What is happening to VW’s executives is not a precise analogy to what could occur in the U.S.A. with manufactured housing connected publicly traded firms. German law is not U.S. law. That ‘stating the obvious’ disclosure made, there are some sobering parallels that should give pause to investors in publicly traded firms, and perhaps on a different level, to those in other investment funds that are not publicly traded, depending on the types of disclosures being made.

Let’s dive in, one step at a time, to see why manufactured housing industry investors should be concerned. And if investors should be concerned, that implies that manufactured housing executives in companies should be too.

First, the guts of what CNN reported on Sept 24, 2019.

London (CNN Business) Volkswagen CEO Herbert Diess and the company’s chairman, Hans Dieter Pötsch, were charged by German prosecutors on Tuesday with stock market manipulation tied to the carmaker’s diesel emissions scandal.

The two executives are accused of failing to disclose the huge financial risks of the diesel scandal to shareholders in a timely fashion.

New charges against Martin Winterkorn, the former CEO of Volkswagen (VLKAF), were also revealed in an indictment

running to nearly 640 pages.

Under German law, top executives must inform shareholders of information that can affect stock prices — such as considerable financial risks — as soon as they become aware of them.

In a statement, prosecutors accused all three men of failing to carry out their duty to investors…

##

Next, Under U.S. Law…

Under U.S. law, Allen & Overy said on Feb 16, 2018 that: “Failure to make certain disclosures required under US securities laws can result in SEC enforcement proceedings.” Their about us page says of the law-firm “…88-year history. We will do this by ensuring we always challenge ourselves to bring new and original ways of thinking to the complex legal challenges our clients face.”

The same source elaborated, “Item 303 disclosures, otherwise known as Management Discussion & Analysis of Financial Condition and Results of Operation (or MD&A) disclosures, are intended to provide material, historical and prospective textual disclosure enabling investors and other users to assess the financial condition and results of operations of the registrant, with particular emphasis on the registrant’s prospects for the future…”

Further, “MD&A requires discussions of “known trends or any known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in the registrant’s liquidity increasing or decreasing in any material way.” Then, under the following subheading is the rumble under the feet of executives and investors…

Non-disclosure – regulatory enforcement and, potentially, investor action

“Failure to make the disclosures required by Item 303 can result in SEC enforcement proceedings. Until recently, however, there was no appellate authority suggesting that Item 303 could give rise to a private right of action by investors for Item 303 violations.

The landscape changed in 2016, when the U.S. Court of Appeals for the Second Circuit held that investors have a private right of action under Section 10(b) of the Exchange Act and SEC Rule 10b5 when a registrant fails to make a disclosure required by Item 303.1 The Second Circuit’s view is that Item 303 creates an actionable duty to disclose.”

Last quote from this source for the purposes of this report, is this factoid that Cavco Industries and others have become quite aware of through their own lived experiences.

“Shareholder activism is already prevalent in the United States and continues to increase. Activist investors generally attempt to encourage changes in a registrant’s management, policies, practices or social responsibilities (eg, climate change initiatives). Failure to make required disclosures around trends that may materially impact a registrant could lead to exposure to activist shareholder litigation on a number of fronts.”

Why This Should Raise Warning Flags for Manufactured Housing Industry Firms, Investors

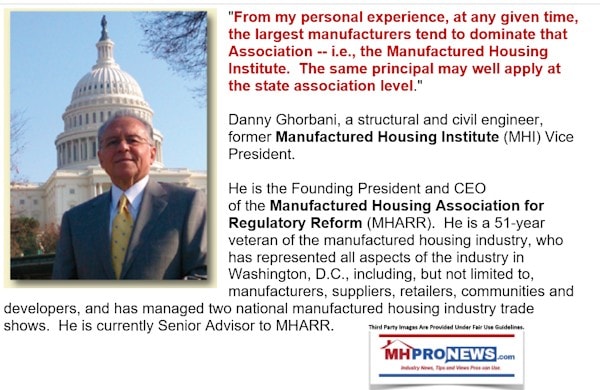

Arguably, among those trends are the types of legal and regulatory issues that have been raised by the Manufactured Housing Association for Regulatory Reform (MHARR), whose president and CEO is an attorney. Further, there are the issues that have been raised by MHProNews and MHLivingNews, one of numerous examples, is linked below.

