In a media release to the Daily Business News on MHProNews, Legacy Housing Corporation (LEGH) provided the following snapshot last night of their 2019 first quarter results.

In the release below, MHProNews has turned the quote brown and bold, to make it pop, as is often done here. Otherwise, the text is as supplied by Legacy.

Legacy Housing Corporation Reports 2019 First Quarter Results

BEDFORD, Texas, May 13, 2019 (GLOBE NEWSWIRE) — Legacy Housing Corporation (Nasdaq: LEGH) today announced its financial results for the first quarter ended March 31, 2019.

Financial Highlights:

- Net revenue for the first quarter of 2019 was $38.0 million, compared to $42.7 million in the first quarter of 2018, a decrease of $4.7 million or 11%. The first quarter of 2018 included home sales of approximately $8.9 million as a subcontractor operating under a contract with FEMA. Excluding the FEMA home sales in 2018, there was a net increase in organic net revenue from the first quarter of 2018 to 2019 of $4.2 million, or a 12.4% improvement.

- Our interest income in the first quarter of 2019 was $5.5 million, a 25% increase from the $4.4 million recorded in the first quarter of 2018.

- Our consumer loan portfolio outstanding principal balance increased by $1.7 million net in the first quarter of 2019 to $98.9 million, inclusive of the allowance for loan loss and other discounts. Our manufactured home park loan portfolio outstanding principal balance increased by $4.6 million to a total of $62.5 million, an 8% increase from the end of 2018.

- The income tax expense for the first quarter of 2019 was $2.0 million, compared to approximately $4.0 million in the same period of 2018. This decrease in tax expense was primarily attributable to the one-time recognition of deferred taxes of $2.1 million in the first quarter of 2018 related to the partnership conversion to a corporation.

- Net income was $7.2 million in the first quarter of 2019, compared to $5.4 million for the comparable period in 2018, which equates to a 33% increase in net income.

- Net income per share for the first quarter of 2019, based on basic and diluted weighted average shares outstanding, was $.29 versus $.27 for the comparable quarter in 2018.

- On April 12, 2019, we announced a share buyback program of up to $10 million of outstanding common stock. On April 17, 2019, the Company purchased 300,000 shares of its common stock at the price of $10.20 per share.

Curtis D. Hodgson, Executive Chairman of the Board, commented, “The Company performed well in the first quarter of 2019, especially considering there was a softening in some of our key markets in December of 2018 that continued into January of 2019. Every month in the first quarter was better than the preceding month in terms of the company’s overall performance and demand for our products, and we are optimistic this momentum in our business is providing a runway for the Company’s growth into the second quarter and for the remainder of the year. One area in particular I’d highlight is that we had more than a 78% increase in financed sales to manufactured home parks in the first quarter of 2019 compared to the same time period in 2018.”

This shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Management Conference Call- May 14 at 9 AM (Central Time)

Senior management will discuss the results of the first quarter of 2019 in a live webcast and conference call on Tuesday, May 14, 2019 at 9:00 AM Central Time. To register and participate in the webcast, please go to https://edge.media-server.com/m6/p/jnc5pnkk, which will also be accessible via www.legacyhousingusa.com under the Investors link. In order to dial in, you may call in at (866) 952-6347 and enter Conference ID 2799889 when prompted. Please try to join the webcast or call at least ten minutes prior to the scheduled start time.

About Legacy Housing Corporation

Legacy Housing Corporation builds, sells and finances manufactured homes and “tiny houses” that are distributed through a network of independent retailers and company-owned stores and are sold directly to manufactured housing communities. We are the fourth largest producer of manufactured homes in the United States as ranked by number of homes manufactured based on the information available from the Manufactured Housing Institute. With current operations focused primarily in the southern United States, we offer our customers an array of quality homes ranging in size from approximately 390 to 2,667 square feet consisting of 1 to 5 bedrooms, with 1 to 3 1/2 bathrooms. Our homes range in price, at retail, from approximately $22,000 to $95,000.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Securities and Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Legacy Housing undertakes no obligation to update any such forward-looking statements after the date hereof, except as required by law. Investors should not place any reliance on any such forward-looking statements.

