In response to an inquiry during the Q&A of their most recent quarterly earnings call, Legacy Housing CEO Duncan Bates said: “we have a lot of parks that we are filling up.” Bates also said: “we’re impacted just like the other manufacturers on the park side of the business.” It was one of several headline-referenced remarks that make this report significant for those seeking to understand Legacy Housing better as well as the broader manufactured housing industry’s performance.

Frankly, various factors delayed MHProNews report and analysis on the most recent earnings call for Legacy Housing Corporation (LEGH). Though we are routinely the only manufactured housing industry trade media that covers and unpacks with appropriate analysis the remarks of publicly traded firms, nevertheless our preference is to cover items more swiftly than this report which Yahoo and Thompson Reuters reported. That acknowledged, it may have been a ‘blessing in disguise’ that this report is occurring at this time, as the analysis in Part II will reflect.

The highlighting in Part I is added by MHProNews. Part II is our additional information with more MHProNews analysis and commentary.

In Part I, several edits of typos below were made by MHProNews. While it is not unusual for there to be some modest glitches in the transcripts, this one had for whatever reason had perhaps more than any we’ve encountered in some time, perhaps ever. For example. Max Africk, not max aspheric. Several small l spellings of Legacy were corrected with the appropriate capital L for Legacy. A “legacies” vs “Legacy’s” was corrected, along with Curt instead of Kurt. Also, energy star was corrected to read Energy Star. Alex Rygiel, B. Riley Securities was added above replies from Bates in two places, 16 wides vs. 16 lives, parks vs. parts, etc. While such tweaks by MHProNews arguably significantly improved the accuracy of what follows, the transcript may still not be perfect.

As normal, highlighting should not be construed to mean that the transcript should be scanned, and the only focus should be on MHProNews highlighted text. Earnings calls and interviews like the recent one linked here which is longer than this one is often longer articles but are nevertheless routinely popular and well-read with our core audience.

Part I

Q4 2023 Legacy Housing Corp Earnings Call

Thomson Reuters StreetEvents

Participants

Duncan Bates; President & Chief Executive Officer; Legacy Housing Corp

Max Africk; Corporate Secretary & General Counsel; Legacy Housing Corp

Jeffrey Fiedelman; Chief Financial Officer; Legacy Housing Corp

Mark Smith; Analyst; Lake Street Capital Markets, LLC

Jay McCanless; Analyst; Wedbush Securities

Presentation

Operator

Good day, and thank you for standing by, and welcome to the Legacy Housing Corporation Q4 2023 earnings call. (Operator Instructions) Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, Duncan Bates, President and CEO. Please go ahead.

Duncan Bates

Good morning. This is Duncan Bates, Legacy’s President and CEO. Thank you for joining our call to discuss Legacy’s year end 2023 results. I apologize for the release late Friday circumstances outside of our control delayed the release, and we will tried to avoid Friday releases in the future. Max Africk, Legacy’s General Counsel, who will read the Safe Harbor disclosure before getting started max

Max Africk

Management’s prepared remarks today will contain forward-looking statements, which are subject to risks and uncertainties, and management may make additional forward-looking statements in response to your question.

Therefore, the company claims the protection of the Safe Harbor for forward-looking statements that is contained in the Private Securities Litigation Reform Act of 1995. Actual results may differ from management’s current expectations, and therefore, we refer you to a more detailed discussion of the risks and uncertainties in the company’s annual report filed with the Securities and Exchange Commission. In addition, any projections as to the company’s future performance represent management’s estimate as of today’s call, legacy assumes no obligation to update these projections in the future unless otherwise required by law.

Duncan Bates

Thanks, Max. I am joined today by Jeff Siemon, Legacy’s Chief Financial Officer. Jeff will discuss our 2023 financial performance. Then I will provide additional corporate updates and open the call for Q&A. Jeff?

Jeffrey Fiedelman

Thanks, Doug. And product sales decreased to [$145.1 million] or 34.7% in 2023 as compared to 2022. This decrease was driven by a decrease in unit volumes and the conversion of certain independent dealer consignment arrangements to inventory finance arrangements in 2022 that did not occur in 2023.

The conversion of consignment arrangements to inventory financing arrangements resulted in an increase to product sales of approximately $29.1 million during 2023 between December 31, 2023 and December 31, 2022, our net revenue per unit sold decreased 10.4% to $59,600. Dealer and community customers purchased smaller, less option homes to meet customer demand in 2023.

The decrease was not driven by price concessions during the year, consumer MHP, and dealer loans. The interest income increased to $37.4 million or 31% from 2023 to 2022. This increase was driven by increased balances in the MHP and consumer loan portfolio between December 31, 2023 and December 31, 2022, our consumer portfolio, our consumer loan portfolio increased by $17.5 million, and our MHP loan portfolio increased by $39.2 million.

These increases are net of principal payments and loan loss reserves. Other revenue primarily consists of contract deposit forfeitures, dealer finance fees and commercial lease rents, an increase to $6.6 million or 3.5%. The increase was driven by growth in forfeited deposits and servicer fee revenues, offset by a decrease in consignment fees. Steelers carry bus inventory in 2023, cost of product sales decreased $50.4 million or 33.6% in 2023 as compared to 2022.

The decrease in costs is primarily related to a decrease in units sold. Product gross margin was 31.3% for the year ended December 31, 2023, selling general and administrative expenses decreased $3.3 million or 11.9% in 2023 as compared to 2022. This decrease was primarily due to a decrease in salaries and benefits costs, warranty costs, consulting and professional fees, partially offset by an increase in loan loss provision, legal expenses and marketing and advertising expenses.

Net income decreased 19.6% to $54.5 million between December 31, 2023 and December 31, 2022. At December 31, 2023 we had approximately $0.7 million in cash and cash equivalents compared to $2.8 million as of December 31, 2022. Legacy’s outstanding balance on our credit facility at December 31st, 2023 was $23.7 million.

During the fourth quarter, we drew on our facility to make significant investments in our land developments and to fund multiple financing opportunities that surfaced near year end. The balance on our credit facility, it’s below $11 million. Today, Legacy delivered a 13.0% return on shareholders’ equity over the last 12 months. At December 31, 2023, Legacy book value per basic share outstanding was $17.91, an increase of 14.2% from the same period in 2022.

Duncan Bates

Thanks, Jeff. I appreciate you and your team’s hard work on the audit and the 10 K filing. Let’s start with Legacy’s financial performance. Then I will discuss the market and give other corporate updates. First, I would like to address a few onetime items that impacted our numbers for the reported period in 2022, we converted Legacy’s dealer financing program from consignment arrangements to inventory financing arrangements.