Publicly Traded Manufactured Housing Firms – Which Source Do You Trust More? Why? MHI, MHARR, Others

Under consistent pressure from voices inside the industry, but most visibly from MHProNews and our publicly-focused MHLivingNews sister-site, MHI recently made a significant pivot.

Under Pressure, MHI Pivots “HUD Must Implement and Enforce its Enhanced Preemption Authority”

An attorney with ties to MHI along with a prominent MHI member then dropped these arguably self-contradictory bombshells.

In the wake of those and numerous other reports, MHI subsequently produced the following video, perhaps the latest fig-leaf defense to appease members, state associations, and others. A report that analyzes that MHI video is linked here.

With antitrust and other legal concerns rising in the U.S., and with increasing scrutiny aimed at the manufactured housing community sector, there are contacts and reasons to believe that these will in time result in investigations and actions that could prove problematic for MHI member firms. But make no mistake, other non-MHI member firms could be impacted too. When a well is polluted, as an analogy, all who drink from that well’s water risk contamination.

Senator Elizabeth Warren Takes Aim, Blasting Again MHI Member Company in 2020 Campaign Stop

MHProNews has previously disclosed that there have been several communications with federal officials. Additionally, third-party metrics – while not able to discern who specifically visits the MHProNews website – does ‘detect’ when a visitor is from a .gov extension. Thousands of such hits occur, as was reported at this linked text-image box below. Rephrased to make the point, federal officials are finding what we publish to be of keen interest to them. State and local officials have too.

What Are Federal Officials Researching About Manufactured Housing?

Further, there are swirls of other publicized interest from lawmakers that MHProNews has reported. One of several such examples is linked below.

Last for now, are mainstream media reports of interest in Clayton Homes and their related lending. That should not be construed as being limited only to Clayton. The report yesterday on Havenpark Capital, another MHI member firm, should be as sobering as it is eye-opening.

With resident leaders increasingly alarmed over ‘black hat’ type behavior, plus concerns from manufactured home industry independently owned businesses, there are numerous reasons to believe that MHI connected firms could face certain legal and regulatory headwinds. That is especially true if they fail to give appropriate disclosures to their investors.

Furthermore, even disclosing certain risks may still beg questions, concerns – and possible legal actions – based upon MHI’s purported misinformation, half-truths, and per an informed insider source, outright lies and deception by the Arlington, VA based trade group to their own members and followers related to topics like financing and the Duty to Serve (DTS).

That is a placeholder for when that information will become public, as the reliable insider source insisted. Until then, what is public is the following.