###

Legacy is one of the publicly traded firm’s that is tracked in our evening market report, that provides the closing ticker on companies that operate and/or invest in the manufactured housing industry. Last night’s closing numbers and featured report are linked here.

Competitors of Legacy have told MHProNews ‘that no one works harder than those guys.’

In the light of Casey Mack’s statement quoted above, it is worth noting that Hodgson, Legacy’s Executive Chairman of the Board and company co-founder with Kenny Shipley, CEO, pointed to increased results in their community outreach. For those seeking business to business (B2B) or B2C marketing that performs, click here and scroll the menu of professional business development services.

The photos from Legacy were not part of their release, but are provided here under fair use guidelines. MHProNews holds no position in this firm, nor others that we track and report on in the manufactured housing industry. Previous reports on Legacy are found after the byline, notices, offers and email headline news signup, further below.

The final point to be made is this. There are firms – Legacy, and others – that are bucking the industry’s downslide trend. When one can do it, that clearly means others can too. Certainly, Legacy is promoting their product, and that promotion must be distinctive enough – and more visible because it is often here, at the industry’s runaway #1 trade publication – for them to be getting better wholesale and retail results. That contrast between Legacy’s results and that of the industry at large is noteworthy.

ICYMI, see the report below.

Declining Manufactured Home Shipments More Serious Than Retailers, Communities Being Told

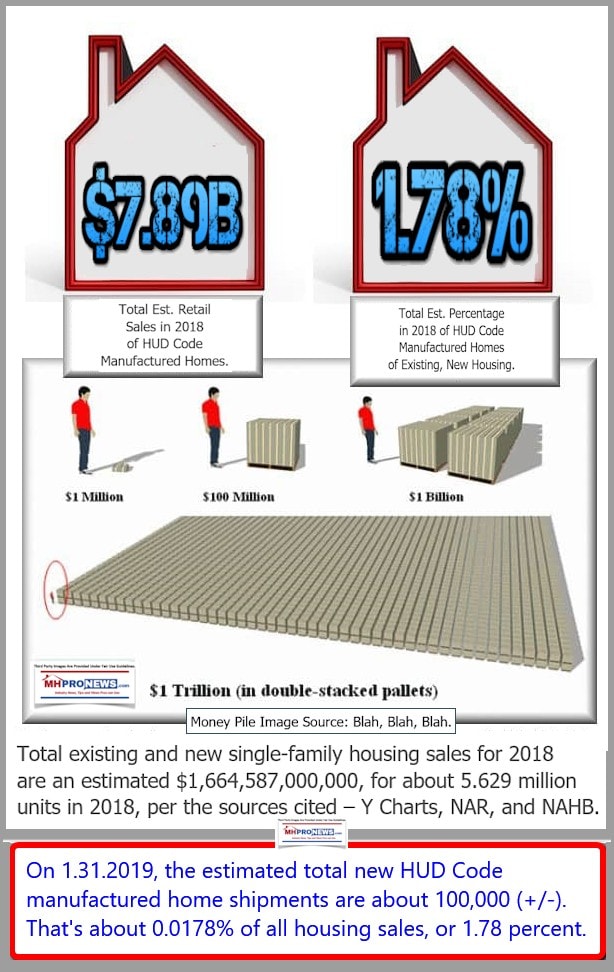

These are prudent points to ponder. In an affordable housing crisis, the industry ought to be soaring, not snoring. The best way to view the graphic below is to consider the upside potential of the industry. Those are similar to the points made by Legacy’s leaders during their IPO. Rephrased, there are companies doing better than the industry’s purported ‘leaders.’

That’s this morning’s second look at manufactured housing “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Legacy Housing Corporation’s $10 Million Stock Repurchase, Plus Manufactured Home Market Updates

Legacy Housing Announces Corporate Role Changes, Plus Manufactured Housing Market Updates

Insider Trade During SEC Mandated ‘Quiet Period’ at Legacy Housing Corp

Legacy Housing Exclusive to MHProNews on Firm’s Solid IPO, Plus MH Market Updates

B2B Statistics, Trends 2019 – April 2019 Snapshot of Manufactured Home Professional Readers