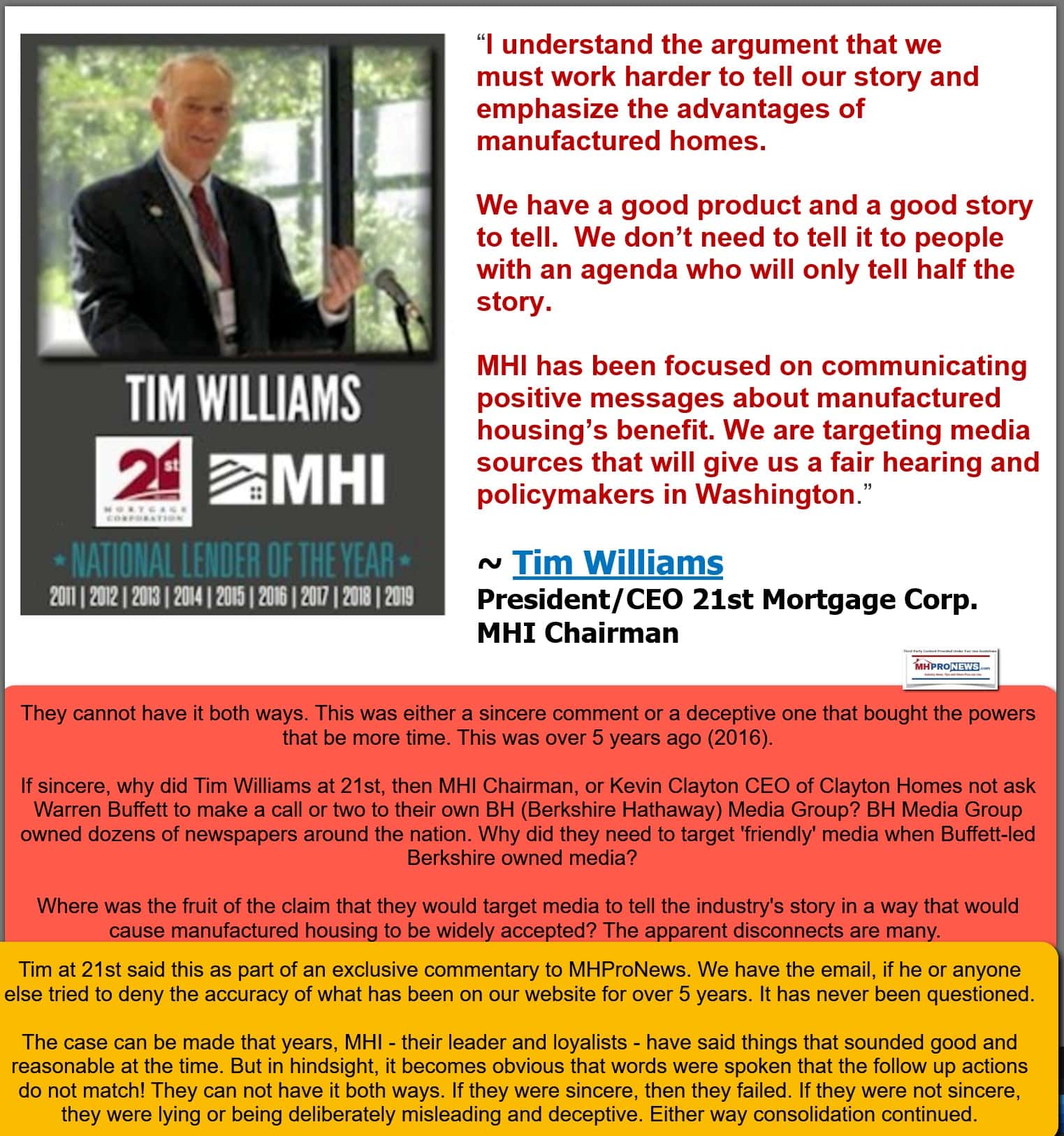

“Many of our friends in the industry, including my friend Tony at MHLivingNews, have questioned why MHI hasn’t made a strong rebuttal response to the PBS story.” So said then Manufactured Housing Institute (MHI) chairman Tim Williams, President and CEO of 21st Mortgage Corp to MHProNews in an exclusive statement about what was framed as an ambush journalism report that harmed the image of the manufactured home industry. Williams said as part of his detailed statement what steps would be taken by MHI leadership to avoid and change that admittedly problematic pattern. Fast-forward to April 16, 2021 and the latest from NPR on manufactured home community living that features the troubling pull-quote: “prisoners of the mobile home park.” The MHI CEO Lesli Gooch, Ph.D., statement cited by Chris Arnold for NPR seemingly defends firms like Havenpark Communities. Yet Havenpark is one of several MHI members that has purportedly violated the MHI/NCC ‘code of ethical conduct,’ which insiders have told MHProNews has occurred without apparent consequence to Havenpark or other violating MHI/NCC members. That snapshot should leave professionals, advocates, investors, public officials, and others asking — what has the leadership at MHI done to learn the lessons of the past? How serious are MHI leaders about advancing the industry and its public image?