The goal of this conversion was to move our dealers to an industry standard inventory finance program. The conversion resulted in a one-time increase in product sales of $29.1 million in 2022 approximately $20 million of the $29 million was recognized in the fourth quarter of 2022. Please keep this in mind as you evaluate the quarter and year end performance in 2023, the energy tax credit program changed and Legacy adjusted.

Accordingly, in 2023, we started building nearly all of our HUD Code units to Energy Star standards, a voluntary program that will serve our cut that will save our customers money for the year ended December 31, 2023, Legacy could only claim tax credits for homes built and sold in 2023, lowering the tax credits recognized during the year.

Our effective tax rate jumped from 17.5% in 2022 to 20.8% in 2023. For 2024, we anticipate reducing our effective tax rate back towards 18% as we claim credit for homes built in 2023, but sold in 2024 for the year ended 2023 Legacy implemented CECL, a loan loss accounting framework required by FASB. The standard requires an entity to reflect its current estimate of all expected credit losses.

The adoption resulted in an increase in portfolio allowances of 900,000 at transition in the first quarter of 2023, the allowance at the CECL allowances have increased 158% to $2.2 million at December 31st, 2023 from 840,000 at December 31, 2022. I’m proud of our team’s execution, controlling expenses during a lower demand environment.

And 2023, we managed SG&A down 11.9% in overhead expenses effectively and ended 2023 with 29% net income margins for the year with no adjustments. Legacy’s board launched our management team laser laser focused on the bottom line. We have held pricing levels and held production levels as we continue to build a backlog across the manufacturing plants.

Shipments were lower in the fourth quarter than we would have liked. I underestimated seasonality on the dealer side, further delayed shipments from both Texas and Georgia plants to mobile home parks and weather up north delaying shipments of sub-contracted units from our partners.

These factors all contributed to lower shipments during the fourth quarter as Jeff mentioned, consumer MHP and dealer loan interest income increased to $37.4 million or 31% from 2022 to 2023. We will continue to deploy capital into our loan portfolios in 2024. The notes are performing well, and we like the stable and recurring revenue housing affordability in the US continues to deteriorate. Large numbers of potential homebuyers are priced out of the traditional housing market.

Our products and financing solutions serve the 50% of US households that make less than $75,000 a year, we believe in our industry and continue to see signs of a gradual recovery in 2024 as the economy stabilizes and credit eases.

Moving on to the market. The retail or dealer side of our business continues to show signs of life. We just work through the seasonally seasonally slower period, but foot traffic is still up from mid 2023 and dealers are selling homes. We believe that most of the destocking issues from early 2023 are behind us. The reorder rates continue to lag, but inventory carrying costs are higher. Two important data points right now. Interest from new dealers and Legacy’s products and financing solutions is high.

Legacy has signed up more new dealers this month than any other month since I started. Second, our Heritage stores are on track for the best sales month in the last 12 months on the communities or Park side of our business. Sales to community owners and developers remained stable, but shipments lag like other manufacturers, we have battled delayed shipments due to SAP-related issues and discriminatory zoning practices new manufactured housing developments have been impacted by high interest rates.

In Q4, we started to see an interesting trend as traditional community developers and investors started taking delivery of small HUD units and tiny homes for RV parks if they have purchased and converted these smaller units did impact our average selling price in the fourth quarter.

A quick update on some of the projects I discussed last call. Here’s where I’m focused hiring. We continue to build the team at Legacy. I mentioned that we are hiring young hungry talent last quarter. My mandate from the Board now is to also hire senior professionals with industry experience to increase depth in important areas of our business like financing, sales, engineering and manufacturing. We still have some key positions to fill, but I am excited to see the contribution as these individuals get up to speed working capital.

Working capital is still a focus from December 31, 2022 to December 31, 2023, we reduced our raw material inventory by 23%. We still have work to do on finished goods inventory at our Georgia plants sales, Kenny and I have been heavily involved in recruiting and training talented sales professionals. We are systematizing our sales process by adding tools and technology as the newer sales team gets up to speed. We are starting to see results. And as the market improves, we are well positioned from a sales standpoint.

Workforce housing, I continue to believe workforce housing is a big opportunity for Legacy. We hired a team to focus exclusively on this product line during the fourth quarter. The team is quoting and winning small orders. We are managing this area closely and are excited about the opportunities we see land development.

I mentioned during the call that we hired a dedicated team to prioritize and accelerate land development, completing Phase one of our Dell down Bastrop County project outside of Austin is our top priority. You will see in our numbers the capital to complete this project is accelerating. We continue to evaluate ways to maximize the value of these projects for our shareholders.

Two new areas that I want investors to keep an eye on. As our Heritage stores performance improves, we think there’s an opportunity to add additional stores. We only sell about 10% of our production through our company-owned stores compared to almost 50% from some of our competitors. Second, we are exploring opportunities to add financing products to better serve our customers. Our senior leadership team has been working with customers to understand their needs and is evaluating if these programs makes sense for our business.

One final thought I discuss valuation on our last call. Legacy is a high quality business with strong consistent margins, high insider ownership, low leverage and the ability to redeploy its earnings at high rates of return. We are long term focused and one quarter does not define us now that our foundation is stable. The right conversations are happening at the Board level about strategic growth projects. Our management team is excited to see what we can do over the next few years.

Operator, this concludes our prepared remarks. Please begin the Q&A.

Question and Answer Session

Operator

Thank you. (Operator Instructions)

Alex Rygiel, B. Riley Securities.

Morning, Duncan and Jeff. This is Matt on for Alex this morning. Damon and I will have quick questions. Hey, so I was just wondering if you could follow up on your November call. We obviously talked about a lot of positive trends that you’re seeing retail improvements. You had some positive backlog from the October show. Has anything shifted like more positively or maybe you know, just in a negative direction since then, you know, man, it’s been spotty.

Duncan Bates

We were really excited coming out of the out of the show and we’re able to secure a lot of orders, and we had a pretty good run build in those orders. But during the fourth quarter, we just had a lot of things that worked against us and ultimately slowed down shipments. And so what we decided was let’s hold production at current levels and let’s continue to build a backlog.

And we’ve got we’re all heading to Biloxi after this call we’ve got great shows specials. And so we’ve been continuing to push on the sales side.

I think the biggest change is that we are seeing the impacts of higher interest rates on the park side of our business now, you know, and that’s something that we have a lot of parks that we are filling up.

I think that and, you know, new development is slower than we like, but it’s still it’s still stable. And we’ve had some some nice-sized orders. We’re working on some more at, but it hasn’t we’re impacted just like the other manufacturers on the park side of the business.

