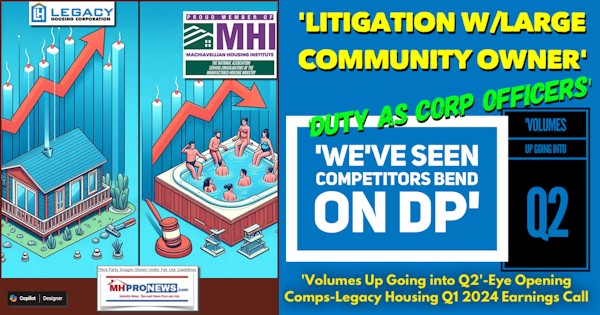

According to a recent report on financial news site Defense World: “Legacy Housing had a return on equity of 12.33% and a net margin of 29.70%.” Per the financial news site Insider Monkey transcript that follows, Legacy said: “end of the first quarter 2024, Legacy’s book value per basic share outstanding was $18.46, an increase of 13.1% from the same period in 2023.” Litigation was a topic of conversation in the transcript from Legacy Housing’s (LEGH) recent quarterly earnings call. But so too were other issues similar to larger rivals. For example. Smaller and less costly manufactured home sales have been mentioned not only by Legacy Housing, but also by larger publicly traded Manufactured Housing Institute (MHI) member producers too. The headline remark about doing their duty as corporate officers ought to bring cheers to some, while raising questions about and from others. As is typical of so many of the expert insights and news-analysis from these dives into quarter results, there are eye-opening insights for those willing to see the realities of the marketplace beyond the fluff that often emerges from rival publications, bloggers, or arguably MHI itself. When manufactured housing is underperforming for a protracted period of time, as is obviously the case, thinking people want to understand ‘why.’ Investors want to understand too. Because on some things Legacy Housing is willing to be contrarian, there are remarks that follow from this discussion provided in Part I that will be unpacked in Part II.

Note that ‘comps’ in the headline above is short for competitors and the purported association ‘advocate’ – the Manufactured Housing Institute (MHI) – that may be anything but; more on that in Part II as well.

A photo and its caption used by Insider Monkey has been omitted from the following transcript shown in Part I, as is reflected by the ellipsis (…) below.

While the yellow or aqua highlighting were added by MHProNews, that is not intended to keep a reader from reading every word with care.

There are a few apparent typos that has been corrected (e.g.: “park” vs “part”) by MHProNews, but for the most part, other than these noted items, the transcript is as produced by Insider Monkey. Terminology errors are in the original.

Part I

Legacy Housing Corporation (NASDAQ:LEGH) Q1 2024 Earnings Call Transcript

Sun, May 12, 2024, 9:23 AM EDT8 min read

Legacy Housing Corporation (NASDAQ:LEGH) Q1 2024 Earnings Call Transcript May 10, 2024

Legacy Housing Corporation isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Good day and thank you for standing by. Welcome to Legacy Housing Corporation Quarter One 2024 Earnings Conference Call. At this time, all participants are in a listen only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker today, Duncan Bates, CEO. Please go ahead.

Duncan Bates: Good morning. This is Duncan Bates, Legacy’s President and CEO. Thank you for joining our first quarter 2024 conference call. Max Africk, Legacy’s General Counsel, will read the safe harbor disclosure before getting started. Max?

Max Africk: Thanks, Duncan. Before we begin, I will remind our listeners that management’s prepared remarks today will contain forward-looking statements, which are subject to risks and uncertainties, and management may make additional forward-looking statements in response to your questions. Therefore, the company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Actual results may differ from management’s current expectations and any projections as to the company’s future performance represent management’s best estimates as of today’s call.

Duncan Bates: Thanks, Max. I’m joined today by Jeff Fiedelman, Legacy’s Chief Financial Officer. Jeff will discuss our first quarter performance, then I will provide additional corporate updates and open the call for Q&A. Jeff?

Jeff Fiedelman: Thanks, Duncan. Product sales primarily consist of direct sales, commercial sales, inventory finance sales and retail store sales. Product sales decreased $12.5 million or 28.8% during the three months ended March 31st, 2024, as compared to the same period in 2023. This decrease was driven by a decrease in unit volume shift, primarily in direct sales, mobile home park sales and inventory finance sales categories. The decrease was offset by increased sales at our company owned retail stores. For the three months ended March 31st, 2024, our net revenue per product sold decreased primarily due to a shift in product mix to smaller units into a large sale of homes from our leased home portfolio to a mobile home park customer at a lower average price than our typical new home.

Consumer MHP and dealer loans interest income increased $2.9 million or 38% during the three months ended March 31st, 2024, as compared to the same period in 2023 due to growth in our loan portfolios. This increase was driven by increased balances in the MHP, consumer and dealer loan portfolios. Between March 31st, 2024, and March 31st, 2023, our MHP loan portfolio increased by $28.2 million. Our consumer loan portfolio increased by $17.9 million and our dealer finance notes increased by $2.1 million. Other revenue primarily consists of contract deposit forfeitures, consignment fees, commercial lease rents, service fees and other miscellaneous income and decreased $0.1 million or 3.1%, during the three months ended March 31st, 2024, as compared to the same period in 2023.

This decrease was primarily due to a $1.0 million decrease in dealer finance fees, a $0.2 million decrease in commercial lease rents partially offset by a $1.1 million increase in forfeited deposits. The cost of product sales decreased $8.5 million or 29.3% during the three months ended March 31st, 2024, as compared to the same period in 2023. The decrease in cost is primarily related to the decrease in units sold. Selling, general and administrative expenses increased $0.5 million or 8.8%, during the three months ended March 31st, 2024, as compared to the same period in 2023. This increase was primarily due to a $0.3 million increase in warranty costs, a $0.1 million increase in legal expense, a $0.2 million increase in professional fees and a net $0.2 million increase in other miscellaneous costs partially offset by a $0.3 million decrease in loan loss provision.

…

Other income expense increased $0.4 million or 29.9% during the three months ended March 31st, 2024, as compared to the same period in 2023. There was an increase of $0.6 million in non-operating interest income offset by an increase of $0.2 million in interest expense. Net income decreased 7.0% to $15.1 million in the first quarter of 2024 compared to the first quarter of 2023. Basic earnings per share decreased $0.05 per share or 7.5% in the first quarter of 2024 compared to the first quarter of 2023. As of March 31st, 2024, we had approximately $0.6 million in cash compared to $0.7 million as of December 31st, 2023. The outstanding balance of the revolver as of March 31st, 2024, in December 31st, 2023, was $11.8 million and $23.7 million, respectively.

At the end of the first quarter 2024, Legacy’s book value per basic share outstanding was $18.46, an increase of 13.1% from the same period in 2023. In November 2022, our Board of Directors approved a share repurchase program to authorize the repurchase of up to $10 million of the company’s common stock. We repurchased 91,187 shares for $1.9 million in the open market during the three months ended March 31st, 2024. Between April 1st and May 9th, 2024, we repurchased 170,342 shares for $3.5 million in the open market. As of today, we have a remaining authorization of approximately $4.6 million.

Duncan Bates: Thanks, Jeff. I want to add some color on the market and provide other corporate updates. As discussed, sales were down during the first quarter, but they also are improving as housing affordability remains at a multi decade low with no signs of changing. First, on the dealer side, our current business is heavily dependent on dealers. Seasonality impacted dealer sales during the first quarter, but started to accelerate late February. Reorder rates are still lower than we would like due to higher inventory carrying costs. Sales at our company owned retail stores are also improving. To drive dealer sales, we launched a new special this week that includes concessions on popular home models. Initial feedback has been positive.

