Noteworthy headlines on CNNMoney – Hackers steal 2 billion rubles at Russia’s central bank. Italy’s referendum risks pushing banks over the edge. U.S. health spending rose nearly 6%, fastest since 2007. Unemployment drops to 4.6%, lowest since 2007.

Some bullets from MarketWatch – Oil scores weekly gain of over 12% on back of OPEC pact. FCC raises fresh concerns over “zero-rating” by AT&T, Verizon. Mark Hulbert: There’s a 65% chance that the U.S. stock market will rise in 2017.

Oil up 1.04%. Gold up 0.73.

Newsmax commentator Peter Morici says a modest correction is ahead, while prior Reagan Administration official, CNBC contributor Larry Kudlow gushes, “Everyone’s a Winner with Trump’s Across-the-Board Tax Cuts.”

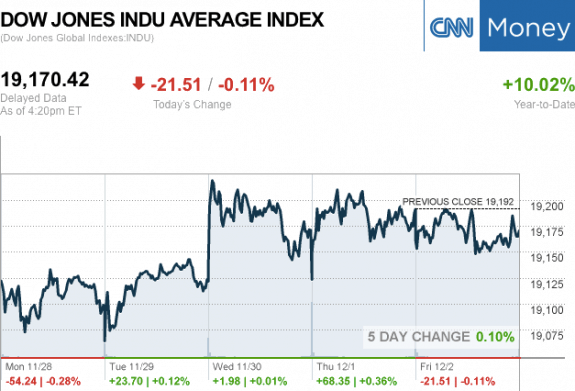

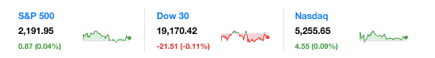

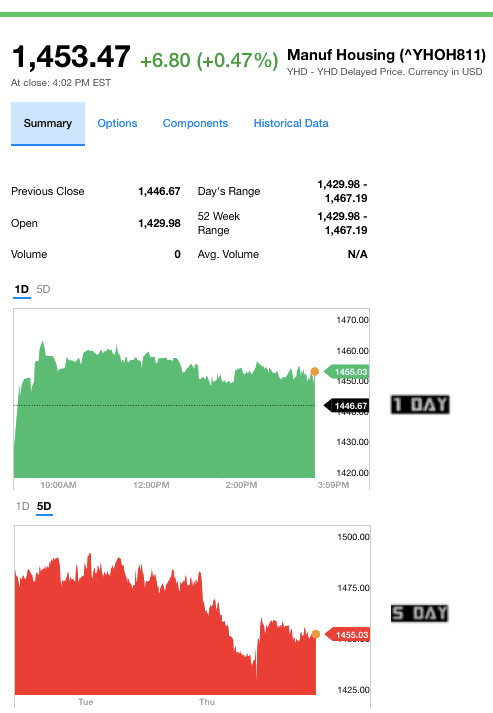

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,191.95 0.87 (0.04%)

Dow JIA 19,170.42 –21.51 (-0.11%).

Nasdaq 5,255.65 4.54 (0.09%).

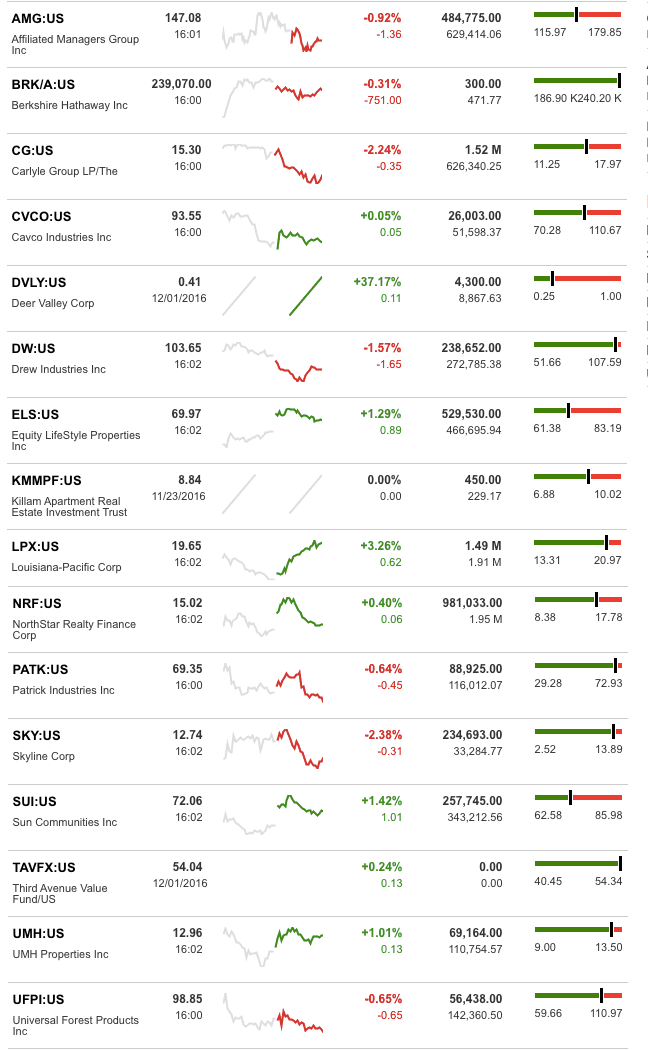

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Louisiana-Pacific Corp. (LPX) and Sun Communities Inc. (SUI). The top two sliders for the day were The Carlyle Group (CG) and Skyline Corp. (SKY). Killam held steady today, as the stock is only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

Manufactured Housing Composite Value (MHCV) Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.