Alex Rygiel, B. Riley Securities.

Okay, great. Thank you. Also just talking more about Del Valle, I know that you had hired a new team to kind of focus on your land development and you’re supposed to finish the roads and water treatment plants and maybe that’s part of some of the slower development. But do you have any sense, any better sense for timing of some of the or the home deliveries into Del Valle or even Horseshoe Bay at this point?

Duncan Bates

So we have made some proud progress in Horseshoe Bay, Horseshoe Bay, some individual lots, and we own about 300 of them that we are we’re putting homes on and selling. And we’re probably, I’d say, a month and a half away from opening a sales center there, which should accelerate the sales of those of those homes. And we’ve already sold a few higher. We sold a few homes this quarter in Horseshoe Bay. So there is we are making progress in Horseshoe Bay and the other.

The other area where we’re really focused on the land development side is Del Valle, you’ll see if you look at our CapEx, I mean, we wrote some really big checks at the end of the year from the we’ve got the water lines and we’ve got the sewer lines and we’ve got the power there working on the drainage and roads now and starting the water treatment plant.

And so our goal, I really don’t think we’ll have houses on it in 2024. But I think it’s pretty early in 2023 and or sorry, 2025. And we are we’re pushing hard on it and our dollars are starting to really accelerate. And we’ve got the right team working with Curt on that project to get back on track.

Alex Rygiel, B. Riley Securities.

Okay. And then just a final question on your new focus on potentially expanding your Heritage or your you’re in home sales. I guess I’m here. Can you talk a little bit about how much capital is required to open up a new location and kind of what your kind of return Horizon time line looks like and just what locations you’re looking to expand and yet —

Duncan Bates

I want you guys to keep an eye on it. I won’t say it’s perfect, but, you know, when Legacy went public, they use[d] the IPO proceeds to build a retail presence and we’ve had some challenges from managing our retail stores. But I finally feel like we’re heading in the right direction there, which is the first step to ultimately growing and that piece of our business.

And there’s a lot of benefits that we pick up and by know, by adding company-owned retail stores because you capture the retail margin and you accelerate you know the financing opportunities to our consumer loan portfolio and the first the first lot will be in Horseshoe Bay, and that’s that’s mainly to serve that development as we’ve as we put houses on those lots. But there are several other areas that you know that we’re looking at. And from a from a capital contribution standpoint, I mean, we’re not talking about huge dollars. You know, about half of our slots right now are leased and the others are owned.

So we don’t have to necessarily go out and buy a piece of land every time we open up a lot. But it just seems like an area as we you know, as we’ve gotten better at managing Heritage and there’s still some there’s certainly some improvement or a ways to go. But I think as we get that business really hum and then it opens up the opportunity to add more stores. And if you look at our larger competitors, you know right now, I mean, they’re they’re selling, you know, up to 50% of their production through their store. So we’ve got a lot of white space ahead if we can get this. Right?

Alex Rygiel, B. Riley Securities.

Right. Thanks again, and I’ll turn it over.

Operator

Thank you.

Mark Smith, Lake street.

Mark Smith

Sorry, I guess first question for me at Duncan. Let’s stay on the retail stores. Do you guys run any more regional promotions? Did we see a SP. in where does that kind of move within the retail store segment as the sales there look pretty solid?

Duncan Bates

Yes. The idea is let’s talk about all our dealer sales, not just the Legacy sales. But I’d say that the dealer side of the business and is improving and we continue we’ve been really impressed. I’ve got my secret sales weapon Kenny out there running down new dealers. And we’ve added a lot of new independent dealers, which is great for us because when the Park Side cycles, we do really need the dealers and we like the financing opportunities on the consignment or on the federal investors’ consumer financing side.

So we’re seeing some good improvement on the dealer side. It is patchy, though there are certain geographies where people seem to be doing better than others. I think that there’s also we’re seeing this divergent divergence between the dealers that have embraced technology and we’re using social media and finding customers on the Internet versus others that haven’t.

And so I think that there’s some some room to help them improve as well. Some detail, but we haven’t done we haven’t dropped prices across the board. Know we’ve we’ve taken production down, you know, to meet the demand and they’re building the backlog. But the dealer side of the business is fairly strong.

Mark Smith

Okay. And then if we have, you know, if we maintain the sales mix similar to where it was here in Q4, can you just talk about margin outlook and how much of the decline here in margins in Q4 was really due to sales mix versus anything else happening?

Duncan Bates

Yeah I mean, we were impacted I mentioned we have these big orders where on the park side, where we shipped smaller HUD-Code units, been tiny homes to Scott, a few customers who are converting RV park. So I think that that has impacted us. But across the board, both on the dealer side and the park side, the shift has been has continued to be toward smaller homes.

I mean, where we used to sell a lot of large 16 wides to parks. You know, people are moving to 14 wides and 12 wides some. So I think that you know that that has had an impact, but I don’t I anticipate that everyone’s only going to be buying smaller homes, you know, for the next two years. So I mean, it’s just something that we’ve seen here in the very near future or very near history.

Mark Smith

Okay. And then as we look at the loan business within consumer loans, are you guys using rate to drive an increase in that business it looks like rates have maybe come down throughout the year and even into Q4. Any commentary on kind of what you guys are charging and how that’s impacting the business?

Duncan Bates

Yeah I mean, you look at that loan portfolio in its entirety and we went through we went through a period where I’d say rates were stable and then interest rates were super low. Now, interest rates are high and you know, are the older loans have higher interest rates and a loan, say from the last three years.

But we are pushing rate higher now we with the set with federal investors, we have very strict underwriting requirements as we have used. You know that we have kept our rate low because we’re not borrowing to lend, but in certain unique situations where we’re financing a certain type of borrower or certain types of borrowers, you know that where the credit quality is a little bit lower. I mean we’re certainly pushing rates higher. So I think we’ll get back to a point where the rates are. Our chattel loans are closer to what they were four or five years ago than over the last few years.

Mark Smith

Okay. And the last one for me, Jeff, sorry, I think I missed it. Did you talk about where the balance sheet where the debt is today.

Jeffrey Fiedelman

Today, we’re under $11 million on our line of credit. So it’s come down considerably since the end of December —

Mark Smith

Okay. And maybe that’s the one more follow-up on that. Just as we think about use of capital going forward, you guys spent a little bit more here recently on some investments. How should we look at kind of CapEx and use of capital going forward here in 2024.

Duncan Bates

I think on the on Bastrop County, Q4 is a pretty good indicator of what the next few quarters will look like from a CapEx standpoint for that specific project. So I think CapEx hit the hit. The plants is fairly stable. We’ve had we’ve worked through several projects. We’ve invested in the plants and with things like new routes and updated walkways and other things to keep our workers safe.