On the community or park side of our business, our park business is slower and has been impacted by high interest rates, similar to other real estate asset classes. Rates have driven M&A transaction volume down and cooled new development. We are gaining momentum in the park sales with smaller units. 400 square foot to 600 square foot tiny homes and small HUD code single wide, low monthly payments through our financing program allow park customers to make money renting these homes in nearly all markets. We held a spring show in Eatonton, Georgia in late April for dealer and park customers. It was our first show in Georgia since 2020. We are still rounding out orders, but the show was very successful. Over the past 18 months, we’ve spent a tremendous amount of time improving product quality at our Eatonton plant.

The houses look great and the changes were well received by customers. The show allowed us to clear finished goods inventory at the plant and build a nice backlog. Despite lower volumes during the quarter, we carefully managed factory overhead and expenses. Product gross margins were higher than average during the first quarter due to a large sale of leased homes to a community owner. We continue to monitor product gross margins closely and see manufacturing efficiencies improve when we ramp production. For corporate updates, since our last earnings call, we repurchased over 260,000 shares of common stock at an average price of $20.56. Repurchases were limited by restrict — by trading restrictions and a narrow open window between year end and first quarter.

We utilized 54% of our $10 million repurchase authorization. The Board will increase the authorization as needed. Legacy’s business fundamentals have not changed. The market is slower but improving over 2023. There was confusion with our fourth quarter numbers and the stock traded down to liquidation value. We will continue to repurchase shares aggressively when this happens. We’ve continued to add team members in key areas of our business. The land developments are progressing and we are evaluating proposals to sell or partner on some of the properties. There is significant value to unlock on our balance sheet, driving earnings growth and realizing this value as management’s top priority. Operator, this concludes our prepared remarks. Please begin the Q&A.

Operator: Thank you. [Operator Instructions] Our first question comes from the line of Alex Rygiel from B. Riley Securities.

Q&A Session

Duncan Bates: Hey, Alex.

Alex Rygiel: Thank you. Good morning, Duncan.

Duncan Bates: Hey, good morning.

Alex Rygiel: So it sounds like heading into the second quarter, unit volumes going to be picking up from the first quarter? Is that a fair conclusion to come?

Duncan Bates: Yes, that’s fair. We’re shipping a lot of houses right now.

Alex Rygiel: Excellent. And then as it relates to sort of inventory on the yard, where does that stand?

Duncan Bates: Yes, we’ve struggled with that at our Georgia plant for a few quarters now and that was the key — or one of the key reasons for having a Georgia show, which was the first show that we’ve had since 2020. And so we’re starting to ship that product now and the goal is to have most of it cleared out by the end of the second quarter.

Alex Rygiel: That is super helpful. And then a little bit of directional guidance on the consumer and MHP loan interest. You stepped up in the first — in the fourth quarter, kind of stepped down in the first quarter. What’s sort of the normal run rate there at the moment?

Duncan Bates: Yes, there’s some key — I mentioned the confusion in the fourth quarter. Obviously, we don’t report fourth quarter numbers, but when — I think when investors backed into the fourth quarter numbers, they were surprised by some moving around of revenue from the loan portfolios. And so it makes it a little different — or difficult to compare. But right now, I mean, we’re over $10 million. I think we’ll pretty consistently be over $10 million in interest revenue a quarter for all of 2024 moving forward.

Alex Rygiel: Excellent. Thank you very much.

Duncan Bates: Thanks, Alex.

Operator: Thank you. One moment for our next question. Our next question comes from the line of Mark Smith from Lake Street.

Mark Smith: Hey, Duncan. Guys, I want to start just on the loan portfolio. Can you just give any more detail on that, the default loans in litigation happening with the one borrower within MHP? I know some of those moved to current assets. Any additional insights into that?

Duncan Bates: Yes, look, this is obviously active litigation and it’s with a long-term customer. And so we’ve got a disclosure in the file, but I’ll summarize that for you right now. We have a par[k] customer that we worked with for over 13 years and he’s built a nice portfolio of communities into which we financed over 1,000 mobile homes. And we accelerated a large portion of these notes just due to slow payment or nonpayment. And as you can imagine, it’s taken a lot of my time and the team’s time to work through this situation. I think this is a situation that can be resolved outside of the courtroom. But our duty as officers of this company is to protect our collateral. And so, we’re pursuing the collateral right now. The collateral is comprised of over 1,000 mobile homes where the principal outstanding is 50% or less of a replacement cost and that’s excluding equity for the setup and building the pads.

We’ve also got first liens on several mobile home parks in this portfolio and there’s limited outstanding debt. And the notes are cross collateralized and personally guaranteed by multiple individuals, some of which have pretty significant net worth and are — and can be held joint in several liability for these debts. And so, we’ve spent a ton of time on this with our auditors. We valued all the collateral and we think that there’s a significant amount of equity into this portfolio. And so we haven’t — although these notes are in default and they’re — when we accelerated them, they’re accruing interest at 17.5%, most of which has been offset by an accrual. But our goal is to resolve this relatively quickly. But ultimately, if we’ve got to go take all the collateral, we’re currently taking action to do that.

And you’ll see another disclosure where we actually, during the first quarter, foreclosed on one mobile home park that I think at the price that we’re into it, there’s significant upside value. And so we’d like to resolve it, but if we keep — if we need to take everything, we’ll do that and protect our shareholders and our investment.

Mark Smith: Okay. The MHP portfolio has always been really solid and safe, I think, from the outside. Has anything changed fundamentally within that portfolio or is this just kind of a one-off situation with this one borrower?

Duncan Bates: Yes, it’s — I think it’s a unique situation. And obviously the size is unique, but nothing’s changed in that portfolio. We’ve had situations over the last few years that we’ve worked through and we’ve been able to recover all of our principal outstanding and in most cases the accrued interest as well. And so I don’t see this as any different than those other situations except for it’s a larger chunk.

Mark Smith: Okay. Looking at product sales, you just talked about unit volumes looking better here into Q2. I’m curious on kind of selling price and mix. Are you seeing the mix shift back to some higher priced homes or is it still staying at some smaller, lower priced homes?

Duncan Bates: Yes, we’re — it’s still — I’d say it’s still at lower priced homes. We seem to be really competitive from a price standpoint on the smaller homes. And I think just housing affordability, whether it’s stick built or it’s — or its factory built, it’s a problem. And we’re selling — it’s not only on the par[k] side where we’re selling smaller units. We’re also selling a lot of smaller units on the dealer side of our business. And that’s — it’s an area where we’re really competitive. It doesn’t help our average selling price, but I think that we’ll continue to be able to drive volume. And on both sides of the business, we’ve had sales whether it’s at the Georgia show or the dealer sale that I just mentioned, that will drive volumes kind of throughout the year.

I mean, we’re expecting a better year this year than last year, but it’s a tricky market, so we’re just — we’re managing it closely and we’re adjusting as we need to and watching our expenses and we’re just going to take it one quarter at a time.

Mark Smith: Perfect. Last question for me. You brought up the backlog in your commentary. Just curious, any additional insights on kind of where the backlog is today and kind of your comfort level with that?

Duncan Bates: Yes, I mean, our goal really is building our backlog. We’ve held production at pretty consistent rates for the last two quarters, but they’re well below where we’d like to be. And the goal has been build a backlog and you can start ramping production because we don’t want to ramp too early and we’ve made that mistake before. So, we’re a few weeks out across all plants. In an ideal world, I’d like to be 8 to 10 weeks out, but we’re not there yet. And — but I think first quarter and just given that the dealer side of the business is stronger, we saw the impacts in the first quarter of the seasonality. And as we get into the spring selling season, that should improve. And that combined with some sales and concessions, we’re hoping to build the backlog and ultimately ramp up production where we can get some efficiencies on the manufacturing side.

Mark Smith: Excellent. Thank you.

