Don Dion on Seeking Alpha provided an executive summary goes like this.

“LEGH’s quiet period is set to expire on Jan. 8, 2019.

Our research has demonstrated that prices enjoy a temporary increase around the expiration of quiet periods.

Risk-tolerant investors should consider buying shares ahead of LEGH’s quiet period expiration,” said Dion on SA.

Dion provides a disclaimer, which read as follows:

“Disclosure: I am/we are long LEGH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.” Dion also says of himself, “Long/short equity, special situations, momentum, event-driven.”

By contrast, MHProNews has done business with Legacy, as well as some of those who sell Legacy products, but only on a marketing basis. That said, the Daily Business News on MHProNews wasn’t asked or commissioned to do this review. We curate and compose articles on subjects that our management deems relevant to our industry. Our timing and curation are solely ours. Legacy will be as surprised as you are that this our next report.

Why Legacy and Why Now?

Legacy, as Dion noted, “manufactures, sells, finances, and distributes tiny homes and manufactured houses through a network of [retail] stores throughout the U.S. It is the fourth largest company in the U.S. that produces manufactured homes…”

That’s later statement by Dion is not quiet accurate, as LEGH have no known presence in the West, Alaska, Hawaii or other U.S. locations. Legacy is focused more on the South Central, South Eastern and Midwestern states, with their website having the full details.

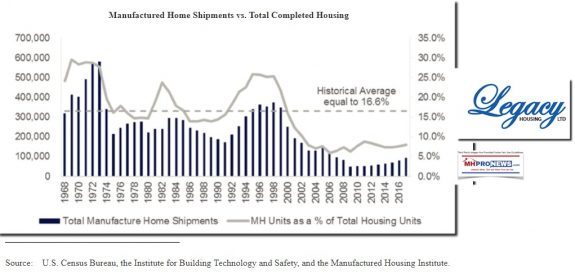

While the HUD Code manufactured home industry’s latest production report indicates that manufactured housing took a dip in November, Legacy reported as part of their IPO filing that they have their largest backlogs in their firm’s history.

The purpose of the LEGH IPO was to raise capital for more company-owned distribution. Meaning, more vertically integrated retail centers.

That’s something that other producers of HUD Code manufactured homes, modular housing, or ‘tiny’ park model style homes are also doing or considering.

https://www.manufacturedhomepronews.com/manufactured-housing-industry-new-hud-code-home-retailing-more-exploring-going-vertical/

As one of the sources in the Going Vertical article linked form the text/image box above has told MHProNews, not a day goes by that they don’t consider going vertical themselves.

Legacy isn’t just considering it. They are taking action. That’s what co-founders and co-presidents of Legacy Ken E. Shipley and Curt D. Hodgson are known for doing. Acting, not just talking.

SA’s Dion correctly notes they are the number four producer of HUD Code manufactured homes, per the LEGH IPO data, adding:

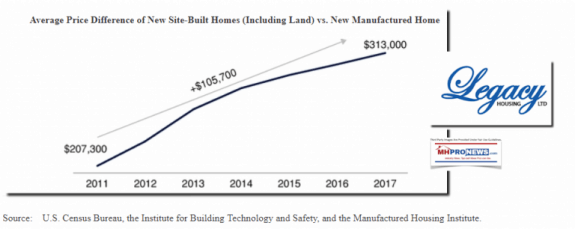

“The homes range in price from $22,000 to $95,000 and in size from 390 square feet to 2,667 square feet. Legacy Housing reports that it sold 3,274 sections in 2017 and 3,045 sections during the first nine months of 2018.”

That’s the kind of growth the industry at large should be achieving. That’s one of the reasons we selected this topic. Investors are among the readers here, because as Evergreen’s —— said on Forbes recently, there is a serious lack of accurate information available about manufactured housing. Thank you so much, Manufactured Housing Institute, which claims to represent all aspects of factory built housing. Seriously?

Yeah…right. Here is now a quiet period is defined.