But you know, no meaningful uptick in the plant CapEx and you know, but back to your back to your question on the on the credit line, what essentially happened at year end, we had and we had some larger checks that we had to write four for Bastrop for road work and for the water treatment plant. But credit is tight. And there’s a lot of there’s a lot of people in our industry that and no need to borrow money for certain projects.

And these are secured loans at relatively high interest rates with personal guarantees for assets that we wouldn’t mind owning if there’s a problem with the credit. And so we put a lot of money to work at the end of the year, and we continue to see those opportunities to generate great returns with it with the secured loan and ultimately help some of our customers out with projects that it will get some orders once they get through the development.

Mark Smith

Okay, great. Thank you.

Operator

Thank you.

Jay McCanless, Wedbush.

Jay McCanless

Good morning and thanks for taking my questions and good morning. So if we could start with the decline in product sales for the fourth quarter. Maybe could you break out what that decline was for the retail dealers versus the parks versus your park customers?

Duncan Bates

Yeah, I mean a big well, I don’t have the exact split in front of me, but I can follow up with you with an exact number, but at a high level on the dealer side, you know, we came off our we came off our show. We started shipping a lot of houses and then we hit a seasonably slower period where dealers wanted us to hold off on shipping homes.

And the park side, like I mentioned, has been spotty where a project will go and you’ll be able to deliver a few months of houses or in many cases, there’s significant delays with utilities or permitting or or, you know, other other things that happen for these developments are retrofits. And so we kind of just how to it’s a little bit of a perfect storm and some delays on the park side and just some seasonality on the dealer side.

We’ve also got I think, you know, Jay, we’ve got some partnerships up north with some other manufacturers that build our floor plans. And I think that that continues to be a good opportunity for us. But with the weather up there, we just couldn’t ship anything and you know it just we’ve been pushing we’ve been pushing hard all year and we just we kind of hit a point where there was a lot of delays in shipments and you see that in our fourth quarter results.

Jay McCanless

But could you give us any color on how product sales are trending thus far in the first quarter?

Duncan Bates

Yeah, they’re the they’re looking they’re looking pretty good. I’ve had I’ve had some delays shipping houses out of Georgia, which just seems to be one thing after another there, but we’re pretty close, I think, to getting back on track. So we had in the beginning of beginning of the quarter, we had homes caught up and the are there that you know that we’re clearing out now as quickly as we can.

But in Texas, it’s been it’s been pretty consistent as we thought and when we spoke last quarter that we were we looked really good and we were planning on taking up production. And what we’re doing now is we’ve decided, hey, let’s keep production where it is and keep building the backlog. We keep running specials, keep focusing on sales.

We’ve got a lot of new sales reps that are getting up to speed. And you know, they’re they’re making sales and they’re making commissions and it’s up. It’s it’s fun to watch. But hope for for Q1, I think it looks better than better than Q4 on you know, but but maybe not as good as that some of the prior quarters and early 2023.

Jay McCanless

And then just thinking about gross margin 31 and change for fiscal ’23 and maybe what’s your outlook for fiscal ’24 and there anything we any issues we need to be thinking about from a cost side, whether it’s rising OSB prices or some other things going on? Maybe maybe walk us through how you’re thinking about gross margin for the full year?

Duncan Bates

Yeah I mean, look, I think if you go back and you look five years backwards and kind of our gross margins, they tend to be in the higher higher 20s versus low 30s. And so the margins look pretty strong right now and I don’t anticipate a major change between, say this quarter and next quarter, but I think over the long term and they will revert closer in the high to the high 20s and stay at these levels as material prices, it start to increase.

Jay McCanless

I think you said on pricing that you guys have been holding pricing, especially on the dealer side. Is that continued into the first quarter. And do you think based on now that that Georgia is starting to ship again, you’ll be able to hold prices there, too?

Duncan Bates

Yeah, I mean, look, there’s price and volume is related, obviously, as you know, throughout this entire slower period. And I think 2023 is a great example. You know, could we have given homes away and really increase the throughput through the plants?

I’m sure I’m sure we could have. But like I mentioned on the call, our Board wants us to be extremely bottom line focus. And I don’t know, I think for other manufacturers that are cutting cutting price. I mean, I don’t think material costs are going down. And and frankly, I know labor costs aren’t going down. And so we’re going to rightsize our SG&A and rightsize our overhead for a slower period and continue to hold price some as the market recovers, even to the detriment of on volume.

Jay McCanless

Okay. And that actually was going to be my next question on SG&A. It sounds like you’re going to be doing staffing, higher income staffing as you build out some of the different portions of the business. I guess how harsh, from a total dollar standpoint, should we expect that to ramp up by some percentage in ’24 as you’re adding more and more personnel?

Duncan Bates

I think it will be a little bit higher, but you know that we’ve had some I mean, you guys have seen the press releases and with some of the NEOs, I mean, we’ve had a lot of turnover at the senior level, which I think in many cases is a good thing for the business long term.

But what the Board has said is, look, you know, we launch you in addition to hiring young people like let’s add some, let’s add some bench strength and key areas of our business because some of these some of these areas are are significantly larger than when we went public and you need more senior people and so I think as we find the right people, we’ll hire them and we’ll pay them well. And I think the contributions will be great.

We’ve already we’ve already made some great new hires at the senior level and there they’re contributing. So I do see some I do see SG&A maybe going up slightly, but a lot of it is just offsetting some other senior people that have it didn’t have retired or moved on from the business.

Jay McCanless

That’s good color. Thank you. And then I appreciate all the commentary on Del Valle, but maybe could you talk about some of the other land holdings that Legacy has and what your thinking is on those parcels now?

Duncan Bates

Yeah. And I think I mentioned or I talked a little bit about it, Jay, last call. I mean, really what we’re going through is we’re prioritizing where we want to allocate capital on these developments. And, you know, in many cases, we’ve sat on some of these things so long and that you could if we don’t think a project is viable for a community for us to do internally, there may be a better owner of that.

So I think that there’s a bucket of prop of properties that we could look to ultimately divest, and we’ve held them for long enough where you make two, three, four times your money on the raw land. And there’s a second group of properties where you know, over this time period, the dynamics have changed. And so you’ve got a city sewer now coming to the project in the next year or so.

Jay McCanless

And we’re looking at those and the feasibility of those projects as MH communities, whether it’s with us or someone else finalizing the development? Or is this piece of land or does it have a better and higher use that we can return that we can generate returns for our shareholders by DNO by them.