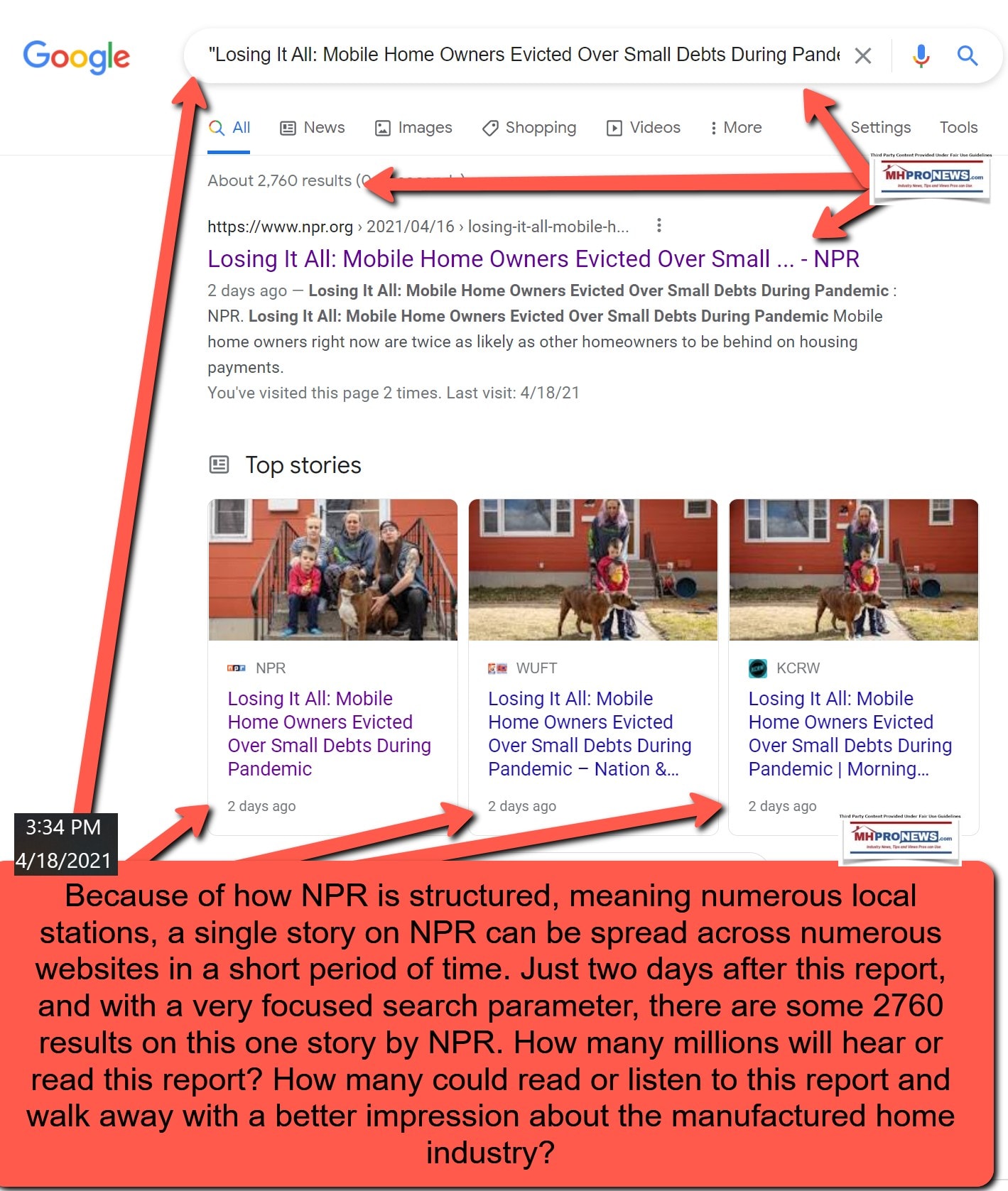

To unpack this latest involving ‘publicly supported’ NPR, seen as a sister operation to PBS, the entire NPR audio and transcript of their report, save some of the images, are shown below. The text and audio of the NPR report will be presented in this report, fact-check, analysis, and commentary in a transformative way. Because as NBC News recently reported about predatory behavior in manufactured home communities during the COVID19 outbreak, this NPR story involving Havenpark is arguably part of a larger pattern of MHI member brands that are routinely adding another ‘black eye’ to the industry’s image.

By happenstance or design, note that what has been going wrong within our industry can be documented to parallel the rise of the Berkshire Hathaway era of our profession. Since Berkshire bought into manufactured housing, by accident or design, the manufactured home industry’s shipments and production levels have never recovered to their pre-Berkshire epoch levels. Given Berkshire’s ample resources, how is that to be explained? Who does that pattern benefit? Consolidators.

Who does that pattern harm? Arguably millions of those seeking their part of the American Dream, including manufactured home industry professionals who lost or sold out their firms at a discount, which literally totals some ten thousand plus operations.

Here is the NPR report, dated April 16, 2021. It will be followed by additional information, MHProNews, analysis, and commentary. Typos and terminology errors are in the original report. Those NPR images which are shown have had the MHProNews third-party content notice added, but are otherwise as in the original.

“Losing It All: Mobile Home Owners Evicted Over Small Debts During Pandemic,” Chris Arnold for NPR