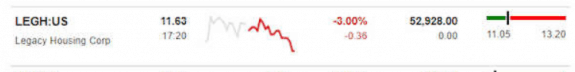

Dion said that “Legacy Housing priced at $12 after setting a price range of $10.75 to $12.75. During its market debut on Dec. 14, the company’s stock closed at $12.10. LEGH reached a high of $12.5 briefly on Dec. 17 before falling back to close at $12.20 that day,” which may be accurate, but the stock has been under $12 during the broader market’s recent slide.

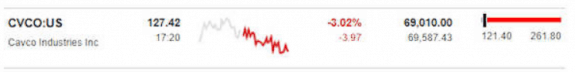

Here above are the closing numbers for last night, from our evening market report on a basket of manufactured home industry-connected tracked industry stocks that are publicly traded.

Among those every-business-evening tracked manufactured home connected stocks is Third Ave Value Fund. Third Ave, in the later part of 2018, reportedly shed all of their shares of Cavco Industries. That occurred shortly before a Cavco insider told MHProNews about the Joe Stegmayer connected “Debacle.” Cavco has been trading at less than half of their prior high for the last 12 months. While the two operations are quite different, it is an interesting data-point.

More on Third Avenue and Cavco are found at the linked text/image box below. Hint, the SEC being part of the federal partial shut down may be a breather for them, but there are several shareholder plaintiffs attorneys circling around CVCO.

You can see the rest of Dion’s 2 pages of commentary are this link here. As noted above, some of his insights are fine, others may need some factual tweaks. So caveat emptor.

Take Aways?

The points or take-aways of this report are several. Let’s just look at a few.

- The industry in general’s slow down is inexcusable, in as much as there is an affordable housing crisis, and HUD Code manufactured homes are the most affordable type of permanent housing in America.

- Legacy is bucking-the-trend. While some producers, or MHI mouth pieces – and those two are not the same sets of people – have given us their reasons for the downturn, it’s arguably excuses or a cop out. Others, not just Legacy, are growing in their local markets. If others can, then logically others who do things properly should be able to do so too.

- The Manufactured Housing Association for Regulatory Reform (MHARR) about 14 months ago published a formal report calling for a new post-production trade organization. They did a detailed review as to why they made that recommendation to the industry-at-large.

- Indeed, since then a new communities trade group has launched. The jury’s hasn’t yet convened, much less ruled on that trade association. Some think that just because it isn’t MHI, that alone is enough. NMHCO has hired Tom Heinemann as a lobbyist. formerly with HUD, MHI, and who consulted with a GSE. Will those be good credentials? Or will they prove to be problematic? MHProNews will observe, and keep you posted. The proof is always beyond the words, in the doing.

MHARR Recommending Independent Collective Representation for Post-Production

Washington, D.C., November 15, 2017 – The Board of Directors of the Manufactured Housing Association for Regulatory Reform (MHARR) has authorized the public release of a comprehensive internal study by the Association of the past, present and future representation of the post-production sector (PPS) of the federally-regulated manufactured housing industry.

Profitable, Ethical Solutions

The solution to the affordable housing crisis is hiding in plain sight. We’ve said that for years, and others in media are picking that theme up. But it can’t be a few times a year message. It’s one that must be repeated often in local markets, like yours.

Sunshine Homes proved they could buck the trends, Legacy Housing are doing the same – each with entirely different product lines. You are either defining yourself in your market, or something else is going to do it for you. In the later case, that may be to the detriment of your interests. “We Provide, You Decide.” © ## (News , analysis, and commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Bridging Gap$, Affordable Housing Solution Yields Higher Pay, More Wealth, But Corrupt, Rigged Billionaire’s Moat is Barrier – manufacturedhomelivingnews.com

America woke up today to division. But perhaps 75 percent (+/-) of the nation’s people could come together on a plan that demonstrably could do the following. Increase the U.S. Gross Domestic Product (GDP) by some $2 Trillion Annually, without new federal spending.