris Olympics with Ralph Lauren

- Hang out with Team USA at the Paris Olympics? Here are some extravagant options for deep-pocketed gifters

- How Goldman Sachs is navigating a more turbulent world

- Ryanair’s soaring profit means regular payouts to shareholders for first time in 40 years

- Heinz’s newest ketchup tastes like pickles

- Behold ‘Grok,’ Elon Musk’s AI chatbot with a ‘rebellious’ streak

- China hasn’t been this scary for investors in 25 years

- China’s corruption watchdog investigates former ICBC banker as clampdown continues

- Tyson recalls 30,000 pounds of chicken nuggets

- After a $1.8 billion verdict, the clock is ticking on the 6% real estate commission

- Google, Lendlease axe plans for $15 billion development in Bay Area

- Striking actors are reviewing Hollywood and TV studios’ ‘best and final offer’

- William Lewis is named publisher and CEO of the Washington Post

- Here’s how America’s economy could begin to weaken

- The Taiwanese American cousins going head-to-head in the global AI race

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.