Barbara Gaught stands outside the home she’s now renting in Billings, Mont., with her 5-year-old son, Blazen, and their dog, Arie. Gaught and her family were evicted from the mobile home they had owned outright and lived in for 16 years because they fell behind on ‘lot rent’ for the little plot of land under the mobile home.

It was a pretty brutal holiday season for Barbara Gaught in Billings, Montana. Back in December, just a week before Christmas, she got an eviction notice.

“It was at like six thirty at night that a sheriff came and taped a notice on the door,” she says. “On a Friday night.”

Gaught hadn’t responded to a court summons the month before. She didn’t think she could be evicted so soon. After all, she owned her home outright. But she’d fallen behind on the relatively small amount of money she pays in rent for the patch of grass and driveway her home sat on. And because of that, she now had just a couple of days, till Monday, to be out of her home.

So she brought her 5-year-old son to a relative’s house. And she and her older children started throwing things into bags.

“We packed our stuff,” she says. “It was horrible. There was a lot of tears involved.”

Like about 20 million Americans, Gaught lived in what’s called a manufactured home. In other words a mobile home that gets brought in by a truck but then sits on a patch of land — often in a mobile home park.

For a lot of people, this makes homeownership affordable. Even brand new mobile homes on average cost less than half of a single family house or a condo. And 80% of manufactured housing residents own their homes. Gaught had owned hers for 16 years.

“I was a really young mom,” she says. “One thing I was so proud of was the fact that my kids weren’t moving from place to place to place.”