Duncan Bates

Yes, we haven’t so much selling it and having somebody build stick-built homes on it. But our focus for all of these projects is we want to sell more manufactured homes, we want to finance more manufactured homes. And so we’re really we’re viewing all the from the lens of MH that is a big headwind I mean, it’s the biggest headwind is where do you put them, but we’re fighting the same battles with and, you know, the regulators that all of our customers are and you know, but we’re trying to pick our battles and we know we’ve got a few that make sense to go ahead and take the full. It take the full way, and that’s where we’re allocating capital as we prioritize the other projects.

Jay McCanless

It’s great. And then the administration announced some changes to the Title one program for changes they made in a long time are those changes any benefit to Legacy would would would increased Title One financing be something of a challenge for your consumer loan book, maybe any benefit or help you saw in those recent announcements?

Duncan Bates

Yeah, I don’t think it’s going to have a huge impact on our business. Like I don’t think that changes, you know, cannibalize the you know, the on the volume to our consumer loan business. I believe all of these changes were on the FHA financing side. That’s just a little bit different then than what we do here. But is a longer more administratively intense process. So right now, I don’t see I don’t see a big impact, but if something changes off, we’ll talk offline.

Jay McCanless

Got it. Got it. And then the last question I had we’ve heard from some of your stick-built competitors that and our mortgage qualification has been getting more difficult, not just because of higher rates, but now you’re seeing credit card debt starting move up, other types of debt moving up, and that’s causing more qualifications for certain site built built for certain site builders, I guess are you guys seeing any of that in your consumer loan book right now? And how do you feel like the quality of the loan book has been trending through the quarter so far?

Duncan Bates

Yeah, our loan book continues to perform really well. And we made a senior hire who had run it financing business in our industry, and he’s been working with the team and doing his analysis. And these like man, this like you guys have a good formula here for underwriting and you are outperforming the competitors.

And I think the key thing with with our consumer financing portfolio is we have a very specific our customer that we finance and we don’t move on things like downpayment and extras like financing storage, sheds in septic tanks and other add-ons that you ultimately can’t recover. We want to provide a reasonable rate and a high quality product for a borrower.

And but they’ve got to have skin in the game. And I think big because we haven’t been on those and we’ve seen a lot of others bend on those. You know, we haven’t seen large changes to you know, to the downside in the performance of our consumer loan portfolios.

Jay McCanless

Okay, that’s great. Thanks for taking all my questions.

Duncan Bates

Sure. Thanks, Jay.

Operator

Thank you, both. (Operator Instructions) At this time I would now like to turn the conference back over to Duncan closing remarks.

Duncan Bates

Our team, one of one other thing our team is heading to the Biloxi mobile home show today through Wednesday, Kenny and I leave directly after this call. So if there are any industry folks on the call who will be attending the show, we’d love to we’d love to see and spend time with you and show you some of the houses. We have set up there and discuss some of the specials that we’re running right now.

Thank you for joining today’s earnings call. We appreciate your interest in Legacy Housing. Operator, this concludes our call.

Operator

This concludes today’s conference call. Thank you for participating. You may now disconnect. ##

Part II Additional Information with More MHProNews Analysis and Commentary

This is the most recent Yahoo finance screen capture as of the date and time shown.

While each of the highlighted remarks has some degree of significance, the three sets of remarks that are at or near the top in importance in MHProNews’ expert view are the following.

- 1) When Legacy Housing CEO Duncan Bates said: “we have a lot of parks that we are filling up.” With Bates adding: “we’re impacted just like the other manufacturers on the park side of the business.” Noting the terminology issue, the far more important concern is one that MHProNews raised with MHI member producers and the Manufactured Housing Institute (MHI) leaders at an MHI event some 7 years ago. It was and remains obvious that at some point manufactured home communities (MHC) will ‘fill up.’ That’s not rocket science, it is borderline self-evident and thus a stunning fumble by MHI leaders. Has Legacy raised that and the next issue with MHI leaders? More on that question below.

- 2) “Dealer and community customers purchased smaller, less option homes to meet customer demand in 2023.” This has been reported by others, not just Legacy (see links further below). Which begs the question that multi-year MHI member Frank Rolfe – perhaps ironically – aptly pointed to. Namely, why has MHI continued to push CrossMods when the trend has been toward less costly units? “But across the board, both on the dealer side and the park side, the shift has been has continued to be toward smaller homes,” said Bates.

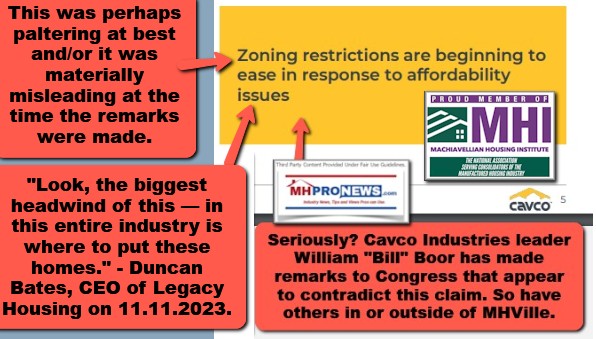

- 3) Once more the topic of “discriminatory zoning practices” was raised. Bates and Curt Hodgson have both addressed this repeatedly. That begs the question: has Legacy raised that zoning/placement barriers issue with MHI leaders? More on that question further below.

4) Then, there are several possible implications from this statement. “But our focus for all of these projects is we want to sell more manufactured homes, we want to finance more manufactured homes.” Considering that at face value and looking back at what other publicly-traded Manufactured Housing Institute (MHI) members have said and done in the last several months, a fascinating picture emerges.