Duncan Bates: Thanks, Mark.

Operator: Thank you. One moment for our next question. Our next question comes from the line of Jay McCanless from Wedbush.

Duncan Bates: Hey, Jay.

Jay McCanless: Thanks for taking my questions. Hey, Duncan. So kind of following on the last question, with the downward price mix you’re seeing at this point, is it possible you think this year that you guys could sell more products, but still be down in revenue just because of that sales mix? Or are you thinking that dollar revenue is going to be up year on year for 2024 versus 2023?

Duncan Bates: I think I’ll have better insight into that next quarter. We’re trying to sell as much as we can. I mean, sales are the top focus right now and we’re pushing the team pretty hard. We have seen a move to — toward our smaller products. So it certainly could be the case where you sell more units, but your revenue is down. That said, I really feel like from an internal sales sentiment standpoint, that sometime kind of like last summer, end of last summer, really felt like the trough for me. And it’s been — we’ve hit some air pockets. I mean, we felt like we really had sales moving after the show last October. And then you start to see the par[k] customers back up where they’re having challenges with utilities or with municipalities and it delays shipments. But we — it feels like things are smooth, sales are below where we want them to be, but we’ve made some adjustments that we should start to see the benefits of in the second quarter.

Jay McCanless: Okay. Great. And really good performance on the gross margin this quarter. How sustainable do you think that is and anything that we need to be mindful of either from a lumber price increase or anything of that nature?

Duncan Bates: Yes, gross margins were — product gross margins were high this quarter and they were impacted by — we’ve got a leased portfolio where we actually lease homes in mobile home parks. We don’t offer that program anymore, but we had a sale of a large chunk of leased homes to that community owner in the first quarter. And so that skewed gross margins to the upside. I think our goal is to hold them. I mean, we watch it very closely, but this quarter was significantly higher than the last few. So I think we’ll revert toward the average of, say, the last four quarters. But if we can get production up, we’ll pick up some efficiencies. And we still haven’t used the price lever. We’ve held prices at the detriment of volume and used financing concessions.

But if we do need to use the price lever to drive volume, that’ll have an impact on gross margins, but it won’t be drastic. I think it’ll be offset by some manufacturing efficiencies where we’re currently not absorbing all the overhead and pushing that through cost of goods sold.

Jay McCanless: But actually was going to be our next question, Duncan, I was going to ask you about have you been able to hold price? Sounds like you have. What — I guess, if you’re holding price, what are you seeing from some of your competitors that are — that can build maybe not all the way down to the — some of the prices you guys can do, but in that lower — call it, lower priced single section home arena, what are you seeing out of them?

Duncan Bates: Yes, I think the guys with — without a balance sheet and with — without much of a backlog, I mean, mainly independent players, we’ve certainly seen price decreases there. I think just given the consolidation in the industry, we’ve got rational competitors, but we’ve seen some lower pricing here within the past two weeks that surprised us. I think — or I know we’re really competitive on the tiny homes and the smaller single wides. As you get into the larger product, especially at the dealers, our — you see the impacts of us holding prices, I think, compared to other competitors that have dropped them. But we’re monitoring that very closely. I mean, we’d like to get our volume up and that’s the key goal right now is get — build a backlog or keep continue to building the backlog and get volume up. And — but shipments during the second quarter, we’re looking pretty strong so far.

Jay McCanless: Good to hear. So could you talk about in the consumer book, we did see an increase both sequentially in year on year for delinquencies there. That’s not uncommon. We’re seeing that in the stick-built world, too. But maybe could you talk about what type of stresses you’re seeing on that portfolio? And if we do stay in this higher for longer environment, kind of what are some of the worst levels we’ve seen in that portfolio, like beginning of COVID or something like that as a frame of reference?

Duncan Bates: Yes. And look, we think internally a little bit different about delinquencies compared to the accounting for delinquencies. And so when we think about our retail loan portfolio, we look at what percentage of the portfolio have we not received a payment in 30 days? And we started — we brought this servicing in house around 2012. And at that time, over 30 was running close to 6%. And then you’ve seen us work that down to 2021, it was close to 1.3%. So just — we’ve got a great program and we’ve got a great team that services this. I know that delinquencies have or defaults problematic accounts have increased slightly, but they’re still well below the national average. And there’s certain elements of our retail financing program that contribute to this outperformance.

One of them, I mean, we take real down payments. I mean, we have — across the board, we have a minimum down payment and we’ve seen some of our competitors bend on that. And it seems like a race to the bottom. We also — we don’t finance a lot of extras. We don’t finance decks or septic tanks or storage sheds. And so a lot of those items, right, you get — they’re added onto the loan, but you don’t collect much from them. And finally, we — with our retail finance program, we have a holdback with our dealers that gives us some additional cushion. And I think all of these — all of those items contribute to the outperformance. And we’re monitoring it closely. You’ll see that the reserve actually came down in the first quarter on the retail finance side of the business.

And the reason for that is we do a look back when we calculate the reserve. And in many cases, we’re collecting more on the repos than the outstanding principal balances for homes that were sold pre-COVID and paid on for a few years. And so I feel good about the team and the performance of the portfolio. It — even if it continued to creep up, it wouldn’t worry us. I think if you started, you got closer to 5% or 6%. That’s where we’d really — we think there’s a concern, but we’re still well below that.

Jay McCanless: That’s great. And maybe, if we could, an update on Bastrop and some of the other parcels — land parcels?

Duncan Bates: Yes. We hired an internal team. We’ve been working through the properties. Bastrop continues to progress. We’re putting in the roads now phase one. We’ve got phase two working as well. We’ve got a lot of utilities in there. We’re building a water treatment plant. So the — there is a lot of focus on Bastrop. You’ll see us continuing to invest capital there. Some of the other properties I talked about on either the last call or the call before, just working through where we are on those properties and ultimately determining the highest and best use for them and — from a shareholders’ standpoint. And so we’ve received some interesting proposals to sell certain properties or to partner on certain properties and we’re working through that now. And I think you’ll start to see some movement during the second quarter on those.

Jay McCanless: Okay, that sounds great. Thanks for taking my questions.

Duncan Bates: Yes. Thanks, Jay.

Operator: Thank you. [Operator Instructions] At this time, I would now like to turn the conference back over to Duncan Bates, CEO, for closing remarks.

Duncan Bates: I want to thank everybody for joining today’s earnings call. We appreciate your interest in Legacy Housing. And if you have any questions on the quarter, feel free to give Jeff or I a call or shoot us an email. Thanks a lot. Bye.

Operator: This concludes today’s conference call. Thank you for participating. You may now disconnect. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

1) As a sort of relevant housekeeping note before diving into this specific analysis, MHProNews has for the past several years steadily increased the length of our articles. From the time we launched our news items, we went from USA Today style 1 to 3 paragraph length reports to sort of mid-range length articles, to now producing articles that routinely are thousands of words in length. Others in our profession, at least anecdotally, have not apparently followed suit. Those rivals might say in their own defense – correctly so – that most mainstream news reports are only several hundred words long. So, from a few paragraphs, to usually well under 1000 words, those rivals in manufactured housing trade publishing ‘keep it brief,’ they often want to pack in the key words (i.e.: SEO related items, etc.), and keep it easy for them to produce. Those bloggers willing to go over 1000 words on occasion are arguably routinely in the self-promotional or event promotional business. Perhaps a bit akin to a MHVille production company not wanting to get too far ahead of their skis on ‘ramping up’ production, no one that is a serious publisher wants to lose an audience over the length of their reports. In that narrow regard of wanting to keep an audience and build upon it, MHProNews has a bit of commonality with would-be rivals. But in most respects, what readers find here in the way of content is radically different than they do everywhere else. We fit the contrarian definition quite well. Monitoring results, which we periodically report to our readers, the known evidence reflects that our traffic is up. Pageviews per visitor for MHProNews are still above the average reported by SimilarWeb for mainstream media (e.g.: CNN or Fox News). While we are down on pageviews per visitor from roughly 20 months or so ago, we are still well ahead of the pack.