Gaught (right) holds her 9-month-old grandson, Adonis, while her daughter Trinity, 16, holds her newborn baby at the home they now rent in Billings, Mont. Gaught’s 5-year-old son, Blazen, plays in the background. She says out of all of them, Blazen has been most upset about losing the house. “It’s hard to explain to him why his home’s not his home anymore,” Gaught says.

Louise Johns for NPR

“It costs five to ten thousand dollars to hire a company to move your home off the lot that you rent,” Voigt says. “Older homes structurally can’t handle a move, and it’s very difficult to find a new lot.”

So she says families can end up being prisoners to the mobile home park. And if people fall behind on that ‘lot rent’ for the land under the home, she says some companies that own mobile home parks quickly move to evict them.

“The landlord turns around, rents the home or sells it again, adding to their profit margins,” says Voigt. “The resident has lost not only their home but their life savings.”

Often the courts allow this — since the homeowner can’t move the home.

During the pandemic, many people like Barbara Gaught have been having trouble paying because they’ve lost work. Gaught and her fiancé both work in construction and had to stop for a time after COVID hit. That’s when they fell behind on the lot rent.

Nobody’s tracking this nationally. But one group, the Private Equity Stakeholder Project, looking at just a handful of counties in a few states, has found upwards of 1200 eviction filings against people in mobile home parks. “That just scratches the surface,” says Jim Baker the group’s executive director.

Lesli Gooch is the CEO of the Manufactured Housing Institute, which represents mobile home parks and the factory-built housing industry more broadly. She says many mobile home parks have been doing all they can to be flexible with struggling residents.

“They did rent payment arrangements, we just had somebody do a vaccination clinic,” she says. “Across the board, the owners and operators were really trying to keep their residents safely housed.”

Barbara Gaught wasn’t so lucky.

The company that owns the land under her mobile home is called Havenpark. It filed an eviction case after she fell just one month behind on the lot rent and owed $621 in rent and fees. And pretty soon, she says she had a notice on her door that she had to get out in just two days.

“I believe, when they put the notice on our door, we were two-and-a-half months behind,” Gaught says. “And they weren’t taking any partial payments, so it was one of those things where I either had to have all of the money or none of the money. They really were, like, we’re just going to screw you big time.”

Havenpark says it tried to avoid evicting Barbara Gaught.

The company declined an interview with NPR but said in a statement that she received all the required notices during the eviction process. And that it tried to call her twice. If she’d responded the company says it would have worked with her and referred her to government rental assistance programs. But since she didn’t respond, the company said it was left, “with no choice but to proceed with eviction.”

Gaught sits outside the house she now rents in Billings with her three children. The family had to leave suddenly when they were evicted, and still haven’t been able to find a cat they had at the mobile home park. “We looked and called around forever and we just could never find her,” Gaught says. It was her 5-year-old son Blazen’s (left) cat. “And that was slightly devastating to him.”

Louise Johns for NPR

“No, that’s not true they had a choice,” says Amy Hall, an attorney with Montana Legal Services Association who helps families try to avoid eviction. “They could have worked with her longer to try to give her time to get caught up.”

Gaught says for a time she was getting out of a bad marriage, and even when other things in her kids lives weren’t going well, they had the house. “There was always that place for them to come home to. It was the safe place.”

But the pandemic is laying bare that mobile home owners are often very vulnerable. On average they make half as much income as regular single-family homeowners, and during the pandemic have been twice as likely to be behind on their housing payments.

The loans they get often don’t have the same protections as regular mortgages. Then there’s the biggest vulnerability for those that live in mobile home parks.

“They don’t own the land under their home,” says Elisabeth Voigt. She’s a director at Manufactured Housing Action, a nonprofit that advocates for better legal protections for mobile home owners.

While manufactured homes are often called mobile homes or trailer homes, most are not very mobile. Moving them is a major undertaking. It often means installing wheels and welding on tow hitches.

Havenpark points out that Gaught failed to respond to a court summons. And says that if she had, she likely could have gotten a repayment plan through the court and kept her home.

Hall says that’s true, especially if she’d managed to get a lawyer. There’s also an order from the Center for Disease Control and Prevention that could have protected her if she knew about it.