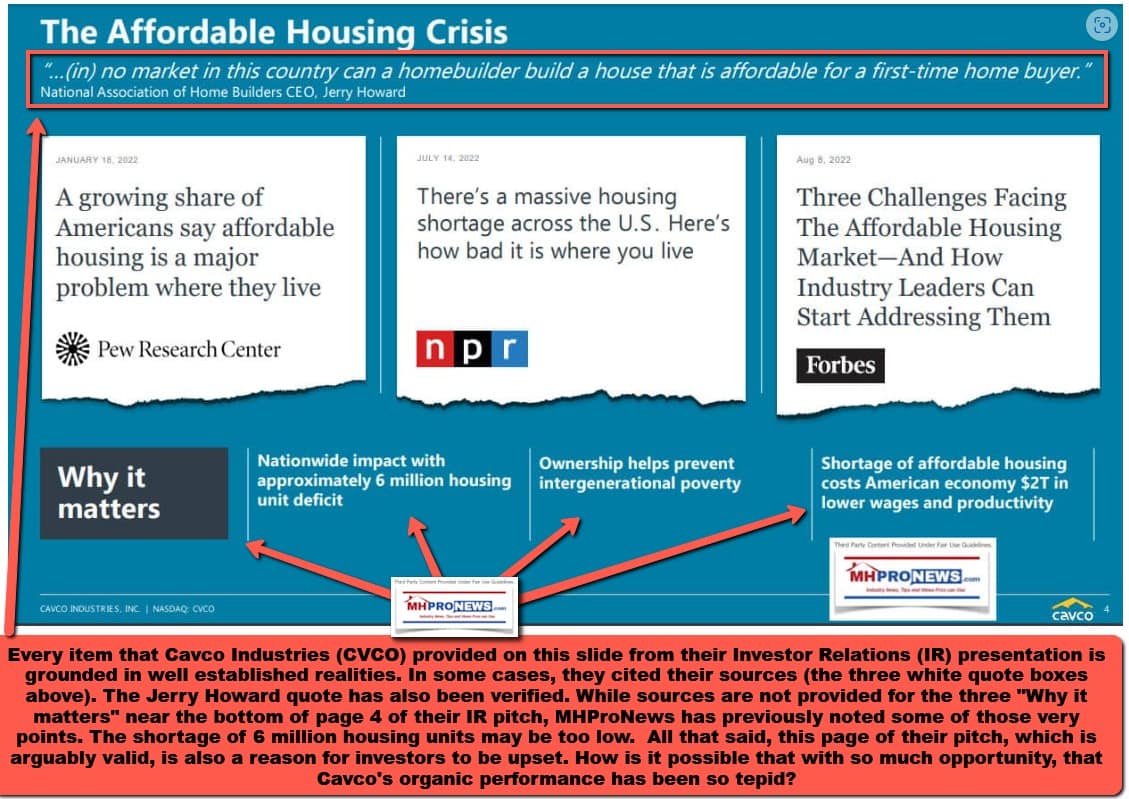

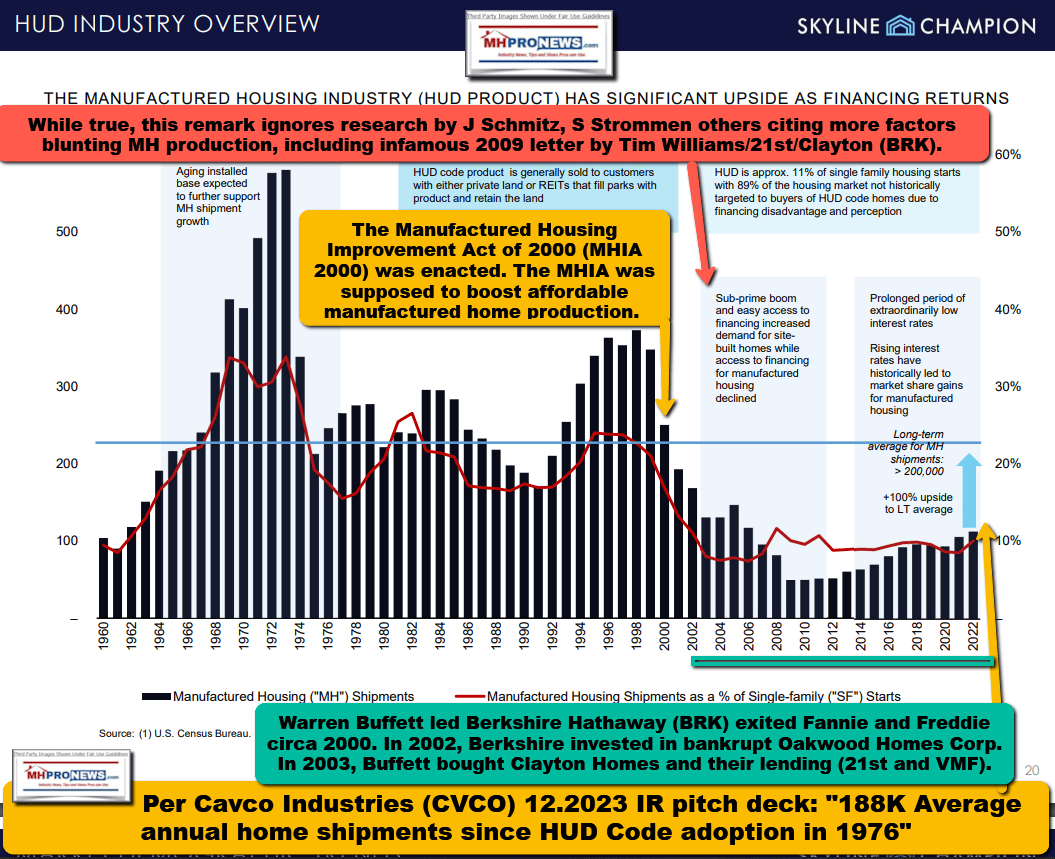

a) In no particular order of importance, starting with this item from Cavco Industries.

b) And this below from Cavco, which William “Bill” Boor currently holds the role as MHI’s chairman. Note that the image below can be increased to a larger size in several devices, click the image and follow the prompts.

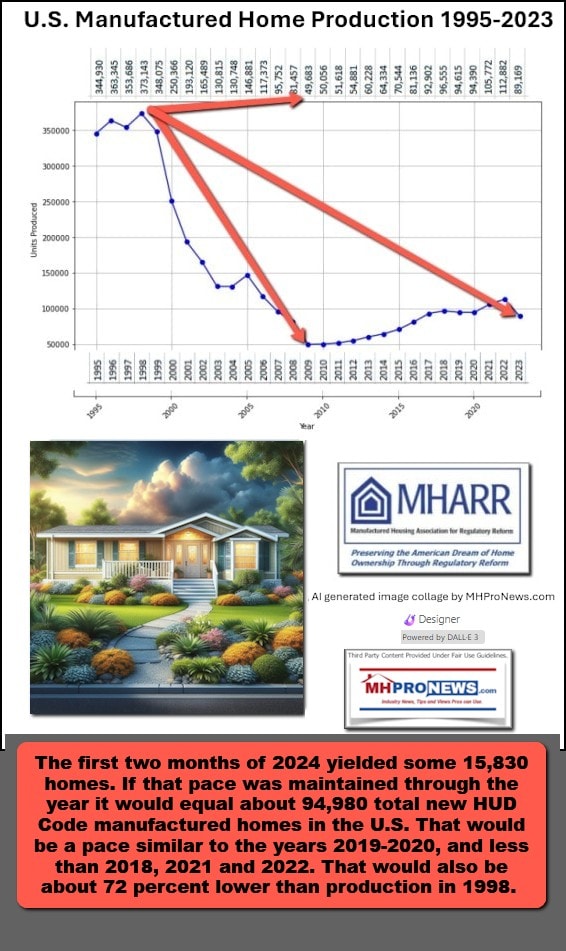

c) The above and what follows is evidence that manufactured housing could be producing some 5 to 10 times (perhaps more) as many new homes annually as it currently has been or could have building in recent years.

d) About a year ago, Greg Palm put the following to Cavco’s Boor, who apparently danced around that topic. ‘Why is manufactured home industry production so weak?’ Bingo – a correct question. Hold those thoughts.