What that means is that people are not only reading longer reports with analysis like this one, but then they click on several of the links and read still more.

2) Furthermore, based on the known data, length of reports have not deterred readers perhaps because we also provide meaningful details. Here on MHProNews, this isn’t a case of someone merely bloviating or pulling their shoulder out of joint to pat their own back or that of some event they want to promote. Our reports-analysis holds tightly to reality. We produce not merely ‘content’ but meaningful content. By having done so for years on end, this gives us a startling “durable competitive advantage” that simply no one else in MHVille trade publishing can match. Others may pay to promote their sites, kiss certain ample derrières, and do other things that ought to benefit them, and perhaps in some ways, that works for them. That said, they have remarks that absolutely fail to authentically challenge prevailing narratives in a journalistic fashion. Even when, for example, a certain blogger slams this or that trade group, it is done on a sort of junior high school level. The lack of accuracy on items that they are supposed to have knowledge of can be stunning. While the methods used by our rivals may serve to keep their respective audience’s attention, it likely explains why MHProNews has long dominated. As a rival mentioned in passing, when people at events are talking about something that they read online and are discussing it over a drinks or a meal with other colleagues, it is MHProNews (or MHLivingNews) that they are discussing. Per sources deemed reliable, every major company and untold hundreds of smaller firms have one or more people reading our reports. We have federal and state officials who are readers. Attorneys are scouring our reports. It would be difficult to imagine that investors (who sometimes reach out directly) by sheer laws of averages would likely be doing so too.

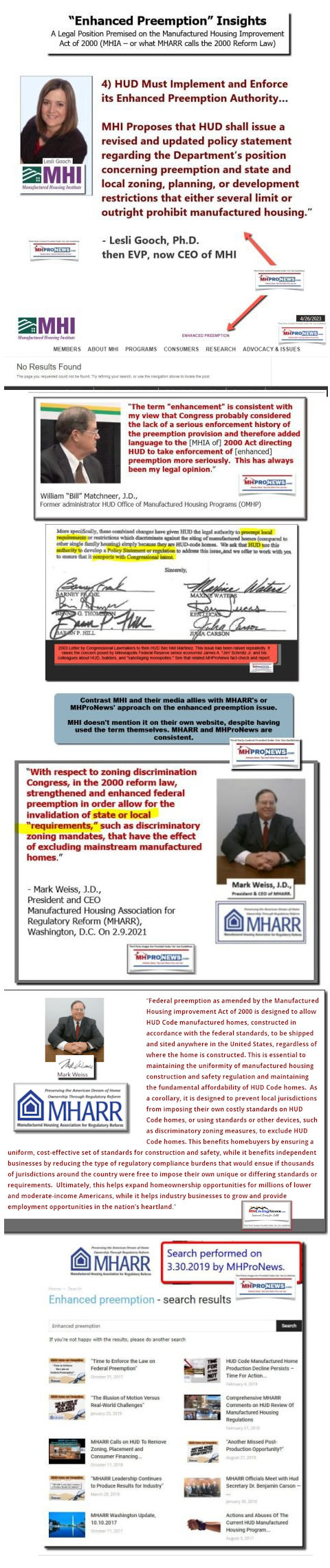

Now, why does all that matter with respect to this report about Legacy? Or by extension, Legacy and their rivals? Those would be fair questions.