But Hall says a lot of people don’t know their rights. And the process moves very quickly.

Mike Eakin is a lawyer in Billings who does pro-bono work. He says just in his area mobile home evictions are keeping him busy.

“Quite a bit,” Eakin says. “Since last fall, at least twenty to twenty five cases at mobile home lots that Haven Park has purchased here in Billings.” He adds that he’s got more cases involving other mobile home park companies too.

In Barbara Gaught’s case, court documents show that she owed less than $1,200 when she got evicted. And so for that relatively small amount of money, she lost a home she owned outright, and lived in for 16 years.

Meanwhile, she says all this has probably been hardest on her 5-year-old son. “Out of everybody, I think he was the most upset about losing the house.”

Gaught says her dad helped her work out an agreement with Havenpark where she wouldn’t owe the $1,200 and the company could keep the mobile home. She, her dad, and their lawyer say the company wouldn’t even let them take a storage shed off the property. They say Havenpark insisted on keeping that too.

Gaught was able to go back, so her 5-year-old could see the house one more time. She says she’ll remember that forever.

“Just him saying, ‘goodbye house,’ ” she says.

“It’s all he’s known in his short little life, and it’s, it really sucked.” Gaught says it’s hard not to feel like she failed her kid not being able to protect him from that. “It’s hard to explain to him why his home’s not his home anymore.”

Gaught says after staying at motels and with friends for months, the family finally found a house to rent. It costs more than twice what she was paying to the mobile home park in lot rent and fees. But she says she can afford that now because she’s working again.

So she says if she’d just had a little more time catch up, she she wouldn’t have had to lose her home.”

##

The original report with all images are shown at this link here.

“If You Want to Be Miserable, Apply Now!”

On the same date as the NPR story about Havenpark Communities was published, the review below was published on Indeed by someone that stated that they worked for the company as an accounts payable person – a collector. The former employee was warning others away from working for MHI member Havenpark.

If you want to be over worked, no pay, constantly criticized, under appreciated, and a below value employee. Look no further! Respect could not be more missing in a company. Plan on no raises and to be crapped upon at all times. No process and they do “shout outs” to only the favorite employees that know how to kiss management repeatedly. If you want to keep your soul, conscience, integrity, motivation and sanity then you should probably knock thinking of working here out of your mind. If you want to be miserable APPLY NOW!”

MHProNews reached out to NPR to ask the following:

- “Did Arnold know about the MHI/NCC Code of Ethical conduct for member firms such as Havenpark Capital?”

- “If so, was MHI asked why Havenpark and others that are MHI members and that have arguably failed to keep those purported MHI/NCC ethical standards have per sources never faced any consequences?”

As of publication time, no formal response from NPR was received, other than to confirm the media inquiry. Had they replied, additional questions might have been asked too.

When “MHI affiliate” state association members, or MHI/NCC members, and others are getting de facto lumped into such reports, it should be raising more than eyebrows, shouldn’t it? Those who strive to do business in an ethical fashion are in the eyes of many being lumped in with predatory firms.

Those firms accused of predatory behavior include brands such as Havenpark, “Frank and Dave” operated firms, and others routinely happen to be MHI members and/or MHI state affiliate members. That is part of an arguably problematic pattern. That pattern is made manifest in the reports linked from within or following this report.

