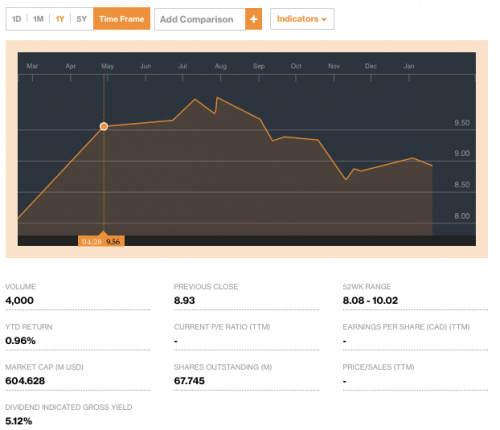

Killam Apartment REIT (TSX: KMP.UN) has reported its financial results for the fourth quarter and year ended December 31, 2016.

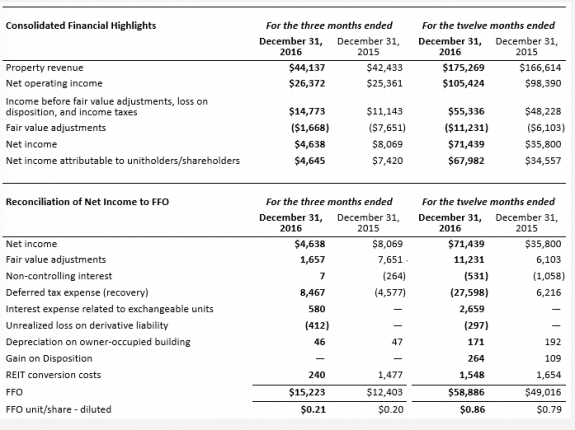

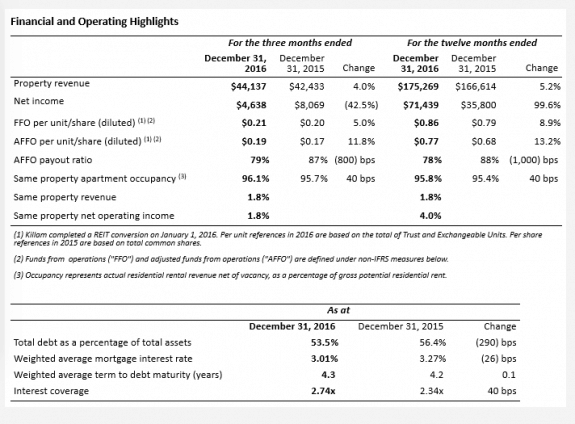

Killam generated funds from of operations (FFO) per unit of $0.21 in Q4 2016, a 5.0 percent increase over Q4 2015.

Similar to the results for the year, growth was attributable to higher earnings from the same property portfolio, lower interest expense from refinancing and the Q3 2016 repayment of $57.5 million of convertible debentures, and growth from acquisitions and developments.

Killam achieved same property revenue growth of 1.8 percent in in the quarter, attributable to increased rents of 1.6 percent and improved occupancy levels. The same property apartment portfolio achieved 96.1 percent occupancy during the fourth quarter, up from 95.7 percent during Q4 2015.

“Killam delivered strong results in Q4, and for the year,” said Killam President and CEO Philip Fraser.

“We achieved many successes during 2016, reflected in our financial performance: solid growth from our existing portfolio, strong demand for our recently completed developments, portfolio-enhancing acquisitions in our core markets, and interest expense savings. In addition, we strengthened our balance sheet with reduced debt levels and an expanded acquisition credit facility.”

Overall in 2016, Killam generated FFO per unit of $0.86, an 8.9 percent increase from the $0.79 generated in 2015. FFO growth was attributable to a 4.0 percent increase in same property net operating income (NOI), interest expense savings on mortgage refinancings and convertible debenture redemptions, and accretive returns from developments and acquisitions.

Killam also completed $71.5 million in acquisitions in 2016, contributing positively to net income, and their newest development, Southport Apartments, was fully leased by November and also positively impacted earnings in the year.

“The benefit of our established development program stood out last year,” said Fraser.

“The lease-up of Southport Apartments in Halifax exceeded our expectations and reinforced the opportunity to add value through developments. We are excited about our two current projects and our pipeline of over 1,000 units for future development. Development will continue to be an important part of Killam’s growth strategy going forward.”

Daily Business News coverage of the most recent acquisitions by Killam is linked here.

In addition to multifamily apartments, Killam owns 35 manufactured home communities in Atlantic Canada and Ontario.

Killam is also one of the manufactured home industry stocks monitored each business day on the MH Industry’s leading professional news resource, the Daily Business News, on MHProNews. For the recent closing numbers yesterday on all MH industry-connected tracked stocks, please click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.