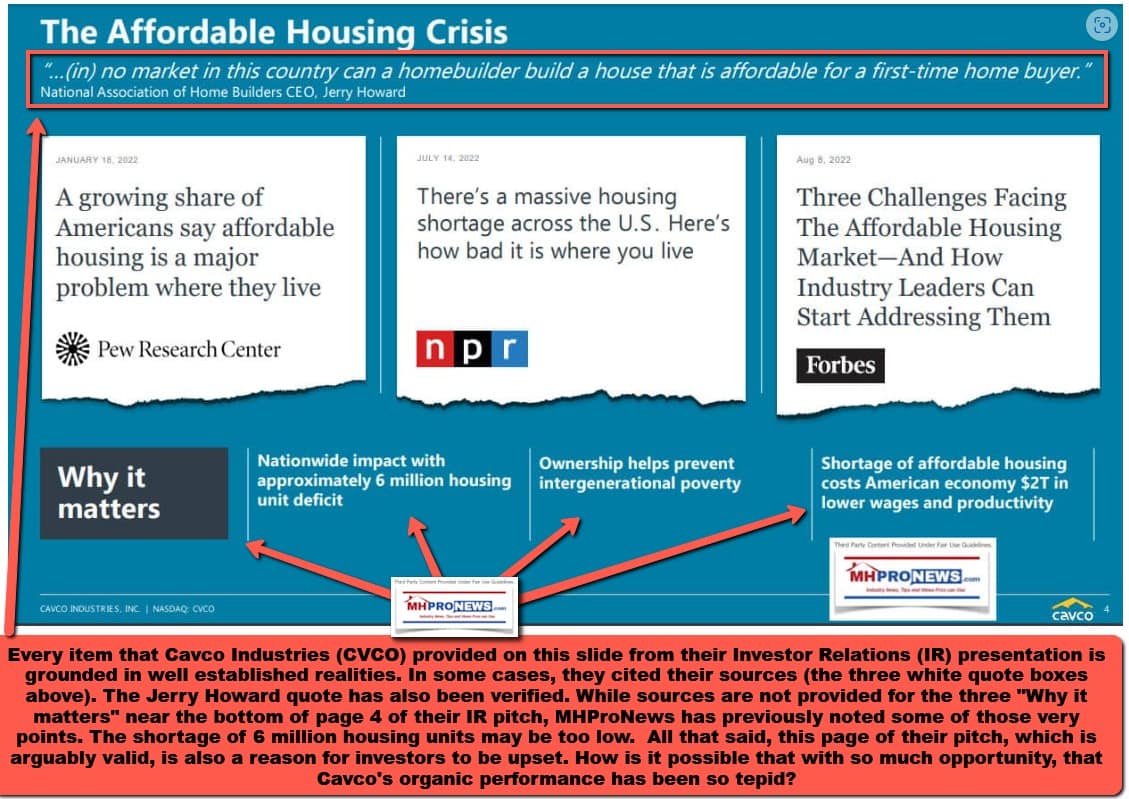

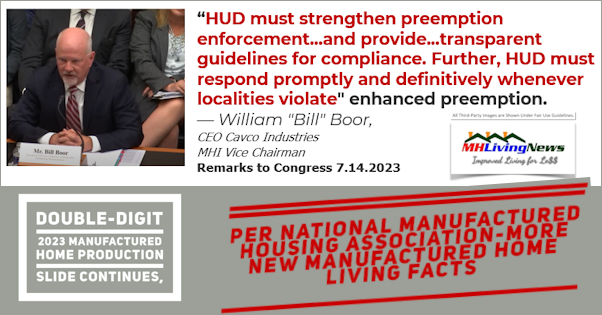

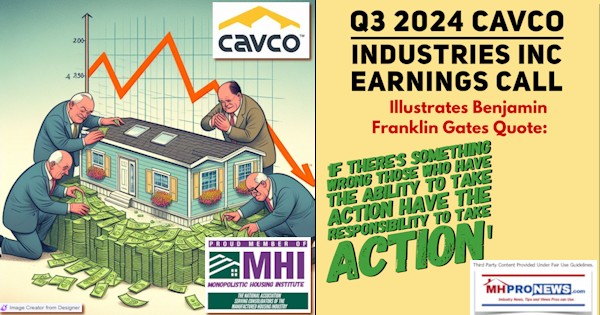

3) When far larger Legacy rival Cavco Industries (CVCO) made their investor pitch include the following screen shot shown below, it was arguably a smart move. But only to the extent that they then do what the following insights should compel them to do in the interests of growing their own business and increasing the value to their shareholders. For Cavco say there is 6 million units needed (which should have been footnoted with a source for that statement, but MHProNews would and has observed that it may be higher than 6 million), and then fail to authentically press for certain actions that their own corporate leader has called for to Congress, it defies logic and points to a problematic range of potential legal issues for the firm (and, by extension, for MHI). Because others in MHVille trade media either ignore such disconnect, perhaps don’t grasp them at all, or are perhaps so deeply in bed with their corporate masters that they wouldn’t dare expose them, etc. The lack among others who publish or blog of true journalism makes them weak. Ironically, a parallel analogy might be made between MHI and the Manufactured Housing Association for Regulatory Reform (MHARR). By MHI failing to provide information that MHARR does, MHI has paradoxically handed MHARR a durable competitive advantage in the narrow sense of offering consistent and reliable information that is factually accurate.

4) The late Howard Walker, J.D., was long part of an apparently successful firm. He offered some useful insights and access when asked. These remarks that follow will be applied to this outline, so they are shared in service to the reader, not as merely as some self-serving point as a rival to MHProNews might want to do.

5) When AI powered fact checks using perhaps the top-rated freely available system per several sources, Bing‘s Copilot, it has said several times that MHARR is more transparent that MHI. Copilot has said that MHARR has avoided the kind of scandals and apparent conflicts of interest that MHI and MHI-linked leaders have stepped into on numerous occasions. Transparency seems to be, based on known information (which is the only kind that can be remarked about, no one can meaningfully report on something unknown to them), a problem for several MHI linked leaders and firms. But it doesn’t seem to be a problem with Legacy Housing (LEGH). Duncan Bates has said some less than glowing things about issues at his own firms, as is reflected by reading past reports (some of those are linked below). But by doing so, Legacy is arguably building their own credibility. To draw the analogy between the first few paragraphs in Part II and Legacy (and not because there is any apparent financial links between our firm or theirs), by laying out facts and evidence in a reasonably transparent way, people curious to learn more may find the answers that they seek. Bates, his bosses, and newer team members at Legacy are building a business that seems to fulfill the requirements of transparency that a publicly traded firm is supposed to provide. While that may seem unremarkable, from our vantage point as the premier information resource in MHVille, we can assert that like it or not, it is remarkable. Which is why these remarks and background are warranted.

6) That’s not to say that Legacy doesn’t have areas of possible improvement. They ought to be obvious, and in many cases Legacy’s own leaders have made them.

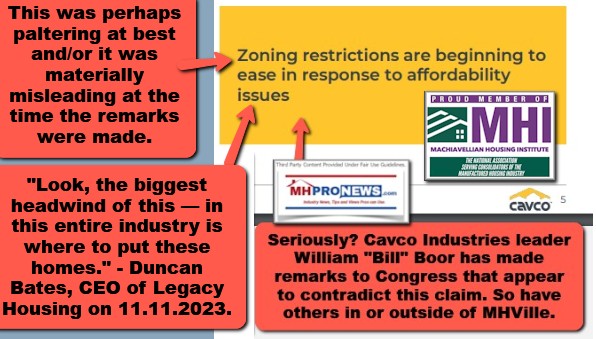

![DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPut[HUDCodeManufactured]HomesMHProNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2023/11/DuncanBatesPhotoLegacyHousingLogoQuoteZoningBarriersLookBiggestHeadwindIinThisEntireIndustryIsWhereToPutHUDCodeManufacturedHomesMHProNews.jpg)

7) While Cavco’s Bill Boor said something similar to Congress, his own firm’s investor relations pitch deck contradicted his words. That’s the sort of material disconnect that ought to be inexecutable and swiftly addressed.

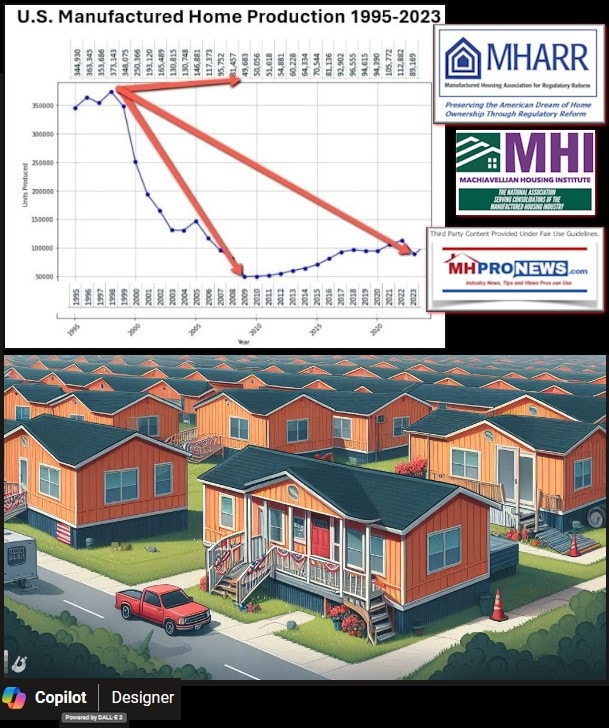

8) The problems with not only Cavco, but many of Legacy’s rivals at MHI are potentially numerous. But it might be boiled down to something like this. Many of the larger MHI member firms (larger than Legacy) are apparently focused on consolidation. But if that is the be-all and end-all of their goals, they are in other ways strangling the industry that they claim to be championing or to which they are pitching their case to investors as a solution for affordable housing that could deliver millions of units. It isn’t that such an achievement for manufactured housing isn’t possible, it obviously is, because history demonstrates that potential. But when even analysts are on occasion asking questions and making remarks that point to a weakness or softness in manufactured housing, that ought to be a red flag for public officials, media that actually grasp the meaning and gives a hoot, and it certainly should be an issue for trade media and bloggers to address in a consistent and not self-contradictory fashion.

9) It may seem odd to critique Frank Rolfe, who on some purely financial levels has clearly done well with is partner Dave Reynolds and their various business interests. But it is precisely how that success was attained that ought to be brought into focus. There is a case to be made that Rolfe, Reynolds, and others like them may at some point be wiped out in a wave of antitrust litigation. That ‘moat’ that Rolfe has bragged about could be reversed and breached by a simple application of the light of truth, common sense, common decency, and a correct and vigorous application of the law. If “Team Biden” was about more than just talk and hot air about antitrust, with some posturing efforts for effect, Rolfe and many in the manufactured home communities (MHCs) sector and production sectors involved in MHI might already been caught up in state and/or federal level antitrust action.

10) That said, let’s pivot back to something Rolfe said that was apt. It is obvious that CrossMods has been a dismal market failure if it was measured by production numbers alone. CrossMods, per our source, have never been ‘a thing’ at Legacy Housing. That was a push by Clayton Homes, and to some extent, by Cavco and Skyline Champion. The word CrossMod was reportedly trademarked by MHI. Who, besides those 4 entities, actually cares? The market results have been dismal. But it isn’t just the costlier CrossMods that have failed to perform. Essentially, other MHI firms as well as Legacy have reported a move to smaller and less costly homes. This has caused a drop in average selling price (ASP). It contributes to lower dollar volumes. See what others have said in their own words.