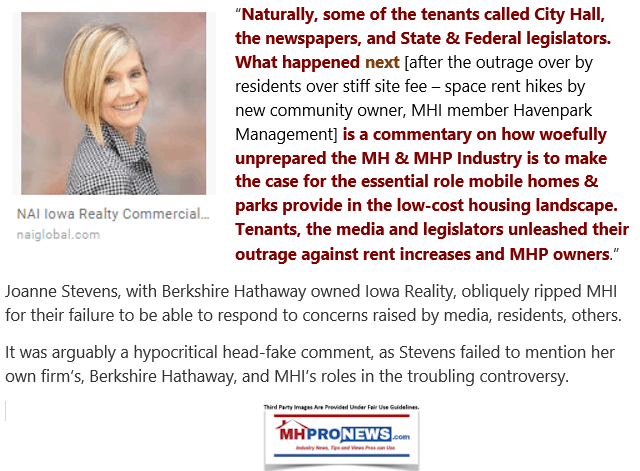

If someone takes seriously the complaint of MHI member and Berkshire-commercial realty broker leader Joanne Stevens, she asserted that the industry – think MHI, state association affiliates – were not doing their jobs properly. While it was a different incident that Stevens’ comment was rendered on, it is arguably part of the same pattern that MHI’s Gooch is trying to defend what should not be defended. As a MHEC executive that has communities as members previously told MHProNews, it is not the job of an association to protect bad actors.

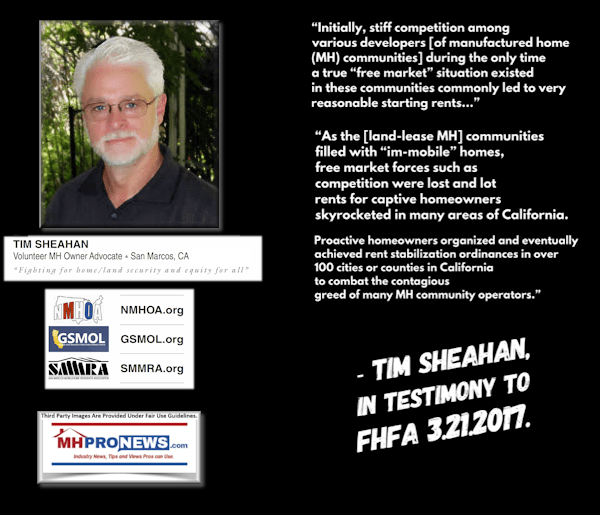

Within that context, circling back to Tim Williams comments some 5 years ago, what has MHI done to change that problematic pattern?

Despite promises by two different past MHI chairman, Nathan Smith and Tim Williams who in their own words pledge to learn from and avoid past mistakes, why is it that the pattern continues? Isn’t it more confirmation of the allegations made by those who claim that MHI insiders are manipulating the system in a way that fosters consolidation and drives out smaller companies? Doesn’t that pattern only lead to more negative news from consumers who are becoming prey to predatory operators?

Yet Another MHInsider “Sabotage Monopoly” Play?

Minneapolis Federal Reserve researcher James A Schmitz, Jr. and his colleagues have written a series of reports on how “sabotage monopoly” tactics were being deployed in manufactured housing.

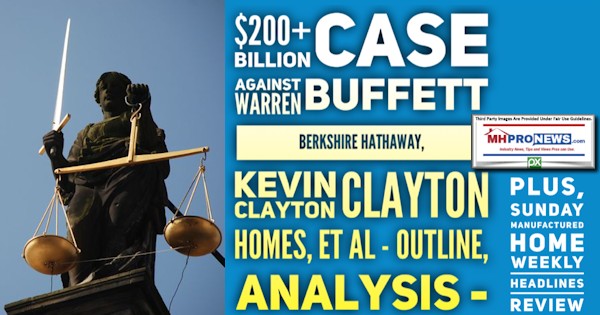

The case laid out by Samuel Strommen at Knudson Law has not yet been publicly and extensively addressed by MHI or Berkshire leadership. Why not?

As tragic as what NPR says occurred in the case of Barbara Gaught, which they assert is one of numbers of such instances, the troubling reality is that the social costs go well beyond each of those troubling tales. Because NBER researchers, during the end of the Obama-Biden and then the early part of Trump-Pence administrations, made the case that not having affordable housing near where it is needed is costing America some $2 trillion dollars annually in lost GDP. When manufactured homes are not being properly used, the harms done go well beyond our industry and its homeowners.