5) Then there are the implications of the stakes held by private equity giants such as BlackRock, Vanguard, and State Street in companies that are MHI members.

6) Elaborating on the impact of private equity on broader housing market, consider the following Q&As with Bing’s artificial intelligence (AI) powered Copilot, using its balanced or blue setting, which is the MHProNews norm.

Are the stakes of private equity firms such as BlackRock, Vanguard, and State Street in single family rental housing and/or multi-family rental housing large? Doesn’t limiting production of new housing, from the vantagepoint of some of those private equity firms, tend to mean that they may want an underproduction of new home construction to push rents higher?

Okay, but now look at the influence of private equity on multifamily rental housing, and elaborate.

7)

Okay. Private equity giants are obviously also invested in conventional housing builders, and the conventional housing market, isn’t that correct? Elaborate on that point.

8)

Marketplace and others have made the point that conventional builders have been to some extent throttling or pacing new construction, is that correct? Doesn’t that also have implications on limiting new home production and thus keeping housing costs higher than they might otherwise be if a more robust housing construction was occurring?

Learn more

9)

Prior NAHB CEO Jerry Howard made some remarks that Cavco Industries has cited in its investor relations pitch. “Right now, in almost no market in this country, can a [conventional] homebuilder build a house that is affordable for a first-time homebuyer,” National Association of Home Builders CEO Jerry Howard said on Fox Business. “We can’t do it. The costs that are on us make it impossible.” Explain the signficance of that to the broader housing market and manufactured housing more specifically. Then, to your earlier point about a 3.8 million unit shortage of affordable housing, haven’t several members of Congress cited evidence that the housing shortage is more along the order of some 6 to 10 million units, perhaps higher?

You mentioned zoning and placement barriers to manufactured housing. CEO Duncan Bates with Legacy Housing, a member of the Manufactured Housing Institute, has said that zoning barriers are the single biggest hurdle to more new manufactured home production and placement, correct? Is there any evidence that you can find online where someone at Legacy apparently raised the subject of MHI using litigation to force HUD and/or a local jurisdiction to honor the enhanced preemption provision of the Manufactured Housing Improvement Act of 2000?

11)

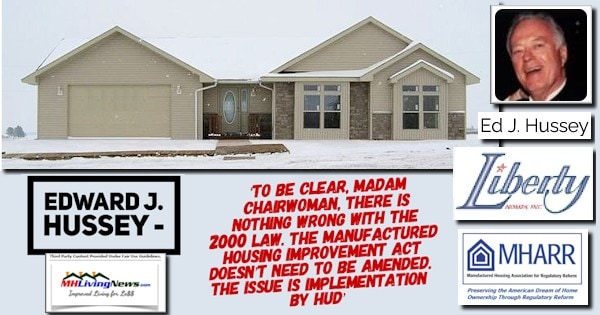

Pardon me, Copilot, but I’m not sure I agree with part of what you just said. Quoting the dubious remarks: “MHI has raised the issue of using litigation to force HUD (the U.S. Department of Housing and Urban Development) and local jurisdictions to honor the enhanced preemption provision. The goal is to ensure that local zoning regulations do not unduly restrict the placement of manufactured homes.” I am aware of the Manufactured Housing Association for Regulatory Reform (MHARR) offering to work with a Manufactured Housing Institute linked state association to pick a test case and sue to force HUD to comply with the 2000 Reform Act and its enhanced preemption provision. But I’m not aware of any remark by the Institute online where a Manufactured Housing Institute leader said they are considering litigating the issue. Please give me specific linked examples of that quoted statement you made, because I think it is in error.

12)

Okay, let’s further clarify your responses. The Manufactured Housing Association for Regulatory Reform has specifically offered to litigate this issue, correct? There is no known specific remark by MHI online where they even use the term “enhanced preemption,” even on their own website, correct? Hasn’t The Institute been repeatedly criticized for posturing and paltering on this issue of the implimentation of the “enhanced preemption” provision of the MHIA of 2000? Aren’t several Institute member firms on record saying in investor relations pitches that the lack of new development is useful to their business models? So, given the known facts, such as over 20 years of delays in MHI NOT suing to get enhanced preemption enforced, the fact that several of their larger communities members apparently believe that may benefit them, isn’t the Occam’s Razor conclusion that they are posturing and paltering to mollify those that want federal preemption enforced while they in fact have dragged their feet on meaningful action that could have overcome the zoning barrier issue years ago via legal action?

14) Then, there is the unique stance of MHI member UMH Properties (UMH). While they have not directly challenged MHI, their remarks shown in the deeper dive report below clearly reflect their view that the facts indicate that new communities can be developed at a higher rate of profitability than buying an older land lease community, fixing it up, and filling it up with new homes for sale and/or lease.

Note that this isn’t the first time that Copilot has said words to the effect, quoted above: “I appreciate your [i.e. MHProNews] thorough analysis and attention to the nuances of this issue.” There is an evidence-based case that NO ONE ELSE in MHVille trade media other than MHProNews/MHLivingNews are looking at the broad range of evidence that is available and are then drawing reasoned-based inferences from known facts and evidence. While other bloggers and trade media, or MHI itself seems to be duplicitous on several issues, as Copilot put it

“(MHARR) has indeed been proactive in advocating for the enforcement of federal preemption rights. MHARR has consistently emphasized the importance of the enhanced preemption provision within the Manufactured Housing Improvement Act of 2000 (MHIA).”

By contrast, here is the scenario with MHI, per Copilot’s review of the facts.

> MHI’s Position and Criticisms:

- You are correct that there has been criticism directed at the Manufactured Housing Institute (MHI) regarding their handling of the enhanced preemption issue.

- Some critics argue that MHI has not taken sufficiently assertive action to ensure that local zoning regulations do not unduly restrict the placement of manufactured homes.

- The perception that MHI has been hesitant or ineffective in enforcing federal preemption has led to frustration among industry stakeholders.

15. Now, with those added marketplace points in mind, let’s return to Legacy’s remarks in their most recent earnings call.