11) The ‘amen corner’ at MHInsider and ManufacturedHomes.com is revealing in as much as they fail to point out the obvious. Not only have CrossMods not worked as pitched, but they have arguably been a drag on the industry as a whole. Instead of consistently pushing and FIGHTING for enhanced preemption enforcement for all manufactured homes, MHI and those brands linked to CrossMods have pushed for acceptance of CrossMods. It only makes sense if CrossMods are an example of ‘sabotage monopoly tactics at work. Nor will MHI and those Big Three linked brands respond to the growing evidence and allegations.

12) It is a matter of sources and observation that Legacy, while an MHI member, doesn’t seem to play politics in manufactured housing. Legacy has a reputation for putting their nose to the grindstone and focusing on their own business. Right or wrong, that’s how it is. That may be a benefit to them should CrossMods or other possible market manipulation concerns erupt in what might be the waning days of the Biden-Harris regime or what could emerge in a Trump 2.0 Administration. Several of the larger antitrust actions that the Biden-Harris administration has been involved in originated under ‘Trump 45.’ A special report is planned. But until that special report, one point is that Legacy, by not noticeably doing more than paying dues to MHI, could well avoid what may be a wave of antitrust, RICO, and other legal issues involving MHI, the Big 3, and their consolidation-focused community operators. The fact that industry politics is an issue at all ought to be one of several red flags for regulators, who seem to be asleep at the switch in a Madoff-esque fashion.

The critique of the following “MH2x Project” has rocketed up to near the top-read reports, perhaps due in part to the fact that finally (if belatedly) “All About Allen” mentioned the market failure of CrossMods. But as is true of much of what Allen has said, he mixes useful and inaccurate information. It takes an authentic expert willing to tell the truth to sift out what’s of potential interest from clearly errant remarks. For instacne, Allen likes to periodically roll out his ‘bigger boxes for bigger bucks’ remarks. The man doesn’t seem to grasp that while single sections can fill a community slot as well as a multi-section (true enough), that doesn’t mean that a sizable market segment exits that have and will by a ‘bigger box’ for bigger bucks. Multi-sections for years have been roughly half of production. It isn’t that CrossMods was a terrible idea. It is that CrossMods made no sense as deployed. There have ALWAYS been upscale models of manufactured homes, as well as lesser optioned models. “All About Allen” just doesn’t get it, or is willing to ignore reality.

That said, the significance is that there has long been a market for nicer manufactured homes as well as actual modular homes. This writer has walked full two story manufactured homes, Cape Code style manufactured homes with a finished upper level, and a range of other models that include basements, attached or detached garages, and so on. The industry has a tremendous range of opportunities. All of which point to the core issue. MHI and its larger brands are behaving in a fashion that has limited the market, instead of expanding it. That’s debatable, but they would lose. The facts support our contentions. The facts and a rationale analysis make them look like collaborators in a scheme to limit the manufactured housing market from within in order to consolidate the industry.

13) Yet another special report is pending that is going to provide even more evidence of just how poorly MHI is advocating for the industry. What does this have to do with Legacy Housing, or for that matter, other independents such as Nobility Homes (NOBH) or other firms that aren’t publicly traded? Much. If MHI were even batting a proverbial .250, they’d be scoring more runs as measured by production and achievement of their claimed goals. In such an apparently collusive environment, where multiple MHI member firms are being sued for allegations that include antitrust violations, Legacy, Nobility, and others are doing reasonably well. Could they do more? Perhaps, and how that might be done could be a part of a follow up report. But what is apparent is that when outside researchers looking in have directly-or indirectly critiqued MHI and their ‘big boy’ brands, it should be de rigueur that thinking investors, professionals, others in media, public officials, and a range of stakeholders should lean in and ask, what is going wrong in manufactured housing? In the light of an industry that has much going wrong, Legacy, Nobility, and several others are doing surprising well. That they could be doing far better logically would follow if MHI were doing its job properly.

14) If not for MHARR, it is entirely conceivable that manufactured housing independents may have vanished a decade ago. The fact that MHInsider and Manufactured Homes rarely mention MHARR reports is scandalous. Other than MHProNews/MHLivingNews, which aren’t trade groups but are trade publications, what trade group has done more to expose what has been going wrong in manufactured housing?

15) Let’s begin to sum up. Legacy Housing and others is swimming in shark, piranhas, and allegator infested (man-eating amphibians) waters. Who said? Warren Buffett, Kevin Clayton, and others.

16) That Legacy is doing as well as it has in such an apparently treacherous environment speaks volumes about them, their leaders, team, and it speaks as well about other surviving independents too. Note that what should have been mentioned by Doug Ryan is that the type of monopolization being observed is oligopoly style monopolization. Who says? Consider the implications of what the late Sam Zell said.

17) Are there steps that Legacy could take to benefit from the treachery? You bet. Are they doing so? If so, beyond one-point MHProNews has not yet reported on, it is not yet evident from publicly available information. More on that in a possible future report.

18) Legacy has overall grown, and they have maintained profitability, even in difficult times.

19) MHProNews may circle back to these remarks from Legacy, as time or circumstance permit, prior to their next quarterly report. Until then, for the detail minded, look carefully at the highlighted items and the linked and related reports. But for now, the following closing thoughts will hopefully prove useful to those seeking to better understand the manufactured housing market in general, or Legacy more specifically. In no particular order of importance are the following possible takeaways.

a) Legacy is apparently willing to admit errors, pivot as needed, adjusting and then moving ahead. This goes back to not only the legal requirements for a publicly-trade firm, but also to the ethics as well as the legalities of transparency that Howard Walker (quoted at the link here and above) expressed without giving away company trade secrets.

b) Legacy has acknowledged the headwinds, while planning and working towards executing on plans that could see a significant boost in their stock valuation. MHProNews is not predicting a huge jump in valuation in the short term, with a big BUT. If Legacy taps into the ‘reverse moat’ operations in a robust fashion – by pressing the apparent weaknesses of the Big Three and MHI caused by apparent and evidence-supported allegations of collusion, Legacy might easily double or triple in valuation in the foreseeable future. In fairness, Nobility Homes or others in MHVille might also double or triple in production/sales potential with fairly common-sense steps being executed. Note these, as is true of other industry-expert remarks published by MHProNews, are our editorial observations and are not to be construed as the stealth remarks of sponsors or others. We at MHProNews show, quote, and link what others say. We also make our own observations.

c) Legacy above, along with UMH Properties, have directly and/or by implication revealed the drag on manufactured housing production being caused by issues arising from the land-lease community sector.

d) The industry is heading for another downturn, that is all but guaranteed, UNLESS certain common-sense steps are taken by MHI leaders and or independents who pull together in a more cohesive fashion to lead the industry out of its 21st century doldrums. There are a dwindling number of vacancies in land-lease communities. The need to address the zoning barriers issue is long overdue. It is going to be obvious to anyone who reads enough of our reports that MHI is part of the problem and has not been part of the solution at least for the last roughly 15 plus years. As a point of fact, former MHI president and CEO, Chris Stinebert has made it clear that the industry’s turnaround should have begun some 20 years ago.

e) Each of these facts are potential areas of opportunity for investors willing to be contrarian. The evidence and common sense strongly suggest that at some point, antitrust suits and/or regulators will finally kick in and root out what’s gone wrong in manufactured housing. At that point, the behavior of firms like UMH Properties, Legacy, Nobility and others who didn’t totally drink the Kool Aid of focusing too much on consolidation will be revealed.

f) As noted herein and prior reports, it isn’t that Legacy is perfect. They admit as much. But their going the distance, and steps taken to prepare for difficulties (again, as noted in this and prior reports), make it clear that they can continue to not only survive, but potentially to thrive. If the legal issues that are beginning to dog community operators spills into the production-finance-retail side of the industry, it is obvious that Legacy, Nobility, UMH, and others like them will benefit. MHProNews has no stake in any of these firms. But if we did, we’d be betting on firms that are behaving more like those named in this paragraph, and would be shorting firms that have made themselves vulnerable to possible antitrust, RICO, or other violations.

h) It may be the case that some potential and past sponsors can’t, won’t, or don’t stomach the exposure of such topics. Nonsense! The industry is likely to end up stronger by addressing its core issues. In fact, ignoring or downplaying issues that are holding manufactured housing back may allow for some short-term profits, but they will likely cost far more over time. See the UMH linked reports to learn more. Note that these are not some recent discoveries for MHProNews. UMH has recently made statements that are broadly in keeping with issues that MHProNews and our MHLivingNews sister site have reported on for years.

i) It seems that Legacy’s co-founders are creating a team for the future. That’s what a corporation should be looking to do. Meanwhile, what about Cavco, Skyline Champion, ECN Capital-Triad, or others? Are they only thinking short-to-mid term? What happens when MHCs are full and zoning barriers are still not removed?