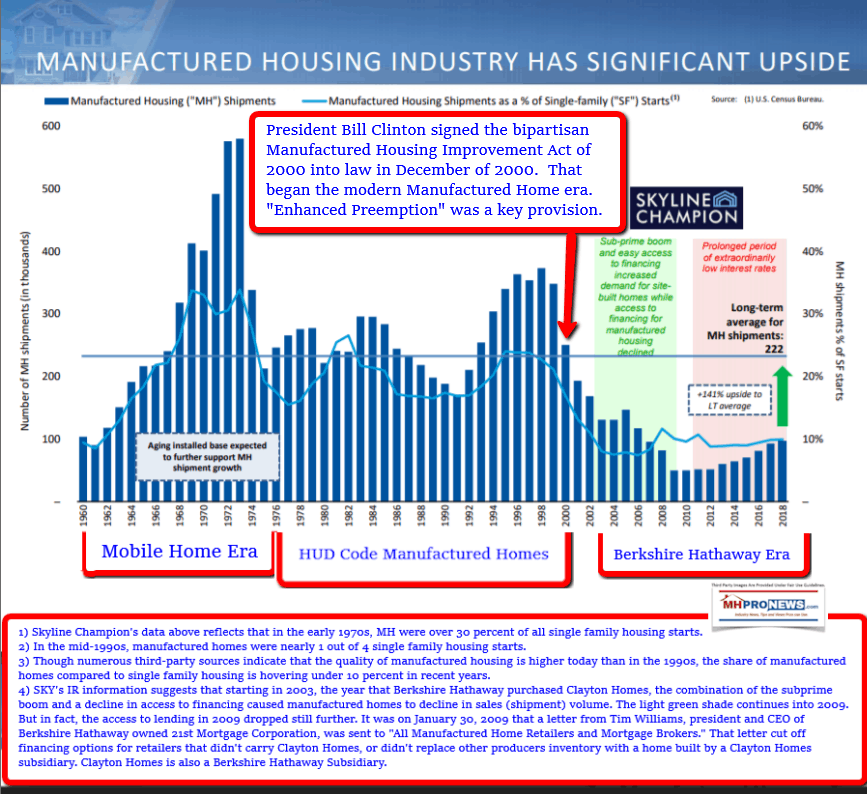

Further, a Democratic lawmaker is on record pushing a DTS related topic. Each of these private and public concerns dovetail with what MHProNews broke almost 2 years ago about the posture of Berkshire Hathaway owned brands toward keeping the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac out from doing serious lending in our industry.

That stance by Berkshire is matched from sources we’ve heard from directly connected to Fannie and Freddie. Summed up, MHProNews has known for some time that DTS being applied robustly to chattel or ‘home only’ lending was an illusion. Listening tours, appearances at meetings, these were ‘feel good’ efforts designed to placate manufactured housing professionals. Mark your calendar. Unless leaders in Congress from one or both major political parties, or the Trump Administration makes this an issue, DTS being robustly applied is not going to happen. You read it here first.

That is a brief survey. There is far more, as some of the related reports below the byline will outline and go into more details.

It should be noted for first-time or newer readers that MHProNews – which until about 2.3 years ago was given prompt replies to inquiries made to MHI, Clayton Homes, or 21st Mortgage, among others – has given those organizations and their attorneys repeated opportunities to clarify, clear up, or refute issues raised in reports like those shown on this page. Further, sources in those organizations tell us that they are routine readers, and our website has numerous places that remind readers that their feedback is welcome.

While MHI hired an outside attorney that at one point threatened this publication, after our leadership’s pushback, they too have since gone mute.

But each of those factoids and allegations ought to beg questions. Why would MHI hire an attorney when they have been invited repeatedly to correct any factual errors, or otherwise reply? Why would they or their puppet masters object to being directly quoted, when that is allowed by law for media such as this?

Industry sources have told MHProNews that they have been ‘pressured,’ by those connected to MHI, in ways designed to thwart the industry’s clear understanding of critical issues. If so, that raises possible RICO and other legal issues. All of these types of concerns beg for federal and state investigations, but may also provide fodder for plaintiffs attorneys.

It is also worth noting that MHProNews has a page-length message from a Berkshire Hathaway board member. We may opt to publish that at some point in the future. But the short version of that could be summed up by saying that the Berkshire board member’s message doesn’t address the kinds of issues like the one documented at the link below. Perhaps the board member knows what’s up, perhaps not.