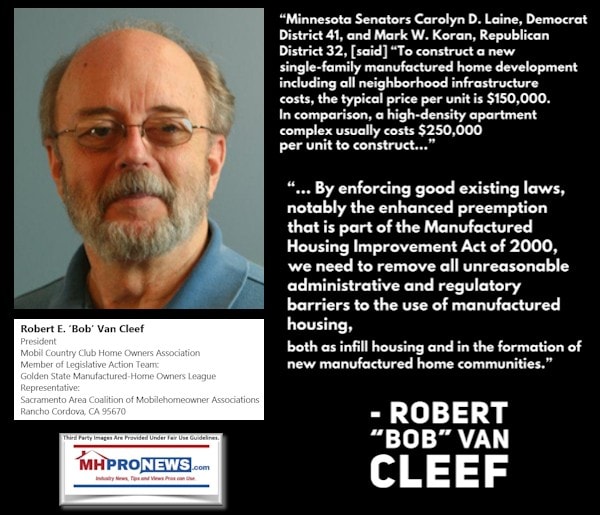

The smaller production-focused rival of MHI, the Manufactured Housing Association for Regulatory Reform (MHARR), has made the argument for years that the industry should be laser focused on implementation of good existing federal laws.

Doing so, says MHARR, would boost sales and remove many of the financial pressures being felt by current and potential manufactured home consumers.

But instead, MHI in recent years has been into photo and video opportunities. There have been boasting about the coalition of housing groups. Yes, they posture saying some of the right things, but where is their proven effort to make their words bear measurable fruit? Restated, what have those photo ops and MHI’s much touted coalition accomplished? The industry’s production is in a modest decline. Why aren’t sales soaring if MHI is doing their job properly?

Given that the laws exist to remedy that dynamic, yet are not being properly implemented, the argument can be advanced that these patterns have been costing manufactured home industry independent firms billions of dollars annually. The total social impact could total into the trillions.

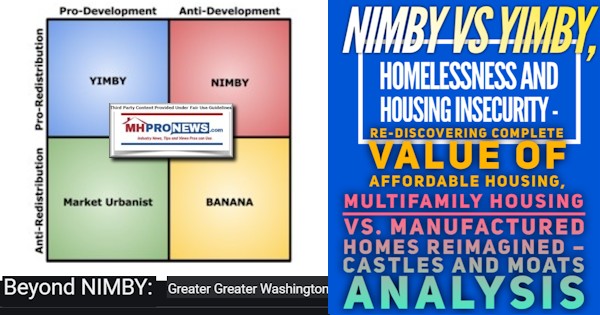

While it is sad to hear NPR use the pull quote “Prisoners to the Mobile Home Park” – MHI members Frank and Dave have been quoted saying similarly.

To change the years of this problematic dynamic, white hat industry professionals should take charge of their associations.

Or, if that is not possible, then they should take the advice of Thomas Jefferson, who wrote: “all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed.” While that was being applied to governments, the same could be applied logically to trade groups that are failing white hat firms and others. “…when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.” Once more, while the topic is governmental, the same logic applies to trade groups

Like a Patient that Doesn’t Like the Medical Experts’ Diagnosis.

Some in our profession do not like the fact that time and again, when the issues are examined and the root causes are traced back, they routinely lead to the same cast of characters. But not liking the evidence is akin to a patient that doesn’t like the diagnosis, and keeps going to other doctors, hoping one will tell him something different. The realities are what they are.

Nothing that is problematic is changed until it is honestly understood, dealt with, and then challenged as necessary.

Then there are some who have turned a blind eye to what has happened to literally thousands of their colleagues. History suggests that pattern will not change until it is challenged.

The good news is this. The various laws, once they are understood, should favor those who have been ripped off. But that will not be handed to anyone without doing something for it. Freedom is never free.

To obtain positive change, to reach the industry’s true potential, people of good will should join other whistleblowers, tipsters, and others who have publicly questioned the decisions – and in several cases, the legality – of actions taken by those who like the Ohio Manufactured Home Association (OMHA) Executive Director Tim Williams has praised. If factual, evidence-based reports like this do not cause OMHA’s Williams, Birch and others like them to do an about face, what will?

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in-your-face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.