20) As a programming notice. Several special reports are pending. They will shed more evidence-based light on issues raised in this and linked reports. Watch for them here, because our ‘durable competitive advantage’ is the truth told in sufficient detail so that anyone can follow along and see the logic. No one is better positioned for the current circumstances and the future than those who are willing to tell it like it is and deal with those realities. Those who have to ignore reality in order to function are only asking for trouble. Odds are good, they’ll find that trouble they seek to ignore.

There is no one, no one else, in MHVille trade media willing to shine a factual and evidence-based light on these and other issues as MHProNews has done for years. The facts well told has power. The truth can set you free. Those just aren’t ancient and true wisdom that sound nice. Over time, they are proven methods for sustainable success. Building a foundation on sand is routinely a bad idea.

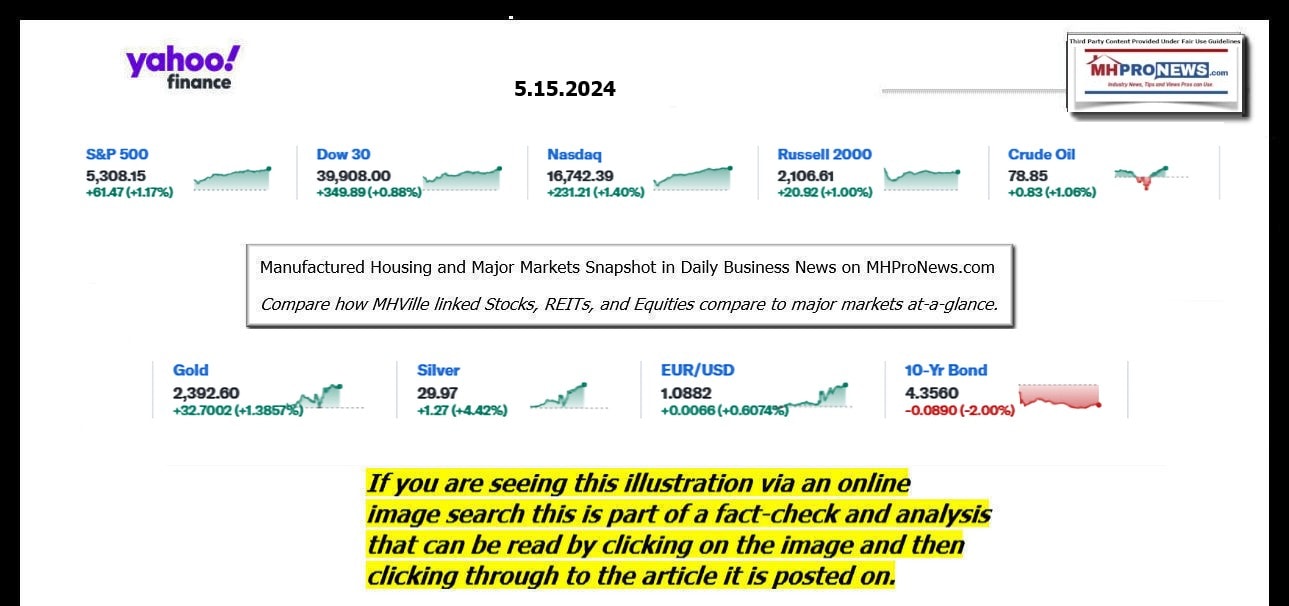

Part III – Our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market moves graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that may be impacting manufactured housing connected investing.

Headlines from left-of-center CNN Business – 5.15.2024

- Have you decided to retire abroad?

- A customer shops at a grocery store on February 13, 2024 in Chicago, Illinois.

- Stocks hit new highs after inflation data shows a cooldown in April

- A GameStop location is seen on May 13, 2024 in Silver Spring, MD. Shares of the video game and collectables retailer, which saw unprecedented gains at the start of 2021 that triggered Congressional hearings and market reform, have once again begun to rise, seeing as high as a 118% gain in a single day of trading today.

- How bad bets on meme stocks led to a $1 billion wipeout

- A customer shops for food at a grocery store on March 12, 2024 in San Rafael, California.

- Think corporate greed is the leading cause of inflation? Think again

- Grocery prices are finally falling

- An Uber rideshare vehicle idles in a line to pick up passengers at Los Angeles International Airport (LAX) on February 8, 2023 in Los Angeles, California.

- Uber will soon let riders book a shuttle to the airport

- Dec 25, 2023; Kansas City, Missouri, USA; Kansas City Chiefs quarterback Patrick Mahomes (15) scrambles from Las Vegas Raiders defensive tackle Adam Butler (69) and defensive end Tyree Wilson (9) during the second half at GEHA Field at Arrowhead Stadium.

- Netflix to air NFL games on Christmas Day in major expansion into live sports

- Frank McCourt, owner of Marseille prior the Ligue 1 Uber Eats match between Marseille and Reims at Orange Velodrome on August 12, 2023 in Marseille, France.

- TikTok’s new suitor is former Dodgers owner Frank McCourt, as another lawsuit pushes back against ban

- Senator Chuck Schumer (D-N.Y.), the Senate Majority Leader, walks through the U.S. Capitol during a Senate Vote, in Washington, D.C., on Thursday, May 2, 2024.

- Chuck Schumer and bipartisan group of senators unveil plan to control AI – while investing billions of dollars in it

- In pictures: Microsoft co-founder Bill Gates

- The backbone of America’s economy was just dealt a serious blow

- Burberry’s profit slumps by a third as sales in China plunge

- Why Biden’s monster EV tariffs could inflame a Europe-China trade war

- Taylor Swift’s ‘Eras Tour’ could be worth almost $1 billion to British economy

- The pandemic has changed when Americans expect to retire

- Boeing may be prosecuted after breaking safety agreement that prevented criminal charges for 737 crashes, US DOJ says

- News publishers sound alarm on Google’s new AI-infused search, warn of ‘catastrophic’ impacts

- Your child got less college financial aid than you hoped. You’re not a bad parent if you don’t make up the difference

- YouTube blocks Hong Kong protest anthem after court order

- Here’s where child care costs at least twice as much as rent

- OpenAI executive is out after key role in CEO Sam Altman’s ouster

- China’s Alibaba profit tumbles 86% though revenue beats estimates

- GameStop, AMC shares skyrocket after meme stock trader posts for first time in 3 years

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Headlines from right-of-center Newsmax – 5.15.2024

- Tenney Seeks Special Counsel Probe of Biden’s Israel Bomb Freeze

- Claudia Tenney, R-N.Y., is calling for Attorney General Merrick Garland to appoint a special counsel to investigate President Joe Biden after he said he would freeze the delivery of 1,800 bombs to Israel over its invasion of Rafah. [Full Story]

- Israel at War

- Netanyahu: Israel ‘Not a Vassal State of the United States’