Then there are these remarks by Legacy. In no particular order of importance, in addition to those already cited above, are these insights.

- “when Legacy went public, they use[d] the IPO proceeds to build a retail presence and we’ve had some challenges from managing our retail stores.”

- “because when the Park Side cycles, we do really need the dealers”

- “we’re looking at those and the feasibility of those projects as MH communities,”

- “And so we’re really we’re viewing all the from the lens of MH that is a big headwind I mean, it’s the biggest headwind is where do you put them, but we’re fighting the same battles with and, you know, the regulators that all of our customers are and you know, but we’re trying to pick our battles and we know we’ve got a few that make sense to go ahead and take the full.”

- “we’ve had a lot of turnover at the senior level, which I think in many cases is a good thing for the business long term.”

- “we’ve got some partnerships up north with some other manufacturers that build our floor plans.”

In 2023 the “park side” indeed “cycled.” Production fell sharply. Now that communities are picking up, so too is production.

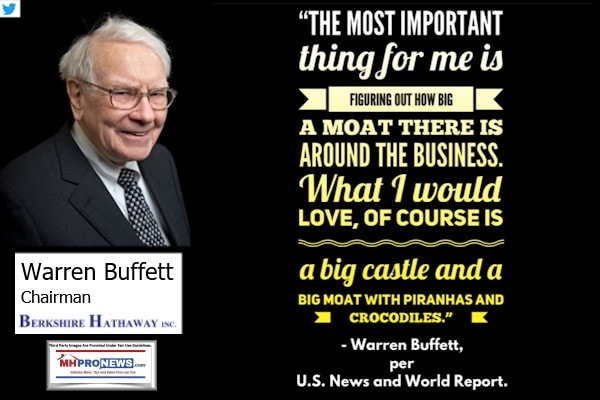

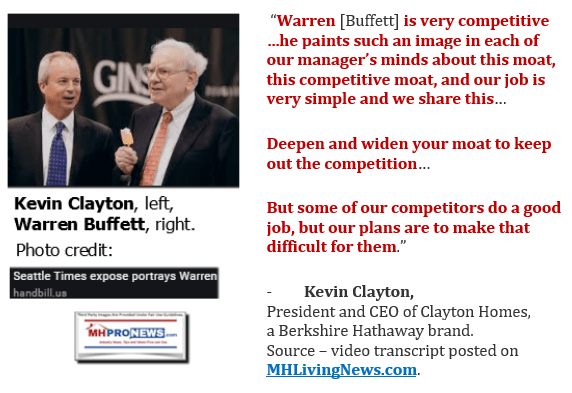

16) Put differently, there is an evidence-based case to be made that not only Legacy Housing, but other MHI member producers – and non MHI member producers too – are suffering the effects of marketplace manipulation. Either MHI corporate and staff leaders are incompetent, which seems unlikely, or they are executing on a plan that consistently consolidates the industry while keeping the production level of new HUD Code manufactured homes low. As Copilot noted, often citing MHARR, MHProNews, MHLivingNews, the recent Ledger op-ed, and various interrelated mainstream media press releases, there is clearly a challenge for a smaller firm to properly navigate the treacherous waters that Warren Buffett described as being filled with man-eating amphibians.

17) Absent a multi-decade view of what has been occurring in the manufactured housing industry, it would be all too easy to miss the details that make what Copilot called an astute and nuanced analysis possible. It would be easy to commend Legacy for getting as far as they have up the food chain of manufactured housing, given the sobering reality that many far larger firms have failed since the turn of the century.

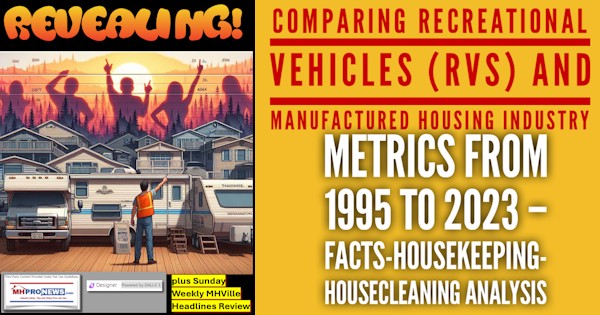

18) Unless someone – be it investors, business owners, career minded individuals, public officials, attorneys, affordable housing advocates, and others – understands the mendacity, paltering, posturing, treachery, and duplicity of some in manufactured housing, it is difficult to grasp why the manufactured housing industry has so badly underperformed in the past 2 decades. While a longer article, the one below has been the most runaway most popular reads in our most recent eblast. We’ll plan to provide some site data in the near future. But suffice it to say for now that industry professionals are seemingly hungry to understand why the industry is underperforming so badly, when as MHARR frequently points out, good laws exist that if properly enforced would yield many times more sales than are currently occurring.

19) For those of us in MHVille that were around at the turn of the century or before, it would be difficult to imagine that manufactured housing could be performing at such a poor level at this point in the 21st century. Once a far larger share of the U.S. housing market, manufactured home could be even bigger today. But it will arguably take a combination of moxie, chutzpah, resources, wit, wisdom, a dash of humility and a healthy dose of business ethics to recognize that MHI’s insiders are part of the problem, not part of the solution. The graphic below can be expanded to a larger size.

20) The antitrust cases that MHProNews/MHLivingNews foreshadowed well in advance of their being launched are potentially a signal for the opportunities in disguise that the treacherous have given to the righteous with the needed ingredients mentioned in #19.

21) MHProNews has long made the point that within MHI, and similarly in MHI linked state associations, there are ‘good guys’ and ‘bad guys’ in terms of firms that are apparently willing to cross a line in market manipulation and those who have not done so. The oligopoly monopolistic insiders at MHI could very well have handed smaller firms a path ahead, so long as the smaller firms are willing to fight the legal and messaging battles necessary. In several respects, MHLivingNews and MHProNews – and of course MHARR – have laid the evidentiary foundation for doing so.

22) Until that happens, here is the outlook for Legacy, per Yahoo’s latest report on what market analysts are saying.

23) In MHProNews’ view, firms such as Legacy and Nobility could very easily be several times bigger than they presently are. Meaning, there potential is quite good.

24) But to tap that potential, a mix of sound business, appropriate messaging and deft legal strategies could be the key to achieving record growth. The appealing point, in our view, is this. The giants that dominate MHI could be paying for the growth of smaller firms, given the correct legal efforts. Because if Samuel Strommen, now J.D., is right, then those smaller firms are owed sizable sums by larger firms who have colluded to manipulate the marketplace for years. See the linked and related reports to learn more.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’