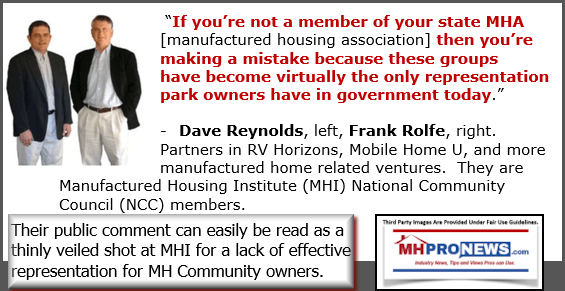

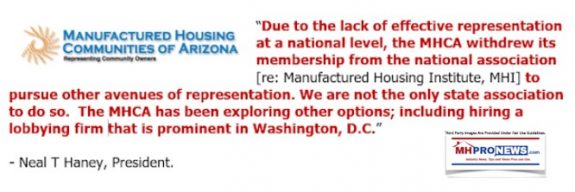

Given that MHI’s own exiting president gave a polite back-handed slap at the Arlington, VA based trade group, there are ample reasons for concerns about the legitimacy of their ‘representation’ of the industry that they have claimed for years.

Making Affordable Manufactured Housing Appealing and Great Again

That outline should be examined by the legal team of publicly traded firms, investors, public officials, and other interested parties. MHProNews’ management plans to continue to pursue allegations and evidence of unethical and potentially illegal actions undertaken by firms connected with MHI and arguably dominated by the Omaha-Knoxville based industry firms and their ‘big boy’ allies.

Our publisher L. A. ‘Tony’ Kovach has used the analogy of the wisdom of not feeding a hand that bites yours.

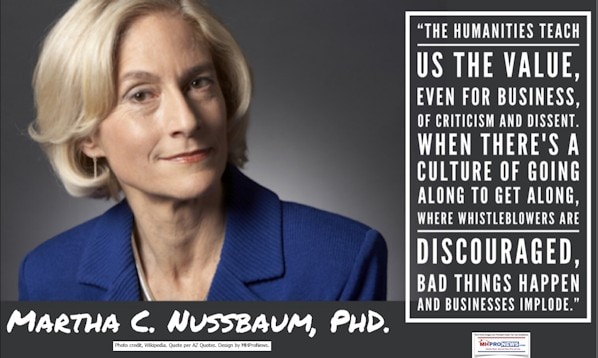

If national and/or state associations have been weaponized, as some have alleged, why are they to be trusted? When MHProNews provides a quote, it is obviously to make a point. No person or organization, ourselves included, is perfect. We therefore point to the ancient principle of separating the wheat from the chaff. That disclaimer noted, the next quote bears a bit of explanation. History – the actual track record of a company, person, or organization – is a good predictor of future behavior. Yesterday, as an example, before Mitt Romney came out with a statement about the Ukrainian phone call and related transcript, MHProNews speculated that it would occur. That proved accurate, based upon Romney’s historic pattern of behavior. The humanities include history.

Thanks to numerous sources of information inside the industry, from public officials, and from the general public, MHProNews and MHLivingNews enjoy a unique but sobering position. Certainly the ‘big boys’ might have a similar advantage, but the vast majority of industry professionals do not have the same level of insights given to us, which we in turn share in an appropriate fashion with the industry. Understanding principles, considering from first-hand sources what is actually occurring vs. what is being claimed or postured, following the evidence and the money trails has highlighted what Senators Bernie Sanders (VT-I), Elizabeth Warren (MA-D), and President Donald J. Trump (GOP) have all said. The system is rigged. The distinction is in how those informed professionals plan to unrig a rigged system. If American politics and economics is to a significantly degree ‘rigged,’ why would it be a surprise if manufactured housing is too?

All of this implies responsibilities for company or organizational executives who may have a fiduciary responsibility to others. It has impacts on investors, who ought to be able to count on those who are using their money to have done so in a responsible manner.

Consider the related reports linked above but also those further below the byline, notices, and offers. After the Cavco ‘debacle’ and the VW reminder, this should not be taken lightly. The industry is underperforming. There has to be good reasons why. Step by step, year by year, we have unpacked the evidence, money trails, and logic that points to troubling realities that are costing others serious money.

That’s your pre-dawn first look today at the industry’s most-read and most-trusted “News through the lens of manufactured homes and factory-built housing,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.