- Israeli Defense Chief Challenges Netanyahu on Post-War Plans

- Netanyahu Pushes Drafting Ultra-Orthodox Into Military

- Speaker Johnson: Biden Carrying Water for Hamas, Iran

- Israel Exposes Hamas Terrorist Gunman at UN Site

- Phillips to Newsmax: Hamas Willing to Let ‘Every Palestinian’ Die | video

- WH Giving $1B in New Weapons, Ammo to Israel After Hold

- House to Vote on Condemning Biden on Israel Aid Block

- Biden Threatens Veto of ‘Unwise’ Bill on Israel Aid | video

- Israeli Tanks Push Into Rafah; Civilians Flee

- Qatar PM: Gaza Cease-Fire Talks at Stalemate

- Newsmax TV

- Lankford: Reviving Bipartisan Border Talks ‘Not Serious’

- Huckabee: Can’t See ‘Reasonable’ NYC Jury Convicting Trump | video

- Malliotakis: Trump in ‘Good Spirits’ Despite Trial | video

- Roger Stone: Cohen’s Duplicity Why Feds Passed on Case | video

- Christina Bobb: Defense May Rest After Prosecution Case | video

- Clyde: GOP Once Opposed to Trump Will Work With Him | video

- Jesse Binnall: Cohen’s Credibility Undermined

- Murphy: US Has ‘Obligation to Stop Putin’ | video

- Donalds: Focus on Biden Record, Not Trump Trial | video

- Newsfront

- Trump, Biden Agree on June, September Debate Dates

- President Joe Biden and former President Donald Trump agreed Wednesday to hold two campaign debates – the first on June 27 hosted by CNN and the second on Sept. 10 hosted by ABC – setting the stage for the first presidential face-off in just weeks…. [Full Story]

- Feds Halt Funding for Wuhan-Linked Organization

- The Department of Health and Human Services announced it will suspend [Full Story]

- House Passes FAA Bill Addressing Aircraft Safety, Refund Rights

- Congress gave final approval Wednesday to a $105 billion bill [Full Story]

- RFK Jr. Rips Debate Exclusion: ‘Undermines Democracy’

- Independent presidential candidate Robert F. Kennedy Jr. on Wednesday [Full Story]

- Aging Texas Bridge Closed After Barge Strike

- The U.S. Coast Guard closed the Gulf Intracoastal Waterway on [Full Story]

- Alternative Groups Emerge Amid Boy Scouts’ Changes

- After changing its name to the more inclusive Scouting America, the [Full Story] | Platinum Article

- House Oversight Panel Seeks Cassidy Hutchinson Docs

- A Republican-led House committee examining the select committee that [Full Story]

- Ukraine: Putin’s Call for Talks to End War ‘Hypocritical’

- Ukraine: Putin’s Call for Talks to End War ‘Hypocritical’

- Ukrainian presidential adviser Mykhailo Podolyak dismissed Russian [Full Story]

- Related

- Blinken Praises Ukrainian Resilience in Touring Kyiv Grain Facility

- French, Dutch Seek EU Sanctions on Financial Institutions Helping Russia Military

- Report: Putin Purged Defense Ministry Over Nuke Secrets Leak

- New Russian Defense Minister: Must Win While Minimizing Casualties

- Zelenskyy Postpones Foreign Trips as Ukraine Pulls Back Troops

- Russia Vows to Destroy All US Military Equipment in Ukraine

- Russia: Blinken’s Kyiv Visit Sign of US Alarm Over Frontline

- Tenney: Special Counsel Should Probe Biden on Israel

- Claudia Tenney, R-N.Y., is calling for Attorney General Merrick [Full Story]

- Experts: Election Polls Should Be Viewed With Caution

- Even though a spate of polls shows former President Donald Trump [Full Story] | Platinum Article

- Rasmussen Poll: Voters Say Media Covers Issues Poorly

- Only 28% of voters rate the national news media as doing a good or [Full Story]

- Crandall: Abortion Increases Risk for Heart Disease

- An alarming new study found that pregnancy loss, whether natural or [Full Story]

- Trump: I Have a ‘Great Silent Majority’

- Former President Donald Trump said a “great silent majority” of [Full Story]

- Border Crossings Slowing With Help From Mexico

- S. Border crossings are slowing with help from Mexico, reports NBC [Full Story]

- Slovakia’s PM Robert Fico Shot, Fighting for His Life

- Slovakia’s populist Prime Minister Robert Fico was wounded in a [Full Story]

- Related

- Biden Condemns Shooting of Slovak Prime Minister

- Biden WH Pushing Dems to Vote No on Israel Resolution

- The White House wants Democrats in the House to vote against a [Full Story]

- Haley Takes Votes From Trump in Md., W.Va, Neb.

- Former South Carolina Gov. Nikki Haley, who hasn’t been a candidate [Full Story]

- Ipsos Poll: Trump Pulls Into Dead Heat Nationwide

- President Joe Biden and Republican challenger Donald Trump are tied [Full Story]

- Cygnal Poll: Black Voters Fleeing Biden, Democrats

- President Joe Biden and Democrats are losing support among Black [Full Story]

- South Dakota Gov. Noem Banned From 7th Native Tribe

- South Dakota GOP Gov. Kristi Noem has now been banned from seven [Full Story]

- Suspect Identified in Attack on Actor Steve Buscemi

- Police identified a suspect wanted for an alleged assault on actor [Full Story]

- Jamie Dimon Calls on US to Focus on Fiscal Deficit

- The United States needs to focus on reducing its fiscal deficit or it [Full Story]

- NYC Mayor: Migrants Would Be Good Lifeguards

- New York Mayor Eric Adams said he has a solution to the city’s [Full Story]

- Migrants in NYPD Attack Offered Plea Deals

- Six migrants charged with attacking New York City police officers in [Full Story]

- Pentagon: Navy to Help Defend Gaza Aid Pier

- The Navy will help defend the pier being built by the U.S. military [Full Story]

- Overdose Deaths in the US Declined Last Year

- The number of U.S. fatal overdoses fell last year, according to [Full Story]

- Inflation Eases to 3.4 Percent, Below Estimates

- S. consumer prices increased less than expected in April, [Full Story]

- Shohei Ohtani’s Interpreter in Court Ahead of Plea Deal

- Ippei Mizuhara, who previously served as Los Angeles Dodgers [Full Story]

- Frank McCourt’s Project Liberty to Bid on TikTok

- Entrepreneur and former Los Angeles Dodgers owner Frank McCourt said [Full Story]

- Miniature Poodle Sage Wins Westminster Dog Show

- A miniature poodle named Sage won the top prize Tuesday night at the [Full Story]

- Hunter Biden Loses Bid to Delay Gun Trial

- Hunter Biden lost his latest attempt on Tuesday to delay the start of [Full Story]

- More Newsfront

- Finance

- Senators Seek $32B for AI, Safeguards

- A bipartisan group of four senators led by Majority Leader Chuck Schumer is recommending that Congress spend at least $32 billion over the next three years to develop artificial intelligence and place safeguards around it…. [Full Story]

- A Primer for Investors on Data Centers

- Community Colleges Offer Clean Energy Training

- GameStop, AMC Tumble as Meme Rally Peters Out

- Beat Inflation With This Simple Investment Strategy

- More Finance

- Health

- Private Insurance Holders May Pay More in Hospital

- Having private insurance may not be all it is cracked up to be when it comes to hospital bills, new research warns. In a report published Monday by the nonprofit research institute RAND Corp., researchers discovered that patients with private health insurance may wind up…… [Full Story]

- Study: Spending Time Online Boosts Well-Being

- Biking May Help Prevent Knee Arthritis

- FDA Approves First HPV Self-Test Collection Kit

- Surgical Teams With More Women Improve Outcomes

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.